The economy this autumn is still growing, inflation is low, unemployment is down. Whether this proves the success of supply-side economics or is just another deficit-driven Keynesian recovery will be argued for years to come. It seems to me clear that the enormous federal budget deficit was largely responsible for the recovery and that it could become extremely dangerous if it is not controlled. The important question now is how the recovery can be sustained in view of all the urgent financial problems facing the economy. These include the record domestic budget deficit and the record deficit in the balance of trade; they also include a national debt that will soon amount to $2 trillion and a third world debt that will soon amount to $1 trillion. In effect, we are now borrowing heavily from our children to finance a great many expenditures we really cannot afford. This is neither moral nor prudent.

Will the current growth of the economy eliminate these deficits? Those who believe that it will might recall that the most important rule in business is never to bet the entire company. By betting so heavily on growth, we are running the risk of having our national debt over-whelm the federal budget. Financing that debt threatens to absorb far too much capital needed for investment in the domestic economy if it is to sustain growth, improve its comparatively low rate of productivity, and compete successfully abroad.

The Congressional Budget Office has estimated that by 1989—even assuming an average real growth rate of 4 percent between 1983 and 1989—the national debt will amount to almost 50 percent of GNP, up from 35 percent in 1983. Interest on the national debt will be 16 percent of the budget and it will be growing swiftly. To pay that interest, a government would have to make a grim choice: either to cut social programs and the military budget beyond anything now contemplated or to increase taxes constantly.

It has been argued that the level of the debt need not cause concern because, in 1960, the national debt stood at close to 50 percent of GNP. Important differences, however, exist between 1960 and today. First, more and more of our debt is now financed from abroad (last year about $80 billion), a situation unlike that of 1960. We are therefore at the mercy of foreign investors who, should they lose confidence in the US economy, could create a dollar crisis and higher interest rates in short order. Without the additional capital available from abroad, our low rate of national savings would not be sufficient to accommodate the foreseeable needs of both government and private business.

Two other differences from the economic situation in 1960 are instructive now. The 1960 debt was the result of borrowing during World War II and the Korean War; and the budget deficits between 1960 and 1965 hovered between zero and 1.3 percent of GNP. A rapidly growing economy in the 1960s kept the deficit below 3 percent of GNP even at the height of the Vietnam War. The debt as a percentage of GNP dropped rapidly, and lower interest rates kept the impact on the budget within bounds.

Now we have a completely different situation. Despite a growing economy the continuing deficit requires the government to borrow between $180 and $240 billion each year. The debt is growing much more rapidly than GNP. Interest on a steadily growing debt feeds on itself, like a form of financial cancer. The situation of the US too closely resembles that of New York City between 1970 and 1975 and that of Argentina, Brazil, and Mexico between 1975 and 1982.

There is much talk of the need for greater fairness in any future economic policy, and much of it is justifiable. Between 1980 and 1984, the share of disposable family income of the poorest fifth of the population actually declined from 6.8 percent to 6.1 percent. The share of the most prosperous fifth of the population increased from 37 percent to 38.9 percent. Clearly that is not an acceptable trend in any society committed to the idea that all parts of the population should benefit from growth and prosperity.

In dealing with our budget problems, however, we cannot create the illusion that fairness means that the government will simply do more for the poor, the unemployed, the retired, the minorities. All these groups stand to suffer from a fiscal breakdown that could cripple economic growth, or cause a great surge of inflation, or both. If sacrifices have to be made to avoid those consequences, fairness means that the largest sacrifices must be made by those who can best afford them; but, unfortunately, some sacrifices will also have to be made by all groups above the poverty level.

This was the general principle we tried to follow in resolving New York City’s fiscal crisis. It should be the basis for the new policies for taxes and entitlements that will be needed to deal with the problems of the budget and the national debt. In my view much is at stake. In one way or another, the most urgent problems facing the US in the world economy—the rise of the dollar, the safety of our banking system, the dangers of protectionism—are all related to our federal budget deficit.

Advertisement

The Budget and the National Debt

The budget deficit is causing the national debt to grow at a rate almost twice the growth in GNP. That is a prescription for national bankruptcy. If that rate continues, interest on the national debt will grow to more than $200 billion a year by the end of the decade, preventing more and more vital government programs from being carried out as government revenues are consumed in debt payments. In addition to the obvious costs being incurred domestically, the international effects are increasingly dangerous. As a result of escalating indebtedness, the level of the dollar is constantly pushed upward, putting many American industries in difficulty, unable to compete with cheaper foreign imports at home or to sell in markets abroad. The government’s borrowing requirements, a major factor in maintaining interest rates at very high levels, increase the risk to our banking system of large-scale failure by third world countries to pay their debts. We are fostering speculation instead of investment. We are purchasing short-term prosperity by starving the rest of the world of badly needed capital and destabilizing the international monetary system. Since we live in a world market whether we like it or not, we cannot continue much longer

Some, including President Reagan, have argued that rising interest rates are largely a matter of psychology—that they move up in response to the premature and self-protective fears of bankers that deficits will lead to inflation. Although high interest rates are not solely caused by deficits, this is a superficial view. Several factors are at work in the rise of interest rates, among them the deregulation of financial institutions. But the most important factor of all, in my view, has been the vast increase in the use of debt by all the sectors of the economy. The US government debt grew from $290 billion in 1960 to $1.4 trillion in 1984. Corporate debt grew from $40 billion in 1960 to $400 billion in 1983. Mortgage debt grew from $470 billion in 1973 to $1.7 trillion in 1983. Third world debt grew from $80 billion in 1970 to $800 billion in 1984.

Neither the savings rate nor the capital of financial institutions or corporations has kept up with this explosive growth of debt, much of which has to be constantly rolled over and refinanced. Monetary policy is not the answer to this problem; we must reduce the demand for credit. While there is no magic number for the appropriate proportion of debt to GNP, it makes obvious sense to stabilize an apparently runaway situation and to limit the growth of the debt as closely as possible to the growth of GNP.

Eventually we will be forced to do something about the deficit. But what should we do and when? The answer to “when” is easy; as soon as possible and preferably before the next economic downturn. If we have to close the budget gap during a period of recession we would run risks that seem to me very dangerous indeed. We could then be faced with a growing deficit as a result of recession, increasing interest rates and a collapsing dollar as a result of capital outflows, and a banking crisis as a result of both. This is not a risk worth running. A deficit reduction program should begin as soon as possible after the election and no later than early 1985. The question of “how” and at what velocity is more difficult.

Vice-President Mondale has proposed to reduce the deficit by two-thirds—or about $160 billion—by 1989. He proposes about $85 billion in new taxes (about $25 billion in corporate taxes, and the rest from income taxes); about $24 billion in expenditure reductions and $51 billion as a result of interest cost reductions. President Reagan, for his part, has asserted that no new taxes are required and that continued growth and savings in government efficiency will eliminate the deficit—a position he restated in the first debate with Mondale. That hardly seems likely.

I have several reservations about the Mondale plan. It relies too heavily on tax increases—especially personal income taxes—and is vague on how expenditures would be controlled. As a result, the financial markets and the Federal Reserve will likely be skeptical about its effectiveness and the reduction in interest rates Mr. Mondale hopes for would not take place. But the plan is, at least, a serious one, worth serious discussion. It does not, as the administration has done so far, wave away the deficit and debt problems with assurances that growth and tighter control of executive spending will somehow make them go away.

Advertisement

With the economy as strong as it is now, I would suggest a program to close the gap more rapidly and more rigorously by about $150 billion over three years—half through taxes, half through budget cuts. The Congressional Budget Office projects a deficit of about $216 billion for fiscal 1987. Such a reduction would leave about $60 billion of deficits—about 2 percent of GNP. The lower interest rates that would result from a lower deficit should eliminate much of that balance as the cost of government borrowing falls.

Taxes

Higher taxes will not create economic growth. Simply taxing the rich will not abolish poverty, or create jobs, or lead to investment in improved technology. If taxes are increased, this should be done in the way least likely to slow down the economy. Any tax increase, moreover, should also be combined with a simplification of the tax system that would result in lower personal rates and fewer deductions and loopholes.

Taxes should be increased in two ways. First, by a tax on consumption—not an indiscriminate sales tax, but a tax on energy consumption that would encourage energy conservation and the use of small, fuel-efficient cars instead of the present return to large ones. (Its other advantages could be considerable, as we shall see.) Second, a minimum tax should be imposed on corporations, which are, in many cases, paying little or no taxes at all. In 1975, corporate taxes made up 15.6 percent of federal revenues; in 1983 they made up only 6.2 percent of revenues.

The bill of Senator Bradley of New Jersey and Congressman Gephardt of Missouri suggests, in my view, the most useful pattern for personal taxes. It proposes a minimum rate of 14 percent—which would apply to four out of five taxpayers—and a maximum personal income tax rate of 28 to 30 percent, while eliminating many deductions and most tax shelters. If the maximum personal income tax rate is around 30 percent, moreover, there would be no need for the proposed “indexation” that would adjust tax rates to take account of inflation. Indexation is a necessary brake on spending when marginal tax rates are high; its benefits are reduced as marginal rates come down. Under this tax structure, moreover, capital gains could be taxed at the same rate as ordinary income. A minimum corporate income tax somewhere between 15 and 20 percent (depending on the definition of income) seems to me equally sound. The Bradley-Gephardt plan, if it were combined with the elimination of indexing and a minimum corporate income tax, could raise an additional $20 billion by the third year.

A consumption tax on energy could be applied through a combination of excise taxes on crude oil and oil import fees. These energy taxes should raise between $40 billion and $50 billion annually; phased in over three years, they would not hurt the economy. Part of these taxes would undoubtedly be translated into higher gasoline prices. However, gasoline prices in Europe are $2.50 to $3.00 per gallon; here such a tax would still leave gas prices at 50 percent of European prices.

The critical question concerning any new tax increase is whether the revenue raised will simply be translated into new spending or whether it will genuinely be used to reduce the deficit. The only way to ensure that the energy tax revenues would be used to offset the deficit would be to set them apart from other revenues. One way to do so would be to create a trust fund into which all new energy taxes would be paid. The trust fund would be managed by the Federal Reserve Bank, which would use the proceeds solely for the purpose of retiring a part of the federal debt.

In order to make this arrangement an effective deterrent to spending, two additional features could be attached: first, it could be combined with a limitation on the growth of the federal debt to a fixed percentage of GNP. Second, it should provide for the energy tax (or another tax segregated for debt repayment) to increase automatically by the amount that the debt limit is raised, in any one year, beyond those limits.

These provisions would ensure that the government’s unrestrained freedom to borrow would be both sharply curtailed and combined with an offsetting tax penalty. By reducing the need for government financing by some $40 to $50 billion per year, it would also make more money and credit available to the financial markets for investment. It would ease the pressures driving up interest rates and might allow the Federal Reserve to carry out an easier monetary policy without risk of inflation.

A variation of this arrangement was used when New York City sales taxes were segregated from the expense budget to guarantee the payments on MAC bonds. Segregating a new source of federal revenue for the sole purpose of reducing the size of the national debt deserves serious consideration now. It will not relieve either the president or Congress of the need to control the growth in expenditures; on the contrary, a comprehensive revision by Congress of our tax and budget structure remains our most urgent national need. However, if deficits are inevitable because of the demands of a great many political interests, a mechanism such as the energy trust fund not only would help to keep down interest rates, but would offset to some degree our low national savings rate. In effect, the trust fund would be a national savings plan. As for a constitutional amendment to balance the budget, that would be like a unilaterally declared nuclear freeze: it would give a quite unreal illusion of safety, without any guarantee of the real thing.

Military Budget Cuts

Annual defense outlays will grow from $300 billion to $400 billion from fiscal year 1986 to fiscal year 1989. Virtually every conceivable military system is being acquired: MX, B-1, Trident II, air-, sea-, and ground-launched cruise missiles, Stealth, to name just a few. Funds have already been appropriated for the “Star Wars” defense system. I am not a military expert, but I am familiar with large organizations. There is no question in my mind that the military budget, like that of practically any huge organization, can be cut significantly without affecting our military capacities. The Congressional Budget Office, among others, has made a convincing case for a multibillion-dollar annual savings in the procurement of weapons systems. The Committee on National Security has proposed a “prudent defense budget” slowing the growth of outlays from $282 billion in fiscal year 1986 to $365 billion in fiscal year 1989.1 Military pensions and other personnel costs also seem to me capable of being cut substantially. An annual rate of savings of $25 to $30 billion, by the third year of such a program, can and must be achieved.

Social Programs

No one can talk convincingly about reducing the budget deficit without also discussing entitlements—social security, Medicare, Medicaid, etc. Establishing fair limits to the growth of entitlements may be the most important issue facing this country. Medical advances are being made on every front—in pharmaceutical and DNA research, in diagnostic techniques, in operating-room procedures and equipment. The resulting increase in life expectancy could be dramatic. How this will affect not only social costs, but the agonizing choices to maintain life or accept death, is now only dimly perceived. Recent speculation that applying every available technology to every patient could eventually require more than 100 percent of GNP is not as wild as it may sound. Significant changes and savings are obviously necessary and a detailed program for ways of containing costs will have to be worked out. Lowering social security benefits for people in the higher income brackets will probably become necessary. So will taxing some benefits, putting a limit on cost-of-living allowances, changing benefits for new entrants into the social security system, etc.

I doubt that the problem of medical care, however, can be dealt with just as a matter of making a number of more or less painful adjustments. We have to reexamine the entire system, in which the various attempts to regulate the rising fees charged by doctors have not been notably successful, and in which a two-class system of medical care has, for the most part, prevailed.

We would do well to examine objectively other systems of medical care to see what we can learn from them. The following description of the Canadian system is suggestive:

Canada’s provincial health-insurance systems, like ours, use third-party reimbursement. You go to the doctor, and the insurance system pays the bill. But in the United States, the insurer might be Blue Cross Blue Shield, or Prudential, or Medicare, or one of hundreds of others. In Canada, there is only one insurer—the provincial health plan. Each patient simply pays the bill with a credit card, and the insurance system reimburses the provider. As a result, Canadian hospital administrative costs are about one sixth those of American hospitals. Moreover, with one unified system, the state has a much easier time regulating rates, procedures, and fees. In the early 1970s, when Canada first adopted its comprehensive plan, it was spending about the same total health outlay as the United States: roughly 7.3 percent of GNP. Since then, health-care costs in Canada have stabilized at about 7.5 percent of GNP, while in the United States, they have soared to the 9–10 percent range.2

This does not mean that the US should or could simply adopt the Canadian system. But if the Canadians have managed to contain costs and provide reasonably good medical services through comprehensive health insurance, then Congress should ask why we have not been able to do so here.

Freeze on Spending

In view of the complexity of these budget cuts and their urgency, I believe a one-year freeze on all spending programs is worth considering while a new tax plan is worked out. This would save about $40 billion during the first year and may well be the most practical approach for the time being. In any case, Senator Dole was right to recommend that a bipartisan economic “summit” conference be held immediately after the election, to deal with the budget. If we wait until the next recession, it will be too late.

Any new approach to social programs will be irresponsible if it does not confront the deep question of poverty in the US. It is a melancholy, but undeniable, fact that there are more poor people in this country today than there were a few years ago. The income disparity between classes seems to be growing larger, and there is little on the horizon to suggest change for the better. The recent Urban Institute study stated:

From 1980 to 1984, the typical middle class family’s income rose from $18,857 to $19,034 or up about 1 percent. The average income of the poorest one-fifth of all families declined from $6,913 to $6,391, or by nearly 8 percent, whereas the average income of the most affluent one-fifth increased by $37,618 to $40,888, or by nearly 9 percent.3

Although the tax and budget policies of the Reagan administration no doubt aggravated this problem, it derives from deep trends in the economy that would face any administration.

Economic growth and new technology now have a tendency to leave behind larger and larger numbers of people who lack the skills, education, or social advantages that would enable them to compete for jobs. The technological changes now being made will put the same downward pressure on employment in the service industries as it has in manufacturing industries. More and more people will have fewer and fewer chances to accumulate even a minute amount of savings or capital.

A one-year freeze on expenditures would permit a serious review of social welfare programs on the basis of need and means. The current low inflation makes this the most appropriate time both to forgo current cost-of-living adjustments and to reconsider the entire welfare system. Any new approach must explicitly recognize the quite different claims of those who need Medicaid and school lunches, for example, and those who benefit from Medicare and federal pensions.

Taxes have to be weighed on the scale of fairness. Not only should American business pay a minimum corporate tax but the effects of any new energy taxes on lower-income families should be mitigated. Those in low-income brackets who drive to work could, for example, receive low-interest loans enabling them to trade in their old cars for fuel-efficient, small, new, American-made automobiles. Moreover, we can collect more in taxes from well-to-do people if we have a system of lower tax rates with few deductions than we could if we had higher rates and more shelters. Under such circumstances, gains on capital should have no preference over ordinary income.

President Reagan’s election in 1980, and the subsequent tax and budget programs of his administration, showed that there was, rightly or wrongly, a political consensus that income redistribution had gone too far. However, taking from the poor to give to the well off, in times of high prosperity, is not tolerable for long in a democracy. Income redistribution may not solve all the problems of poverty but the current trends have to be reversed at the very least.

Again I think we must examine a wider range of possible solutions. Recently, for example, Dr. David Owen, one of the leaders of the Social Democratic party in England, proposed a new plan for creating capital and savings for those at the low end of the British economic scale. He suggested that the British government distribute the shares of government owned companies such as British Airways, British Telecommunications, etc., to those below a certain level of income. This would create some capital and savings for people who would probably have little access to both for many years. The London Financial Times supported this suggestion.

Although the US government does not own industrial concerns to the same extent that the British government does, nevertheless the US government is in many businesses. It not only owns TVA and Conrail but has large holdings of coal, timber, and gas and oil leases, among others. The recurrent proposals to “get the government out of business” in the US might be reconsidered with such a plan as Dr. Owen’s in mind. Instead of selling Conrail, TVA, or others, the government might set them up as operating companies and devise ways to distribute their shares to those at the lower end of the income scale. Instead of transferring more income from one set of Americans to another, we could transfer capital assets from the government into the hands of its needy citizens.

A year’s freeze of the budget would enable the administration and Congress to consider other fundamental changes needed by our society. Aside from slowing the growth of military spending, should there not be a shift from military to domestic public construction in view of the shameful conditions of our inner cities, many of our roads, much of our low-income housing? The Japanese and Germans are suggesting a gradual lowering of the work week to spread employment. The forty-hour work week has been in effect for forty years while technology has exploded and productivity in many industries has grown significantly. Bearing in mind the need to stay competitive, and the dangers of interference in labor–management relations, the government could still stimulate reconsideration of such longstanding industrial practices. These and many more questions concerning our basic social priorities should be assessed apart from the passions of an election year.

The Dollar and the International Monetary System

By most standards, including purchasing power and relative levels of inflation, the dollar is overvalued by 25 to 30 percent in relation to the major European currencies and the yen. The result has been a projected $130 billion trade deficit for the US balance of trade and a disaster for many domestic industries, which have been making strong demands for protectionist measures. The level of the dollar is partly caused by high interest rates, partly by the fact that we are forced to borrow abroad to finance the deficit, and partly by the attractiveness of US markets as political and economic havens for capital. For Japanese and European exporters, the overvalued dollar has meant high profits; it has helped to keep US domestic inflation down by keeping commodity prices from rising. At the same time, the cost of the dollar has been extremely harmful in the third world and to the nonindustrialized countries generally.

An orderly, gradual reduction in the value of the dollar, as a result of responsible budget actions, is highly desirable; a precipitous decline, as a result of large capital outflows, would create serious problems. The Federal Reserve, for example, might well raise interest rates to stem capital outflows and to finance the deficit just at the time when the economy could least afford it. That would produce the worst possible outcome. The dollar will always command a premium simply because of the political and economic power of the United States throughout the world; there is no need to superimpose a surcharge because of our budget problems.

Convincing action to cut the budget, and the fall in interest rates that should result, will help in turn to reduce the overvaluation of the dollar. Equally important, however, is the need to rebuild and maintain an orderly international monetary system. The dramatic gyrations of foreign exchange rates, the explosion in world indebtedness, speculative flows of money during the last twelve years have had a major destabilizing effect on world trade, on the economies of many countries, and, as a result, on the political stability of a large part of the world. Although it is impossible to go back to a fixed-rate system, we should seriously consider negotiating a system where the main trading currencies would be allowed to fluctuate only within certain limits. This would mean coordination among the major central banks and finance ministries of the US, Western Europe, and Japan. Only the US can take the lead in proposing such arrangements, and the US can do so only if it first takes serious action to put its own financial situation in order.

The Banking System and International Debt

Many factors were responsible for the current dangerous overextension of the US banking system. Petrodollar recycling and the creation of a trillion-dollar unregulated Eurodollar market in the 1970s; deregulation of financial institutions coupled with overaggressive lending and lax oversight in the US; careless borrowing by overseas borrowers—all these had a part in creating a dangerous situation. About $800 billion in international debt is owed to Western banks. Some $350 billion is owed by Latin America alone, about $100 billion to US banks. Banking regulation permits our banks to make loans in an amount roughly equal to twenty times their capital. A number of our largest banks have lent more than 100 percent of their capital to Brazil, Argentina, and Mexico alone, which have a combined debt of $230 billion. It is worth noting that the total capital of all US banks is probably less than $100 billion. Notwithstanding current claims in the press that the crisis is largely over, the problem will not go away.

There is no neat solution to this problem. A long process of adjustment is clearly needed in which the US government should have an active part. Two goals should be paramount: to protect the US banking system, while maintaining our banks in a position to finance our economic growth; and to adjust the interest and the maturity dates of the debt to the social and economic capacity of the borrowers to pay, under continued but modified supervision by the IMF. Continued rollovers, as in the most recent agreement with Argentina, simply serve to buy time. In the case of Argentina, it may not even be very much time.

Lower interest rates throughout the world as a result of a reduced US budget will certainly help to achieve both objectives. To the argument that the government must not interfere with the market system, the answer is that we are doing so right now. In rescuing the Continental Illinois Bank from bankruptcy, we are now in fact nationalizing one of the ten largest banks in the country. The FDIC has already provided $5 billion to save the bank and the amount will probably go higher. The FDIC will ultimately own 80 percent or more of the bank.

Continental Illinois carried $40 billion in assets on its books. The FDIC and the Federal Reserve have unconditionally guaranteed all of its deposits, payments to all its general creditors, and complete liquidity in its operations. I have no doubt myself that the bank could not have been allowed to fail, but the sweeping nature of the US government commitments—far beyond anything we have seen since 1932—has yet to be analyzed and understood. If the government follows the precedent of the Continental Illinois rescue, and it seems safe to conclude that it will, it has unconditionally guaranteed all the depositors (not just those up to $100,000), all the general creditors, and the liquidity of all major US banks. That would be a trillion-dollar commitment.

After the election, the US should take the initiative in dealing with the international debt problem. It should not wait passively for demands to be made when politicians, treasury officials, and bankers here and abroad suddenly become fearful of collapse. A plan should be developed by the Federal Reserve and the US Treasury, together with the IMF and the banks, that will provide longer and easier repayment terms for Latin American borrowers. Some US government guarantees would have to be part of any such plan. The condition for revised terms should be continued fiscal restraint on the part of the borrowers, and open and safe markets for US capital. Such a plan should keep our banks strong and active while requiring them both to maintain higher levels of capital and to use more conservative accounting so as to protect depositors and investors. As in the Continental Illinois case, the costs would have to be allocated among bank shareholders, creditors, and US taxpayers.

Having already put the credit of the US behind our large banks, we should use the leverage conferred by this commitment to defuse a situation that could, if it is allowed to continue, cause havoc not only to the banks but to all of Latin America. The current formula for dealing with this problem is to impose austerity on Latin America in order to maintain the myth that our bank loans are worth 100 cents on the dollar. I believe this policy, if it continues, will create more communists during the next decade than Fidel Castro and the Sandinistas could during the next fifty years.

International Trade and Protectionism

As long as the international monetary system remains chaotic and the dollar overvalued, the strains in trade relations between the US and other countries will become acute. Both here and abroad, the demands for protection for domestic industries will rise, whether in the form of tariffs, export quotas, or government subsidies conferring advantages over foreign competitors.

Last May I recommended to the International Trade Commission an industrial policy that would give the steel industry temporary protection in exchange for explicit undertakings by the industry to modernize. These would include commitments by management to new investments in modern facilities and funds for displaced workers; by the unions to wage restraints; and commitments by both to profit sharing and improvements in productivity. The ITC, in announcing its decision to recommend steel import quotas to the president, specifically asked that they be made conditional on such undertakings. This is the central bargain of industrial policy. It should apply to the auto industry and the UAW when the issue of quotas on Japanese automobiles again arises during the coming months.

President Reagan’s decision was to reject mandatory quotas but to require “voluntary” agreements from steel-exporting countries which are the equivalent of an 18 percent market share agreement. In order to maintain a facade of “free trade” and “market mechanism,” the administration and the American consumers will get the worst aspects of protectionism (i.e., quotas and higher prices) without any of the benefits of an explicit industrial policy (i.e., industry commitments to invest and union commitments to wage restraint and productivity). An opportunity has been lost that we will all pay for.

If as a result of timely budget actions the value of the dollar is lowered the need for quotas or tariffs would obviously be reduced; so would the period during which protection from foreign competition would be justifiable. Protectionism is destructive. Allowing our basic industries to be destroyed because of an overvalued currency is suicidal. Both can be avoided if interest rates and the value of the dollar are brought down as a result of new fiscal policies, and a rational use of industrial policy.

The current strength of our economy, coupled with the low rate of inflation, provides a spectacular opportunity to ensure long-term growth for our economy. If the problems I have discussed are dealt with soon, the American economy could respond strongly and steadily for the long-term. However, if we wait for the next recession before we act, we could be faced with higher deficits, higher interest rates, a collapsing dollar, and a banking system under great pressure. The choices facing us then will make the current ones look easy.

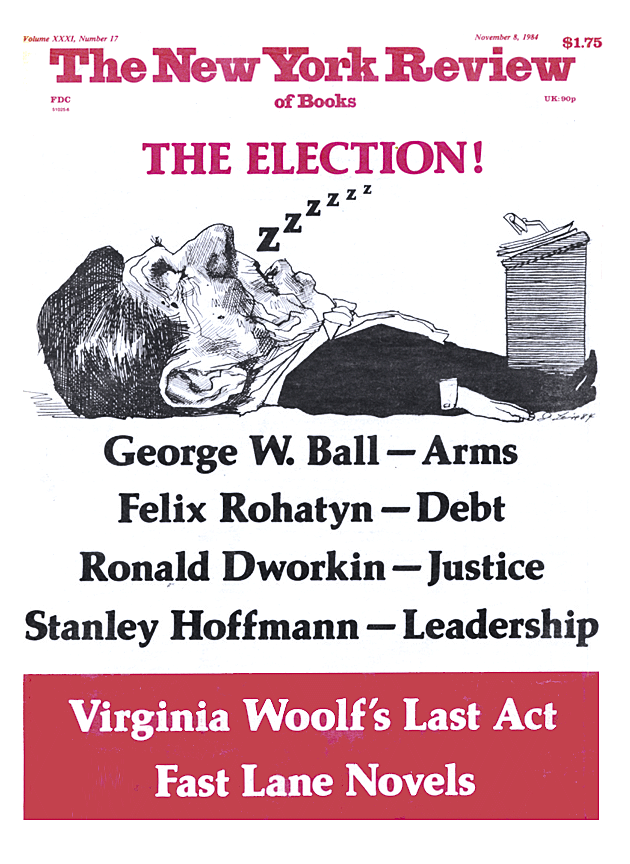

This Issue

November 8, 1984

-

1

See Reducing the Deficit: Spending and Revenue Options, Congressional Budget Office (Washington, D. C.: Government Printing Office, 1984). See also Spending for a Sound Defense: Alternatives to the Reagan Military Budget, issued by the Committee for National Security, 2000 P St., NW, Washington, D. C., 20036 ↩

-

2

From The Economic Illusion: False Choices Between Prosperity and Social Justice, by Robert Kuttner, recently published by Houghton Mifflin, pp. 251–252. ↩

-

3

See The Reagan Record, edited by John L. Palmer and Isabel V. Sawhill (Ballinger, 1984), p. 320. ↩