In response to:

The Budget: Whom Can You Believe? from the August 10, 1995 issue

To the Editors:

Felix Rohatyn’s article on “The Budget: Whom Can You Believe?” [NYR, August 10] could not be more timely and useful. Above all, I salute his criticism of the federal budget as a “grotesque document that reflects neither accounting nor economic reality.” Rohatyn makes clear that this is largely because the budget makes no distinction between the ordinary expenses of government, which are properly financed by tax revenues, and a quite separate class of expenditures for public investment that are properly financed by the sale of government securities. As a consequence of mixing together current and capital spending, the budget shows a “deficit,” whenever the government borrows, regardless of whether the activities financed by the proceeds of its bond sales are the salaries of Congressmen and bureaucrats, or the construction of an aviation guidance system.

Rohatyn wants to rescue us from this hopelessly misguided course by establishing a capital budget separate from the regular expense budget. The expense budget should normally be in balance. The capital budget, however, would be limited to projects which qualify for borrowing because their usefulness long outlasts the period of one year to which a current budget applies. Rohatyn does not mention that many European governments already follow this practice. The British, for example, classify government expenditures into those “above” and “below” the line—above-the-line-items referring to ordinary running expenses of government; below-the-line expenditures to items like schools and bridges that constitute parts of the public infrastructure.

Rohatyn strongly endorses the clarifying role that a capital budget would serve, but he does not explain a second, much more “radical” consequence it would entail. Once borrowing for capital purposes has been legitimated, the conventional political opposition to “deficits” loses its rationale, and becomes of necessity the much more complex problem of determining how large public investment spending should be. There is no easy answer to this question except that “zero” would imperil our long-run social and economic prospects.

To be sure, the difficulties of establishing a reasonably accurate capital budget are vast—as Rohatyn says, today we do not even know how much public borrowing is for investment. And once we do know, problems remain. How rapidly does one depreciate investment in, say, public health research? Do we count defense spending as investment? But assuming the Congressional Budget Office could give us plausible figures, how large should the total be? Private capital spending comes to just over one trillion a year, a potpourri of plant and equipment, office buildings, homes, new Disneyworlds, and the like. Its size is determined by the prospective profits it will earn its investors. A very rough guesstimate of public investment might come to something like $200 billion a year. Is this the right amount? The question is undeniably difficult and properly controversial, but at least a capital budget puts the whole “deficit” question—that is, the appropriate size of government borrowing—into a new light.

It is here, incidentally, that I must take issue with Rohatyn’s assertion that public investment projects should provide for “paying back the interest and principal on the bonds.” That advice may be true for corporations whose capital projects are designed to yield profits, but cannot be applied to public projects which will never directly repay their sponsoring agencies unless we put tolls on every road and charge admission to every public school. In the long run, to be sure, public investment should improve our health, education, and general environment and thereby increase our incomes and our ability to pay taxes, but rarely, if ever, will user taxes alone—the equivalent of private price tags—repay the cost of the originating project.

One last word: Public investment creates public debt, exactly as private investment normally creates private debt. One hears much these days about the “burden” this public debt will impose on our children. We hear less about the consequence of removing that burden by retiring our debt. Retiring debt means that there will exist fewer and fewer government bonds, which are our debt. When there is no longer any debt, there will no longer exist any securities backed by the full financial capability of government. In what bonds will our children then invest the Social Security retirement trust? What will their banks, or businesses, or they themselves use as giltedged securities? Zero public debt would not be a blessing; it would be an unmitigated catastrophe.

Thus, as with the deficit, the debt is a matter in which well-meant moral judgments, taken from our private experience, seriously impede our understanding of the way in which complex economic societies work. Public borrowing is not a fall from grace, but a necessity for a healthy capitalism. Public debts do not lead to bankruptcies, but create assets without which no commercial nation could operate. Felix Rohatyn does not extend the thrust of his argument to its full extent, but I hope we would not think he would disagree with the conclusions to which they lead.

Robert Heilbroner

Bridgehampton, New York

Felix Rohatyn replies:

I very much appreciated Robert Heilbroner’s thoughtful comments on my article. I do wish to clarify what may be a misunderstanding. Mr. Heilbroner interprets my saying that investment projects should provide for “paying back the interest and the principal on the bonds” as referring to repayment solely from user fees, tolls, or other similar devices. That, as he points out, would be an inappropriate basis for financing public borrowing.

I simply meant that if a dedicated tax, such as a gasoline tax, is used as security for the repayment of bonds, that repayment should take place on a schedule that would pay off the bonds more or less simultaneously with the expiration of the useful life of the project financed. The tax, and not the fees, would provide the principal source of payment.

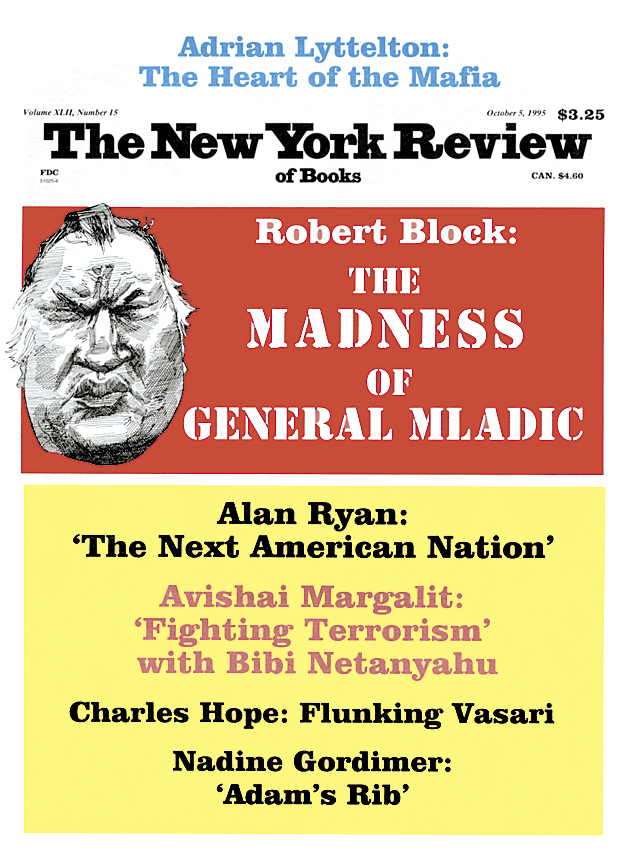

This Issue

October 5, 1995