INTRODUCTION

George McGovern’s proposals for tax reform and redistribution of income, originally released in January and published here in slightly revised form, should be read and reread by every one of the more than one hundred million Americans who dropped in the mailbox last Saturday or Sunday, with mixed feelings of civic pride and desperation, their income tax returns for 1971. McGovern’s brief statement contains more hard common sense and practical wisdom than the tired platitudes and inconclusive technical disquisitions that fill the 300 pages of the President’s Economic Report, which was transmitted to the Congress a few days after Senator McGovern made his program public.

The distribution of income is clearly emerging as the issue that will dominate the American political scene in the closing quarter of this century. The share that each member of our society receives in the immense and still swelling stream of goods and services produced annually by the American economy not only largely determines the level of satisfaction of his daily needs but also provides means for attaining many, if not all, of his highest aspirations. But more than this, under our political institutions the income and the amount of wealth controlled by any one group, in relation to other groups, determines decisively the power it can wield in influencing, not to say in directing, all government activities.

Twenty-five percent of the total gross national income is controlled directly by the government, and a much larger proportion indirectly. It is not surprising that by exercising a decisive influence on government policy, particularly in the economic sphere, a small group of citizens controlling a disproportionately high share of the national income and a still greater share of the national wealth has been capable of defending its economic and political dominance against all assaults.

In view of the close interdependence among all the parts of the modern industrial economy, the distribution of income and of wealth naturally depends, to some extent, on every one of its social and economic institutions. However, the power of the government to levy taxes, to borrow and to print money, and to use this immense purchasing power in any way it sees fit has long been recognized as one of the most effective means of bringing about a distribution of income compatible with the prevailing standards of social justice—or as an equally effective means of thwarting attempts to do so.

By the Middle Ages the Magna Charta had linked the notion of equitable taxation with the idea of social justice. The tea tax symbolized the English yoke to the rebelling Bostonians. None of the inequities of the Ancien Régime in France was hated more than the exemption from taxation enjoyed by the Church and the aristocratic upper class. The English orthodox economists, liberal in both senses of that term, staked their hopes for a truly free and fair society on a radical tax reform; so did the heterodox American Henry George.

But the cardinal importance of just taxation has receded in the American political conscience in the last thirty years. While government participation in the management of the national economy has mostly increased, it now consists mainly of trouble-shooting interventions rather than fundamental economic and social reform. Year after year we witness an endless sequence of rescue operations made necessary by the inability of the traditional system of private enterprise to deal effectively with all kinds of problems created by economic growth and the headlong rush of technological change. Decaying metropolitan areas, ailing transportation systems, “structural” unemployment, and a despoiled environment are only a few of the woes that the Republican administration tries to lessen—so far with little tangible success—by a flow of rules, suspended rules, and haphazard measures.

Our once equitable and effective system of taxation has fallen victim to these hapless operations. Exemptions, accelerated amortizations, deductions, and credits of all kinds—avowedly intended to protect the tender sensibilities and to encourage the timid adventurers of rugged private enterprise—have fatally weakened, if not entirely destroyed, the progressive nature of the income, inheritance, and corporation taxes. The “value added tax” now quietly engineered behind the scene, which is nothing less than a universal sales tax, would deliver a coup de grâce to the taxation system of which this country was once rightfully proud.

Senator McGovern proposes to restore and to strengthen the role of taxation as a stern guardian of social justice and an effective instrument of social reform.

Many of the ills that both the federal and the local governments are now trying to cure, or at least to camouflage by various emergency measures, will vanish with the elimination of their fundamental cause—a lopsided distribution of national wealth and income. Canceling all exemptions and deductions would not only restore the honesty and effectiveness of the income and the corporate profit tax. It would also do away with the immense effort now devoted both to legitimate and illegitimate tax avoidance and to tax enforcement. The recent shift from conventional to no-fault automobile insurance has demonstrated how large the savings from such streamlining can be.

Advertisement

McGovern’s tax reform proposals should become the central issue in the electoral campaign. President Nixon has again and again disarmed the opposition by making its proposals his own. It is most unlikely that he will want to do so in this case. What he would have to sacrifice are not lofty principles but hard cash.

Many Americans feel themselves the victims of economic discrimination at the hands of the federal tax system. Although that system is, in many respects, one of the most enlightened in the world, it is an undeniable fact that millions of ordinary, working, middle-income families pay their taxes as required by law, while many of the wealthy use a variety of devices to escape their rightful tax burden. At the same time, the man in the middle sees billions of dollars going into welfare programs that don’t work. In short, many Americans pay their taxes dutifully and feel that others are exploiting the tax and welfare systems.

The most urgently needed change in our systems of taxation and public assistance is to place far greater emphasis on fairness. Each American should feel that he is getting his money’s worth and that he is being treated exactly like every other American. Each American should pay his fair share and each American should receive his fair share. That is clearly not the case now.

I

Tax Reform

The purpose of taxation

In the United States, taxes pay for those activities which we wish to have carried out by government rather than by the private sector. The costs are supposed to be carried by each income group paying its share and by those within each income group paying a similiar amount. The progressive tax system asks those who are better off to bear a greater share of the load than those who have less ability to pay. In general, the progressive system is one of the most positive elements of our tax system.

Individual income taxes

Previous efforts at tax reform have failed to bring our system closer to a truly progressive one. Every effort at reform shows that the cloth of our tax codes is so worn that every patch rips another hole somewhere else. Even more importantly, efforts to promote fairness by giving everyone his own loophole are slowly dismantling the progressive federal income tax.

The actual tax system is just about half as progressive as it is supposed to be, according to the tax rates adopted by Congress. While nominal rates range from 0.1 percent at low incomes to 69.2 percent for those with incomes over $1 million per year, actual rates on average range from 0.7 percent to 34 percent.

Two taxpayers with the same annual income pay quite different taxes. A factory worker or a schoolteacher whose taxes are withheld from his wages cannot take advantage of loopholes. He may expect to pay almost $1,000 in taxes on earnings of $10,000. A wealthy person who receives $10,000 income from state and local bonds will pay no federal taxes at all. Clearly this system is unfair.

And these inequities are not theoretical. On the basis of 1969 tax returns, the last year for which figures are available, some 21,317 people earning more than $20,000 paid no federal taxes whatsoever. That includes fifty-six people with incomes in a single year of $1 million or more.

Because the effort to close one loophole at a time has been a failure and because to do so would still leave a great number of inequities until all were closed, we should shift to a really effective minimum tax. While a minimum tax was created in 1969 tax legislation, it is actually window dressing and is not effective. Recent reports indicate that some who earn over $1 million still pay no taxes.

I propose a minimum income tax so that the rich could not avoid their share of the tax burden no matter what loopholes they used. One possible formula would be a minimum income tax to apply to all those with total incomes in excess of $50,000. The entire income of any person in this range would be subject to payment of taxes at a rate of 75 percent of the current statutory rates at the rate that they would have to pay if there were no loopholes. All income regardless of source would be included. (Of course, if the computed tax exceeds the minimum tax, it would be payable.)

If this minimum income tax were now in effect it would bring in approximately $5 billion during the present fiscal year and $6 billion in fiscal 1973. That would amount to about a 7 percent increase in receipts from the individual income tax. This increase would be paid by the wealthiest 411,000 out of the 76 million federal taxpayers.

Advertisement

This basic tax reform would not unfairly penalize the wealthy just because they were well off. It would simply ensure that they could not dump their tax load onto the backs of already hard-pressed middle-income taxpayers.

Corporate taxes

The strength of the American economy is due mainly to the dynamic growth of the private sector led by corporations and other businesses. It is sound public policy to create the conditions for business to function effectively.

The federal tax system has been used to help the corporation. As Joseph Pechman, one of the leading tax experts in the United States, points out: “A special tax on the corporate form of doing business is considered appropriate because corporations enjoy special privileges and benefits.” In order to stimulate corporate economic activity, the federal government can and does alter tax rates. That is the principal form of assistance that has recently been given.

The present corporate tax rate is 48 percent of the taxable base defined by law. Of this, 22 percent is the normal tax which applies, without the 26 percent surtax, to the first $25,000 of corporate net income. This feature is of special benefit to small businesses—some 77 percent of the taxpaying corporations. It should be maintained.

In each postwar recession, demands have arisen to stimulate the economy through corporate tax reductions. These have taken the form not of overt tax reductions but of covert rate reductions in the form of increased depreciation allowances and special devices such as the investment tax credit. Such devices transfer profits from the taxable category to the untaxable category. In the process, the corporate income tax is gradually being abolished.

Because of steady reductions in the taxable base over the past twenty years, the effective corporation income tax rate has been cut in half. There is a real question about how much farther we can go.

The time has come to end the dismantling of the corporation income tax and to re-establish a fair balance between personal and corporate income tax collections. As a result, I have opposed the new depreciation guidelines and the investment tax credit. Special loopholes, such as percentage depletion, need not be phased out, but a broad balance also needs to be established between taxable and untaxable earnings of corporations. As it is, we have tipped that balance too far in the direction of untaxable earnings.

I propose that the actual corporation income tax be returned to its 1960 level by the elimination of the special loopholes that have been opened since then. (About two-thirds of the gap between the present level and the 1960 level results from Nixon Administration cuts in the last year.)

This reform of the corporation income tax would raise approximately $9 billion in the current fiscal year and about $17 billion in fiscal 1973 (based on Administration estimates of increased corporate activity).

This proposal for increasing the corporation income tax rate does not mean reduced government assistance to business. If the entire McGovern economic program were to be applied, there would be more stimulus to business than is available from the tax privileges now in effect. This program includes an immediate $10 billion fiscal stimulus to create new jobs and use underutilized capacity, economic conversion from a war to a peace economy with the extensive use of government contracting for specific purposes, and the Minimum Income Grant, discussed below, which would greatly stimulate consumer purchases. Nothing spurs profits like a strong full employment economy, which has the highest priority in my economic program.

In short, our corporations must be healthy and growing if our economy is to prosper. But we have a wider range of tools at our disposal than perpetual reductions in the corporation income tax.

Estate and gift taxation

Most Americans subscribe to a fundamental belief of our Founding Fathers that we should be allowed to keep a fair proportion of what we earn but should not be allowed to inherit great wealth. Yet, in practice, the loopholes in our gift and inheritance taxes are much greater than those in our income taxes. Just 9 percent of all families own 50 percent of all private assets. More than a quarter of all private assets are owned by less than I percent of the population. Although some of these fortunes are based on earned income, most are based on inherited wealth.

Estate and gift tax rates are high. But actual rates are a tiny fraction of the theoretical rates.

Estate and gift taxation should be reformed in the same manner as the income tax. Instead of proceeding to close loopholes one by one, a whole new system needs to be constructed.

Gift and inheritance taxes should shift from a tax on the estate or giver to a lifetime cumulative tax on the recipient. This shift would make it possible to prevent tax avoidance and would be more fair, because it would regard the money received as income to the recipient, which it is.

The cumulative lifetime tax on recipients should take the following form: A base amount would be exempt from taxation—this amount is now set by the government at $60,000. Then a progressive tax would be levied, reaching an upper limit of 77 percent—the current statutory ceiling—on an estate of $500,000 or more. The base exemption should be increased when the estate includes a wholly owned proprietorship.

While it is impossible to calculate the exact amount of such revenues resulting from this proposal, a conservative estimate would indicate the doubling of present tax receipts from estate and gift taxes. That would mean additional tax revenues of $4 billion in the present fiscal year and $5 billion in fiscal 1973.

State and local taxes

While the federal tax system is generally progressive, with room for improvement, the state and local tax systems are far less progressive and do not respond as directly to changes of income of taxpayers. It is well known that there has been excessive reliance on the property tax.

The property tax revolt may be a major issue in the coming months. The federal government may have to step in to allow for a reduction of property taxes used to support education—perhaps their complete removal. As I indicated in July, 1971, in my proposals on revenue sharing, the states should be given the incentive to raise more of their revenues from progressive income taxes. In addition, the federal government should take over at least a third of the total bill for primary and secondary education. Funds should be distributed to school districts in line with an equalization formula as is outlined in my revenue sharing proposals.

It has been suggested that a value added tax, which in effect is a national sales tax, should be used either as a method of increasing federal tax revenues or as a method of reducing or eliminating the property tax or both. I disagree. In the first case, we should increase individual and corporation taxation, as indicated, rather than resort to the national sales tax. In the second case, a shift to the value added tax would represent a retreat from the far sounder revenue sharing approach. In addition, while the federal government should assume a greater share of the cost of education, certain local services are associated with the ownership of property, and there is thus a justification for some property taxation. Also, as mentioned above, the property tax can be cut by a shift to more progressive forms of taxation by the states.

In any case, the value added tax or national sales tax is against the interest of middle- and low-income people. It is a regressive tax on consumption, which cannot, of course, be reduced beyond a certain point necessary to ensure a decent life. And it represents a backdoor method of increasing individual taxes just after a reduction in taxation on individual incomes has been enacted.

Conclusion

The federal tax system is basically sound, although it has been riddled with special privileges for the rich. We should move now to establish a fair tax system for all Americans.

The reforms of the federal tax system relating to individual and corporation income taxes and to estate and gift taxes would result in additional revenues of about $18 billion this fiscal year and $28 billion in fiscal 1973. This amounts to an additional $140 in federal income for every man, woman, and child in the United States. Depending on how these additional revenues were applied, they could bring about the reduction or elimination of the local property tax for education; be spent on other urgent national needs such as rebuilding our cities, pollution control, adequate nutrition for all; or could go a long way toward financing the Minimum Income Grant program, discussed below.

II

Redistribution of Income

The need

The present tax system contains inequities because it does not levy a correspondingly fair burden on all taxpayers. While the rich benefit from the tax system, middle-income groups and low-income groups including the poor do not receive such benefits. Those with medium incomes find they are paying their taxes but not receiving either the kind of tax breaks given to the wealthy or the kind of public assistance payments made to the poor. The poor find that, as soon as they go to work, they are subject to extremely high rates of income taxation because of their sudden sharp reduction of public aid when they earn their first dollar. The net result is mounting frustration for those in the middle and a future of poverty for those who are heavily penalized when they seek to work their way out of welfare dependence.

There are other weaknesses of the public assistance or welfare program. Many people in need are not covered; family groups are penalized; benefits are insufficient; migration from one state to another is encouraged; extensive controls are applied; and it is possible for taxpayers to be worse off than those receiving public assistance.

A number of welfare proposals are now pending before the Congress. I sponsored the proposals of the National Welfare Rights Organization in an effort to ensure that benefits will take into account real needs. Naturally these proposals deal only with those on public assistance—not medium-income taxpayers. Some of them represent major improvements in the present system. But none of them offers the broad application of the Minimum Income Grant described below. Even the negative income tax proposal has the defect of creating or, more properly, maintaining a two-class society—those who pay and those who receive.

The Minimum Income Grant

I propose that every man, woman, and child receive from the federal government an annual payment. This payment would not vary in accordance with the wealth of the recipient. For those on public assistance, this income grant would replace the welfare system. It has also been suggested that the national income grant could replace certain social security benefits.

There are a number of methods by which this proposal could be implemented. Some are discussed here. These methods require full examination by the best economic talent available, and the plan chosen must have the support of the President, if it is to have any chance of adoption. For these reasons, the present proposal is not designed for immediate legislative action. Instead, it represents a pledge that, if elected, I would prepare a detailed plan and submit it to the Congress.

One proposal calls for the same payment to be made to all Americans. This is the credit income tax idea, proposed by Professor Earl Rolph, and more recently associated with the name of Professor James Tobin of Yale, immediate past president of the American Economic Association, former member of the Council of Economic Advisors, and a member of the National Economic Advisory Group of the McGovern Campaign. Using a 1966 base, Professor Tobin suggests a payment of $750 per person. At the present time, a payment of almost $1,000 per person would be required. This would amount to $4,000 for a family of four—just about the official poverty level boundary.

Another formula has been suggested by Leonard Greene, president of the Safelight Instrument Corporation of New York. Under his “Fair Share” plan, each adult would receive $900 a year and each child would receive $400. This would amount to $2,600 for a family of four.

It should be stressed that neither of these proposals relates to the size of the family unit; the payments are made on an individual basis. Thus, there would be no incentive for a family to break up in order to receive higher total benefits.

A third formula would involve payments according to the family group. Joseph Pechman of the Brookings Institution has shown that “the relative incomes that would provide roughly equivalent standards of living appear to be in the ratio of 75:100:25 for single, married, and dependent persons, respectively.” The payment of the Minimum Income Grant could be made according to such a formula. In this case, adequate account would be taken of those who receive welfare and who live alone.

Financing the Minimum Income Grant

As redistribution of income, the Minimum Income Grant would represent no additional cost to the Treasury. Funds to finance the grant would be expected to come from those above a designated break-even income and would take the form of additional taxes. If the break-even income for a family of four were set at $12,000, about 20 percent of federal taxpayers would experience a tax increase, while about 80 percent would be able to keep all or part of the grant.

It is expected that those below the poverty line would keep all of the grant, while those between the poverty line and the break-even point would keep a gradually decreasing amount as their incomes rose. The loss of grant benefits would thus be sufficiently gradual as not to discourage those on welfare from seeking a job (in fact, it would encourage them to seek work) and would provide a significant income supplement to the millions of Americans in the medium-income range. Thus, for example, a family of four with its own income of $8,000 would be able to retain an additional $2,000 of the Minimum Income Grant.

Professor Tobin’s explanation of the credit income tax suggests that the grant would be tax-free but that each person would be required to pay a uniform income tax to the Federal Treasury (a 33.3 percent tax is suggested with the $750 payment). Although this might seem to be a regressive tax, the tax credit resulting from the grant would cause it to have a progressive effect. While taxes would be much higher for the wealthy, others would receive significant tax relief. Professor Tobin uses the example of a family of four with an income of less than $9,000 that would pay no taxes at all.

This credit income tax proposal would imply a redistribution of income of some $14.1 billion from those above the poverty line to those below it. The redistribution from those above the break-even income line to those below it but still above the poverty line would amount to $29 billion. These figures demonstrate that while the Minimum Income Grant would represent a total reform of the present welfare system, it would actually provide more money to medium-income taxpayers than it would to the poor.

Leonard Greene’s Fair Share would be financed by the present progressive tax system plus a 20 percent tax surcharge on all taxpayers. The Minimum Income Grant, according to Mr. Greene, would not be tax exempt. This proposal distributes the cost over a greater number of taxpayers but the burden on any one of them is lower than under the credit income tax formula.

It would not be necessary to finance all of the Minimum Income Grant by tax increases. The billions of dollars saved in welfare benefits and the cumbersome administration of the welfare system—a total since it began of $9.6 billion or $1.4 billion in fiscal 1970—could be allocated to the grant. It should be noted that this procedure would represent a major saving for states and localities which would not be required to finance the welfare system and could use the resulting funds—an estimated $5 billion—to lower property taxes. This step would represent additional income assistance to medium-income taxpayers. (To the extent that social security payments were replaced by the grant, social security funds could be used to finance the system.)

In addition, the revenues resulting from the kind of tax reform proposed earlier ($28 billion in fiscal 1973) could be applied to the grant.

Finally, the justification for the personal exemption on individual tax returns would be removed by the adoption of the Minimum Income Grant. If the personal exemption were removed, the federal government would receive $63.6 billion in additional tax revenues. These funds could also be applied to the grant.

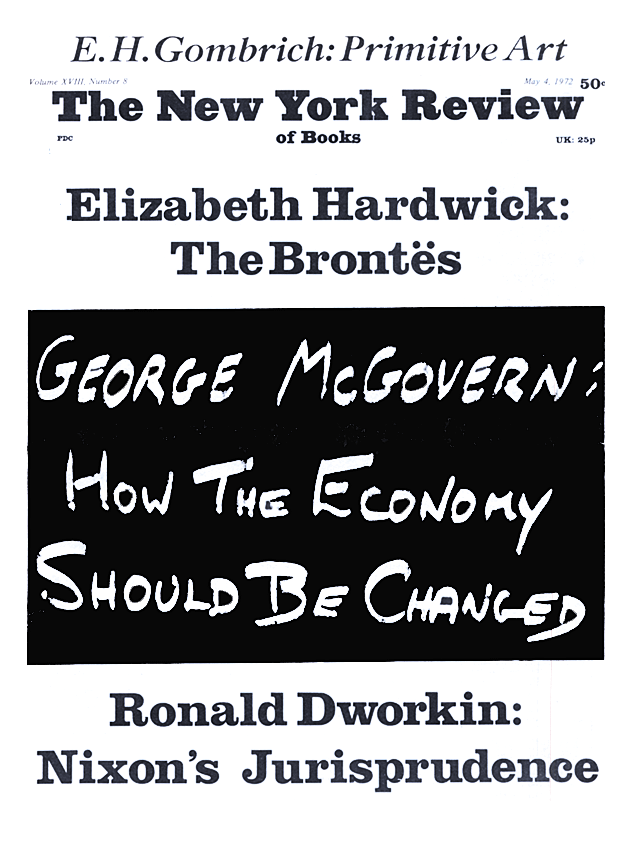

This Issue

May 4, 1972