The darkest consequence of oil diplomacy, in America, is a political language, a premonition. Already the world energy crisis has brought threatening changes in US economic policy. These changes are evident in Kissinger’s and Nixon’s plans for “energy independence.” But the new policies go beyond oil commerce to world trade in all materials, promising conflict in wheat and copper, metals and minerals.

In its most menacing form, the new US policy anticipates a “next crisis” of raw materials and of US dependence upon the Third World. Strategists of the policy see a need, specifically, for independence in materials other than fuels; they fear that oil power will become a precedent for commodity power in copper or coffee or manganese. Such fears correspond to a theory of US foreign policy which emphasizes economic issues and relations with the Third World. But the new alarmism also has immediate implications in US politics.

In the last few months, US politicians have addressed themselves repeatedly to the “materials crisis,” while discussing issues from deep-sea mining to anti-Americanism, from grain supplies to foreign aid. The boldest recent words came in January, when the House of Representatives defeated a bill allocating $1.5 billion to the World Bank’s International Development Association (IDA), which provides easy credit for the poorest of developing countries.

The bill was supported by the Nixon Administration. Its congressional partisans argued that foreign aid was justified by “enlightened self-interest” and by “economic realities.” They noted that developing countries supply one-third of US raw material imports; that the US imports more than half its consumption of six “basic raw materials,” including, for example, manganese, “from countries like Gabon, Zaire, and Brazil.”1

This argument did not sway the geopoliticians of the Congress. Representative John Dent, for example, a Democrat from Pennsylvania, said that US aid to resource-exporting countries, without “some kind of a string attached,” “puts us in the position of being suckers to the point that an American no longer knows where to stand or how to stand.” A “closedown” by the mineral-producing countries, he said, would make the oil crisis seem like “a little Sunday school picnic.” He declared that “we have only two years to get ourselves in a position to become free and independent for our Bicentennial birthday.”

Other representatives seemed encouraged by Representative Dent. Representative Carter of Kentucky: “We are raiding Uncle Sugar. We are getting too soft.” The precedent of oil-producing countries was invoked. Wayne Hays, the Democrat from Ohio, said that the bill would not help “the poor of the world and all that.” He reminded his colleagues that the Saudi Arabian ambassador was “gliding around this city right now” in a Cadillac limousine, and urged that Congress “sort of serve notice that we are not going to be pushed around by these people.” The bill was defeated by 248 votes to 155.

Representatives Dent and Hays may seem to speak with a peculiarly sharp congressional voice on the particularly charged subject of foreign aid. But many other politicians express similar fears. Senator Charles Percy sees all resource-producing nations, “whether it be bauxite [aluminum ore] or whatever…looking over the shoulder of the sheiks.” Last December, Interior Secretary Rogers Morton noted the efforts at cooperation of bauxite producers, and warned of a “minerals crisis and a materials crisis”; he subsequently described his warning as a necessary attempt to “wave the flag,” because, “You know, there’s a lot of anti-American sentiment around,” and “I’d hate to see us…have to go around the world begging with our hat in our hand for some of these essential minerals.”2

On the same day that the House defeated the IDA bill, Senator Lee Metcalf was also talking, in the Senate, about manganese imports, Gabon, and the “economic clout” of Zaire. Metcalf, a prominent liberal and opponent of the Indochina war, has this month held public hearings to look more closely at manganese. In the Senate, he introduced a bill to “promote” the mining by US corporations of minerals from the ocean floor, and to encourage national “self-sufficiency.” Mineral deposits on the Atlantic and Pacific seabeds, Metcalf said, are “rightfully part of our national heritage”; he feared a “situation” in mineral commerce “similar” to the crisis of oil power at which the world now “gapes.”

The argument about raw materials to which Metcalf and Morton allude, although not new, may appear newly apt. Yet the danger of US “dependence” is hard to demonstrate—the danger, that is, for the US. A raw materials “crisis” may in fact threaten not the rich but the poor world; the security of Zaire not America; the sellers not the buyers of cobalt or copper. Any dangers may have to do less with dependence than with the political apprehension of peril, in US policy. Secretary Morton’s “crisis” has little relation, also, to fears about the rate at which rich countries are using nonrenewable resources. It is concerned, rather, with international politics; with the presumed new economic power of certain poor countries.

Advertisement

The materials argument has been stated clearly by an economic analyst named C. Fred Bergsten, whose work Senator Metcalf cites. Bergsten, of the Brookings Institution and formerly of the National Security Council, is the leading strategist of the next trade crisis.3 He is concerned, in general, to influence US foreign policy toward greater preoccupation with the Third World; he favors a largely economic involvement which he likens explicitly to the Nixon Doctrine in international security.

This involvement is justified, Bergsten argues, because of the threat to US interests posed by the “rising…power of many countries in the Third World.” “It is no longer clear that the United States would emerge ‘the winner’ in confrontation with the Third World.” Recently, watching the successes of oil-exporting countries, Bergsten has emphasized the specific threat of “producer cartels” formed by poor resource-exporting countries.

The present oil situation, in Bergsten’s words, is “just the beginning,” “of course, the prototype,” and OPEC, the Organization of Petroleum Exporting Countries, “has shown other countries how to do it.” OPEC may be, for exporters of other materials, both a model and a source of political or financial support.

Materials “alarmists” point out that the US, which imports only 35 percent of its petroleum, imports a much higher proportion of its supplies of certain strategic materials, including, for example, more than 75 percent of its consumption of aluminum ore, nickel, manganese, cobalt. A few countries dominate world exports of some materials: cobalt from the ubiquitously feared Zaire (once the Belgian Congo); copper from Chile, Zambia, Zaire, and Peru; bauxite from Guinea, Guyana, Surinam, Jamaica, and Australia.

In the alarmists’ scenario, these groups of countries will form increasingly powerful cartels. Bergsten expects that the existing organization of copper exporters, CIPEC, “may soon join OPEC as a household word”; bauxite exporters met last month in Guinea (having been presented, by the US business press, with the scary but unsolicited acronym BAUPEC). Such groups may now use their market dominance—in Bergsten’s phrase, their “tremendous clout”—to raise prices or to insist that “they process the materials themselves.”

The trouble with this scenario is that OPEC provides a fairly unreliable guide for other producers. The National Commission on Materials Policy reported last June that it could “isolate” no commodity except oil “for which the economic and political basis for [effective cartels] exists.” No group of bauxite or copper producers, certainly, has the political affinity of Arab oil-exporting states, the geographical closeness and economic predominance of the Persian Gulf countries.

More important, few Third World countries aside from the oil states have the economic resources and international reserves to emulate Libya, Kuwait, or Saudi Arabia in limiting exports. Zaire, for example, with its manganese and copper “power,” has a national income per capita of $102, compared to $1,850 for Libya, and international reserves of $8 per capita, compared to $1,400 per capita for Libya.4 Bergsten writes that “the monetary reserves of the Third World have risen by $33 billion in the last three years, so many of its members could finance” cartels—but the “Third World” in question includes all the rich oil-exporting states.

The question of OPEC states financing other resource-exporting countries raises separate issues. Very recently, the industrialized nations have begun to worry about what Senator Metcalf describes as “an Arab-led movement to organize developing countries….” This anxiety is based in part on the fact that Zambia and other copper-exporting nations have conferred several times with OPEC countries; the European press has also reported “rumors” that rich Arab states are buying not only gold but also copper, “other commodities such as tin and rubber,” and “even the ‘softs,’ coffee, cocoa, and sugar.”5

Such activity is justifiably alarming to the industrialized countries—as alarming as other likely dispositions of the hundreds of billions of dollars of OPEC revenues. Yet OPEC stockpiling may have little to do with the hopes of the poor Third World, or with the redistribution of money and power. Bergsten suggests that OPEC will “support the formation of other cartels, as one way to avoid opprobrium for bankrupting the ‘developing countries.”‘ This is perhaps an inadequate explanation for the motives of, say, Saudi Arabia, which has so far shown little interest either in befriending or in organizing African and Latin American nations.6 Copper is probably, for Saudi Arabia or Kuwait, a rational investment. Any “copper power” would accrue to OPEC, not CIPEC. Like thousands of Western investors, OPEC financiers may see commodities as a safer holding than yen or pounds or Wall Street stocks. But for Peru, or Zambia, a rich Kuwaiti commodity speculator will look much like a rich Swiss.

Advertisement

A further difficulty with OPEC as a model for other cartels has to do with the character of US “dependence.” The effect of material imports on the US balance of payments, which Bergsten emphasizes, is relatively small; in 1972, before the recent oil price increases, net US imports of petroleum were worth $3.85 billion, compared to $268 million for copper metal, $163 million for bauxite, $514 million for all ores and scrap, textile fibers and wood materials.

The copper situation, at least, need hardly cause panic at the US Treasury: the US is the largest world producer and relies on imports for only 8 percent of its copper, down from 35 percent in 1950 and 60 percent in 1945. Bergsten wrote in The New York Times that the US is “or soon will be heavily dependent on imports” of vital commodities, including copper—but the US government estimates that by 2000 the nation will still import only a third of its total copper demand.7

The US—more easily than Japan—could increase national, “independent” production of, for example, timber. It is cheaper to stockpile manganese, or copper, than petroleum.8 Just as “substitute” fuels can be crushed from coal or shale, so many metals can be mined from poor domestic ores, as well as from, say, the ocean floor. Aluminum-bearing rocks are even found in the same parts of Wyoming as oil shale. US mining corporations seem, in fact, about as afraid of the “materials crisis” as oil companies are of the energy crisis; like the oil companies, whose profits have increased with OPEC revenues, they may expect to profit from, and perhaps encourage, price increases by foreign governments.

In the case of bauxite, corporate optimism is particularly open, and the alarmist case particularly difficult. In a recent Wall Street Journal report, the chairman of Alcoa, the leading US aluminum company, “leans back at his desk” and says he has “no indication” of any problem with a bauxite cartel. Aluminum executives mention the poverty of the producing nations, and say that Australia alone could supply “free world” bauxite needs for 100 years. The Alcoa chairman alludes to new domestic ores, which Secretary Morton describes as “abundant”; he notes that ore forms a tiny part of the cost of aluminum; few foreign countries, he says, have the technology or the electricity to produce finished aluminum.9

Because it is difficult to show the menace of Third World “power,” alarmist strategists are driven to very elaborate fears and a very revealing rhetoric. Secretary Morton notes that a crisis of mineral prices would be “gradual,” and therefore “more insidious” than the energy crisis. “If we ever get at their mercy…,” he wonders. Bergsten fears that cartels may increase prices by such “subtle pricing and marketing strategies” that rich countries will not notice, and will fail to develop natural or synthetic substitutes. He also invokes the yet more menacing possibility of what he calls an “unofficial multi-mineral cartel,” where producers of, say, copper, tin, and bauxite cooperate to prevent consuming countries from substituting one of these metals for another—a scenario which supposes considerable technical virtuosity on the part of an organization now reaching from Surinam to Thailand.10

In the article where he anticipates “subtle pricing,” Bergsten also speculates that Third World countries may cut other prices “subtly enough to avoid early detection and clear ‘blame.”‘ Four paragraphs on, he summarizes the ways in which poor countries “can seriously hurt the US”: “any LDC [less developed country] which undertook such action would do so with sufficient subtlety that tough US responses would be difficult to mobilize.” World commerce, in these phrases and fears, becomes a National Security Council exercise, a “game” matching equal antagonists in a struggle of signals and subtlety and political drama.

Like petroleum geopolitics, the rhetoric of mineral jeopardy evokes a frightening past, of Nazi planners searching for tungsten and bauxite, of economic warfare continued into war. Bergsten’s analysis, his NSC toughmindedness, suggests a less dramatic but closer danger—in US policy toward the poor world.

Raw materials cartels may achieve some redistribution of wealth; any CIPEC or “BAUPEC” is better than none in protecting the economic interests of primary producers. Occasions like the forthcoming special session of the UN General Assembly, organized by Algeria to discuss raw materials and development, could bring an improvement in export conditions for poor countries. But in US policy, these changes seem to encourage an ominous mood. We need not regret the old world of aid and trade and exploitation if we dread a new, less hidden economic politics.

Like Project Independence for energy, policies to avert the resources “crisis” will demand a retreat from world trade. In 1960, a leading US prophet of atomic energy, Alvin Weinberg, alarmed about the “recent Suez crisis,” declared:

It has been thought that an interdependent world—exchanging products and raw materials—is a more stable world. My own impression is the reverse. I think that a world of economically self-sufficient nations would be more stable than an economically interdependent world.11

Weinberg is now director of research and development for the new Federal Energy Office, and his views of fourteen years ago are acclaimed again.

Two issues, of substitution and of “food power,” show the changes likely to follow a diplomacy of “independence.” Fears of a materials crisis encourage and glorify the perennial search to find substitutes for the primary products of the Third World. A new protectionism could also deny markets to countries that “process the materials themselves” into industrial products. Senator Metcalf (of Montana, per capita income $3,897) is concerned about the “economic clout” of Zaire (per capita income $102). His ocean-mining bill helps American companies to exploit their “heritage” of deep-sea minerals, using an advanced and protected technology; it also threatens the interests of poor mineral-exporting countries.

Agricultural politics are even more menacing. Rich countries control the major and growing share of all food exports, and the US is overwhelmingly predominant: last year, it accounted for 90 percent of world soybean exports, three-quarters of corn exports, half of all wheat exports, and was even the major exporter of rice.12 The first famous embargo of 1973 was the US ban on soybean exports, in June. American farm exports are, for the enthusiastic business press, “a major weapon of international diplomacy,” while President Nixon has recently rejected, on behalf of the US, “the lion’s share” of responsibility for carrying world grain reserves.

US “food power” has been discussed mainly with respect to a “counter-embargo” against, for example, Saudi Arabia, which in 1971 imported $20 million worth of US rice. A US embargo would be only a trivial irritation for the richest oil states; for Zaire or other “resource-rich” nations, and above all for the poorer countries which lack resources, US food supplies could mean life or death.

Like Arabian oil, US wheat last year trebled in price. “Food for Peace” shipments, to countries already devastated by oil price increases, are one-fifth as great this year as they were in 1970. Food power, in the US, can be a matter of inadvertence, “market forces,” concern about domestic inflation. Meanwhile, the Soviet Union plays a politics of starvation, as it sells to India its shipments of US grain. Japan, reducing its exports because of the oil shortage, has interrupted fertilizer sales to India, Pakistan, and Bangladesh, apparently saving its scarce surplus for China, where “fertilizer power” offers political advantage.

Even the present, vaunted commodity inflation has redistributed little economic “clout” to most poor countries, who now pay enormously higher prices for their food and other imports from industrialized countries. The persistence of such dependence is hardly surprising. But it should cast doubts on the arguments of “materials crisis” analysts—and on their largely unargued presumption about the new economic “power” of the Third World.

The political mood of the “materials crisis” darkens American foreign affairs as well as economic policy. The mood of Representative Dent, yearning for aid with “some kind of a string attached.” Or of the National Commission on Materials Policy, which recommends, discussing “national security” and materials imports, that the US “increase the dependence of supplying countries upon continuing US good will.” The mood, in fact, of the official “policy paper,” quoted by Roger Morris in the “Op-Ed” page of the Times, concerning US relations with the genocidal regime in Burundi, where the UN has just discovered $14 billion worth of nickel. “Normalizing” relations with Burundi would improve the “competitive position” of US companies, and would “increase US influence over the final disposition” of the mineral trove.13

The strategists of materials jeopardy are generally fastidious about such forthrightness, in foreign or in economic policy. Bergsten, for example, favors trade liberalization and opposes “nationalistic beggar-thy-neighbor policies.” He feels that the Third World “deserves a much higher place among the priorities of contemporary American foreign policy.”14 In the congressional debate about the IDA, his arguments were cited in favor of foreign aid. He doubts that a “dollar diplomacy will work very well” in the 1970s; and writes that “the thought of military intervention seems remote after the domestic divisiveness of Vietnam.”

Yet Bergsten and other analysis have some responsibility for the new mood of US policy. This mood is nurtured by the language of jeopardy: by the presentation of Third World “power” and US dependence, of “subtle strategies,” of poor countries that might “emerge ‘the winner’ in confrontation” with the US. Bergsten writes, of the Third World, that “even a perception of [US] obstinacy or neglect…could trigger action”; his own words and signals may also be perceived or misperceived by US political opinion.

For Bergsten, arguments about resources and economic power provide “a rationale for US involvement,” on the grounds of “national self-interest,” “simple insurance principles,” “Realpolitik.” He favors “policy tools” that are “primarily economic,” economic cooperation with the Third World, and cooperation with other rich countries in dealing with the Third World. Yet his prescription occasionally sounds less benevolent, at least by analogy:

The Nixon Doctrine explicitly envisages a process in which US help for other countries would evolve from direct involvement through support for their own security capacity to general support for the economic base on which they can construct their own security capability, a close parallel to the process called for here. But the Administration has attached inadequate priority to these issues…. [Italics added.]

This process, this more vigorous Nixon Doctrine, could transcend consultation and cooperation. Since the early 1960s, opponents of the Indochina war have looked for secret US economic interests in Vietnam: Are Americans in Indochina because of oil, or rubber, or tin from Thailand? Now these economic and geopolitical interests, in Africa and around the Third World, are a matter for open national anxiety.

Such forthrightness, at the very least, has its own dangers. Somewhere, in some security establishment, officials on a “Zaire desk” must be reading the Congressional Record and thinking about mineral imports: about manganese and money; more “strings”; more appropriations to spend on increased “dependence” for Zaire. In the case of Burundi, it is nickel and new US aid that must be linked. According to the officials quoted by Roger Morris, “It is difficult over time to maintain a large diplomatic establishment in Burundi without any apparent substantive raison d’être” in the shape of US aid.

The US military has itself adopted the new language in Senate testimony supporting the 1975 military budget. Admiral Moorer mentions “geopolitical realities,” “our great dependence on overseas sources of raw materials”; he emphasizes the need for “general purpose forces,” at “the lower end of the violence spectrum.” General Creighton Abrams, who sees “low violence” armies as providing “leverage in negotiations with friends as well as foes,” declares that “oil, for instance, may be only the first of many vital resources used as strategic weapons against us. The threat is multi-dimensional—and very real.”15

In the worst future, the “raw materials crisis” could express political frustrations: a surplus rage; a fury on the part of politicians that America lost to OPEC, that no one “did anything” about the Persian Gulf, that the Saudi ambassador is “gliding around this city right now.” Such a future is not, I think, particularly likely. The “crisis” will be, instead, a matter of mood, of a geopolitical language that is newly and bleakly uninhibited.

For US policy, however, this mood is bad enough. The energy crisis has endowed a frightening economic diplomacy of oil producers and oil consumers, of “cooperators” and “bilateralists.” At his recent Washington conference, Henry Kissinger proposed a “Project Interdependence” to complement “Project Independence”; it is an interdependence of the rich, based on American economic power, in resources, advanced technology, the ability to hold contingency supplies; a perfectly Kissingerian formulation, in short, for peace through force, cooperation through predomination. Poor countries were not invited to Washington, and they are the immediate losers in the energy war. A politics of resource alarmism could make them the long-term losers, as well.

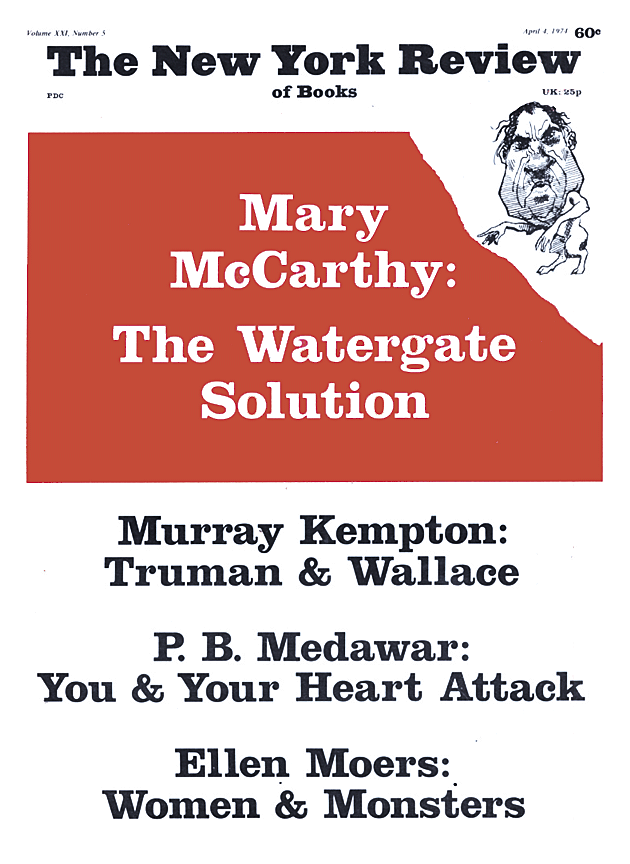

This Issue

April 4, 1974

-

1

Congressional Record, January 23, 1974. ↩

-

2

Interview in Forbes, February 15, 1974. ↩

-

3

“The Threat from the Third World,” Foreign Policy, Summer, 1973; Washington Post, January 13, 1974; New York Times, January 27, 1974; also “The Threat Is Real,” answering criticism by Stephen Krasner, both in Foreign Policy, Spring, 1974. ↩

-

4

United Nations, Monthly Bulletin of Statistics, February, 1974. ↩

-

5

London Times, January 14, 1974. ↩

-

6

A recent proposal by Colonel Qaddafi to establish a three-tier oil price has received little support in OPEC, while African countries have accused the Arab Bank for Industrial and Agricultural Development of seeking profit not development. Senator Metcalf’s fear of “Arab-led” cartels was based on a report in the Journal of Commerce of a press conference given by the Shah of Iran. At that press conference, the Shah mentioned neither bauxite nor copper nor any other “endangered” commodity; he suggested that “very rich” oil countries might invest in Indian production of iron ore, a commodity entirely unsuited to the creation of a producers’ cartel. ↩

-

7

The National Commission on Materials Policy, “Final Report,” June, 1973, p. 2:9. ↩

-

8

A year ago, the Nixon Administration decided to sell much of the national stockpile of strategic metals, at the urging of mining corporations and in defense of the “American consumer.” It now seems likely to reverse that decision. ↩

-

9

Wall Street Journal, “Whatever Happened to the Big Bauxite Crisis?”, January 24, 1974. ↩

-

10

Bergsten also introduces the prospect of a similarly devious attack on rich breakfasts. “An alliance among the producers of coffee, cocoa, and tea could preempt substitution by drinkers around the world.” One might guess, actually, that coffee prices would have to rise quite far before many consumers would switch to other drinks. So coffee producers would not even need a “multi-beverage cartel.” Bergsten writes that the “coffee cartel is already so far along that its producers were content [last year] to let expire the international coffee agreement”; the agreement also expired because of political differences among the forty or so nations involved. Meanwhile, the real price of US coffee imports has fallen more or less steadily since the mid-1950s. In 1972 prices, coffee imports cost 82 cents a pound in 1955, and 43 cents a pound in 1972; cocoa imports 58 cents a pound in 1955 and 25 cents a pound in 1972; and tea imports $1.04 a pound in 1955 and 42 cents a pound in 1972 (Statistical Abstract of the United States, 1973). ↩

-

11

Science and the New Nations, edited by Ruth Gruber (Basic Books, 1961). ↩

-

12

US News and World Report, January 14, 1974. ↩

-

13

The New York Times, March 3, 1974. ↩

-

14

Other theorists, some of them less fearful, also argue that poor countries deserve more US “attention” relative to the Japan-Europe-US and China-the Soviet Union-US “triangles”; see, for example, Stanley Hoffman in Foreign Policy, Fall, 1973: “Once again, good ideas are being carried too far, and the American pendulum doesn’t know how to stop in the middle. Having (often for the wrong reasons) exaggerated the importance of the “South” yesterday is no reason to forget it today.” ↩

-

15

Senate Armed Services Committee, statements of Admiral Thomas Moorer and General Creighton Abrams, “United States Military Posture for FY 1975.” ↩