Americans have reason to worry about their competitiveness on world markets. The deficit in America’s balance of trade is running at an annual rate in excess of $120 billion. This represents the loss of three million American jobs, jobs that would exist if exports matched imports. To finance such a deficit America must borrow abroad, and at current rates America will, by mid-1985, become a debtor nation, having borrowed more from foreign countries than it has lent, for the first time since World War I. As with Mexico and Brazil, interest payments on foreign debts are eating up more and more of the resources that could otherwise be used by Americans.

While everyone is familiar with America’s competitive failures in its old smoke-stack industries at the tail end of the economy, the failures seem just as ubiquitous in high-tech industries that are supposed to be the most competitive and productive. In 1984 the Japanese expect to make twenty million home video recorders, generate billions of dollars of sales, and provide hundreds of thousands of jobs. How many home video recorders will be made in America? Precisely zero: 100 percent of them are imported.

At last count the United States had one-thirtheenth as many programmable robots, relative to the size of its labor force, as Sweden; with one exception, every American robot manufacturer lost money in 1983. Foreign competitors had such a head start in constructing industrial robots that American producers had to sell their products below cost to compete.

The US government not long ago opened to competitive bidding the contract for laying a glass-fiber optics telephone cable from New York to Washington. A foreign firm won the bidding by a substantial amount but its bid was rejected on the grounds of national security, despite the fact that the firm comes from one of our allies. Perhaps the problem of US competitiveness is best symbolized by the fact that ski outfits worn by the American ski team at the Winter Olympics were made abroad. Our world-class athletes represent something less than a world-class economy.

Observations such as these lead to a simple question: Can America compete in world markets? A superficial reading of Can America Compete? by Robert Lawrence would suggest that the answer is “yes.” “US manufacturers, aided only by changes in the exchange rate, were able to compete successfully in an environment characterized by emerging competition from developing countries and Japan and by growing government intervention and protection in Europe.” Since this view reflects the thinking of most of the economists at the Brookings Insititution, we may call it the Brookings line.

The DRI Report on US Manufacturing Industries, a collective effort led by the late Otto Eckstein of Data Resources, Inc., an economic forecasting firm, answers “no.” The “decline of position of manufacturing is a major historical development for this country,” the authors write on page one. “There are so few exceptions to the decline of the international positions of US manufacturing industries that one must seek more general causes that act on the entire economy. Without a strongly advancing manufacturing industry, the US economy is hardly likely to maintain its progress in the decades ahead.”

Which answer is correct? If we follow the DRI line, but the Brookings line is correct, we would rush to fix something that does not need fixing and may end up damaging what we have. If we follow the Brookings line, while the DRI line is correct, we end up with a standard of living that falls relative to the rest of the world. Having the correct answer makes a difference.

Before analyzing the arguments on both sides, however, one must clear away the underbrush of agreement. The DRI Report states, “No degree of cleverness on the part of management, no new-found co-operation between employers and workers, no industrial policies by the federal government can overcome the handicaps of an overvalued dollar and a domestic economy disrupted by credit crunches and recession every three or four years.” Virtually everyone agrees on this point. The disagreements come in the next sentence. “Better national economic and financial policies will not solve our industrial problems, but without them the more specific solutions cannot prove successful.” By contrast, the Brookings economists seem to be saying that better national economic and financial policies—“macroeconomics” in the jargon—will by themselves solve the problem of competition.

In view of this belief, it is not unfair to ask the Brookings economists to specify the “better” macroeconomic policies they have in mind, but apart from general references to tighter fiscal policies—cutting the budget—and looser monetary policies—lowering interest rates—Lawrence says little about this. Still, if we put aside the problem of specifying better macroeconomic policies, the question remains whether something else needs to be done.

As is usually the case when two sophisticated analysts differ on the facts, the problem is not really the “facts” but differences in the precise questions being posed. DRI and the Brookings authors seem to be raising identical questions, but they are actually quite different ones.

Advertisement

If the question is simply “Can America compete in world markets?” the answer is of course “yes,” and the Brookings line is correct. Bangladesh and other very poor nations compete successfully on world markets with a surplus in their balance of payments. They do so by competing as low-wage countries with low standards of living. If their rates of growth in productivity lag behind those of the rest of the world, they simply accept a gradual fall in the value of their currency, their relative wages, and their relative standard of living.

If the relevant question is “Can America compete in world markets with wages and a standard of living second to none?” the answer is clearly “no.” The Brookings document does not disagree, for Lawrence proves that the US can compete successfully if it has a continual decline in the value of the dollar, in its relative wages, and in its relative standard of living. As Lawrence states, “Aided by several devaluations, US firms were able to compete from 1973 to 1980″ (my italics). To be precise, Lawrence finds that American manufacturing could compete, but only with the help of a 13.5 percent decline in the price of US exports between 1973 and 1980.

In the longer period between 1965 and 1982 analyzed by DRI, the US, as a whole, could not successfully compete. Lawrence agrees. He finds that more than half of the jobs lost in US manufacturing from 1980 to 1982 could be traced to falling exports and rising imports. He writes, “In short, slowing productivity growth is a serious problem from the point of view of living standards. But it is not a cause of decreased competitiveness in international markets.” That is of course true. To fall behind in the race for growth in productivity is to have falling wages and standards of living relative to the countries winning the race.

But such a decline is precisely what Americans don’t want and it is precisely what they are worried about when they talk about competitiveness. They do not want to gradually become low-wage “haulers of water and hewers of wood.” They want to compete as a high-wage society with standards of living approximately equal to those of the world’s economic leaders.

Both books give the right answers to the questions they pose, but it is the DRI’s book that poses the right question.

Lawrence’s book is mainly interesting for the light that it sheds on how fast American wages and standards of living would have to fall for the US to remain competitive with the rest of the world. In attempting to show that the US competitive problem is explained solely by macroeconomic variables such as changes in the GNP, Lawrence uses econometric equations to explain historical movements in American exports and imports. These equations show that to regain an equal balance in our balance of trade the US would need a 28 percent decline in the value of the dollar, and once that is attained the dollar would have to fall forever by 0.4 percent per year to maintain the balance. A 28 percent decline in the value of the dollar will have visibly negative effects on American standards of living. While 0.4 percent per year may not seem like much, just such small persistent differences caused Great Britain to slip from being the country with the world’s highest per capita GNP at the turn of the century to a position near the bottom of industrial countries eighty years later.

Lawrence’s equations also give us some insight into recent slippages in the US competitive position. For both imports and exports Lawrence estimates two equations—one with data from 1964 to mid-1980 and one with data from 1964 to mid-1983. By comparing the two equations it is possible to isolate the structural deteriorations that have occurred in the American position during the last three years. Such a comparison reveals that during those years foreigners have bought fewer US exports when their own industrial production rose than they previously did. It also shows that they are more sensitive to the price of US exports, cutting their purchases back more than they previously did when American prices rose. So far as our own imports are concerned, a given increase in the American GNP now leads to a bigger rise in imports than it previously did. A fall in foreign prices also leads to a bigger rise in American imports than before. Such shifts are the mark of a country whose exports are becoming less distinctive, less competitive, and must, to an ever greater extent, be sold as simply cheaper, while foreign exports into the United States are becoming more distinctive and more competitive. Less and less do they have to be sold simply on a price basis.

Advertisement

When Lawrence adds the data from 1980 to mid-1983 to his equations, they show consistent movement toward a weaker American position. His analysis makes it clear that strong underlying adverse trends are running against the United States; and these will gradually increase the annual decline in the value of the dollar that would be necessary for the US to remain competitive.

In fact, there is reason to believe that Lawrence’s equations underestimate the magnitude of the shift against the United States. The extra three years of data were added during a period of rapid military build-up. Military spending is a captive market for American manufacturing. We don’t ask for competitive international bids on military equipment. If we did, all of our navy’s ships would be made in Japan. But this means total manufacturing looks much stronger than it would if civilian manufacturing were separated out.

In addition, the period has been one of protection. Lawrence quotes data showing that the percentage of US manufactured goods protected by non-tariff restrictions such as quotas and other import barriers has risen from 20 percent in 1980 to 35 percent in 1983. If such protection had not occurred, the adverse shift against the United States would have been much larger than was estimated by Lawrence.

America also has a bilateral deficit in high-tech products in its trade with Japan and is merely holding its own in its trade in such products with Germany. An inability to compete against Japan and Germany on high-tech products here in the US foretells an eventual inability to compete in other countries.

As the DRI Report recognizes explicitly, and Lawrence’s book implicitly, the problem for the US is not competitiveness—that is merely a symptom of a more serious disease—but lack of growth in productivity. The accompanying table shows the level and rate of growth of manufacturing productivity in some major industrial countries.

According to DRI, manufacturing productivity in the United States is now below the levels achieved in most of northern Europe and some of southern Europe. This conclusion is controversial. Lawrence maintains that the US decline has not been quite so great. This may or may not be true since it is very difficult to translate output measured in different currencies into a common dollar measure.

The most important problem, however, does not concern the first column of the table, where arguments are possible, but the second column, where there can be no arguments. Everyone agrees that the United States has scored near the bottom in the competition for growth in productivity since World War II and that it continued to do so during the most recent period for which comparative data are available. This means that even if the rest of the world has not yet passed us in absolute productivity, it is only a question of time before it does so. And since it would take a substantial amount of time—a minimum of five to eight years—to reverse the growth rate of America’s productivity, the time to start making that turnaround is now, whether we are, or are not, behind in absolute terms.

This brings us to the controversy surrounding industrial policies. Here much of the debate seems theological (how much respect should be paid to the god of free enterprise?) and has concentrated on the rather narrow issue of whether the United States does or does not need a public investment bank. The Brookings economists claim to dislike industrial policies. Lawrence dutifully includes a chapter attacking the straw-man version of them, by which central planning would be achieved through a government agency attempting to pick winners and losers. As a policy, that would of course be a loser and Lawrence has no difficulty in deflating it. But in the next chapter, “Toward More Appropriate Structural Policies,” Lawrence essentially embraces industrial policies without being willing to use the name. What is thrown out by the front door is dragged in by the back door.

The Brookings report can do this because of the prevailing confusion over what industrial policies are all about. Industrial policies are to a nation what strategic plans are to a firm. They outline the basic strategy the nation intends to follow in increasing economic growth and in meeting foreign competition. In both cases the aim is not a fixed doctrine that a firm or a nation must follow but a flexible strategy that evolves in response to changes in the environment facing either the firm or the nation. It should be a strategy that the firms and other social organizations within the nation—or the divisions within the firm—have helped to develop, and want to follow, but need help in implementing.

Above all, the creation of an industrial policy should be an educational process—a sharing of information, a forum for industry, labor, and government discussions—in which each can learn about the problems of the other and how all can mutually interact to solve their joint problems. Industrial policies are designed to allow individual decision makers to coordinate their actions voluntarily so that they can jointly increase the likelihood that they will all be successful in reaching their individual objectives. Thus, for example, business might promise new investment and labor changes in work rules if government were willing to help finance additional research and development expenditures in a particular industry. Or government might promise changes in the tax code that would make it easier to finance new ventures if labor and business would agree to restrain wage and price increases.

As far as Washington policymaking is concerned, industrial policies are essentially an attempt to increase the influence of the industrial community. They can only work if what DRI calls an “industrial viewpoint” is brought to bear on government decisions. Many people, especially liberals, complain about the excessive influence of the business community on policymaking, but one should remember that it is the financial community—the banks and other suppliers of investment—and not the industrial community, that often has the decisive influence. Industrial firms would have little influence in Washington if it were not for the political power of the industrial unions. Unless it walked through the door with the UAW, the Ford Motor Company could not get the time of day from Congress.

In addition to general consultation and bargaining among business, labor, and government, most industrial policies in the other advanced nations work in three ways.

(1) A government agency is established to partially finance civilian industrial research and development on new products or new production processes. Such research is undertaken by a number of firms on a cooperative basis with a view toward producing “medium-term” results—i.e., within, say, five years. Projects are funded in a peer review process in much the same way that the National Science Foundation now awards projects to universities. All of our international competitors have such an agency.

(2) Government seeks systematically to reduce the costs of capital and increase its availablity to industrial firms. This might entail the reestablishment of private and public investment banking. (Real investment banking was made illegal in the United States in 1933 under the Glass-Steagall Act which prohibited banking institutions from using their funds to make direct, “hands-on” equity investments in industrial firms. What we now call investment banks, such as Morgan Stanley or Lehman Brothers, are merely brokerage firms that bring together savers and investors.) It might also require changes in tax laws or restrictions in consumer credit provisions to increase the supply of industrial capital.

(3) The government has some systematic procedure for dealing with what is essentially “industrial triage.” Suppose a sick industry, such as steel or machine tools, comes to the government asking for protection from foreign competition, for government loans or any other form of government aid. The industry—the firms, the unions, the industry’s banks, its suppliers—are first required to come up with its own plan to remake the industry into a world-class competitor. Once this plan has been elaborated by industry—not by government—the government examines the plan to see whether it is workable and, if it is, what cooperative government actions are needed to complement those promised by industry and labor. Not only the Japanese, but the German, Scandinavian, French, Italian, and Austrian governments have for years been willing to take part in such plans.

While not wishing to use the name, Brookings has an industrial policy:

…an independent analytical agency could be established and charged with the responsibilities of maintaining records and issuing reports on governmental assistance to industries and firms in all sectors of the economy for the purpose of bringing greater coherence to the totality of policies…. Whenever new measures were undertaken, the agency would estimate the costs and benefits and record the objectives as stated by policymakers. All policymaking bodies would be required to file information on policy actions to the agency. In subsequent years, the agency would evaluate the efficacy of such policies.

In fact, this approach is more centralized—and puts more power in the hands of a federal agency—than anything suggested by the proponents of overt industrial policies, such as Robert Reich or Felix Rohatyn.

Concerning the three functions of industrial policy I have mentioned, Lawrence wants more government support for industrial research and development. He also has his own program for industrial triage. Sick industries are to be rescued with diminishing tariffs that offer tariff protection for a while but grow smaller and finally vanish at the end of a specified period. Firms in troubled industries are also to be allowed exemptions from antitrust laws if they wish to merge. Workers in those same industries would be given a subsidy to help make the adjustment to competition with foreign trade. This would be equal to 50 percent of the difference between the wages in the jobs they lost because of foreign competition and the job they now have.

Where foreign competitors benefit from trade subsidies from their own governments, or from restrictions those governments place on American products, the US, according to Lawrence, should retaliate only in “cases in which US national economic welfare is clearly adversely affected and in which US retaliation is likely to make the nation better off.” Who could disagree? Where negotiations do not lead to the elimination of the special subsidies foreign governments give their industries, the US government should supply credits to match that aid. Lawrence would also have the US government apply vaguely outlined political pressures so that American firms could participate in Japanese industrial policy programs and have open access to the Japanese market. A fine project, no doubt. The only question is how to do it.

The only kinds of industrial policies neglected by Lawrence are those for increasing the supplies and lowering the costs of industrial capital. Believing as he does in the perfections of American capital markets, he has no recommendations here other than broad advice to tighten fiscal policies and ease monetary policies. By contrast, DRI would lower the cost of industrial capital not only by more firmly controlling the budget, but by ending preferential financing for nonindustrial investments (such as commercial office buildings) and making it easier to borrow long-term capital to acquire assets with a long life span (such as technologically advanced factories). The means for carrying out the last objective are left unclear, but the reinvention of investment banking, public or private, is one possibility.

According to DRI we Americans now spend less on civilian R&D than our major competitors and less than we ourselves used to spend. Parity should be the goal. Government should encourage policies to increase the supply of technical manpower and should increase funding for research and development. And, like the Brookings document, the DRI Report wants international trade policies to concentrate on reversing the declining share of US goods in world markets and opening up foreign markets, especially those in Japan. When it comes to what should be done, there is much covert agreement between Brookings and DRI, and both propose an industrial policy. But even more important than DRI’s recommendations is its sense of urgency. Since Otto Eckstein knew that he was dying while the DRI Report was being written and that this was his last chance to say something to Americans, it seems right to quote him at length:

To assure a more successful development of US manufacturing industries, an industrial viewpoint should be introduced into economic policy decisions…. Industrial development must become an explicit objective of economic policy….

The trade deficits are real and will lead to further damage to our industries. The capital flows that will be needed to offset these trade deficits will generate future interest payments that will be a burden…. The United States now experiences a “structural” trade deficit in the $40 to $60 billion range….

A nation that casually surrenders leading industrial positions through policies of neglect will find it difficult to stage a comeback, particularly if the period of non-competitiveness stretches on for more than a few years….

The danger lies in too slow an adjustment process. If the present macrosituation is allowed to continue, more markets will be lost and the damage to our trade position will become irretrievable. The present problems will not keep: in the absence of improvement in the current decade, they will become insoluble by the next one.

Of course neither Eckstein nor anyone else can show just how to make industrial development an “explicit objective” for politicians, corporate executives, and labor leaders. Either they will recognize what has happened and work out an industrial policy or they will continue to rely on the magic of “competition”—rushing to the government for ad hoc rescue efforts when they are in trouble. The real question is whether our political economy is capable of absorbing the fact that we are now losing the economic race.

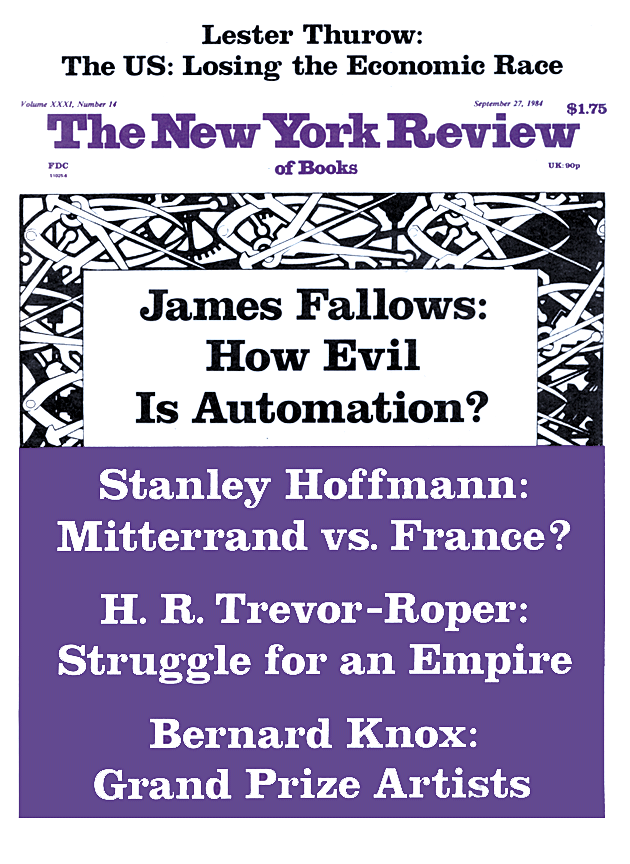

This Issue

September 27, 1984