One of the less celebrated of the convergent tendencies of modern capitalism and communism, free enterprise and comprehensive socialism, is the way both are put at risk by their best rewarded and most ardent partisans. This is now superbly evident in the Soviet Union in the current resistance to the Gorbachev—or any serious—reforms by the comfortable and often privileged bureaucracy. It is from there that comes the strongest affirmation of so-called socialist principles and the need for stolid adherence thereto at whatever cost. Inherent in this huge bureaucracy is the economic stultification that manifests itself in low economic growth and irrelevant response to consumer wants and needs.

The same adverse contribution by the greatest beneficiaries of the system has long been noticed in the nonsocialist world and especially, perhaps, here in the United States. It was the affluent and privileged, and notably the great business interests, that most aggressively opposed the welfare state—opposed Social Security, help to the deprived, low-cost housing, health care. Also trade union organization and support to agricultural prices and income. Also, in the post-Keynesian age, the assumption of macroeconomic responsibility by the state, however imperfectly discharged, for the overall performance of the economy—for countering economic depression, unemployment, and inflation, and seeking a satisfactory rate of economic growth.

Forty years or so ago the name of John Maynard Keynes aroused at least as much antipathy in the business community as that of Karl Marx, more perhaps because his ideas were a more clearly present danger. It was by these ideas, and more especially by those leading to the welfare state, that the powerful forces of anger, despair, and alienation implanted by capitalism were subdued. And those who would otherwise be suffering were brought in our own time, at least in part, to the support of the Republicans and George Bush. If the attitudes of those with the most to lose had prevailed, there can be little doubt that the system by which they were supported and rewarded would have fallen into yet more grave disrepute and perhaps would have been lost.

The determination of its greatest beneficiaries to put the capitalist system at risk has continued and, if anything, increased in the 1980s. It is now manifested in the field of corporate finance; its method is to exploit for private gain two features of the modern corporation that make it especially vulnerable to damage.

The first of these flaws, already noted and warned against in the company structures of his time by Adam Smith, is the anomaly of profit maximization. According to all capitalist principles, profit is for the property owners; it is for the latter, the shareholders, that the effort is made. Yet in the modern great corporation it has long been accepted in fact—though not, alas, in economic theory—that the ordinary shareholder, either individually or collectively, is normally without power. His, her, or their revenue is maximized by a management that is sovereign in its own authority. Profit is maximized but in a presumptively selfless way by one group of people for others who are mostly unknown to them.

This, as noted, has long been recognized. In the 1930s it was affirmed in hard statistical form by Adolf A. Berle, Jr., and Gardiner C. Means (Means, unjustly forgotten, died a few months ago), and again in the early 1940s in a persuasive tract by the late James C. Burnham.1 What did not follow was the acceptance of the fact in the established microeconomic theory. The latter depends, and absolutely, on the aforesaid commitment to maximizing profits. But in the dominant part of the economy, as indicated, this maximization is carried out by an authority that does so on behalf of others. This is far too inconvenient for everyday economic instruction or, more especially, for the equations in which economists delight, and so, not for the only time, economics rejects as fact what it cannot accommodate readily to the theory.

The other vulnerable feature of the modern corporation is in the relation of its debt to equity—that of bonds and bank loans in varying form to the common stock wherein reside the legal ownership of the corporation and the voting rights of the shareholders. Here, albeit with grave risk to the enterprise, lies an opportunity for the ambitious to retrieve the legal power of stock ownership—the power otherwise lost through wide dispersal of that ownership and the inevitable and admitted ignorance of the individual stockholder or, for that matter, the stockholding mutual or pension fund or other institution.

By substituting debt for equity—borrowing against the credit of one company to buy the stock of another with which the first will be merged—control can be exercised over the acquired company at the price of increased, sometimes greatly increased, debt for the combined operation. Or, defensively, money can be borrowed by management to reclaim stock and thus to ensure management control of the company, again at the cost of increased debt. The established reference here is to leverage, a word that implies a certain financial magic and that, in fact, always means an increased interest obligation that the earnings of the acquired or defended corporation may or may not be sufficient to meet. Dividend payments may be missed; defaulted interest payments, in principle at least, mean bankruptcy.

Advertisement

The foregoing, simple though it seems (and indeed is), is nonetheless the essential basis of modern corporate finance and, in particular, of the frenzied action that, in recent times, has characterized its practice. If it has seemed more complicated, this is for two reasons. Even very simple circumstances tax the mental resources and the perception of many of those involved. A great deal of money changes hands, and we have an aberrant but inescapable tendency to associate the presence or handling of money—of large financial transactions—with acute intelligence. One has only to know some of those so concerned or even to wait and watch their ultimate fate to see how odd this is. In the highest of high finance, as we have recently seen once more, the paths of presumed financial intelligence lead regularly, if not to the grave, at least to the minimum security slammers.

That a certain diligence is required in financial transactions is not in doubt; the practitioners and their acolyte lawyers are known to work relentlessly. Needed also are at least an elementary knowledge of corporate accounting and the ability to digest and remember the information so revealed. Needed most of all is a relentless desire to accumulate money at whatever cost to reputation or personal liberty. But not much else.

Just before his day of reckoning in the securities markets in the fall of 1986, Ivan Boesky, then held to be one of the most glowing of the financial geniuses of our time, had completed for publication a book on his market operations and their setting. (As he headed for jail, it was thoughtfully withdrawn from circulation by the publisher.) Although Mr. Boesky had presumptively competent help on the writing, the volume could not have won him a mail-order MBA from the most primitive correspondence college. It is a work of extraordinary triteness. Such are the financial insights of reputed financial genius.

It is a mark of this limited financial intelligence that the miracle of leverage is rediscovered approximately every ten years. It is also a measure of the intellectual subtlety of the innovation in these matters that the most celebrated financial discovery in recent times is that high interest rates, if high, even exorbitant, enough, will be sufficient to sell high-risk bonds. These instruments, in fact, owed their innovative distinction entirely to their abruptly descriptive name—junk bonds.

Leverage and high-risk debt were the wonder of the late 1920s. In those years leverage—huge debt controlled by minuscule stock holdings—allowed Samuel Insull to build a vast midwestern utilities empire of such complexity that he could not possibly have understood it himself. And it allowed Ivar Kreuger in Europe similarly to create an enormous structure of debt, some of it in bonds that he had forged and issued against the assets of unwitting creditors. And in those years, exploiting the miracle of leverage, Goldman Sachs created the Goldman Sachs Trading Corporation, which created the Shenandoah Corporation, which created the Blue Ridge Corporation, at each step selling bonds to buy stock in the next step. When the day of reckoning came, Samuel Insull went to Greece, Kreuger to a Paris store to buy a pistol to shoot himself, and Goldman Sachs, its breathtaking innovations all but worthless, retreated to a greatly chastened conservatism. Recurrently in ensuing years leverage—the offshore funds of Bernard Cornfeld, the real estate investment trusts, other lesser episodes—has been rediscovered, evoking the breathless admiration of those principally concerned, including the many eventually expropriated.

Firmly in this current of history and by its standards by no means the least celebrated is the great Wall Street investment firm of Drexel Burnham Lambert, its Wunderkind Mr. Michael Milken, and its energetic and briefly luminous stars and associates, Messrs. Dennis Levine, Martin Siegel, Ivan Boesky, and others.

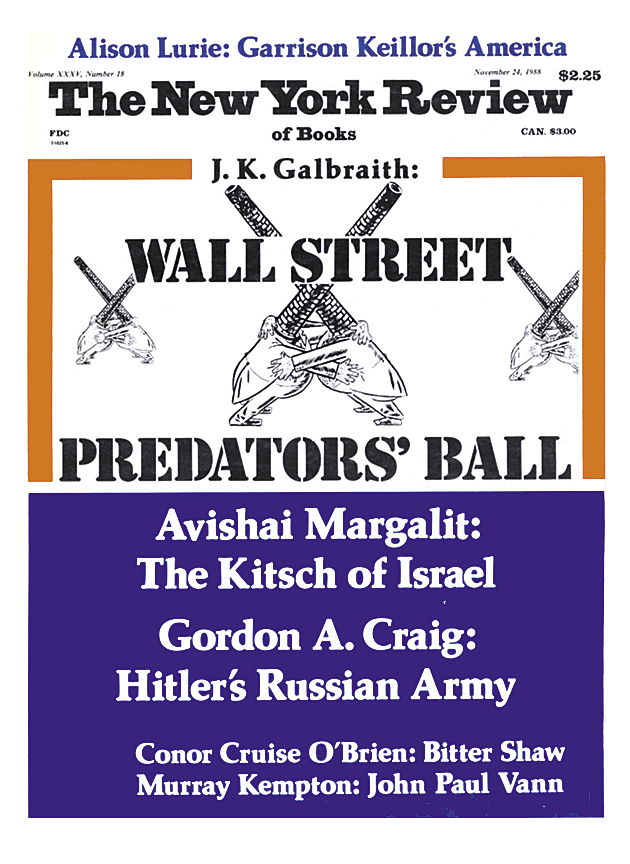

In these last several weeks two important documents have appeared about these operations. The first and most interesting is Connie Bruck’s superbly researched and competently written book on the modern history of Drexel Burnham Lambert.2 The title, The Predators’ Ball, comes from one of the company’s more imaginative sales operations, a corporate fiesta in Beverly Hills at which, according to Ms. Bruck, appropriately ascetic prostitutes were brought to the support of the sale of junk bonds. (In Tokyo, in a well-considered concern for local custom, the more ardent of the company clients and prospective clients were taken, by her account, to local massage parlors as company guests.)

Advertisement

Ms. Bruck traces the history of Drexel, with particular attention to its junk bonds and corporate takeover financing, from the early origins of the company down to just before the recent and heavy charges of securities violations. These, in no slight measure, she anticipates. She accords special attention to the rise and, as these matters go, the programmed troubles of Mr. Michael Milken, the great junk-bond star of the firm. Mr. Milken, although a senior executive in Drexel Burnham, operated as a more or less independent entity not from Wall Street but from his personally preferred, less inhibiting precincts in Beverly Hills. Though now approaching middle age, he began as a very young man. Long of reclusive tendency, he was known to be nice to his family and of modest inclinations in his living arrangements—an agreeable but not ostentatious dwelling in the San Fernando Valley. With this otherwise sensible existence went a seemingly uncontrollable commitment to work and moneymaking—his day began at 4:30 or 5:00 in the morning and continued unabated until evening.

His commitment to effort and associated accumulation carried Mr. Milken, the SEC alleges, well beyond legality. Whatever the outcome, one cannot but assume that there has now been a major impairment of his personal life and happiness. Here powerfully evident again is the limited intelligence that characterizes these operators and operations. To risk so much for unneeded money—Milken is thought to have several hundred millions—is not something that a minimally perceptive person would do. There is further evidence of the modest qualifications here required: Mr. Milken thought it a sufficient recommendation for some of his associates that they were his high-school pals.

In the beginning Milken made a certain reputation for providing bond credit, as opposed to bank credit, to small or perilous enterprises at rates of interest relevant to the risk. There was no harm and some good in this, as also in his handling of securities of firms already in trouble, from whom the more orthodox investors were in irrational flight. But from this he graduated into providing the high-risk, high-leverage funds for the corporate raiders and for the green-mailers—those who buy in order to be paid more to desist—and for the protective buyouts by management groups that sought to keep the voting power of the shareholder from falling into hostile hands. Then, from the privileged prior knowledge of these operations and their effect on securities prices, came the temptation to inside trading for personal and corporate enrichment.

It is with yielding to this temptation, at a personal advantage running into the hundreds of millions, that Mr. Milken, his associates, and Drexel are now charged. The charge, it should be noted and perhaps stressed, does not mean guilt; that, as always, is for the courts to establish. It does surely mean a disruption of all the norms of life which, to repeat, it would have been a minor mark of intelligence to avoid. A somber aspect of this disruption, as recent newspaper accounts tell, has been the need for Mr. Milken to take to the road, make speeches, ask that he be called Mike, and take poor kids out to the ball games. All this is to establish the image not of self-serving and reclusive avarice but of a hail fellow, thoughtful financier, and committed public benefactor. One wonders if it wouldn’t have been more intelligent public relations to protect the reputation of being wholly one’s natural self.

It cannot be supposed that the activities in which Mr. Milken and his firm were engaged served, on balance, any useful purpose. That we have contented, even somnambulant, corporate managements none can doubt. Bureaucracy is the great black hole of both modern capitalism and modern socialism. But that the corporate raider or the attempted raid is a remedy will be believed only by those rewarded or the rather larger number who are committed to the belief that God has so arranged matters that all that occurs under alleged free enterprise is ultimately benign.

The corporate raids and raiders merely exploit the corporate anomalies earlier mentioned; there is no evidence that they improve corporate performance. Granted the bureaucratic flaws of the managers, there is no indication that the raiders, innocent of any knowledge of the business and sometimes even of what is being produced, will do any better. The over-whelming likelihood, given their experience only in financial manipulation and enrichment, is that they will do worse. What is reasonably certain is that the threat of a raid will divert all management attention to protective steps. And whether the raid is successful or rendered unsuccessful by a management buyout, the result will be a legacy of debt and fixed interest charges that will be met at the expense of needed and useful new investment.

There is also the cost involved. In the process of attack and defense (including the concession to greenmail), huge sums go to the raiders and also to the attacking and defending investment houses and to the lawyers on each side. All of this is for no economically productive result of any kind, although we can be sure that some-where there lurks a well-rewarded lawyer or investment banker who will seek to discover one.

Ms. Bruck takes note of a study by Mr. Reagan’s Council of Economic Advisers showing that security values immediately after a raid were often higher than before. This, in turn, was assumed to serve the administration commitment to laissez faire, to the belief that the invisible hand was guiding those financial transactions to some socially useful result. But, alas, she also cites an objective study not preordained in its conclusion by F.M. Scherer of Swarthmore College. This showed that mergers and takeovers were usually not of the somnambulant but of the more efficiently run companies; that they brought in amateurs or incompetents who impaired operating effectiveness; that they led to short-run profit maximizing at the expense of longer-run development; and that the firms were less profitable in the aftermath. The sell-offs of parts of the acquired corporations after the raids, however unfortunate for those so sold and their workers, did improve the efficiency of what was left. Only this last discovery was on the side, however dubiously, of economic improvement.

A year or so ago while testifying before a congressional committee on these matters, I shared the witness table with the head of Goodyear, then but recently under threat of a takeover, against which it had hired Drexel in order, according to Wall Street comment, to keep it from being on the other side. My companion was all but tearful as he told of the trial and trauma the company had experienced and what this had done to its business. Those engaged in the takeover game cite effusively the entrepreneurial spirit that inspires them and the economic and social good that flows therefrom. Such self-serving recitation of cliché should evoke only vulgar sounds.

The second of the informative pieces of writing on recent and still current financial aberration is a group effort. It is summarized in Litigation Release No. 11859 of September 7, 1988, and detailed at length in Complaint for Injunctive and Other Equitable Relief, addressed to the United States District Court for the Southern District of New York. The leading author is Mr. Gary Lynch, counsel for the Securities and Exchange Commission, and listed with him are nineteen other contributing scholars. It tells in brisk, economical, and workmanlike language over 184 typewritten pages of the alleged misbehavior of Drexel Burnham Lambert, the Pennsylvania Engineering Corporation, and six individual alleged malefactors, headed, not surprisingly, by Mr. Michael Milken. Charged in detail are extensive self-enriching operations from

insider trading stock manipulation, fraud on Drexel’s own clients, failure to disclose beneficial ownership of securities as required, and numerous other violations of the securities laws.

Much of the adverse information leading to this complaint came from Ivan Boesky, who considerably reduced his time in jail by fingering Drexel after he himself had been brought to the law by one Dennis Levine. All this is in the great self-enforcing system of Wall Street in accordance with which each delinquent seeks to save himself by turning in his companionate malefactors, real or alleged. This salutary process still continues; subsequent newspaper accounts advise that Mr. James Dahl, featured by Ms. Bruck as Mr. Milken’s “most aggressive” junk-bond salesman, has now gone (or been taken) over to the government to tell what he knows, with immunity on anything so disclosed.

The concise and purposeful prose of Mr. Lynch and his coauthors has to do only with civil proceedings. Ahead, with Mr. Dahl’s enlightened help, is the more serious specter of criminal indictments, of the danger of which the Drexel operatives have now been formally advised. The government’s case is not an easy one. The separation of good information from wicked information has certain subjective aspects. However, on this, as on other misfeasance, the forthright prose of Mr. Lynch and his colleagues is, to say the least, impressive.

The question remains what it all means and what, if anything, should be done. In much popular attitude and comment the junk-bond scandals are held to be the consequence of extreme greed—a younger generation overcome by avarice. This I’m inclined to reject. Greed is not abnormal in our system; we have, on the contrary, a very substantial literature affirming its favorable effect on economic effort. Those charged with greed can and invariably do assume that any such criticism comes from those not so fortunate in pursuit of wealth. There is, as here suggested, a far stronger case for the juvenile obtuseness that commits those so afflicted to self-destructive excess where money is concerned. Nothing much of a remedial sort can be done about this. Also, as is sufficiently evident, it incorporates its own rather severe corrective punishment.

I am also inclined to dismiss concern for those who buy the high-risk bonds and face the possibility, even probability, of loss. Those disposed so to invest will, according to the established rule, be somehow separated from their money, if not in one way, then in another. So also those who invest in junk by way of mutual funds, trusting the presumed and exiguous wisdom of their managers. For gullibility there is no easy solution. A tear should indeed be shed for the unknowing and passive victims of pension-fund managers who also have been big buyers in the junk-bond market.

The larger economic and social consequences for a country that needs to conserve, protect, and improve its industrial plant do call for attention. Some of the problem comes from the upper-bracket income-tax reduction that was supposed to free funds for productive investment and syphoned it instead into destructive takeover operations. That, given our present moral and functional commitment to the rich, will not soon be corrected. It would be less difficult to arrest the merger and takeover frenzy by direct means were we so disposed. Control by one method or another of credit used, directly or indirectly, in order to buy voting stock would excellently serve the purpose. One thinks, for example, of a requirement, perhaps by the SEC, of a showing of public advantage in the transaction so to be financed. Nothing, certainly, would so cool the takeover frenzy as a provision for a hearing on the public merits of a particular case. Doubtless such restraint should be confined to firms above a certain size; no doubt also there could be exceptions allowing takeovers of failing enterprises or other special cases. The problem rests not at all in any difficulties in devising practical action; this, much eloquence to the contrary, is easy and obvious. The barrier to action is exclusively theological. We are now required to act—or not act—in accordance with the belief that uninhibited financial operations, however disastrous for economic performance, however verging on insanity, must be left strictly alone. The deregulation of the savings and loan societies, the “thrifts,” and the resulting incompetence, recklessness, and fraud are currently costing honest and competent firms and the depositors therein tens of billions of dollars and could cost the taxpayer even more. Nonetheless, even here regulation is not deemed urgent. Regulation, for our current rulers, remains the Great Satan, which does wrong even when, for the most obvious purposes, it does good.

This Issue

November 24, 1988

-

1

Adolf A. Berle, Jr., and Gardiner C. Means, The Modern Corporation and Private Property (The Commerce Clearing House, 1932), and James C. Burnham, The Managerial Revolution: What is Happening in the World (John Day, 1941). ↩

-

2

According to Ms. Bruck, she was offered generous terms by Drexel not to write the book, specifically full compensation for her revenue from expected sales. Mention should also be made of an important and characteristically literate earlier book by John Brooks, The Takeover Game (Dutton, 1987), on the general setting of these operations. And of Board Games by Arthur Fleischer, Jr., Geoffrey C. Hazard, Jr., and Miriam Z. Klipper (Little, Brown, 1988), a competent lawyerly discussion of recent corporate and financial practice, deleterious and benign. ↩