Martin Mayer’s tale begins back in the happy days of Good King Ike, when Americans coursed about the globe, displaying the contents of their wallets with the same pride and to the same effect as the sons of that earlier imperial republic used to tell foreigners in their own capitals, “civis romanus sum.” Our guns were respected but our money was venerated. It was the Almighty Dollar in a manner no one much younger than forty can believe, but which Mayer tries to depict by giving some of the underlying numbers which made our currency so strong:

…with only 5 percent of the world’s population, the United States had 40 percent of its total industrial output. More than half the world’s entire production of petroleum was American, and half its production of motor vehicles. Exports were only 5 percent and imports only 4 percent of national income…. But 20 percent of all world exports and 15 percent of all world imports were American.

In short, behold the country John Connally and George Bush and Teddy Kennedy think they still live in, a nation which needed nothing from abroad, made most of what was worth making and, being next to absolutely independent, had no particular need to sell what it made to someone else. The dollar was worth so much because it was issued by the government of the one society in the world that had a lot to sell. It was a claim on goods chunking out of the factories right then, actually on the shelves of the stores, even as the dollar’s owner could feel the thick durability of its paper, so in contrast to the trashy material upon which inferior nations printed their treasury notes. Boy, were we smug.

This book takes us from those proud times to our own era, wherein Walter Cronkite tells us nightly how the greenback is being despised in Tokyo, spurned in London, and laughed at in Bonn. In the aggregate, it tells us that if the dollar fetches so few deutsche marks now, it is because of twenty years of increasingly blunderous mistakes by presidents, Treasury and Federal Reserve officials. There are qualifying statements and sentences and paragraphs to be picked out here and there which argue in other ways, but the force of the book, its main direction, is to make one think that, had our international financial affairs been handled more capably, American tourists would not find Parisian hotels prohibitively expensive.

American stay-at-homes are finding New York hotels prohibitively expensive and for that you can’t blame the mistakes of our financial diplomats at under-reported international meetings in Basel. But Martin Mayer does—sort of. He is too knowing and too sensible a man to put all the onus of US inflation—the fate of the domestic dollar—on the deals European central bankers cut with the Treasury; but this unavoidably is one implication of a book which devotes most of its pages to chronicling those deals.

In the book’s last chapter, he gets down to basic causes, as he sees them:

The erosion of the dollar abroad has the same causes as the erosion of productivity at home. The cost of overregulation and of taxing the efficient to subsidize the inefficient are felt not only in domestic inflation but in an internationally depreciating currency…. What has gone wrong is a generation of neglect of the need for investment, the use of governmental process to achieve public purpose by imposing unacknowledged private costs, a willingness (nay, eagerness) in the academic and political community to beat down what Keynes described as “the animal high spirits of businessmen,” and an abuse of the regulatory agencies by interest groups (especially supposed “public interest groups”) seeking to use them to achieve missions far removed from their established purposes.

This angry sibilance from the normally temperate Mayer goes by the name, in fashionable Republican circles, of “supply-side economics.” Too long, we are told, the emphasis has been on demand-side economics—meaning putting bucks in the pockets of the lower income orders—so that the money to buy the machines to make life’s goodies has been wasted on direct payment to the worthlessly unproductive. One is tempted to observe that Mayer invested a lot of good research time and interviewing effort to end up with this kind of reactionary rage, but the author’s anger is a controlled one, and, given the book’s opinions, you can be sure an expensive attempt will be made to merchandise it. So he should be answered, which isn’t as easy as it would be if you could say he was altogether off base. He isn’t. We’re stuck with an ancient, rusting industrial plant.

The best way to appreciate this is to take an Amtrak ride through the once great workshop cities of Pennsylvania, New York, Ohio, or Illinois. You probably can’t do that, because the ancient, rusting railroad is no longer able to haul you or freight on our corridors of commerce. So take a car, preferably an inferior one of American manufacture, and when you see Reading, or Altoona, or Youngstown, or Schenectady you’ll think you are touring a museum showing the Birth of the Industrial Revolution. These places look like the English Midlands and the factories are often as old. Moviegoers saw them wonderfully photographed in the back home Pennsylvania scenes of The Deer Hunter. Sudsy, sooty montages of the Edwardian era, iron work barns wherein the old ways of forge and open hearth are passed down from father to son. Industrially speaking, we are the old world craftsmen and Japan, Germany, and Mexico, yes, despised, bean-eating Mexico, are the leaders.

Advertisement

The reason Mayer gives for this state of affairs may cater to what the executives of the Book of the Month Club would like to see people read, but little else can be said for passages like: “a strike in 1959 had established permanent relations between US steel users and foreign suppliers, which through the years had been a continuing drag on the balance of payments—and the high price of the settlement had made US steel production uncompetitive with that in the rest of the world, apparently forever.”

The refutation for such assertions comes in the recent steel plant closings in which management told workers who were happy to take pay cuts and keep their jobs that no wage level was low enough to keep those decrepit places open. Time and time again, as most recently with Chrysler, when American workers have had to choose between low pay and no pay, they’ve elected the former. Managements in other industries, when faced with high labor cost, have reacted by increased automation so that by spending money on machines, fewer and less highly trained, and therefore cheaper, workers could be used. The genius of Ray Kroc and McDonald’s is that he figured out a way to make hamburger manufacture a relatively capital intensive industry. What a shame he wasn’t drawn into steel making as a young man.

Even with the investment tax credit program, now eighteen years old, steel companies preferred to pocket their profits and not worry about the day when their foreign competitors could outsell them. It wasn’t price alone that gave the Japanese their chance. They take better care of their customers with special orders, rapid delivery, and assured supply. Industrial customers have gotten from their Japanese suppliers the same ingenious and energetic hustle retail customers have seen with the Hondas and Panasonics.

Martin Mayer and the conservative choir of which he is part have come up with the economic equivalent of their old pitch to unleash Chiang Kai-shek. Release business from the unproductive fetters in which it languishes and it will produce for you. There is a great deal of badly drawn up and hideously administered regulation—that is indisputable—but not all recent regulation is indefensible. Without the environmental regulation of recent years, much of this continent would look, smell, and taste like an unflushed toilet in the men’s room at Yankee Stadium toward the end of the second game of a double header.

Economists of Mayer’s school don’t understand that the cost of clean water only looks like a drag on productivity because nobody’s making money off it; therefore, it isn’t counted as part of the gross national product. If everyone who in any way enjoyed or used the now much cleaned up water in the Hudson River or Lake Erie had to pay the Perrier company for the right to catch a fish, take a picture, go for a swim, or wash their baby in it, clean water would have an economic value that could be cranked into standard formulas so that it wouldn’t show up in the statistics as driving “productivity” down. (In simplified form, productivity can be said to be the number you get when you divide all that is made for sale by the total number of workers in the country.) Pure air is as much a value as white sidewalls or four-track tape decks and the only reason it isn’t counted as part of economic growth is because of the way economists have chosen to keep the nation’s books.

Next, although, “on an absolute scale, the United States is still doing fine,” “foreigners win an increasing proportion of our patents, and introduce an increasing proportion of new products and processes.” Foreigners, Mayer points out, also save more, so that their banks have more money to finance these products and processes. He does not point out that during the time span he is considering, the United States has spent somewhere in the neighborhood of a trillion dollars for guns. That’ll buy you quite a few up-to-date steel mills. Had less inventive inspiration been lavished on the cruise missile, how might the peaceful arts have been advanced?

Advertisement

Any nation will fall behind if it makes heroes of its crusaders, entertainers, lawyers, and journalists rather than its scientists, inventors, and developers—if it insists on always [Mayer’s italics] ranking the values of cleanliness, safety, and “fairness” above those of efficiency, output, and investment.

So be it, if you say so, Mr. Mayer, but while the entertainers have been getting the adulation, the businessmen have been getting the money. The investment tax credit and the cut in the capital gains tax are the most visible. But here is what Volkswagen got for locating a plant in Pennsylvania:

The state would build a $10 million rail spur and a $15 million highway extension to serve the plant. It would provide the auto company with $40 million in a 1 3/4 percent long-term loan to finance the plant’s completion, and an over $3 million subsidy to train VW workers. A state teachers’ and workers’ pension fund would provide another $6 million in loans for construction and when the plant was finished, local government would allow millions of dollars worth of tax abatements. For the first two years, VW would be given a 95 percent property tax abatement; in the next three years, 50 percent. During 1978, when the East Huntington plant was to produce over 50,000 cars, VW would pay local government less in taxes than the cost of a single new Rabbit. In addition..the United Automotive Workers union…agreed to…receive lower wages than at other UAW plants.*

The amount of public money going into private, supply-side investment hasn’t been calculated but it must be enormous. In view of tax exempt bonds, tax abatements, and lesser known federal entities like the Economic Development Administration, the description of our investment effort supplied by Mayer and many others is misleadingly incomplete. The type of businessmen who complain about lack of investment money have, for example, crowbarred a multi-million-dollar subsidy out of local, state, and federal governments for a new home for the American Stock Exchange. Surprisingly, the same public aid packages designed by businessmen to channel investment capital into enfeebled industries may lead to discouraging private investment. That appears to be the case with certain Mid-western railroads which seem to have given up all reinvestment but the minimum essential to repairs because the success of the Eastern railroads in getting bailed out has convinced them future capitalization for their industry will come from the Treasury.

“Americans,” Mayer, like so many other conservative supply-side thinkers, warns us, “in the next few years are going to have to get used to living a little less well than they lived before—because…resources must be set aside from consumption to pay the costs of the capital investment the nation now really must make.” Americans already are living a bit less well, and since the famous economic pie isn’t growing as fast as the population, there is every reason to think the slow slide will continue. Indeed, with our old machinery, our inflation, and our various counter-cyclical anti-recession devices, we are about to add a new economic anomaly, a new contradiction in terms, to stagflation—full employment poverty or gradual impoverishment.

Here is an economy already showing signs of enfevered inflation, spot shortages of material, parts, and trained personnel, despite the lay-offs in the automobile industry. Real buying power has been dropping, savings are as low as they’ve been since the end of World War II, so there’s no place for new capital investment money to come from but, by the trickery of inflation, to pay people less for the same amount of work.

Added on that are the new arms expenditures. Depending on which faction you believe, those increases will constitute anywhere from 2 to 5 percent of the gross national product, a truly prodigious diversion of wealth to economically useless purposes. Doubtless, the new war orders will enable manufacturers to dust off the rustiest, least efficient machines which have been standing, coated in discolored oil, in the back of the shop, and put them to work at the highest possible per unit costs. For industries like steel, that will be a blessing; they can live off the sheltered noncompetitive military market while foreign importers go on munching into the price sensitive civilian markets.

The sequellae from that development will be that we’ll have yet less to sell abroad and still higher adverse balance of payments, something Mayer discusses at great length and in the unhappiest of tones. Given this plausible chain of events, we will have realized the full employment poverty trick at the same time we’ll rack up another first—the first time in the twentieth century war production won’t bring a surge upward in the standard of living. In the four previous wars, the only Americans who got hurt were the soldier boys and not so many of them compared to the casualties other nations absorbed. Hence, especially among blue collar workers, there is an association between defense spending and prosperity. If that now reverses itself, the coming years may see less ardor for throwing roundhouse punches in far distant brawls.

Nevertheless, given our dependence on oil and other foreign raw materials and preference for Japanese cars, Mayer is right when he says, “We must now trade to survive, like Britain or Japan.” But what are we to sell? Do we let others supply us our steel in return for selling wheat and medical technology? Perhaps we should resign ourselves to specializing in what we make best, but you don’t have to be Scoop Jackson to wonder about the prudence, the national security aspects of letting our ability to manufacture such essentials wither away.

Mayer has nothing to say about such questions. He issues a generalized command to invest more and work harder without saying on what, when, or how. He displays the same kind of rigorous thinking as conservative politicians who keep saying cut the taxes by a third—just do it, don’t think about it; and the money the citizens keep will shortly multiply into more goods and services.

In the main, though, this book describes not why the economy weakened the dollar’s value, but what the pertinent American officials did overseas in response to the symptoms of creeping monetary leukemia. If you don’t know some of the vogue words international governmental banking has used over the past three decades, this book will explain to you what a “clean float” is, or the “twist,” or the “snake.” This, however, is the sort of information people who need to know it already do know and the rest of us can do without.

One is never sure whom Mayer is talking to. Given some of the hedgings, vaguenesses, pats, and pinches administered to off-stage characters, there are pages which read as if the author is addressing himself to his personal circle of economists and bankers. There are other pages in which extraneous matter is put in apparently for the purpose of making economics exciting to laymen: “Otmar Emminger read Schultze’s comments in his starkly modern office in the Bundesbank in suburban Frankfurt. He is a lean, long-headed man with a fringe of brown hair and watery brown eyes, immaculate, echt Deutsch, with a rather sour expression that conceals a rather expansive personality.”

To the fuzziness about whom the book is for is added an uncertainty of focus and argument. The work is so narrowly devoted to our monetary diplomacy that it is unsatisfactory as a description of American economic power and influence overseas. For the same reason, it can’t serve as a history. Most of it is just about money, the life and adventures of Uncle Sam’s nephew, Dan Dollar, and a great deal of space is devoted to such matters as the gradual shift from fixed rates of currency exchange to the system we have today, where the rates bob up and down on Cronkite every night.

Such floating rates displease Mayer. He liked the old system under which you got so many German marks to the dollar, so many French francs, and the ratios never changed. If you’ve got the ratios right to begin with, it’s a set-up that works well, so long as one country or the other doesn’t go on a deflationary or inflationary tear. But if we’re going to cheapen our dollar, we can’t expect the Germans to give us five of their marks for it forever. At some point, they’re going to decide exchanging good money for bad isn’t much of a bargain and inform us that from now on we only get three of their marks for our mini-bucks.

That, essentially, is why the fixed rate system put into effect at the end of World War II died in the 1970s, and Mayer explains that death clearly. For Americans trained in the humanities but suddenly made aware that much of their creature comforts are contingent on foreign trade he supplies information worth having. The same for Mayer’s narration of how the dollar got to be the universal currency and his description of what happens around the world when that currency is tampered with. But that, like the descriptions of the tidal movement of money back and forth across the oceans looking for higher interest rates or better investment possibilities, is too mechanical and too separated from the goods and services money buys, from political and military events, to be very informative.

So the fate of the dollar still needs writing about by someone who has a deeper sense of the economy and can tell us something we don’t know, something which goes beyond a gentlemanly reworking of the prevailing conservative grumpy view.

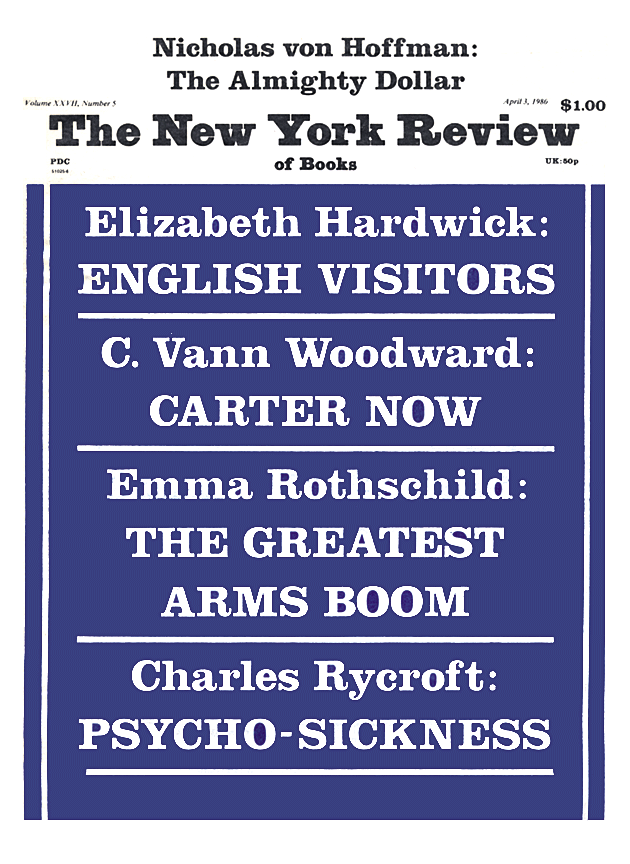

This Issue

April 3, 1980

-

*

The Last Entrepreneurs: America’s Regional Wars for Jobs and Dollars, by Robert Goodman (Simon & Schuster, 1979), pp. 2-3. ↩