1.

When the Bush-Cheney administration proposed to replace Social Security with a system of individually accumulated, individually owned, and individually invested accounts, my first thought was that its goal was to take the Social out of Social Security. It took a few minutes longer to realize that it also intended to take the Security out of Social Security.

That attempt failed. In recent years, however, a mixture of public and private policy decisions and impersonal market developments has had the broad effect of shifting many financial risks from established institutions, including even society at large, to individuals who are unable to cope with them in an adequate way. Information may be impossibly difficult for citizens to process; or else the basic information may not be available to individuals or private groups. Sometimes the scale of the possible bad outcomes may be overwhelming. Sometimes the appropriate insurance market cannot function or just does not exist. The result is that individuals and families can be the casualties of situations that once would have been handled by a more centralized and more bearable allocation of risks.

The current turmoil in credit markets and the recession that is sure to follow are likely to drive this trend further. Banks, insurance companies, and other financial institutions have seen too many risks go sour. They will be more determined than ever to push further risks onto those needy borrowers who are too weak and too ignorant to bargain hard. Families, small businesses, and other borrowers of last resort will be under great pressure.

Peter Gosselin’s excellent and thoughtful book, High Wire: The Precarious Financial Lives of American Families, is not the first to explore this territory. Two others that come to mind are Louis Uchitelle’s The Disposable American1 and Jacob Hacker’s The Great Risk Shift.2 Gosselin is like Uchitelle in combining social criticism with substantial stories of recognizable people who have been trapped by bad luck or bad judgment in this new you’re-on-your-own world; he differs in covering a much broader variety of risks and risk-bearers than Uchitelle’s focus on workers and job-related risks. Hacker’s book also ranges over many issues, but does not have Gosselin’s expert journalistic use of recognizable cases. (Professor Hacker is currently engaged in a Rockefeller Foundation–sponsored effort to construct a general “Index of Economic Security”—to show empirically how economic security varies over time and across social groups.)

Gosselin, who works in the Washington bureau of the Los Angeles Times, does a fine job of connecting the stories he tells to general ideas and to economy- wide statistical markers, some developed for his particular purpose. He has produced a readable and valuable book. In this connection it cheers me up to see how he has profited from a stay at the Urban Institute, a leading non- ideological research center in Washington. (I am on the board of the Urban Institute, but our paths never crossed there, though we are acquainted.)

2.

A grasp of the basic principles of insurance will provide indispensable background for understanding both the scope of Gosselin’s argument and also the possible remedies for the failure of social arrangements that he highlights. So I include a brief primer on that subject, using the relatively straightforward example of fire insurance.

Imagine a population of a million similar families, living in a million more or less similar houses. From long experience it is known that the chance that any given family will suffer a severe fire in any given year is about one in ten thousand. In other words, we can expect about a hundred fires per year. The same experience tells us that the average amount of damage per fire is $200,000. So the total damage per year is some $20 million. Serious house fires are rare, but when one occurs it is devastating to the unlucky family.

The existence of fire insurance makes an enormous difference. If each of the million families pays an insurance premium of $20 a year, all damages can be reimbursed. Major house fires would still not be welcome events; but they would not be financially catastrophic. The small probability of a large loss is eliminated, and replaced by a small but certain cost. Insurance companies would have to charge a bit more than $20 per house, to cover administrative costs and profit. Also companies would have to build up a reserve, to allow for the fact that annual losses would surely fluctuate around the average of $20 million, with an occasional bad year. On the other side of the ledger, investment of the reserves, presumably in reasonably safe and liquid securities, would offset at least some of the costs of the system.

Nevertheless, fire insurance has its problems, two in particular. Notice, first, that the existence of fire insurance does nothing to diminish the number of fires. Insurance is a way of pooling or sharing risks, not of eliminating them. In fact the opposite is true: the existence of fire insurance probably increases the number of fires. In the absence of insurance, one has to expect that home owners will be very careful about loose matches, old soldering irons, and other such dangers. The knowledge that they are fully covered may lead to some carelessness, and to more fires. This sort of effect is called “moral hazard.” (It is why subsidized flood insurance encourages people to live in flood plains.) Insurance companies have devices to discourage moral hazard. Deductibles and co-payments are two such devices: no fire is costless to the insuree. Required precautions are another device; every insured home is supposed to have an approved extinguisher and smoke alarms.

Advertisement

The second problem is different. All houses are not alike, after all. Some are more fire-prone than others. To take an extreme case, suppose that 90 percent of the million homes have, for various reasons, essentially no risk of fire. The hundred fires per year all come from the remaining 100,000, each with a probability of one in one thousand. They are responsible for the annual damage cost of $20 million. The 900,000 fire-free home owners very likely know this. They are in effect subsidizing the fire-prone houses, so they will choose not to buy insurance. Only the fire-prone homes will be in the market.

This is called “adverse selection.” To be viable, insurance companies will have to charge a premium of $200 per year, and even some of the fire-prone home owners may balk. You can easily imagine how the whole insurance market might unravel if there are houses of many degrees of fire-proneness: each time the rate rises, the least vulnerable, least fire-prone customers may drop out, leading to a still higher rate and still more dropouts. Insurance companies may respond by refusing coverage altogether to very fire-prone houses (or refusing health insurance to people who look as if they might actually become seriously—or expensively—sick). Modern information technology and data-mining techniques make it possible for insurance companies to pinpoint the known risks associated with individual applicants and quote “appropriate” rates.

Naturally, they do; but this only further undermines the insurance principle. Unless something drastic is done about it, adverse selection can lead to a situation in which precisely those who need insurance most cannot get it, or cannot afford it. Keep in mind that it is in the self-interest of the safe or healthy not to be in the same insurance pool, paying the same rate, as the fire- or sickness-prone, because they will be paying in more than the costs they incur, so that others can pay in less. In such cases, if adequate insurance is to be provided, there may have to be external regulation or direct public provision.

3.

Gosselin interprets his theme broadly, and his book covers a lot of ground. A sample of topics will convey the scope:

(1) A marked tendency for incomes to become more subject to large fluctuations, especially recently, so that both poor and moderately affluent people are increasingly exposed to the risk of a large—like 50 percent—drop in income from one year to the next.

(2) The growing unwillingness of employers to support defined-benefit pension plans that impose on them the obligation to pay benefits based on previous earnings to retired employees, and the replacement of such plans by defined-contribution plans, 401(k) and others. These leave the retirees facing the possibility that their own bad investment choices or just the accident of retirement during a down period in the securities markets will reduce eventual benefits below normal expectations. This risk is on top of the well-known fact that many employees, out of ignorance, inattention, or inertia, simply fail to accept clearly favorable options when offered, and for the same reasons, as well as bad luck, often invest predictably badly. It seems inevitable that the recent volatility in equity markets will induce even more employers to convert pension plans to forms that leave the risks of stock market and bond market fluctuations squarely on the employees.

(3) The erosion of employer-provided health insurance, and the occasional tendency of insurance companies to welsh on expected benefits, either by appealing to small print in the contract or simply by stonewalling.

(4) The failure of the federal government to produce an organized plan for the resettling of the victims of post-Katrina New Orleans, leaving many former inhabitants with the Hobson’s choice of either trying to rebuild in the absence of any assurance that enough of their neighbors will do the same, so as to render the old neighborhood livable, or else abandoning their property and moving elsewhere.

That is quite an assortment of contingencies, and there are others. What they have in common is that individuals have difficulty coping with situations that combine high uncertainty and large potential loss. Neither collective protection nor private insurance on affordable terms is available to them. This striking variety of circumstances adds interest and importance to High Wire, especially by showing, with some drama, that the shifting of risks from institutions to individuals occurs up and down the income scale, affecting the apparently solid middle class as well as the poor.

Advertisement

This expository advantage comes at some cost, however. Different circumstances implicate different aspects of the insurance principle. Gosselin’s agenda does not permit him to discuss them all in any depth, or to show how they are related through the general properties of insurance. I will try here to sketch a few of the complexities in the hope of helping readers to see that the issues emphasized by Gosselin’s account are really quite central to major matters of social policy.

4.

Start with the most general and most complex indicator of risk: the year-to-year volatility of personal incomes. Gosselin’s statistical analysis confirms what others have found. Although precise results may differ according to the source of the data, the time period, the definition of income, and the population studied, the general conclusion has to be that ordinary people are now more likely to experience large fluctuations in earnings than they were three or four decades ago. There is an element of paradox here: during the very same period—from the mid-1990s to the present—year-to-year fluctuations in national income have become noticeably milder, a fact that has come to be called the Great Moderation. So the aggregate economy has become more stable while individual fortunes have become less stable.

There is no arithmetic difficulty in this: your total calorie intake per day could become more uniform even while the daily contributions from meat, fish, fruits, and vegetables were coming to vary more erratically. That would only require determination about your consumption of calories. But it is natural to wonder why the economy has evolved in this particular way. There are many possible explanations, and many of them can be true. Rapid technological change may be eliminating long-tenure jobs and the continuity of income that they bring. The general shift in employment away from the production of material goods and toward the production of services tends to stabilize aggregate employment and income, because the demand for services is less vulnerable to the business cycle than the demand for goods; but job shifts and job destruction within the service sector may have become more frequent. More broadly, as an economy gets richer, and necessities form a smaller portion of expenditure, the whims of fad, fashion, and minor changes in tastes can lead to erratic fluctuations in the market value of particular skills and occupations, and thus to volatility of individual earnings. Whatever the underlying explanation, the fact remains.

Statistical volatility is an abstract fact. Gosselin humanizes it by choosing as his basic indicator the chance that a person or family will experience a year-to-year drop in income of more than 50 percent. Sure enough, this probability almost doubled between the decades of the 1970s and the 2000s, from one in twenty to about one in eleven. (The probability of a 50+ percent rise in income also increased from about one in nine to one in seven. Volatility works both ways, but it is the bad surprises that hurt.)

Then Gosselin does an interesting thing. What sorts of contingencies would lead to such a drastic and sudden reduction in a family’s income? The obvious suspects are major unemployment, illness, retirement or disability, divorce or separation, death of a spouse, even birth of a child leading to one parent’s withdrawal from a job. Adding all these together, Gosselin finds that their combined incidence was somewhat lower in the decade between 1994 and 2003 than it had been between 1974 and 1983. If one of them happens, however, the chance that it leads to a 50 percent drop in income was much higher in the later period than in the earlier one. So it is the financial risk that has jumped, not the generic hard luck. This sounds suspiciously like the tearing of a safety net. Welcome to the world of Individual Responsibility—the approach to economic security that has been advocated by government and the private sector in recent years.

There is a market-based way to deal with these bad episodes. Careful, foresighted individuals and families can save some or all of their favorable windfalls—those increases that are 50 percent, or greater or smaller ones—and use them, and borrow if necessary, to smooth over the bad patches. This hap-pens, to a statistically visible extent. Family spending on consumption is in fact less volatile than family income. So families do smooth the income peaks and valleys on their own. No doubt the sequence of saving and borrowing is at work, but borrowing is costly, and there may be other mechanisms operating, like contributions from extended family or charities. All but the most affluent families must pay a much higher interest rate when they borrow than the interest they earn when they save, so income smoothing is not as easy as it sounds, and is certainly expensive.

Now instead, imagine constructing a sort of income insurance policy. We do have unemployment insurance, but it typically replaces only half or less of wages and expires after twenty-six weeks. (Another thirteen weeks have been tacked on temporarily as a response to the current slowdown or recession.) At least in fantasy one can imagine a broader policy to insure incomes that collects regular income- related premiums from policyholders and promises in return to replace a substantial part of any shortfall from some defined average income that would have to be determined for each policyholder separately.

But it is hard to imagine a private insurance company offering such a policy on anything like workable terms. The standard difficulties besetting any insurance scheme would be much too acute. The moral hazard problem—the danger that individuals would use the insurance as a way to take frequent holidays from work—could perhaps be partially controlled. For example, limiting insurance benefits to the replacement of only a small fraction of the shortfall from “average” income is analogous to a large co-payment or deductible; but if the replacement fraction is very small, the risk reduction conferred by insurance is also very small. Alternatively it might be possible for the insurance company to require valid certification that the reported income shortfall is not voluntary; the analogy is then to an outside medical examination in disability insurance. Even so, moral hazard surely does not disappear.

The adverse selection problem for private income insurance seems an order of magnitude tougher. Most individuals know more about their own income prospects than any insurance company could ever find out. Inevitably the insurance rolls would be filled with potential losers and risk-takers. Those with conservative temperaments and relatively secure jobs and those who can pretty safely look forward to stable or rising income with increasing experience and seniority would be sensibly inclined to avoid the stiff insurance premium and protect themselves against stepping on broken glass and other bad luck by saving up for the rare and unpredictable rainy day. It is hard to see how a universal private market for income insurance could survive.

But—and this is where the argument has really been leading—why does it have to be private? Gosselin is aware, though many have forgotten, that the idea of “social insurance” would once have seemed far more natural than it does today. Think again about the contrast between Roosevelt’s Social Security and the Bush-Cheney “Ownership Society.” It is not just a matter of this or that piece of legislation. The thought underlying social insurance is that life is a gamble, especially economic life. There will be winners and serious losers. The losers are singled out by bad luck, or occasional bad judgment, or even the wrong personal idiosyncrasy at the wrong time. In any case, we are in a sense all better off if we share the risk of losing and convert the small risk of damaging loss into a small, universal, and certain cost. This may have been a more natural frame of mind in the Great Depression of the 1930s than during the Great Moderation, when income growth was strong and inflation was relatively stable.

The irony is that the very fact of the Great Moderation makes social insurance more easily practical. When the national income is stable and secure, the allocation of a small fraction of it to the stabilization or near stabilization of individual incomes is at worst a minor burden and a widely shared burden. The otherwise difficult problem of adverse selection is essentially nullified because the insurance pool is not self-selected, but is by definition the whole society; the social insurance premium takes the form of a tax. (It is probably a good idea for benefits under an income insurance scheme to be part of taxable income: the more “normal” the better.)

Moral hazard, however, is always with us. It is plausible that a state-run universal social insurance system would be better able than a private company to detect and prevent exploitation of the system by malingerers. Maybe success would depend on the creation of a norm of good citizenship; something like that underlies the establishment of social insurance in the first place. It seems to work in the Nordic countries—though not without strain—where the tradition of social insurance is strongest. The US has a long way to go. Gosselin cleverly cites the Mayflower Compact and its proposal to create such laws and regulations “as shall be thought most meet and convenient for the general good of the Colony, unto which we promise all due submission and obedience.” That is indeed a long way from where we are now. Gosselin mentions that forty-one of fifty men on board signed.

5.

The other important institution that has been engaged in shifting risk to individuals is the business firm as employer, especially the large firm. The main risks to think about are those connected with nonwage benefits like pensions and health care. (It is also important that the average length of job tenure has been decreasing, but that has many causes and is best dealt with as part of the general issue of income volatility.) Health care is a specialized subject unto itself, and I will not dwell on it. But there are some general principles underlying this whole change in the landscape that are implicit in Gosselin’s excellent account, but need spelling out, so that we can understand what is possible.

The first thing to understand is that changes in pension or other benefit arrangements are not simply transfers between employer and worker. Pretty clearly it is the total cost of an hour of labor that matters to an employer, however it is divided between cash wages and benefits. The preferences of workers are not so transparent; but nonwage benefits are obviously very important, and it is a reasonable first approximation that workers, like their employers, value a dollar of wages about equally with a dollar of benefits. But then it is the total cost of an hour of labor that the fundamental forces of the labor market—whatever they are—must be determining. The allocation between benefits and cash wages will depend on other factors, like tax laws, the duration of contracts, transaction costs, and the like.

The point to remember is that one cannot really talk about benefits as if they were independent of wages. Anything that happens to one of them will affect the other. By the way, between December 1998 and December 2007, according to the Department of Labor’s Employment Cost Index, wage and salary costs per hour in US private industry increased by 32 percent and hourly benefit costs, including health benefits, by 50 percent (both uncorrected for inflation). That tells us something about levels of spending, but does not speak to the question of risk-bearing. One suspects that most businesses, as they shift from defined-benefit to defined-contribution pension plans such as the 401(k), have also taken the opportunity to reduce their pension costs, and thus their total labor costs, overall. It would be interesting to have comprehensive data on that point, but I do not know of any.

The usual story is that US businesses have had to put heavier pressure on labor costs as they faced intensified competition from imports generally and especially those from emerging economies with low wages and negligible benefits. It is also thought that technological changes have had much the same effect: decreased demand and therefore downward pressure on the wages and benefits of even moderately skilled labor. There is certainly some truth in that kind of account.

The question, for Gosselin and his readers, is whether that is the whole story, or whether there is another factor: a sea change in public and private beliefs about the norms of the labor market, the responsibilities of business firms, nonprofit organizations, and governments toward the lot of their employees, clients, and citizens. When Ronald Reagan fired the air traffic controllers in 1981, was he just tending to the efficiency of the air transport system, or was he also sending a message to the private economy that the implicit rules of the game had changed and that unions could expect no protection, much less sympathy? If the latter, it is a message that could also extend to the behavior of insurance companies toward their policyholders, and still elsewhere. Gosselin believes that the message was intended and understood. If the government thinks that individuals have no claim on society, but should stand or fall by their own incapacities and mistakes, then business firms are surely not responsible for picking up the pieces.

6.

Gosselin’s last case study—the aftermath of Katrina in New Orleans—is quite different from the others, but it has something in common with them that is worth attention. He does not focus on the Lower Ninth Ward; it is not news that poor black families do not attract the attention or the assistance of our leaders. Instead he follows the difficulties faced by a couple of reasonably well-off, rising, property-owning families as they return to their devastated houses and deserted neighborhoods, and try to decide what to do next.

When they think of rebuilding, they are handicapped by penny-pinching authorities and incompetence. Clean-up lags, services are not restored. Maybe worst of all, the Army Corps of Engineers cannot or will not certify that the levees are sufficiently restored to protect against the hundred-year flood; as a result, flood insurance is unavailable, and lenders are unwilling to commit funds. That is poignant but not unexpected. What connects all this to the rest of the book is that the potential returnees are faced with a problem of collective action. They could perhaps pull it off if they knew that their neighbors were committed to the same effort, if there were good reason to expect that a livable neighborhood would be recreated.

But that seems to be beyond reach. The neighbors are scattered and uninformed. Many of them may be going through the same difficult decision process and coming up against the same stumbling blocks. There is no central agency or community organization offering guidance, and no centralized source of funds to permit and reward cooperation. The logical place to look was the federal government, but the administration seemed to lack the will or the imagination or, more likely, both. Gosselin makes a striking contrast with a nearby community in which a long-standing Greek Orthodox religious group was able to provide the needed organizational focus and access to resources.

The analogy to social insurance is apparent. This is another case in which individual action tends to unravel because the solution to the problem has an all-or-nothing character—what economists call increasing returns to scale—and because each individual’s action affects other individuals’ decisions directly, and not through prices—what economists call externalities. Individuals are asked to take a chance that is just too risky for each of them alone. Coordination at the center is required. A free-market economist would see this. A free-market ideologue would not.

7.

The standard argument for leaving all the responsibility and decisions to the individual in the free market is that, in appropriate circumstances, that is the route, and maybe the only practical route, to economic “efficiency.” Any interference is a “distortion,” and the consequence of such distortion is that the economy produces less than it could. (A more up-to-date version is that messing with the atomistic market tends to cripple “innovation,” but we actually know little about how that works, in either direction.)

One standard counterargument is that the circumstances are not always appropriate. The classic example is that private economic activity, for instance, the burning of coal or oil in furnaces or cars, may damage everyone’s environment by emitting carbon dioxide and changing the climate. In those cases, and there are many, market prices give the wrong signals; regulation or taxation or subsidization is justified precisely to restore efficiency. The New Orleans story is another illustration of this point: perceptive government intervention could have done much to assure the rebuilding of the city.

But efficiency is not the issue here, at least not the main issue. The transfer of risk from social and private institutions to individuals transfers a burden, mainly from the strong to the weak. That is primarily an issue of equity. It will surely become more urgent in current circumstances, perhaps urgent enough to be seen as a central political issue. Suppose that the best way to relieve that burden is by sharing the risk through universal social insurance. The premium then has to be a tax, a tax on work or enterprise, or some productive activity, and such a tax is a distortion, a source of inefficiency, a true cost to society. What then? I know what Gosselin would say: a society that won’t pay a small cost to preserve equitable and fair treatment of, among others, the sick, the old, the unemployed, and the victims of natural disaster is not much of a society. Is that a minority view?

— October 23, 2008

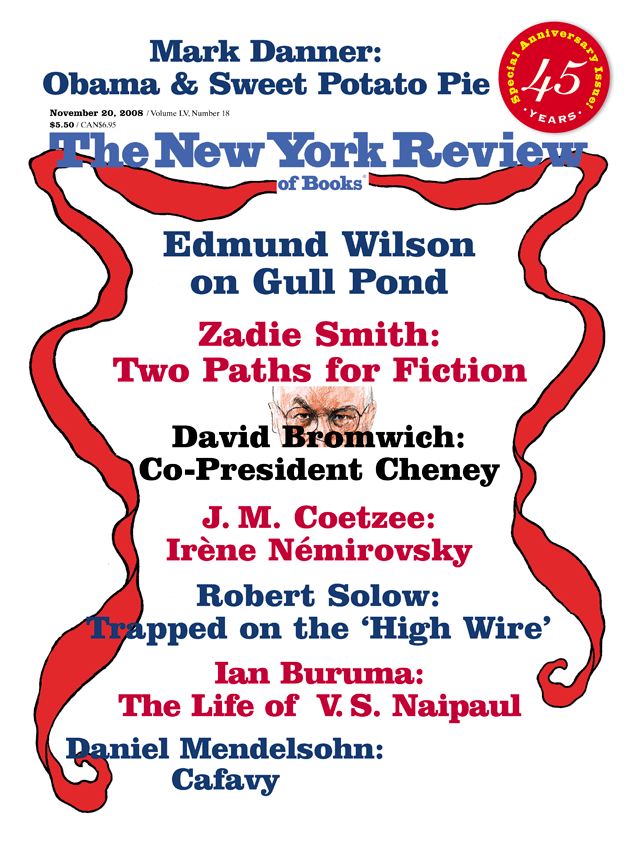

This Issue

November 20, 2008

The Co-President at Work

At Gull Pond

Two Paths for the Novel

-

1

Knopf, 2006; reviewed in these pages by James Lardner, June 14, 2007. ↩

-

2

Oxford University Press, 2006; reviewed in these pages by Jeff Madrick, March 20, 2008. ↩