On May 10, an auction at Christie’s set new prices for recent contemporary art. A Willem de Kooning, Two Women, painted in the mid-1950s, sold for a record $1.2 million, the highest sum ever paid for a work by a living American. Work by other Abstract Expressionists also sold high—a Franz Kline for $240,000, an Adolph Gottlieb for $110,000, a Sam Francis for $242,000. A harder-edged painter, Richard Lindner, brought $300,000 and an early Frank Stella fetched $260,000. (Add 10 percent to all these prices for Christie’s cut.)

As far as de Kooning fans were concerned the price paid was juste, since Two Women is regarded as one of the artist’s finest canvases. More interesting, perhaps, was the perspicacity of the purchaser, the art dealer Allan Stone, who in the past has acquired many de Koonings in all shapes and sizes. Obviously, Mr. Stone was confident that if and when he offers this painting for sale he will make a decent profit. De Kooning’s reputation has been secure for years; such an acquisition would hardly seem like a gamble.

But at the same auction, two other paintings by much publicized artists failed to reach estimated prices—a Mark Rothko and a Roy Lichtenstein. High evaluations were placed on these “names.” The Rothko—long in the possession of Mr. Ben Heller—was frozen at $500,000, below which Mr. Heller would not budge. The bidding never reached it, and both the Lichtenstein and the Rothko were withdrawn.

Were these artists overevaluated any more than those who brought in equally spectacular prices? Was there a change in the taste or mood of the buyers, as in the case of buying or selling any other commodity? The more one examines these questions the more difficult it becomes to frame plausible answers. Well, one says, there is the reality of time passing; the public becomes accustomed to the successes of celebrated artists and the volume of publicity that attends them. But how then to account for the enthusiastic reception now being given to a wholly new batch of painters, around New York only for a few years, all of them in their early thirties or late twenties? Variously called New Realists or Neo-Expressionists, they have “arrived,” from Germany, Italy, and the provinces of America. The new painters, for all their brashness and ineptitude, have attracted a lively market which admires big, splashy, noisy, turbulent canvases, filled with soft-porn and hardcore banality. The new collectors are willing to pay handsomely in the tens of thousands, and do.

Can one explain this latest phenomenon because of another change in taste or a change in investment styles? Has art collecting acquired a street-smart angle? Have art dealers learned a new form of hype and have more artists become willing to fill the demand? More than 200,000 “artists” compete with one another in New York, and of them only a few dozen crash the big time. On the other hand, in Fernand Braudel’s notion of the longue durée, it would seem that the process and development of good art is usually slow, and fame often occurs only at the end of an artist’s life or afterward. This has been true for many of the better American painters—for instance Harnett, Peto, Blakelock, Demuth, Anne Ryan, Fairfield Porter. Detecting “quality” is often a hesitant, hit-or-miss, contradictory matter. What, one can justifiably ask, is “quality”?

But fashions in taste come and go—regionalists like Grant Wood or Joe Jones were replaced by the Surrealists and Neo-Romantics (Dali to Tchelitchew), who were then pushed aside by American Abstract Expressionists. The directions art has taken since 1960 are so numerous as to be confusing. Braudel’s longue durée has little meaning when we observe the speed with which new directions in painting and sculpture have emerged and disappeared. The rapid organization of galleries, several hundred of them, have matched the hyperactivity of the artists.

The change from the small, rather compact “art world” of the 1940s to the explosive, hustling scene of today is surely one of the most radical changes in the history of the art market. When I organized and opened a gallery in 1951 it was in an old building on East 53rd Street. We were on the first floor, which was reached by climbing the steps of a stoop. Under our front window a sign, “Ice and Coal for Sale,” indicated that below the stoop materials for heat and cold were available. Our rent was $85 a month. We were one of perhaps three or four galleries in New York that specialized in new painting by unknown young American artists. The monthly expenses for such an enterprise—electricity, telephone, mailing, etc.—came to about $400, but even at that it took several years before the gallery could show a profit. (Luckily we had a patron who paid the monthly bills.)

Advertisement

But for all the shabbiness of the building our gallery was an agreeable, handsome space, designed by an Italian architect, Roberto Mango, who had the skill and know-how to create a functioning art gallery on a shoestring. It held together for about four years, at which time the ceiling collapsed and we moved to the corner of Madison Avenue and East 67th Street in a fine old mansion that was eventually torn down. The rent went up but by then we had attracted enough buyers to keep going. During the next ten years my gallery moved three more times, the rent continuously going up as well as all other expenses.

Simultaneously a rash of galleries specializing in contemporary avant-garde American artists mushroomed in larger and larger office spaces, the price of art rising with each new entrepreneur. While the decline of the international market that was located securely in Paris had already begun in the late 1930s, this expansion of the market in New York began slowly, and was not noticeable until 1954, when it became clear that New York had entered a new epoch of art merchandising.

At about this time paintings by the group called Abstract Expressionists began to sell for prices between $3,000 and $7,000, a big advance over the previous decade. It was considered “not bad” that Pollock’s Blue Poles was sold by Sidney Janis to a Dr. Fred Olson in Connecticut for $6,000, of which Pollock received two-thirds. Adolph Gottlieb’s paintings were being purchased by private collectors at what seemed reasonable prices. Paintings by Franz Kline, William Baziotes, and Robert Motherwell were reaching a variety of museums and individuals. Mark Rothko would not sell his work except occasionally, perhaps one a year. Clyfford Still refused to sell his work except under certain conditions: the contracts for sales were drawn up by himself.

Whenever a museum such as the National Gallery or the Metropolitan purchases a picture costing $2 million or $3 million, a queue forms instantly, and continues for weeks. The line for Aristotle Contemplating a Bust of Homer by Rembrandt (to name one such piece of real estate worth an executive’s ransom) cozened several thousand art lovers in 1972, all astonished and bemused that a piece of canvas with some paint on it could cost that much. Pictures that are demurely absent from the passions surging around the market are, at best, put up with, smiled upon, ignored. Is it possible that some of Bouguereau’s paintings (and some of Frederic Church’s) have something to tell us? This might seem substantiated by the fact that only recently a large Church set a new auction record for an American painting. One would also hesitate to say that Bouguereau’s reputation will never be revived. Remembering the enthusiasm of Baudelaire for many painters who are all but forgotten today, perhaps we should pause and consider the ups and downs of taste, and at least the possibility of other points of view. I recall Willem de Kooning once saying that there were few paintings, old or new, which he didn’t enjoy in one way or another. (It was, of course, never his concern to influence taste.)

The question, however, of who creates the “market” for high-priced contemporary painting is not so simple as it would at first seem. Perhaps the most widespread view is that the market is the result of favorable reviews. Critics give people certainty of taste and knowledge. If enough writers say an artist is superior, then he no doubt is taken to be. Thus, there are those who maintain that the prestige and fortune of the Abstract Expressionists, among them Pollock, Rothko, Gottlieb, and Still, were created by Clement Greenberg, a no-nonsense critic with a firm sense of his own taste. But a careful reading of Mr. Greenberg’s writings (one must say “careful,” because he is more often than not misquoted and quoted from other quotations by his detractors or disciples in Artforum, Art in America, October) would show that he has liked a wide variety of painters and sculptors, many of whom did not become famous or make money. Few other critics have been so aware of the way taste functions and the way it changes; Mr. Greenberg seems to believe that art is a sort of steeplechase and that some people have the ability to predict the outcome. The truth is that Mr. Greenberg’s criticism was and is constructed along certain philosophical and aesthetic lines which include a “success” syndrome. It is not necessary to name the artists whom Greenberg has liked who have not been successes; he would be the first to admit that certain artists such as de Kooning, for whom he has felt little enthusiasm, have enjoyed enormous success.

The question then arises: does The New York Times heavily influence the market? In short, have reviews by Hilton Kramer, John Russell, or Grace Glueck changed the course of artists’ careers on the market? It is hard for me to believe that these critics have had or even want this power. Like everyone else, they have their likes and dislikes. They are overworked, must attempt to be just and, at the same time, honest—a large order considering the huge number of exhibitions that open month after month in New York. Hilton Kramer wrote with perception about artists such as Anne Ryan and Mary Frank; collectors did not rush to their galleries to buy their works. The same could be said about the other critics who have also written well of their favorites.

Advertisement

Perhaps the most serious regular critic was Fairfield Porter, who wrote for Art News between 1951 and 1959 and from 1959 to 1961 for The Nation. It was only after Rackstraw Downes’s well-edited collection of Porter’s writing was published in 1979 that the public was able to understand Porter’s sensibility and shrewd observations. He expressed the pleasure of seeing art as an experience and the work of each individual artist as a separate experience. Whether on abstract or representational art, Porter’s keen intelligence and sharp eye were able to demonstrate what made for excellence and delight. However, I suspect Porter’s criticism had little effect on the market or the museums; it was never à la mode since he had so little flair for received ideas.

But what had an enormous effect on the New York art scene was the arrival of Frank Lloyd in 1963 and the subsequent opening of the hugely prestigious Marlborough Gallery. This was but a branch in an ever-growing international operation that included galleries in Rome and Tokyo. Originally started in London, the Marlborough galleries brought with them heavy capitalization, a large stock of nineteenth- and twentieth-century masterworks, and high-powered methods of promoting them to rich collectors. All the important Abstract Expressionists except de Kooning joined with Lloyd to create the first large-scale international market for American painting and sculpture. And, of course, the taste for such art was immediately encouraged and made alluring to the richest collectors at home and abroad. Marlborough’s success during the next ten years set up a new style of competition. Other galleries selling very expensive goods—Knoedler, Pace (even Wildenstein wanted to be in the act)—spurred the art economy to ever grander heights. Hundreds of small galleries also opened, many during the real-estate boom of SoHo, land of luxury lofts, boutiques, and gourmet delicatessens. Dealers such as André Emmerich, Arnold Glempsher, Richard Bellamy, Leo Castelli, and Ivan Karp were among the most persuasive and influential with a tidal wave of the new rich. For the old rich there were E. V. Thaw and a half dozen other private dealers who convinced many of the richest collectors to acquire first-class works of art, both old masters and moderns.

Then too, during the 1950s and 1960s Dorothy Miller, curator at the Museum of Modern Art, became celebrated for her special exhibitions, which did much to change public taste toward little-known or unknown Americans. Henry Geldzahler, while curator at the Metropolitan Museum, had a similar effect, especially in making acceptable Pop art, David Hockney, and the latest in colorfield painting. But in general most curators, for instance those at the Whitney Museum, do not possess so much power.

This is not true, however, for the advisers who select works for such corporations as Chase Manhattan Bank, the McCrory Corporation, Prudential Life, Philip Morris, the Ciba-Geigy Corporation, to name only a few. Millions of dollars are spent annually for what in the end is a profitable investment. Since the best advisers work for a retainer’s fee, they do not take cuts from the people, the galleries, or the painters from whom they buy, thus preserving their plausibility as counselors to the corporations. It may be that such corporations will become the major patrons of modern art. If so, I don’t like to think what will happen when the choices of “experts” trying to please corporate executives increasingly dominate the market.

When in November 1975, after some years of indecision, I closed my gallery at 50 West 57th Street to become a private dealer my reasons were many and mixed. Certain of my best-selling artists had left for bigger galleries; expenses had risen disastrously; it was difficult to compete with heavily capitalized galleries. But the real truth lay elsewhere: I was bored, not a little, but profoundly. Museum curators, critics, collectors, the artists, the hangerson had for me become disagreeably tedious. The “art world,” I found, was becoming something I detested. But when I turned from public art dealing to private I didn’t foresee that there are in such marketing (anything from a Dürer print to a Maxfield Parrish) just as many frustrations and cul-de-sacs. “Well,” said a friend, “at least most of the pictures you’re handling are by ghosts happily dwelling in heaven.” He was not, however, counting the recently dead artists whose work is militantly guarded by widows, children, and very distant cousins.

The main difference in private dealing, I discovered, was the people involved. And what a gaggle of go-getters these turned out to be—all over town. The most nauseating group was the young married women with time on their hands specializing in “art for offices”—sometimes whole suites of offices where masses of brightly colored prints, drawings, and gouaches decorated the walls of jerry-built high-rises. Some specialized in cheering up doctors’ and dentists’ waiting rooms or placing kinetic light-ups and movables opposite operating chairs. Other entrepreneurs concentrated on the big corporate patrons. They engaged themselves in filling the lobbies, courtyards, plazas, and terraces of the new glass and steel edifices rising along Madison, Park, and Third avenues. Invariably this was done with tangles of bent cable, slabs of Corten steel, high-buffed stainless, or massive hunks of granite, both round and square.

Another group specialized in tapestries to lighten the grimness of vestibules and stairwells. Somewhere, in Ecuador perhaps, natives were hooking away at big zigzags, arcs, circles, rectangles, or polka dots of eye-filling intensity to soften the impact of elevator banks. New business was pouring into foundries in Long Island, upper New York State, or New Jersey to “fabricate” jumbo-sized constructions by artists famous, near famous, or quite unknown who prepared mole-sized maquettes for elephantine productions. These celebrations could be found on the lawns of benign industrial plants, secure amid the expensive landscape engineering, visible proof of business supporting art and improving the community.

I, however, found myself quite incapable of such vigorous salesmanship or of applying myself to the going tastes in corporate decoration. I was more like the rather timid pushers who serve a drink or take a possible buyer to lunch, or simply get an appointment to see a would-be customer. Hours on end would be spent on and then near the telephone, waiting for the return call that never came. Then, gradually, the timid ones would start consorting with each other. One has a Masson but no client, the other has a client but no Masson. We all became quite friendly in a sheepish way. Someone would call and say: “See if you can get me a 1929 wooden Arp.”

“But they’re impossible to find.”

“Your friend Virgil Thomson owns an important Arp. Can’t you convince him that this is a good time to sell?”

“I’ve talked with Virgil about that. He doesn’t sell anything. He likes his artworks. He doesn’t need the money all that much.”

“How about Jeanne Reynal’s Rothko?”

“She sold it years ago. And she gave up acquiring pictures.”

“And Mrs. Chester Dale? Surely she needs money.”

“But she doesn’t. She’s perfectly comfortable.”

It was true that I had many friends and acquaintances who owned fine pictures and statues. Once in a while I would be called on to look at something. One time it was a Watteau—worth over $1 million. I was led to believe by the silly old gentleman who owned it that he was interested in selling. Ah, I thought, if I could sell just this one canvas, I’ll be in clover. And off I rushed, consulting a Watteau specialist, having X-rays made, urging the work upon a large international art broker. The painting was indeed a Watteau, good as gold. The broker would pay a million and a quarter for this tiny piece of real estate. When I triumphantly returned to my de-acquisitioner, he exclaimed, “Oh, good! And now I know what it’s worth. I wouldn’t dream of letting go of anything so beautiful.”

When I told one of my private dealer colleagues about my disappointment, she became agitated. “Get a lawyer! Sue him! Charge him for consultation services!” But I realized that such a lawsuit would cost me more than any fee I might receive and that my client, being very, very rich, had expert legal advisers. Tant pis.

Up and down Madison Avenue they run, the courtiers of the art world, making their 1 percent, 5 percent, 10 percent, occasionally 100 percent. Sometimes they make a real killing. For instance, my friend Jane Wade sold a gigantic Henry Moore to a Midwestern city and was able to retire from the business. But for a lazy person like me, art jogging held no attraction and once again I wearied of a race I could not sustain—let alone win.

Of course, working the auction block or running up and down the avenue is not the same as maintaining a competent private gallery. There still exist at least two dozen or more such galleries which stubbornly continue to cling to high standards. But the kind of gallery I once ran seems as obsolescent now as the small, serious, and quirky world of artists and collectors I used to know.

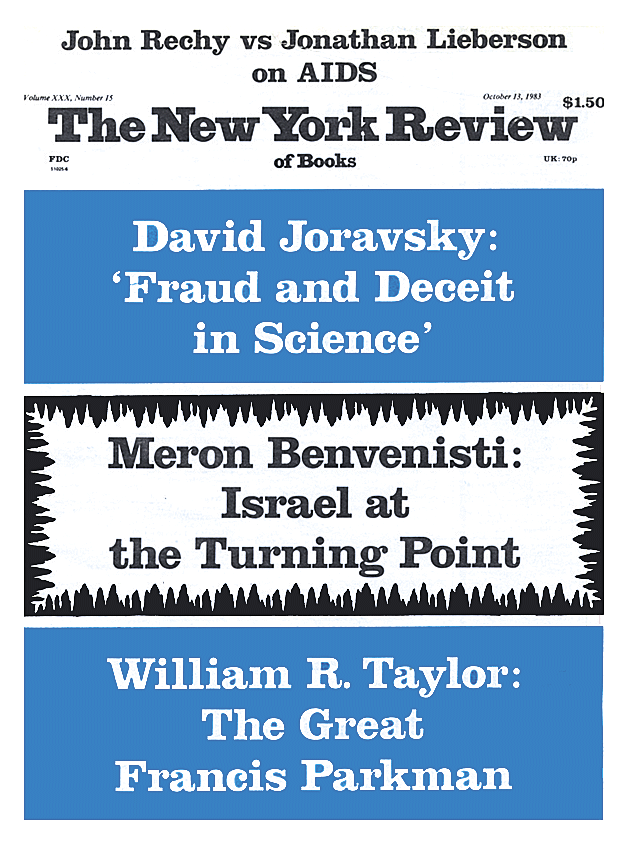

This Issue

October 13, 1983