“There is something in the American character,” said Jefferson to his daughter as she struggled with her studies, “that regards nothing as desperate.” Thus he observed, whether with irony or admiration is unclear, the essence of a religion that would later be called Americanism; a religion that finds nothing tragic in human endeavor, for which evil is always external, for which thoughts are the same as things, and which regards despair as the ultimate sin. So Jefferson anticipated our glory and our folly to the present day as President Carter promises a politics of love and justice, together with a balanced budget, full employment, and a chastened bureaucracy, while Americans by the millions trample the accelerators of their jumbo cars as if the fossilized forests had been as vast as their own zealous optimism.

Michael Harrington is a leading American socialist who shares this native optimism. Though he feels that capitalism has already settled into its grave, a second coming is on the way. “That human life will be radically transformed in the medium range of the future cannot be questioned any longer,” he writes with prophetic conviction. The only question left is whether this “collectivist society which is emerging even now [will] repress or liberate men and women.” To this discouraging question he supplies what he takes to be a hopeful answer. “If the spirit of the new Karl Marx [is] our companion in the struggle,” liberty will probably prevail.

What he means by the “new Karl Marx” is the subject of his current book, a book that has less to do with economics, as one might suppose from its title, than with theology. The premises of The Twilight of Capitalism are that Marx lives and that human freedom depends upon understanding his true gospel, a gospel much mangled by his vulgar apostates. “Before Marx can be restored to the future,” Harrington writes, “he must be rescued from a murky past.” The first half of his book he devotes to this project. These pages are in effect an anthology of Marxian writings in the form of a dialogue between Harrington and such contemporary Marxists as Louis Althusser, Jurgen Habermas, and Herbert Marcuse, among others, and their aim is to “rescue” Marx from the “murky past” of Stalinism and its vulgar materialism.

For readers who like to follow scholastic arguments over the meanings of disputed texts, these pages may have much to offer. But for readers interested, as Marx himself was, in the actual problems of contemporary capitalism—in the declining rate of profit, for example, or inflation, or in limited resources and the outlook for rational planning under such difficult circumstances as prevail in the industrial countries, whether capitalist or socialist, The Twilight of Capitalism offers little that is original.

The second half of his book Harrington calls “The Secret History of the Contemporary Crisis.” In these chapters he promises to show that modern capitalism “can be understood only [sic] in the light of the themes developed by Karl Marx in Das Kapital.” In fact, Harrington’s analysis in these chapters can be understood in the light of nothing more subtle than conventional left liberalism. “The energy crisis of the seventies,” for example, “resulted from a generation of government policy that followed or subsidized corporate priorities”; or “under welfare capitalism…the state socializes more and more capital costs, but the private sector continues to appropriate the profits.” It was hardly necessary for Harrington to have labored so over his Marxian texts in the first half of his book in order to show in the second that the Vanderbilts made off with the profits while the tax-payers paid for the railroads, just as the Vanderbilts’ descendants enjoy tax shelters while the rest of us pay for subsidized housing.

The Marx that Harrington invokes in Part I of his book is not, of course, the one whose bearded scowl hangs over the squares of Moscow and Peking. Nor is he the grim Marx who wrote in his Forward [as Harrington spells it] to the Critique of Political Economy that the “mode of production of material life determines the social, political and spiritual life process in general,” that consciousness—how people feel and act—is determined by material conditions and not the other way around. For Harrington, as for many other Western Marxists, this crude determinism greatly distorts what Marx in his later writings really meant or what modern liberal socialists would like him to have meant. It ignores, for example, the part that human will plays in determining events.

What Harrington prefers to this early Marxian formula is a Marxism in which causality is reciprocal, in which material and immaterial factors are related to one another “organically” in an “atmosphere” which “bathes but does not predetermine every relationship within it.” What it means for an atmosphere to bathe a relationship is unclear, though the distinction that Harrington seems to be making is analogous, in his view, to the difference between the rigidly determined universe of Newtonian mechanics in which each atom bends to a universal law—where everything is seen from a single point of view—and the indeterminate world of modern science, with its ambiguous quanta, its concern with paradigms and its principle of uncertainty: between a totalitarian universe and a liberal one or between the single-minded certainties of Stalin—“the supreme scientist who deciphered the inexorable laws of history”—and the dilemmas of the modern welfare state. “Einstein,” Harrington writes, “put the matter succinctly…. ‘It is,’ he said, ‘the theory which decides what we observe.’ ”

Advertisement

Though Harrington promises to show “that the successor to capitalism will be based on conscious economic planning…and that it could take the socialist form that Marx looked for,” his preference for uncertainty probably explains his reluctance in this book to connect his Marxist “paradigm” with socialist practice as it might be applied in the everyday world. He tells us nothing, for example, about how to legislate the redistribution of wealth within a democratic society or how to achieve working-class autonomy without alienating the flow of capital in the meantime or how to meet working-class demands when those demands have already been “bathed” by the capitalist “atmosphere.” A book on the decline of capitalism might have said more about what is actually happening in the world or how the collectivist society that Harrington foresees can accommodate liberty, to say nothing of its own material needs, no matter which version of Marx one reads.

Though Harrington finds many passages in Marx’s writings to support his “paradigm” of a new, relativistic, and “organic” Marx, a passage that seems to impress him more than almost any other comes not from Marx at all. “All social life is a fabric of tightly woven threads,” this passage begins. “The change of which the corporation is the driving force is a complex process in which many things are altered at the same time and in which cause becomes consequence and cause again. No description is uniquely correct; much depends on where one breaks into the matrix.”

According to Harrington, this is a “brilliant” statement of what Marx meant by causality, a pluralist outlook which allows for no single interpretation of the historical process and thus for no single interpreter. The passage is from J.K. Galbraith and it suggests what Harrington is trying to prove in this book: that his evangelical Marxism is consistent with democratic socialism. What Harrington fails to show, however, is that democratic socialism is consistent with the actual world of scarce resources, high unemployment, ardent nationalism, and concentrated economic power, or that collectivism, with or without the “new Marx,” is compatible with anything but despotism. He is content simply to assert that “the welfare state is an arena of struggle that is normally and systematically biased in favor of the powers that be, but in which gains can be made by the left…. The popular forces, if they are massively and effectively mobilized, can make incremental gains of considerable value.” This cheerful truism is Harrington’s thesis, an article of faith that belongs to the American tradition of left liberal populism far more than it does to Karl Marx.

Peter Drucker, whom Fortune has called a “writer of great brilliance,” and whose book on management is “momentous” according to Business Week, has written a new book in which he not only agrees with Harrington that socialism and democracy are compatible but that the United States has already become a socialist country. So congenial, in fact, is American democracy to Marxian socialism that this profound development has had only a “trivial” effect on the American system, so “trivial” that hardly anyone but Drucker himself has noticed this “Unseen Revolution.”

What he means is that by the end of 1974 about 30 percent of the stock market had been bought up by institutional investors on behalf of employees’ pension funds and that within a few years these funds will own more than half the shares in the American industrial economy. According to Drucker, “the means of production, that is the American economy (except for agriculture) is [sic] already being run for the benefit of the country’s employees.” This is something new indeed, but whether the result is socialism and whether the country’s employees are really the beneficiaries are assertions that Drucker doesn’t bother to prove and which he may not really believe.

What he does believe is that he has identified a greatly expanded American rentier class consisting of retired employees in whose interest he can once more defend American corporate practice as he has done in his many previous books on the subject. But this new rentier class is not quite so extensive as Drucker implies by his claim that “the means of production” are “already being run for the benefit of the country’s employees.” By 1973, according to Drucker’s own estimate, only some 50 million employees out of an employed work force of some 85 to 90 million belonged to pension funds. By 1985, Drucker thinks, about 65 million employees will be covered, but this will still leave between 20 and 25 million employees without pension benefits. What is worse, about 17 percent of employed workers are covered by union pension funds or by funds run by state and municipal governments, and these, in Drucker’s view, are “in deep trouble and both are badly in need of reform.” Worse yet, “one fifth to one quarter of the labor force members will [retire] with only social security. If they get any retirement income from other sources it will be too little to make any difference.”

Advertisement

In Drucker’s socialist America, those workers who had poorly paying jobs or were only intermittently employed—for example, a great many women—will barely subsist. Finally, about one tenth of those who reach retirement age will have “no benefits at all.” Welfare clients, self-employed craftsmen, small businessmen, artists who could not afford to provide for their own retirement will “get nothing or next to nothing.” For workers in these categories “pension fund socialism” will be quite indistinguishable from capitalism at its most brutal.

Astute readers will quickly see that in other respects too Drucker’s pension fund socialism is much the same as capitalism. According to Drucker, this new socialism is likely to generate a characteristically capitalist class struggle between pensioned employees interested in increased corporate earnings and currently employed workers interested in maximizing their present incomes regardless of earnings per share.

Furthermore, according to Drucker, by the late 1980s the population as a whole will have matured to the point where pension funds will no longer produce surpluses to be invested in the American economy but will have to pay out more than they can expect to take in from employees on the job. The result, in Drucker’s opinion, will be a severe capital shortage, one that will endanger the assets on which the new American rentier class of retired employees depends for its subsistence. Drucker’s answer to this problem is “the abolition or sharp reduction of the tax on capital formation, that is, the corporate income tax.”

A still worse drain on capital formation is the demands of “the very poor and the disadvantaged blacks for equality at the expense of efficiency.” These demands are economically intolerable under Drucker’s socialism. They are also morally intolerable. “Inequality,” he writes, “whether based on rank, wealth, birth, priestly function or learning…is proper, just, natural and indeed necessary.” If Harrington’s Karl Marx is really Professor Galbraith, Drucker’s is Ronald Reagan.

Much of Drucker’s disingenuousness in this book can be understood as the sort of torpid whimsy that high-priced business consultants concoct to amuse their clients—in the present case an exercise in late Hapsburg black humor, Drucker being a relic of that quaint epoch. But there is another, quite alarming, question which Drucker’s book inadvertently raises that can’t so easily be dismissed.

According to Drucker, those employees who own the means of production through their pension funds are at a serious disadvantage compared to investors who buy and sell securities on their own, for “they cannot act rationally in their own interest. They cannot control the business management of their own pension funds, even though they are the owners.” Like so many rentiers before them, they are at the mercy of their stewards, in this case institutional investors who dispose of the pension fund assets entrusted to them without consulting their true owners. Drucker estimates that by the end of 1974 these stewards had invested about $150 billion on behalf of their clients in corporate shares. It is this investment, according to Drucker, that has resulted in the ownership of 30 percent of the means of production by America’s employees.

Drucker also estimates that pension fund assets have doubled every five years for the past quarter century and that 70 percent of these assets have been invested in corporate shares. If these assumptions are true it is reasonable to conclude that between 1964 and the end of 1974 the funds acquired considerably more than $100 billion worth of corporate stock. What Drucker doesn’t add, however, is that despite these enormous purchases over the relatively short period of a decade, the Dow Jones Industrial Averages for 1974 reached a high of 891.66, a fraction of a point beneath the high ten years earlier when the Dow stood at 891.77. For the entire decade the Dow reached a high of 1051.50. In the same period the consumer price index rose by more than 65 percent so that in constant dollars the employee pension funds invested in the market lost nearly two thirds of their purchasing power, assuming that the Dow is a reasonable measure of the market, the CPI a reasonable measure of inflation,1 and that the institutional investors did about as well as the Dow itself.

That the market failed to rise in keeping with prices generally despite this huge institutional investment can be explained only on the assumption that while billions of pensioner dollars were going into the market, comparable sums were being withdrawn from the market by individual investors who, unlike Drucker’s pension fund socialists, could and did “act rationally in their own interest.” What seems actually to have happened is not the triumph of pension fund socialism but the use of employee pension funds to prop the market up while much of the smart money got out more or less intact. Drucker rejoices in the fact that though these pension funds are “collectivized,” as are “the employing institutions themselves,” they remain “private” in the sense that they are “non-governmental.” But from the point of view of the poor pensioners, private enterprise seems to have done them in as effectively as it seems to have done in the public employees of the City of New York who have also become through the purchase of city bonds on their behalf the unwitting part owners of an economy whose former proprietors are trying energetically to abandon it. No wonder so little controversy has accompanied Drucker’s silent revolution.

During the same ten-year period in which the employee pension funds were buying up so large an interest in American industry, how good an investment was the American industrial economy as a whole? One answer has been suggested by Professor William D. Nordhaus of Yale (and now a member of President Carter’s Council of Economic Advisers) in a Brookings study published in 1974 on the profitability of American industry in the postwar period.2 Nordhaus’s calculations are elaborate but they can be translated as an attempt to answer this question: how much yearly profit would an investor have made during this period if at the start of each year he had raised the money to buy all of America’s factories, mines, transport systems, patents, etc.; everything, in other words, but its farms and financial institutions? What would the rate of this hypothetical investor’s return have been on such an investment, allowing for the interest rates he paid, the depreciation of his plant and inventories, inflation, and so on?

For the period 1964 to 1973 (which is as far as Nordhaus’s figures go) this investor would have seen the after-tax return on his investment decline from 9.1 percent to 5.4 percent, a drop of some 40 percent, even though 1973, according to Nordhaus, was a year of “booming profits.” (See his Table 5 reprinted here.)

Table 5. Genuine and Nominal Rates of Return on

Nonfinancial Corporate Capital, and Tax Rates, 1948-73

For 1974 Nordhaus expected the rate of return on invested capital to drop still further, despite the “breathtaking” profits expected for energy companies in that first year of the oil crisis. (Pre-tax profits during the 1964-1973 period declined by about a third.) By the end of the period, if Nordhaus’s figures are correct, a rational investor acting in his own interest would, and probably did, prefer to leave his money anywhere but in the declining shares of large American industrial companies, provided he could find a ready buyer to bail him out.

For many such investors the purchase of their shares by pension funds seems to have been a providential way out of this dilemma. The passivity with which the funded employees have accepted this bargain suggests that there is indeed “something in the American character that regards nothing as desperate,” just as Harrington finds nothing desperate in the prospect for equitable redistribution in an economy which, according to Professor Nordhaus, finds it increasingly difficult to provide for its rentier class, to say nothing of its poor.

This reluctance to face the likely impact of what appears to be a crisis in industrial society whether from Nordhaus’s ideologically neutral point of view or from the point of view of Harrington’s socialism or Drucker’s corporatism (Drucker also foresees a severe capital shortage by the 1980s) can be explained only as an act of faith, a pious regression to formulas and assumptions that belong to the age that celebrated industrial progress as an unmixed and inevitable blessing and whose ideology was confirmed by the New World’s seemingly endless resources. These resources could, one believed, be transformed by human will to produce whatever version of utopia one chose; for socialists eventual equality through social ownership, and for capitalists security for those who adapted best to the conditions of survival. This faith in industrial progress and its political counterpart, in the ideals respectively of working-class autonomy or of a free market which guarantees free institutions generally, no longer has much basis in fact, nor is it necessary to read Karl Marx or the subtle computations of Brookings economists to sense what has happened.

Well before the energy crisis emerged, our increasingly collectivized industrial system had begun to show signs of strain, whether by Nordhaus’s measure of declining profits or by one’s own perception of the constantly rising cost of an extravagant standard of living whose average quality was steadily declining—a decline that could be seen in the collapse of neighborhoods, the wreckage of the natural environment, and the compulsive production of generally useless and increasingly expensive goods while real needs went unmet.

Fifteen years ago Jane Jacobs and Paul Goodman among others noticed that whereas industrial society had once thrived by inventing profitable solutions to problems that had traditionally obstructed human welfare, now the industrial system had itself become such an obstruction as it became centralized, unresponsive, and mandarin; wasteful, dangerous, and beyond human scale. By 1966 the inefficiency and extravagance of the system, sharply heightened by Johnson’s Vietnam deficit, $10 billion of which was deliberately concealed, made the energy crisis of the Seventies all the more likely as the oil producing countries wondered at last why they should allow this profligate system to continue exploiting their limited patrimony at bargain prices.

In such circumstances appeals to the ideological orthodoxies appropriate to an earlier stage of industrial development are in effect prayers for endless oil or for nuclear reactors that give off no radiation or for coal that leaves no waste or for solar energy that can be produced without enormous reallocations of capital. The problem that really confronts us is to undertake whatever new technologies there may be which will supply enough energy to maintain an acceptable standard of living and at the same time sustain life itself for the developed as well as the undeveloped world. What is depressing is that we are obliged to depend upon an archaic, collectivized, and unresponsive industrial system to provide this solution.

We appear to be in a situation not unlike that of the inhabitants of the great river valleys of the ancient world whose economies also came to depend upon an unreliable natural resource and who inevitably fell under those despotisms that organized and financed the dams and canals by which their collectivized cultures marginally survived. The difference between them and us in the West is that we have arrived at our impasse with established habits of individual liberty and a recklessly high standard of living. No wonder we look away and continue to practice a jejune optimism, whether of the left or right, as our national religion.

Among the most cheerful of these believers are the economists themselves. Professor Nordhaus, for example, has calculated not only what a hypothetical investor would have earned on his investment each year since World War II had he bought up the American industrial economy as a whole, he has also calculated what such an investor would have had to pay in interest on the money he borrowed to buy the industrial economy in the first place. What he wants to find out is the relation of the cost of this capital to total corporate income—how much of the total industrial pie, to use the bakery metaphor favored by economists, goes to bankers and other sources of capital. This is a complicated calculation since it involves a number of variable factors including federal tax policy with respect to investment capital and so on; but what Nordhaus finds is that the proportion of total corporate income earned by money-lenders has also fallen “more or less continuous[ly],” since World War II.

Nordhaus’s explanation of this situation is curious. The decline in interest as a share of total corporate income, he says, is the result of a “fall in the cost of capital.” In other words, finance capital has earned less because money-lenders decided to charge lower rates of interest to industrial borrowers. But this conclusion appears to be a tautology, since the falling cost of capital is itself the problem and cannot, therefore, be its own cause. What one really wants to know is why the bankers settled for less and less since World War II and whether there is a connection between this phenomenon and the falling rate of return on invested capital—whether the bankers are getting a smaller share of corporate income because corporate earnings, in relation to aggregate investment, have themselves shrunk. Is it possible, for example, that industrial investors, apprehensive of poor results, have become increasingly reluctant over the years to borrow capital to expand their businesses so that the supply of capital has tended to exceed demand for the period of Nordhaus’s study, with the result that the cost of capital has fallen accordingly?

Is it possible, in other words, that the real reason for the declining cost of capital is that the industrial system as a whole has grown less efficient—that capital, management, and labor (whose real wage has not increased either) are all getting less because American industry has been wasting their respective efforts in enterprises that make less and less profit, as Nordhaus’s calculations of aggregate return suggest? Only the tax collector, according to Nordhaus, seems to have increased his share of aggregate income since World War II.

For this gloomy situation Nordhaus seems determined to find a cheerful explanation. The main reason he gives for the declining cost of capital is “the dissipation among investors of the fear of another Great Depression,” and thus their willingness to risk their money at lower rates. But why, if this is so, hasn’t the law of supply and demand driven the rates back up? Why haven’t industrial borrowers rushed to take advantage of these lower rates and in their enthusiasm so depleted the supplies of cheap capital as to force the cost of money higher? That Nordhaus connects the falling cost of capital to the mental state of bankers and not to falling rates of industrial profits suggests that he too prefers to regard nothing as desperate and, in the American style, has confused thoughts with things.

What seems more likely is that the continuously falling share of the industrial pie earned by capital reflects not the confidence of lenders but the fears of borrowers, the same fears perhaps that led the proprietors of the American industrial economy during the Sixties and early Seventies to accept the transfer of so much of their ownership of the means of production from their own accounts to those of the employee pension funds.

Recently, such fears have become explicit with the reluctance of industrial borrowers to increase their debt no matter how seductively low the lending rate has fallen.

“To go into debt, businessmen will need to see a change in the economic climate, a real pick up in business which we have not got right now,” said Irving Kellner, an economist with the Manufacturers Hanover Trust Company, as he tried a few months ago to explain the economic “pause” in which manufacturers chose not to increase their inventories or add to their plant despite the sharply reduced prime lending rate. In the last quarter of 1976 investment in plant and equipment was only 3 percent above the level to which it had fallen at the low point of the recession of 1975. The normal post-recession gain since World War II has been 10 percent, according to The New York Times, and, allowing for inflation, the current lag is still worse than the 3 percent rate suggests.

Meanwhile, the Wall Street Journal, quoting a Commerce Department survey, predicts sharply reduced capital spending in the first half of 1977. Spending growth will amount to 1.2 percent in the first quarter and 1.5 percent in the second, as against an estimated real rate of 3.5 percent throughout 1976. For the Western industrial world as a whole, including Japan, OECD expects real gross product to decline from the 5 percent rate of 1976 to 3.75 percent in 1977. In Western Europe OECD expects the rate to fall to 2.5 percent in the first half and 2.25 percent in the second. An editorial writer for The New York Times, commenting on these estimates, urges that the United States, West Germany, and Japan “aim for faster growth with new policies of stimulation,” but typically this writer doesn’t say what these policies should be or why they should work. Perhaps he means still lower interest rates than those that have so far failed to attract business investors.

Even so sanguine a capitalist as Alan Greenspan, the acolyte of Ayn Rand, is worried that “long-term investment by industry in capital goods has been growing at a slower rate than anticipated,” a tendency “not limited to the United States.” The problem, he thinks, is “a lack of confidence by investors in long-range prospects for the economy. There is a perceptible dampening in the inclination of private business to commit itself to very long projects.”3

The accumulation within the American economy of unwanted capital, like the accumulation of seven and a half million unwanted workers—to say nothing of those armies of Americans who are not classified as workers at all—together with the gift, as Drucker sees it, of the means of production to America’s future pensioners—a gift which these employees have actually if unintentionally bought with their own wages—raises the possibility that capital and labor may eventually no longer be profitably invested in our industrial economy at all: that Professor Nordhaus’s calculations of return on capital may one day reach the vanishing point.

It is from this perspective that the recent book by Arthur Okun, the former chairman of President Johnson’s Council of Economic Advisers—and now a senior fellow at the Brookings Institution—seems an ultimate expression of that credo quia absurdum which Jefferson originally pointed out to his daughter.

Okun claims to occupy a middle ground between the socialist goal of redistribution and the commitment to maximum corporate investment at the expense of economic equality that Drucker, for example, advocates. He imagines a “trade-off” between money spent on support for the poor and money invested in further production; between greater “equality,” to use his terms, and greater “efficiency.” Though he favors equality in principle he also feels that “carving the pie into equal slices would shrink the size of the pie,” that is, equal distribution would leave too little for reinvestment just as a corporation would soon go out of business if it distributed all its earnings as dividends and left none for investment in new plant. Drucker quotes with approval Okun’s relative preference for efficiency and shares his assumption that capital invested in production necessarily produces a proportionate profit.

Okun further assumes that “more is better,” regardless of what “more” includes. Capital invested in “more whiskey, more cigarettes and more big cars,” rather than in attempts to improve the condition of the poor, is still capital spent in the interest of efficiency—baking a larger pie from which rich and poor alike will ultimately benefit. Harrington chides Okun for this choice, but Okun defends himself “without apology.” “It is my choice and I hope [it] is accepted as reasonably rational.” He also defends without apology his view that “more is better,” even though “some warn that economic growth that generates more output today may plunder the earth of its resources and make for lower standards of living in the future.”

But Okun’s assumptions are rational only on the theory that capital invested—whether in more cigarettes and larger cancer wards or more whiskey, bigger cars, and larger accident wards—necessarily returns an appropriate profit or other economic benefit. If Nordhaus’s figures are correct, then Okun’s assumptions need to be examined further since it is anything but clear, as any businessman knows, that investment and reward are necessarily positively related. Nordhaus’s “surprising conclusion” is that there was an “absence of ‘net’ profitability in the corporate sector during this period; that is, price was just sufficient to cover all costs including the cost of capital.”

As for the “basic facts,” Nordhaus writes, they “are not in dispute. Over the postwar period the share of measured earnings has declined in a dramatic way.” “What happened,” he asks, “to all the oligopoly profits earned by automobile and steel companies, and where were the rents to important inventions earned by computer, electronics, and other high-technology firms? The conclusion must be that whatever super-normal and monopoly profits or returns to technology accrued were offset by inefficient firms or perhaps by firms concerned with ‘managerial objectives’ and nonprice competition.”

Okun, in his defense of a free market-place, quotes Trotsky, who said, “In a country where the sole employer is the State opposition means death by slow starvation. The old principle, who does not work shall not eat, has been replaced by a new one: who does not obey shall not eat.” But Okun ignores the extent to which all industrial economies have become increasingly collectivized while the areas in which a free market still functions have become increasingly marginal, a phenomenon which, in the postwar period, coincides with Nordhaus’s “dramatic” decline in the “share of measured earnings.” The possible connection between these events is something that economists might well ponder. The worldwide network of interlocked industrial hierarchies is itself now a kind of collective super state—one that Trotsky never dreamed of—and one whose effects many economists, including those discussed in this article, still fail to acknowledge as they argue over issues whose substance exists largely in memory.

In the world dominated by this collective super state, those who don’t obey risk going hungry, but those who do obey may also slowly starve as the industrial system grows increasingly inefficient while leaving room for fewer and fewer alternative enterprises. Socialists and capitalists alike might now ask themselves how this rigid system already beset by declining returns on investment can hereafter cope with the impact on all its activities—from the production of food to the defense of its environment—of the gradual exhaustion of conventional energy supplies. It was Marx’s idea that declining industrial profit within an increasingly collectivized capitalist economy was a precondition for the socialist millennium. Such illusions are no longer possible. Declining profits and collective industrial organization now confront us with a different, more brutal, crisis, one for which no happy outcome seems likely.

The reality that now bears down on us is the more or less immediate need to reawaken the creative powers that generated our industrial economy in the first place and to apply these powers to the development and use of new sources of energy. What makes this task difficult is that the present industrial system and its ideologies now seem to be the major obstacles in the way of such a new awakening.

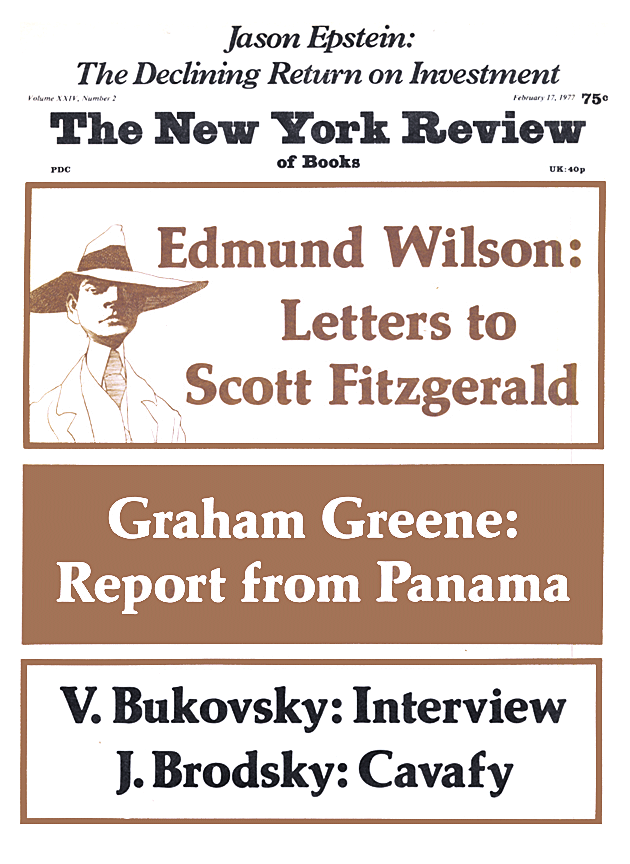

This Issue

February 17, 1977

-

1

The Consumer Price Index stood at 78.8 at the end of 1963. By the end of 1974 it had reached 132.6. ↩

-

2

“The Falling Share of Profits,” in Brookings Papers on Economic Activity, vol. 1, 1974, edited by Arthur M. Okun and George L. Perry, pp. 169-208. ↩

-

3

A year ago some of these same experts were complaining not of unwanted capital and reluctant borrowers but of a capital shortage and reluctant lenders. The distinction is actually a matter of perspective. For the capitalization of high-yield gold mines or offshore oil deposits or gambling casinos there will seldom be reluctant lenders or apprehensive borrowers. For a marginally profitable industrial economy there will usually be plenty of both. Complaints of a capital shortage or of a scarcity of borrowers are usually accompanied by appeals from bankers and businessmen for lower corporate taxes or lower federal discount rates or occasionally for direct federal loan guarantees to such chronically unprofitable firms as Lockheed and General Dynamics. Such appeals for federal subsidies to corporate profits are generally accompanied by requests that federal environmental standards be reduced or abandoned. ↩