Fifteen years ago New York was still mainly a manufacturing city; in fact it had more industrial employees than any other city in the world. Nearly half the people here worked full time and nearly a million of them, or more than a quarter of the work force, worked at the production of goods. Eighty-thousand New Yorkers worked in the food trades, baking bread and brewing beer for the city’s nearly eight million citizens. A quarter million worked in the apparel industry. More than 20,000 ground lenses and made scientific instruments. One-hundred twenty-five thousand worked in the printing trades.

But New Yorkers did so many other things too that you could live here for years and never think of New York as a manufacturing city at all. Most of the city’s industry was tucked away in old lofts in odd corners of Manhattan or in small plants in Long Island City or Brooklyn. There were no great steel mills or automobile factories to dominate the city’s economy or its landscape. More than a third of the city’s factories employed fewer than twenty people each. New York’s industry was nondescript and, like much else that supplied the city’s vitality, largely invisible.

It was one of New York’s pleasures then that you could stay pretty much in your own compartment, painting pictures or teaching school or selling whatever you sold while the rest of the city became a kind of backdrop, often colorful, often squalid, usually a blur—something you noticed from the window of a bus or an airplane. You didn’t have to think about it if you didn’t want to, and why would anyone want to? In the outer boroughs there are thousands of New Yorkers who almost never come into what they call the city, by which they mean Manhattan. You can live here for a lifetime and never notice that New York is bounded by one of the world’s great rivers or that it is made up of hundreds of settlements with names like Tottenville, Corona, and Ravenswood or that it has, or once had, dozens of downtowns.

For years the city seemed to run itself by a kind of anarchic common sense. No doubt this was much of its charm for people who came here from smaller, less intimate places. New York lent itself to privacy, to eccentricity, and thus to a kind of freedom unavailable elsewhere. If New York was often a cold city where hardly anyone cared if you lived or died, it was also a city that left you alone to work out your own salvation. The city, for all the socialist talk of its intellectuals and the kaleidoscopic mergers of the alien corporations that had begun to operate here, was still by 1960 or so a kind of living museum of pre-monopoly capitalism: an anachronism as it was to turn out, but still in retrospect the climactic event in the history of those bazaars that arose centuries ago in Venice and Ravenna and moved slowly westward by way of Antwerp, Paris, and London. In New York there was almost nothing that couldn’t be bought or sold or made or put together or created or destroyed, including of course the city itself.

Yet as hermetic and various as life here was in those days, it was by no means uniformly so. For all its diversity and toughness, New York, along with the rest of the world, was being drawn up in spasms of conglomeration, as in some great geological shift. Businesses, neighborhoods, whole cities and towns were abolished or fused together in unlikely new arrangements. Sometimes this happened with the help of government, as when new federal and state highways funnelled the city’s former taxpayers out to the synthetic new suburbs. Sometimes it happened according to the designs of bankers and developers and the brutal logic of balance sheets. But always the cause appeared to be remote, obscure, and autonomous. By the end of the decade, nearly everyone in the city—the landlords, the tenants, the bankers, the welfare clients, even the bureaucrats themselves—complained that something called “they” was running the city and running it badly.

By the middle Sixties you could see the city and its people changing all around you. New construction was going up everywhere, herding the old residents and their businesses into ever narrower enclaves, or driving them out of the city altogether. Meanwhile the expanding ghettos were overflowing with refugees driven here by the mechanization of Southern agriculture and by Southern welfare practices that made Northern cities seem deceptively generous by contrast. In the late Fifties, Southern legislators joked that the meager welfare programs which they diligently enforced provided one-way bus tickets north for their unwanted blacks. Between 1960 and 1970 the proportion of blacks in the city had risen from 14 percent to 21 percent, most of them trapped here by a city that didn’t need their labor and that had, in fact, begun to export its menial and routine work to less costly labor markets, often to the same areas which these new arrivals had recently abandoned.

Advertisement

In the past twenty years the proportion of New Yorkers with incomes beneath the national median has increased from 36 percent to 49 percent. Between 1960 and 1970 a million or more middle-class taxpayers, including 600,000 Jews, had moved out. As the Sixties progressed the city’s remaining bourgeoisie was facing extinction as it struggled and fell in the damp embrace of fresh cement, in the transistorized roar of the ghetto and the rising cost of everything, especially the cost of privacy which once could have been had here almost for the asking but which had now increasingly become the privilege of the very rich, more isolated than ever in their midtown compound.

In 1960, 140 of the country’s 500 largest corporations had their headquarters here. By 1975, forty-four of them had left, including Borden, Texaco, Allied Chemical, and Nabisco. There are now some thirty million square feet of unrented office space in Manhattan. In 1975 permits to build only 4,400 new housing units were issued in the city, a decline of some 70 percent from the year before, which itself showed a decline of 30 percent from the year before that. The city which had lost some 250,000 housing units from 1960 to 1970 was losing them at the rate of more than 30,000 a year in the 1970s. The landlords say that the city’s rent control laws force them to abandon their properties because their arbitrarily restricted rental incomes can’t cover the rising cost of maintaining their buildings. Even so, according to The New York Times, controlled rents in the city have risen three times as fast as tenant incomes over the last five years. Building maintenance costs however have risen still faster.

The result is an impasse. To decontrol the city’s 640,000 controlled apartment will put thousands of needy tenants on the street unless the city itself pays the rent of those who can’t afford the higher rates, as it now pays the rent of its welfare dependents. To maintain controls will only increase the rate at which the landlords abandon their properties. In the last ten years the city’s subway system has lost 20 percent of its riders, the result partly of higher fares, but mostly of unemployment and decayed neighborhoods.

Since 1958 the city has lost more than 400,000 manufacturing jobs, a decline of some 40 percent which represents more than $3.5 billion in lost wages. In the year ending June 30, 1975, the city had lost 115,000 jobs in all categories. Employment was at its lowest level since 1950, the year that the city first kept such figures. Not only was the city itself, in effect, bankrupt; the bankruptcy rate for businesses and individuals in the Eastern District of New York, that is, the boroughs of Staten Island, Queens, and Brooklyn, as well as Long Island, increased last year by 72.7 percent against a national increase of 34.3 percent. Among the businesses that failed was the Silvercup Bakery, which had once supplied bread for the city schools. The schools now buy bread from bakers in Connecticut and New Jersey.

The city’s printing industry, which produced 18 percent of the nation’s printing output five years ago, now produces 12 percent. Since 1960 employment in the printing trades has fallen by a third. One reason for the drop, according to the city’s economic development administrator, is that in the 1960s an urban renewal project wiped out 110 printing companies in lower Manhattan.

One million one-hundred thousand New Yorkers are now on relief, many of them the grown children of parents who themselves spent their lives on welfare. Another 400,000 New Yorkers now depend upon the city’s $4 billion public payroll to support themselves and their families. Between 1960 and 1974 the number of city employees in New York for every 10,000 citizens increased by 69.9 percent and their average earnings in the same period rose by 129 percent. Of the twenty-four largest American cities only Washington, DC, has a higher proportion of public employees. One reason for the increase in personnel was the additional services required by the welfare immigrants. Another was that the city payroll had itself become a form of welfare for many of the city’s employees. Between 1961 and 1975 the city’s annual contribution to the municipal employee pension funds rose from $168 million to $973 million, by far the highest such increase for any American city.

Felix Rohatyn, the investment banker who contrived the city’s temporary rescue from insolvency last year, warned that “the pain is just beginning. New York will now have to undergo the most brutal kind of financial and fiscal exercise that any community in the country will ever have to face….” That Mr. Rohatyn more or less by himself kept the city from bankruptcy suggests the fragility of the institutional arrangements by which the city temporarily survives. That it took Mr. Rohatyn’s colleagues in the city’s banks until last spring to grasp the city’s plight suggests the obtuseness with which they had managed their affairs and the city’s all along. Not only had the bankers continued to advance expensive credit to their luckless client when even a waterfront loan shark would have called it quits; for years they had joined the city in backing the wrong horses: office towers that nobody wanted, shopping centers that ruined local merchants, housing schemes that are now tottering toward bankruptcy. Meanwhile, in their private councils, the banks drew red lines around the ghettos, agreeing to deny mortgages to those proscribed areas, no matter what the qualifications of individual borrowers. The ghettos soon collapsed, leaving it to the city’s hapless taxpayers to support their miserable inhabitants.

Advertisement

In retrospect history is a record of the inevitable, yet there is little in history that men cannot have done differently. New York’s decline is probably inseparable from a general crisis in capitalism, the same crisis that has affected Detroit, London, and Tokyo. More modestly it is a result of the recession of the early Seventies, and perhaps too of the gradual westward shift of the American population whose center by 1970 had drifted to the southwestern corner of Illinois. Obviously new technologies and cheaper labor markets have hurt New York’s industry. Fifty years ago most of the books published in New York were also printed here. It would be foolish to print them here now.

Yet the rows of unwanted office buildings, the ravaged neighborhoods with their abandoned apartments, the empty factories, the shoals of semiliterate dropouts, the bankruptcies are all partly the result of choices that turned out badly. It was not history alone that ordained the destruction of 110 printing companies in lower Manhattan or that destroyed hundreds of other businesses to build the World Trade Center with its floors of vacant offices or that legislated the welfare differentials that helped stimulate the huge migration from the South to the city’s red-lined ghettos or that built expensive apartments on an island in the East River so that the prospective tenants, if in fact there are any, will have to be lofted ashore by aerial tramway to do their shopping. (It costs about five times as much to create a new apartment in such projects as the one in the East River as it would to rehabilitate an apartment in much of the city’s old but still usable housing.)

New York is typical of the many old industrial cities that have lost jobs since World War II, but according to Herbert Bienstock, the New York regional director of the federal bureau of labor statistics, New York should have been less affected by changes in industrial patterns and by the recession than other cities. “The industrial structure of New York City, with relatively smaller concentrations of recessionsensitive, goods-producing industries, would suggest some greater relative strength during periods of general economic contraction,” he said. “Such strength was not in evidence during the recent period of national employment decline and subsequent recovery.” Between 1970 and 1972, for example, the median family income of New Yorkers decline by 3.5 percent in constant dollars.

Since 1969, when employment here was at its highest, New York has lost 500,000 jobs of all kinds, more than the total employment of Cincinnati or Kansas City. Between 1970 and 1973, when the country as a whole gained 7.6 million jobs, New York City should proportionately have gained 466,920. Instead it lost 200,000. That this happened suggests that forces beyond the ordinary vagaries of industrial devolution were at work here.

Amid the practical anarchy that characterized New York’s economy for more than a century no single industry or group of industries achieved the autonomy that the steel and aluminum makers, for example, enjoyed in Pittsburgh or that gave the auto makers absolute power over the fortunes of Detroit. New York, when it flourished, was never at the mercy of an industrial autocracy or the fortunes of a particular product. Even the huge apparel industry was split into so many competing units that its influence over the rest of the city was slight. It was this lack of a controlling center, according to Mr. Bienstock, that should have supplied New York’s resiliency. For Jane Jacobs and her followers it was this same anarchy that had always given New York’s economy its unique strength; that supplied the ferment in which one enterprise in New York bred another in the apparently random way that mutations occur in nature.

Thus New York’s financial industry helped spawn the specialized printing trades which produced its prospectuses; these printers in turn helped generate the skills that supported the city’s graphics and advertising industries, and these supported the complex network of writers and artists and agents and technicians that bred the city’s communications industries. New York’s economy was a demonstration of the principle that where there is enough genetic activity new forms of life are likely to emerge and the more adaptable of them will survive, producing new species and so on endlessly.

Within this wilderness of economic possibility there emerged, however, a dialectical exception. By 1961 New York employed more than 125,000 construction workers, a more numerous and far more highly paid industrial group than almost any other in the city, including the ladies’ garment workers. Moreover, the construction industry was a uniquely cohesive unit, politically and ethnically, dominated by a handful of politically connected contractors and their captive unions. Its links to the city’s financial and political leadership were evident at a hundred Waldorf banquets. The proof of its hegemony was broadcast on thousands of billboards announcing this or that new housing project or highway, usually financed in large part by federal funds and endorsed by the current mayor and his collection of city commissioners. Inevitably there evolved a coalition among the city’s building trades, the mortgage bankers, the investment houses, and the politicians. Nothing short of the city’s impending bankruptcy would inhibit it.

Much of the construction industry’s power over the city and its neighborhoods evolved from the various public authorities that emerged during the depression of the 1930s, particularly the autonomous agencies contrived by Robert Moses which raised huge sums for public works, usually through the sale of bonds guaranteed, as a rule, by the state treasury and marketed by the city’s investment banks. These agencies also brought federal funds into the city and state for the construction of public projects whose appeal to the city’s politicians was even greater than it was to the citizens themselves. Where the public saw a handsome new bridge or highway interchange, the politicians saw a Niagara of public money with which to employ loyal constituencies and at the same time reward themselves and their companions with multitudes of contracts, architectural commissions, condemnation awards, legal fees, and bureaucratic appointments.

At the same time the politicians could assure the taxpayers that these projects would cost the city little. The money came from Washington or from the sale of bonds whose burden would fall on future generations. The construction industry thus became for the city what aerospace was for the West and the South, the region’s major conduit for federal funds and a vehicle for the sale of securities, sponsored by various public treasuries, often in later years without the specific consent of the taxpayers who would eventually have to redeem them.

Within the city’s own political structure, the construction industry and its satellites became what the party clubhouses had been for earlier generations—a mechanism for distributing patronage to party workers and for infusing money throughout the political machine. That the industry also constructed buildings and highways was almost incidental, much as the care of the elderly became incidental in many of the city’s nursing homes under state and federal medical programs. The ghost within the machine was a system of political preferment and control more powerful than anything the city had known before. A century ago, William Marcy Tweed, a mayor whose crookedness was exceeded only by his intelligence, observed of New York that its “population is too hopelessly split up into races and factions to govern it under universal suffrage except by the bribery of patronage and corruption.” In our own time it was mainly the construction complex—the builders, the autonomous agencies, the federal and state bureaucracies, the banks—that generated the patronage, by which the politicians attempted to dominate the city’s “hopelessly split up races and factions.”

When New York first built its subways and its present water supply system, it did so with its own resources and through corporations responsible for their own profits. Though these projects supplied the usual opportunities for patronage, the results were useful public works from which the city still benefits. The wanton construction since the war, on the other hand, has produced public housing that has not only devastated existing neighborhoods but that has itself so deteriorated that much of it is now indistinguishable from the surrounding slums. New public hospitals stand empty while the hospital system as a whole remains 25 percent unused for lack of personnel. Expensive new highways are choked with traffic while mass transit languishes. Yet to criticize the works of New York’s builders was, in the 1960s, to criticize America itself and the imperial notions of progress that it promoted. The construction workers who attacked the antiwar demonstrators on Wall Street in 1970 were acting, as it turned out, not only on orders from Washington; they were supporting an absurd war which was yet another manifestation of the same berserk Keynesianism that was devastating the neighborhoods of their own city. Today the construction industry has shriveled, along with the city itself. Last year the city lost 30,000 construction jobs. Of the 75,000 jobs left in the industry, some 40,000 will probably disappear within the year. Like the ghetto leaders of the 1960s, the construction workers were the temporary and fortuitous beneficiaries of governmental programs that no longer interest the parties in power as much as they once did and for which there is no longer as much public support.

What remains in doubt are the city’s regenerative powers. In the 1920s the city’s Regional Plan Association, a group of high-minded bankers and real estate developers, advised that an expressway be built across lower Manhattan that would link the proposed Holland Tunnel with the Manhattan Bridge and thus supply a connection between New Jersey and Long Island. Nothing came of this scheme at the time. The plan was revived, however, by Robert Moses in the 1950s, but rejected by the Board of Estimate in response to public protests. The expressway which was to have crossed Manhattan at Broome Street would have destroyed what was still a thriving industrial neighborhood north of Canal Street. It would also have uprooted the city’s traditional Italian neighborhood that extends south from the lower reaches of Greenwich Village, and it would have jeopardized Chinatown, south of Canal Street, as well. The threat to the city’s living tissue was incalculable.

Apprehensive residents of the area soon recognized that the federally funded expressway was consistent with schemes to redevelop all of lower Manhattan from Greenwich Village to the Battery. Jane Jacobs, for example, observed that Robert Moses’s proposal for an extension of Fifth Avenue through Greenwich Village’s Washington Square Park was probably intended as the northern link to the new expressway, a link that would have destroyed hundreds of sturdy residences and countless businesses in its path.

The expressway’s main sponsor was the Downtown Lower Manhattan Association. Its leader was David Rockefeller, whose Chase Bank had just built a new headquarters in lower Manhattan. Among the other sponsors was the Port of New York Authority, an autonomous bi-state agency which was about to build its World Trade Center in the same area. Harry Van Arsdale, the leader of the city’s trade unionists, was another sponsor, and so was Peter Brennan, the head of the city’s construction workers who later became Nixon’s labor secretary. The American Automobile Association was another sponsor.

Among the expressway’s opponents was John Lindsay, then a Republican congressman who was running for mayor. Once he was elected, however, Lindsay became a supporter of the expressway, presumably in response to Mayor Tweed’s famous rule of city government. The inhabitants of the area were adamant in their opposition. They demonstrated. They protested to the feckless new mayor. They signed petitions and attended hearings, all to no avail. Anticipating the expressway, businesses closed down, factories moved away. Between the late Sixties and the early Seventies the area known as “The Valley,” which extends from 34th Street south to Canal, lost some 85,000 jobs. To quiet the expressway’s opponents the plans for the new road were altered. Instead of a surface highway the project’s sponsors would build a depressed highway and above it they would build a new school. This scheme was probably their undoing. An environmental study showed that students would be asphyxiated in their classrooms by fumes from the traffic below. One environmental study led to another and the expressway was eventually abandoned on the eve of Lindsay’s second campaign for mayor.

Along the western part of the route which the expressway was to have taken were several blocks of abandoned loft buildings, handsome, spacious structures, many of them a century old, with powerful façades of stone or iron. Soon artists driven southward by the redevelopment of Greenwich Village moved into these lofts, at first in violation of the city’s housing codes. Since the area was south of Houston Street, they named it SoHo. They opened galleries, restaurants, and bookstores, and they accomplished without having intended to what decades of urban renewal had failed to do. They restored a neighborhood and became its taxpayers. Though SoHo’s residents are mainly middle class and the area is anything but the industrial neighborhood that it once was, its revival suggests that the spontaneous generation which once characterized New York’s growth remains a possibility.

It was the abandonment of the expressway that led to SoHo’s revival and to the continuing vitality of the Italian and Chinese neighborhoods nearby, with their crowds of tourists, their innumerable shops and restaurants, their live poultry markets, their small manufacturing plants, and their surplus electronics and secondhand machinery dealers.

In the area to the south, however, which is now dominated by the two huge towers of the World Trade Center, the outcome was different. Here there were no traditional residential groups to oppose the vast renewal schemes that were proposed for the area in the early 1950s. Though some 550,000 people worked in the government offices, the financial center, and the wholesale markets south of Canal Street, almost no one lived there. The hundreds of small merchants, the radio and electronics dealers, the produce wholesalers who occupied the ancient Washington Market—New York’s equivalent to Les Halles—were easily overpowered by the downtown bankers and their companions at the Port Authority, the joint agency of New York and New Jersey which administers the bridges and tunnels that link the two states and whose access to the bond market through the tolls that it collects is practically limitless.

Here the same combination of forces—the Rockefeller bank, the Authority itself, the construction unions—that had been defeated earlier, now prevailed. The Authority’s plan was to build a trade center which would become the world’s largest office building, two towers of a hundred stories each. Inevitably it would replace the small commercial and manufacturing establishments that had traditionally occupied the area.

In the early 1960s the local businessmen sued the Port Authority, arguing, among other things, that since the vacancy rate in the city’s office buildings was already at 9 percent, there was no need for the Authority’s new towers. In 1966 the appellate court ruled against the merchants and by the end of that year some 400 commercial tenants left the area. The following summer the Authority opened bids for $100 million worth of construction. Most of these contracts and those that were to follow went to suppliers from outside the city—to Otis Elevator, Borg Warner, Pacific Car and Foundry, and so on. By December the estimated cost of the project had risen to $575 million. It would eventually go far higher, but the banks that handled the Authority’s bonds were happy to supply the money, given the security provided by the taxing power that the Authority had over the city’s commuters who used its tunnels and bridges.

The designation of the new buildings as a trade center was disingenuous. Under its charter the Port Authority is supposed to maintain the Hudson River crossings and promote the interests of the Port. It is not supposed to use its borrowing power to erect office towers. However by calling its new buildings a World Trade Center it could declare them a port facility. Had the Authority invested instead in mass transit it would not only have diluted the income from its bridge and tunnel tolls, it would have offended the banks that marketed its bonds. The banks had no interest in commuter railroads no matter how they might benefit the region and its taxpayers, and thus, in the long run, benefit the banks themselves. David Rockefeller and his Chase Bank were especially eager to have a neighboring office tower to accompany their new downtown headquarters. Typically the banks were wrong. The Trade Center would find it hard to attract tenants to its lifeless and remote area. Inevitably the taxpayers would pick up the bill for their mistake.

Meanwhile the vacancy rate in Manhattan’s existing office buildings had increased still further. As a precaution the Authority arranged to lease 1.9 million square feet of space in the new buildings to the State of New York. The state accepted the arrangement without seeking lower bids elsewhere. Thus the taxpayers were asked to pay twice for the Trade Center, once with their bridge and tunnel tolls and again with their state taxes. Since interest on the Authority’s bonds was tax exempt, and thus in effect subsidized by the public, the taxpayers were asked to make a third contribution to the project. And since the Trade Center does not pay normal real estate tax but makes what it calls “negotiated payments in lieu of taxes,” the taxpayers make yet a fourth contribution. How they were to benefit from the Trade Center was unclear.

The Trade Center was completed in 1972 and except for those floors occupied by the state much of it stands vacant. The New York Times reported that one of the foremen on the project earned $76,000 in overtime pay during the final year of construction. The area south of Canal Street has lost 50,000 jobs since 1968. Except for rush hour and at lunch time, a lunar quiet dominates the Trade Center and the streets around it.

Twenty years ago the area where the Trade Center now stands adjoined the old Washington Market, a chaotic jumble of stalls and ancient buildings which housed the city’s produce market. In 1959, as plans for the Trade Center were being completed, the city’s commissioner of markets announced that the Washington Market, which had served the city for more than a century, was now obsolete and would have to be vacated. The merchants who occupied it were told that they were being moved to a remote neck of land in the southeast Bronx called Hunts Point. The United States Department of Agriculture declared that the new market would save consumers $18 million a year and that it would be built at the geographical center of the city—a center that happened to be miles away from the actual centers where the restaurant keepers and grocers who patronized the produce market had their businesses. Meanwhile the city announced that it had received a federal grant to plan the old Washington Market area as a new complex of office buildings, warehouses, and factories.

By 1961 plans for the new Hunts Point Market were far advanced. So was its estimated cost which had risen from $22 million to $30 million. By the end of the year the Board of Estimate approved a plan to redevelop the old market area at a cost of $100 million and it condemned the existing buildings in which the merchants were still attempting to do business. A few months later the Board abandoned its original plan and approved a new one that would cost $150 million. Except for the demolition of the old buildings, nothing came of either plan. By 1965 the area was devastated, a few stubborn merchants still clinging to their stalls amid the wreckage.

The new Hunts Point Market opened in 1967 with about 150 merchants. It stands behind its grim security fence, a great gray hulk surrounded by the rubble left over from its construction. Since the city has ordered that no merchants can do business outside the boundaries of the market, the adjoining streets promise to remain dilapidated indefinitely. A year after the market was completed the city accepted a new proposal for the old Washington Market area. It was to cost $190 million and would include a community college, middle-income and luxury housing, and an industrial complex. Nothing came of it.

The merchants at the new complex now complain that it takes an extra day for fresh produce to reach consumers, that the new market is too expensive, and that doing business there is less convenient than it was in the old market. “Cheaper?” a radish merchant told a reporter. “It’s more dear. Downtown you had a customer for everything. You could get rid of it all there. Here you got to keep it till next morning. We should have what they waste here in a year.” A greens merchant agreed. It costs twice as much at the new market, he said. “Here you back a couple of trucks against the platform and the customers can’t get in.” Edgar Fabber, the city’s commissioner of Ports and Terminals, said of the new market, “I think it’s the best investment the city has made in the last twenty years.”

In fact the investment was unnecessary. Fifty years ago Americans ate 414 pounds of fresh produce a year. By 1971 they were eating only 239 pounds. In the last ten years deliveries of fresh produce have fallen by a fifth nationally. In New York City they have fallen by a third. The old Washington Market, for all its antiquity, could have accommodated this reduced volume as it slowly expired of obsolescence. Meanwhile it would have sustained the hundreds of downtown businesses that clustered around it, benefiting from the traffic that the market generated and serving its countless incidental requirements.

The abandonment of the Lower Manhattan Expressway and the regeneration of SoHo; the construction of the World Trade Center and the eerie necrosis of lower Manhattan; the failure of the myriad projects undertaken under the Federal Housing and Urban Development Act of 1966 to restore the city’s neighborhoods or to create new ones—these events hardly suggest that the current moratorium on capital spending will, in itself, assure the city’s future. The city’s problems are by now so complex that there may be no solution to them at all. Between 1965 and 1973 the city’s expenditures were increasing at a compound annual rate of 13.1 percent while its tax receipts were increasing at a rate of only 6.8 percent. By 1975 the city had used $1.5 billion in capital funds to meet its current expenses, while it was also incurring $4.5 billion in short term debt, an increase of 700 percent over 1967. For the fiscal year 1975-1976 the city has budgeted $1.784 billion for debt service, more than two and a half times what it spends as its share of direct welfare payments.

The construction complex was not in itself responsible for this disaster nor is New York the only city facing such problems. Yet the Trade Center and projects like it have probably hastened and intensified a decline that might, in other circumstances, have been less precipitous. Certainly the near bankruptcy of the various state construction agencies—particularly the Urban Development Corporation, whose impending collapse last year first alerted the bankers to the shakiness of the city and state generally—could have been avoided had the politicians been more cautious in their commitments to useless new building projects.

In retrospect it now seems clear that what the city needed during the past twenty years were not new office towers and highways, or even urban renewal and slum clearance programs; much less its surfeit of hospitals and such pompous and extravagant confections as the Urban Development Corporation’s Welfare Island middle-income housing project—what the politicians call at their ribbon-cutting ceremonies commitments to the city’s future. What the city needed instead were commitments to its difficult present and to what could be preserved from its vital past: for example, the abolition of rent control and the provision of rent subsidies to needy tenants, steps that would spare the landlords the impossible choice of subsidizing their tenants out of their own pockets or abandoning their buildings. The political objections to such additional public expenditures are obvious. But the cost to taxpayers would be far less than the cost of lost properties and the more egregious waste involved in supporting such agencies as UDC with public funds.

The few neighborhoods that survived or came back to life during the city’s decline—parts of the West 70s and 80s, SoHo, Bedford Stuyvesant, Park Slope—were the ones that more or less restored themselves, often house by house, block by block, usually with relatively small loans from local banks and state-financed mortgage guarantees, occasionally with foundation grants; or neighborhoods like Corona and the West Village that resisted the developers, often through years of litigation and public protest.

The industries that typically flourish here and may survive the city’s difficulties are similarly resistant to external discipline, self-governing, impulsive, polyglot, mysterious: the diamond market, the fashion and cosmetic trades, the restaurants, the investment banks themselves, the publishers, the port. New technologies, cheap labor, the myriad inconveniences of the city are not likely to make them abandon New York’s tolerant and complex environment. That so many corporate headquarters have left could have been predicted. New York is less amenable than most other places to corporate rationality, cost effectiveness, and the people who value such things, especially if they don’t need what the city can offer by way of specialized services and supplies, middlemen, craftsmen, or people with a talent for anticipating fashion.

New York will probably continue to lose its manufacturing jobs and with them the revenues to balance its budget. The city’s last two breweries are closing their plants and discharging some 1,100 workers. One of them is moving to Pennsylvania, the other is going to New Jersey where water, sewage, and electricity will cost the company $1.6 million less. Since the real cost of these utilities can hardly be much less twenty miles away in New Jersey than in Brooklyn, the brewer’s gain and the city’s loss actually amount to the value of the indirect taxes included in these utility charges. Where the city once exported goods, it now exports jobs—to Indiana and Tennessee where it makes the books that are published here; to rural New Jersey (where Women’s Wear Daily and this paper are now printed); to California where the television shows that New York produces are filmed, including “Kojak,” the series about a New York City detective; to garment plants in all parts of the world.

In the unaccustomed space provided by the decline of the building trades, new kinds of work may turn up here spontaneously, growing out of crevices in the city’s surface as they did in the past; but they are unlikely to replace many of the jobs or much of the income that the city is losing. The more likely prospect is for a continuing decline in industrial work, a reduced tax base, and higher rates for those who remain. Auditors assigned by the federal treasury to examine the city’s accounts have projected revenue losses of $571 million over the next three years. To meet its needs for 1976 alone the city must raise an additional $400 million. To balance its budget by 1978 it must cut its expenses by $1.6 billion over the three-year period, according to these auditors.

The misery that this implies for the city’s dependent poor is unimaginable. The Wall Street Journal complains from time to time that New York’s problems result from its excessive compassion for these people; but if New York’s poor were to depend upon the personal good will of their fellow citizens, they would probably starve here as readily as elsewhere. What the city pays its poor, it pays to keep them out of sight and under control. On a per capita basis it doesn’t pay much; less, for example, than Detroit, Chicago, and Philadelphia; more than Baltimore, Los Angeles, and Houston, adjusted in all cases for local variations in city, county, state, and federal contributions. Unlike most other cities New York pays about 30 percent of its welfare costs out of its own revenues, a matter of just over a billion dollars for 1976, which includes direct welfare payments as well as the cost of related social services.

Los Angeles, Chicago, Philadelphia, and many other cities handle welfare more easily; they derive their local welfare shares from a county-wide tax base. For years politicians and editorial writers have talked about extending New York’s archaic boundaries to include the suburbs within its taxing area. But the suburbs, which are afflicted by many of the city’s own problems, are less likely now than ever to agree to such a scheme.

Still more dim at the moment are the proposals for a national welfare system, for example a negative income tax or a guaranteed wage. Such proposals assume that welfare migrations are a national problem, not a local one. A federal assumption of welfare costs would, in itself, balance the budgets of New York and many other impoverished cities. A uniform federal welfare standard would also encourage the remigration of the unemployable urban poor to regions where they might live more cheaply. But these are likely to be the same regions which encouraged their departure to the cities in the first place. Their political opposition to a uniform national welfare standard can be depended upon.

When Daniel P. Moynihan, as Nixon’s first domestic affairs adviser, proposed a national welfare program he was attacked by conservatives who thought the scheme would give the poor too much, while many liberals thought it would give them too little. Nixon himself, whose support for the proposal was never strong, finally abandoned it. Moynihan was soon replaced by John Ehrlichman. Who would now revive his Family Assistance Plan? The constituencies that might benefit from it seem weaker then they were when Moynihan first proposed his plan. Its opponents are stronger. The prevailing wisdom is that New York and the other old Eastern cities are finished anyway. The country’s future has shifted westward, to the sunbelt. As New York once carelessly discarded its own marginal neighborhoods, so America may have decided that New York itself can now be junked.

Meanwhile, the poor seem to suffer more or less passively. Their mayhem affects mainly themselves. For all the terror they are said to inspire, the tourist trade flourishes, perhaps for the same reason that it does in Pompeii, but more likely because New York, for all its misery, remains uniquely exhilarating. The restaurants are busy. Hotel rooms are scarce. Cabarets and theaters thrive. Eight new musicals are scheduled to open by spring. Ballet is everywhere. Three and a quarter million visitors came here last year. Wistful champions of the city’s well-being contemplate the hordes of tourists and urge that casino gambling be legalized here. Las Vegas showed a profit of a billion dollars last year. New York, they say, can do still better.

In the short run the city’s financial problems are unthinkable. How the city will cut its expenses by $1.6 billion by 1978 remains the mayor’s secret. Like his fellow citizens he probably expects that something will turn up.

Meanwhile, with the defection of the banks and other traditional markets for its securities, New York now depends upon its public employees’ pension funds to buy its dubious bonds. It is a desperate solution, for the undercapitalized pension funds depend in turn upon the city’s annual contribution of $1.25 billion for their own solvency. It is a case of two brave old marathon dancers, each holding the other up, with long days and nights of shuffling still to go.

The prospect is dark, but cities don’t die easily, much less a city like New York. A Japanese jeweler has just signed the most expensive commercial lease in the city’s history for his new shop on Fifth Avenue. The builders report a strong market for luxury housing and are planning a few new buildings. The ghettos are for the moment “quiet,” at least for those who don’t go there. The Port Authority wants to build a new convention center at the bottom of Manhattan to stimulate its moribund Trade Center and justify its construction of a new hotel in that desolate area. Since the hotels, theaters, and restaurants are in midtown and transportation between the two places is almost impossible except by the dilapidated and dangerous West Side subway, the Authority’s proposal is more than normally batty. It may also be illegal, since the Authority’s charter makes no provision for building a convention center. That even The New York Times has found the wit to oppose the Authority’s plan and urges a midtown site for the convention center instead offers another grain of hope. Who knows? We may survive. It’s hard to imagine how, but it’s harder to imagine that we won’t.

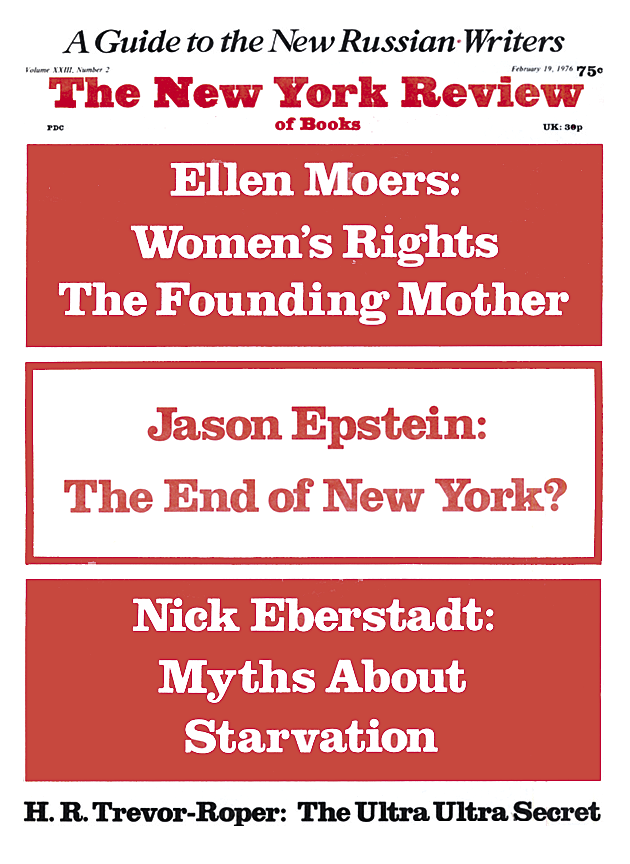

This Issue

February 19, 1976