In response to:

A Deficit of Civic Courage from the June 1, 1989 issue

To the Editors:

Benjamin Friedman’s “A Deficit of Civic Courage” [NYR, June 1] offers a comprehensive presentation of the conventional wisdom on “the budget deficit.”

As Friedman discerns it in the Report of the National Economic Commission, the deficit “is now too large and…should be reduced.” The deficit is costly because “the government borrowing needed to pay for it absorbs saving that otherwise would be available to invest either in productive capital in the US or in earning assets abroad.” These arguments are gravely wide of the mark, and miss our real problems.

For starters, nowhere does Friedman mention that the official US federal deficit is already way down from where it was a few years ago. A relevant measure of any deficit—household, business or government—must be in terms of income. An individual who has to borrow $10,000 against an income of $50,000 has half the potential burden of one who has to borrow only $8,000 against an income of $20,000. In fact, the federal deficit is now some $60 billion below its 1986 peak and running at 3.1 percent of the Nation’s income, or gross national product, which is just half of the 6.2 percent of six years ago.

Further, a critical question for the long run is whether the federal debt, which increases each year by the amount of the deficit, is growing faster than the national income. It no longer is doing so; the debt has now stabilized at some 42 percent of GNP, considerably higher, it is true, than the 26 percent in 1980, but far below the 110 percent figure at the end of World War II.

What is more, proper measurement would bring to the fore a serious question of whether in any economically meaningful sense we have a government budget deficit at all. If the federal budget were kept in a manner consistent with prevailing business accounting practice we would substitute depreciation for the Office of Management and Budget’s $200-odd billion of investment expenditures, and knock some $70 billion off the “deficit” right there. We should knock off another $80 billion or so for the “inflation tax,” the amount that the government gains, and bondholders lose in a year, as inflation eats away the real value of Treasury securities. And finally, in regarding the total government impact on the economy, we would count some $50 billion of state and local government surpluses, in no small part due to federal, deficit-creating grants-in-aid, amounting to over $100 billion. All these corrections turn the alleged current deficit of about $160 billion to a real government surplus of some $40 billion, and that without including the gains from substituting depreciation for investment expenditures in state and local budgets.

The ultimate questions, though, are not whether we can call the current budget in surplus or deficit but rather, what is its effect on the economy, and what can we do with the budget to improve the economy, and the country, now and in the future? To answer these questions it is time to get beyond arbitrary and misleading accounting and political rhetoric and opportunism and face some facts. Friedman raises one of the real issues, the extent to which we are properly providing for our future, which relates to properly measured saving and investment. What he fails to note is that real, structural budget deficits, by stimulating the economy, have over most of our post World War II history been associated with growth in consumption but also growth in total product and domestic private investment. The explanation is simple. When the government gives us income and wealth by its spending that it does take away fully by taxing, we in turn spend more. As we thus buy more business products, business has the incentive to increase its productive capacity for now and the future by investing in new plant and equipment.

The drop in our net foreign investment in recent years is the other side of the coin of the large purchases of imports by a relatively prosperous people. Reducing the deficit would cure this essentially by depressing the economy so that we buy fewer Toyotas, along with fewer Fords and Chryslers. The increasing number of unemployed would buy very little of anything. To the extent our trade or current account deficit, which is our negative net foreign investment, is a problem—and it too has been mismeasured and exaggerated—the solution is to be found in a less constraining monetary policy, which would lower the cost of the dollar to foreigners and raise our exports.

But most important of all is a point at which Friedman barely hints. Provision for the future involves much more than business accumulation of plant, equipment and inventories and acquisition of assets overseas. It involves overwhelmingly the maintenance and development of our public infrastructure of roads, bridges, and airports, of our natural resources and our land, our water and the air we breathe. It involves the maintenance of public safety and a successful war on drug addiction. Most critically, it involves investment in research and new technology and in what economists call human capital, the basic training and education of our people. Virtually none of this is counted in the official measures of the saving and investment which Friedman and others view with alarm.

Advertisement

Yet this investment in public and human capital dwarfs all the rest in its amount and in its importance for our future. Billions of dollars “in” social security trust funds and new computers and office buildings will do little for a nation whose youngsters continue to rank last among advanced nations in math and science skills, whose middle schools are viewed as a disaster, and of which much of a generation of school drop-outs grow up functionally illiterate.

The tragedy is that the persistent hyperbole about the menace of our alleged budget deficits and the insistence upon further reducing them, given the political, public and economic objections to raising taxes, are helping make impossible the major increases in public investment our society so desperately needs.

Robert Eisner

Northwestern University

Evanston, Illinois

Benjamin M Friedman replies:

Robert Eisner is surely right in arguing that America needs more public investment, not less—including investment in physical infrastructure like highways and port facilities, and also in the training of our work force. Our crumbling bridges and overcrowded airports are obvious to anyone. Repeated studies have shown that investment in such public capital is just as important to our economy as private investment in new plant and equipment, and in some cases more so. The failings of American basic education are also becoming increasingly widely recognized, as are the consequences for the productivity of our industries when they must employ ever more workers who can neither read nor reckon.

But it is wrong to think that public investment in any of these forms caused the chronic fiscal imbalance America has experienced throughout the 1980s, and wrong too, I believe, to think that returning to a more nearly balanced budget need shrink our public investment further. Indeed, putting the deficit problem behind us as soon as possible may well be the best way to allow for a genuine renewal of our much neglected public investments.

On average during the 1980s, only 1.2 cents in every dollar of federal spending has gone directly into nondefense physical capital investment—down from more than 2 cents per dollar in the 1970s, and 1.4 cents in the 1970s. Federal grants to finance physical capital investment by state and local governments have likewise declined, from 3.5 cents per dollar of federal spending in the 1960s and 3.7 cents in the 1970s, to just 2.3 cents per dollar in the 1980s. The real story behind today’s huge federal deficit lies elsewhere—specifically, in the combination of increased military spending, across-the-board personal income tax cuts, and protection of big-dollar entitlements that formed the core of the Reagan fiscal program.

For just the same reason, the best way to attack the deficit problem now is not to nickel-and-dime to death our now meager public investment. There are plenty of other, better options. Congress has already acted to slow the growth of military spending, and talk of tax increase is increasingly in the air if not yet on the President’s lips. Hostility to cuts in entitlements is also softening, especially if they are to be part of a package in which the inevitable short-run sacrifice is widely shared, and if the cuts chosen come from benefits paid to middle-and upper-income groups. Surely any of these actions—better yet, the whole package—is preferable to allowing our physical infrastructure to deteriorate still further, or sending yet more illiterates into the job market.

Professor Eisner also questions whether we should want to narrow the deficit in the first place, raising the specter of a faltering economy with too little spending and too much saving. Rehearsing once again the lessons of the Great Depression is not helpful when those lessons are no longer apt. America’s chief economic problem today is not too much saving but too little, both because our private saving rate has declined (to the great disappointment of advocates of lower tax rates and other supposed saving incentives) and because financing the federal deficit absorbs so much of what we do save. As a result, our investment in private capital has declined along with our investment in public capital, and our productivity has faltered. We have also had to rely on massive borrowing from abroad, thereby transforming America into the world’s largest debtor, and on ever more sales of assets to foreigners.

The fear that our economy would stagnate without the stimulus of so large a federal deficit is difficult to understand today. Yes, it would be unwise to cut spending and/or raise taxes by enough to balance the budget all at once. But there is no prospect of our doing so. At best we will implement the changes we need over several years. Yes, the economy would suffer if we pulled back from the extraordinarily expansionary fiscal policy of the 1980s without also easing monetary policy. But achieving a more healthy fiscal-monetary policy mix is the whole point, as Federal Reserve Chairmen Paul Volcker and Alan Greenspan have both repeatedly emphasized.

Advertisement

Finally, Professor Eisner argues that we need do nothing anyway, because the official deficit figure is already declining and, if revenues and spending were measured properly, the budget might already be in surplus. This is unpersuasive. The official figures show a smaller deficit primarily because they subtract from the general account deficit the large and growing Social Security surplus. But to use the Social Security surplus merely as an offset to ever larger deficits only guarantees that the retirement of the baby boom generation will result in the acute conflict between retirees and workers that today’s high payroll taxes are supposed to enable us to avoid. Similarly, while Professor Eisner’s own outstanding work has done much to show how the federal government’s accounts would look on a properly constructed basis, in the end the changes he recommends are selective. For example, if the government followed most private business in reporting the present value of their future pension obligations, proper allowance for the retirement of military and federal civilian employees would add another $1 trillion to the national debt.

In sum, we do have a deficit problem, and the resulting drain on our saving is eroding the basis for our future prosperity. We should fix this problem—but not, of course, by actions that would just threaten our prosperity in a different way.

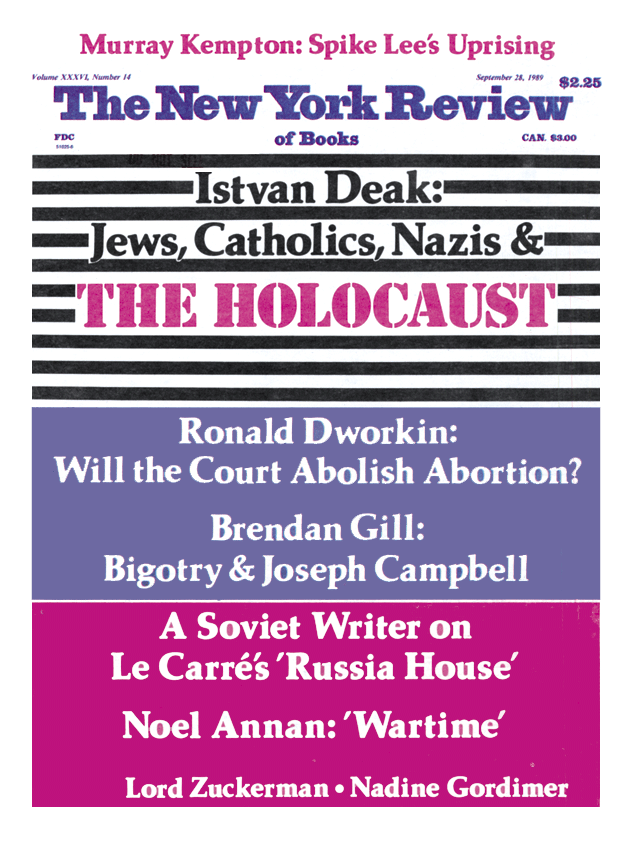

This Issue

September 28, 1989