In response to:

Lifting the Silent Depression from the October 24, 1991 issue

To the Editors:

The day that New York’s water system flooded the city’s subway from Grand Central station is not a day to take issue with Robert Heilbroner’s proposal for financing a large program to improve America’s rotting public infrastructure. But I doubt that investment in public facilities, however desirable as such, will correct a depression resulting from the loss of ground by American business in competition with foreigners in export markets and at home in the US, where foreign goods account for 95% of consumer electronics, 50% of machine tools, 30% of automobiles. Professor Heilbroner claims that public investment will make a great contribution to the productivity of the private sector. But why choose so indirect a route to improve the performance of private business? Infrastructure in Japan is far more overloaded than it is here, and the discomfort of daily life would be intolerable to most Americans. But this has not prevented Japanese corporations from making rapid advances in productivity.

I would agree that our private consumption should be complemented by public parks, clean cities, uncongested highways, a less polluted environment, to the extent of our willingness to pay for these things. But Professor Heilbroner’s ingenious plan for raising the necessary revenue includes the continuation of federal budget deficits at their average rate of around $200 billion a year, financed by borrowing as at present. He assures us that this will be all right, because the borrowing would be into a capital budget and reserved for productive purposes, just like a capital investment budget for a business. However, the federal government is not a business, and one aspect of its finances is that they set the policy framework in which the private sector operates.

Budget deficits have contributed greatly to the present economic difficulties. They stimulate domestic demand, which should be helpful to American industry; but the stimulus also tends to create inflationary price increases, which the Federal Reserve seeks to control by raising interest rates. Government policy thus has one foot on the accelerator of deficit spending and the other foot on the brake of interest rates. Enervated by this alternation of stimulus and restraint, American business has now fallen into a state of nervous depression. The Fed is desperately reducing interest rates in order to revive the subject; but as soon as business shows signs of recovery, up the interest rates will go again for fear that the deficit will lead to inflation. The reliance upon high interest rates to check the inflationary stimulus of a persistent budget deficit has discouraged long term research and development; favored foreign competition by overvaluing the dollar against other currencies; fostered the junk market for high yield, high risk securities; whipsawed the savings and loan institutions; and redistributed income from middle class taxpayers to wealthy government bondholders.

Therefore, the first objective of policy, whether by a tax program or by expenditure cuts, should be to balance the budget. It may be objected that this is too sweeping, that other industrialized countries also run budget deficits. They do, and they also have private savings rates twice as high as America’s, which offset the effect of government dis-saving. There is, alas, no corresponding resistance to fiscal disease in this country.

Raymond M. Frost

(Retired) Director

Economic Development Institute

of the World Bank

Coral Gables, Florida

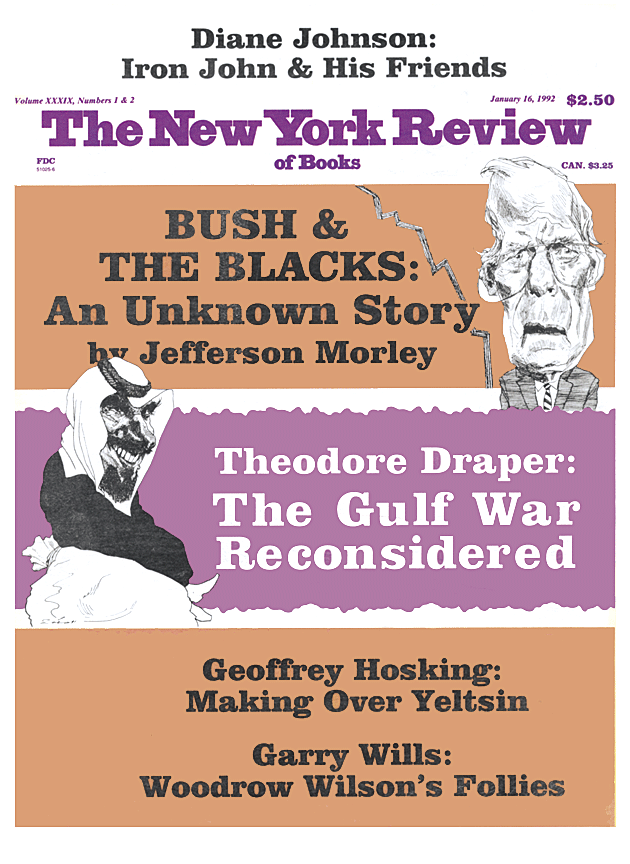

This Issue

January 16, 1992