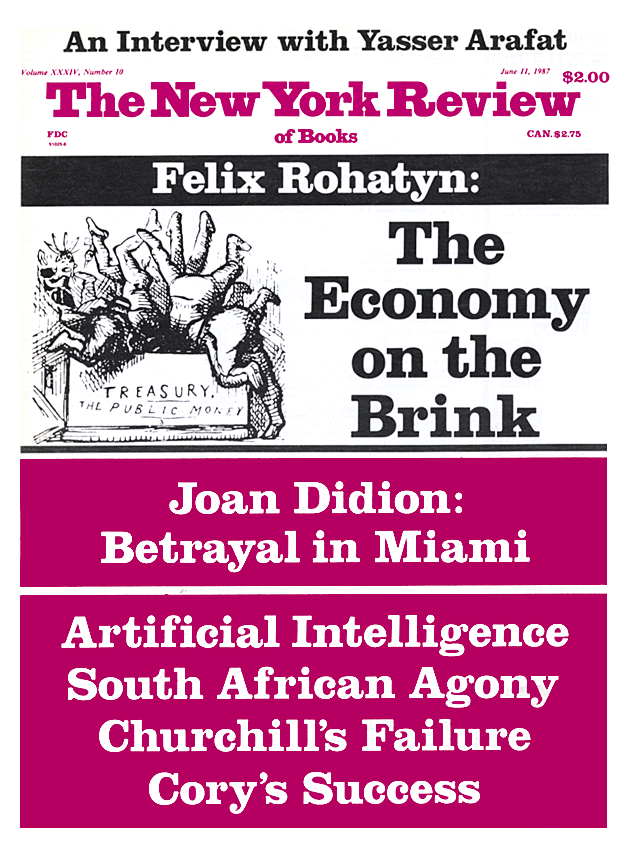

The United States today is headed for a financial and economic crisis. What appeared to be only a possibility five or six years ago became a probability more recently, and has now become a virtual certainty. The only real questions are when and how. In addition, when the crisis occurs, it will entail, quite possibly, a worldwide recession. How can such a statement be made when the Dow Jones index is at 2300 and unemployment has edged further and further down?

The facts are that the US has been guilty of the most irresponsible fiscal behavior in its history during the last seven years. American fiscal folly, coupled with the inability to coordinate economic policies with Europe and Japan, has created an ever-increasing worldwide pyramid of debt that cannot withstand a major recession. The US is on its way to becoming the world’s largest international borrower, and since the worldwide financial markets are interconnected, a serious US economic downturn automatically has worldwide repercussions.

The United States, and the rest of the world, will pay a heavy price for the fact that we have committed $2 trillion for a defense program of dubious value; that we have been unwilling to limit the growth of entitlement programs like Social Security and Medicare regardless of the need of the recipient or of his ability to shoulder some of the costs; and that, in an act of the ultimate financial cowardice, we have attempted to pass on to our children the cost of this behavior by borrowing from tomorrow instead of taxing today.

There are several results of this behavior, many of which are not always visible. The first, and perhaps least noticed, is that when it comes to our economy we are no longer an independent country. For the first time in our history, we depend on foreign capital to finance day-to-day operations of our government. In 1986, almost half of our budget deficit of about $180 billion was financed by foreign purchases of treasury securities, mainly by the Japanese. From a financial point of view, we are being colonized.

Second, in order to provide Japan and Germany with the funds that we need to borrow, we have allowed our domestic markets to absorb an ever-increasing amount of foreign goods, largely as a result of a gross overevaluation of the dollar during the years between 1980 and 1984. Even though we have dramatically changed course since 1985, collapsing the value of the dollar with other dangerous consequences, our trade deficit reached $160 billion last year and seems to be locked in for years to come. It is worth noting that, even if we were able to reduce our trade deficit by $20 billion per year, by 1995 our external debt would be about $1.5 trillion and the interest on that debt about $120 billion annually.

Third, our domestic national debt has doubled over the last five years and is well over $2 trillion. Interest on the debt alone will be about $125 billion. Corporate debt, partly as a result of unbridled takeover activity fueled by the new phenomenon of the junk bond market, is at its highest level in twenty-five years. By the end of 1986, the total long- and short-term debt of nonfinancial institutions was about $1.6 trillion.

Fourth, the debt of the less-developed countries (LDCs) to governments and banks is now more than $1 trillion as a result of year-after-year rollovers, whereby debtor countries borrow the interest on their debt and add it on to the principal amount.

There is no purely American solution to any of our major economic problems. The US cannot afford a recession that would drive our deficits to more than $300 billion and possibly cause a crash in the value of the dollar as well as in the stock and bond markets. The result could be extensive domestic and international banking defaults, a world recession, and political instability in large parts of the globe. Avoiding such an outcome, if it is possible, would involve a delicate combination of coordinated domestic and international efforts:

—The US would cut its budget deficit, through a combination of new taxes and reductions in spending. This will inevitably mean a temporary reduction in the standard of living.

—To counteract the risk of recession, we would reduce interest rates and run an easier monetary policy.

—To avoid a collapse of the dollar, Japan and Europe would have to stimulate growth, cut taxes, and increase spending.

—And to promote growth in the third world, the US, Japan, and Western Europe would have to agree on an aggressive plan of debt restructuring and on providing significant amounts of new capital for the debtor countries.

It is hard to see how any of this can happen in a US presidential election year. Under normal circumstances, even if the next president were willing to embrace such programs, they probably would not be enacted until 1990. That may well be too late.

Advertisement

We need a coherent economic strategy; we do not have one. The government’s only active policy is to drive down the value of the dollar with everything else “on hold”; no serious action is being taken to reduce the budget deficits, and there is no real change in the debt structure of the less-developed countries. A few tariffs have been imposed on some Japanese products. The administration simply seems to be hoping for a “soft landing”—a dangerous strategy and one likely to fail. Here are some of the risks involved:

(1) We have now had six years of economic growth, fueled by consumer spending, military buildup, and borrowing. The likelihood of a recession in the next two years becomes greater and greater as consumers reach the limits of their borrowing capacity and domestic investment remains soft.

(2) The coming weakness in the US economy must be replaced with growth in foreign economies. As the dollar collapses, the German and Japanese economies will slow down considerably, for both countries depend significantly on sales to the US. Combined with the inability of less-developed countries to grow as a result of crushing debt service, we are coming close to causing a worldwide economic slowdown without helping ourselves in any real way.

(3) There is no precedent or analogy for the worldwide financial structure that has been created in recent years. The amounts of capital that are richocheting around the world dwarf anything that has been experienced. One and a half trillion dollars per day now flows through New York’s Clearing House Interbank Payment System (CHIPS), which processes all the domestic and foreign payments passing through New York banks. This amounts to one third of our annual Gross National Product. The relationships between exchange rates and trade, between interest rates and economic activities, between fiscal and monetary policies, have become less and less predictable. The potential for a major shock in the credit system and the securities markets gets greater and greater.

The fallout from some of these problems goes considerably beyond the economic sphere. The ability of democratic governments in Mexico, Brazil, Argentina, the Philippines, etc., to survive in the face of continued reductions in the standard of living is questionable. Radical political movements will spring up, calling for the repudiation of debts to the Western banks; whether or not they succeed, they could bring on right-wing military dictatorships that may follow similar debt-related policies. The problems that would be created for the US by a radicalized Mexico are obvious. Whether the radicalization is left-wing or right-wing, the result may be the same: virulent anti-Americanism and an increasingly unstable southern border. The problem of illegal immigration, already extremely serious, will become even greater. The racial and political tensions in the US, especially if we are in the throes of a recession, will heighten considerably. And no one has made any kind of estimate of the additional military cost of having to maintain tighter security on the US-Mexican border.

In our own country, we have combined runaway borrowing and deficits with neglect for our domestic needs and a climate of deregulation pushed to dangerous extremes. For the sake of competition, we have broken up AT&T, and the result has been both bad service and higher prices. We have deregulated the airlines and the resulting price wars did, indeed, lowers fares, However, one airline after another is on its way to bankruptcy or to being acquired by another. The result will be a few huge airlines, with questionable financial structures, poor service with possibly higher prices, and worrisome safety factors. Deregulation of the financial markets has resulted in an explosion of private debt, unprecedented market speculation, and the sordid abuses in the financial industry that have been coming to light in recent months. Deregulation, as with most things in life, has to be done in moderation; it has been carried too far. The free market is not always right; it surely is not always fair. It should not be turned into a religion.

Our budget priorities have also been misconceived. The continued military buildup, together with the growth in entitlements, cannot be sustained in the light of our other needs. The recent collapse of a bridge in upstate New York was a small reminder of a major problem, the immense need to rebuild our domestic infrastructure. It is estimated that $50 billion may be required nationally for bridges alone, which does not seem unreasonable in light of New York City’s $15 billion commitment to mass transit in the decade of the 1980s. A major domestic reconstruction program for such facilities as railroads, bridges, waterworks, roads, and school buildings must be undertaken soon. It will be more labor-intensive than a continued military buildup and will be a better long-run investment for the country. It cannot be financed without changes in our priorities.

Advertisement

Contrary to some predictions, the productivity of American industry has increased significantly during the last decade. However, no amount of improvement in productivity will make up for wild swings in the value of the dollar which have driven vast amounts of US manufacturing permanently abroad. No amount of productivity will survive competition with the Korean, Malaysian, or Taiwanese standard of living. To create jobs and businesses that add high values to raw materials through skill and technology we need an educated work force. We are not creating one. Our primary and secondary education system is a disgrace, particularly in our large cities. Future generations of inner-city students are condemned to spending unproductive lives. The human cost in crime, misery, and racial tensions is unacceptable, the financial cost to the country’s economic capacity is equally great. It is absurd to think of the US as a worldwide economic power unless it can undertake a major effort in education, together with the investment in infrastructure that has to go with it.

Our renewed dependence on imported oil for our domestic energy needs should also be a source of concern. The collapse in oil prices, coupled with the dramatic deterioration of the financial position of many large US oil companies has caused operating rigs to be reduced from over 4000 in 1982 to about 600 today. Imported oil will again supply over 50 percent of our requirements and it may supply a significantly greater proportion by the early 1990s. We cannot once again become hostages to the Middle East for our energy needs. The region is becoming increasingly unstable and we cannot afford the risk of a sharp rise in energy prices in the midst of a 1989 or 1990 recession.

At the same time, a major opportunity may be open to us. Whatever problems we may have, the Soviet Union has many more. It is impossible for a rigid, bureaucratic, totalitarian system to survive competitively in the advanced, industrial, global environment of the late twentieth century. The Soviet system, if it is to adapt to modern telecommunications and data processing, and other new technologies, without which it cannot compete, may have to open itself up politically, provide greater benefits to its population, and limit its imperial ambitions. Its ability to physically control the life of its neighbors in Central Europe may become more limited.

General Secretary Gorbachev seems to understand this reality. The next few years may provide the opportunity for large changes in the relationships between the Soviet Union and the US. Both our countries need to make major investments in our domestic economies for social as well as for competitive reasons. Those investments can only be made by reducing investments in defense. In addition, the Soviet Union will need credits and technology from the West. No doubt there is a risk that a more successful Soviet economy will result in a more aggressive Soviet state. There is, however, a greater risk that a continued, uncontrolled arms race, coupled with rising political tensions, will lead not only to ruinous expenditures but to armed confrontation.

Of course arms control agreements with the Soviets must be carefully monitored. But the notion that anything that is good for the Soviets is automatically bad for us is absurd. Our present vacillations about Soviet proposals on nuclear arms reductions in Europe are an example. Some prominent officials and commentators in the US and Europe are worried that eliminating short-range missiles, together with medium-range missiles, will leave Europe at the mercy of Soviet conventional forces. First, the notion that the Soviets will invade Western Europe is far-fetched, given NATO’s strategic and tactical nuclear capacities on the one hand, and the fact, on the other, that the Soviets have continuing difficulty in controlling Eastern Europe. Second, the Soviets have indicated a willingness to discuss conventional force reductions. Third, if such reductions do not take place, we should suggest to our European friends that they build up their own conventional forces. Our allies are clearly not carrying their fair share of the defense load. But there is no valid reason not to begin the process of nuclear arms reduction, and we may never see a better opportunity for doing so.

As for long-term global economic strategies, the advanced countries must look for ways to create new, large-scale demand from regions other than Western Europe, North America, and Japan. The main economic risk to the West is not inflation but deflation. Too much capacity has been built up throughout the world with insufficient demand to absorb it. During the next few decades, such additional demand could be encouraged to come from the less-developed countries, and the Soviet bloc. Our long-term international economic strategy should include the following:

(1) Major commitments of Japanese and West German capital to finance the future growth of the less developed countries while we negotiate to restructure their existing debt, enabling those countries to meet the demands of their people.

(2) Step-by-step arms control agreements and parallel economic cooperation with the Soviet Union and the Soviet bloc countries aimed at their becoming a major factor in creating additional demand for the world’s economy.

(3) A new Bretton Woods conference to try to evolve a more stable international monetary system. This is long overdue. This should be the main item for consideration on the next economic summit in Venice in June 1987. Such a conference should take up the subjects of exchange rates and debt. They cannot be separated. Concerning currencies, the conference should deal with both near-term and long-term objectives. For the near term, the conference should aim to establish “target zones” for the dollar, the Deutsche mark, sterling, and yen—ranges in which exchange rates would be permitted to fluctuate under an agreement to keep the rates from breaking through either end of the range. At the same time, large-scale interventions in the markets to defeat speculative runs on the main currencies must be backed by a sizable and credible intervention fund. The main central banks should as soon as possible establish a $20 to $30 billion exchange stabilization fund for this purpose.

The recent series of agreements among the Group of Five—the US, UK, Japan, Germany, and France—has succeeded in collapsing the dollar but in little else, since there has been no real coordination of economic policies among the OECD nations. For the long term, an expansion of the European Monetary System to include sterling, dollars, and yen should be considered. The EMS on the whole has been successful in maintaining a level of cooperation and coordination among its members. Devaluations and reevaluations have occurred, but as part of an orderly, gradual process. It is time to study how the system can be expanded. In order to do so, however, the obvious fact to be faced is that the dollar now accounts for some 80 percent of the world’s currency reserves—the currency that governments and international agencies hold to finance international trade; this disproportion must be counterbalanced by larger volumes of other currencies than are available today. The European Currency Unit (ECU)—which is based on a “basket” of European currencies—and the yen offer the best possibilities.

In the long run, currencies cannot be stabilized without considerably closer coordination between nations and in some cases, integration of their economic policies. Central to both goals will be the creation of currencies or baskets of currencies in sufficient volume to counter-balance the dollar.

Such a long-term strategy would still involve major efforts to reorganize our own economy and to avoid the major economic crisis which is almost upon us, notwithstanding the difficulties of pursuing difficult changes in economic and political policy during an election year. Politicians have a tendency to re-create the last election just as generals have a tendency to fight the last war. If they follow the conventional wisdom, the Democratic presidential candidates will refuse to discuss any increase in taxes and the Republican candidates will duck the issue of possible cutbacks in Social Security and other entitlements. That will doom any serious action on the budget deficit until 1990. Neither Democrats nor Republicans, moreover, will want to propose a restructuring of third world debt—extending repayment periods and writing off loans—while the farm sector, the energy sector, and other parts of the US economy are in difficulty. As for American ties with the Soviets, we may expect that prominent Republicans will compete to show they are more hawkish and tough-minded than their colleagues; and Democrats will fear being perceived as “soft on communism.”

The presidential candidates in 1988 thus confront implicit choices. If they discuss the country’s economic situation realistically and truthfully, they risk political suicide. If they make promises about taxes, entitlements, and energy policy that they cannot possibly keep, they risk being unable to govern if they are elected.

One way to avoid what will be seen as self-defeating choices would be to try to create a consensus among moderate Republican and Democratic leaders on some of the fundamental economic constraints that will face the next president. This could be done by establishing a bipartisan congressional commission modeled on the Temporary National Economic Commission set up by Franklin Roosevelt in 1938 to study the country’s economic problems. The commission would consist of members of Congress, business and labor leaders, and academic experts. They would be evenly split between Republicans and Democrats and would represent ideologically moderate wings of their parties. Their task would be to identify the main issues and principal ways of dealing with them responsibly. Even if the commission did not reach a consensus on how to solve the major economic problems, it could frankly lay out the choices—and the limits on them—in analyses that could strongly influence campaign debate.

With respect to the deficit, the options of higher income taxes or new types of consumption taxes, such as energy taxes, would leave much room for argument—as would mechanisms to make certain that new taxes do not become translated into new spending programs. When it comes to trade, the options would include a further lowering of the dollar, temporary tariffs, or some forms of limited industrial policies. As for interest rates and the Federal Reserve, the commission could analyze the differing approaches to monetary policy, for instance directly controlling interest rates, on the one hand, or, on the other, aiming at stability based on the price of gold or the value of some basket of selected commodities. (It could also, I hope, arrive at a unanimous recommendation to continue Paul Volcker for another term.)

With respect to entitlements, the possibilities of applying a means test or of taxing well-to-do recipients should both be examined. And as for third world debt, the options to be considered would include government involvement as part of a major restructuring program of the type recommended by Senator Bradley of New Jersey, or the continuation of rollovers together with some version of the current Baker plan under which the debtor countries would be eligible for additional credits if they undertake economic reforms emphasizing the workings of the market.

A commission would provide a coherent frame for debate of the economic alternatives. Its very existence would not only infuse some realism into the national debate but also give candidates courage to state unpalatable truths. It would also provide the domestic background for considering the critical foreign policy issue of the 1988 campaign, namely America’s long-term relationship with the Soviet Union.

It may well be too late in the day for such a commission. But even if some kind of economic crisis is now inevitable, the issues I have mentioned will still have to be dealt with, and how we do so may determine the depth and severity of the crisis. Facing reality now will require sacrifice on the part of everyone as well as bipartisanship and cooperation between business and labor. It will call, finally, for leaders who are willing to make it plain that if we are not capable of exercising restraint in our financial expectations, we will find ourselves in great danger.

This Issue

June 11, 1987