No doubt about it, the giant energy companies are talented survivors. Think of the crimes fairly or unfairly charged against Exxon and its six large “sisters”: collusion with Arab oil producers, strangling independent operators, withholding available supplies, spoiling the environment, offering bribes at home and abroad, sabotaging solar energy, and wasting an increasingly scarce resource. One would have thought that a country willing on slender evidence to ban saccharin might actually have done something to tame the private government of oil.

In fact, there was a moment during the winter of 1973-1974 when such action appeared likely. Just after OPEC’s embargo, Congress called a group of dignified corporate officials down to Washington, and the entire nation enjoyed on the nightly news programs the spectacle of Senator Henry Jackson bullying them. Nothing like this had happened since the head of General Motors publicly apologized for spying on Ralph Nader.

It was a heady time. Legislators competed with each other to introduce severe statutes that would split up the energy conglomerates according to their different functions of producing, refining, and marketing (a favorite scheme of the late Senator Philip Hart), or set up TVA-like government-managed enterprises on federal oil lands (the aim of Senator Adlai Stevenson’s Federal Oil and Gas Corporation), or subject energy prices and policies to increased regulation by Washington. (Practically every congressman declared himself as favoring the last of these.)

Denouncing the big oil companies became itself a small industry. After warming up on the subject of ITT,1 the British journalist Anthony Sampson produced in 1975 an equally acid account of the Seven Sisters and the energy-addicted societies they have labored to create.2 At the end of 1976, John M. Blair, a lifelong critic of the industry, a civil servant, Senate staff member, and economist, published his last major work, The Control of Oil,3 a nearly encyclopedic analysis of the devices, domestic and foreign, legal and illegal, that the major oil companies have used to manipulate world markets for oil and gas in their own interest.

John J. McCloy, of all people, supplied a series of interesting footnotes to Blair’s chronicle. McCloy headed a special investigating committee following Gulf Oil’s embarrassment by the SEC’s revelation of its political briberies. His report4 spoke of dummy Bahama corporations set up to channel illegal contributions to American politicians and usually legal but ethically dubious payments to their foreign counterparts. McCloy’s committee, established by Gulf itself, pointed out that the $12 million in questionable payments “spread over more than a decade” was “relatively small” in proportion to Gulf’s $12.5 billion assets, $18.2 billion in gross revenues, $1 billion net income, and $56 million in charitable and educational contributions. Still, McCloy and his associates thought it right for Gulf to confess its sins, and promise to offend no more.

Among its other merits, Robert Engler’s second book5 about the oil industry gives a convincing explanation of why no effective restraint on the industry’s conduct of its affairs has yet been enacted by Congress or, for that matter, proposed by any president. Engler’s tightly organized exposé is far more substantial than Anthony Sampson’s intelligent reporting, and it is more clearly written than Blair’s valuable but somewhat diffuse book. As Engler notes, his new work is less a product of original research than an interpretation of existing evidence. “Today the scholar is inundated by materials on oil policy and politics. The challenge…was one of winnowing and interpreting rather than searching and organizing basic facts about oil.”

To a commendable degree, Engler has met this challenge. He begins with the 1973-1975 oil crisis, which for most Americans was an utterly unexpected calamity. As Engler among others has demonstrated, the logic of preceding events made the OPEC boycott almost inevitable. As a relatively weak organization, OPEC had failed to organize a boycott after the Six Day War of 1967. By 1973, it was manifestly becoming more militant, more eager to find a suitable excuse for shifting the balance of power between its members and the arrogant oil concessionaires who for decades kept payments to host countries low. Hence the Yom Kippur War provided an ideal political pretext for economic extortion (or, according to one’s sympathies, rectification), as eagerly exploited by Iran, Indonesia, and Venezuela as by the Arabs of Saudi Arabia, Kuwait, and Abu Dhabi.

What ensured eventual success for OPEC was the earlier triumph of the Seven Sisters in convincing the Eisenhower administration to enact quota limitations upon imported oil. Proving that any argument will do to persuade good friends, corporate lobbyists explained to indulgent cabinet officers and members of Congress that the nation’s very security would be imperiled by depending on foreigners for a vital raw material like oil. Why not develop our own oil and gas within Fortress America?

Advertisement

Acceptance of the peculiar logic of this argument not only accelerated the depletion of American oil reserves but—and this is the point Engler stresses—it also propped up oil prices for the major companies during a period when supplies were ample. As American resources shrank, the oil quotas were relaxed even before the 1973 war. Nevertheless, by 1973 the US became sufficiently vulnerable to the interruption of OPEC exports—though far less so than Western Europe and Japan—as to put strong powers of intimidation in the hands of OPEC.

For the major industrialized nations OPEC continues to be a disaster. The 1973-1975 mini-depression from which Japan and the West have yet adequately to recover is the most obvious measure of OPEC’s disruptive influence. Longerterm consequences include a drastic shift in the power relations between advanced and developing societies as well as the decline in the growth rates of the former. If, as now appears inevitable, the politics of the rest of this century are to be dominated by issues of redistribution, both within the industrial nations and between them and the rest of the world, much of the blame (or credit) belongs to the OPEC members and their willing, indeed indispensable, accomplices, the major oil corporations.

A disaster for the developed countries, OPEC was an unmitigated tragedy for the abysmally poor nations of the “Fourth World,” those nations of Africa, Latin America, and Asia unblessed by oil or other riches. Although OPEC’s propaganda blames the plight of the Fourth World on the rising prices of finished goods imported from the West, the facts, which Engler might have presented more sharply than he does, tell a contrary tale. Ghana, which spent $35 million on imported oil in 1973, paid $179 million in 1975. Brazil in 1975 paid $2.37 billion for oil. Two years earlier a mere $654 million covered Brazilian energy needs. Between 1968 and 1976, the balance of payments deficits, on current account, of the nonoil developing countries rose from $6.8 billion to an estimated $32.0 billion. Most of the increase was the consequence of OPEC pricing policy.6

For their part, the oil companies reacted adroitly to the new situation, and no one should underestimate their cleverness. True, the Saudis quickly moved toward complete nationalization of Aramco, the consortium of energy giants which had owned, developed, and exploited the rich oil fields of the Arabian peninsula. But in Saudi Arabia Aramco has constructed something like a technocratic modern state within a feudal state, and the Saudis would be bereft without it. Exxon and the other companies remained on good terms not only with the Saudis (whose crude oil accounted for 23 percent of US imports in 1976) but with their other hosts; they soon negotiated purchase agreements which guaranteed them dependable quantities of crude petroleum.

Engler shows why the Seven Sisters had reason to be pleased. Each of these companies is an “integral operation”—refining, transporting, and marketing the product as well as merely pumping it out of the ground. It was easy enough for them to substitute profits in these “downstream” activities for the gains surrendered to King Khalid, the Shah, and miscellaneous strongmen. The oil companies smoothly shifted from exploiting the countries in which their concessions happened to be located to exploiting the markets in which petroleum products eventually were sold.

No doubt it was an embarrassment that profits swelled obscenely just as motorists found themselves waiting impatiently for five gallons of gasoline on alternate days. Rumors of fully loaded tankers cruising in the Atlantic and refineries operating below capacity added nothing to the popularity of the energy giants. But again the oil managers showed how neatly they could deal with adversity. The major companies and the Nixon-Ford administration cooperated to shift responsibility for shortages first to the Arabs and second to wasteful American consumers who, without thought for the morrow, were lavishly using oil and gas—just as they had been encouraged to do by the oil industry, among others, for most of their lives.

On November 26, 1973, after the Yom Kippur War, Nixon himself delivered these inspiring words: “We use 30 percent of all the energy…. That isn’t bad; that is good. That means we are the richest, strongest people in the world and that we have the highest standard of living in the world. That is why we need so much energy, and may it always be that way.” As usual, Nixon’s “facts” were dubious. Sweden, whose standards of living are by some criteria higher than those in the US, makes do on less than 50 percent of the energy per capita consumed in this country.

In tones of civilized irony, Engler describes the generosity of the oil companies in paying, bribing, and generally cosseting federal civil servants, politicians, regulators, and academic experts. At least until very recently, the Department of the Interior was almost a fief of the oil industry (Carter’s own policies remain unclear). As for the State Department, it “came to accept,” as Engler writes, “that the industry had grown up and was now the best instrument for protecting the energy base of the nation. In this context the State Department plays the part of an international law firm. Its clients are the oil corporations, that is, the American people.”

Advertisement

So mutually beneficial a relationship also suppressed any need for public agencies to collect independent statistics. It came as a surprise to some during the energy crisis that the oil companies controlled the only available information about the size of existing oil inventories, the quantity of oil being shipped to the United States and other destinations, the amount of recoverable reserves, and the percentage of unused refinery capacity. When the Nixon administration created a Federal Energy Administration, as a matter of course it staffed the agency with industry people. Who else knew enough to shoulder the heavy responsibility of policing the industry?

Exxon, Mobil, Gulf, and others spread the new wisdom of frugality in advertising and public relations campaigns that give no sign of abating. Whatever the cost, the public must be convinced that they are sober, disinterested, benevolent—in effect private foundations for the public good. In New York it is easy to confuse Channel 13 with a subsidiary of Exxon and Mobil, whose names are flashed at us before we see the worthy BBC productions imported by Public Broadcasting. Over Lincoln Center (largely a Rockefeller enterprise) flies the flag of Exxon, heir of the founder’s Standard Oil of New Jersey. Those who tire of Albert Shanker’s Sunday advertisements can now read Mobil’s Thursday messages on The New York Times op-ed page. Meanwhile, US oil imports have tripled since the 1973 oil embargo and domestic crude production is down 12 percent. Our imports of Saudi oil increased 45 percent in 1975 alone.7

In short, the oil companies have gotten away with it. Greatly daring, Congress did limit oil depletion allowances. But the industry is the beneficiary of so many other loopholes that the effect of this largely symbolic action on profits is trivial. Carter’s energy program, stressing conservation, will leave untouched private dominion over oil and gas as well as most other sources of energy. Until Congress considers them, it will be difficult to judge all the elements in Carter’s plan—including higher gasoline taxes, financial penalties on auto manufacturers who continue to turn out inefficient cars, increases in natural gas prices, and new taxes on domestic oil. But it seems highly unlikely that any tax on windfall profits will recover very much of the extra revenues that oil companies stand to receive from higher prices. It is equally improbable that low-income families will be fully protected by the tax rebates for efficient cars that are currently under discussion. As Engler concisely demonstrates, the major oil corporations now own a large percentage of coal lands, have strong holdings in nuclear power, and they finance (as a hedge) a limited amount of solar research.

What are the answers? Engler’s case for taking public action is wholly convincing but just what action should be taken is far from clear. John Blair advocated antitrust suits to break up or restrain the companies. Of this solution, Engler is rightly skeptical: “Antitrust enforcement still awaits the right chance and backing to prove its efficacy. Unfortunately, the first condition for success appears to be the absence of corporate power.” Would nationalization of the companies be preferable? The British experience is not reassuring. Although since 1914 the crown has owned a controlling interest in British Petroleum, “BP shows no evidence of any higher adherence to public objectives.” British governments, Labor or Conservative, have refrained from interference in “commercial affairs.” In recent years BP proved itself a loyal member of the brotherhood of oil by paying off Italian politicians just as Shell and Exxon do.

Engler expects few public gains from administrative reorganization, the policy that Carter and Schlesinger are likely to follow. At the moment federal supervision of the industry is dispersed among more than sixty federal agencies. If Congress accepts centralization under a new Secretary of Energy, presumably James Schlesinger, Engler concludes that industry control over government is more likely to be enlarged than reduced: “Reform simplifies the cooptation of the federal bureaucracy into the expanded energy establishment. It eases the transition to a corporate state.” Treasury Secretary Michael Blumenthal, an increasingly powerful force in the Carter administration, was one of the few businessmen publicly to endorse national economic planning, presumably under safe business auspices.

Engler derives some encouragement from the increasing influence of environmental activists on municipal and regional decisions. Yet, as he recognizes, effectively decentralized energy planning has a realistic chance only if accompanied by “long-run energy planning that is in harmony with public goals of development and participation.” Much too briefly, Engler sketches a possible solution of his own. He urges Congress to set up a temporary national energy committee armed with a “mandate” to work out new modes of public control and to devise a smooth formula for phasing out selfish corporate dominance. The committee’s agenda should include review of the “familiar spectrum of ameliorative proposals,” such as federal chartering of corporations, mandatory disclosure of industry data, public representation on corporate boards, fragmentation of the companies along the lines proposed by Senator Hart, and prohibition of ownership of competing energy sources.

Well aware of presidential use of commissions to prevent anything from being done, Engler proposes a two-year limit on the life of his new national committee. He would recruit committee members who are not politicians and are not associated with the oil industry. After two years he would replace the committee by a national energy planning board “responsible for shaping and coordinating energy policy in harmony with economic and technological goals arrived at by related planning agencies also to be created.” In America, Engler implies, one begins by planning for planning. But he suggests no reason why the usual alliance of industry, politicians, and subsidized experts will refrain from either burying this proposal or, worse, supporting it the more readily to take effective control of the new agencies to be established.

Engler, I regret to say, gives us no believable reason to doubt the dispiriting judgment that effective public control of the corporate brotherhood of oil will become a political reality only after a considerably more acute crisis reveals the inadequacy of the private government of oil. He has written the best single study of the energy industry so far. But his own program for controlling it proves yet again that no amount of insight and ingenuity is a substitute for a major shift in American politics and public opinion: for only such a change could bring unbridled corporate power under a rational system of federal control.

This Issue

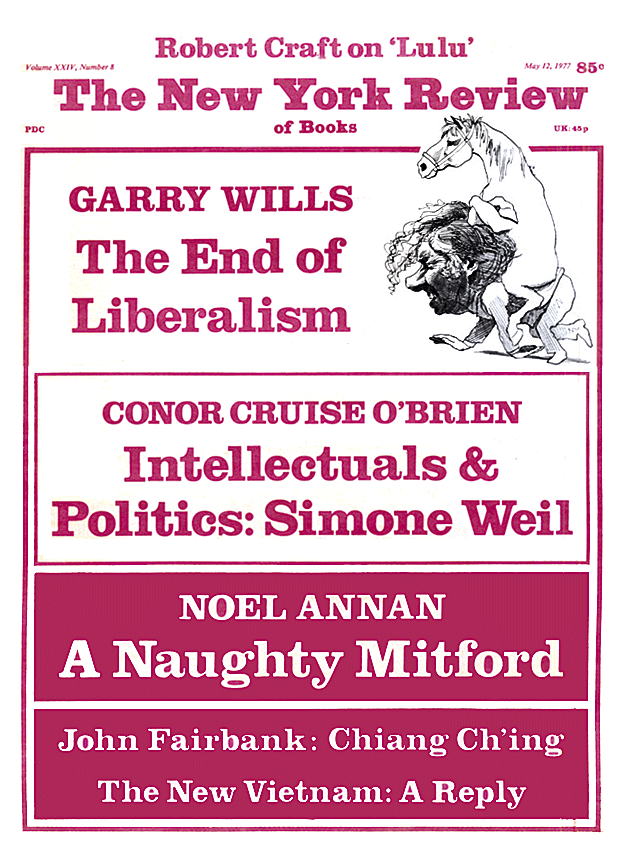

May 12, 1977

-

1

See The Sovereign State of ITT, by Anthony Sampson (Stein & Day, 1973). ↩

-

2

The Seven Sisters: The Great Oil Companies and the World They Shaped (Viking, 1975). ↩

-

3

Pantheon, 1976. J.K. Galbraith reviewed Blair in this journal in the February 3, 1977 issue. ↩

-

4

The Great Oil Spill (Chelsea House, 1976). ↩

-

5

His The Politics of Oil (1961) has just been reissued as a paperback by the University of Chicago Press. ↩

-

6

See the April 1977 issue of Petroeconomic File. ↩

-

7

See the calculations of Kai Bird, The Nation, April 9, 1977, p. 426. ↩