October 16, 1996: The US economy was in its sixth consecutive year of expansion. Only 5.2 percent of the labor force was unemployed, at that time nearly as low a rate as at any point since before the OPEC cartel raised oil prices in 1973. Inflation during the previous twelve months had been just 3.0 percent. Profits earned by American corporations had risen 75 percent since 1992. The Dow Jones index closed that day at 6,020; stock prices had doubled since 1992. Staring straight into the camera, with a television audience of over 100 million for his second live debate with President Clinton, Senator Bob Dole announced, “We have the worst economy in a century.”

George W. Bush is unlikely to repeat Mr. Dole’s mistake. America’s business expansion is now in its tenth year. Unemployment is 4.1 percent. Overall consumer inflation edged up to 3.5 percent during the past year, but the reason for the increase since 1996 was higher world oil prices, not domestic inflation. “Core inflation,” excluding prices of food and energy, has been just 2.4 percent. Corporate profits have risen another 33 percent since 1996. On September 15, the Dow Jones closed at 10,927. Running against prosperity is a losing strategy.

The obvious question is who gets the credit for this success. Should it be Mr. Clinton, whose 1993 budget package raised taxes despite critics’ warnings that doing so would wreck the expansion (and against the opposition of literally every Republican vote in the US Senate)? Or congressional Republicans, who fought to hold down spending on most government programs outside the Defense Department? Or Alan Greenspan, who had the insight and courage to allow the expansion to use resources to an extent that most mainstream economists had persistently warned would create new inflation?

But most elections are not about looking back. The economic issues confronting American voters this year turn on questions about how we should use this remarkable prosperity now that we have it.

1.

The easiest way to understand the extraordinary opportunities that the combination of today’s prosperity and today’s policies presents is to take a one-question economics quiz: When the government runs a budget deficit year after year, it accumulates debt; conversely, when the government runs a budget surplus year after year, it accumulates…what?

If the answer seems hard to find, the reason is that there is no answer. The situation in which the US government now finds itself is sufficiently unusual that we do not even have a generally accepted vocabulary with which to discuss it. For the first time since 1969, the government is now taking in from taxes and other revenue sources more than it spends. But in contrast to 1969, when the surplus was tiny, today it is large. According to advance estimates from the Congressional Budget Office, the surplus for the fiscal year 2000 (which ended on September 30) was probably $232 billion, or 2.4 percent of US national income. More importantly, while the surplus in 1969 was an isolated event, not to be repeated for thirty years, the government now stands to run surpluses for some years to come. Assuming that current tax and entitlement policies will continue and that the one third of its spending that the government directly controls will grow in pace with inflation, the CBO projects that the surplus would continue to grow for the next ten years, reaching $685 billion, or 4.4 percent of national income, by 2010. The Clinton administration’s ten-year projections are roughly similar. At this pace, by 2009 the government would have no more outstanding debt held by public investors. (The Social Security Trust Fund would still hold plenty of Treasury IOUs.) From then on, the government would be accumulating what we do not have a ready noun to identify.

No one believes that such a circumstance will come to pass, at least not within the foreseeable future. Current tax policies will change; so will current entitlement policies. It is also highly unlikely that the government’s “discretionary” spending will grow merely in pace with inflation, which would require that government programs, including those for defense, shrink indefinitely in proportion to a growing economy.

The real question, therefore, is not whether something in this picture will change, but what? For purposes of the election debate between Mr. Gore and Mr. Bush, the question is what should change. A large and ongoing budget surplus at a time of economic prosperity presents an extraordinary, perhaps unprecedented, opportunity. How should would-be leaders use that opportunity? Appropriately for an election debate, the answer hinges not just on the details of the candidates’ policy proposals but on some issues of fundamental economic philosophy.

First, who should do the economy’s saving? It is useful to frame the matter in this way because there has been for some years a broad consensus that increasing the US economy’s overall saving would be highly beneficial, since the savings would be available for investment that strengthens the economy. American families and businesses have traditionally saved less of their incomes and profits than have their counterparts in other industrialized countries, but the difference has become greater in recent years as the US private saving rate has sharply fallen. After we allow for depreciation of the houses and the business factories and machinery that are wearing out and becoming obsolete, we find that in 1999 all US families and businesses together saved just 4.1 percent of national income—down from an average 9.8 percent during the 1960s and 1970s. As a result, our ability to invest in productive economic assets has become increasingly dependent on our borrowing large amounts from abroad (borrowing equal to 3.4 percent of national income last year). Even so our investment rate remains below what it was a quarter-century ago.

Advertisement

Saving more, so as to invest more, would be useful not just because it is good to make the economy more productive but especially because of the impending retirement of the baby-boom generation. As the ratio of retired workers (plus other dependents) to active workers rises, those Americans still on the job will have to become progressively more productive if the nation’s overall standard of living is to keep pace. Moreover, having to pay an ever larger share of the US national product to foreigners, in order to service the debts we are building up through our continual borrowing from abroad, will further take away from our ability to maintain living standards at home. Additional savings that go into investments that improve productivity would help just where we will need it. So would additional savings that take the place of borrowing from abroad.

But who should, and can, and will, do that saving? In the absence of changes in tax or spending policies, the federal government would account for an increasing share of it.1 The alternative, of course, is to let the public do its own saving by returning the surplus in the form of tax cuts. And this is the first philosophical divide along which Mr. Gore and Mr. Bush differ in the economic policies they offer.

Mr. Bush’s tax plan would cut marginal income tax rates for all taxpayers, allow additional deductions for two-earner families (thus reducing the “marriage penalty”), increase the child credit, extend the charitable deduction to taxpayers who do not itemize, raise the limit on corporate donations, and eliminate estate and gift taxes altogether. Mr. Bush’s own estimate of the total reduction in federal revenues resulting from these changes is $1.3 trillion between 2001 and 2010, enough to eliminate 60 percent of the cumulative ten-year surplus (apart from Social Security) projected by the CBO under current tax and entitlement policies and with discretionary spending growing just with inflation.

The various targeted tax reductions proposed by Mr. Gore have quite different aims and outcomes. In contrast to Mr. Bush, who mostly favors a general lowering of tax rates, Mr. Gore’s program, called “Prosperity for America’s Families,”2 is frank about using the tax code to promote a variety of public policy objectives, including individual saving, improved education, owner-occupied housing, and business research and development—they add up, after he takes account of anticipated revenue increases from proposed elimination of corporate tax shelters and other tax loopholes, to only $480 billion between 2001 and 2010.

It is possible to debate these competing proposals on several practical grounds. One is concern that the estimated reduction in revenues may be understated, especially in light of the need, on which most Republicans and Democrats agree, to raise (or index) the threshold at which the “alternative minimum tax” begins to apply, in order to avoid having an ever greater proportion of taxpayers become subject to this highly unpopular feature of the tax code. Making this adjustment could add as much as $100 billion to the revenue reduction under Mr. Bush’s proposal in particular. A second is the likelihood that a recession may come along at some point to reduce incomes and profits, thereby depressing tax revenues for reasons unrelated to any new legislation.

There is also the near certainty that the government’s discretionary spending will increase by more than inflation, hence also claiming a part of the projected ongoing surplus. Finally there is the fact that after 2010, when the baby-boom generation begins to retire, the government’s fiscal outlook will take a sharp turn for the worse even under the most optimistic assumptions. (In some respects, 2010 is therefore about the worst possible cut-off point for a supposedly long-term budget analysis.) No doubt each of these concerns will be debated this autumn. But none involves a fundamental philosophical difference.

The question of who should do America’s saving does. In the end, this issue is likely to turn primarily on who is capable of saving, or willing to save. What buttresses Mr. Gore’s position is the likelihood that in the end the public mostly wouldn’t save what it got back in lower taxes, but would use it for consumer spending—in other words, a repetition of what happened after the Reagan-Kemp-Roth tax cut in the early 1980s. What supports Mr. Bush’s position is the likelihood that in the end the government wouldn’t save its surplus revenues either, but would use them to fund more spending—in other words, a repetition of the experience under Presidents Johnson and Nixon.

Advertisement

Who’s right? Alas, in all probability both views are correct. But at least the idea of having the government run a surplus is a matter of public policy that one can debate on its merits. The chief threats to such a surplus are from policies requiring more spending; but each new expenditure is at least subject to a vote in Congress as well as to the hazard of a presidential veto. Having the general public save more is instead a matter of private behavior, and one of the strongest lessons from the last two decades is that we know very little about how to use tax incentives or other devices of government policy in order to influence people’s private decisions on how much to save. The best guess is that, in the end, the surplus will be fairly small; that private saving won’t rise much; and that the increase to national saving will therefore be small as well. But the chances of a sizeable increase to national saving over the next ten years would be better under any plan that retains the surplus and uses it simply to pay down government debt.

2.

A second philosophical issue that divides many Democrats from many Republicans, and that underlies much of the discussion of economic policy in this campaign—although neither Mr. Gore nor Mr. Bush has addressed the matter in just these terms—is closely related to the first. For the first time in nearly two decades, many American politicians have now returned to debating government spending programs on their own merits, free from the overriding need to reduce the budget deficit that dominated so much of the discussion of government spending throughout the 1980s and during much of the 1990s. The questions of what would be a good use of America’s economic resources and what role government should play in achieving national goals have therefore moved back toward the center of the debate over economic policy.

No one will ever know whether the architects of President Reagan’s fiscal policy deliberately created a chronic, record-size deficit as a way to throttle government spending. Mr. Reagan himself made clear that he saw reducing taxes as a means of limiting government spending; but at least in his public statements he always maintained that he did not foresee the large deficits that he produced through a combination of cutting taxes, increasing military spending, and maintaining entitlements for the retired elderly. Intended or not, however, large deficits occurred, year after year, even at nearly full employment. And in retrospect they clearly put a brake on most categories of federal spending—eventually including defense and Medicare benefits for the elderly too (though not Social Security benefits).

The discussion of government spending in the 2000 election is therefore similar to what we have seen before in one respect but, in another way, different from the campaigns of recent years. The similarity is that while both Mr. Gore and Mr. Bush regularly refer to ten-year budget projections, which assume that discretionary spending will rise only in pace with inflation—and Mr. Bush refers also to an alternative CBO projection that allows no growth at all in discretionary spending (and therefore shows a far larger surplus)—neither candidate has had much to say about whether such projections make sense as a reference point for planning future fiscal policy.

Almost half of all of the government’s “discretionary” spending goes for defense. In 1999, out of $575 billion in total discretionary spending, the Defense Department accounted for $261 billion and about half of the Energy Department’s $20 billion budget represented the cost of maintaining the nation’s nuclear arsenal. (The final budget breakdown for the 2000 fiscal year is not yet available.) Most of the talk today, from Democrats as well as Republicans, points to higher defense spending, not lower. President Clinton has signed legislation providing for a significant increase in defense spending in fiscal 2001, including a 3.7 percent pay increase for all military personnel.

Moreover, many of the programs that make up the other half of “discretionary spending” serve needs that plausibly increase as the country’s population grows and the economy expands, even apart from any proposed new initiatives: they include law enforcement, interstate highways, tax collection, bank supervision, promotion of US exports, laboratory research, disaster relief, and so on. Already for fiscal 2001, it looks as if total discretionary spending will be well above the CBO’s projected estimate. Many economists outside government therefore think the assumption that all this activity will merely grow in pace with inflation is highly unrealistic.

The problem is more serious for Mr. Bush. Because he has chosen to devote so much of the projected surplus to cutting taxes, the idea that the surplus may turn out to be far smaller than projected either raises the prospect of a return to deficits or suggests the need to cut back on spending in ways that he has not discussed. (A third possibility, of course, would be to reverse the tax cut later on. The experience of the 1980s suggests that once taxes are cut, and deficits emerge, tax increases to eliminate the deficit follow but only after a long time and the accumulation of much government debt.)

Mr. Gore, by contrast, has made it clear that he does not expect discretionary spending to increase only in pace with inflation; nor does he think that such a policy would be a good one. His “Prosperity for America’s Families” describes $1.26 trillion of “investments in priorities”: in education, in health care, in the environment, in reduction of poverty, and in national security. (The amount of detail in Mr. Gore’s plan is extraordinary—for example, $8 billion for after-school programs, $300 million for small-business health insurance, $2 billion for improving the electricity grid, $500 million for community prosecutors, along with the big-ticket items like $50 billion for a targeted increase in retirement benefits for widows and widowers, $50 billion for subsidies for schools, $95 billion for expanded health care coverage, and $100 billion for the military.) For Mr. Gore, therefore, the question is simply whether it is plausible to assume that the parts of discretionary spending he is not proposing to increase will grow only with inflation.

What is new this year, however, is that when either candidate does propose new spending, whether for Mr. Bush’s limited suggestions on education or any of the dozens of specific items in Mr. Gore’s comprehensive plan, nobody can raise the instant objection that such initiatives would only worsen the deficit. Those conservatives who resist almost all forms of government spending have therefore had to fall back on the desire for “a smaller government.” Appealing to this general principle, as Mr. Bush has repeatedly done, also obviates the need to debate specific proposals on their merits, and it has apparently proved appealing in some quarters; but it lacks the concreteness of the concerns about the deficit that overshadowed such discussions in previous years. More significantly, it opens the way for what turns out, after all, to be a debate on the merits of particular programs. If what the government is doing is providing disaster relief to Montana communities stricken by forest fires, or building highways for Oklahoma truckers, is it really so obvious that the government should be smaller?

This change in the direction of America’s fiscal debate is still new, and its effect on national politics has yet to reach full force. Even so, two specific examples make clear that the effect is already significant. Medical care, especially for the elderly, is as important an element of this year’s campaign as in prior years. The pivotal issue this time around is whether the Medicare program, which for decades has paid hospital and doctors’ bills for Americans over age sixty-five, should also pay for drugs prescribed for outpatients.

Mr. Gore has offered a plan to pay the full cost for the low-income elderly, and to subsidize the cost for all others, at a total outlay estimated at $253 billion between 2001 and 2010. Mr. Bush has instead offered a $158 billion plan to include prescription drug coverage within a broader overhaul of Medicare to provide not just direct fee-for-service coverage, as in the past, but subsidies that elderly citizens could use to purchase insurance from private companies, including HMOs, if they chose. (In the interim, while these more sweeping reforms are being made, Mr. Bush would rely on state-level programs—which now exist in only about half of the states—to pay for prescription drugs for those with low incomes.)

The debate on this issue has mostly revolved around the relative merits of these two different approaches—one relying on government, the other more on the private sector—to solving what is increasingly perceived to be a serious problem. The question has been raised whether the private insurers who are central to Mr. Bush’s proposal will find it sufficiently profitable to sell prescription drug coverage to the elderly, especially to those whose medical histories make plain in advance that they need expensive medicines. There has also been some discussion of whether helping elderly Americans pay for their prescriptions is a good use of the country’s economic resources in the first place. But no one has pointed to Mr. Gore’s $253 billion plan, for example, as a budget-busting scheme that would worsen an already precarious fiscal situation.

A second useful example is the widely debated proposal to spend $60 billion (initial estimate only) to build an on-shore antimissile system. Mr. Bush has endorsed this idea. Mr. Gore, following the Clinton administration’s lead, has neither endorsed it nor opposed it.

Military spending is always an interesting contradiction for political and economic conservatives. Many use terms like “government spending” as if defense contractors donated weapons systems to the government free of charge and Defense Department employees were unpaid volunteers. Calls for lower spending, and repeatedly expressed preferences for a smaller government, usually leave it to the listener to understand that the military is not included. But America’s spending on defense has been very large throughout the post- World War II period, and it continues to be. Under either Mr. Gore or Mr. Bush, it will presumably become larger.

Objections to the proposed new antimissile system have mostly concentrated on whether the United States can construct such a defense without abrogating existing arms control treaties and, even if so, whether our proceeding unilaterally with such a program would set off a dangerous new round of nuclear weapons competition. Opponents have also pointed out the general absence of technical evidence so far that such a system, if put in place, would actually work. (Military spending poses a contradiction for conservatives in yet other ways. Despite years of criticizing liberals for launching social programs with little or no evidence that they would be effective in serving their stated purpose, and for relying simply on the argument that the stated objective is so important that there is a moral imperative to act, many of the same people now point to the importance of guarding America against nuclear threats from rogue nations as grounds for going ahead with an antimissile system despite a lack of scientific evidence that it would ever work.) The same argument of likely ineffectiveness also suggests that the country would be better off to save the $60 billion—in other words, to pay down this much more government debt and get the benefit of the greater savings and investment.

But as in the case of Mr. Gore’s prescription drug plan, nobody is claiming that $60 billion (and presumably far more, with the usual cost overruns) for an antimissile defense system would break the budget. Nor is anyone likely to offer such an objection when Mr. Bush offers details of how he would rebuild the nation’s defense establishment. In the fortunate circumstances that America enjoys today, it is once again possible to consider such ideas on their merits. And different perceptions of these merits turn on differences in opinion over what government should do.

3.

The third philosophical issue underlying this year’s economic debate is that of distribution and redistribution of income. It is useful to state the issue in this dual form because the subject has arisen mostly in discussions of Mr. Bush’s tax cut proposal, and it is impossible to have a meaningful debate over how taxes redistribute the fruits of American prosperity without also taking into account how the economy has distributed those fruits in the first place.

A few basic facts set the stage for this year’s tax debate. First, higher-income citizens pay most of the tax raised under the individual income tax. According to the most recent available data (1997), the median US taxpayer has an “adjusted gross income” for tax purposes of about $25,000. But taxpayers with incomes above the median account for 95 percent of the individual income tax paid. The 6 percent of taxpayers who have incomes above $100,000—four times the median—account for 55 percent of the tax paid. Only three taxpayers out of every thousand have incomes above $500,000; even so, they account for 24 percent of all taxes paid. The important implication is that it is impossible to cut individual income taxes by a genuinely large amount without having most of the direct benefit accrue to taxpayers with higher than average incomes.

Second, Americans with higher incomes have enjoyed greater income growth not just during the prosperity of the 1990s but throughout the 1980s as well. Families with median incomes now earn 12 percent more than they did twenty years ago, after allowing for inflation. Those in the top one fifth earn 44 percent more. Those in the top 5 percent earn 78 percent more. (Not everybody in the top one fifth or top 5 percent today was in the same relative position twenty years ago, but there is easily enough continuity to make such comparisons meaningful.) It is therefore not hard to understand why Republican proposals for large cuts in individual income taxes—two bills in Congress during this past session, and now Mr. Bush’s plan—have not generated the kind of fervent support that the Kemp-Roth proposal attracted twenty years ago. Today the taxpayers who would get most of the benefits are already enjoying significantly higher incomes despite their higher tax bills.

Third, under the individual income tax code the large-scale widening of income inequalities that has occurred in the US pushes up tax payments faster than it pushes up incomes. As a result, the share of our overall national income paid to the federal government in individual income taxes is now 9.9 percent, up from a low of 7.7 percent as recently as 1992. Similarly, the share of national income that the government receives in all taxes combined is now 20.4 percent, compared to 17.5 percent in 1992. (This increase accounts for about half of the story of how what used to be a big budget deficit turned into a big surplus.) Pointing to these high ratios of taxes to national income as grounds for cutting tax rates makes much less sense when it is the rise in inequality—i.e., the disproportionate increase in incomes at the top—far more than the nation’s general prosperity, that has caused the increase.

Fourth, personal income taxes and payroll taxes such as Social Security together account for more than four fifths of the federal government’s revenues. But in contrast to the individual income tax, which is still progressive even after we take into account the deductions and other devices that upper-income taxpayers use to reduce their payments, the payroll tax that funds Social Security is regressive. Taxpayers reporting adjusted gross incomes of $200,000 or more on average pay 27 percent of that in income tax, while those with incomes of $25,000-$30,000—just above the median—on average pay only 8 percent. By contrast, the Social Security payroll tax is a flat 12.4 percent rate up to the current annual earnings ceiling of $76,200, and zero after that. (The Medicare part of the payroll tax is a flat 1.45 percent with no ceiling, and is therefore neither progressive nor regressive.)

The contrast between the progressive personal income tax and the regressive Social Security tax bears particularly on the debate over what to do about Social Security, a subject that has emerged in this year’s election as a topic of major concern on its own. The center of that debate is how to pay for the retirement of the baby-boom generation. Because the Social Security system is by design currently taking in more in payroll taxes than it spends on benefit payments to today’s retirees, the Social Security Trust Fund is ac-cumulating a steadily larger positive balance. But once the members of the baby-boom generation start to retire, the fund will soon have to begin running down that balance. After a while—according to current projections, by 2037—the trust fund will be exhausted. At that point it will be necessary to raise payroll taxes, or to cut benefits, or to find some other source of revenue. Since most of the government’s revenue other than from payroll taxes comes from the individual income tax, finding another revenue stream to buttress Social Security would implicitly mean turning to individual income taxes.

Neither Mr. Gore nor Mr. Bush has expressed any interest in raising payroll taxes. Similarly, neither has supported any explicit reduction in Social Security benefits. The central issue of the debate is instead whether to turn to sources of revenue other than the payroll tax—i.e., the individual income tax—to shore up Social Security. Such a step would be a major change in national policy. Since its inception in 1935, Social Security has relied exclusively on the payroll tax (plus the earnings of the trust fund’s investments of excess payroll tax collections in US Treasury obligations). But a major challenge to the system will soon be presented by the baby boomers’ retirement; and the resistance to either tax increases or benefit cuts displayed by this year’s presidential candidates is no doubt a fair representation of popular sentiment.

By resisting a large cut in income taxes, Mr. Gore would implicitly keep those tax proceeds available for possible use in filling the future hole in Social Security. More explicitly, he has also proposed to transfer to the Social Security Trust Fund a part of the surplus that the government will be running outside the Social Security system (the so-called “on-budget” sur-plus). Doing so is directly equivalent to general revenue financing—in other words, individual income tax financing—of Social Security. By contrast, Mr. Bush would give up most of the on-budget surplus as a result of his income tax cut, and in any case he has not proposed to transfer any of the remainder to Social Security.

Why does it matter which tax source the government uses to pay for Social Security benefits? Most obviously it matters because income taxes are progressive while payroll taxes are regressive. Hence how the bill is paid has a lot to do with how the burden is shared.

Moreover, in light of the future shortfall that Social Security faces, just who is to pay the bill, and by what means, also has a lot to do with whether, in the end, anyone will do so at all. In other words, the question is whether future retirees will receive benefits comparable to what today’s retirees get, and perhaps even whether the Social Security system will survive. Holding on to most of the “on-budget” surplus generated by the income tax, and even dedicating some of that surplus to Social Security now, makes it more likely that the system will continue. It also makes it less likely that the system’s survival will require either an increase in the regressive payroll tax or large benefit cuts, which would be especially painful for lower- and middle-income families. (It should be kept in mind that 30 percent of all elderly Americans have virtually no income other than their Social Security benefits, and for 63 percent of them, the benefits amount to at least half of their income.)

4.

Social security is an especially powerful issue in this campaign not only because of the program’s importance to so many citizens but also because the questions raised by potential Social Security reform plans reflect the different economic philosophies being debated this year. The question of whether the coming shortfall should eventually be met by payroll tax increases or by holding on to surplus income tax revenues is only part of the story. Who should do America’s saving is central to the Social Security debate as well.

Mr. Bush has not followed Mr. Gore in proposing to transfer to Social Security some part of the government’s on-budget surplus. Indeed, the principal idea he has offered on this matter is to transfer funds from the Social Security Trust Fund each year, in the amount of about one sixth of Social Security’s annual receipts from the payroll tax, to finance mandatory personal savings accounts for all wage earners. The main objective would be to allow these funds to be invested in assets that bear a higher rate of return than the Treasury securities to which the Social Security Trust Fund is limited. Others, including President Clinton last year, have proposed achieving the same objective by allowing the trust fund itself to invest in equities, corporate bonds, and other higher-yielding assets. But the idea of having a part of the federal government, even one as independent as the Social Security Administration, become a large-scale investor in stocks and bonds issued by private companies has troubled many both in and out of government. Hence the use of private accounts, over which individuals would directly exercise investment control, has seemed attractive.

The key question here, however, has been where the money is to come from to fund such accounts. Mr. Gore has proposed using the government’s on-budget surplus to fund supplementary personal accounts only for low-wage earners—a very limited use of private accounts. This would be yet another way to turn to general revenue financing—that is, to the progressive personal income tax—to bolster Social Security. Two years ago my Harvard colleague Martin Feldstein offered a much more ambitious proposal to fund individual accounts in the amount of 2 percent of annual earnings (up to the ceiling covered by Social Security) for all wage earners, also using the on-budget surplus for financing.

Mr. Bush’s plan resembles the Feldstein plan in both scale and scope. But because Mr. Bush has already proposed to use most if not all of the projected on-budget surplus to pay for cutting individual income taxes, it is not available to fund individual savings accounts. Hence Mr. Bush proposes to fund these new accounts by diverting a part of the payroll tax revenues that now go into Social Security.

So far the debate over this idea has largely taken place among professional economists, away from the glare of the campaign. One of the issues under discussion has been what would happen if people chose investments that happened to turn out badly, and how much it would cost to insure against such outcomes. Another is whether the administrative cost of running these tens of millions of accounts would absorb too much of any additional return that individuals could plausibly expect to earn. Conversely, fees that represent a cost to the owners of the accounts would be a bonanza to the brokerage and mutual fund industries. A third issue is how much of any extra returns people earned would go to pay for higher benefits instead of being “clawed back” into the Social Security system. In the newest Feldstein plan, which has been made to look more like Mr. Bush’s in that the personal accounts are funded out of the Social Security payroll tax, it is 75 percent. Each of these questions deserves more public attention than it has gotten.

From an economic perspective, however, the most fundamental issue is whether transferring funds to some form of mandatory personal savings accounts would lead to an overall increase in what America saves. The answer depends on how the accounts are financed, and on what would happen to the funds if they were to stay where they are.

Mr. Gore’s limited plan for low-income earners probably would add to national saving, for two reasons. Most low-income Americans do little if any saving on their own, and so it is unlikely that those who receive such accounts would see them as a reason to put less into whatever savings accounts they already have. And to the extent that Mr. Gore’s use of surplus revenues in this way would be an alternative to a tax cut, it adds to saving because the evidence of recent years indicates that much of any cut in individual income taxes would go into higher consumer spending, not more saving. (To the extent that the use of the surplus in this way is an alternative to simply paying down more government debt, there is no increment to total saving.)

Neither of these arguments applies to Mr. Bush’s plan. Because the personal accounts he proposes would be funded in proportion to workers’ earnings (up to the Social Security ceiling), most of the money would go into accounts for the benefit of higher-income earners—i.e., the very people who already have other savings, and who could offset what goes into the new accounts by saving less elsewhere. And because the money to fund the accounts would come from payroll tax revenues that otherwise would flow into the Social Security Trust Fund, from the perspective of overall saving all that would happen is a shift from one government pocket to another. Indeed, when proponents of personal accounts financed in this way argue that they would increase national saving, their argument rests explicitly on the assumption that the government will go back to spending, each year, the surplus in the Social Security account by running an equal or larger on-budget deficit. In other words, despite the promise to take a “lockbox” approach to Social Security, any claim that the Bush plan would add to national saving assumes that the government would be unable to live up to that promise.3

Whether this and other questions about the future of Social Security—as well as about the philosophy that underlies economic policy—will be clearly debated in the current campaign will be a major test of the seriousness and the competence of the two candidates.

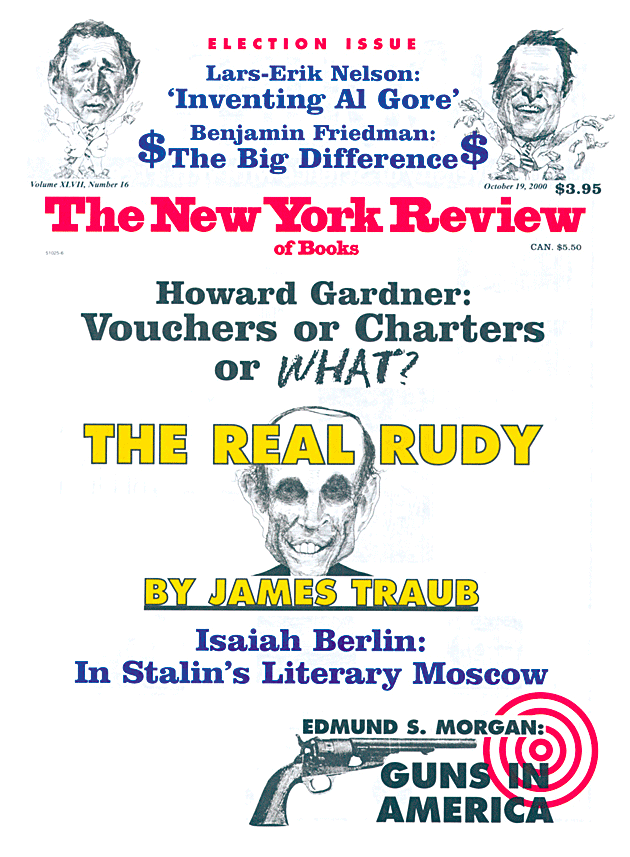

This Issue

October 19, 2000

-

1

This does not mean that the government would play any additional role in allocating the nation’s savings—at least not for some years, and probably not ever. As long as the government had some debt outstanding (until 2009 on current projections), it would add to national savings merely by paying off its publicly held obligations. The market would allocate that additional savings in the same way that it allocates private savings; that is, the investors who had held the redeemed obligations would decide what to do with the cash they received from the Treasury, and a good part of the money would be saved, whether in corporate bonds or in other ways, providing money for investment. Only after the government had completely retired its outstanding debt (if that ever occurred) would there be a need for concern about ways of allocating savings that did not depend on the market. ↩

-

2

Available through Mr. Gore’s website: www.algore2000.com. ↩

-

3

See Douglas Elmendorf and Jeffrey Liebman, “Social Security Reform and National Saving in an Era of Budget Surpluses,” mimeographed, John F. Kennedy School of Government, Harvard University. ↩