Five years after the onset of the financial crisis that badly damaged the US economy, the nation remains mired in chronic joblessness. The unemployment rate, stubbornly above 8 percent, actually makes the situation look better than it is. Many millions have given up looking for work and no longer figure in the statistics. Long-term unemployment remains at levels unseen since the Great Depression. Young Americans are entering the worst job market in at least a half-century. For both the long-term unemployed and new job seekers, this sustained absence from the workforce will have permanent effects on both their earnings and their well-being. And not just theirs. We have all lost, and continue to lose, from the prolonged mass idleness of potentially productive workers.

Yet Washington is stuck in neutral. Worse than neutral; it is in reverse. As the last elements of the 2009 stimulus phase out, the initial flood of federal aid has slowed to a trickle. If no agreement is reached before early next year, the trickle will become a huge backward flow, as President Obama’s payroll tax cut and all the Bush tax cuts expire while automatic spending cuts agreed to in previous legislative sessions kick in. Already, Republican leaders are threatening to replay last year’s standoff over the debt ceiling. Meanwhile, state and local governments—prohibited from running sustained deficits, increasingly dominated by anti-spending forces—continue to cut aid to those out of work and slash programs that invest in the nation’s future while laying off teachers and other public workers. Without those layoffs, the current unemployment rate would probably be around 7 percent.

Against this backdrop, no book could be more timely than Paul Krugman’s End This Depression Now! Since the crisis began, Krugman has argued with consistency and increasing frustration that the United States has become caught not in a normal recession, but in a “liquidity trap.” Since interest rates are already at rock bottom, normal measures, such as easy credit, won’t work, and expanded government expenditures must play a central part in boosting anemic demand. Otherwise, the efforts of private citizens to pay down debts laid bare by the financial crisis will continue to hold the economy back.

To Krugman, this is all the more regrettable because it is almost wholly preventable. We know what to do, he argues: increase public spending and make it clear that monetary expansion will continue until the economy fully recovers. Krugman advocates greater federal aid to state and local governments, as well as an aggressive effort to relieve private mortgage debts. He also argues that the Fed has been too timid in setting higher inflation targets to restore expectations of growth. “Unfortunately,” Krugman writes,

we’re not using the knowledge we have, because too many people who matter—politicians, public officials, and the broader class of writers and talkers who define the conventional wisdom—have, for a variety of reasons, chosen to forget the lessons of history and the conclusions of several generations’ worth of economic analysis, replacing that hard-won knowledge with ideologically and politically convenient prejudices.

Krugman is at once ruthless and humorous in taking on these prejudices. Early in the crisis, he started writing about a “Confidence Fairy” invoked by deficit hawks—the notion that credibly tackling the deficit would lead to increased investor confidence and thereby economic expansion. He was equally dismissive of the notion that “bond vigilantes,“ a staple of the Wall Street Journal editorial page, would go after the United States by demanding higher interest rates on loans if the US didn’t immediately slash its deficits. He reserved his greatest scorn, however, for those who predicted that expansionary policies would unleash crippling inflation. This, he insisted, was a “phantom menace.” Weak demand and rock-bottom interest rates have made banks reluctant to lend even with looser money; without such lending and the resulting expansion, Krugman argued, underlying inflation couldn’t and wouldn’t escalate.

A few years later, Krugman has been entirely vindicated in these judgments. Though the US deficit remains large—mainly due to the downturn and policies set in place before it, not the 2009 stimulus—interest rates have not spiked; quite the opposite: they are at record lows. The bond vigilantes and runaway inflation are nowhere to be seen. Economic performance has been unimpressive in the countries that have voluntarily slashed spending, such as the UK and the Baltic states of Estonia and Latvia. As Krugman patiently argues, stalled investment and the pattern of unemployment across different sectors of the economy point again and again to a shortage of demand as the central problem. By contrast, the evidence provides virtually no support for the repeatedly shifting conservative talking points about incipient inflation, business skittishness over regulatory uncertainty, or a sudden collapse in the quality of the American workforce.

Advertisement

Clearly, however, those driving eco- nomic policy in Washington do not agree—and that is what really frustrates Krugman. He laments what he sees as the growing insulation of America’s economic and political elite from the struggles of ordinary Americans. “For middle-income families, even before the crisis,” he writes,

there was only a modest rise in income under deregulation, achieved mainly through longer work hours rather than higher wages.

For a small but influential minority, however, the era of financial deregulation and growing debt was indeed a time of extraordinary income growth. And that, surely, is an important reason so few were willing to listen to warnings about the path the economy was taking.

In this indictment, Krugman is joined by another Nobel laureate economist, Joseph Stiglitz, whose claims are much more sweeping than his. In an argument that dovetails with those of Occupy Wall Street protesters, Stiglitz insists that the huge and growing divide between the richest 1 percent and “the 99 percent” is not just one concern among many, but the defining characteristic of a thoroughly sick economy. We may be the richest nation in the world, but poverty is higher and social mobility between generations lower than in other rich nations. In other respects, our model is bloated: we release far more carbon dioxide and use far more water on a per capita basis; and we spend far more on health care, while leaving tens of millions uninsured and achieving health outcomes that are mediocre at best.

The reason, according to Stiglitz, is that the vaunted American market is broken. And the reason for that, he argues, is that our economy is being overwhelmed by politically engineered market advantages—special deals that Stiglitz labels with a term familiar to economists: “rent-seeking.” By this, he means economic returns above normal market levels that are derived from favorable political treatment. In the most powerful parts of The Price of Inequality, Stiglitz chronicles the blatant tax and spending giveaways to big agriculture, big energy, and countless other sectors. Yet he also pointedly argues that much of the rent-seeking that plagues our economy takes a more subtle form, also familiar to economists: “negative externalities,” or costs that economic producers impose on society for which they don’t pay.

The spectacular profits of the energy industry, for example, rely heavily on the failure of regulation to incorporate fully the social and economic costs associated with environmental degradation, including climate change. Similarly, the increasingly aggressive activities of Wall Street—whether in the marketing of unsound mortgages, the use of excessive leverage, or the irresponsible use of derivatives—create huge risks for the economy as a whole. Yet these risks are largely not taken into account in the prices paid in financial markets. Without effective regulation, the costs are borne by all of us—most acutely by the struggling millions who have been pushed out of jobs.

Weeding out these and other forms of rent-seeking would thus promote both efficiency and equity, and Stiglitz provides a broad list of reform ideas, ranging from strict regulation of financial markets to more effective anti-trust laws. Yet he is most passionate about the need for political reform. Either those at the top will realize that things must change, or, he suggests, the kinds of popular revolts sweeping Middle Eastern nations will come to the United States. “In important ways,” he writes,

our own country has become like one of these disturbed places, serving the interests of a tiny elite. We have a big advantage—we live in a democracy—but it’s a democracy that has increasingly not reflected the interests of large fractions of the population.

Indeed, the most striking feature of these two books by Nobel Prize–winning economists is their emphasis on politics. Economists have traditionally insisted on the primacy of economic factors. In studying growing inequality, for instance, they have focused on economic forces like trade and technological change. Only in recent years (in part through the urgings of iconoclasts like Krugman and Stiglitz) has there been a turn to politics to explain America’s distinctive economic challenges—a reorientation that brings economics back toward its original conception as the science of political economy.

No one can doubt that the American political economy has changed dramatically over the last generation. Perhaps most fundamental is a transformation that Stiglitz and Krugman seem to assume and barely mention: the huge shift in the relative influence of business and labor. The sharp decline of unions outside the public sector (where they are now deeply embattled) has not only affected the bargaining power and compensation of employees in the workplace; it has also greatly weakened the major organized group most capable of defending less affluent Americans in the political arena.

Advertisement

Adding to this imbalance is the ever-rising flood of money into American politics, vividly on display in this first presidential race to take place after the Citizens United decision. Commentators wonder whether President Obama can hold even in the resulting money contest. But the impact of big donors and highly partisan outside groups is likely to be at least as great, and more lopsidedly Republican, in the battles across the nation for control of Congress and especially of the House. Like the presidential race, the congressional contests are well on their way to record spending levels, particularly for continuing GOP control of the House.

What’s more, campaign contributions are only a small proportion of political spending. The organized energies of corporations and the wealthy influence every aspect of American governance. These efforts range from direct lobbying of political officials, to drives to shape both mass and elite opinion, to the long cultivation by conservative activists of a Supreme Court majority advancing a more pro-business economic agenda, to the carefully planned use of fiscal crises in many states to mount a frontal assault on public sector unions.

For the Republican Party, the effect of the new balance of organized power has been radicalization. Economic interests that support the GOP have ample money to give, and they give it aggressively. Donors have had enormous success in creating organizations to set and enforce a hard-right agenda. Such organizations include Grover Norquist’s Americans for Tax Reform, influential think tanks like the Heritage Foundation, and state-level lobbying organizations like the American Legislative Exchange Council, financed by the conservative multibillionaires Charles and David Koch. This rightward march is long-standing, but it has only been accelerated by the rise of the Tea Party—itself supported in part by some of the same groups.

The story on the other side is very different. While the shifting balance of money and organization has encouraged Republicans to become sharply more conservative, it has created conflicting incentives for Democrats. Still reliant on their traditional but declining base within organized labor, they have nonetheless sought—with increasing success at least until recently—to develop pockets of financial support within sympathetic corporate quarters. Now that the financial industry has swung back toward the GOP, it is easy to forget that tapping Wall Street donors allowed Democrats to approach financial parity with Republicans in the 2000s. And unlike the GOP, where moderates have essentially vanished, some important groups of Democratic politicians self-consciously describe themselves as centrists (usually, they are also the ones most actively seeking business support). The result for Democrats has been an awkward dance between tepid populism and compromised centrism that has frequently divided the party and muddled its message.

The disturbing effects of these two growing imbalances—between the rich and the rest and between a conflicted Democratic Party and a more united and aggressive GOP—are exacerbated by America’s ailing political institutions. Our constitution was designed to simultaneously make compromise necessary, owing to the separation of powers, and also to facilitate compromise by making sure that individual politicians would not coalesce into hardened blocs. In writing Federalist 10, however, James Madison did not anticipate the rise of hyperpartisanship and money-driven politics or the emergence of the Senate filibuster as a routine method of minority obstruction. The necessity to compromise still applies, but the features intended to facilitate compromise, such as staggered terms of office and the dependence of politicians on highly distinct local constituencies, no longer reliably work. The result is not only gridlock, but (especially on the GOP side) a form of zero-sum conflict in which any action that might be helpful to the other party is by definition an action to be relentlessly opposed.

This immobilization and trench warfare reinforces all the forces pushing toward greater inequality. First, a government that cannot act has no way of responding to disruptive economic change. This is a big part of the story of recent financial excesses, as powerful interests effectively stalled efforts to adapt financial regulations to rapidly evolving markets. Second, gridlock and incessant bickering disgust and alienate voters, feeding confusion, distrust, and disenchantment. As ordinary voters set their sights lower or disengage, they cede political ground to well-organized activists and economic interests.

Finally, gridlock blurs accountability, making it easier for politicians to depart from voters’ priorities. In parliamentary democracies, voters can relatively easily reward or punish politicians. The party or coalition in power, from the prime minister to the backbenchers, must bear responsibility. In the United States, responsibility is much harder to assign—especially now that a party needs at least sixty votes in the Senate to overcome the omnipresent filibuster. GOP leaders know the president and his party are likely to receive most of the blame for poor economic performance, even if the scorched-earth resistance of conservative Republicans is the biggest obstacle to enacting the president’s policies.

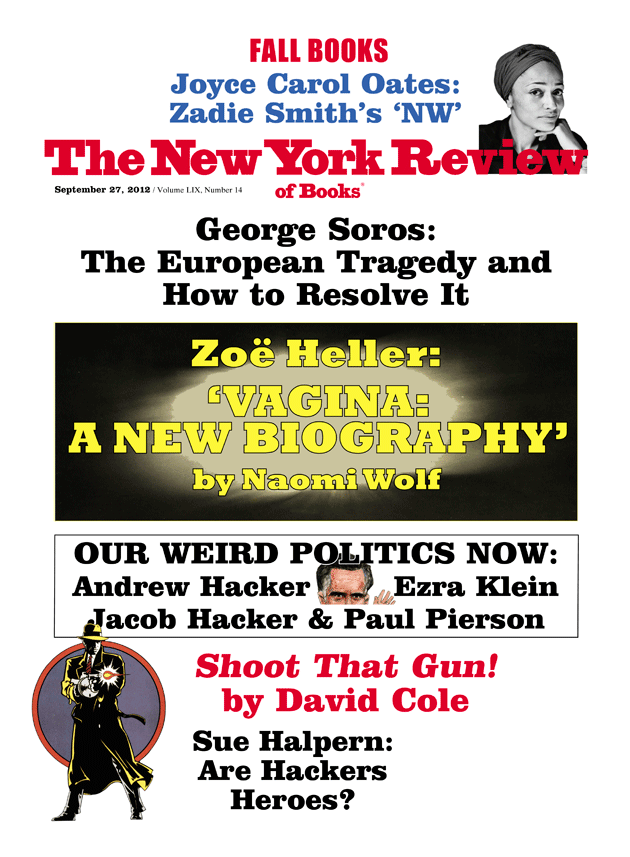

Ken Light/Contact Press Images

House and doll, Firebaugh, California, 2009; photograph by Ken Light from Valley of Shadows and Dreams, which pairs his images of the economically hard-hit Central Valley with text by Melanie Light. It includes a foreword by Thomas Steinbeck and has just been published by Heyday.

Without a clear understanding of the forces reshaping American politics, efforts to reverse these trends are unlikely to triumph. By putting politics center stage, Krugman and Stiglitz greatly advance that cause. Yet neither offers a fully convincing diagnosis, albeit for very different reasons. In Stiglitz’s case, the problem is that his book is too sweeping. In his view, the political system is wholly owned and operated by and for the top 1 percent. This is certainly the direction in which things have been trending, but it ignores the notable, if limited, successes Democrats achieved both before and after 2008, including the Affordable Care Act, and it does a disservice to the efforts of many political leaders on behalf of middle-class economic interests. For all the pull of money, the differences between the two parties on economic issues are greater than they have been since at least the 1930s. To take only one example, which could be endlessly multiplied, current GOP plans to “repeal and replace” the Affordable Care Act would result in around 50 million more Americans without health insurance.

Krugman’s view is more measured. He believes inequality is a huge problem. But he recognizes that there is considerable uncertainty regarding many matters about which Stiglitz expresses greater confidence. For example, he notes that we still do not know exactly how or by how much rising inequality contributed to the financial crisis. And he is often astute in outlining the formidable barriers to better policymaking in Washington.

Yet Krugman sometimes falls into the opposite trap: he plays down the deep structural barriers that advocates of reform face. Krugman keeps returning to the notion that President Obama did not aim high enough or try hard enough. The economic stimulus was too small; the president too deferential to Wall Street; the White House too slow to recognize the need for additional action and too timid in demanding that action once it did. These complaints certainly have some basis, but they seriously understate the hurdles the president had to surmount.

From the day he entered office, the president was engaged in fierce organized combat with well-financed defenders of the status quo and a monolithically opposed Republican Party. To get the Affordable Care Act through Congress, President Obama not only had to court recalcitrant Democratic moderates (after it became clear that the few Republican moderates would be of no help). He also had to buy off the major industry interests, whether insurance companies, hospitals, or the pharmaceutical industry, which meant, above all, forgoing more direct and effective measures to control costs.

With regard to the stimulus, Krugman makes a strong case that the president and his economic advisers should have pushed for more. Still, from the outset the main constraints he faced were political. There is little reason to think that a bolder administration could have gotten stimulus expenditures that were close to what was required. (A more self-inflicted wound, which Krugman rightly bemoans, was the weakness of the administration’s efforts to tackle the crippling problems of the housing market—underwater homes, defaults, foreclosures—that continue to drag down demand.) Nor, given the continuing rightward shift of the GOP, is there reason to think that the administration’s lack of leadership represents the big problem today. “All that is blocking recovery is a lack of intellectual clarity and political will,” Krugman concludes. Yet even the most strong-willed president would still confront an army of powerful interests, a radicalized GOP majority in the House, and the filibuster in the Senate, along with a lot of Democrats caught between their traditional constituents and commitments and an increasingly money-driven political world.

Krugman’s equal emphasis on the need for “intellectual clarity” provides the justification for his important book. As he recognizes, the struggle over how to fix the economy is in part a battle of ideas, and the Keynesian prescriptions that Krugman favors (and he marshals impressive evidence in favor of them) are losing that battle. Yet it has to be acknowledged that proponents of these ideas have struggled to win favor with voters as well as elites. The Keynesian insight that, under special conditions, increased government spending can create demand and boost growth is, for many, counterintuitive and complex (even Krugman’s lucid discussions are occasionally hard going), and it runs up against traditional notions of household thrift. Revealingly, even during the heyday of American liberalism, FDR and other leaders rarely argued for spending on Keynesian grounds. They called for concrete programs—from unemployment insurance to progressive taxation—that had the effect of boosting demand when the economy was slack.

Today, the argument for a positive role for government is harder to make than ever, and not just because one party categorically rejects it. Public distrust of government is deep—in large part, ironically, because many citizens feel it is under the thumb of powerful economic interests—and polarization has fueled skepticism that there are any accepted economic prescriptions. Americans say the economy must be fixed, but that doesn’t mean they know how to fix it, much less think Washington can fix it.

Still, voters do have some ideas about what should be done. A majority of Americans have consistently told pollsters that creating jobs is a much higher priority than tackling the deficit. And when asked how deficits might be reduced, the public strongly endorses increasing taxes on the wealthy and cutting defense spending. The problem is not that these ideas couldn’t guide policy. It’s that they have almost no political traction in Washington. The most influential Republican budget plan—the blueprint put forward by Representative Paul Ryan and given even greater prominence by his selection as Mitt Romney’s running mate—would do just the opposite of what most people say they want. The plan would add to the Bush tax cuts for the wealthy; increase, rather than cut, defense spending; and enact huge cuts in social programs for the poor and middle class, including Medicaid and Medicare. These are changes that polls show Americans (including, at least with respect to Medicare, even Tea Party supporters) strongly oppose.

While the Ryan budget is at odds with the stated priorities of the majority of Americans, one group appears quite supportive of its general thrust—the superrich. Most polls reach few if any extremely wealthy Americans. But thanks to a pilot poll recently commissioned by a team of political scientists, we now know that the very rich are indeed different from the rest of Americans: They place much higher priority on deficit reduction and cutting spending, and much, much lower priority on reducing unemployment.*

Certainly one of the most striking features of current debates is the economic hawkishness of the American upper crust. Krugman and Stiglitz are rightfully amazed at how, once the most intense part of the crisis was past, economic elites averted their gaze from the ongoing hardship. That powerful CEOs and financial executives could cause so much damage and yet restore their position (and paychecks) so quickly suggests an extraordinary culture of self-justification and demand for deference. Perhaps most telling is the apparently genuine and widespread fury among financial elites at Obama’s occasional, mild criticisms of their excesses.

Nowhere are the effects of unequal power clearer than in the shifting commitment of elites to limited government and deficit reduction. When many of today’s loudest deficit hawks had the opportunity a decade ago, they repeatedly chose policies that worsened the deficit in order to lavish benefits on the wealthy and powerful business interests. These benefits ranged from two huge tax cut bills to new subsidies for the oil and gas industry to an unfunded Medicare drug benefit full of handouts for the pharmaceutical industry. They were backed by the economic seers of their era, such as former Fed Chair Alan Greenspan, who insisted, astonishingly, that large-scale tax cuts were justified in 2001 because then-projected surpluses might eventually eliminate the federal debt, forcing the federal government to begin buying up corporate stock. Occasionally the mask slips off entirely. During the last round of intense fighting over the deficit, in the mid-1990s, then House Majority Leader Dick Armey confessed:

Balancing the budget…is the attention-getting device that enables me to reduce the size of government. Because the national concern over the deficit is larger than life…. So I take what I can get and focus it on the job I want. If you’re anxious about the deficit, then let me use your anxiety to cut the size of government.

America’s long-term debt picture poses serious problems, as both Stiglitz and Krugman recognize—especially in funding health care, for example—but Krugman pointedly reminds us that the economic and social costs of a premature pivot toward deficit reduction are catastrophic. (He quotes Keynes: “The boom, not the slump, is the time for austerity.”) The forces demanding major cuts now, however, are immensely powerful. To take just one example, former commerce secretary Pete Peterson (with a huge personal fortune built on Wall Street) has dedicated roughly half a billion dollars to the cause of reshaping elite and public discussion of deficits. Peterson and other deficit hawks have funded activities ranging from highly publicized Washington meetings with administration officials and politicians, to advocacy organizations insisting that deficits pose the nation’s greatest crisis, to educational materials for high schools. The latest such effort is a $25 million campaign led by the Peterson-funded Committee for a Responsible Federal Budget that includes one hundred CEOs of Fortune 500 companies. These campaigns are cast as nonpartisan drives for good governance and shared sacrifice. Far too often, however, the push for austerity falls on weak claimants rather than weak claims.

The priorities of the wealthy and powerful show up not only in the premature focus on deficit reduction, but in the way austerity seems likely to be targeted. A genuine effort to combat long-term deficits would address the myriad ways, documented by Stiglitz and many others, in which the federal government subsidizes economic behavior that has real costs for our society—whether by failing to require companies to pay a tax on their carbon emissions or allowing billionaire hedge fund managers to pay taxes at rates far lower than those affecting middle-class families.

Most obviously, since projected long-term deficits are largely driven by rising health costs (which threaten the private sector at least as much as the public), a serious response to long-term deficits would address the factors that make our health care by far the most expensive in the world. We would follow the example of other nations, using the buy- ing power of government to produce real cost containment in the medical industry, rather than following the blueprint outlined in the Ryan Plan, which produces “cost savings” by simply gutting the programs that give tens of millions of Americans access to care.

This is the central message of Krugman and Stiglitz: we have a choice. Politics got us into our economic mess, and only a revitalized politics can get us out of it.

This Issue

September 27, 2012

Pride and Prejudice

Cards of Identity

Are Hackers Heroes?

-

*

The average wealth of those polled was around $14 million; the average annual income was just over $1 million. See Larry Bartels, Benjamin Page, and Jason Seawright, “Democracy and the Policy Preferences of Wealthy Americans,” paper presented at the annual meeting of the American Political Science Association, Seattle, September 2011. ↩