What is the outlook for American society and, more specifically, how can our society adapt to an economy in distress? It is a vast question that I can only speak to from a rather limited, but nonetheless eye-opening, experience, as chairman of New York’s Municipal Assistance Corporation. But, in brief, I would say that the outlook for American society is highly uncertain and that it cannot, in the long run, adapt itself to an economy in distress.

Austerity and democracy do not walk hand in hand in the United States, except in wartime. The near-bankruptcy of New York City created in 1975 something like a “moral equivalent of war” for city and state politicians, as well as business and labor leaders. Before then the city had, for years, plunged toward disaster. Year-to-year deficits were papered over by accounting gimmicks; pension plans were underfunded; industries were driven away by high taxes and low productivity; borrowing was more and more relied on to finance operating deficits while capital programs were starved; the political leaders refused to face reality: all of these made disaster inevitable.

It was only when this became apparent, when month after month one bankruptcy deadline after another had to be faced, that Governor Carey called on business and labor to join forces with government in order to devise a program that would head off the crisis and bring the city back to life. The programs that accomplished this were initially harshly deflationary, them followed by a gradual shift to moderately relaxed fiscal policy and support of business, which led this year to New York City’s first truly balanced budget in memory.

It is worth analyzing what we were able to do in New York as well as the limits beyond which we could not go, under the severest kind of pressure, since New York is, in certain respects, a mirror of the US. There is after all little difference between New York City’s mounting year-after-year deficits from the mid 1960s to 1975 and the fact that the national budget has been in balance only twice during the last fifteen years; little difference between New York City burying its operating expenditures in its capital budget and the $15 billion annual financing of the US government that is “off-budget” (i.e., the loan guarantees and similar commitments that do not appear in the budget); little difference between New York City having driven business south and west as a result of high taxes and low productivity and the US driving business abroad for the same reasons; little difference between New York City selling short-term notes to finance its deficits and the US financing with the shortest of all notes, namely demand deposits of OPEC oil producers; little difference between New York City’s sky-rocketing pension costs and the requirements that social security be adjusted to the cost of living (COLA). New York City faced actual bankruptcy by its inability to pay off its debts when they came due; the US is facing the national equivalent of bankruptcy in the form of uncontrolled inflation requiring increasing levels of national debt to be paid off in currency worth less and less.

Looking back over the last five years in New York, during which a deficit of $1.8 billion annually was brought to zero with a minimum of social disturbance, one can see two distinct phases. First came the brutal shock of actions intended to stop the hemorrhaging: these included a wage freeze coupled with deferrals of past increases; a 20 percent reduction in the work force; increases in transit fares and tuition at City University for the first time in 120 years; reduction by the banks of interest rates paid by the city and extension of the time period of the city’s loans; shifts in pension costs from the city to the unions; increased taxes and the creation of a state-run control board to pass on the city’s budget.

These programs, most of which were negotiated or set in motion by the Municipal Assistance Corporation, were coupled with limited federal credit assistance. They enabled the state-created MAC to provide a total of $7 billion of long-term financing to the city, both to refinance past accumulated short-term debts as well as to finance its increasing deficits and increasing capital programs over the period. The large initial layoffs of city employees were followed by a period of limited attrition and then by a stabilization of the work force at its present level; the wage freeze was followed by a two-year labor settlement at 4 percent annually.

But then austerity had to yield to the reality of society’s pressures, and a more recent settlement was made at essentially market rates between management and labor. Tax increases were replaced by tax cuts designed to favor businesses. Harmony was broken by a transit strike this spring. Increasing social tension in the ghettos of Harlem and Bedford/Stuyvesant culminated in ugly demonstrations to block the closing of just one facility of the city’s sprawling municipal hospital system. Civil service reform is still politically impossible and real progress on improving management and productivity is largely confined to rhetoric. Some of the city’s essential services have deteriorated.

Advertisement

Still, what saved the city was a limited period of austerity, imposed under the direst of threats, followed by gradual relaxation while a prosperous city economy, together with inflation, generated the growth in revenues to bring about a balanced budget. From 1975 to 1980, the expenditures of New York City grew in the aggregate by less than 10 percent, while the state’s expenditures grew by 35 percent and the federal government’s by 80 percent. The secret of our success, both at the city and state level, temporary though it may be, was to clamp a lid on expenditure growth while business activity and additional state and federal aid generated enough revenue growth to allow us to survive. As John Kennedy said: “A rising tide floats all ships.”

It must be remembered that our imposition of extreme austerity was temporary, that it was essentially imposed by outside forces—i.e., the state, the federal government, and the workings of the bond market—that it required the courageous political leadership of the governor, as well as a true social contract with business and labor. The people of the city were willing to make real sacrifices as long as they believed that those sacrifices were relatively fairly distributed, that there was an end in sight, and that the result would be a better city, a better environment, and a better life. What we did in New York City was completely alien to the concepts of “No Growth” and the “Zero Sum” society so fashionable in economic circles these days.

Americans today are confused and dispirited. They have seen our country, over the last twenty years, dissipate its world-wide economic, military, and spiritual leadership at a more rapid rate than any other major power in history. They are accused, with some justification, of being wasteful and lazy by political leaders whom they perceive at best as inept and at worst corrupt; they hear business leaders calling for belt-tightening and conservative orthodoxy from the comfort of their corporate jets. No wonder people are dispirited.

The United States today, like New York City in 1975, is on the edge of crisis. Financially, militarily, spiritually we are like an airplane about to stall. The answer, however, does not lie in a simple acceptance of “less for everybody”; I would invite economists of the no-growth school to walk in the South Bronx and convince people there that a reduced standard of living is required to curb inflation. I believe that most Americans, just like New Yorkers, would accept a limited period of austerity provided they are assured that we are in a crisis that justifies it, that their particular group is not bearing an unfair share of the burden, and they have a clear sense of how their sacrifice will ultimately lead to a better life for themselves and their children. This requires courageous political leadership with a program that has the following objectives:

A. Opportunity for private employment for most Americans who want to work;

B. A strong currency with reduced inflation;

C. A military policy that will insure US security against any aggressor.

Just as New Yorkers accepted a period of higher taxes, lower services, and, in many cases, loss of income for a perceived goal, i.e., the solvency of the city, so now Americans in the rest of the country would, in my view, accept a period of austerity if they really believed there was serious prospect of change. They have no reason to believe it at this point. The presidential campaign has offered little hope in that connection. At this writing it is clear that whoever is elected, we are condemned, because of uncertain leadership and a Congress unwilling to face responsibility, to stumble from inflation to recession and back, with each stumble worse than the one before. I do not believe that our society will stand the strain over the next four years. Our next president will face an emergency during his term of office, either internationally or domestically, possibly both, and the real issue now is how it will be faced.

It seems to me that we face different types of critical problems today:

- Problems like that of energy, which should have been apparent for years, where solutions are obvious, but to which the political structure cannot respond.

- Problems of inflation and productivity, about which there is a great deal of theoretical—one might say theological—controversy, and very little knowledge, in which the spectrum of professional opinion is exceedingly broad, and therefore no political consensus can even begin to be formed.

- Problems of our security vis-à-vis Russia. We do not seem able, at a cost of $140 billion a year, to project a credible sense of the US as a world-wide power. At the same time, we seem incapable of continuing a process of reduction in weapons competition by ratifying SALT II.

-

Problems like those in the Middle East, which is vital to our security and our economy, where governments tend to be irrational in conduct and far removed from the exercise of our power.

-

Problems like employment and education in the urban ghetto, which have baffled all attempts at improvement, and which will, with continued “benign neglect,” have consequences that are anything but benign.

Advertisement

-

Problems like the great shift in wealth from the Northeast and Midwest to the energy-producing areas of the US, as a result of price decontrol. This trend will ultimately turn the country into “have” and “have-not” regions. One has only to look at Canada for its political implications and to be mindful of the fact that Canada does not have our existing social strains. This is a problem the political leadership resolutely refuses to acknowledge.

-

The problem of the West and the third world, which must be faced by a coherent policy of the Western nations, a willing OPEC, and a realistic third world, none of which exists today. Western technology must combine with OPEC financing to help the third world. It is beyond the West’s capacity to bear any but a small part of the financial costs of third world development.

-

The problem of the coming capital shortage, which will be created by at least three forces: the enormous financing requirements of the US government; the equally enormous financing that American industry will require to increase productivity and create energy independence; and the drain on our economy of a $100 billion annual payment to OPEC for imported oil. Nonetheless, our economic leaders deny the possibility of a capital shortage.

-

The problem of our relations with Mexico and Canada, which both pose large risks and large opportunities for the US. Mexico, with its oil resources, its fast-growing population, and its distrust of the US, may be our most important long-term foreign policy problem. The potential benefits of a North American Common Market should be explored. But this is not even being discussed peripherally.

These problems are all vital to our future, are all directly related to each other, and require inspired political leadership as well as intellectual honesty to find solutions. It is also well to remember that there are no permanent solutions to anything, only continuing adjustments to continually changing situations. It seems likely that the current political structure and the existing trends will exacerbate rather than help resolve this series of interrelated problems, and, in my judgment, this makes a crisis inevitable.

Our energy problem, together with our exposed strategic position in the Middle East, can only be resolved by a strong commitment to practical independence from imports. This would, in addition, strengthen the dollar by eliminating a $100 billion a year outflow and would help reduce inflation. A stiff gasoline tax; rational development of coal and nuclear energy with a realistic appreciation of the difficulties with each one; a willingness to compromise on environmental issues—none of these proposals is mysterious or new, and yet current politics make efforts to explore and implement any of them practically impossible.

Insofar as the economy, inflation, and productivity are concerned, we cling to theological explanations that are as tired as they are unworkable. Liberal demands for public works and public jobs have to be matched against the failure of such policies during the past twenty years. But the current conservative proposals for tax cuts that favor production, and for tight monetary policy coupled with tight fiscal policy, have failed with equal consistency. When Presidents Nixon, Ford, and Carter tried these methods, they were quite successful in inducing recession, but they wholly failed to reduce inflation; quite to the contrary.

The purest attempt so far is Mrs. Thatcher’s United Kingdom, where the Anglican Church seems to have been replaced by the “Sayings of Milton Friedman.” Income tax cuts coupled with sales tax increases, government spending cuts together with tight money have, after a year and a half, resulted in a 20 percent rate of inflation, an 8 percent reduction in manufacturing output, and the highest level of unemployment since the Depression in spite of the enormous cushion provided by England’s North Sea oil. In view of the record during the past twenty years, it is relatively easy to understand why liberal economic thinking has become discredited; it is, however, more difficult to understand how the conservative monetarist theology continues to enjoy such uncritical popular support while the current example of England’s struggle is vividly in front of us, along with its extraordinary potential for social explosion.

Our business leaders put the blame for inflation on runaway government spending, and call for welfare cutbacks. Government spending is obviously one of several culprits and putting a limit on welfare and Medicaid spending is a necessity, especially for those of us who live in the Northeast and Midwest. But the only practicable way to limit these programs is to provide private jobs for those on the welfare rolls; it cannot be done without some form of government involvement or subsidy. We should also, after seven years of experience, be more realistic about the impact of our payments to OPEC. At the current rate of imports, before price rises that inevitably will result from the Iran-Iraq war, we will, during the next five years, pay over to OPEC approximately half the market value of all companies listed on the New York Stock Exchange. This means that we soon will be turning over the equivalent of half our productive capital built up over the last 200 years for a product we burn every day. Even the lure of huge contracts with the OPEC nations, or the attraction of their large deposits of money in the US, should not blind us to the economic and political power transferred from the West as well as its inflationary impact. Recycling is a myth; it only means lending more and more to people in third world countries who can afford it less and less.

We live today in a “padded society” for the majority, and a “nowhere society” for millions in the urban ghettos. It is a “padded society” because everywhere one turns, one finds padding for security. Cost of living allowances and automatic increases for workers regardless of productivity; constantly increasing unemployment compensation and trade-adjusted payments for laid-off workers; constantly increasing pensions for retirees—every sort of contract and stock options for management regardless of performance; COLAs for social security; government price supports for the farmers.

It is understandable that people want security, but it is the padding of our society that has become our inflationary albatross, not people using credit cards. It is the padding that creates rigidity in wages and prices, regardless of economic activity; that erodes the work ethic; that makes government deficits inevitable in good times and in bad. And management shares guilt with labor and the politicians of both parties by sacrificing the future to avoid facing today. We have created a gigantic pyramid club called “pensions and social security” where more and more retired people expect to enjoy higher and higher levels of benefits to be paid by a society producing less and less. While this goes on, in the ghettos of our cities, with a 60 percent unemployment rate, young blacks are told to stop pushing drugs and find a job and that welfare is a luxury the country cannot afford.

As in New York City, any national economic program, to have a chance of success, must combine austerity with growth. To begin to control inflation, an incomes policy that relates wage and price increases to productivity is essential. This should be administered through benefits and penalties of the tax system rather than through a new bureaucracy. A freeze of both wages and prices should be imposed until such an incomes policy can take its place. That is one aspect of austerity.

A stiff gasoline tax has to be imposed to permit an overall reduction in interest rates and a strengthening of the dollar. We can have no real growth until our interest rate structure is lowered. This cannot be done responsibly until the dollar is strengthened by other means. Part of the gas tax should finance tax cuts that will lead to increased investment and an increase in military spending. The balance should be rebated to lower income groups; those in higher income brackets will just have to pay more. That is another aspect of austerity.

We are in a military competition with the Soviet Union, in which the US is dangerously deficient in conventional as opposed to nuclear power. Against a standing conscripted army we try to compete with a volunteer army at immense cost and low effectiveness. We spend $140 billion a year on defense and cannot airlift three divisions into the Middle East. Until the millennium when peace reigns worldwide, we must have an adequate conscripted army with low pay, with no excuses from service except for health, and a highly professional, highly paid cadre of officers and non-coms. That is the third aspect of austerity.

We must rebuild our older cities, as well as our older industries, and we must do so in a way that also brings work to the ghetto areas. I believe this requires the creation of an entity similar to the Reconstruction Finance Corporation of the 1930s and the cooperation of business, labor, and government, national and local. Unemployment in the ghetto can be solved either by taking the people to the jobs, which I do not believe to be feasible, or bringing the jobs to the people. Our older cities, our older industries, our hardcore unemployed are all tied to the same umbilical cord. An independent financing entity is needed to cope with the fundamental restructuring of older industries, with the renewal of the physical plant of older cities, and to make use of the work potential of the inner-city unemployed. Providing employment in the private sector to the ghetto dweller is not only a humane, social necessity; it is an economic necessity. It cannot be done, however, without cooperation between business and labor and without government support. To the argument that this is undue interference with the free-market mechanism, I would answer than an RFC making equity investments is no different, in basic theory, from a refundable investment tax credit; both methods use taxpayers’ money to provide capital to enterprise.

The RFC, like the Municipal Assistance Corporation in New York City, could extract concessions from various participants before committing itself to invest; the tax credit has no such potential. The RFC could also assist older cities with their capital programs, thereby both creating jobs and improving the quality of urban life. Just as in Canada where the oil-producing provinces have created the Heritage Fund to make investments in Canadian industry and infrastructure, so our own oil-producing states should consider the possibility of investing some of their increasing revenues in the capital of such an RFC. This should be coupled with the borrowing back, on a long-term basis, of a part of the vast amounts of OPEC funds currently deposited on a short-term basis with US banks. That would be another aspect of austerity.

Ultimately this country must look to a future of relatively evenly distributed burdens and benefits, regardless of geography, regardless of class, regardless of race if it is to maintain itself as a strong democracy. The present trends go in the opposite direction and yet our own most serious problems create our greatest opportunities. A determined domestic energy program, coupled with an industrial policy, and the investments in infrastructure and city renewal that go with it, could put the whole country to work for the next twenty years. That, in my view, would be the tide that could “lift all ships.”

Temporary austerity will have to be accepted, on a well-defined basis. We cannot reduce inflation without a tough incomes policy. We cannot limit the growth of government spending without shifting large segments of the population from government support to private employment. This can only happen if there are noninflationary stimuli of the economy, large-scale investment programs, lower business taxes and interest rates, as well as a strong currency. A stiff gasoline tax to fund part of this program, and a tough incomes policy, together with large-scale long-term borrowings from OPEC will help protect the dollar and permit the safe lowering of interest rates. An RFC is not state capitalism; it is a temporary mechanism to restructure on a sensible basis those older, basic industries that otherwise will either disappear or be bailed out by indiscriminate government funding.

In addition, the examples of Germany and Japan should convince us that a genuine partnership of business and labor in government is required to accomplish any program dealing with inflation and the economy. I strongly support the Carter Administration’s move in that direction with the creation of the Economic Revitalization Board and other similar structures. To cries of elitism or the fear of creating a new “establishment,” I say that where weare going otherwise is infinitely worse.

We have recently heard much talk of the Silent Majority, the Moral Majority, and other majorities. The fact of the matter is that our country today cannot muster a majority for anything except complaint. The body politic is so splintered and balkanized that the impotence of the political establishment is a perfectly valid reflection of the negativism and lack of interest of the electorate.

A government of checks and balances has become all checks and no balances. As usual, we have heard the presidential candidates orate about cutting government spending and bureaucracy, instituting great programs, changing the country’s direction. We all know this will not happen. We must face the reality that our problems are getting larger as the system’s ability to cope with them is lessened, a trend that leads over the edge of the cliff. Recently there have been suggestions for fundamental constitutional changes in our government. Some call for a single-term presidency and related limits on congressional terms, others for variations of parliamentary government, as was advocated by Lloyd Cutler in a recent issue of Foreign Affairs, or for a congressional cabinet structure.

These do not, however, have serious prospects at present. Only a major crisis will force the kind of constitutional change advocated by serious students of government today. I believe such a crisis is likely to occur because to avoid it, too many things have to go right, all over the world, for a long period of time. Although it is impossible to predict whether it will be monetary or military, in the Middle East or in Cleveland, the potential for military, economic, or social strife is probably too great to be avoided. When a crisis of sufficient magnitude creates the possibility for fundamental change, it will carry with it enough of a popular majority for action so that a president with a real vision of the future will be able to put his program through. That is obviously a risk for democracy as well as a hope.

In the meantime, the best that can be done is to have a government as competent as possible with a coherent program, no matter how difficult of implementation. We are for the time being locked into a strait jacket of high inflation, low growth, and high unemployment, no matter who the next president may be. This state of affairs carries with it suffering and austerity that are unevenly distributed geographically and socially, and cannot be sustained for very long. It is fantasy, however, to have illusions of real long-term solutions at present.

Today, we could not build our road system, the TVA, or the Manhattan Project. Between the Congress, the courts, the numerous interest groups, these projects would all die on the vine. The concept of democracy in which the minorities are willing to abide by the will of the majority has been much eroded. What little rationality is left in the system is being eliminated by TV politics in which little capsules of show business are supposed to pass for statesmanship.

This country should be able to speak for the nations and interests of the Western world. To abdicate this role to Helmut Schmidt or Giscard d’Estaing, no matter how capable they are, is to abdicate our responsibilities. We are, however, in no position to carry them out even if we had leaders capable of conceiving what they should be. Whether it be the defense of the Middle East, disarmament negotiations with the Warsaw Pact, the problems of the third world nations in their fight against poverty and overpopulation, only the United States can provide the counter-weight to the mass of China and the shadow of Russia.

In 1938, at the time of Munich, Neville Chamberlain rose in the House of Commons to speak for the Conservative Party when a backbencher yelled: “Speak for England!” The United States, I suggest, should speak for the West. It must speak for opportunity, for growth, for social justice, and it must speak with confidence and power. That will only happen when a majority of Americans will decide that the drift has got to stop, and a president with a sense of the future gives direction to the power that will be unleashed. This will not happen today, but it will come sooner than we think.

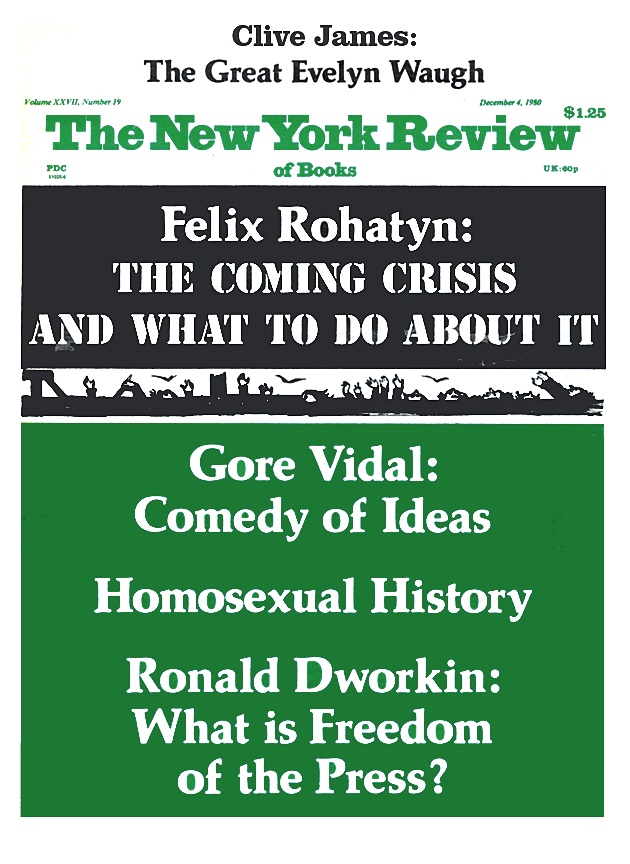

This Issue

December 4, 1980