More than three years have passed since the old-line investment bank Lehman Brothers stunned the financial markets by filing for bankruptcy. Several federal government programs have since tried to rescue the financial system: the $700 billion Troubled Asset Relief Program, the Federal Reserve’s aggressive expansion of credit, and President Obama’s additional $800 billion stimulus in 2009. But it is now apparent that these programs were not sufficient to create the conditions for a full economic recovery. Today, the unemployment rate remains above 9 percent, and the annual rate of economic growth has slipped to roughly 1 percent during the last six months. New crises afflict world markets while the American economy may again slide into recession after only a tepid recovery from the worst recession since the Great Depression.

In our article in the last issue,1 we showed that, contrary to the claims of some analysts, the federally regulated mortgage agencies, Fannie Mae and Freddie Mac, were not central causes of the crisis. Rather, private financial firms on Wall Street and around the country unambiguously and overwhelmingly created the conditions that led to catastrophe. The risk of losses from the loans and mortgages these firms routinely bought and sold, particularly the subprime mortgages sold to low-income borrowers with poor credit, was significantly greater than regulators realized and was often hidden from investors. Wall Street bankers made personal fortunes all the while, in substantial part based on profits from selling the same subprime mortgages in repackaged securities to investors throughout the world.

Yet thus far, federal agencies have launched few serious lawsuits against the major financial firms that participated in the collapse, and not a single criminal charge has been filed against anyone at a major bank. The federal government has been far more active in rescuing bankers than prosecuting them.

In September 2011, the Securities and Exchange Commission asserted that overall it had charged seventy-three persons and entities with misconduct that led to or arose from the financial crisis, including misleading investors and concealing risks. But even the SEC’s highest- profile cases have let the defendants off lightly, and did not lead to criminal prosecutions. In 2010, Angelo Mozilo, the head of Countrywide Financial, the nation’s largest subprime mortgage underwriter, settled SEC charges that he misled mortgage buyers by paying a $22.5 million penalty and giving up $45 million of his gains. But Mozilo had made $129 million the year before the crisis began, and nearly another $300 million in the years before that. He did not have to admit to any guilt.

The biggest SEC settlement thus far, alleging that Goldman Sachs misled investors about a complex mortgage product—telling investors to buy what had been conceived by some as a losing proposition—was for $550 million, a record of which the SEC boasted. But Goldman Sachs earned nearly $8.5 billion in 2010, the year of the settlement. No high-level executives at Goldman were sued or fined, and only one junior banker at Goldman was charged with fraud, in a civil case. A similar suit against JPMorgan resulted in a $153.6 million fine, but no criminal charges.

Although both the SEC and the Financial Crisis Inquiry Commission, which investigated the financial crisis, have referred their own investigations to the Department of Justice, federal prosecutors have yet to bring a single case based on the private decisions that were at the core of the financial crisis. In fact, the Justice Department recently dropped the one broad criminal investigation it was undertaking against the executives who ran Washington Mutual, one of the nation’s largest and most aggressive mortgage originators. After hundreds of interviews, the US attorney concluded that the evidence “does not meet the exacting standards for criminal charges.” These standards require that evidence of guilt is “beyond a reasonable doubt.”

This August, at last, a federal regulator launched sweeping lawsuits alleging fraud by major participants in the mortgage crisis. The Federal Housing Finance Agency sued seventeen institutions, including major Wall Street and European banks, over nearly $200 billion of allegedly deceitful sales of mortgage securities to Fannie Mae and Freddie Mac, which it oversees. The banks will argue that Fannie and Freddie were sophisticated investors who could hardly be fooled, and it is unclear at this early stage how successful these suits will be.

Meanwhile, several state attorneys general are demanding a settlement for abuses by the businesses that administer mortgages and collect and distribute mortgage payments. Negotiations are under way for what may turn out to be moderate settlements, which would enable the defendants to avoid admitting guilt. But others, particularly Eric Schneiderman, the New York State attorney general, are more aggressively pursuing cases against Wall Street, including Goldman Sachs and Morgan Stanley, and they may yet bring criminal charges.

Advertisement

Successful prosecutions of individuals as well as their firms would surely have a deterrent effect on Wall Street’s deceptive activities; they often carry jail terms as well as financial penalties. Perhaps as important, the failure to bring strong criminal cases also makes it difficult for most Americans to understand how these crises occurred. Are they simply to conclude that Wall Street made well- meaning if very big errors of judgment, as bankers claim, that were rarely if ever illegal or even knowingly deceptive?

What is stopping prosecution? Apparently not public opinion. A Pew Research Opinion survey back in 2010 found that three quarters of Americans said that government policies helped banks and financial institutions while two thirds said the middle class and poor received little help. In mid-2011, half of those surveyed by Pew said that Wall Street hurts the economy more than it helps it.

Many argue that the reluctance of prosecutors derives from the power and importance of bankers, who remain significant political contributors and have built substantial lobbying operations. Only 5 percent of congressional bills designed to tighten financial regulations between 2000 and 2006 passed, while 16 percent of those that loosened such regulations were approved, according to a study by the International Monetary Fund.2 The IMF economists found that a major reason was lobbying efforts. In 2009 and early 2010, financial firms spent $1.3 billion to lobby Congress during the passage of the Dodd-Frank Act. The financial reregulation legislation was weakened in such areas as derivatives trading and shareholder rights, and is being further watered down.

Others claim federal officials fear that punishing the banks too much will undermine the fragile economic recovery. As one former Fannie official, now a private financial consultant, recently told The New York Times, “I am afraid that we risk pushing these guys off of a cliff and we’re going to have to bail out the banks again.”

The responsibility for reluctance, however, also lies with the prosecutors and the law itself. A central problem is that proving financial fraud is much more difficult than proving most other crimes, and prosecutors are often unwilling to try it. Congress could fix this by amending federal fraud statutes to require, for example, that prosecutors merely prove that bankers should have known rather than actually did know they were deceiving their clients.

But even if Congress does not, it is not too late for bold federal prosecutors to try to bring a few successful cases. A handful of wins could create new precedents and common law that would set a higher and clearer standard for Wall Street, encourage more ethical practices, deter fraud—and arguably prevent future crises.

Basic financial fraud involves a financial firm’s relationship with its clients, investors, or trading partners. The securities laws of 1933 and 1934 require full and fair disclosure of material risks, those that reasonable investors would consider important. Moreover, even if the securities laws did not exist, the employees of the financial firms could be charged with violating a variety of other federal and state antifraud statutes, which prohibit making false statements in various circumstances. New York State passed an especially aggressive law in 1921, which gives prosecutors expansive powers to fight financial fraud. The common law, created through rulings over the years by judges, also prohibits fraud under many conditions.

Many people may understand that crimes typically have two central elements: actus reus, a guilty act, and mens rea, a guilty mind. To convict someone of criminal fraud under any of the laws we have mentioned, a prosecutor must prove both that the defendant misrepresented important facts to investors and also that he or she knew those facts were false. In other words, failure to disclose pertinent facts to investors out of sheer negligence can’t give rise to prosecutable fraud; there must be full knowledge that such essential information is not being disclosed.

But it is difficult to prove criminal knowledge. For one thing, the facts in financial cases are usually complicated. Not very many jurors, for example, would feel competent to assess the correlations in a mathematical model that misled investors about the riskiness of subprime mortgages.

Moreover, bankers almost always protect themselves from the possibility of lawsuits and prosecutions by warning their clients, often in pro forma statements, about hidden risks and conflicts of interest. And Wall Street banks typically require that any person or institution buying their products sign a statement saying that they are sophisticated enough to understand the risks of the investment. In the SEC’s cases against Goldman Sachs and JPMorgan, the clients who bought the complex investments backed by subprime loans received just such warnings, and some courts in the past have held that those warnings protect the banks from liability, even if they sold investments that were too risky, or unsuitable, for their clients.

Advertisement

For a prosecutor to prove criminal charges, there must be solid evidence “beyond a reasonable doubt” that bankers knew what they were telling clients was false. This standard is less rigorous in civil enforcement cases, but any such charge must still be proven, and government agencies often prefer to settle for a fine rather than risk losing in court. Bringing these cases is costly, and the Justice Department must use its resources carefully, as must the SEC and other federal agencies in making civil cases.

In fact, the one criminal case brought by federal prosecutors in 2008 against two hedge fund traders working at Bear Stearns resulted in a verdict of not guilty. Although some e-mails showed that the traders did not disclose important risks to their investors, other e-mails showed that they had hoped the markets would correct. The jury found these persuasive enough to determine that the traders were not completely deceitful.

But the Bear Stearns case did not go to the heart of the unethical behavior at the core of the financial crisis. The most useful compilation of new evidence about this behavior is Wall Street and the Financial Crisis, the recently published report by the United States Senate’s Permanent Subcommittee on Investigations. Created in the 1950s, the PSI is the most important investigative body of Congress and has pursued wrongdoing in organized crime, money laundering, child pornography, and the United Nations Oil-for-Food program. Typically, when the PSI gets involved, criminal convictions soon follow.

The PSI started investigating Wall Street’s part in the financial crisis in November 2008, and its final report, published this April, is bipartisan. It does not explicitly recommend specific criminal charges, but simply lays out the facts. From our conversations with federal prosecutors, we believe they have been scouring the PSI report to find adequate evidence to support a criminal case. The PSI report singles out many credit-rating and regulatory agencies for criticism; but we are going to focus on one that we believe clearly illustrates substantial evidence of criminal fraud and is also at the core of the crisis—the sales of complex mortgage securities to major investors.

The deal in question involves a $1.1 billion offering called Gemstone 7, assem- bled by the large German bank Deutsche Bank. It was sold over seven months between October 2006 and March 2007, at a time when subprime defaults were accelerating and mortgage-based securities were beginning to fall in value. Gemstone 7 was a collateralized debt obligation, or CDO, essentially a pool of subprime mortgage securities, some portions of which are given high ratings by ratings agencies because they are first in line to receive interest payments from the mortgage holders.

The Gemstone 7 pool of mortgage bonds was particularly risky. Numerous e-mails uncovered by the PSI show that Deutsche Bank’s traders knew full well the risks of these securities. Almost a third of Gemstone 7’s securities were subprime mortgages issued by Long Beach, Fremont, and New Century, three notoriously low-quality lenders, according to PSI analyses. According to the Senate report, Deutsche Bank’s own employees used words like “crap” and “pigs” to describe these mortgages, and the bank’s traders even bet against some of these securities themselves.

Deutsche Bank’s salespeople should have informed their clients directly about the risky nature of Gemstone 7’s securities. Instead, they sent clients sales documents that touted the deal, which included only boilerplate warnings, and then aggressively pushed their clients to buy the securities. The evidence suggests they knew what they were doing, and furthermore, they knew the relevant markets in these securities were starting to fall. One salesman’s e-mail stated, “We need to sell it now while we still can.” Another advised, “Keep your fingers crossed but I think we will price this just before the market falls off a cliff.” As the securities started to decline in value, investors were even given estimates of the value that were higher than Deutsche Bank itself made. One investor interviewed by the PSI said that from what he had been told, he believed the securities were good values. Moreover, a major CDO trader at Deutsche Bank sold an enormous volume of similar securities, earning nearly $6 billion for the firm overall.

Other evidence suggests that various people knew that the deal’s triple-A credit ratings were dubious. The PSI report describes how both S&P and Moody’s had given low, subinvestment-grade ratings to one third of the assets in Gemstone 7. Yet both S&P and Moody’s gave triple-A ratings to 73 percent of the securities in the Gemstone 7 offering, and high “investment grade” ratings to nearly all of the securities. Today, the $700 million of investments in Gemstone 7 that Deutsche Bank sold to clients are worthless. Deutsche Bank itself lost a large part of the remaining $400 million of Gemstone 7 that it couldn’t unload on investors, though it tried hard to do so.

Gemstone 7 is a nasty story of deception at the fourth-largest issuer of CDOs in the US. Deutsche Bank was an aggressive dealer in CDOs in the period when the market was beginning to crack. It created fifteen from December 2006 through December 2007, amounting to $11.5 billion. The evidence implicates many of Deutsche Bank’s employees, and is far more convincing than the evidence in many of the various SEC cases.

Yet no legal case has yet been made against the bank. Prosecutors expect a defense from Deutsche Bank to say that it satisfied the law by giving its clients general disclaimers about risks and that the large pension and other institutional investors that bought the securities were highly sophisticated and should have known about the risks even if they weren’t disclosed in detail. The defense might also claim that it was the ratings agencies, not Deutsche Bank, that were to blame. Finally, a jury may not be able to readily understand the complex issues.

But it seems clear to us from the documents we have read that a criminal case should be made based on Gemstone. The evidence of the duplicity of employees is substantial; indeed, it is more substantial than in other cases we have seen. And if there were a guilty verdict, it would establish precedents that would make other prosecutions workable. Then—and perhaps only then—would a strong deterrence against such activities be created. If prosecutors are paralyzed by fear of losses and the complexity of these cases, justice may never be done.

William Cohan, a journalist and ex-banker, begins and ends Money and Power, his comprehensive, though sometimes sprawling, history of Goldman Sachs by laying out the PSI’s evidence related to Goldman. Although Cohan didn’t have the benefit of the PSI’s report (it was published one day after the publication date of his book), he was able to draw from documents made public by the PSI in 2010.

One of the cases Cohan discusses is familiar: the SEC’s civil case already mentioned against Goldman and one of its vice-presidents, Fabrice Tourre, who remains a defendant. In that deal, generally known as the Abacus transaction, Goldman was accused of selling a CDO backed by securities that were chosen by a hedge fund eager to see them decline. Goldman did not inform investors about the hedge fund’s involvement and was even selling some of the same kinds of securities while it urged clients to buy them.

Several e-mails implicated Tourre, but he was not criminally charged, presumably again because prosecutors feared bringing a case with complex facts and broad disclaimers that required a high standard of proof; so Goldman paid a fine that by historical standards was high but was small compared to its own earnings. But what is most interesting about Goldman’s response to the Abacus settlement is the bank’s publication of a sixty-three-page report describing its view of the modern investing world.

Goldman’s report concludes that it should disclose conflicts of interest when it acts as an adviser or fiduciary to its clients. That might seem like an admission of guilt regarding Abacus. But Goldman insists that in the Abacus and similar cases it was not acting as a fiduciary—that is to say, an adviser with responsibilities to point out risks. Rather, Goldman says, it was merely a “market maker.” The law is more stringent about the disclosure requirements of an underwriter or a broker than a market maker.

A market maker trades, say, IBM stock for its clients. It may even build investments in the stock to sell, if possible, at a profit—or it may sell the stock short (that is, without owning it), because it believes it will fall in price. This is a core business for most securities firms for thousands of stocks, bonds, currencies, commodities, and other securities. Until recent regulatory legislation, market makers were also allowed to engage in so-called proprietary trading—speculation on securities they thought were overvalued or undervalued. Restrictions on that practice, known as the Volcker Rule, named after the former Federal Reserve chairman Paul Volcker, who recommended it, are still being worked out—and may well be seriously watered down under the influence of lobbyists.

But when making a market in a particular security, Goldman argues, the firm is not obligated to provide advice or disclose conflicts of interest, even if, say, it believes IBM is overpriced. Instead, the rule is that the buyer must beware.

Still, selling complex CDOs is not the equivalent to making a market in stocks or other widely traded securities. The shares of IBM and countless other stocks, Treasury bonds, and currencies are far more simple to understand and often are subject to independent research analyses. Moreover, Goldman has no involvement in IBM’s business decisions, for example. The CDOs at hand, however, were created by Goldman bankers with help from a hedge fund, and the bankers knew much more than their clients did about how risky they were. Moreover, the bankers actively sold them to investors; they did not essentially accommodate investor needs, as they might with IBM shares. The line between these activities can be fuzzy but, in our view, to sell CDOs as Goldman did is not simply to make a market in them, and we believe prosecutors should test this view in court. They should argue that those who sell complex financial products—not only Goldman but all other banks such as Deutsche Bank—owe their clients further duties as if, as Goldman points out, they were advisers with fiduciary responsibilities.

Insider trading is the one Wall Street crime that prosecutors have treated the same way they treat street crime. Today’s bankers know they could face jail time for trading clients’ shares when they have nonpublic information about the company. As a result, federal prosecutors bring about fifty insider trading cases per year, and both Wall Street and investors benefit from the confidence in US capital markets that this enforcement creates.

A strong argument can be made that the US should treat more financial activities as it does insider trading, making clear that investment firms have broad responsibilities that go well beyond mere market-making. It would require courageous prosecutors to advocate such an approach today, and any defendant would strongly protest the approach as making conduct criminal after the fact. But there are plenty of precedents and arguments for judges to find that bankers have broader responsibilities.

In the case of Gemstone, prosecutors could charge salespeople with committing fraud because they knew the securities they were selling carried risks that their investors did not understand and could not have understood from the limited information provided them. In other words, they would have to take responsibility to some degree for the misguided decisions of investors to whom they failed to give critical information. Prosecutors could also ask a court to adopt a standard by which Wall Street companies should have known the crucial risks even if they didn’t have full knowledge of them. The SEC has recently used this standard in a civil case, charging that an employee of JPMorgan should have known that investors in one of the bank’s CDOs were misled. This approach would make egregious “negligence” criminal in financial cases as it is, for example, in vehicular homicide. Regardless of what happens in this case, Congress could also expressly pass legislation along these lines, or even redefine fraud to apply if bankers knew that securities were designed to circumvent regulations or hide risks.

We doubt that Congress will adopt any of these provisions anytime soon. Nor are we optimistic that state legislatures will take further action. The one state law that is potentially powerful for prosecutors targeting financial fraud, because it does not require proof of knowledge, is New York State’s Martin Act. Prosecutors have to show only that misstatements were made to investors or counterparties, not that there was full knowledge or intent to deceive. However, although the language in the Martin Act appears to apply equally to criminal and civil cases, many lawyers believe that, in view of other law, it is nevertheless unfair to prosecute someone criminally for financial misstatements without requiring that they fully knew their acts were deceptive or at least, as in our proposal, that they should have known. While New York Attorney General Eliot Spitzer successfully used the Martin Act to win settlements from firms like Citigroup in the early 2000s, he never brought a criminal case.

According to recent reports, New York District Attorney Cyrus Vance might use the Martin Act to investigate several Wall Street firms that are based in New York. However, any criminal prosecution would face substantial legal challenge. Moreover, because the Martin Act is a state law limited to New York, it is of no use to the Justice Department in Washington, D.C.

If serious prosecutions of fraud by Wall Street firms are never brought, the public’s suspicion about Washington’s policies toward bankers will only grow, as will cynicism about the rule of law as it is applied to the rich and powerful. Moreover, if investing institutions and individuals come to believe that bankers cannot be trusted, the underpinnings of the market will be eroded. Without solid, well-functioning markets, the economy cannot adequately and efficiently allocate capital to high-valued uses and create jobs. Lack of ethics and corrupt behavior will channel the nation’s resources to uses that are wasteful and unproductive, as they arguably have for several decades now as too many unethical practices have gone unchallenged.

—This is the second of two articles.

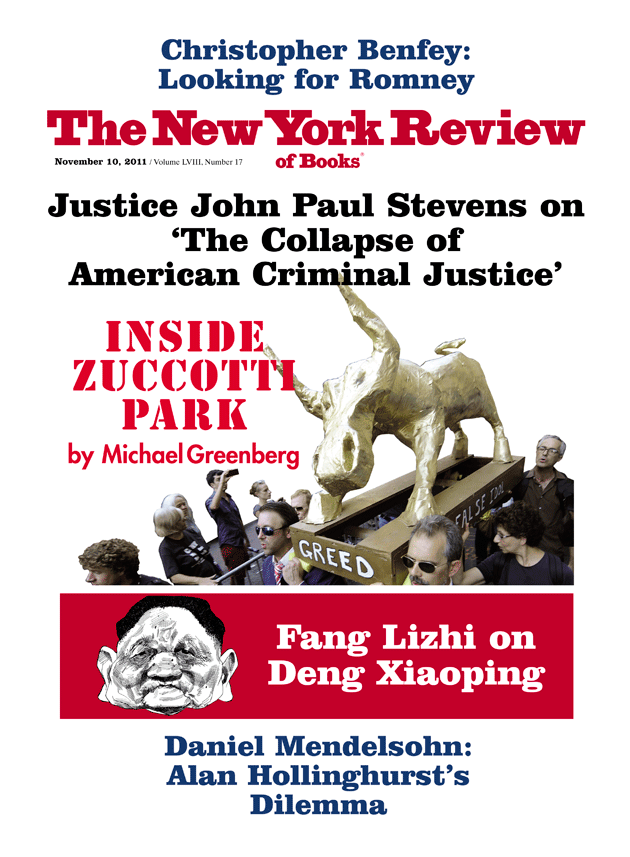

This Issue

November 10, 2011

Our ‘Broken System’ of Criminal Justice

The Real Deng

In Zuccotti Park

-

1

“Did Fannie Cause the Disaster?,” The New York Review, October 27, 2011. ↩

-

2

Deniz Igan and Prachi Mishra, “Making Friends,” Finance and Development, June 2011. ↩