Leon Levy started his career on Wall Street as a security analyst and became a partner in Oppenheimer & Co., then a small brokerage firm, in 1951. He and his partner, Jack Nash, built the firm into one of the leading brokerage and mutual fund companies in the nation. They sold Oppenheimer in 1982 and formed the investment partnership Odyssey Partners. Odyssey is now being liquidated after producing one of the highest rates of return to investors of any such partnership over more than fifteen years. Levy is currently the chairman of the board of trustees of the Oppenheimer Funds based in New York. He is president of the Institute for Advanced Study in Princeton and also president of the Jerome Levy Institute for Economic Research at Bard College, which he founded in 1986.

The following interview took place on September 5.

Jeff Madrick: With the US economy widely considered strong by most conventional measures, many people are confused by how the turmoil in financial markets overseas—from Asia to Russia to Venezuela—could do so much damage to the US stock market. As we are talking in early September, the Dow Jones Industrial Average stands nearly 18 percent below its high of the year. Did you think foreign events could precipitate such a decline?

Leon Levy: You never know what will trigger a decline in the stock market. That word precipitate is an interesting one. When you keep piling up bags on a scale, finally at some point you might put a few too many bags on the scale and break it. What caused the problem? These international markets may be the immediate issue, and problems there do affect the US. But did they precipitate the market decline? That’s way too simple. The causes of America’s problems are deeper and more complex. The US economy is vulnerable, and has been for some time, and that’s the main point that is getting lost amid all these analyses. The stock market usually reflects—at least over time—the course of the nation’s economy.

J.M.: Nevertheless, all eyes seem to be on the international scene. Some people say that, while the collapse of the Russian ruble may have started the recent turmoil in the US stock market, the Japanese recession is the main problem. Is it the linchpin?

L.L.: I don’t think so. But that doesn’t mean the problems aren’t severe. Japan attracts the most attention. It’s the largest economy in the Pacific Rim. It went down first. But I think its problems are typical of the region. I think the same thing happened in Malaysia, Thailand, Korea, wherever you go in East Asia. They are all over-extended.

J.M.: In what ways are they over-extended?

L.L.: Start with Japan. The solvency of its banks, some experts whom I respect tell me, is largely questionable. In the late 1980s, when so many people thought that Japan was economically invincible, it was spending as much as 30 percent of its Gross Domestic Product (GDP) on capital investment. A lot of this was financed by huge loans from banks. As you know, economists think capital investment is almost always good. But, typically, businessmen go too far, especially if they can raise capital when the stock market is high and interest rates low. There is no way Japan can use that many new buildings, that much new plant, that much new machinery. The overexpansion of capital goods is often the great cause of recession or even depression.

J.M.: Few people were saying this in Japan’s heyday.

L.L.: You never know for certain when capital spending is too high. Only afterward. Take New York City, for example. If you owned an office building, and rents are high, and everybody wants to move in, things would be fine. But if the stock market should not be as expansive, which is what happened in Japan and may be happening here, then a firm may decide to rent much less space. Suddenly, conditions are not tight. It now looks as if you have overspent on your building.

J.M.: And this happened more or less across East Asia?

L.L.: Yes. It’s pretty typical of human nature. Why should the East Asians be any different? Remember the real estate market was way too high in Thailand. It collapsed a couple of years ago. If Japan were stronger, maybe it could have done more to bail these countries out. But that would have occurred after a lot of damage had been done. These countries are now all in serious disarray, I would say depression.

J.M.: How do their problems directly affect the US market?

L.L.: They stop buying our exports, first of all. That might not be so bad if we had a strong trade balance. But we don’t. We import more than we export. This is getting worse. The trade deficit is setting new records all the time.

Advertisement

Then, other markets around the world get nervous even at the smallest sign of trouble. Investors want higher rates of return, which weaken economies further. Russia is in bad shape but they are in no way the trigger for our problems, either. They are only a small part of our trade, even though German and US banks are apparently losing a lot of money on their investments there. More important, profits of many other US companies are reduced as sales fall to all these regions. The US market gets more nervous as a result, and stock prices fall further.

As you can see, these market declines have two effects. They have an effect in the real economy when interest rates rise, as they have in many countries abroad. And they also affect the business mood, which can also then have an effect on the real economy. It makes people less willing to undertake an activity. They hesitate to buy something, or build a plant, or expand their business in other ways. This is true in the US as well.

J.M.: What should Japan do to solve its problems?

L.L.: They should use deficit spending to try to stimulate the economy and they may have to do something drastic to save their banks. If the problems in Russia could be solved, that would be helpful also. But what’s going on is no surprise there, either. I feel terrible for them. But they lived under the tsar and they lived under communism. To bring about a deep social change, how long does it take to reeducate a people? I think that takes a few generations. But let’s be clear about this. The US has more of its own internal problems than those posed by these foreign economies, and that’s why our market has been falling so fast in response to them.

J.M.: As you well know, many people believe quite the contrary. The US economy is strong, we are told over and over again. Unemployment and inflation are low. Interest rates are also low, profits are up. Capital spending is strong.

L.L.: All of this is true. I’ve been worried about the economy for a while, and it’s kept growing. But all these things you mention tell us what the economy has done, not what it is going to do. They are mostly lagging indicators. Unemployment is a lagging one. Corporate profits can be a leading indicator, because they can stimulate investment, but we are usually talking about last quarter’s profits. We don’t know about next quarter’s.

J.M.: Is a recession in the US possible?

L.L.: More than possible. I think it is likely. And it could occur within six months. That doesn’t mean I know that it will occur. I’ve been wrong before, as I said. But I think we could get a lot of unemployment as a result. And I think it may be hard to pull out of such a recession for a while.

J.M.: Then let’s talk about the weaknesses of the US economy that might lead to recession. What are they?

L.L.: I think there are three major ones. First, there is the trade deficit. It is growing worse. It reduces growth because sales are going to foreign countries. It makes the US even more vulnerable to declines in overseas economies because they will buy less from us and sell more to us at lower prices. So that’s a big problem.

And now we may get more competitive devaluations in East Asia and Russia and maybe elsewhere. They cut the values of their currencies. That will drive the price of their exports even lower and make our exports relatively more expensive (which is what happened during the GreatDepression).

J.M.: What are the other factors?

L.L.: Americans are saving very little money. On average, people spend almost everything they earn. While some invest in retirement funds, others borrow a lot. As you know, the government revised the savings numbers down recently to an almost negligible amount. Now there may be some troubles with how that’s measured. But it’s clear that one reason the economy has been strong recently is that people are spending so much on goods and saving so little. That can’t continue.

J.M.: Why not?

L.L.: The big reason may be that they feel free to spend because their stocks are doing so well. If people have more and more money in the stock market, and stock prices keep going up, why should they bother to save? Or why should they deny themselves something that they would like to have? This is called the wealth effect.

Advertisement

J.M.: It only works when the market is up.

L.L.: Yes. But what makes it particularly dangerous today is that so many people own stocks and the savings rate is so low. We made a very thorough study of this in 1962 when the stock market was down 30 percent. At that time, we discovered there was no wealth effect at all. But that has all changed, because of the remarkable promotion of mutual funds and other kinds of equity savings instruments. In other words, as people felt richer, because their mutual funds were going up, or their IRAs were going up, they felt they didn’t have to set aside as much money for their retirement or their kid’s college expenses—which, by the way, are the two main reasons for savings.

As stock prices start going down, will this make people spend less money? I daresay it will. The man who is building the largest house in the Hamptons may have second thoughts if he suddenly loses $10 million in the stock market. The same will be true for the average investor. He may not buy a car, or eat out as often, or spend as much at Christmas. And by now some may think they own enough goods. In the Twenties there were so many industries just coming into existence. Autos, the radio, washing machines, refrigerators. Electricity in general. Today we have electronics products. I don’t know how to measure this, but I don’t know how many more we need. I have a number of friends who keep on buying new computers, and they finally get machines that are more powerful than they need.

J.M.: You say there is a third potential weakness in the economy?

L.L.: The third problem with the American economy may be that there is just too much capital investment—an investment bubble. I think this is hard to measure. As we said, you never know when capital investment is overextended until the economy begins to slow down. But I know the world can make more automobiles than it needs. I am told it can make more computer chips than it needs. I think there may be too much investment in high technology. As I say, only when the economy starts to slow does this become obvious. Until then, everything always looks great.

J.M.: Economists typically think of capital spending as the main source of the economy’s strength. The more the better.

L.L.: Yes, that’s what many said about Japan. I am not sure that economics has made all that much advance since John Maynard Keynes. I am not an economist, so I won’t push the argument too far. But you have to know the causal relationship. Capital investment may improve productivity, but new opportunities may also stimulate capital investment. So what is causing what? It doesn’t mean that if you just keep investing, productivity will also keep going up.

J.M.: At some point, you’re saying, certain kinds of capital investment simply become the fashionable thing to do and that’s how economies get overextended.

L.L.: If you can raise the money, which you can do these days, someone will come along with an idea about what to do with it. But it may not be a very good idea. That’s what happened to Japan. But we are not as overextended as they were—that should be made clear.

J.M.: Let me give the conventional argument here, about which I am dubious. A lot of analysts point to the degree of high-technology investment and the computer revolution and say that they will be the source of new growth and rising productivity.

L.L.: Well, we’ve had a lot of electronics investment for a long time. It’s probably improving productivity, but it won’t raise it by a quantum leap. And we may now be investing too much in these things. As I said, some people tell me their computers are too powerful.

J.M.: So, in sum, whatever the trigger, the American economy is vulnerable to a downturn.

L.L.: Exactly. As I said, I think a recession is getting increasingly likely.

J.M.: What does that mean for the stock market?

L.L.: It could mean a serious decline. It’s already been serious, remember. Small stocks are way down.

J.M.: How overvalued do you think the stock market is?

L.L.: Well, I’ve thought it’s been overvalued for some time. And it just kept going up. All markets overshoot. If something’s working, you want to buy more.

J.M.: How do you analyze the value of the market?

L.L.: By the way, I don’t think the odds of being right about the market are remarkably large, though at some times trends are easier to see than at others. Perhaps this is one of those times.

In evaluating companies in the market, I try to determine what you would pay to buy the whole company, based on its actual performance—its products, its sales, its earnings, and its prospects. Then I compare it to the current market value based on the stock price—the price of the shares times the number of shares. Given the way the stock market has been, it’s been a long time since I’ve been able to find many companies I would want to buy.

J.M.: In some fifty years in the business, do you think this market is about as exuberant a stock market as any you have ever seen?

L.L.: I don’t think any of us really remembers how we felt at different times of our life about different things. I’ve noticed people always think that this time it’s the worst. When you’re younger, you are more inclined to believe that the profits you make in the market are due to your own wit or talent. When you get older, maybe you get a little wiser and discover that it’s exogenous forces that are making you all that money.

That being said, today’s market is clearly more exuberant in this one sense. A relatively small part of the population was involved in the stock market in the Sixties. Now, for all intents and purposes, everybody who is middle class is, in some way or another—even in the pensions managed by his employer—involved in the stock market.

J.M.: One reason people are more optimistic today is that they think corporations manage the business cycle better.

L.L.: I think they manage inventories better. Building inventories too fast was once one of the main causes of recession. Companies would suddenly stop producing in order to cut back excessive inventories. Now they hold inventories in line with much greater sophistication. That might reduce the frequency of recessions, but it won’t eliminate them. And there are always new problems developing.

J.M.: For example?

L.L.: With all the attention on increases in corporate earnings these days, I am worried that companies may be getting too liberal with their accounting. Earnings may not be quite as strong as they appear. You know, accounting is not a science. The temptation to put a good face on things seems part of human nature. As much as we want to believe times are now different, human nature has not fundamentally changed in the 1990s.

J.M.: Many economists believe that a recession simply cannot get too far out of hand because the Federal Reserve will pump up the money supply by bringing down interest rates. Should the Fed be lowering interest rates right now?

L.L.: I think the Fed has a few problems, which are inherent in its nature. First of all, they have only one tool, really. That is adjusting interest rates. If you have only one machine, you tend to think it’s more important than it really is. Sometimes you hesitate to use it when you should.

Second, they are a conservative institution. They generally act after the fact. I can hardly ever think of a time when they seriously anticipated what was going to happen in the economy. But I do think that they are very close to the point where they are going to cut rates.

J.M.: Are you as convinced as many economists that the Fed will save the day if the economy falls into a serious recession?

L.L.: I think they have less power than many believe. Let’s go back to the experience of the Thirties. Even if they try to pump up money, who’s going to spend the money on capital goods when things are bad? Who’s going to spend the money on other things if the Fed makes money easier? Japan has the easiest money in the world. And the economy is on its back. So, no, it won’t always be a panacea.

J.M.: What else can be done?

L.L.: Contrary to what a lot of people say, I think we should have a serious government spending program. My real worry is quite the opposite of the worry of many people on Wall Street. Suppose the gloomy picture I am painting corresponds to what will happen—which of course it may not. And suppose tax receipts fall rapidly as personal income falls. And suppose we then show a government deficit. Given current attitudes about balancing the budget, would the government then be willing to spend more money to stimulate the economy? Would Congress and this administration and the electorate? How long will it take to convince them? This is what the Clinton administration is recommending for Japan, with which I wholeheartedly agree. But will we take our own advice?

J.M.: So how bad could it get?

L.L.: Well, having said all that, let’s remember that we now have all the government programs that keep some income flowing. Automatic stabilizers, as they are called. Unemployment insurance. Social Security. We didn’t have any of that in the early 1930s. So there is a higher floor. And I am certainly not saying all that could go wrong will go wrong.

J.M.: Will it take a long while for this stock market to fall to the full extent it might because there is so much optimism around?

L.L.: Oh, I think so. I think all markets take a long time to make their moves. It always takes a while for the mood to change. Look how optimistic everybody was in June or July. A few months ago. Many people running money today never lived through a bear market. Any time the market falls, they think stocks are now selling at a bargain price. And so they buy. Every rally is said to be the end of the problem. We had a great stock rally from late 1929 to the spring of 1930. Then stocks really collapsed. Not that I remember this personally, I want to stress. Nor am I saying this will happen the same way this time around. I certainly don’t think, as I tried to make clear earlier, that we are headed to anything as severe as the Great Depression. But things could get rougher than most anticipate.

J.M.: What investment strategy are you adopting?

L.L.: My investment decisions are essentially very conservative now. I have been inclined to sell stocks from the portfolio and put the money into US Treasury bonds.

J.M.: In this day, many would find that too conservative a strategy.

L.L.: Well, it isn’t simply defensive. I think we are going to get a big move up in Treasury bonds because interest rates will come down more as the economy weakens.

J.M.: How far could interest rates fall?

L.L.: This is the question I am asking myself these days. It would not surprise me to see rates on long-term government bonds fall to 3 or 4 percent from their current 5.2 or 5.3 percent or so. That would represent a rise in the price of the bond of 20 percent or more.

J.M.: That’s serious “upside potential,” as they say.

L.L.: Yes. So it’s not the worst thing in the world to sell stocks and put money into long-term Treasury securities. You could make a lot of money—maybe.

J.M.: You generally stress the uncertainty in economic behavior. It is an issue that I am also concerned with. Professional economists are typically looking for universal answers. But every period of time is unique in important ways, it seems to me. In the 1990s, a fall in interest rates seems to me to have been highly stimulative. Thus we could grow even as the stimulus from federal spending was reduced. Such a fall in rates in a different period of time may not have been as stimulative.

L.L.: Yes. The thing that makes the task of predicting so damned difficult is that all of the variables change in importance each time. In other words, you look back to past history and you may think you have a perfect grasp of what happened, which nobody could have had back then. But that wouldn’t help you much today. Because all the variables in the equation, as it were, would carry different weight today. My big fear is that we are nearer the beginning of the current turn in history than we are near the end.

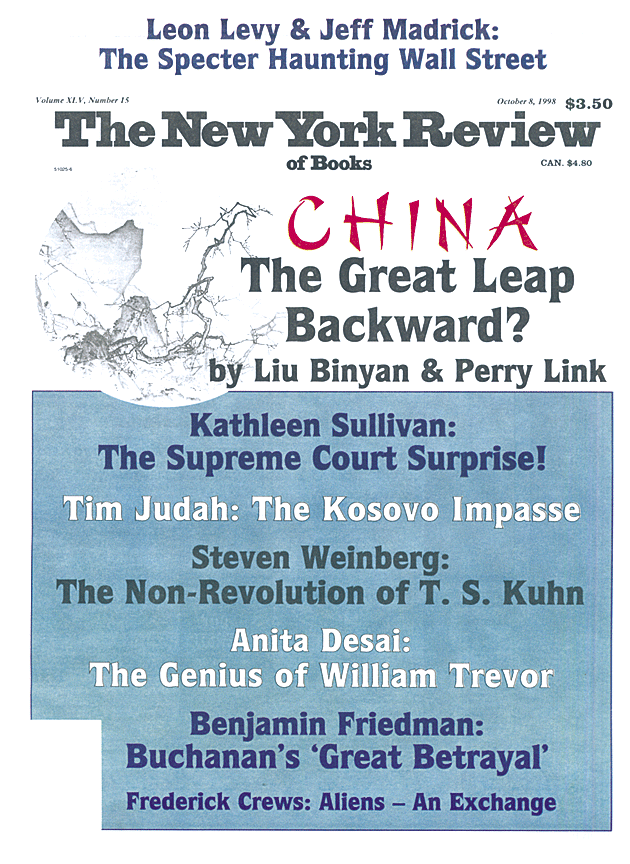

This Issue

October 8, 1998