Practically everyone now agrees that the steep recession of the last two years was caused, at least in part, by lack of government oversight of the financial industry. The half-dozen or so federal agencies that are responsible for regulating the financial community ignored the dangerously risky activities of bankers and traders; so did the Federal Reserve and the US Treasury.

It is true that these agencies faced a tangle of complexities. The institutions deeply involved in the recent crisis include traditional commercial banks that take savers’ deposits as well as investment banks, mortgage brokers, credit-rating agencies, hedge funds, money market mutual funds, insurance companies, and government-sponsored enterprises such as the Federal National Mortgage Association (Fannie Mae).

Among them, these entities control many trillions of dollars, a large portion of which is in the form of derivatives contracts, investment vehicles that enable banks and other investors to buy and sell securities with little capital and also manage risk. (As just one example, if I believe the price of gold will go up, I do not have to buy the bars of gold: for much less money, I can buy a contract—a derivative—that is accepted by a “counterparty,” who will pay me if the gold price rises within a certain period of time, but will keep my payment for the contract if the price falls.) These derivatives, however, are traded over the counter and out of sight of regulators. In recent years special kinds of derivatives, known as credit default swaps, were sold in enormous volume as insurance against risky, mortgage-backed investments but with no government regulations to help insure that counterparties would meet their obligations to pay. Moreover, the interests of all these institutions are well represented in Washington by influential lobbyists. According to the Center for Responsive Economics, the finance, insurance, and real estate industry spent $223 million on lobbying in the first half of 2009, second only to the health care industry.1

President Obama promised soon after taking office to reregulate the financial markets in a comprehensive regulatory bill. The administration released its proposals on June 14 in “Financial Regulatory Reform: A New Foundation,” a lengthy white paper—not extensively covered by the press—that was overseen by Treasury Secretary Timothy Geithner and Lawrence Summers, the director of the National Economic Council, who served as Treasury secretary during the Clinton administration.2 Rarely has an administration had a better opportunity to explore deeply how modern financial markets work and have evolved, and how readily they can be abused.

On balance, the white paper, though it contains several worthy ideas, was disappointing. Offering little more than a wide-ranging summary of existing regulatory proposals, it did not attempt to analyze why the crisis occurred or was so intense; nor did it identify in any detail the rules or regulations that were lacking that might have prevented the crisis. The President, in a mid-September speech on Wall Street, exhorted the financial community to support reform, but essentially reiterated last June’s proposals.

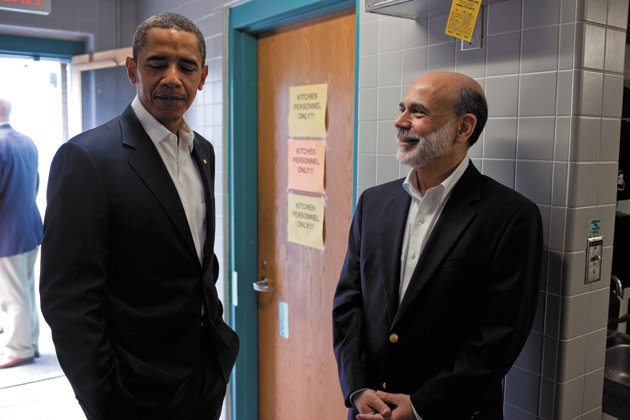

The white paper’s relative lack of new analysis raises questions about what critical lessons the Obama team learned from its closed-door meetings with bankers, brokers, economists, former regulators, a handful of consumer advocates, and the current overseers of regulatory agencies over the preceding months. When Geithner appeared at congressional hearings in July and early August to defend the plan for the first time, he met with open criticism from several of the key regulators themselves, who also testified. They included the chairs of the Federal Reserve, the Federal Deposit Insurance Corporation, and the Securities and Exchange Commission, all of whom had substantive quarrels with the plan.

This opposition may have been inevitable, since the administration wanted to streamline regulatory powers, and possibly eliminate some regulatory agencies altogether. The most refreshing of the administration’s proposals is its call for a new financial consumer protection agency to maintain standards for mortgages, credit cards, and basic investment products. But this idea was publicly criticized by Ben Bernanke, the Federal Reserve chairman, who argued that most of these matters were already under the jurisdiction of the Fed.

For her part, Sheila Bair, the chairwoman of the Federal Deposit Insurance Corporation, who like Bernanke was a Bush appointee, was critical of the white paper’s proposal to place the Fed in charge of minimizing what is known as “systemic risk.” Such risk can occur when a financial institution is so large or interconnected—the insurance giant AIG and the banking conglomerate Citigroup are obvious examples—that its failure can jeopardize the entire financial system. Bair had long differed with Bernanke over the Fed’s financial bailout policies, and warned that the administration’s solution would confer too much power on the Fed. She prefers the creation of a new independent council to monitor systemic risk in which all the major regulators participate.

Advertisement

In July, a group headed by former SEC chairmen Arthur Levitt and William Donaldson also concluded that an independent council, not the Federal Reserve, should have the authority to manage systemic risk. This group was concerned in part by the Fed’s poor performance, before the credit crisis erupted, in regulating the commercial banks and mortgage-writing institutions already under its supervision. The Fed neither demanded that more capital be set aside against risky investments nor raised standards for writing mortgages.

By early October, Bernanke, who was recently appointed to a second term by Obama pending Senate confirmation, seemed more open to the idea of a council of regulators. “We have never supported, and the administration has never supported, a situation in which the Fed would be some kind of untrammeled super-regulator,” he told the House Financial Services Committee.

While this debate has unfolded among the regulators, Democratic members of Congress have also criticized the Obama plan, among them Barney Frank, who chairs the House Financial Services Committee, and Christopher Dodd, who is head of the Senate Banking Committee, and is now proposing to merge four banking regulators, including the Fed, into one super-regulator. Both Frank and Dodd are planning to produce their own regulatory bills, but at this point, it seems unlikely that a comprehensive bill can be passed this year or early next, and the chances of setting up the new consumer protection agency seem smaller. Not only banks but such powerful corporations as American Express have been lobbying hard against it. The Obama administration and Frank are already watering down the proposed duties of the agency.

Responding to the widespread criticism, Lawrence Summers also indicated in mid-September that the administration may be open to modifying some of its proposals, for example by establishing a monitor of systemic risk that includes other regulators as well as the Fed. What is clear, however, is that the Obama administration has lost leadership of the issue of reforming Wall Street.

In fact, much of Wall Street has already returned to the aggressive practices that were widespread before the crisis, including high levels of compensation and the creation and trading of risky derivative contracts. And profits of financial firms, such as Goldman Sachs and JPMorgan Chase, often based on the same sorts of trading as in the past, are for the moment rebounding.

Perhaps the major deficiency of the Obama administration’s plan for financial reform is that it presents no persuasive hypothesis why the credit system collapsed in the fall of 2008. Instead, the Treasury white paper provides a sweeping list of contributing problems—all of them well known—and gives none of them priority over others. They include granting subprime mortgages to people with inadequate incomes; the historically rapid run-up in housing prices over the preceding five years; excessive risk-taking and levels of debt among financial firms, especially investment banks such as Bear Stearns and Lehman Brothers; overreliance on private credit-rating agencies (whose fees are paid by the companies they rate); the widely criticized salaries and bonuses that rewarded risk-taking without commensurate penalties for failure; and the unregulated trading in derivatives, mentioned above, which also encouraged risky investing. Just listing such problems evades what is needed: an inquiry into the principal causes of a system-wide collapse.

In many cases there were relevant regulations that might have been used and were disregarded. The Federal Reserve, for example, had the authority to investigate the risks posed by different kinds of mortgages. One of its governors, Edward M. Gramlich, publicly urged such an inquiry in the early 2000s. But Alan Greenspan, then chairman, rejected his advice.3 Commercial banks also had off-balance-sheet subsidiaries, known as structured investment vehicles, that enabled them to invest aggressively with low levels of capital. The Fed could have investigated or more closely restricted these entities, but did not.

The Securities and Exchange Commission had the power to restrict the amounts of debt taken on by investment banks; yet in 2004 it specifically allowed major investment banks to increase their leverage. By the time of the crisis, they were borrowing thirty times or more than their reserve capital. Nor did the SEC examine and question the quality of the investments the securities firms were making with all the money they borrowed, which it had the authority to do.

There were ample opportunities to tighten regulations as well. The former chairwoman of the Commodity Futures Trading Commission, Brooksley Born, for example, had requested powers to regulate derivatives in the late 1990s, but was denied them by the Clinton administration’s economic team, which included Robert Rubin, then Treasury secretary, and Lawrence Summers, then his deputy. Summers in particular was a powerful advocate of deregulation or light supervision in the late 1990s. They argued that these derivatives generally reduced risk in markets and that regulations would impede investors’ ability to create such instruments, a classic free-market defense.

Advertisement

Every financial crisis seems to have been driven in part by a different false assumption about the behavior of financial markets. The myth this time was that mortgages and securities based on them were backed by real estate, and therefore unusually solid. What was ignored, or systematically understated by complex computerized programs that used historical trends to predict the future, was that the prices paid for the housing eventually far exceeded any reasonable value and the indebtedness of the homeowners could not be sustained.

Banks and mortgage brokers that issued mortgages to home buyers were able to sell them immediately to investment banks and thus were less concerned about the creditworthiness of the borrowers than they traditionally had been. They profited from the mortgages regardless of whether they later went into default. This was possible because the investment banks then packaged these mortgages into complex securities with differing interest rates to make them highly attractive investments to a variety of pension funds, mutual funds, international investors, and even subsidiaries of their own banks. Money market funds, which promised almost riskless investments and catered especially to small investors, lent money to these investment banks and others at low rates, locking themselves into loans that were riskier than they realized. Low interest rates promulgated by the Federal Reserve in the early 2000s to stave off a recession also encouraged more lending.

The first major investment firm to reach the brink of bankruptcy was Bear Stearns in March 2008. The Bush administration, led by Treasury Secretary Hank Paulson, formerly chief executive of Goldman Sachs, feared that the fall of Bear Stearns could destabilize the entire system. If Bear Stearns failed to pay back its substantial debt, other investment banks that did business with it might also be in danger. In conjunction with the Fed, the Paulson Treasury guaranteed $30 billion worth of Bear Stearns assets so that JPMorgan Chase, a relatively sound commercial bank, would buy the firm. JPMorgan Chase paid merely $2 a share for a company whose stock had been trading at $170 a share eighteen months earlier.

By September 2008, however, Paulson and Bernanke—together with Geithner, who as president of the New York Federal Reserve Bank was then a key regulator of the financial markets—were prepared to end government interventions. Following the collapse of Bear Stearns, they had arranged several other bailouts, including for Fannie Mae (and its close cousin Freddie Mac, the Federal Home Loan Mortgage Corporation), and they concluded that by then, private investors had shielded themselves from the worst possibilities. The general public was also getting impatient with the bailouts of very rich bankers, as were some economists and lawmakers, who preferred to see these institutions, and their shareholders, pay for their excesses. Thus, in mid-September, when it emerged that Lehman Brothers, a considerably larger investment house than Bear Stearns, was similarly unable to pay its debts, Paulson, Bernanke, and Geithner faced a dilemma.

Saving Lehman was technically more difficult than saving Bear Stearns, but as the veteran Wall Street Journal reporter David Wessel points out in his valuable book In Fed We Trust, a way to provide government support could have been found. After making futile efforts to find a private buyer, Paulson and Bernanke decided to let Lehman go bankrupt. As Wessel puts it, “Finance houses all over the world had lent Lehman money and couldn’t get it back, or even get clarity if they would ever get repaid.”

The stock market collapsed the next day and the credit markets froze. Mortgage-backed assets had often been used as collateral for loans, and as they fell in value, lenders demanded more assets as collateral, leading to still more selling and a further fall in prices. Then money market funds stopped lending to the investment banks. The result was a modern bank run.

By this point the government had little choice but to intervene. With Merrill Lynch, another of the five big investment houses, also teetering on the brink of insolvency, Paulson, Bernanke, and Geithner immediately found a buyer, Bank of America, to rescue it. They poured $85 billion into the insurance giant AIG, which owed enormous sums to Wall Street because it guaranteed a large volume of credit default swaps sold as insurance to investors and traders.

By authorizing the Federal Reserve to regulate systemic risk, the Treasury white paper aims to prevent the largest firms from ending up in the kind of crisis that engulfed Lehman and AIG last year. It would do this by designating any financial firm—whether it is a traditional deposit-taking bank, an investment bank, an insurance company, or another kind of financial institution—as a “Tier 1” financial holding company (FHC) if it is deemed so large or interconnected that its failure could bring the credit system down. The white paper did not, however, establish the specific criteria on which this decision would be made.

The Fed would then subject these larger firms to more supervision and, more important, to higher capital requirements against loans and investments they make. To aid in the process, the white paper also calls for the creation of an advisory board, the Financial Services Oversight Council, chaired by the Treasury secretary and including other regulators, to gather information and advise the Federal Reserve on the condition of the largest firms. The premise of the proposal is that calamities like the collapse of Bear Stearns and Lehman will not happen in the future because the Fed would have prevented them from taking on dangerous levels of risk or leverage. Nor would banks like Bank of America, the savior of Merrill, or Citigroup, both of them also eventually bailed out, have been allowed to grow so large and be so recklessly managed. In a similar vein, the G-20 agreed in September to place more limits on the leverage of international banks.

But it will take unusual foresight on the part of regulators and often boldness in the face of powerful financial opposition to create effective control of systemic risk. As William Cohan shows in House of Cards: A Tale of Hubris and Wretched Excess on Wall Street, the possibility of Bear Stearns’s failure had become evident to many on Wall Street in early 2007, but Bernanke was slow to react to danger not only at Bear Stearns but at other major finance companies as well, including Lehman. In his hastily written but detailed book, Cohan, a former investment banker, recounts the collapse of Bear Stearns, which, as he shows, had for years been an aggressive investor and underwriter of mortgage-backed securities, borrowing more heavily than almost any other leading investment bank to do so. It also ran two risky hedge funds, which invested in mortgage-backed securities. By March 2007, the managers of those funds were exchanging e-mails about the possibility of a “complete meltdown.”

Similar problems were developing at Citigroup, the largest bank holding company, which, because of its status as a commercial bank, was directly under the Fed’s supervision. There were also reports in the spring of 2007 that Lehman was by then in similar difficulties. In A Colossal Failure of Common Sense, former Lehman banker Lawrence G. McDonald writes that executives within Lehman had been warning its management, particularly the strangely aloof CEO Richard Fuld, of the serious risks. But the prevailing wisdom within the Federal Reserve was that investment firms could now bear more risk because low inflation for a decade had led to more stable markets.

In fact, until late 2007, Bernanke was a leading advocate of the view that the economy had reached a new era of stability, a hypothesis he and others called “the great moderation.” Almost all that mattered was to keep inflation low. This is not adequately discussed by Wessel. Bernanke made a widely read speech endorsing “the great moderation” in 2004. He reiterated this view in a 2006 speech, even as housing speculation and financial leverage were building to historical heights. Only in August of 2007 did Bernanke grasp the urgency of the situation as asset values for mortgage-backed and other securities began to fall broadly, affecting all kinds of financial institutions. And it took a further five months, Wessel contends, for him to take appropriately strong action. When he did, however, Bernanke acted forthrightly and aggressively.

Bair, Levitt, and Donaldson believe they can avoid such myopia by establishing a regulator of systemic risk that is independent of the Fed or any other agency. The Frank and Dodd bills will likely make similar proposals. But they may not make a difference. It is hard to imagine, for example, that when Alan Greenspan was at the height of his reputation, any other regulator could have overridden his influence and demanded higher capital requirements for banks than Greenspan deemed warranted. Had the Obama white paper put forward a clear, detailed plan for assessing the riskiness of firms, some of these issues could have been aired and perhaps even resolved. Would Bear Stearns or Lehman Brothers have qualified as institutions that are large enough to affect the entire financial system and would they therefore have been compelled to hold more capital against investments? The white paper does not say. It has left this question, as it does many other details, to future working groups.

The Obama white paper seems more pragmatic when it is grounded more directly in historical experience. It proposes higher capital requirements, not only for the so-called Tier One financial firms deemed too big to fail but for all financial firms—including both commercial and investment banks—that now create credit. Such an extension of federal oversight is an example of regulation that was badly needed, yet until now never seriously considered. Commercial banks have been driven to a subsidiary role in making loans in the new financial age. As investment banks, pension funds, hedge funds, and other investors around the world bought securitized debt, they became major lenders—a shadow banking system. But these institutions were not directly regulated by the Federal Reserve, and are only loosely regulated by the SEC. Raising capital requirements for such firms would go a long way toward reducing risks. Such rules-based regulations are preferable to reliance on the purely ad hoc judgment of a systemic risk regulator, though again the white paper leaves unresolved the all-important details of who is to be covered and how such capital requirements are to be implemented.

A number of stronger possible prohibitions favored by some economists are not discussed in the white paper. For example, the risk of a systemwide crisis could be limited by distinguishing low-risk banks that take savings deposits and make basic loans from other institutions that engage in riskier activity, like underwriting stock issues and investing in mortgage-backed securities. The original Glass-Steagall legislation of 1933 strictly forbade banks that accept deposits from undertaking investment banking and brokerage activities, a provision that was completely reversed under the Clinton administration. Some experienced observers, such as Paul Volcker, believe in reforming the industry by reinstating a Glass-Steagall-like division.4 News reports claim that the Fed is now considering ways to limit bank borrowing against certain assets, a step in this direction.

The administration’s cautious approach may simply reflect the moderate views of Obama and his economic advisers toward government intervention and a desire to promote innovation and efficiency. These are reasonable if often exaggerated concerns, but the white paper does not pursue them convincingly. Merely mentioning them, as it does, will not reassure those who believe the administration is influenced too much by the financial institutions themselves with which some of its key advisers have close ties. The white paper addresses securitization, for example, by requiring those bankers and mortgage brokers who write mortgages to keep 5 percent of the equity rather than sell them entirely to securitizers, insuring that they take some risk but allowing the markets to work as before. Few believe, however, that a 5 percent stake will make the mortgage companies substantially more vigilant.

On the other hand, the administration has taken a somewhat harder-edged stand on Wall Street compensation, naming a pay czar—Kenneth Feinberg—to oversee bonuses and other payouts for financial executives. According to The Wall Street Journal, Feinberg may demand that bonuses be paid in stock that cannot be cashed in immediately. Yet the white paper itself proposes only a general restraint on compensation, which it says should be aligned with the long-term welfare of shareholders. The House, however, has already passed a bill giving regulators stronger authority to control compensation.

Another critical controversy is over how to regulate derivatives and in particular credit default swaps. The Treasury white paper proposes that these derivatives should be traded through a clearinghouse or exchange, where the trading and prices are transparent. This is a constructive suggestion. But in later discussion, Geithner said he would exempt some customized kinds of derivatives from such oversight, apparently fearful of too much government intervention in this market. Barney Frank has supported a bill to disallow trading in some of these derivatives, though it remains unclear which restrictions will survive in the final legislation. An alternative possibility is to impose a tax on all such trades to discourage them. This is akin to a general proposal made long ago by James Tobin, the late Nobel Prize–winning economist, and recently supported by some officials in Europe.

One matter that is largely omitted in the white paper is the degree to which financial speculation has driven up the prices of key commodities, such as oil. The price of crude oil exceeded $145 a barrel in the summer of 2008 and then plunged rapidly to roughly $35 a barrel by the end of the year. When a major cost to the world’s manufacturers, airlines, freight companies, and everyday automobile drivers fluctuates so widely, it creates dangerous uncertainty for the economy. The Commodity Futures Trading Commission, now under Gary Gensler, an Obama appointee and former Goldman Sachs banker, says that it is sufficiently concerned about the part speculation has had in setting these prices that it will consider proposing rules to limit it.

The white paper also proposes giving federal authorities more direct legal tools to rescue or force the sale of firms like Lehman in financial trouble, and contains a modest proposal to regulate insurance companies more closely. The private credit-rating agencies, which issued irresponsibily high ratings for many mortgage-backed securities, would be required to be more open about how they arrive at their decisions, but they would still be allowed to take fees from the issuers whose securities they are rating. Again, relatively few critics believe that this is an adequate reform. A stronger proposal, for example, made by Columbia law professor John Coffee, would make the credit ratings agencies legally liable for “reckless” behavior.

Hedge funds also get off lightly. Each fund would, according to the white paper, have to register with the SEC and disclose enough information about its finances to determine whether the fund poses a systemic risk, but apparently no more. One constructive proposal of the white paper is to make all stockbrokers legally liable for irresponsibly making recommendations to clients. The more open-ended potential for liability, many legal experts agree, is a better preventive strategy than defining explicit guidelines for legal behavior, which can often be circumvented. Under the current system, only registered investment managers are potentially liable, but stockbrokers often make similar investment decisions for clients.

By the time Franklin Delano Roo-sevelt entered the Oval Office in 1933, the Great Depression was nearly four years old, the unemployment rate had reached 25 percent, and countless citizens were losing not only their jobs but their savings in thousands of failed banks. Amid public clamor, the Senate appointed Ferdinand Pecora, a spirited public prosecutor, to head a Senate investigation into the speculative excesses that helped cause the Depression. He aggressively questioned Wall Street’s elite and brought to public light the self-dealing, conflicts of interest, tax avoidance, and stunning levels of personal compensation of the time. Without such revelations, a variety of new securities laws, including the Glass-Steagall Act and the legislation that created the Securities and Exchange Commission, may not have passed.

Obama’s recession is twenty-one months old, long by any standard other than the Great Depression, and the public is neither as informed about Wall Street behavior nor as angry. At this point, it seems that several regulators, including Gensler, Bair, and Mary Schapiro, Obama’s appointee to head the SEC, are likely to take the lead from the Obama administration in bringing about meaningful reform. Schapiro is undertaking a range of serious investigations into hedge funds, derivatives trading, and other areas. The SEC is of course ashamed that under a different chairman it did not discover the multibillion-dollar fraud of Bernard Madoff, despite prescient warnings from one of its own investigators.

Congress has established a bipartisan committee to question the financial community publicly about the causes of the credit collapse, though it will need a determined investigator to clarify the issues. This investigation itself may be the best opportunity for fresh proposals, although nothing like the Pecora Commission is now in sight.

At the least, the American public is entitled to a clear account of the financial events of the last two years and of who, if anyone, is seriously to blame. The Obama administration has largely worked on these issues behind closed doors. If its white paper is not followed by a genuine open discussion, it is unlikely that the public will understand what happened to our banks, investments, and the economy. And without such clarification, there will not be sufficient political support for a comprehensive and coordinated reregulation of finance.

— October 8, 2009

This Issue

November 5, 2009

-

1

See www.opensecrets.org/lobby/top.php?showYear=2009&indexType=c. ↩

-

2

Timothy Geithner and Lawrence Summers, “A New Financial Foundation,” The Washington Post, June 15, 2009. ↩

-

3

Edmund L. Andrews, “Fed Shrugged as Subprime Crisis Spread,” The New York Times, December 18, 2007. ↩

-

4

Matthew Benjamin and Christine Harper, “Volcker Urges Dividing Investment, Commercial Banks,” Bloomberg.com, March 6, 2009. ↩