The collapse of the Soviet Union and the dissolution of its empire are the source of all sorts of changes in the West. To take an important example, defense-related industries have lost a good chunk of their market, with further shrinkage to come. One sober estimate suggests that a million jobs have already disappeared in defense industries between 1987 and 1992 and another 1.5 to 2 million are likely to go by 1997. Firms that have led their lives in the military-industrial complex do not find it easy to convert to post–cold war activities. This is partly because the general economic environment is far from helpful right now, but also partly because they find it hard to shed old habits of management and production that worked well in the old circumstances but do not fit the new civilian market.

A similar problem, on a considerably smaller scale, faces the military-intellectual complex. Scholars, policy analysts, and writers who used to concentrate on issues of high military strategy or matters of geo-political diplomacy or on questions of arms control also find their market contracting. They too feel the need to convert to some form of post–cold war activity. They too need to change entrenched habits (of thought this time, not management). Intellectual capacity may be just as hard to transfer from one line of production to another as industrial capacity.

Mr. Luttwak is just such a case. For twenty-five years he has written serious books on such topics as the grand strategy of the Roman Empire (1976) and the Soviet Union (1983), and volumes of essays on military questions. He has been a consultant to the secretary of defense, the National Security Council, and the State Department. And he is the author of an interesting how-to-do-it book called Coup d’Etat, reviewed at length in these pages.* Any military electronics firm in an analogous position would find related products more promising than a shift to specialty foods or ladies’ ready-to-wear. In the same way Mr. Luttwak has chosen to cultivate a field he calls geo-economics.

The promises of geo-economics are made pretty clear in Luttwak’s book. He apparently wants to expand Clausewitz’s famous aphorism that war is the continuation of politics by other means to the sharper proposition that trade is the continuation of warfare by other means. He certainly allows little or no room for the possibility that trade between nations can sometimes be mutually beneficial, as is generally thought to have been the case in the quarter-century after the end of the World War II. The vocabulary of geo-economics could be described as alarmist and the tone is generally truculent. The subtitle of the book gives the right impression of the contents. Even that is just a warm-up. The last chapter of the book begins this way.

In geo-economics, as in war, offensive weapons dominate. Of these, research and development force-fed with government support and taxpayers’ money is the most important. Just as in war in which the artillery conquers by firepower territory which the infantry can then occupy, R & D can conquer the industrial territory of the future by achieving a decisive technological superiority. Japan’s new Real World computing program is only one of the many such efforts now underway in the central arena of geo-economics. The European Community and the United States both sponsor their own microelectronics and computing programs, as well as many other projects.

International trade is a battlefield and Mr. Luttwak is back in the familiar business of telling us how to inflict damage on the enemy and win the battle.

Unfortunately the argument leading to all this dogmatism rests almost entirely on anecdote, strong language, and self-confidence. The book opens by taking the reader on an imaginary trip to Kennedy Airport in New York, starting from Tokyo or Zurich or Frankfurt or Amsterdam or Singapore. All those other airports are gleaming and well-equipped, and all the people, from taxi drivers to porters to clerks to customs officials, are efficient, courteous, and helpful. Kennedy, in contrast, is dingy, dirty, and dilapidated, patched with plywood, and getting worse before one’s eyes. The “help” is ignorant, surly, demanding, and unskilled. Unfavorable comparisons with Kinshasa, New Delhi, and Lima nudge the reader into realizing that Kennedy Airport is already a bit of the third world serving as gateway to the United States.

It is a very effective overture, prefiguring several of the themes of the opera to follow. There is an uncomfortably large quota of truth in this unflattering comparison. But what does it have to do with Mr. Luttwak’s argument that the American Dream is now endangered? Kenneth Galbraith’s classic The Affluent Society was published in 1955. Its theme was that the American ideology and American political practice systematically skimp on even essential public expenditures in favor of even frivolous private consumption. Public spaces and public facilities in the United States tend to be grungy and undermaintained. Kennedy Airport is an example. Galbraith was already pointing this out forty years ago, at a time when the American economy was still dominant in the world, still the leader in designing new products and producing old ones efficiently, well before Europe and Japan had begun to catch up. The decay of Kennedy Airport is a disgrace, and it makes a good story, but it has no necessary connection with the endangerment of the American Dream—of which, according to Galbraith, it is a part—and surely no connection that Mr. Luttwak has demonstrated.

Advertisement

It is this lack of any analytical (or even historical) bony structure that makes the book sound more like a burst of personal prejudice than like a reasoned argument about the performance of the US economy. Even when Mr. Luttwak is right about general diagnosis and remedy, he can be wrong about particular causes and particular implications. And he is surely right on some things. Where he is wrong, it is often because he is unconscious of the research of others, or unwilling to believe that anyone can think systematically, carefully, and skeptically about the world economy, or unaware that one needs to do those things.

Before I go any further, a semipersonal digression is in order. On eight or ten occasions in the course of his argument, Mr. Luttwak defends a point not by offering evidence or deduction from some more obvious point, but by remarking that “economics textbooks” or “academic economists” think the opposite, in complete defiance of obvious truth. This habit requires some comment from me. Although I have never written an economics textbook, I am indubitably a standard, ordinary, academic economist. If I were to ignore this ploy, I would perhaps seem to disqualify myself as a critic.

The truth is that Mr. Luttwak is almost entirely ignorant of modern academic economics. It is not his trade, after all. Possibly he has read an elementary textbook; but elementary textbooks are meant to teach simple cases to beginning students. They all tend to start with perfectly competitive markets, for instance, in which no single firm can affect the price at which it sells, or do anything but choose how much to produce and then produce it at the lowest achievable cost. The better textbooks point out later that the set of assumptions needed to create a perfectly competitive market is long and improbable. The better textbooks later introduce the student to markets where there is monopoly power, though also in an oversimplified way. More to the point: academic economists are not, with very few exceptions, taken in by the simple special cases.

Something similar can be said about free trade, but with a twist. Academic economists tend to emphasize the advantages of free trade because they are not obvious. For three-hundred years or so, simple mercantilist notions have seemed plausible, although a world of unchecked protectionism could be worse for everyone than a world of unfettered free trade. In actual fact, we have neither. For a decade or more, the action in the theory of international trade has been on the side of working out the nature and consequences of international trade in a world in which firms are at different technological levels, some are larger than others, and governments intervene in different ways. A good deal of the emphasis has been on forces that cause initial trade advantages to widen. The policy implications are as complicated as the analysis and do not lend themselves to simple slogans.

At least eight or nine of the past ten winners of the Clark Medal (a biennial award bestowed by the American Economic Association on a forty-year-old star) can safely be said to have made a mark precisely by going beyond the simple competitive model, usually by analyzing what happens if some of that model’s very restrictive assumptions are dropped in favor of market power, strategic behavior, and unequal access to information. This sort of intellectual innovation also undermines the idea of laissez faire. That is what “academic economists” value.

The American economy has serious problems. Some of them are short-run in nature, like the weakness and incompleteness of the current recovery from the recession of 1990–1991. Payroll employment is just about back to its 1990 peak. Other problems are longer-run and therefore more deeply rooted, like the slow rate of productivity growth, the accompanying near-stagnation of family income, and the fact that inequality in income is widening, not only between educated and uneducated workers but even within the educated group. Nothing could be more important than to get the diagnosis of these problems straight and to do what we can to fix whatever is broken.

Advertisement

For Mr. Luttwak’s bellicose frame of mind to make sense, however, more than mere problems is required. Truly terrible things must be on the verge of happening, and They must be doing them to Us. Mr. Luttwak’s way of arousing a sense of urgency is to insist that many Americans are “sliding toward Third World conditions.” He points out that in 1990 18 percent of all Americans earned less than the $6.10 an hour that would push them above the poverty line even with two thousand hours of work yearly. Things are now worse, not better. I wish, with him, that more of us thought facts like these to be scandalous in a rich country. But the comparison with the third world is so false that it can only weaken his case. The national income per person of Peru in 1990 was less than one sixth that in the US. Incomes tend to be less equally distributed in poor countries than in rich. It is a fair guess that the Peruvian equivalent of $6.10 an hour was well under a dollar. No one should take pride in being ahead of Peru. But neither is gross exaggeration a good foundation for policy.

In another example of the same sort of overkill, Luttwak remarks that the American underclass, some 15 million citizens, “would have been better off morally if not materially if they had been born in Nepal or Thailand.” I cannot speak for moral comparisons. Materially, however, it can be said that national income per person in Thailand was about $2879 and in Nepal about $729 in 1988 compared with $18,339 in the US measured in equivalent prices. The average Thai is far below the US poverty line. It is no wonder that the flow of migration tends to be one-way. A military thinker should pay more attention to credibility.

Is the US economy being victimized by geo-economic attacks from abroad? Mr. Luttwak, in common with much popular wisdom, takes that for granted. In this view of the world, American manufacturing industry is giving ground to Europe and Japan because industry there is more technologically adept, or more single-minded and unscrupulous in its emphasis on exporting, or more given to sharp practice, or more protected and better subsidized by less inhibited governments—or any combination of the above. No doubt instances can be found of each of those handicaps faced by American manufacturers. But that does not come close to providing a coherent explanation of the decline of manufacturing in this country. To the contrary, the main problems of American manufacturing industry are to be found at home, and that is where the remedies must come from. Those problems include a low rate of investment (and thus a slightly out-of-date stock of equipment), a failure to achieve ongoing reductions in cost and improvements in quality, and some obsolete management practices. The tendency to blame the foreigner—as Luttwak does—is part of the problem. It diverts attention from the real solutions.

One indication that the military analogy is misplaced can be read from the accompanying Table 1.

Table 1 FRACTION OF LABOR FORCE EMPLOYED IN

MANUFACTURING

I have compiled, for a few advanced industrial nations, the recent history of the fraction of the active labor force engaged in manufacturing. If manufacturing employment were like territory, the aggressors would gain what the victims lose. The facts are otherwise. “Deindustrialization” is the common fate of advanced industrial economies. The US has one of the smaller manufacturing sectors, but no smaller than Australia’s or Canada’s. The share of manufacturing employment has fallen noticeably in the United States, but no faster than in Australia, Germany, Switzerland, and Italy. In some ways it would make more sense to look at the share of manufacturing in non-agricultural employment; if that were done, the reduction in France and the United States would be equal at nine percentage points, and Japan would have lost five percentage points of manufacturing employment between 1970 and 1990.

Two forces are clearly at work. First, as populations get richer, they make only limited additions to their consumption of manufactured goods. The pattern of demand shifts in favor of services like education, travel, banking and insurance, restaurant cooking, and health care. At the same time, productivity tends to rise more rapidly in the manufacturing industry than in the service trades in general (although there are exceptions). If production rises slowly and productivity rises faster, employment must fall. The same thing would happen even if there were no international trade in manufactures at all. To clinch the point, the share of manufacturing employment has been falling since 1950 in the US, before the German miracle and the Japanese revival. This is not geo-economics; it is economics.

The second force is that the practice of manufacturing has been spreading to developing countries: Taiwan, Mexico, Brazil, Indonesia, Korea, and now China. Almost certainly it is in neither the moral nor the economic interest of the United States that the third world nations should continue forever as poor producers of crude materials. However that may be, it is certainly not the “artillery” of research and development nor the closet plans of economic general staffs that account for this evolution, but the spread of elementary education to low-wage nations. We can do nothing to stop it anyway; the intelligent response is again to reform our own domestic economy.

This is an important matter because it goes to the very heart of the thesis that international trade and competitiveness are the main source of the decay of American manufacturing industry. Anyone can see what has happened to the US automobile industry and to consumer electronics. It is the most natural thing in the world to fear that the same will happen to computers and then to software. Between 1970 and 1990, imports of manufactured goods went from 11.4 percent of “value added” in manufacturing to more than 39 percent. (Value added is calculated by subtracting the costs of all purchased materials and services from the manufacturing sector’s sales. It is the income actually earned by labor and capital in manufacturing.) Of course US manufacturing exports nearly kept pace: they were 12.5 percent of the manufacturing sector’s value added in 1970 and 31 percent in 1990. It is the trade balance in manufacturing that matters for deindustrialization. It deteriorated over the period, but only by about 1.5 percentage points of GDP. The share of the manufacturing sector’s value added in GDP fell by more than 6.5 percentage points during the same period. That is a lot more than can be accounted for by the trade balance.

This calculation actually overstates the significance of trade. Paul Krugman and Robert Lawrence, from whom I have taken this analysis, point out that not all of the trade balance in manufacturing consists of value added: a dollar of imported manufactures displaces less than a dollar of value added in US manufacturing, because a dollar of manufacturing consists partly of accounting services, health-care costs, and the like. When Krugman and Lawrence incorporate this correction in the analysis, they find that trade in manufactures was a minor factor in the decay of American manufacturing. They write:

From 1970 to 1990 manufacturing declined from 25 to 18.4 percent of GDP; with balanced trade (in manufactures), the decline would have been from 24.9 to 19.2 percent of GDP. In other words, international trade has cost the US manufacturing sector less than one percent of GDP.

American labor—and American capital—would be better off today if RCA and Zenith, not Sony and Toshiba, had seen how to design and make VCRs for everyman. But it is simply false to maintain that the shrinkage of the US manufacturing sector reflects geo-economic aggression from Europe and Japan. Notice that this is not an argument from the presumed abstract virtues of free trade. I have a pretty good idea of what can be claimed for free trade as a matter of logic. It is more than Mr. Luttwak will grant and a lot less than the ideologues of free trade will claim. But the arguments made here are about facts, not theory.

They lead to the conclusion, first, that the US economy is not falling into third world status. That notion could be taken as mere hyperbole. But it is closer to the truth to say that the pattern in the US is not qualitatively very different from what is happening in other advanced industrial economies. The second conclusion is that the less drastic, but still serious, problems of the US economy are mainly internal in origin. They are not inflicted on a helpless giant by economic aggression from abroad and are not mainly the result of international competition. The real story is one of poor economic performance not merely in the US but also elsewhere. Very recently our own economy has been doing better than others; and our competitors respond by occasionally blaming us.

Taken together, these conclusions provide no comfort to Mr. Luttwak’s thesis.

When comparisons are made in units of common international prices for the whole economy, not just manufacturing, it turns out that output per worker and income per person are still higher in the United States than elsewhere. The lead over other advanced economies may have been between 25 and 30 percent in 1988; it is slightly smaller today. The gap was larger forty years ago. It does not take delicate measurement to tell us that other countries have been catching up in productivity and standard of living over a longer run.

Does that reflect a species of strategic superiority and planned economic aggression, or was it the natural course of events that the early postwar lead of the US economy should erode as other countries recovered, rebuilt, and imitated the superior technology and organization of American industry? That is not a question one can answer with precision, but common sense suggests that a large part of the catch-up was inevitable. Capital moves and technology becomes diffused, and some degree of convergence has to be expected, even more so as industry becomes less and less dependent on geographical advantage and easy access to natural resources. Nevertheless it is evident that Japan, and perhaps other countries, have surpassed American productivity levels in some manufacturing industries, maybe even industries that are, in some definable sense, “critical”—electronics for example. Imitation is indeed a form of flattery. It is at least imaginable that American firms could learn something about technology and the organization of production from foreigners. (It is possible, no doubt, that some productive organizational schemes might turn out to be incompatible with some aspects of American industrial culture.) Is some more defensive or aggressive, but anyway more “geo-economic,” response by the US to foreign competition desirable?

One has to be very careful. There is some convincing evidence—most recently from a comparative study by the McKinsey Global Institute of selected manufacturing industries in Germany, Japan, and the US—that protecting and subsidizing an industry may lead to backsliding and weakness. Intense competition with the world leader seems to be a surer way to strength and parity. Mr. Luttwak pretty clearly has an occupational bias in favor of bringing up the artillery, but in fact the case for doing so is not made.

Other proposals surface in the next-to-last chapter, “What is to be done?” Most of them are tame and conventional. Improved primary and secondary education, federal subsidies for applied research and development, shifting the tax base from income to consumption in order to promote domestic saving: I hesitate to mention this, but all of those ideas made their appearance in academic economic journals long ago. There is nothing specifically geo-economic about them.

One last surprise emerges at the end. Why is there an inevitable lust “to conquer the industrial territory of the future”? Mr. Luttwak does not urge, as some Marxists used to do, that there is some inner logical necessity to find new outlets or possess new resources. It is more a psychological urge.

Geo-economics is therefore a very appropriate projection on the world scene of typically meritocratic and professional ambitions, just as war and diplomacy reflected typically aristocratic ambitions, offering lots of desirable roles for military officers and diplomats who were aristocrats, or acted as if they were aristocrats, or at least relished aristocratic satisfactions. The meritocracy of technologists and managers is not much more modest. They do not desire bemedaled uniforms or the diplomat’s ceremonies, but they do want to be in command on the world scene, as the makers of technology, not mere producers under license; as the developers of products, not mere assemblers; as industrialists, not mere importers….

[As] bureaucracies writ large, states as a whole are impelled by the urge to preserve their importance in society to acquire the geo-economic substitute for their decaying security role. Thus countries are likely to be pushed further along the geo-economic path than the balance of costs and benefits would warrant.

Geo-economics, then, is just a matter of bureaucrats, private and public, doing what bureaucrats do. Maybe uniforms would be cheaper.

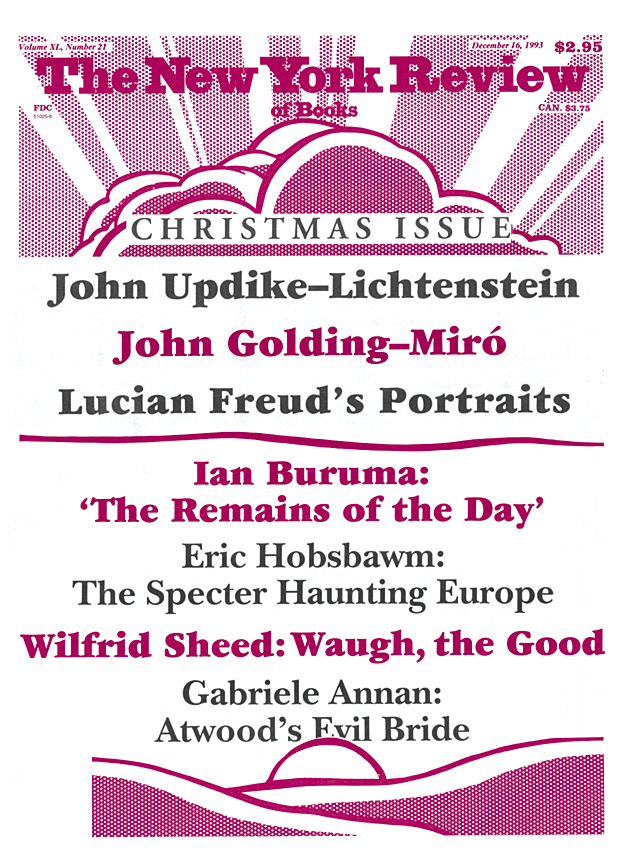

This Issue

December 16, 1993

-

*

See the review by E.J. Hobsbawm, The New York Review, August 21, 1969. ↩