One inescapable principle highlighted by the current financial crisis in the United States is that a democracy gets the regulation it chooses. If voters elect public officials who do not believe in regulation, and if those officials appoint people of like mind to lead the key agencies that make up the nation’s regulatory apparatus, then there will not be effective regulation no matter what the prevailing statutes say.

A further lesson of the crisis, which makes this basic principle of democratic governance crucially important, is that self-regulation by private firms—what many of the opponents of government regulation from Alan Greenspan on down were counting on to take its place—is insufficient to meet the challenges presented by today’s complex financial markets. Two hundred years ago, when the English economist Henry Thornton was setting forth the fundamental principles of central banking, all London banks other than the Bank of England had to be partnerships in which each partner was legally responsible for the bank’s obligations; no other “joint stock banks” were permitted. (Further, the maximum number of partners was six.1)

Today’s financial firms are limited- liability corporations owned by what are often widely dispersed stockholders. And these firms, whose chief economic function is to provide capital to households and nonfinancial businesses, are themselves highly dependent on competitive securities markets to raise their own capital. When the crisis hit, the typical leverage of a large US commercial bank (the ratio of its debts and other liabilities to its stockholders’ equity) was twelve or fifteen to one. At the large investment banks, leverage was more like twenty-five or thirty to one.

The combination of limited liability, widely dispersed stock ownership, and high leverage turns out to be fundamentally subversive of market self- regulation. With limited liability, even if stockholders manage the firm directly—even if the firm has only one owner who manages it himself—the incentive to take excessive risk is already present. The bigger the bet, the more stockholders stand to gain if the coin comes up heads. If the bet goes wrong, once the stockholders’ equity is gone, bigger losses accrue only to whoever holds the firm’s debts or other liabilities (or to the taxpayer, if the government comes to the rescue).

Widely dispersed stock ownership, which is also typical of most large US corporations today, compounds the problem. The traditional notion of corporate governance exercised by a board of directors, acting in the interests of the stockholders, has long been a fiction for many firms. But many fictions are useful ones. No one should be surprised that the primary concern for most corporate executives is how well they do—their job security, their pay, their perks, their prestige—not how well the stockholders do. If, however, what benefits the managers and what benefits the stockholders are sufficiently similar, the difference doesn’t matter much.

The current crisis has helped demonstrate the extent to which this particular fiction has ceased to be useful. With an ever greater fraction of many corporations’ stock held by owners who are either small in scale or passive in their approach, shareowners have become in management’s eyes merely another source of funding: like the firm’s bondholders, but perhaps more of a nuisance. Most managements are open about saying that any shareowner who doesn’t like what the company is doing should shut up and sell the shares to someone else.

Limited liability and dispersed ownership therefore create two distinct and reinforcing layers of the problem that Louis Brandeis (taking a phrase from Adam Smith), nearly a century ago, famously labeled “other people’s money.” Today, with leverage so high, our financial institutions have been using a lot of other people’s money. Even without counting the possibility of taxpayer rescues, most of what is at risk belongs neither to the stockholders nor to the executives.

The key question, then, is why the depositors, bondholders, and other creditors who are bearing so much of these firms’ risk are willing to go ahead and lend them the money. For most small-scale depositors, at least in the United States in modern times, the answer is simple. With the FDIC insuring accounts up to $100,000 apiece ($250,000 since October 2008), why should a depositor exercise much vigilance over a bank’s soundness? The only remaining plausible private-sector constraint on the eagerness of bank managements to take risks, therefore, is the large-scale depositor or creditor or bondholder. Indeed, it’s to this group that Greenspan and others who thought market self-regulation would do the job were looking. As he put it as recently as May 2005:

Advertisement

In essence, prudential regulation is supplied by the market through counterparty evaluation and monitoring rather than by authorities…. Private regulation generally has proved far better at constraining excessive risk-taking than has government regulation.

But it isn’t hard to come up with reasons why market self-regulation by creditors might not be effective either. Many of those creditors buying the banks’ bonds and other liabilities are themselves limited-liability corporations subject to all of the same tensions between what’s good for their management and what’s good for their stockholders (or, if they’re insurance companies, their policyholders). They too—even if they are pension plans run by state and local governments—are operating with “other people’s money.” And they too might be relying on a government bailout in case of trouble.

As if all this weren’t enough, two more specific developments of recent years have rendered the US financial system even more vulnerable. First, the distinction between banking and trading in securities mostly disappeared. This was not simply a consequence of the formal repeal in 1999 of what remained of the Depression-era Glass-Steagall separation of the two functions, a separation that had largely eroded long before. Most of the large commercial banks, facing the need to raise their own capital in competitive securities markets, relied increasingly on profits from trading activities and related fees, in effect turning themselves into hedge funds; that is, they increasingly engaged in betting on market movements and in distributing securities, rather than traditional lending and deposit-taking. (Otherwise, they would have had little reason to retain shares of the mortgage-backed securities for which they earned fees from packaging and selling.)

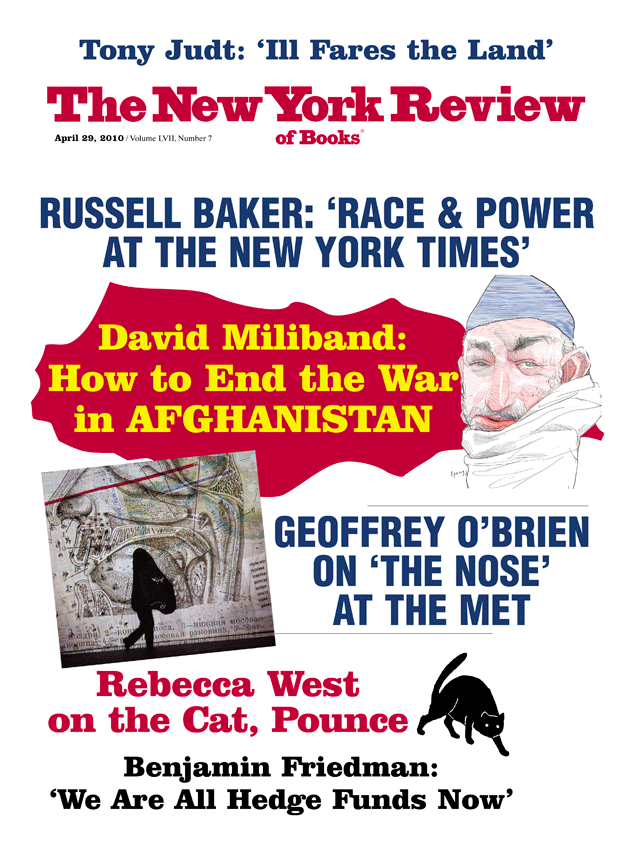

The philosophy seems to be that one cannot operate a bank without having a hedge fund attached. The phenomenon was not limited to banks and insurance companies. Some years ago my employer, Harvard University, decided to become a university with a hedge fund attached. Or maybe the idea was to be a hedge fund with a university attached. Either way, the project came to a bad end. To paraphrase Nixon on the Keynesians, we’re all hedge funds now.

Second, the market for financial derivatives outgrew its original function of enabling financial institutions and other investors to hedge risks that they already bore. Instead, derivatives increasingly provided vehicles for banks, insurance companies, and other financial institutions to take on new, unrelated risks. Here the aim was either to earn trading profits by speculating on changes in the market price of those risks or simply to generate yet another form of fee income. As a result, many of the risks to which financial institutions became exposed bore little or no connection to their basic economic function of providing capital to either individuals or businesses. The risks they bore were increasingly unrelated to their role in financing economic activity, but were merely bets on one side or the other of a zero-sum game. Further, the derivatives market was operating outside the scope of regulation even as a formal matter—i.e., not only were regulations not enforced, but they didn’t even exist for some of these products.

With so many reasons for the likely failure of market self-regulation readily apparent, including failure of Greenspan’s hypothetical regulation by creditors, the gnawing question is why the US did nothing about it. If it’s true that our democracy got the regulation it chose, why in the world did we make that unfortunate choice?

Two recent books, while offering almost identical narratives of this sad history, suggest sharply different answers. To John Cassidy, a fine journalist with a long-standing interest in economic and financial matters, the explanation is intellectual: the increasingly dogmatic and unquestioning belief, on a priori grounds, in the efficiency—indeed, the rightness—of free markets and the outcomes they produce. In How Markets Fail, Cassidy therefore echoes the view of economists George Akerlof and Robert Shiller, in their recent book Animal Spirits, which argued that economists systematically failed to take account of “irrational” influences that affect economic behavior.2

Far more than Akerlof and Shiller, however, Cassidy is interested in the people behind what he calls “the triumph of utopian economics,” and how their ideas came to be so dominant. As he rightly points out, “the notion of financial markets as rational and self-correcting mechanisms is an invention of the last forty years.” Such advocates of market efficiency as the Austrian economist Friedrich von Hayek, the University of Chicago’s Milton Friedman, and contemporary economists like Eugene Fama and Robert Lucas (both also at Chicago) all receive careful attention. So do the political figures who championed their ideas, most prominently Ronald Reagan and Margaret Thatcher. Alan Greenspan, with his bizarre devotion to the Russian-born ideologue Ayn Rand, stands out as the chief villain in Cassidy’s telling, guilty of not just flawed ideas and sinister influence but “much prevarication” as well.

Advertisement

Cassidy contrasts the “utopian economics” that each of these people helped to propagate with “reality-based economics,” which suffers not only from the inevitable intellectual messiness that comes with attempts to analyze the world as it is, but also from failing to line up with the interests of the economy’s self-aggrandizing elites. The centerpiece of Cassidy’s analysis of the difference between these two economic worldviews is the prevalence and potentially damaging consequences of what he calls “rational irrationality”—a situation in which each influential actor does only what makes perfect sense from an individual perspective, but the combined effect of everyone’s acting in this way leads to outcomes that make sense for no one.

In effect, Cassidy is pointing to problems of collective action. Individuals, acting purely on their own, can’t arrive at outcomes that they would all prefer if they had ways of sharing information, making joint decisions, and coordinating their actions. The problem is a classic staple of economic analysis, and there are numerous familiar examples, many from settings far afield from the financial world that is Cassidy’s focus. Mindful of the harm done by what comes out of an automobile’s exhaust pipe, most medium- and high-income countries do not leave it to each car owner whether to install a catalytic converter in the exhaust system. Nor do most cities allow individual families to dump their garbage wherever they find it most convenient to do so.

As these examples suggest (and so does the very name), the solution to most collective action problems is some kind of public intervention. Indeed, that’s what most theories of government, from Hobbes to Adam Smith, are all about. The issue that Cassidy drives home is the need—contrary to the Reagan-Thatcher-Green- span ideology—for government intervention in modern financial markets. Again and again, he shows that either individual firms or their executives were doing what it made sense for them to do, given the situation in which they found themselves. What was wrong was the market setting in which they were operating. Because no individual executive or firm can change the market environment, it’s up to public policy to do the job.

In contrast to the Ayn Rand/Alan Greenspan opposition to intervention in the market as a matter of high principle, Cassidy usefully presents the question of intervention as an empirical matter. Yes, one can imagine a world in which “the problem of distorted incentives” doesn’t often arise, or isn’t especially costly when it does. Cassidy’s point is that we don’t live in such a world. In ours, “market failure isn’t an intellectual curiosity. In many areas of the economy, such as health care, high technology, and finance, it is endemic” (emphasis added). In the particular boom-and-crash cycle we’ve just experienced, “the subprime boom represented a failure of capitalism in the presence of bounded cognition, uncertainty, hidden information, trend-following, and plentiful credit…. All of these things are endemic to the modern economy.” As Cassidy makes clear, these problems are especially acute in financial markets: “In this sort of environment, otherwise known as reality, it is hardly surprising that rational irrationality is often a problem.”

Cassidy clearly knows a great deal of economics, and he tells his story extremely well. Indeed, if there’s a problem in his telling, it’s that he’s perhaps more sophisticated about it than many readers who could well benefit from absorbing his argument may be able to handle. Many of his chapters—on the development of general equilibrium theory (how everything in the economy systematically depends on everything else), for example, or marginalism (why prices are determined by what we’re prepared to pay for the very last item of something we buy, rather than what the whole amount is worth to us)—would make useful supplementary reading in an undergraduate economics course. Readers who are not economists and who aren’t motivated by the incentives of a classroom setting may have to make considerable effort to understand him.

The order in which Cassidy relates this history also creates limitations. He first takes the reader through the development of “utopian economics.” Then he does the same for “reality-based economics”—even though he makes clear that these two intellectual strands overlapped through much of the last hundred years. This sequential organization deprives the history of part of its richness. For example, Cassidy’s excellent though brief discussion of Eugene Fama’s efficient-market theory of asset pricing—Fama argues that prices set in speculative markets embody all available relevant information, and in the way best able to anticipate relevant future outcomes—comes before his equally excellent discussion of John Maynard Keynes’s famous depiction of the stock market as a casino. But Keynes wrote seventy-five years ago and died in 1946; Fama first published his ideas in the 1960s, and he remains active today. Fama knows very well what Keynes said, and sees his own work in part as providing rebuttals to Keynes. Thoughtful readers would like to learn what they are and evaluate them.

But Cassidy leaves no doubt about whom he regards as primarily responsible for what happened to the US financial markets and the US economy. His list of charges against Alan Greenspan is long and serious. As the makings of the crisis fell into place, one by one, “neither Greenspan nor anybody else in authority expressed any concerns. The Fed chairman must have been aware of what was happening.” “In the US economics establishment, nobody listened, least of all Greenspan.” “The Fed chairman had fallen victim to disaster myopia and the illusion of stability.” Greenspan “helped make it easier for financiers to take on extra leverage and risk while pursing a monetary policy that often seemed designed to protect them from their mistakes.” “When historians come to write about the ‘Greenspan bubbles’ [the stock market bubble of 1996–1999 and the real estate bubble of 2004–2006], they will do so with good cause.” More than any other person, “the former Fed chairman was responsible for letting the hogs run wild.”

And why did Greenspan act so perversely? In Cassidy’s eyes, the answer is again intellectual: “There can be no argument that, in this instance, the application of misguided ideas was largely responsible for setting the US economy on its disastrous trajectory.” Greenspan “adamantly refused to take seriously the concept of market failure.” “In the modern economy with a large financial sector, the combination of cheap money and lax oversight, if maintained for years on end, is sure to lead to trouble. But this was something that Greenspan, trapped in the world of utopian economics, never accepted.”

John Lanchester, a British writer better known for his fiction and criticism, relates almost the identical history, and with most of the same factual explanations. (Despite his greater focus on the UK, he too portrays Alan Greenspan as the villain-in-chief.) But he offers a different underlying analysis, more deeply rooted in the political evolution of our contemporary Western society. Cassidy’s book pinpoints the triumph of dogmatic free-market economics—“utopian economics” as he calls it—during the last forty years, but leaves open why this all-important intellectual consensus (to be sure, with plenty of dissenters) happened when it did. Lanchester believes that the “essential precursor” to what happened was the collapse of international communism, including in particular the demise of the Soviet Union:

The way in which the financial sector was allowed to run out of control…took place not in a vacuum but in a climate. That climate was one of unchallenged victory for the capitalist system, a clear ideological hegemony of a type which had never existed before.

Lanchester argues that the West’s decisive victory over communism finally removed the political restraints that had, for nearly a century, held capitalism in check. The ugly side of unbridled capitalism now no longer needed to be hidden. Widening inequality and the increasingly visible excesses of the fortunate few were no longer a problem:

The good guys won, the beauty contest came to an end, and the decades of Western progress in relation to equality and individual rights came to an end…. The Wall came down, and, to various extents, the governments of the West began to abandon the social justice aspect of the general postwar project.

Whether these sweeping claims can withstand careful scrutiny is open to question. In the United States income inequality began to widen either in the late 1960s or in the mid-1970s, depending on the measure one chooses, in either case long before the demise of Soviet Communism. But Lanchester’s notion that events as well as ideas come about not just against the background of their time but in large part because of it—that there are historical reasons why things happen when they do—is inherently appealing. And whatever the merits of Lanchester’s broader claims about social trends and political freedoms (which he makes no real effort to support in detail), his comments on the intellectual triumph of what Cassidy calls “utopian economics” and on the increasing dominance of Wall Street’s interests over Main Street’s ring true. “Under those circumstances,” Lanchester writes, “it could have been predicted that the financial sector, which presides over the operation of capitalism, was in a position to begin rewarding itself with a disproportionate piece of the economic pie.” The political influence that financial firms and individuals accrued, and then wielded in their own interest, made those rewards possible.

Lanchester’s perspective as an outsider to the world of economics and finance leads him to other intriguing connections as well. He relates the powerful social drive toward home ownership—lending on residential mortgages was central to how the crisis began, in both the US and the UK—to the historical sense of dislocation and loss of personal freedom that came with industrialization. He sees in the application of mathematical tools to the design and trading of financial instruments a parallel to earlier transitions in, for example, poetry (beginning with The Waste Land) and music (beginning with The Rite of Spring):

Finance, like other forms of human behavior, underwent a change in the twentieth century, a shift equivalent to the emergence of modernism in the arts—a break with common sense, a turn toward self-referentiality and abstraction.

His discussion of fundamental differences between finance and indus- try recalls the tradition of nineteenth- century European romantic anticapitalism (or, to an American, late- nineteenth-century populism).

Lanchester’s book is also noteworthy for a splendid choice of language and metaphor not usually found in writing on economics and finance: “The banks treated financial irresponsibility as a valuable commodity, almost as a natural resource, to be lovingly groomed and cultivated.” “Assume that capital is like a virus and its motivation is to replicate; it wants to grow.” Ayn Rand’s philosophy of objectivism “seems a sophomoric belief system, whose main truth lies in its unexpressed but profound longing for the world to be a much simpler place than it is.” The credit market is a “dance between lenders and borrowers—a cross between a dance and a fight, like capoeira [the Brazilian martial art] perhaps.” An entire chapter discusses the “funny smells”—relating mostly to things that were too good to be true—by which “financial crashes, implosions, and scandals are always accompanied.” All economic writing should be so evocative.

Readers of Cassidy’s and Lanchester’s books will learn much of the same history, with many of the same personalities and events. But the two give starkly different ideas of what to expect now that the worst of the crisis has apparently passed, markets have stabilized, and most Western economies have haltingly begun to expand once again, notwithstanding continuing high unemployment in the US and debt troubles in Europe. In Cassidy’s telling, the root problem was intellectual: adherence to false ideas about how the economy and the financial system work. But now, “the efficient market hypothesis has finally been discredited,” and “the unfettered free market has disgraced itself in full public view.” The demolition of these dogmas should, to follow the argument to its logical conclusion, bring a turn toward enhanced regulation and other policies more consistent with “reality-based economics.”

And to be sure, there is no lack of useful proposals to that end. In the United States, the Obama administration has submitted legislation to enable the government to take over failing bank holding companies, insurance companies, or independent securities broker-dealers, in the same way that it can now take over a bank. There are numerous proposals to make capital requirements more effective, not only by increasing minimum capital ratios at banks and other key financial institutions but also by tightening the accounting standards that specify what they must hold capital against. (What brought down Citibank was having to take back more than $100 billion in assets for which the bank had assumed responsibility but which it kept off its balance sheet—and therefore against which it held no capital at all.) There are proposals to bring financial derivatives under federal regulation and either to move the trading of credit default swaps (the form of derivative instrument that caused the government to put $180 billion of taxpayer money into insurer AIG) onto an exchange or at least to have them settled through a central clearinghouse—in either case enabling the relevant authorities to maintain some working knowledge of where the potentially dangerous exposures are.

Several proposals, moreover, call for reassigning responsibilities among the principal US regulatory bodies—the Federal Reserve System, the Treasury Department’s Office of the Controller of the Currency, the Securities and Exchange Commission, and others too—in order to achieve better coordination and risk-sharing and also, importantly, to be sure that someone is paying attention to the “systemic” risk of what the largest institutions are doing. All of these ideas, in one form or another, merit support.

Most recently, Paul Volcker, Greenspan’s predecessor as Federal Reserve chairman, has called for a renewed separation between trading functions—in which risk-taking is the central motivation (presumably in exchange for an anticipated profit), rather than an incidental consequence of providing some banking service like lending or underwriting—and ordinary banking, insurance, and other financial service businesses. Known as the “Volcker Rule,” this idea too is a good one. There is little evidence that there is added value from combining, on the one hand, this kind of stand-alone risk-taking and, on the other, functions such as deposit-taking, lending, underwriting, or insurance.3

It is always possible that with the spread of electronic technology, profit margins in deposit-taking and lending, for example, have been so shrunken by competition that the traditional banking business is no longer viable without a subsidy, and that profits from an affiliated trading operation (or what amounts to one) are the most obvious way of providing that subsidy. Such a model is clearly not sustainable, however. (Why would successful traders want to divert their profits to subsidizing a traditional banking business—or anything else for that matter?) Further, as the crisis has shown, it is not clear that taking on risky positions to increase potential returns is reliably profitable. And when losses from risk-bearing accrue to banks in particular, the outcome imposes costs on the economy, and probably the taxpayer too. If it is really the case that ordinary lending and deposit taking are not sustainable businesses without a subsidy, the more plausible remedy would be some kind of public utility model; but the need for a subsidy in the first place is far from demonstrated.

With “utopian economics” now thoroughly discredited, therefore, a reader of Cassidy’s book would infer that some combination of these proposals for regulation of trading and separation of functions—better yet, all of them—will be adopted. If that happens, the US financial markets will be less prone to the kind of crisis we have just seen, and the US economy and taxpayers less exposed to the kind of losses that they have just suffered.

But if Lanchester is right—if the underlying force at work is the mindset resulting from the triumphant emergence of Western-style finance capitalism as the only credible way to organize economic activity—then prospects for meaningful reforms anytime soon are surely limited. As Lanchester puts it, “The rich are always listened to more than the poor, but that’s now especially true since, with the end of the Cold War, there is so much less political capital in the idea of equality and fairness.” The banks and their shareowners may have taken big losses in the crisis, but the bankers (Lanchester calls them “banksters”) mostly made out pretty well, thanks in large part to taxpayer assistance. We now have what Cassidy calls “socialism in our time”—but only for the bankers: “It is a form of crony capitalism.” Why would they want the system to change? Lanchester holds out some hope that democratic action can reform the system, but readers of his book cannot help but be skeptical.

Let us all hope it is Cassidy who is right.

— March 31, 2010

This Issue

April 29, 2010

-

1

I am grateful to Kevin Hoover for pointing out these features of British banking in Thornton’s day. ↩

-

2

Princeton University Press, 2009; see my review in these pages, May 28, 2009. ↩

-

3

There are, however, valid concerns about how to implement the Volcker Rule and what some of its effects would be; see, for example, Hal S. Scott, Testimony before the US Senate Committee on Banking, Housing, and Urban Affairs, February 4, 2010. ↩