The anniversary of the largest oil spill in American history passed with little notice this summer. On July 15, 2010, the ruptured BP oil well in the Gulf of Mexico was finally sealed after gushing oil for nearly three months, but there were few stories to commemorate it a year later, owing in part to the headline-consuming hacking scandal that had broken out at Rupert Murdoch’s News Corp. The occasion might have gone unnoticed even if there had been nothing to nudge it aside, because business-as-usual has returned with surprising speed to the Gulf of Mexico and to America.

A drilling moratorium imposed by President Obama was lifted last fall, tourists are back on the area’s beaches, commercial fishing has resumed, energy consumption is rising across the country, and BP has returned to the Gulf drilling scene—a well it owns was given the first permit after the moratorium was lifted. Tony Hayward, the BP chief executive who was forced to step down in October 2010, largely as a result of the disaster, has gotten his life back quite nicely, raising $2.18 billion earlier this summer for a new investment firm he has set up with the financier Nathaniel Rothschild.

The eleven workers who were killed at the ruptured well, and the 4.9 million barrels of oil that spilled, are slipping out of memory. The short-term environmental damage was not as catastrophic as feared, and the long-term impact—the toll the oil will take as it moves through the food chain of Gulf marine life—is not yet known. Yet the reports of the past year and anniversary-themed books on the disaster provide a trove of data that reveals how the oil and gas industry is as reckless and unaccountable as the too-big-to-fail banks that brought on the financial crisis of 2008. The BP disaster revealed the same problems—lax government regulation, corporate profits despite the risks, a fawning press—that characterized the financial meltdown. Big banks and big oil have more in common than their size.

When our attention was still fixed on the spill, which we could watch via underwater cameras that showed oil spewing from the seabed, everyone was beating up on BP, which was doing its best to blame Transocean, the company that owned and operated the drilling rig, and Halliburton, which carried out a cementing job so badly that it may have contributed to the disaster. Hayward was bumped out of his job once the crisis passed but it has been difficult to know who was responsible beyond BP, or the extent to which BP itself was responsible, just as it has been difficult to know whether the disaster was an inevitability in the risky offshore business or a fluke caused by singular incompetence at BP. As it turns out, both theories are correct.

BP recklessly cut corners whenever it could, but so did Transocean, and so did—does—the rest of the fossil fuel industry. For instance, ExxonMobil, with a better safety record than BP in recent decades, accused its British competitor of substandard practices. “When you do things the proper way, these kind of things do not happen,” said Rex Tillerson, the Exxon CEO, at a March conference. In June an Exxon pipeline burst under the Yellowstone River, spilling about a thousand barrels of oil into pristine waters. A few weeks before the spill, facing pressure from local authorities who were concerned that the pipeline could be ruptured by floodwaters, Exxon briefly shut it down but quickly reopened it, assuring everyone that the pipeline was safe. Once the spill happened, Exxon claimed to have closed the burst pipeline quicker than it had. So much for the “proper way” to do things.

Before the Gulf of Mexico disaster, the media generally treated BP in the respectful, do-no-wrong way that Citibank, Washington Mutual, Goldman Sachs, Bear Stearns, Countrywide Financial, and Merrill Lynch were treated until it was discovered they had done quite a bit wrong. John Browne, BP’s chief executive from 1995 to 2007, was credited with turning a sleepy, tradition-encrusted firm into an aggressive top-rank juggernaut. Browne, who earned a business degree from Stanford and spent his most formative years working for BP in the United States, followed the ever-popular American strategy of increasing a company’s size by acquiring other firms (Amoco and Arco) and boosting profitability by laying off workers. In Browne’s first five years as CEO, BP’s stock price more than tripled.

The story of his rise is well told in Loren C. Steffy’s book, Drowning in Oil: BP and the Reckless Pursuit of Profit. Steffy, a business columnist for the Houston Chronicle, reveals the emptiness behind a much-lauded pivot in Browne’s career: his rebranding of BP as a green oil company. At a Stanford speech in 1997, Browne broke ranks with the rest of the oil industry and announced that BP would invest $20 million in a solar plant as well as research into sustainable energy. The company’s logo was changed and BP, we were told, henceforth stood for “Beyond Petroleum.” The press loved it. As Steffy notes, the Financial Times lauded Browne as “the Sun King of the oil industry,” and Vanity Fair described him, in an issue devoted to the environment, as an “oilman with a conscience.”

Advertisement

Browne showed himself willing to run large risks—cutting the number of engineers, slashing maintenance—in order to increase profit margins. In 2005, a deadly explosion occurred at BP’s Texas City refinery, which had been the victim of relentless cuts to its operating budget. The explosion killed fifteen workers and injured more than 170. Afterward, it was revealed that the refinery manager was desperate to stave off funding cuts ordered by corporate headquarters that he knew were turning the refinery into a danger zone. When he commissioned an outside consultant to evaluate safety problems, the report had warned, “We have never seen a site where the notion of ‘I could die today’ was so real for so very many hourly people.'” A year later, the same dynamic of penny-pinching for the sake of higher profits led to the bursting of a corroded BP pipeline in Alaska; 270,000 gallons of crude spilled onto the tundra.

Though BP’s reputation was sullied and a modest number of unfavorable stories were published, its stock price and earnings remained strong; Browne was still loved by Wall Street and, to a great extent, the press. When he was forced to resign in 2007, it had nothing to do with the deaths and pollution caused by BP. Browne, who is gay, had lied to a British court about the origins of his relationship with an estranged boyfriend who was trying to extort money from him; the two had met on an escort website, Suited and Booted, rather than, as Browne had told the court, jogging in a park. Browne was replaced by Hayward, a longtime deputy. Steffy notes that when the Gulf of Mexico blowout occurred three years later, the correct question to ask was not how could such a disaster happen, but “How the hell could this happen again?”

Just as the financial industry was only lightly policed by the SEC and other agencies, the fossil fuel industry got what it wanted from its overseers. The Occupational Safety and Health Administration (OSHA) hadn’t conducted a scheduled or surprise inspection of the Texas City refinery for five years, even though it is the third-largest refinery in America. After the explosion, OSHA found three hundred “willful violations” of US regulations and fined BP more than $21 million—a tiny amount for one of the largest corporations in the world. BP didn’t bother to make all the changes it promised, so in 2009 OSHA imposed an additional $87 million fine for noncompliance. This didn’t hurt, either, because BP’s net income topped $16 billion that year. In the oil industry as in the financial industry, fines that hardly change the bottom line are principally public relations problems, if that.

The truly maddening story took place offshore. The Interior Department’s Minerals Management Service (MMS)was responsible for overseeing offshore drilling yet its staff was too small for the job—just fifty-five inspectors for three thousand facilities in the Gulf. Worse, there was evidence that many inspectors were industry puppets. Even before the blowout, a federal investigation found that MMS staffers accepted golf and ski trips from the industry, had sex with industry representatives, and used illicit drugs with them. Surprise inspections of rigs were almost never conducted, though required by law. These inspections might not have done much good anyway—Steffy notes that a federal investigation concluded that some inspectors “had so little understanding of what they were inspecting that they simply asked company representatives to explain it to them.”

Many firms used a one-size-fits-all environmental impact statement for their wells in the Gulf, even though the statement mentioned types of wildlife, including walruses, that don’t live there. A wildlife expert listed as a contact by Exxon, Conoco Phillips, and BP had in fact been dead for several years. The MMS hadn’t noticed. When BP applied to the MMS for major safety and design exemptions on its Macondo well (its name for the well that ruptured), permission was sometimes granted not within days or hours but within minutes.

After the financial crisis, the Obama administration was criticized for not cracking down hard enough on the banks and investment firms that had nearly destroyed the economy. One of the reasons for its timidity is that the revolving door between Wall Street and government has meant Wall Streeters don’t just continue to influence policy, they continue to make it. The same holds true in the fossil fuel industry. After the disaster at the Macondo well, the Obama administration went through the rituals of change at MMS. The agency got a new name, the Bureau of Ocean Energy Management, Regulation and Enforcement. The people remained pretty much the same—connected to the industry. According to the Associated Press, which in July obtained previously withheld documents from the agency formerly known as MMS,

Advertisement

About 1 of every 5 employees involved in offshore inspections in the Gulf of Mexico has been recused from some duties because they could come in contact with a family member or friend working for a company they regulate.

Steffy tells this sordid story well, but his book, like others published within a year of the complex disaster, relies to a great extent on news stories and government reports. It can be hard to know in Steffy’s narrative where his own considerable research leaves off and previously published material begins; attribution and footnotes are not as comprehensive as they could be. We therefore don’t always know what we need to know about the forces that shape our lives. Publishers often follow a newsy calendar that does not allow sufficient time for the original investigatory work required. Steffy’s book was published just a few months after the well was capped; it’s quite an achievement that it reads as smoothly as it does.

The perils of hasty work are exhibited in Joel Achenbach’s A Hole at the Bottom of the Sea: The Race to Kill the BP Oil Gusher, published on the blowout’s first anniversary. The book’s first sentence serves as a warning of sorts: “It came out of nowhere, a feel-bad story for the ages, a kind of environmental 9/11.” The clichés and near clichés get worse. Within the next twenty pages we read that the effort to cap the well was “a white-knuckle enterprise” while engineers were “working cheek by jowl” amid “howling political winds” during which scientists “racked their brains.” Sometimes Achenbach seems to have tried to pack as many clichés as possible into his work—how else to explain the following sentence? “The administration had scrambled all of its jets, had sent Cabinet secretaries into overdrive, had written a blank check to the agencies to do whatever it takes to deal with the spill.”

Achenbach, a reporter at The Washington Post, writes to a great extent about what he saw while covering the disaster for the Post. And what he saw—what most must-file-by-the-end-of-the-day journalists saw, because BP and the government made it difficult to visit the spill site and areas where oil fouled the shoreline—was a media circus featuring officials from BP, the Coast Guard, the Energy Department, and the White House. Many of the villains of Achenbach’s book are in the press and television, which he accuses of hyping the pollution threat (he also criticizes his own reporting for the Post), and in the White House, which comes off as caring too much about its image.

Perhaps that was true, but the battle over image is the least important of issues involved in the spill. Although Achenbach’s book has some useful information about the technical challenges faced and eventually overcome by BP engineers and government officials, there is little attribution in the text and he has no footnotes, endnotes, or bibliography. A note at the back of his book mentions a Web page where this information is supposedly posted, but when I checked repeatedly this summer, the page had a notice that said “Under Construction.”

It’s not easy to write a book of investigation. Sources must be developed and checked. Complex technologies and financial transactions must be understood. Ida Tarbell’s magisterial History of the Standard Oil Company was not produced overnight. How can a writer today, with a mortgage to pay and a kid or two to put through college, do the job if her advance covers only a few months of living expenses? One of the answers is found in a rough gem from the pile of anniversary books: Fire on the Horizon: The Untold Story of the Gulf Oil Disaster, by John Konrad and Tom Shroder. Konrad is an oil rig captain who worked for Transocean and for BP as a contractor. With his insider knowledge of the industry, as well as friendships with some of the crew of the Deepwater Horizon, the name of the Transocean rig that drilled the well for BP, Konrad had a huge advantage over professional journalists, who have little expertise in offshore operations. Before the digital era, insiders like Konrad would have remained on the inside, but a few years ago he started a blog, gCaptain.com, and it became a hub for professional mariners. If a rig captain can blog, why not write a book? Konrad teamed up with Shroder, a Washington Post editor, and has written an excellent book that wraps concise explanations of technology into a fascinating story of danger and tragedy on the rig.

Konrad describes with particular clarity the part Transocean played. BP’s actions have gotten a fair amount of attention—the company was pushing Transocean and other subcontractors to work as quickly as possible, in order to reduce costs. BP was paying $500,000 a day to rent the Deepwater Horizon rig, and other costs, such as fuel and supplies, added an additional $500,000 to the daily bill. The sooner the well was drilled, the sooner BP’s financial hemorrhage stopped.

Although BP’s leaders insist that costs are not a factor when safety is involved, their actions, and the statements of people who worked for them, tell a different story. As Oberon Houston, a former BP rig manager, told the presidential commission that investigated the disaster in the Gulf, “The focus on controlling costs was acute at BP, to the point that it became a distraction. They just go after it with a ferocity that is mind-numbing and terrifying. No one’s ever asked to cut corners or take a risk, but it often ends up like that.”

Too much attention is devoted to BP—not because the company deserves a break but because the piling on has fed a perception that BP was a rogue. The rest of the industry has been glad to condemn BP so that our anger focuses on the supposed exception rather than the industry as a whole. This strategy was used in the financial world too, with industry leaders trying to persuade the government and public that misbehavior was limited to egregious lenders like Countrywide Financial, or to reckless traders within otherwise law-abiding firms. It’s the rogue tactic of blame shifting. The truth is that BP, while not the best (as the Texas City disaster showed), was not the worst and was not the only company that put profits ahead of safety. And it’s crucial to remember that BP, Exxon, Chevron, and the other names that we easily recognize aren’t the biggest players in the world of oil—it’s state-owned mammoths like Saudi Aramco, Venezuela’s PdVSA, and Russia’s Gazprom that own and extract most of the world’s oil. If you think BP doesn’t accord sufficient respect to the environment or its workers, just visit a field managed by, say, a Chinese firm. That’s why Konrad’s investigation of Transocean is so important—it reminds us that BP is no exception.

The multibillion-dollar Deepwater Horizon drilling rig, built in a South Korean shipyard and launched in 2001, was an engineering marvel. Rather than being an inert drilling platform towed to a well site and anchored to the bottom of the sea, it had a propulsion system that enabled it to move on its own power across the ocean. Once it reached a drilling site, its dynamic positioning system allowed its engines to adjust for the winds, waves, and currents, so the rig remained stationary over the wellhead on the seabed thousands of feet below. When a well was completed, the rig and its crew of 126 would motor off (slowly—top speed was 4.6 knots) to their next drilling assignment.

With oil prices rising in recent years and offshore drilling increasing, rigs like Transocean’s Deepwater Horizon were in heavy demand; their half-million-dollar-a-day rental price made them lucrative to own and operate. There is a hitch, however. If a rig is unable to drill because of equipment malfunction or maintenance work at port, it earns nothing. The upshot is that just as BP had an incentive to push Transocean to drill as fast as possible, Transocean wanted to keep its rig going even if equipment was aging or breaking down. And that’s what was happening on the Deepwater Horizon, which was overdue for an overhaul. It was beginning to fall apart.

Konrad’s book has much—not always well-sourced, however—about problems on the rig. For instance, the drill shack, which is where the drilling pipe is controlled, had an outdated computer that regularly froze. “It was more than an inconvenience,” Konrad writes. “When the screen froze, the driller was blind.” Even worse, the rig had a faulty blowout preventer (BOP), a four-hundred-ton device placed over the well on the seafloor. In a blowout emergency, the BOP can cut through the drilling pipe and seal off the well, so that oil and gas cannot leak out. But the BOP failed to shut down the rupturing Macondo well. Postmortems have shown that the BOP had faulty batteries and faulty valves that may have contributed to its failure. And the BOP, used on other wells previously drilled by the rig, had not been fully inspected since 2000, even though such inspections were supposed to occur every three to five years.

The most haunting indictment of Transocean’s practices is contained in a report the company commissioned from an outside consultancy just a month before the blowout. The rig was scheduled to undergo long-delayed maintenance after it completed the well, so Transocean wanted a thorough inventory of what needed to be fixed. The report, which Konrad cites without crediting The New York Times, which uncovered it, included interviews with crew members who warned of trouble. “At nine years old, Deepwater Horizon has never been in dry dock,” one worker said. “We can only work around so much.” Another worker described the rig’s rhythm as “Run it, break it, fix it.”

After disasters like the BP spill and the financial meltdown, two outcomes seem possible: real reform and a better system, or superficial change and danger-as-usual. The financial meltdown occurred in 2008, two years before the BP disaster, and it’s pretty clear which way that story is going. Modest financial reforms have been instituted but nobody of substance has been punished, and the big banks are bigger than ever and as powerful as ever, perhaps more so, in view of the Supreme Court’s Citizens United decision giving corporations greater leeway to make political donations. The banks remain too big to fail and could well fail again. The BP spill is following the same unfortunate path.

When oil was still gushing from the damaged well, President Obama did what presidents often do at moments of calamity—he appointed a committee from which little was expected. But his National Commission on the BP Deepwater Horizon Oil Spill and Offshore Drilling produced an excellent report earlier this year. Deep Water: The Gulf Oil Disaster and the Future of Offshore Drilling has more detail and prescriptions than most of the anniversary books, and its criticism is sharp. “The blowout was not the product of a series of aberrational decisions made by rogue industry or government officials,” it states. “Rather, the root causes are systemic and, absent significant reform in both industry practices and government policies, might well recur.” The report makes its point with admirable relentlessness. “The accident of April 20 was avoidable,” the committee continues.

It resulted from clear mistakes made in the first instance by BP, Halliburton, and Transocean, and by government officials who, relying too much on industry’s assertions of the safety of their operations, failed to create and apply a program of regulatory oversight that would have properly minimized the risks of deepwater drilling.

We have been warned, but will there be real reform? Will the revolving door between industry and regulators be shut? Unfortunately, it’s hard to imagine President Obama, who supports more drilling in America, enacting the thorough changes his committee recommends. This is not an era in which lots of government jobs are being created to increase the regulation of an industry that, though unpopular with environmentalists, counts a large number of Americans as employees and shareholders.

Yet the peril posed by drilling is rising, because a new frontier beckons to the industry. Preliminary drilling has begun off Greenland in the Arctic Ocean, where the ecosystem is particularly fragile and spill-containment operations particularly difficult to accomplish, and the Obama administration has given conditional approval for Royal Dutch Shell to drill in Arctic waters off Alaska. Last summer, when icebergs threatened a drilling rig off Greenland, tugboats pulled them away. What happens if there are more icebergs than tugboats, or if the icebergs are too large to tow, or if a tug’s engine fails? The spokesmen for the industry, who insisted that a disaster like the BP blowout could not happen in the Gulf, say we can trust their companies in the Arctic. Their promises are even less comforting than the reassurances we hear from Wall Street about the impossibility of another financial crisis.

Oil firms give codenames to their drilling sites, to throw rivals off the scent of where they are finding oil. The US government, when it sold a Gulf drilling lease to BP in 2008, called the site Block 252. BP, to help raise money for United Way, let its employees bid for the right to choose a codename; the winning group of employees decided on Macondo, after the town in Gabriel García Márquez’s One Hundred Years of Solitude. No one could know how miserably appropriate the choice would be. Both García Márquez’s fictional town and BP’s Macondo were destroyed. The final twist of One Hundred Years of Solitude is relevant, too. A text that had been impenetrable is finally deciphered at the end of the novel. Written one hundred years earlier, it foretold the events that destroyed Macondo. When it comes to drilling for oil and the hazards of climate change, the texts that predict our future are accumulating. They are all too clear.

This Issue

September 29, 2011

School ‘Reform’: A Failing Grade

Coming Attractions

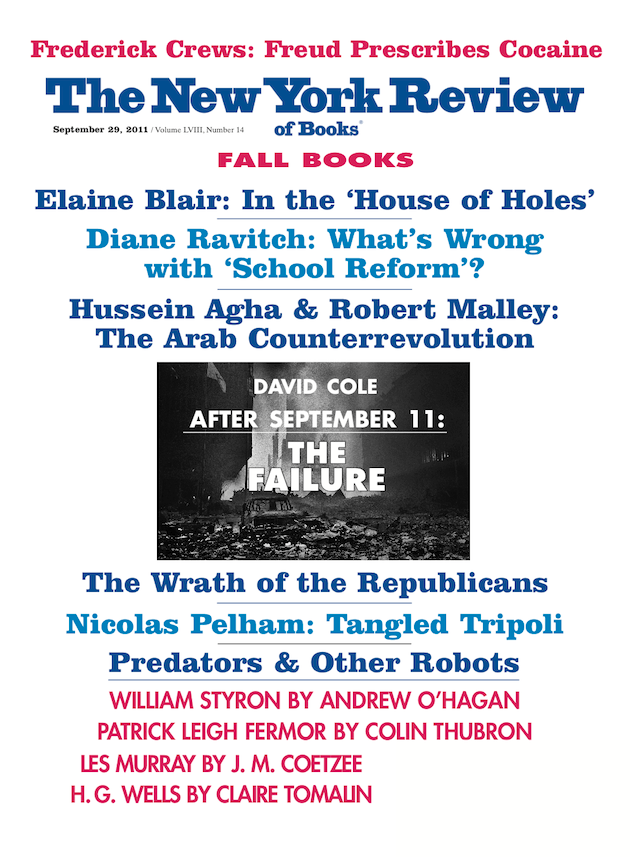

After September 11: The Failure