In response to:

White Mischief from the October 17, 1996 issue

To the Editors:

Jason Epstein’s commentary on “Conservative Mischief” or “White Mischief,” as the headline for some reason reads on the inside pages [NYR, October 17, 1996], pokes around in some interesting places. I found myself easily interested until I discovered that the Laffer Curve was “the most damaging of the intellectual ‘hoaxes’ fomented by conservatives like Irving Kristol and The Wall Street Journal.” It is, Epstein asserts, “the crackpot theory that led Ronald Reagan to believe that huge tax cuts in federal taxes would lead to federal surpluses, when the actual outcome proved to be a cumulative deficit of $3.5 trillion.”

It would take too long to explain the crosscurrents of several separate policies that produced the $3.5 trillion deficit. It has been explained elsewhere. It is incorrect, though, to describe the Laffer Curve as an “intellectual hoax.” It is simply the graphic of an axiom, an eternal truth—the law of diminishing returns. At the time it was put forth, the top marginal rate on interest and dividend income was 70 percent. This was certainly not the highest rate in the world at the time. It was 96 percent in the UK and 97.5 percent in India. The average top rate of income tax around the world was above 60 percent.

At present, there is no marginal income tax rate I know of in the world at 60 percent. Most are below 40 percent, including in the United States, where it is 38 percent. Democratic liberals who have sainted John Maynard Keynes for a great many good reasons are silent when you bring up Keynes’s argument that because of the law of diminishing returns, no tax rate should be higher than 25 percent. The concept behind the Laffer Curve is as old as civilization. There is nothing crackpot about it.

In my 1978 book, The Way the World Works, I named that curve after Arthur B. Laffer, who was the first economist to turn the ancient intellectual concept into a visual graphic. I’d spent the previous four years trying to persuade liberal Democrats that while it is imperative that the richest citizens bear the greatest burden of government, there comes a point in the rates where the rich avoid paying the higher taxes, and the burden falls on those who are not rich. When no Democrats showed interest, I changed my party affiliation and, with the help of Irving Kristol, Jack Kemp, and The Wall Street Journal, sold the idea to Ronald Reagan. That’s the history.

Jude Wanniski

Morristown, New Jersey

Jason Epstein replies:

The Laffer Curve was a hoax because its allure and effect were not increased productivity but a tax cut for the rich. Thus the Laffer Curve illustrates another phenomenon as old as civilization—or even older: the tendency for wolves to dress like sheep.

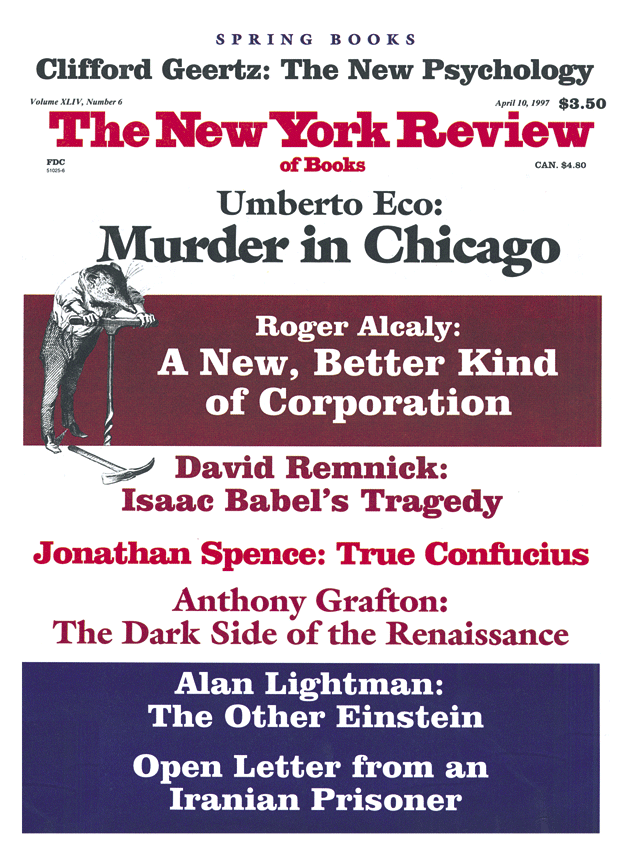

This Issue

April 10, 1997