In response to:

A Case of Inflation from the January 27, 1972 issue

To the Editors:

In a recent review of The New Industrial State [NYR, January 27], Leonard Ross leans on me heavily for both commercial and intellectual aggression against the reading public. I hold generally that authors should suffer in silence—never explain, never complain—except, perhaps, as they have a moral duty to confess even more egregious sins. That is my situation. May I confess?

Professor Ross suspects a certain financial motive in the new edition. Alas, it was very great. The paperback edition of the book is widely used in colleges and universities; to the young, information and figures of even a few years back seem terribly obsolete. So they cease to read and teachers cease to assign and sales suffer—and also, a further point, one no longer persuades. Thus the new edition. The hard cover version which troubled Professor Ross was, however, financially negligible and otherwise unimportant except for attracting reviewers.

I must further confess—as my publishers will affirm—that my policy is to extract all possible revenue from what I write. I do not use an agent; I suspect them of being a trifle soft. The reason for this avarice is elementary. What an author does not receive, a publisher tends to get. Also, I apprehend, publishers do better when under financial pressure. Also there are ways of mitigating such greed. As federal funds and Woodrow Wilsons for graduate study in economics have withered in these last years, book revenues have proved a very handy substitute at Harvard. However this is a delicate point since I have had more than enough left over.

Now while I have the attention of my critic I would like to correct him on his two substantive points. I was greatly influenced in my now distant youth by Veblen and still am. (I am currently editing a new edition of The Theory of the Leisure Class to appear later this year.) But Veblen made no point of advertising, and therewith the initiative of the great corporation, in creating consumer demand. Industrial products, he thought, “show a more perfect adaptation of means to end” but this, he added, “does not save them from disesteem and depreciation, for they fall short under the test of honorific waste.” In Veblen’s view consumption increased in the pecuniary standard of living not in consequence of the encouragement or promotion of the producer but because of vicarious comparison with the usage of others of the same social class and the urge to conspicuous consumption. Veblen is a treasure-house of ideas. But this does not justify the assumption, noticeable in numerous modern writers whose reading of him I sometimes suspect to be casual, that everything is there. Veblen wrote on these matters just before the turn of the century and before advertising was a visible force.

There are similar difficulties in the case of Berle and Means. Here my debt is direct—and nothing could be less a secret. (I owe much also to James Burnham and Aaron Gordon.) But Adolf Berle believed that the separation of ownership from control would lead to irresponsibility—the managers would loot the firm and the owners. It remained for Robin Marris and William Baumol to show that, after reaching a certain earnings threshold, the managers would emphasize growth. That is what rewards them. This is vital for my argument. In the list of people from whom I have filched, Marris and Baumol must be prominent.

This leads me to a final point. Professor Ross thinks the book lacks originality. I wouldn’t dream of suggesting otherwise. An earlier version of any idea is always available; other people’s thoughts are the rungs up which we climb. And to claim originality is, in any case, terrible academic strategy. It proclaims irreverence for one’s precursors—lousy scholarship, no less. Who wants to be accused of that!

John Kenneth Galbraith

Harvard University

Cambridge, Massachusetts

Leonard Ross replies:

I had meant to tease Professor Galbraith not about his avarice (we are all sinners; Professor Galbraith, as he has often pointed out, distinguished only by success), but about the way his new edition exemplifies every mischief of Galbraithian capitalism: planned obsolescence, misleading advertising, shameless puffery, administered pricing. Also I thought it was a handy demonstration of the vexations of another Galbraith enthusiasm, wage and price control.

Consider the problem of whether or not the books manager of the Harvard Coop was committing a federal offense by removing $6.95 copies of The New Industrial State, first edition, and replacing them with $8.95 second editions, right in the middle of the ninety-day freeze. The question seems to turn on whether changing a few figures made the $8.95 version a “new and substantially revised edition.” To say yes is to invite Ford to escape controls by redoing its grillwork. To say no is to leave authors without guidance on just how many research assistants they must hire to satisfy Uncle Sam. Either way it is a mess.

Now as to scholarship. One bold confession deserves another, and I must admit that my recent rereading of Veblen was concentrated on the forty-one pages in which he says everything that Galbraith had to say about advertising, and not on the many hundreds of pages in which Veblen wrote of other matters. Professor Galbraith seems to have made the opposite mistake. Perhaps one inevitably misses a rung or two while clambering up the ladder of knowledge. In any case, here’s a Veblen sampler, from his 1923 book, Absentee Ownership:

[In the last few years] salesmanship has come unequivocally to take the first place in the business of manufacturing and merchandising….

Judicious and continued expenditure on the like expedients of salesmanship will result in what fairly may be called a quantity production of consumers for the goods and services in question.

As has already been remarked, the quantity-production of customers by appliances of publicity is a craft which runs on applied psychology. The raw material in which the work is to be done is human credulity, and the output aimed at is profitable fixed ideas.

On the question of corporate growth as the object of managerial striving, Professor Galbraith might do well to advance to the back pages of Berle and Means:

Just what motives are effective today, in so far as control is concerned, must be a matter of conjecture. But it is probable that more could be learned regarding them by studying the motives of an Alexander the Great, seeking new worlds to conquer, than by considering the motives of a petty tradesman in the days of Adam Smith. [The Modern Corporation and Private Property, p. 350.]

Finally, on the subject of the claimed originality and accomplishment of The New Industrial State, Professor Galbraith might wish to refer to the words of Professor Galbraith:

Numerous writers had dealt with part of this reality [the new world of the great corporation] but without assuming larger change. I became persuaded, reluctantly, that these parts belonged, indeed, to a much greater and very closely articulated process of change.

[The New Industrial State] stands in relation to [The Affluent Society] as a house to a window. This is the structure; the earlier book allowed the first glimpse inside.

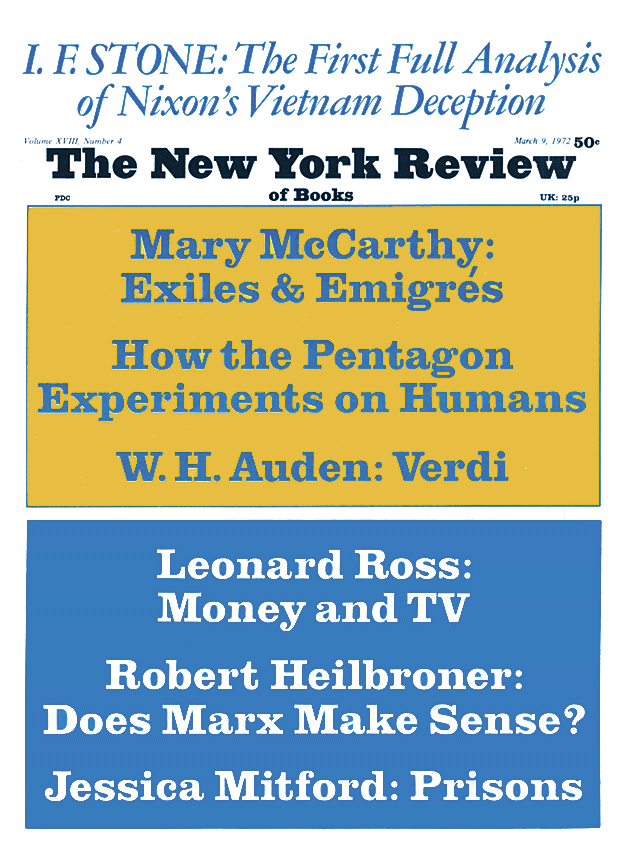

This Issue

March 9, 1972