1.

Do we need another book on Bretton Woods, the conference in 1944 in New Hampshire that established a new monetary system following World War II? The answer is yes. The two excellent existing histories of Bretton Woods, by Richard Gardner (1956) and Armand van Dormael (1978), are now dated.1 New historical materials have become available. Since the crash of 2008 the arcane subject of the world’s money has become urgently relevant. So a fresh look at the famous conference is warranted.

International Monetary Fund

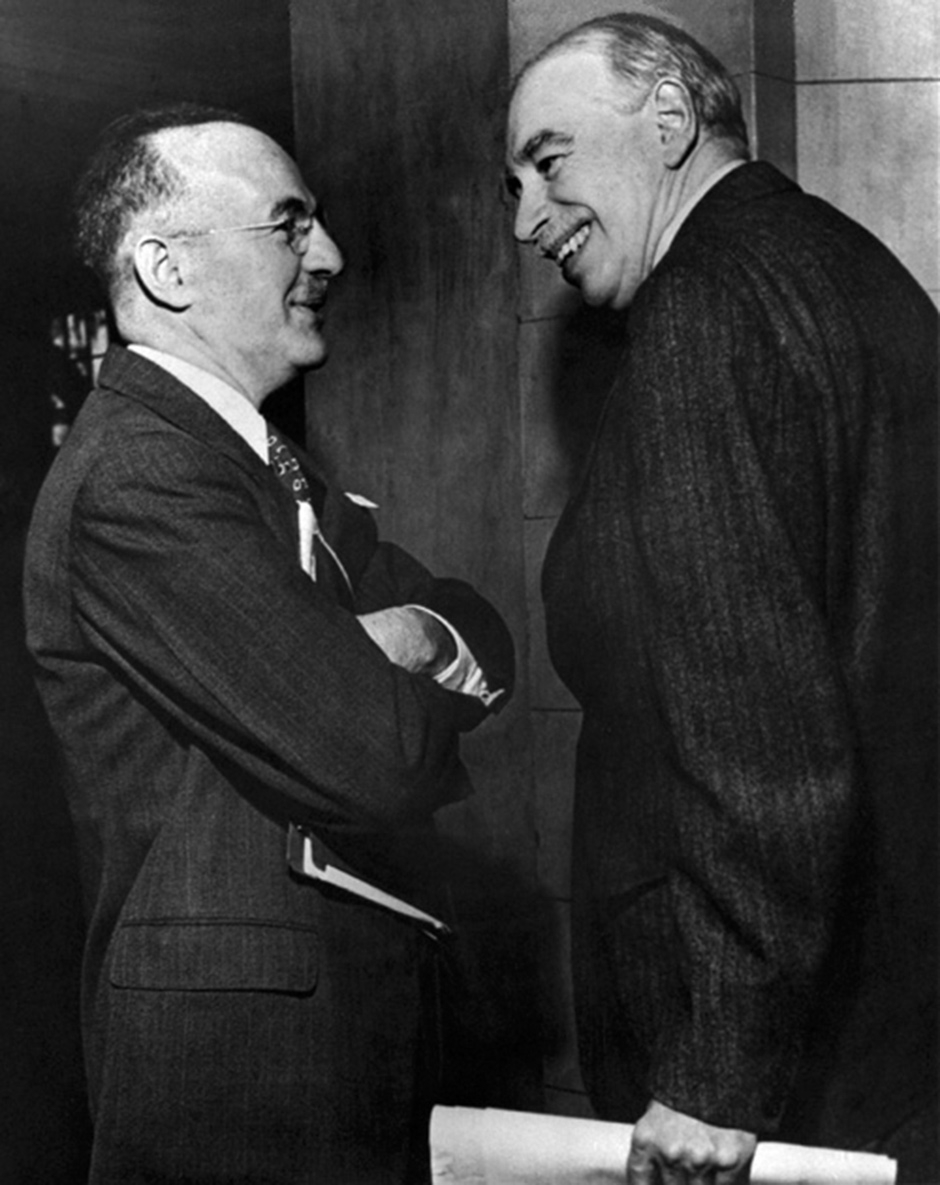

Assistant US Treasury Secretary Harry Dexter White and John Maynard Keynes, adviser to the UK Treasury, at the inaugural meeting of the International Monetary Fund’s Board of Governors, Savannah, Georgia, March 1946. White and Keynes had clashed at the Bretton Woods Conference in July 1944, which conceived the IMF as part of a new postwar international monetary system.

In The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order, Benn Steil has brought together three interesting stories, usually told separately: the life of John Maynard Keynes; the espionage activity of the US Treasury official Harry Dexter White; and the making of the Bretton Woods agreement itself. Steil, a senior fellow at the Council on Foreign Relations, understands the economic issues at stake and has done meticulous research on the history. Every good story that has ever been told about the major actors involved and the happening itself is in his book, and a few more besides. For those who come fresh to the subject, and even for those who know most of it, it is an excellent and revealing account.

At its heart is the clash between the British economist John Maynard Keynes and Harry Dexter White. This is not just a battle between two economists but a competition between two nations, Britain and the United States, for postwar position. For the US the stake was hegemony; for Britain independence. Steil tells the story of how Keynes tried by intellectual superiority to overcome Britain’s weak bargaining position with the United States. In contrast to Keynes, White is merely dour and abrasive. But he compels interest because he has a secret: he was a Soviet agent. Steil’s is the most successful effort yet to link the espionage activity of Harry White to the position he took in monetary politics, though bringing together these two sides of his character remains an elusive task.

The Bretton Woods agreement, as Steil says, set up the “new world order” that dominated postwar monetary history until its collapse in 1971, when Richard Nixon canceled the convertibility of the US dollar into gold. Since then we have lacked a monetary system. Instead we have had a free-for-all with floating, managed, and fixed exchange rates. Excessive accumulation of dollar reserves by countries like China contributed heavily to the financial collapse of 2008. So it is instructive to learn how the leaders of 1944 tried to deal with the problem of international monetary relations—and the conditions of their success and failure.

2.

The run-up to Bretton Woods is framed by the histories of its two main figures, White and Keynes, set against the background of the collapse of the pre-war economic world into disorder and war and Britain’s struggle for survival against Nazi Germany. White is given pride of place for he, rather than Keynes, was the real author of the Bretton Woods agreement.

As Steil notes, the central problem in making sense of White is to link his economic ideas and policies to his activities as a Soviet agent. He did not subscribe to the Marxist theory of the Great Depression, which amounted to saying that it was incurable under capitalism. White was instead an enthusiastic New Dealer; and by the mid-1930s, his policy advice was “thoroughly Keynesian.”

“Stocky, and moonfaced, with round rimless spectacles, blue eyes, and a trim, black mustache,” Steil writes, White was acerbic, quick-tempered and overly ambitious. He was not a top-notch economic theorist, languishing till the age of forty at an obscure American university. But once allowed into Henry Morgenthau’s Treasury—initially as assistant to Treasury adviser Jacob Viner—White displayed a “preternatural ability to explain technical subjects clearly and carefully, and to relate economic principles to actual international political circumstances.” His basic idea, first developed in his Ph.D. dissertation at Harvard, and from which he never deviated, was that a global currency system managed by the United States was an essential condition for the expansion of US exports.

While White was gradually making himself indispensable to Treasury Secretary Morgenthau, he was receiving expensive gifts of Bokhara rugs from the Soviet military intelligence agent Colonel Boris Bykov. His work as a Soviet agent started in 1935 with his arrival at the Treasury, when he started giving Whittaker Chambers, then a courier working for Soviet intelligence, official Treasury documents for copying. Chambers later wrote bluntly:

Advertisement

I had never liked Harry White. I see him sauntering down Connecticut Avenue at night, a slight, furtive figure…. He is nervous at the contact, idles along, constantly peeping behind him, too conspicuously watchful.

White gave up spying in 1939, following the Nazi-Soviet Pact, but resumed in 1941, with a new courier, Elizabeth Bentley, after Hitler’s invasion of the Soviet Union in June of that year.

In 1939, Chambers was the first to “finger” White, but his accusations were dismissed by Roosevelt as fantastic, and White remained at the Treasury throughout the war. Bentley’s later testimony had more effect, and White’s government service was terminated in 1946. But proof of his espionage came only after his death, with the cracking of Soviet intelligence codes (the “Venona project”) and later still from KGB files. In these White, under various code names, is clearly identified as a Soviet “asset.”2

Steil makes the arresting claim that White was a “key player” in precipitating the Japanese attack on Pearl Harbor. He was the immediate author of the ultimatum by Roosevelt that is said to have provoked the Japanese attack on December 7, 1941. Among other demands, the ultimatum insisted that Japan withdraw its troops from China and Indochina. Steil writes that, according to former Soviet military intelligence colonel Vladimir Karpov, “Stalin was the real initiator of the ultimatum to Japan.” Just how Stalin transmitted the ultimatum to White is left rather circumstantial, but Steil—without direct evidence—considers it beyond dispute that White wrote “the key ultimatum demands.” If this is so, he was certainly a useful man for the Soviets to have around.

Why did White become a Soviet spy? Steil conjectures that spying raised his self-esteem. Harvard had rejected him; his lowly position at the Treasury rankled. What seems clear is that his espionage, like that of the British spies Guy Burgess, Donald Maclean, and Kim Philby, resulted from his belief that the Soviet Union was the only effective bulwark against Nazism and barbarism, and that to help the Soviet Union in any way was a moral duty. During the war he added the idea that a close military alliance between the United States and the Soviet Union was the indispensable condition of future world peace. He was not a Communist, but he believed that socialist economics “worked” and that the future would see a convergence between the capitalist and socialist systems.

Britain’s role in the benign dual alliance of White’s imagination was simply to be a dependent and dependable ally of the United States. For this to happen, the then-largest imperial power had to be shorn of its capacity for independent action. Britain was to be kept in the war, but only on terms that precluded its establishment as a rival to the United States. This was the geopolitical meaning of the events leading up to the Bretton Woods agreement, and the agreement itself.

In the discussions leading up to Bretton Woods, White confronted John Maynard Keynes, the chief financial emissary of Great Britain. Aged fifty-six when the war broke out, Keynes was nine years older than White. His official position was merely that of adviser to the chancellor of the exchequer, but such was his intellectual and personal authority that, though far from well, he personally conducted all the wartime financial negotiations with the United States. Steil renders a shrewd if somewhat unflattering portrait of the first celebrity economist, and an accurate if somewhat unsympathetic account of Keynes’s economic theory. (He dismisses his 1936 magnum opus The General Theory of Employment, Interest and Money as “a reliable tract on depression economics.”)

Keynes was not an ideal negotiator, his imperious, if not imperial, style being ill-suited for the job of asking for generous treatment. But he had a crucial and underestimated asset: his intellect. The intellectual content Keynes brought to the negotiations made the Bretton Woods agreement more than a geopolitical device. Keynes’s intellectual ability forced White to refine his own ideas. The result was a monetary agreement that, though imperfect, proved durable, unlike the much inferior 1992 Maastricht Treaty for European monetary union, which started to unravel as soon as it ran into trouble.

The road to Bretton Woods began with Roosevelt’s announcement on December 7, 1940, of the Lend-Lease agreement, by which the US turned over ships and military supplies to Great Britain. This came none too soon: Britain had almost run out of money (gold and dollars) to pay for its war purchases in the United States and, without Lend-Lease, might well have had to sue for peace. In April 1941 Keynes came to Washington on the first of his wartime financial missions to negotiate the terms of what Churchill called “the most unsordid act in history.” Since Lend-Lease was to take the form of a gift of supplies to Britain, haggling over the terms of a loan was not the issue. Rather there were two. The first was, how much Lend-Lease was Britain to get? It turned out that the United States was determined to keep Britain on short rations: enough to continue the war, but not to replenish its gold and dollar reserves.

Advertisement

The second issue concerned the non-financial “consideration” that the US would require in return for the gift. This, it turned out, was a promise by Britain to give up its imperial preference trading system, which discriminated against American goods. When confronted, on his visit in April, with this “consideration,” Keynes raged against what he called the “lunatic proposals” of Secretary of State Cordell Hull. But being of constructive mind, he rejected the idea of promising anything the US wanted and then shuffling out of the promise after the war. Instead, he turned his attention to how Britain might safely and honestly give the United States the assurance it wanted and at the same time help construct a more rational postwar monetary system than the gold standard. The result was his proposal for an International Clearing Union, which he drafted over one weekend when he was back in England in September 1941.

3.

The fatal flaw of the gold standard, as Keynes saw it, was that it lacked a mechanism for adjusting deficits and surpluses in countries’ balances of payments. He wrote: “The process of adjustment is compulsory for the debtor and voluntary for the creditor.”3 The debtor must borrow; the creditor is under no compulsion to lend.

The Keynes plan was designed to provide for symmetrical adjustment by creditor and debtor countries. Central banks would hold their international reserves—i.e., their assets in gold or foreign currencies—in an International Clearing Bank. The balances held by creditors would be automatically available in the form of “overdrafts” to debtors up to an amount limited by the “quotas” they had been assigned. Persistent credit and debit balances would face a rising tariff of penalties. This would “incentivize” countries to shrink their balances to zero over the course of a year. This ingenious scheme was designed to achieve what the gold standard was supposed to do automatically through movements of gold between surplus and deficit countries.

Steil correctly identifies Keynes’s theory of “liquidity preference”—the desire to hold assets in cash—as the “theoretical kernel that seeded Keynes’s new thinking about global monetary reform.” In the General Theory Keynes had pinpointed the “propensity to hoard” as a major cause of depression. He viewed the growing stockpile of gold reserves by the United States, buried in the vaults of Fort Knox, as the chief cause of the world crisis between 1929 and 1932, because it forced deflationary policies on other countries committed to the gold standard. So a crucial defense against future depressions was an international monetary system that prevented the accumulation of reserves by any country. Countries would have to use their reserves or lose them. Keynes thought that, with this monetary system in place, Britain could safely commit to fixed exchange rates and free trade. Keynes wanted his international bank to have enough capital—and Britain’s quota to be large enough—for Britain to avoid having to ask America for loans after the war.

There was, however, no way that the United States, then the world’s chief creditor, was going to cede ownership and use of its gold reserve to an international institution. Specifically, the Americans were determined to get political leverage from loaning out their surpluses, in order to tie borrowers—including Britain—to American interests. But White was working out his own way of making the surrender of imperial preference palatable to Britain. This was his parallel plan dating from March 1942 for an International Monetary Fund. Countries would lend a small proportion of their reserves to the fund, which could then use them to help members who had temporary difficulties with their balance of payments. The IMF would give such help while keeping the countries under strict surveillance, including monitoring of their domestic policies. Agencies for coordinating world trade and postwar reconstruction completed White’s tripartite structure.

The plans of Keynes and White were conceived independently of each other; they overlapped but were not identical. White wanted a reformed monetary system to guard against protectionism, for example in the form of tariff barriers; Keynes wanted a reformed system to guard against depression and unemployment. Whereas Keynes wanted to lock the United States into a rule-based international financial order, White insisted that the United States must maintain control over its reserves, so it could lend them out on its own terms. White’s plan ensured the supremacy of the dollar, because, in the actual circumstances, the dollar alone was convertible into gold. In Keynes’s plan, the money issued by the International Clearing Bank (which he called “bancor”) could not be converted into gold.

White’s plan upheld the doctrine of adjustment of the debtor economy to protect the creditor; Keynes’s plan would have transferred the onus of adjustment onto the creditor. White’s plan called for surveillance of debtor countries’ policies as a condition for loans; Keynes’s plan made intrabank transfers—up to the levels of the “quotas”—almost automatic. White’s plan expressed the optimism of the “coming” power, Keynes’s the pessimism of the “going” power. Both were considerable intellectual achievements: the first serious attempt in history consciously to construct an international monetary system that worked for the benefit of all.

In a chapter called “Whitewash,” Steil shows convincingly how the intellectually sophisticated Keynes plan was defeated by the heavier political artillery behind the White plan. The New York World-Telegram explained why:

The kid who owns the ball is usually captain and decides when and where the game will be played and who will be in the team…. Since the US now owns some twenty-two billions of the world’s reported twenty-eight billions of gold, we think Uncle Sam is going to be the captain of the team or there will be no game…. The idea of “supplanting gold as the governing factor” and apportioning the voting power on the basis of pre-war trade, which would give Britain about fifty per cent more voting power than the US, not only is not good baseball—it is not even cricket.

Even so, the White plan was too generous for many Republicans who denounced the “Keynes-Morgenthau” proposals as a conspiracy to seize America’s gold and pour it into the “European bottomless pit of debt.” The fund, thundered the Chicago Tribune, “is designed to enrich other countries at our expense and make inflation in America inevitable.” At the same time, Keynes was under pressure from British imperialists like Beaverbrook not to concede on imperial preference.

Keynes recognized political reality: “I fully expect,” he wrote to the economist Roy Harrod on April 27, 1943, “that we shall do well to compromise with the American scheme and very likely accept their dress in the long run.” It was not just the dress, but the logic of the White plan that the British were driven to accept: the Americans, Steil writes, “simply rejected [Keynes’s] views on every major matter.” Keynes’s banking principle—the creation of credit by the bank—was sacrificed to White’s principle of loans limited by subscription of capital. Because of the limits set to the US subscription, White’s fund was to have about one third of the capital of Keynes’s bank, leaving the Americans free to use nearly all their gold as they wanted.

There were to be no restrictions on accumulation of reserves in gold or dollars, but there would be heavy policing of fund loans. Members of the fund were to pledge themselves to make their currencies convertible into gold or gold-convertible currencies at a fixed rate. Exchange rates could be altered only with fund approval. The British obtained a couple of concessions: a “scarce currency clause” that would allow a country to limit imports from a persistent creditor, and a more extended transitional period than the Americans wanted. These were the only remnants of Keynes’s grand plan to force creditors to adjust to the needs of borrowers.

The Bretton Woods conference itself, held at a hastily refurbished hotel in New Hampshire between July 8 and 22, 1944, was organized by White. The story of the conference is well known, but Stein tells it well. White chaired the crucial Commission I on the Monetary Fund, shunting off Keynes as chairman of the less important Commission II on the World Bank. Ensconced in his hotel sitting room, Morgenthau would assign “quotas” to the impecunious claimants queuing up at his door. The Soviets, as one historian noted, struggled “between the firing squad…and the English language.” In the end, the agreement that was reached was shaped not by Keynes’s General Theory, but by the determination of the State Department to end discrimination against American exports, and the Treasury’s determination to concentrate financial power in the US.

There is an important epilogue to the Bretton Woods agreement, by which the United States further restricted postwar Britain’s room for maneuver. American management of Lend-Lease had ensured that Britain emerged from the war with minimum reserves and a hugely depleted export trade; and Keynes had failed to secure a bank or a fund big enough to finance Britain’s huge prospective balance of payments deficit. So with the abrupt cancellation of Lend-Lease in August 1945, Keynes was forced to go on his last mission to Washington to beg for an American loan. By now almost terminally ill, he hated the assignment. “May it never fall again fall to my lot,” he wrote to his mother, “to have to persuade anyone to do what I want with so few cards in my hands.”

The loan agreement of December 1945 gave Britain a credit of $3.75 billion (much less than Keynes had asked for) for five years at 2 percent interest (he had tried to get a grant). In effect it abolished the protections for Britain during the transitional period that Keynes had so painfully won at Bretton Woods. Within a year of ratification of the loan agreement the pound had to be made convertible, all exchange restrictions removed, and the system of imperial preference scrapped. White’s efforts to secure a considerably more generous loan for the Soviet Union also foundered. Keynes died four months after his return from Washington; his rival and coarchitect Harry White died two years later, before he could be indicted for espionage.

4.

Steil believes that both Keynes and White were deluded: Keynes for trusting the Americans and White for trusting the Soviets. White was certainly naive about the Russians, but were the British so deluded about the Americans? Steil talks of the “Faustian bargain Britain struck with the United States in order to survive the war.” This is a curious use of the legend. Faust strikes a bargain with the Devil (or at least his servant Mephistopheles) in return for power and riches. Reliance on the United States was hardly that. In any case, it was Churchill who signed the bargain, not Keynes.

The charge against Keynes summed up by Steil is that he sacrificed Britain’s interests for the sake of his “Grand Design.” Britain got “nothing out of Bretton Woods that it could not have gotten on better terms many years later.” What it needed in 1945 was “short-term financing at reasonable cost with few geopolitical strings attached, and possibly a lower exchange rate.” That Keynes “chose to push on with Bretton Woods, and then the American loan, in spite of…wretched terms for Britain, suggests more than a touch of personal pride and concern for his place in history.”

This verdict is superficial. Keynes pursued his “Grand Design” not because he was naive about American politics, but because he was conscious of Britain’s weakness and thought that the United States was the world’s best hope. In this he was less naive than White, with his trust in the Soviet Union. Once the cold war started, the fanciful Roosevelt-Morgenthau-White project of an American-Russian duopoly collapsed. It was suddenly recognized in Washington that Britain was not a rival, but an essential—if subordinate—ally to the United States. American stinginess toward its wartime partner whose strength it had grossly overestimated gave way to generosity as $13 billion was poured into Western Europe to “save it from communism.” The Churchill-Keynes strategy of never breaking with the United States, however great the provocation, was vindicated, though not in the precise form either envisaged.

Today the monetary question needs to be posed somewhat differently: For how much longer can the world’s chief debtor—the United States—continue to supply the international monetary system with its main reserve asset, the dollar? Governor Zhou Xiaochuan of China’s People’s Bank reminded the world in 2009 of Keynes’s “far-sighted” plan for a new international reserve currency to replace the dollar. The main lesson of Bretton Woods is that if a new “grand bargain” is to be struck on reserves and exchange rates, it will have to be done by a few technicians representing a few leading powers. The Bretton Woods system was an Anglo-American creation. Its successor—if there is one—will be negotiated between America and China.4

-

1

Richard N. Gardner, Sterling-Dollar Diplomacy: Anglo-American Collaboration in the Reconstruction of Multilateral Trade (Oxford: Clarendon Press, 1956); Armand van Dormael, Bretton Woods: Birth of a Monetary System, (Holmes and Meier, 1978). ↩

-

2

This has long been denied by IMF historian James M. Boughton: see “The Case Against Harry Dexter White: Still Not Proven,” IMF Working Paper 00/149, 2000. But it is more than enough for a court to convict. ↩

-

3

The Collected Writings of John Maynard Keynes, edited by Donald Moggridge (Macmillan/Cambridge University Press/Royal Economic Society, 1980), Vol. 25, p. 28. ↩

-

4

For an updated version of the Keynes plan, see Paul Davidson, The Keynes Solution: The Path to Global Economic Prosperity (Palgrave Macmillan, 2009). ↩