The December budget deal, worked out between Representative Paul Ryan and Senator Patty Murray, has been widely greeted with relief. Since the first days of the Obama Administration in 2009, Washington has been in a pitched battle over the budget, with endless fights over stimulus packages, temporary tax cuts, spending limits and sequestration, fiscal cliffs, debt ceilings, and government shutdowns. Who would not welcome a moment of bipartisan calm, especially when the economy still needs to break out of its prolonged torpor?

Yet the budget battles have never been quite what they’ve seemed, and the new bipartisan agreement is not a victory of bipartisan reason. Despite all of the budget turmoil over the past five years, the long-term trajectory of the US budget has remained remarkably and dangerously unaltered. With this new agreement, the US takes another step toward a diminished future.

The long-term budget trajectory is the combination of three trends. First, ever since Ronald Reagan’s successful assault on government, beginning in 1981 (“Government is not the solution to our problem; government is the problem”), federal tax revenues in a normal year have stabilized at around 18–20 percent of the Gross Domestic Product (GDP). Adding in state and local governments, the total tax take in the US is around 30 percent of GDP. In Canada, Europe, and Japan, the total tax take (national, state, and local) is at least several percentage points of GDP higher than in the US. Canada averages 38 percent, Germany 45 percent, and social democratic Denmark 55 percent. (Supporters of supply-side economics may be interested to learn that Denmark ranks as the happiest country in the world in the Gallup International polling of life satisfaction.)

Democrats are called the tax-and-spend party, but Bill Clinton, Barack Obama, and the congressional Democrats have consistently opposed proposals for any marked increase in federal revenues as a share of GDP. When Democrats fight their perennial battles to close loopholes and raise taxes on the rich, their proposals typically add up to around 1 percent of GDP at the maximum. Obama’s budgets since 2009 have consistently called for federal revenues below 20 percent of GDP as of 2020, not more. Remember that Obama called for making George Bush’s temporary tax cuts permanent for 98 percent of Americans, allowing possible increases only for the top 2 percent of income earners. In the deal made for the budget in January 2013—in response to the “fiscal cliff”—the Bush-era tax cuts were in fact made permanent for approximately 99.5 percent of households.

Second, outlays on major mandatory programs like Social Security, Medicare, and Medicaid have continued to rise relative to GDP. (These programs are called “mandatory” since the benefits are fixed by law rather than by annual appropriation.) Other notable mandatory programs include food stamps and unemployment insurance. In 1980, the mandatory programs cost 9.6 percent of GDP. By 2013, they had risen to 13.6 percent of GDP. (Note that all budget data refer to the fiscal year, or FY, rather than the calendar year.)

The rise in mandatory spending relative to GDP has resulted from the increased coverage of these programs (e.g., the expansion of the population reached by Medicaid), as well as the increased costs of health care and the aging of the population. Rising health care costs and aging will lead to further increases in outlays relative to GDP unless there are changes in coverage, benefits, or costs. The Congressional Budget Office projects that spending on health programs (including Medicare, Medicaid, and Obamacare) will rise from 4.7 percent of GDP in 2013 to 5.9 percent of GDP in 2023, and to 8.1 percent of GDP in 2038 under current legislation and cost trends.

Third, health care and military spending have so far resisted reforms that could save vast amounts of money. The excessive costs of US health care are notorious, but neither party has dared to grapple with the lobbying power of the private health care industry, which is after all the single largest industry in the entire country. America spends around 18 percent of its GDP on health to obtain what other high- income countries get for around 12 percent of GDP. The difference is around $765 billion of waste, fraud, and abuse each year, roughly 5 percent of GDP, as described in a recent major study by the authoritative, government-sponsored US Institute of Medicine. Americans vastly overpay for medicines, hospital stays, outpatient visits, and countless procedures.

Bloated military spending is also notorious, with many billions spent on useless wars, hundreds of superfluous military bases, unnecessary nuclear weapons systems to fight a Soviet enemy that no longer exists, and high-cost conventional weapons systems that the generals often don’t want but that congressmen crave to create jobs in their districts. All of this waste, plus the bloated intelligence budgets (now estimated to be around $53 billion per year, roughly 0.3 percent of GDP), has added up to military outlays of around 5 percent of GDP in recent years.

Advertisement

Combine these three long-term trends, and the underlying fiscal problem is clear. Revenues amount to around 19 percent of GDP; mandatory programs require around 13.6 percent of GDP and rising; and security-related spending runs at around 5 percent of GDP. There is no room to fund civilian discretionary programs, a vast category that includes education, job training, protecting the environment and regulating land use, infrastructure such as roads, community development, housing, agriculture, and the technologies of the future, including advanced biomedical research, nanotechnology, information technology, renewable energy, and more.

The result is chronic budget deficits, and a chronic squeeze on the part of the economy associated with America’s future, the part where we invest to remain prosperous and globally competitive. These budget deficits in turn bring us to the fourth category of the budget (in addition to the mandatory, security, and civilian discretionary programs): interest payments on the growing public debt.

Currently the interest costs on the debt are around 1.5 percent of GDP, yet they will rise significantly in the coming few years. The public debt stands at around 75 percent of GDP, and the interest rate paid by the government is around 2 percentage points; hence the level of debt servicing (1.5 percent of GDP equals 75 percent of GDP times 2 percent per annum). Yet almost all observers believe that when the Fed ends its quantitative easing program—when it begins to “taper,” to use the new catchphrase—interest rates will rise to 4 percent or higher. The interest costs would then rise to 3 percent of GDP or more. This will further increase the budget deficit, either accelerating the rise of public debt or forcing some other adjustments, such as further cuts in spending.

The reader will by now see the fundamental problem, one that is far deeper than the repeated episodes of shutdowns, sequesters, and threatened defaults. There are simply no federal revenues available under the current tax laws to fund the civilian discretionary part of the budget. With total revenues set below 20 percent of GDP, and the sum of mandatory programs, interest servicing, and military spending amounting to around 20 percent of GDP or even more, all discretionary spending is destined to be financed through deficits or to disappear in budget cuts and spending limits.

Despite the endless budget skirmishes, the short-term stimulus packages, and all of Obama’s heartening speeches about investing for the future, the fact is that America is on a path of gutting critical public investments in education, job training, science, technology, and infrastructure. This dark secret has been true since Obama’s original run for the White House in 2008. His campaign pledge to make the Bush-era tax cuts permanent for almost all Americans meant that there never was an Obama plan (or a plan by the congressional Democrats other than a few dozen progressive members) to fund the public investments needed for America’s future.

It is worth looking at Obama’s first budget in 2009 to recall these hard truths, which have been obscured by mountains of rhetoric. In the budget sent to Congress in August 2009, Obama foresaw federal revenues at 19.2 percent of GDP in 2019, the last year of the ten-year budget. Thus, he put himself squarely in line with the political consensus that allows no increases in long-term revenues relative to GDP. To accommodate that position, Obama already had his eye on reducing the share of national income allocated to civilian discretionary programs. The August 2009 budget has civilian discretionary programs falling to just 3.1 percent of GDP, compared with an average of 4.5 percent of GDP in the 1970s, 4.1 percent of GDP in the 1980s, 3.5 percent of GDP in the 1990s, and 3.6 percent in 2008, the last budget of the Bush administration. In other words, Obama’s much-vaunted plans to invest in our future were never in the budget. By July 2013, Obama’s own budget plans called for civilian discretionary spending to decline to a mere 2.5 percent of GDP in 2023, the final year of the updated ten-year period.

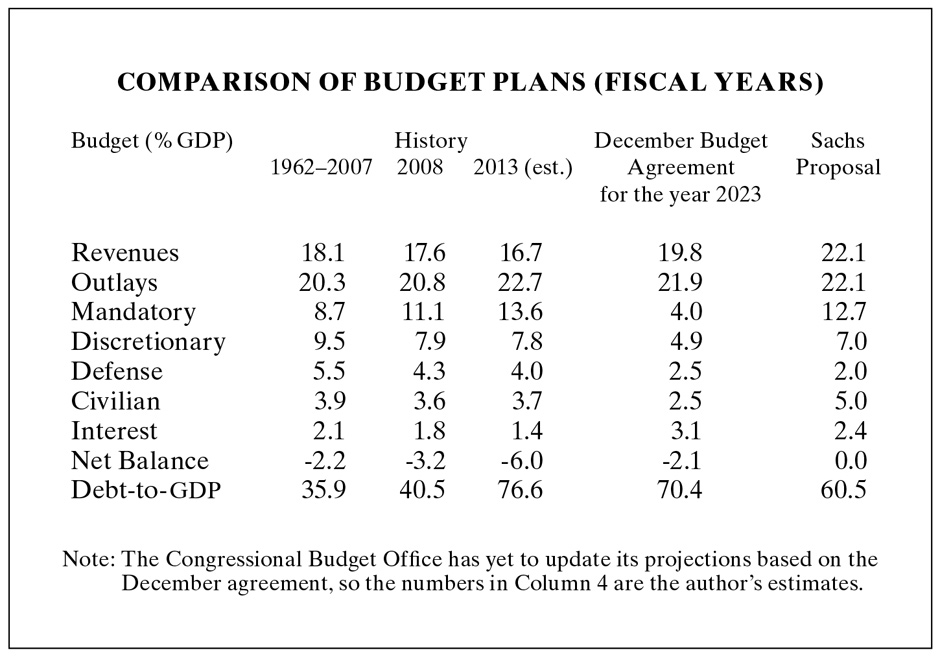

The new budget agreement announced on December 10 cements these draconian and ill-judged cuts. In fact, according to the budget ceilings in the agreement, both military and civilian spending are now on track to decline to around 2.5 percent of GDP by 2023. The Republicans have accepted steep declines in military spending as a share of national income, while Democrats have acceded to the gutting of the civilian discretionary budget.

What is to be done? Consider four possible courses of action. The first is to continue to sleepwalk into the future, as we’ve been doing now for three decades. As public investments in science, technology, the environment, and education continue to shrink, US technological prowess will decline; the physical environment will continue to deteriorate (as our energy policy remains defined by drilling now and forever); and at least half of our children will never get the skills they need for decent jobs in the twenty-first century.

Advertisement

A second course would be to fund the civilian budget through more deficit spending. This would be a possible outcome, for example, if the Democrats regained control of the House. This has also been Paul Krugman’s well-known advice, and for many progressives it has become the standard position. Several arguments are made for it: that large deficits will lead to more employment and tax revenues in an underemployed economy (the Keynesian “stimulus” argument); that today’s very low interest rates will persist; and that there is no serious problem with the debt–GDP ratio rising to high levels in the future. In this view, we’ve been at high debt–GDP ratios in the past (such as after World War II—the debt–GDP ratio was 80 percent in 1950) without evident harm to long-term growth.

I do not agree with this position. I am worried about the rising ratio of debt to GDP, which has already doubled since 2007, from 36 percent of GDP to 71 percent of GDP. Most importantly, when interest rates return to more normal levels the burden of debt servicing will be quite steep. At 3.1 percent of GDP in 2023, as projected by the Congressional Budget Office, the interest costs would be larger than the projected defense budget and the civilian discretionary budget. Debt servicing will eventually crowd out vital areas of spending. There are also unbudgeted future burdens—in health and retirement programs—that will further exacerbate the debt problems.

A third approach would be to cut some mandatory spending to make room for more civilian discretionary spending. In general, Republicans have shown a special zeal for cutting both the civilian discretionary programs and the mandatory programs. In particular, among the mandatory programs they would end Obamacare and slash Medicaid, food stamps, and unemployment insurance.

The Democrats of course have rejected cuts to mandatory spending, especially on the grounds that such cuts would hit the poorest Americans at a time when poverty is high, unemployment is recalcitrant, and the bonanza of wealth for the richest Americans is unprecedented. (On the recent Forbes list, the richest 400 Americans now have a total of $2 trillion in net worth, an average of $5 billion per person.) Democrats are therefore far more drawn to arguing that more debt won’t hurt us much, and might even help.

I would like to argue for a fourth course, one with new revenues far larger than Obama and the congressional Democrats have espoused, and with cuts to the bloated costs of the health care system. That system is flagrantly and notoriously overpriced, by roughly 50 percent compared with health care costs in other high-income countries. If even half of that excess cost were eliminated through serious reforms in health care pricing, the direct federal outlays on health would fall by as much as 1.5 percent of GDP. Revenues would also rise indirectly, by as much as 0.3 percent of GDP, because lower health care costs would also mean lower itemized tax deductions on private health care plans. In total, we could probably gain nearly 2 percent of GDP in deficit reduction without sacrificing the quality of health services.

Health care reform would entail forcing today’s doctors and other health care providers to rationalize their pricing and administration, for example by legislating a requirement of one price for all patients, rather than the highly discriminatory pricing arrangements that prevail today, in which many hospitals charge whatever they can get away with, using an opaque and grossly unfair pricing system. We could also lower medical costs by increasing the number of primary-care physicians trained each year, and allowing more procedures to be done by paramedics. Hundreds of billions of dollars of savings would be achieved by cutting back the excess earnings in the health sector, including overpaid specialists, high-cost hospitals, drug companies charging sky-high prices for patent- protected medicines, and private health insurers. The heads of “not-for-profit” hospital systems could no longer expect the multimillion-dollar paychecks they are now collecting.

Progressives should also certainly support the ongoing cuts in military and intelligence spending, and additional ones pushing the military budget down to around 2 percent of GDP—a level that would still leave the US the largest military power and spender in the world. The US would have to plan on more diplomacy and fewer wars of choice, a shift that would increase rather than diminish our security.

As for civilian discretionary spending, the US needs more of it, although better concentrated. Important new civilian programs—such as low-carbon energy, upgraded infrastructure, science and technology, and training for twenty-first-century skills, such as the use of information technologies—will require new partnerships between the government and private investors. One excellent proposal, made in these pages by Felix Rohatyn,* is for a National Infrastructure Bank. The government would put in perhaps $10 billion per year at the start to leverage another $100 billion per year of private financing for roads, bridges, power grids, and coastal flood protection, among other projects. Similar public-private initiatives are needed to face the urgent challenge of climate change and to exploit the vast growth potential of science and technology, including information technology, nanotechnology, genomics, and much more.

To accomplish these goals, we will need government financing that provides a much greater role for private investors as well. I outline the costs and benefits of this proposal in the accompanying table, which shows in detail the historical values of revenues and spending, and compares the new bipartisan budget agreement with what I believe to be a far more acceptable alternative. Specifically, I would suggest that the civilian discretionary budget be targeted at 5 percent of GDP in 2023, together with defense spending at 2 percent of GDP and mandatory programs at 12.7 percent of GDP. This last figure is equal to the Democratic budgets minus the savings in health care. I would also aim to keep interest payments down to 2.4 percent of GDP by running smaller budget deficits than the Democrats now envision. In sum, total outlays in 2023 would be around 22.1 percent of GDP. We would need tax revenues of around that level as well in order to keep the debt–GDP ratio on a gradual downward path.

Where can the added 2 percent of GDP in revenues be raised? In addition to the loophole-closing that the Democrats have proposed, we should adopt a wealth tax on very high net worth, say 1 percent on net worth above $5 million in financial assets. This would raise around 1 percent of GDP from the very richest Americans. A new Financial Transactions Tax, as will be adopted in Europe in 2014, could also raise perhaps 0.25 percent of GDP. More aggressive taxation of offshore corporate income now hidden away in tax havens by the likes of Google, Amazon, and Apple would also bring in tens of billions of added revenues per year. The practice of letting hedge fund owners cap their federal income tax rates at 15 percent by using the capital gains tax rate should have been scrapped years ago. It is an abuse that has been maintained through the heavy political influence of Wall Street on both parties. There never was a scintilla of justification for it.

Revenue increases like these will certainly not be agreed on in the near future, at least not before 2015, and probably not before 2017. Such changes in the budget must be central to the program of a political movement; they will not emerge simply from an agreement of this Congress and White House. Yet the Democrats have stopped trying to think through the large-scale problems of the future. They have wittingly or unwittingly bought into the destruction of the civilian discretionary government even as they continue to talk about long-term investment in America’s potential.

Such investments in our future will remain a lie until we are serious once again about funding them, by cutting waste and raising revenues as needed. All of this can be accomplished, but only by facing down the corporate lobbies, including the private health care providers, the military-industrial complex, and Wall Street. Obama wouldn’t do it. Yet that’s the real change that we need.

Is such a new political movement possible? I think it is, despite appearances to the contrary. Obama’s coalition—the young, minorities, and university-educated urbanites—has shown that it is indeed a winning coalition, whether by the Democrats or even by a third party that comes to supplant them. A majority of public opinion favors action on the issues I have outlined: more taxation of the very rich, and more spending on education, clean energy, and job training. The public wants a smaller military and less meddling overseas. The problem is not with public opinion but with the narrow self-interest and social outlook of powerful corporations, interest groups, financial lobbyists, and large investors.

Obama has been brilliant in gaining and holding power, but unwise in failing to use it for progressive purposes. He surrounded himself in 2009 with unimaginative advisers and revolving-door bankers who told him to avoid major fights with the powerful lobbies. Rather than taking on the problem of inflated health care costs, he brought in the health care industry to support the expansion of health coverage. Rather than taking on the egregious tax abuses of the corporate sector and the very rich, he settled in January 2013 for an almost symbolic rise in taxes for those with incomes above $400,000. Rather than reforming the budget, he pursued a deficit-financed two-year stimulus that provoked the Republicans, piled up public debt, and achieved next to nothing for the long term. From the very start of 2009 he budgeted for a decline in discretionary government programs as a share of national income. Americans were first confused and ultimately disillusioned by the contradictions between Obama’s high-minded rhetoric about investing in the future and the reality of dispiriting cuts to those very programs.

Much as conservatives hate to admit it, the landslide election of Bill de Blasio as mayor of New York City may prefigure the start of a new swing of the national political pendulum as well. He won a resounding victory, in part by calling for a small rise in taxes to fund preschool education, a major reform that would help relieve the disadvantages faced by poorer children. The recent meeting of mayors at the White House may give a hint of possible local pressures for increased public investments and public services. We’ve been on a thirty-year course of diminished public investments in our future. The dismal results are plain to see. As the historian Arthur Schlesinger Jr. famously noted, we can observe cycles between private greed and public service at roughly thirty-year periods. Even though the new budget agreement looks like a new bipartisan consensus, I believe that it will be merely the lull before a far more decisive struggle to restore a forward-looking national strategy, and a budget to match.

—January 8, 2014

This Issue

February 6, 2014

The Whistleblowers

The Most Catastrophic War

On Breaking One’s Neck

-

*

Felix G. Rohatyn and Everett Ehrlich, “A New Bank to Save Our Infrastructure,” The New York Review, October 9, 2008. ↩