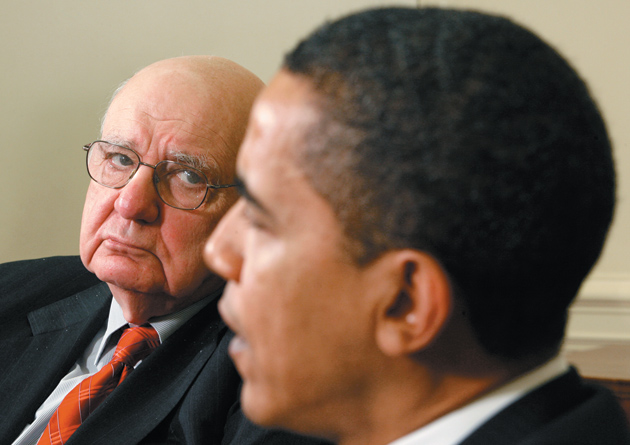

Some five years ago, at a conference of the Stanford Institute for Economic Policy Research, I lamented that “the growing imbalances, disequilibria, risks” were giving rise to “circumstances as dangerous and intractable” as any I could recall—intractable not just because of the combination of complicated issues, but because there seemed to be “so little willingness or capacity to do much about it.”

Part of the story is familiar. In the United States, savings practically disappeared as consumption rose far above past relationships to national production. That consumption was satisfied by rapidly growing imports from China and elsewhere in Asia at remarkably cheap prices, helping to keep inflation well subdued. The resulting seemingly inexorable increase in our current account deficit was easily financed by an equally large flow of short-term funds from abroad at exceptionally low interest rates. In fact, money was so easily available that it supported what became a bubble in housing, with rising home prices reinforcing a sense of prosperity and high consumption.

It was not so much that the imbalances were hidden or unknown. In particular, the Chinese surpluses and American deficits were widely thought to be unsustainable. But for the time being, the world economy was growing strongly. China in particular was mainly interested in developing its industry by encouraging exports, and the United States was not prepared to balance its national budget or to restrain the consumption and housing boom.

At the time, I suggested that the most likely result would not be well- thought-out and complementary policy actions. Rather, sooner or later, the necessary changes would be forced by a financial crisis.

I certainly did not anticipate the nature of the crisis that eventually ensued, its complexity, its force, or its impact right across the industrialized world. Subprime mortgages, credit default swaps, CDOs—squared, tranched, or otherwise—were not part of my world. Nor, I can add, had I ever imagined that the financial markets over those frightening weeks in the fall of 2008 would virtually freeze up. The sense of mutual trust upon which operating financial markets depend was lost.

Now we know that trillions of dollars of official funds came to the rescue of the broken system in the form of loans, capital, and guarantees. Flows of finance have been restored, albeit with large areas of continuing public support. The residential mortgage market in the United States—by far the largest sector of our capital market for the time being—remains almost wholly a ward of the government. Now, another range of uncertainty has arisen. Sovereign credits have come into question, most pointedly in the Eurozone but potentially of concern among some of our own states.

Any thoughts—any longings—that participants in the financial community might have had that conditions were returning to normal (implicitly promising the return of high compensation) should by now be shattered. We are left with some very large questions: questions of understanding what happened, questions of what to do about it, and ultimately, questions of political possibilities. The way those questions are answered will determine whether, in the end, the financial crisis has, in fact, forced the changes in thinking and in policies needed to restore a well-functioning financial system and better-balanced growing economies.

The Stanford Institute prize announcement sets out a simple proposition I suspect we all would support: “Economics is fundamentally about efficiently allocating resources so as to maximize the welfare of individuals.” I think it is fair to say that for some time the dominant approach of economic theorizing, increasingly reflected in public policy, has been that free and open financial markets, supported by advances in electronic technology and by sophisticated financial engineering, would most effectively support both market efficiency and stability. Without heavily intrusive regulation, investable funds would flow to the most profitable and productive uses. The inherent risks of making loans and extending credits would be diffused and reallocated among those best able and willing to bear them.

It is an attractive thesis, attractive not only in concept but for those participating in its seeming ability to generate enormous financial rewards. Our best business schools developed and taught ever more complicated models. A large share of the nation’s best young talent was attracted to finance. However, even when developments seemed most benign, there were warning signs.

Has the contribution of the modern world of finance to economic growth become so critical as to support remuneration to its participants beyond any earlier experience and expectations? Does the past profitability of and the value added by the financial industry really now justify profits amounting to as much as 35 to 40 percent of all profits by all US corporations? Can the truly enormous rise in the use of derivatives, complicated options, and highly structured financial instruments really have made a parallel contribution to economic efficiency? If so, does analysis of economic growth and productivity over the past decade or so indicate visible acceleration of growth or benefits flowing down to the average American worker who even before the crisis had enjoyed no increase in real income?

Advertisement

There was one great growth industry. Private debt relative to GDP nearly tripled in thirty years. Credit default swaps, invented little more than a decade ago, soared at their peak to a $60 trillion market, exceeding by a large multiple the amount of the underlying credits potentially hedged against default. Add to those specifics the opacity that accompanied the enormous complexity of such transactions.

The nature and depth of the financial crisis is forcing us to reconsider some of the basic tenets of financial theory. To my way of thinking, that is both necessary and promising in pointing toward useful reform.

One basic flaw running through much of the recent financial innovation is that thinking embedded in mathematics and physics could be directly adapted to markets. A search for repetitive patterns of behavior and computations of normal distribution curves are a big part of the physical sciences. However, financial markets are not driven by changes in natural forces but by human phenomena, with all their implications for herd behavior, for wide swings in emotion, and for political intervention and uncertainties.

Important questions about the governance of businesses and the relationships between principals and their agents are being reexamined. Most obviously and appropriately, the role of regulation and supervision, their necessity, their methods, and their difficulties are being reconsidered.

Virtually all developed economies have long had official institutions responsible for regulating their banking systems. To a lesser extent, there has been oversight of financial markets and nonbank financial institutions. In the United States, there has been a particularly complicated and intrusive institutional structure. But as a broad generalization, these existing structures, in all their variety, largely failed to prevent cascading financial failures, with severe economic damage.

One response has been a broad international effort to review capital requirements, leverage restraints, and liquidity practices, extending even beyond the traditional area of commercial banking. These are matters that by and large are within the existing competences of national regulatory authorities. Over the past two years, there has been much useful analysis and large areas of conceptual agreement. But even with that concentrated effort, it has been difficult to reach operational consensus.

The fact is that the exercise of effective regulatory and supervisory authority is always difficult on a national level, and those difficulties are multiplied when dozens of countries are involved. There are large political constraints and industry pressure. Consider the ten-year effort by the G10’s Basel Committee on Banking Supervision to coordinate capital requirements—completed just in time to be largely rendered moot by the financial crisis.

To me, the lesson is clear. There are deep-seated structural issues that must be dealt with by legislation. Moreover, there should be common elements among nations hosting significant international financial markets and institutions. As this is written, the US Senate has passed one fairly comprehensive legislative approach. There are some parts of that bill that I would prefer to see changed, redrafted, or eliminated in the negotiations to reconcile it with the House bill during the coming weeks. This is particularly true in clarifying the limits on proprietary activity of commercial banks, including trading in derivatives. However, I do think that taken as a whole the bill does incorporate basic approaches that can and should be part of our international consensus.

The central issue with which we have been grappling is the doctrine of “too big to fail.” Its corollary is so-called moral hazard: the sense that an institution—its creditors, its management, even its stockholders—will be inclined to tolerate highly aggressive risk in the expectation that it will be rescued from possible failure by official financial support.

That is not a new concern. Commercial banks in the ordinary course of their business have deposit insurance and access to Federal Reserve credit in times of stress. In practice, creditors of the largest banking institutions have been protected. The quid pro quo has been extensive regulation to limit risk. The underlying assumption has been, quite correctly in my view, that these banking institutions perform absolutely critical functions in our economy. They manage the payment systems, nationally and internationally. They provide safe and liquid facilities for depositing money. They are an indispensable source of credit to most businesses.

Now, the situation has been changed. A vast “shadow banking system” has emerged alongside, and is importantly dependent upon, traditional commercial banks. Investment banks have become financial trading machines. Hedge and private equity funds are active, operating in large part on borrowed funds. Financial affiliates of some industrial firms have expanded into the capital markets to the extent, in a few cases, that the risks have jeopardized the entire company. Derivatives, including credit default swaps hardly known a decade ago, have become speculative vehicles, exceeding their use as hedging instruments. Fragmented regulation and supervision, if present at all, have been weak.

Advertisement

To a substantial extent, it was those “nonbanks” that were at the epicenter of the crisis. Contrary to well-established central bank practices and with active government support, many of those same institutions received extensive assistance to remain viable.

Dealing with this great extension of moral hazard has become the largest challenge for financial reform. Central to that effort in thinking both in the United States and in Europe has been the creation of a new “resolution authority” that could supersede conventional bankruptcy procedures when the potential failure of a “systemically important” financial institution threatens to undermine the stability of the financial system.

Essentially, an official agency following established procedural safeguards (in the US presumably the FDIC) could seize control of the failing institution, deal with its immediate obligations to maintain continuity in the market, but then promptly arrange for an orderly liquidation: stockholders and management would be gone, and creditors placed at risk, as in a normal bankruptcy. Ideally the path toward liquidation (including the sale of parts of the company) would be eased by setting out a “living will”—dissolution priorities prepared by large nonbank institutions and reviewed by their supervisors. Put simply, the concept is to prepare for a dignified burial—not intensive care with hopes for recovery.

The largest nonbank institutions would also be subject to supervision with respect to their capital, leverage, and liquidity—matters that, according to the Senate bill, would be overseen by the Federal Reserve. The intent is to permit the nonbanks to compete, to innovate, to actively trade, and to make profits free of highly detailed intrusive regulation. They should also be free to fail.

Put simply, there would continue to be a federal safety net implicitly subsidizing strongly regulated commercial banks, as has been the practice for decades, even for centuries—here and abroad. Other institutions, and their creditors, should not expect official protection. The clear possibility of failure without a “bailout” will be reflected in lower credit ratings, in higher financing costs, and in market-imposed restraints.

The logic of that approach is embedded in the Senate bill. Commercial banking would implicitly be supported in its wide range of relations with businesses and other customers. Proprietary trading, hedge funds, and other potentially profitable but risky activities not related to their essential responsibilities should clearly be prohibited for banks. The essential logic is that the taxpayers need not, and should not, be called upon to support essentially speculative activities within the protected, implicitly subsidized financial sector.

There are other key elements in the Senate bill. Importantly, there is a strong effort to force trading, clearance, and settlement of derivatives into organized exchanges and clearinghouses. New responsibilities for coherent oversight of the entire financial system are set out. Regulatory authorities are clarified. In all these areas, a high degree of international cooperation is necessary. My hope is that the legislative initiative underway will provide a solid foundation for strong American leadership in that effort.

None of these reforms will assure crisis-free financial markets in the years ahead. The point is to keep the inevitable excesses and points of strain manageable, to reduce their scale and frequency, and in the process more effectively contribute to the efficient allocation of our financial resources.

As we well know, the critical policy issues we face go way beyond the technicalities of law and regulation of financial markets. There is growing awareness of historically large and persistent fiscal deficits in a number of well-developed economies. The risks associated with the virtually unprecedented levels of public debts as we emerge from recessions are evident. In California, as in my own state of New York, it’s not a matter of intellectual awareness but of practical confrontation.

If we need any further illustration of the potential threats to our own economy from uncontrolled borrowing, we have only to look to the struggle to maintain the common European currency, to rebalance the European economy, and to sustain the political cohesion of Europe. Amounts approaching a trillion dollars have been marshaled from national and international resources to deal with those challenges. Financing can buy time, but not indefinite time. The underlying hard fiscal and economic adjustments are necessary.

As we look to that European experience, let’s consider our own situation. We are not a small country highly vulnerable to speculative attack. In an uncertain world, our currency and credit are well established. But there are serious questions, most immediately about the sustainability of our commitment to growing entitlement programs. Looking only a little further ahead, there are even larger questions of critical importance for those of less advanced age than I. The need to achieve a consensus for effective action against global warming, for energy independence, and for protecting the environment is not going to go away. Are we really prepared to meet those problems, and the related fiscal implications? If not, today’s concerns may soon become tomorrow’s existential crises.

I referred at the start of these remarks to my sense five years ago of intractable problems, resisting solutions. Little has happened to allay my concerns. But, of course, it is not true that our economic problems are intractable beyond our ability to react, to make the necessary adjustments to more fully realize the enormous potential for improving our well-being. Permit me a note of optimism.

A few days ago, I spent a little time in Ireland. It’s a small country, with few resources and, to put it mildly, a troubled history. In the last twenty years, it took a great leap forward, escaping from its economic lethargy and its internal conflicts. Responding to the potential of free and open markets and the stable European currency, standards of living have bounded higher, close to the general European level. Instead of emigration, there has been an influx of workers from abroad.

But now Ireland has been caught up in its own speculative excesses and financial deficits, culminating in a sharp economic decline. There is a lot of grumbling, about banks in particular. But I came away with another impression. The people I spoke to had an understanding that the boom had gotten out of hand. There seems to me a determination to do something about the situation, reflected not just in the words of the political leaders but in support for action among the public. And there is a sense of what is at stake, that the gains they made in recent years have been placed in jeopardy. The urgent need to get back on a sustainable budgetary and economic track is well understood.

I hope my quick impressions of Irish attitudes and policies will be borne out and that that small country will not be caught up by a European crisis beyond its control. In the United States, we don’t seem to me to share the same sense of urgency. We view ourselves as a huge and relatively self-sufficient country, in control of our own destiny. We have time to sort out our priorities, to decide what to do, and to do it. There are elements of truth in those propositions, but the time we have is growing short.

Restoring our fiscal position, dealing with Social Security and health care obligations in a responsible way, sorting out a reasonable approach toward limiting carbon emissions, and producing domestic energy without unacceptable environmental risks all take time. We’d better get started. That will require a greater sense of common purpose and political consensus than has been evident in Washington or the country at large.

—May 25, 2010

This Issue

June 24, 2010