On May 4, the Obama administration announced a plan to crack down on offshore tax havens, which it said are costing the United States tens of billions of dollars each year. The President’s proposals were primarily aimed at finding ways to increase revenue from wealthy companies and investors who use loopholes in the law and offshore subsidiaries to reduce their US taxes. But the administration is largely missing a far more devastating problem related to offshore finance: money gained from criminal and other illicit sources. With the use of tax havens and other elements of an increasingly complex “shadow” financial network, vast sums of illegal money are being shifted throughout the global economy virtually undetected.

Illicit money is usually generated by one of three kinds of activities: bribery and theft; organized crime; and corporate dealings such as tax evasion and false commercial transactions. Be- cause they are largely invisible, flows of illicit money across borders are difficult to measure. The World Bank estimates that they range from $1 trillion to $1.6 trillion annually, of which about half—$500 billion to $800 billion—comes out of developing countries ranging from Equatorial Guinea to Kazakhstan to Peru.

Friedrich Schneider, an Austrian economist, suggests that money laundering on behalf of organized crime and other illegal sources in just twenty OECD countries amounts to some $600 billion per year. Global Financial Integrity, an organization in Washington, D.C., finds that illegal flows of money from developing countries to banks in Western countries may reach more than $1 trillion annually. While there are different ways to quantify the problem and obtaining reliable data is difficult, these estimates are within a surprisingly narrow range.1 Taken together, they suggest that trillions of dollars of illicit money are flowing through international financial markets. Where is this money coming from?

Drug trafficking, racketeering, and terrorist financing are among the leading causes of money laundering, while in recent years the financial corruption of rogue political figures such as General Sani Abacha of Nigeria, Vladimiro Montesinos, the former intelligence chief of Peru, Pavlo Lazarenko, the former prime minister of Ukraine, and others has received much attention in the press. In fact, however, organized crime accounts for only about a third of illicit money flows, while money stolen by corrupt government officials amounts to just 3 percent. The most common way illicit money is moved across borders—accounting for some 60 to 65 percent of all illicit flows—is through international trade.

According to the World Trade Organization, the total annual global trade in goods and services before the current economic crisis was approaching $40 trillion2; but as much as $2 trillion of the total may be illicit money that has been illegally moved out of a country, or has been used to provide illegal kickbacks to corrupt executives or officials.

Russia has experienced what is probably the greatest theft of resources ever to occur in a short period of time, some $200 billion to $500 billion since the early 1990s. Almost all of this was accomplished by the deceptive underpricing of exports of oil, gas, diamonds, gold, tin, zinc, nickel, timber, and other resources. Oil was ostensibly sold abroad for as little as $10 a metric ton, with the balance of the real value paid into European and American bank accounts of Russian oligarchs. China has experienced a similar drain of financial assets, again accomplished through underpricing exports of, at first, consumer goods and now a widening range of technology products.

Of any major country Nigeria has probably had the highest percentage of its gross domestic product stolen—largely by corrupt officials—and deposited externally. Since the 1960s, up to $400 billion has been lost because of corruption, with $100 billion shifted out of the country. Of the population of about 150 million, some 100 million live on $1 to $2 a day. Unrest in the poverty-ridden Niger Delta is so severe that oil production has dropped from a peak of 2.6 million barrels a day in 2006 to 1.7 million today.

Venezuela’s state-owned oil company, Petróleos de Venezuela S.A., has abused transfer pricing to shift enormous wealth abroad. Crude oil is underpriced and sold to Petróleos’s twenty-three foreign refineries in the United States, Europe, and the Caribbean, which then sell gasoline and other products at normal prices; the profits are thereby largely kept outside the country, for the use of corrupt officials. Hugo Chávez recently appointed his sixth managing director as he attempts to wrest control of the company, which is the state’s principal provider of revenue, while at the same time running a government as corrupt as its predecessors.

In these and other cases, a common strategy for hiding and moving large sums of money is falsified pricing in international trade. Prices are falsified in one of two ways. In the first, the invoice from the exporter is sent to an office in a tax haven where it is rewritten with an altered price. Then the new invoice is forwarded on to the importer. Alternatively, a false price may appear on the invoice sent directly by the exporter to the importer after they have agreed, usually verbally, to deposit a portion of the payment in a foreign account. Unlike invoices that are rewritten, this second form of mispricing is invisible in recorded international trade statistics but can be detected by comparing major and consistent deviations in pricing from normal world market prices. For example, research by Simon Pak and John Zdanowicz has shown systematic underpricing on invoices for US exports, including car seats exported to Belgium that were invoiced for $1.66 each; ATM machines exported to El Salvador for $35.95 each; and forklift trucks exported to Jamaica for $384.14 each. By this strategy, the US exporter drastically reduces its US tax burden, while presumably receiving much larger sums from the buyer that may then be hidden in offshore banks.

Advertisement

Within multinational corporations, the practice of mispricing can also be used as a tax-avoidance strategy. Take the following simplified example: a company in country A makes photocopy machines that have a production cost of $1,000. The company establishes a dummy corporation in a tax haven that buys the copiers at cost for $1,000 apiece. Since the company has not made any profit on the sale, no taxes are owed. The dummy corporation in the tax haven then sells the copiers to another subsidiary in country C, at a price of $2,000 each. Now the company in country A is making a profit of $1,000 on each machine sold, but since the sales are through the offshore dummy corporation, the company pays only those marginal taxes that are charged in the tax haven. The subsidiary in country C may in turn sell the copiers on the open market for $1,500 each, allowing it to claim, for tax purposes, a $500 loss on the $2,000 purchase price. But since the company in country A owns all of the parties involved in the transaction, it is actually making a $500 profit on each sale.

The Global System of Illicit Finance

Falsified pricing and other money-laundering techniques have been facilitated by the rapid growth of tax havens and secrecy jurisdictions ranging from Monaco to the Cayman Islands. By welcoming disguised corporations, anonymous trust accounts, fake foundations, and other entities for hiding money, these offshore financial centers create the space in which many billions of dollars in unseen and unrecorded proceeds can be shifted across borders.

Minor parts of this system were in existence earlier, but the 1960s marked the takeoff point for two reasons. First, from the late 1950s through the end of the 1960s, forty-eight countries gained independence from colonial powers. Many leaders in these new countries, sometimes influenced by domestic instability and cold war politics, wanted to take money abroad; bankers in Western countries responded by devising creative strategies such as the use of secret accounts and false invoices for moving large sums across borders. Leaders including Mobutu Sese Seko in the Congo, Ferdinand Marcos in the Philippines, Suharto in Indonesia, and others made use of dozens of overseas banks competing for their millions of dollars of ill-gotten gains.

Second, during the 1960s a number of large corporations became multinational, establishing hundreds of locations across the globe, sometimes even moving corporate headquarters offshore. “Tax planning”—devising creative ways to reduce or avoid corporate taxes—became a normal practice.

Thus, decolonization and the growing international reach of corporations propelled the development of a whole system of offshore finance that was designed to avoid taxes and regulation. In the process, the system also obscures the origin and destination of the increasingly large sums of money passing through it.

Of course, some financial activities in tax havens are perfectly legal, and many individuals and corporations may use them simply to move funds offshore to reduce their tax exposure in their country of residence. But by enacting privacy laws and allowing corporations and individuals to be represented by trustees, many such havens permit companies and foundations established in their jurisdictions to mask the true identity of their owners. This enables all types of depositors to circumvent standard accounting and reporting requirements on transactions and profits simply by routing them through a tax haven. In recent years, the Swiss bank UBS created offshore accounts for thousands of US clients, violating US law in the process. The bank is paying a $780 million fine on the resulting criminal charge and is being forced to provide the names of 4,450 of its US clients in settlement of a civil action by the US.

Through the combination of low or no taxes, little or no financial reporting requirements, lax regulation, and well-defended secrecy, tax havens have grown to the point where they control an estimated $6 trillion in assets. Many now cater to particular market niches. The Isle of Jersey serves companies such as Bank of America and Morgan Stanley that are active in the London market, just as Panama, which is used by AIG and American Express, among other companies, serves the US market, and Vanuatu the Australian market. Mauritius is a channel for investments into India. Cyprus is a preferred center for Russian money laundering, and the British Virgin Islands have become especially favored by Chinese businesses shifting illicit capital in and out of their home country.

Advertisement

Providing the highest level of secrecy are Liechtenstein, Singapore, Dubai, and the Turks and Caicos Islands. Bermuda and Guernsey use favorable tax laws to draw in billions of dollars in reinsurance funds from firms such as Scottish Re. The Cayman Islands, which hold nearly $2 trillion in foreign-owned cash and other liquid assets, are home to more than ten thousand “collective investment schemes” such as hedge funds.3 Banks in Switzerland, London, and New York, among them Credit Suisse, Barclays, and Citigroup, serve very rich clients by directing transactions through more than twenty Caribbean tax havens.4

Economic Development

Through the 1990s and into the current decade, overseas development assistance to poor countries has totaled about $50 billion to $80 billion a year from all sources. But compare this amount to the World Bank’s estimate of $500 billion to $800 billion of capital that is being sent illegally out of these same countries: for every $1 handed out across the top of the table, the West has been receiving back up to $10 under the table. This outflow of illicit money is the most damaging economic condition in the developing world. It drains hard currency reserves, increases inflation, reduces tax collection, widens income gaps, forestalls investment, stifles competition, and undercuts free trade. Until development experts account for total capital going into and coming out of recipient countries, aid will continue to be offset by a much larger counterforce of fleeing capital.

In recent years some human rights groups have begun to address flight capital and other forms of financial corruption as a human rights issue, among them Global Witness, Human Rights Watch, Christian Aid, Action Aid–UK, and the Open Society Institute. The environmental group Greenpeace’s recent report “Conning the Congo” is an example, criticizing a Swiss-based logging group for “using an elaborate profit-laundering system designed to move income out of Africa and into offshore bank accounts.”5

The international system of illicit finance has another serious consequence—its contribution to the shift of taxes away from large businesses, which can evade them, and onto everyday workers. This assures rising incomes for the wealthy and visibly stagnating incomes for the middle class, contributing to the dramatic increase in income disparity in rich and poor nations alike. Political analysts have largely ignored how a capitalist system increasingly operating outside the rule of law affects the ability to spread the rule of law. How can the US and other countries claim to extend democracy while they allow an international financial system to flourish that worsens the condition of poor people?

Consequences for Security

The growth of illicit finance comes at a heavy price not only to taxpayers in advanced nations and poor people in developing nations, but also to global security. For almost every kind of criminal organization, a major concern is transferring illegitimate gains into the legitimate financial system. Beginning in the late 1960s and 1970s, the Medellín and Cali cartels and other drug traffickers started making use of tax havens and countries that allowed them secrecy to launder their proceeds. In 1989 the G-7 authorized the establishment of a Financial Action Task Force in Paris to address this problem. Now, twenty years later, how effective has it been against the flagrant target, the drug trade? In fact, the supply of illegal drugs has not been curtailed and prices are largely stable, except in Europe where soaring demand has elevated traffickers’ receipts. Meanwhile, over the past two decades, other kinds of racketeers—ranging from arms dealers to human traffickers—have begun using the same offshore financial mechanisms to launder tens of billions of dollars.

Many militant groups and terrorist organizations now use the same system of offshore finance. During the decade before the September 11 attacks an estimated $30 million to $50 million a year was passed to al-Qaeda through fake foundations, disguised corporations, and bankers based in tax havens. Supporters of Hezbollah have engaged in cigarette smuggling in the United States and diamond smuggling in West Africa. Hamas is believed to be active in crime and money laundering in the triborder region of Latin America where Brazil, Argentina, and Paraguay meet. In Iran, the Islamic Revolutionary Guard Corps is allegedly involved in smuggling oil, arms, electronics, and consumer goods, possibly amounting to $12 billion a year.6

The Saddam Hussein regime was especially adept at large-scale money laundering. During the decade after the Persian Gulf War, Saddam amassed some $10 billion via the Oil-for-Food program, smuggling, and kickbacks on trade transactions, which helped to purchase radar systems, combat helicopters, tanks, and other armaments. The Iraqi regime’s lavish military spending helped persuade the United States, Britain, and others to believe that it had the capacity to acquire weapons of mass destruction. If it were not for Saddam’s manipulation of illicit finance, Western forces might not be in Iraq today.

What Is to Be Done?

International efforts to address illicit financial flows are plainly inadequate. In many Western countries, tax laws have many loopholes and legislation against money laundering is poorly enforced. For example, the United States bars the incoming proceeds of drug trafficking as well as terrorist financing, bank fraud, and theft by foreign government officials; but it does not bar proceeds generated abroad from such activities as handling stolen property, counterfeiting, contraband, slave trading, human smuggling, trafficking in women, environmental crimes, and foreign tax evasion.

In April, the Manhattan district attorney’s office filed charges against a Chinese defense company for using shell companies to channel the proceeds of armament deals with the Iranian military through New York banks, including Bank of America, JP Morgan Chase, and American Express Bank. Both the parent Chinese company and its Iranian client had been barred from doing business in the United States, but the source and destination of the illicit money was unknown to the banks in question. Indeed, US Treasury Department officials estimate that 99.9 percent of the money that US law prohibits from entering the country is accepted for deposit the first time it is presented to a US bank.

Can anything be done? The goal should be to curtail this activity, not to try to stop it, which would be impossible. Widespread support for a few select and straightforward steps would do much to contain illicit financial networks.

The European Union Savings Tax Directive is one example of such a step. Put into effect in 2005, it requires tax information to be automatically shared among twenty-four European countries, with Austria, Belgium, and Luxembourg planning to join over the next two years. Ten overseas territories associated with the UK and the Netherlands are also participating. Currently, the agreement requires disclosure to EU governments of payments to nonresident EU citizens of interest earned on deposits, corporate and government bonds, negotiable debt securities, and investment funds.

European leaders are now discussing extending this oversight to corporations, shell companies, trusts, and foundations, as well as requiring companies to report dividends, realized capital gains, income from pensions and insurance, and interest on other types of bonds. Annual reporting of such earnings will go a long way toward curtailing tax evasion by citizens and corporations in EU member states. Such automatic sharing of financial information should become a global standard.

The European Economic and Monetary Affairs Committee of the EU Parliament has also approved a proposal to require country-by-country reporting of profits by corporations within the EU. Corporations currently compile these figures for internal purposes but do not report such information to state regulators. Country-by-country accounting to such regulators for revenues, costs, and profits would therefore not be a burden to corporations but would be hugely beneficial to tax authorities and go far toward reducing the usefulness of tax havens.

Financial institutions should be required to know the beneficial owners of every entity with which they do business, going beyond nominees and trustees to the names of individuals or publicly quoted parent companies. The USA Patriot Act, signed into law shortly after the September 11 attacks, took such a step regarding foreign shell banks operating behind cloaks of secrecy. It prohibited any US financial institution from receiving money from a foreign shell bank and any foreign financial institution from transferring money to the US received from a foreign shell bank, and even banned wire transfers of such funds that momentarily passed through New York City correspondent banking accounts. In other words, with a stroke of the legislative pen, the threat posed by foreign shell banks was largely removed from the shadow financial system—which will now try to circumvent the new law.

Senator Charles Grassley of Iowa has also proposed a bill that would eliminate the loopholes in US anti-money-laundering laws by specifying simply that it is a felony offense to knowingly handle the proceeds of a crime, including tax evasion, whether committed in the United States or abroad. Senator Carl Levin of Michigan and other lawmakers have proposed a tax haven abuse act aimed at substantially curtailing tax evasion by US citizens and corporations. Key provisions of Senator Levin’s bill are now being incorporated into a similar bill drafted by Senator Max Baucus, chairman of the Senate Finance Committee. At first somewhat behind Europe, momentum is now building in the United States to deal with these issues.

A simple step available to developing countries to curtail abusive transfer pricing, and recently recommended to Congo by the Washington-based organization Global Financial Integrity, is to require two signatures on commercial invoices. On the standardized invoice form, importers and exporters would each have to confirm that prices reflect world market norms, constitute no violations of anti-money-laundering laws anywhere, and contain no element of mispricing for the purpose of manipulating customs duties, VAT taxes, or income taxes in the exporting or importing countries or jurisdictions through which the transaction passes. If multinational corporations asked employees to sign patently false statements giving such assurances, they could potentially be held criminally liable under the laws of exporting or importing countries.

Countries with adequate banking sectors but severe transfer pricing problems, such as Russia, can require imports and exports above a certain value to be covered by confirmed, irrevocable letters of credit containing a provision that 100 percent of export proceeds must be remitted by the importer’s bank to the exporter’s bank. Such letters of credit can likewise require that banks verify prices on invoices, as is now required in the United States under standards set by the Federal Financial Institutions Examination Council.

The World Bank should declare the entire question of world financial movements to be a problem demanding immediate analysis and action. Cutting the flow of illicit flight capital out of poor countries by even 25 percent, a modest goal, would leave more money in poor countries than the total of overseas development assistance provided by rich-country donors. Far greater than a 25 percent reduction in such outflows is readily achievable, if the political will is there.

Recent scandals are widening the perception that illegal, hidden dealings are incurring huge costs to the global economy. Enron, WorldCom, and Parmalat; Liechtenstein and UBS involvement in tax evasion; Elf Aquitaine and alleged BAE Systems corruption; the financial forces behind today’s severe banking crisis—these and many more cases confirm the destructive role played by a global financial system that permits trillions of dollars to evade accountability.

Yet the first two meetings of the G-20 left every element of the shadow financial system in place, albeit with promises that some regulatory improvements would be applied to tax havens, banks, and financial instruments. A containment strategy is emerging, but it is far from being adequately applied. The culture of financial opacity and corruption, if continued, will increase the misery of the poor and undermine the stability of nations throughout the world.

—November 5, 2009

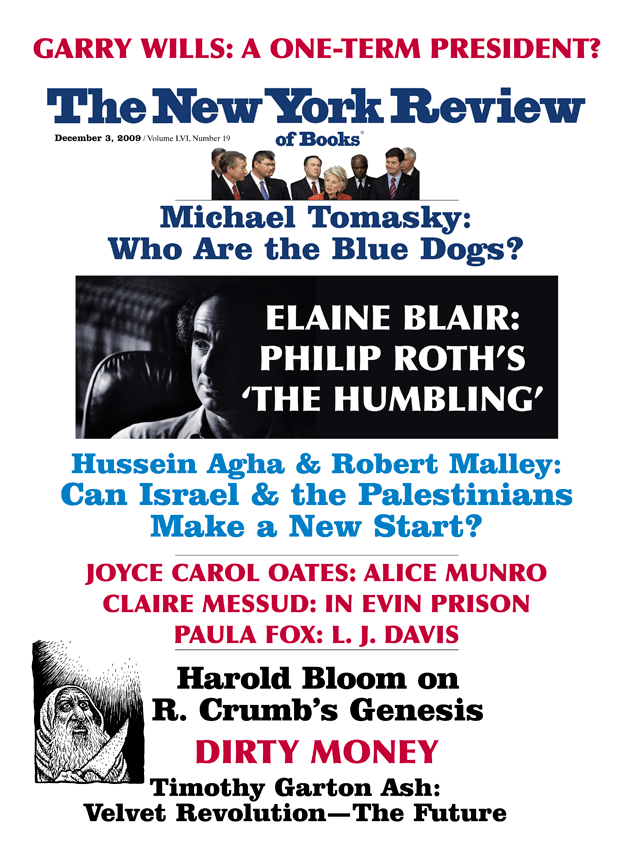

This Issue

December 3, 2009

-

1

See “Stolen Asset Recovery (StAR) Initiative: Challenges, Opportunities, and Action Plan (World Bank, 2007); Friedrich Schneider, “Money Laundering and Financial Means of Organized Crime: Some Preliminary Empirical Findings,” Johannes Kepler University of Linz working paper (July 2008), p. 24; and Dev Kar and Devon Cartwright-Smith, “Illicit Financial Flows from Developing Countries: 2002–2006” (Global Financial Integrity, 2009), pp. 21–22. ↩

-

2

World Trade Organization data puts global exports and imports of goods and services at $33.8 trillion in 2007 and $39.1 trillion in 2008. ↩

-

3

Cayman Islands Monetary Authority, “Regulatory Framework: Statistics” (June 2008), available at www.cimoney.com.ky/section/regulatoryframework/sub/default.aspx?section=PD&id=666. ↩

-

4

Richard Murphy, “Tax Havens: Creating Turmoil” (Tax Justice Network UK, 2008), p. 24. ↩

-

5

“Conning the Congo” (Greenpeace International, July 2008), p. 2. ↩

-

6

Ali Alfoneh, “How Intertwined Are the Revolutionary Guards in Iran’s Economy?,” Middle Eastern Outlook , No. 3 (October 2007). ↩