Not the least striking revelation of Michael Lewis’s excellent book, The Big Short, is that this author of financial best-sellers has changed his mind. In a column for Bloomberg News in early 2007, he praised the rapidly expanding market for derivatives. Visiting the annual meeting of financiers and policymakers at the World Economic Forum in Davos, Switzerland, that year, he was exasperated by the fears of some of the participants. “None of them seemed to understand that when you create a derivative you don’t add to the sum total of risk in the financial world,” he wrote, sounding arguments very similar to those made by Alan Greenspan. “You merely create a means for redistributing that risk. They have no evidence that financial risk is being redistributed in ways we should all worry about.”

As we now know, derivatives were the instruments that enabled Wall Street to stretch capital dangerously far—and were at the center of the financial crisis that began that year. They are investment contracts between two parties based on other securities, which require little capital up-front, enabling buyers and sellers to take temporary large investment stakes inexpensively, including in mortgage securities. “What we have found over the years in the marketplace is that derivatives have been an extraordinarily useful vehicle to transfer risk from those who shouldn’t be taking it to those who are willing to and are capable of doing so,” Greenspan told Congress in 2003. Lewis wrote in 2007: “The most striking thing about the growing derivatives markets is the stability that has come with them.”

Soon after Lewis’s column, the housing market crashed. Then, in the fall of 2008, the financial markets collapsed as well, business lending worldwide came to a standstill, and Lewis apparently began to reconsider practically everything he had written on this subject. He heard that a hedge fund manager named John Paulson made $4 billion betting against mortgages by means of derivatives. “It was late 2008,” he writes in The Big Short. “By then there was a long and growing list of pundits who claimed they predicted the catastrophe, but a far shorter list of people who actually did.” Lewis, whose first book, Liar’s Poker (1989), was a revealing insider’s account of the beginnings of the new mortgage markets, decided to find out what the handful of people who did “stand apart from mass hysteria” understood that others didn’t.

Through these contrarians, he untangles in depth the sources of the crisis in ways that none of the recent literature on the subject has matched. Lewis shows that abstract principles govern the affairs of men much less than do plain, homely, and base human motives. The financial crisis, he concludes, was the work of people on Wall Street and mortgage brokers who acted in their self-interest without fear of either legal or economic reprisal. Whereas former treasury secretary Robert Rubin argued that “we all bear responsibility for not recognizing” the “possibility of a massive crisis,” Lewis shows that it was indeed possible to know what was going on—and more to the point, that the most dangerous activities in financial markets could have been stopped.

The recent Securities and Exchange Commission suit against Goldman Sachs, which alleges that John Paulson chose the risky mortgage bonds that Goldman bundled together and deliberately sold to others, will not surprise readers of this book. Paulson made a billion dollars by betting against derivatives based on those bonds, and Goldman’s investors lost a billion dollars. It was a small drop in a dark ocean.

Lewis relates in detail the stories of the shrewd leaders of three investment firms who were convinced by the early 2000s that the mortgage market was bound for a downturn if not outright collapse. These were not heroes. If they had a moral conviction that powerful forces on Wall Street were rigging the market, most were more interested in making money than in challenging a bad system. The exception was Steve Eisman, a “strident” Republican who voted for Ronald Reagan twice and had done research on mortgage lenders as an analyst for Oppenheimer & Co. in the early 1990s. He became incensed that these lenders made so many deceptive loans to home buyers who likely would not be able to repay them. Some blamed the homeowners. “‘I’m going to lie on my loan application?’ Yeah, people lied,” he said. “They lied because they were told to lie.” Working on Wall Street turned him into a political liberal.

Eisman was observing the first round of subprime mortgages—loans made by mortgage brokers, known formally as originators, to people with poor credit scores and generally poor prospects of repayment. He became furious at what he saw. A Harvard-trained lawyer from a well-off family, Eisman went on to bet against what he saw as financial injustice with, to his partners, sometimes uncontrollable intensity. In 2004, he started his own hedge fund, FrontPoint, later to be bought by Morgan Stanley, and his obsession with subprime mortgages only grew.

Advertisement

It was by now the second stage of the subprime boom, the first having ended in the late 1990s with one mortgage broker’s bankruptcy after another. Not merely tens but now hundreds of billions of dollars’ worth of subprime mortgages as well as hundreds of billions of dollars’ worth of more conventional mortgages were issued each year and they were repackaged into mortgage-backed securities and sold by Wall Street bankers to pension funds, insurance companies, and other investors in the US and around the world. This had become known as securitization. Eisman knew he could sell stocks short, i.e., by selling shares he did not own but borrowed and keeping a profit when their price fell. But he could not yet figure out how to sell short the mortgage market itself, in which hundreds of billions of dollars’ worth of securitized bonds were being issued and used as collateral for the bad loans he saw being written by unscrupulous brokers.

Meanwhile, Lewis writes, Dr. Michael Burry was also trying to figure out how to sell short the inflated mortgage bond market. Burry had been fascinated with the stock market since he was a boy. And Burry was obsessive, shutting out most of the rest of the world when he could. He attributed his antisocial behavior and single-minded intensity to having lost an eye to cancer as a child. Later, when his son was diagnosed with Asperger’s syndrome, he discovered that he had it also.

Burry became a doctor and served as a resident at Stanford Hospital, but gave it up to open an investment firm, Scion Capital. By 2004, he had a successful record as an investor in unpopular, undervalued stocks. But now, his analytical interest turned to the mortgage market. He started by observing the rising number of dubious mortgages being written. By doing more research, he came to believe that the huge numbers of mortgage bonds being packaged by Wall Street and sold to investors around the world were ultimately doomed. His own investors were dubious. Why would he turn from investing in undervalued stocks to selling bonds short? But Burry was persistent.

Charlie Ledley and Jamie Mai started Cornwall Capital Management in a shed behind a friend’s house in Berkeley, California, in 2003. A natural contrarian, Ledley believed, writes Lewis, that “the best way to make money on Wall Street was to seek out whatever it was that Wall Street believed was least likely to happen, and bet on its happening.” But what made Ledley and Mai especially good at what they did was their tenacious research. It did not take them long to decide that they had to invest against the latest and, by sheer volume, the greatest rage of the age, Wall Street’s mortgage bonds. Securitization had gone much too far.

Lewis traces the thinking of these four men as they try to make sense of the new markets that seemed on the surface to make no sense at all. Trillions of dollars’ worth of new mortgages were written in the 2000s, and, once securitized, they became the primary source of income for many of Wall Street’s major firms, especially after the collapse of high-technology stocks in 2000. As the availability of mortgages increased, house prices rose at a faster pace than ever recorded, and by 2004 the proportion of adults owning homes rose to a record high of nearly 70 percent. Rising home values were also financing consumption, as new mortgages and home equity loans were taken out to buy appliances and cars and to send children to college. Interest on mortgages continued to be tax-deductible, while interest on credit cards and auto loans was not.

Wall Street began to securitize mortgages in the late 1970s and early 1980s, led by bankers at Salomon Brothers, where Lewis once worked, and at First Boston. The process involved turning mortgages into the equivalent of a straightforward bond, a financial piece of engineering that is harder to do than it may sound. Mortgages usually pay higher interest rates than corporate bonds, but they are often repaid early by homeowners, typically when interest rates fall and they can get a better deal, and, therefore, unlike with conventional bonds, investors cannot count on a guaranteed return. The potential for default on the outstanding interest on a package of thousands of mortgages is also often harder to assess than the riskiness of a bond issued by, say, a single company.

To make securitization work, the bankers bundled thousands of mortgages into a single package and sold different classes, or tranches, of bonds based on them. Of all the interest paid by the homeowners each year, a portion was first allocated to the highest tranche, usually comprising 80 percent of all bondholders. Thus, even if homeowners repaid early or defaults were higher than anticipated, this top 80 percent would typically get all the interest expected. After they were paid their interest, what was left went to the next tranche, and so forth down the line. The lowest tier, or mezzanine, got the remains and was most susceptible to loss (other than a small sliver at the very bottom of the line). The key to success was that the ratings agencies, led by Moody’s and Standard & Poor’s, agreed to rate the senior tranche, or 80 percent of the bonds, triple-A. The mezzanine got the lowest rating, triple-B.

Advertisement

Investors around the world poured money into mortgages by buying these seemingly safe and predictable bonds, and Wall Street earned enormous fees for creating and selling them. The triple-A bonds paid 1 to 3 percent more in interest than triple-A corporate bonds. The triple-B bonds were risky but paid considerably more than corporate bonds. Wall Street was able to raise so much money that the scarce commodity was no longer financing for buying bonds but finding home buyers who needed mortgages; originating more and more bad mortgages became inevitable.

When Eisman, Burry, Ledley, and Mai got interested in trying to short mortgage bonds, the originators of mortgages—the major Wall Street banks, and subsidiaries that also originated mortgages—were aggressively selling riskier home mortgages to less creditworthy borrowers. They often did so with adjustable interest rates that began at low levels but would rise after a set period. Lewis writes that even the FBI had warned publicly of an epidemic of fraud.

Then, in 2004, the Federal Reserve under Greenspan started slowly raising short-term interest rates, after having cut them sharply in the preceding three years. When rates on the adjustable rate mortgages were reset upward, and thus the monthly payments due on them went up as well, Eisman and Burry reasoned, defaults would soon rise, especially on the growing number of subprime mortgages. Homeowners were told by mortgage brokers that they could refinance and get a new low-rate mortgage because home prices would keep rising. The brokers didn’t say that if house prices simply flattened out, that option might no longer be available. By 2005, average prices were flattening and by 2006 they were falling.

Huge numbers of new subprime mortgages, written in 2004 and 2005, would become especially vulnerable to defaults in 2006 and 2007, when their adjustable interest rates went up. If interest wasn’t being paid, the mortgage bonds would fall rapidly in price. Several of the investors in Lewis’s book saw that the triple-B tranches, the ones that bore the losses of interest from defaults first, would be sharply affected almost immediately.

But how could you sell short the triple-B tranches? That is, how could you sell a mortgage bond without owning it and therefore profit when it falls in value? Burry was the first to find a way. The instruments called credit defaults swaps (CDSs) had been invented years earlier to provide corporations with insurance against the failure of borrowers to repay loans. The buyer of the insurance, usually the corporation that lent the money, paid an annual fee, based on the size of the loan, to an investor who agreed to compensate the lender for any losses if the borrower defaulted. But no one Burry knew of was writing insurance on mortgage bonds until he started knocking on the doors of the major investment banks to tell them he was willing to buy such insurance. If borrowers failed to pay back what they owed, then Burry would receive payment on the insurance he had bought against that very failure.

Goldman Sachs and Deutsche Bank were the only ones ready to oblige. (Burry got the swaps and derivatives trade association to set up the rules of the trade.) They even let Burry choose the bonds on which he wanted to buy insurance, and Burry was brilliant in his ability to choose bonds likely to fail. Though the Wall Street firms were at first slow to sell the insurance, by 2005, Burry had insurance on $1 billion worth of such mortgage bonds for which he generally paid $2 to $2.50 annually for a credit default swap on every $100 worth of triple-B mortgage bonds. He figured that even if he had to wait three years, it would cost him no more than $7.50 for a possible return of $100 if the value of the triple-B tranches fell to zero.

Not satisfied with ordinary mortgage-backed securities, however, Wall Street bankers had begun in 2000, according to Lewis, to create a new, more opaque vehicle called the collateralized debt obligation, or CDO. This was a derivative based on existing mortgage-backed securities that was in turn divided into new tranches and sold again to investors. The CDOs became very popular in the 2000s, creating more debt to sell at enticing interest rates, with no more collateral. Increasingly, the CDOs were based entirely on the risky triple-B tranches of mortgage bonds—those most likely to be toppled by even a modest rise in defaults. But as it turned out, those triple-B tranches were increasingly being sold as triple-A value. Charlie Ledley in particular could not believe what he saw—or, better put, discovered—because it took him some time to figure it out.

This transformation of triple-B into triple-A or double-A debt was the source of huge fortunes on Wall Street and a disaster for the nation. Wall Street sold a Ford as a Lincoln and at a lower price than a real Lincoln. Making this clear is Lewis’s finest contribution. As with the conversion of plain mortgage bonds into tranches, the ratings agencies often agreed to assign triple-A ratings to the highest tier of the CDOs—80 percent of the new bonds. In fact, however, these were often made up of high-yielding triple-B bonds, which enabled the corporate issuers to pay comparatively high yields on the triple-A tranches of the CDOs, attracting a lot of investors and making fees every step of the way. Many investors never looked into the composition of these CDOs.

To Ledley and Mai, a CDO “was essentially just a pile of triple-B-rated mortgage bonds.” And they were stunned. “It took us weeks to really grasp it because it was so weird,” said Ledley. The principle behind tranching was that even in a market downturn, only some mortgages would go bad, not all of them, and you could create a hierarchy of bondholders. The triple-B tranches were all at the bottom of the pile, however, and they all could go bad almost simultaneously because they were designed to take the first losses. Ledley and Mai computed that if default rates rose to only 7 percent on the mortgages in the CDOs, the double-A and triple-A tranches could fall sharply in value.

Still, the ratings agencies, coached by the investment banks, rated the CDOs as if they were truly diversified—giving the impression that these derivatives were based on a bundle of different kinds of mortgages with geographic diversification that would not all topple together. As Lewis writes, the investors became subject to an illusion:

The machine that turned 100 percent lead into an ore that was now 80 percent gold and 20 percent lead would accept the residual lead and turn 80 percent of that into gold, too.

To Ledley and Mai, the willingness of ratings agencies—led by Moody’s and Standard & Poors—to provide triple-A ratings for a large proportion of the CDOs composed of low-rated mortgage-backed securities amounted to rigging the market. Ledley knew that ratings agencies had conflicts of interest—after all, they were paid large fees by the issuers. But this was the most egregious ratings practice of them all. “Maybe you can’t prove it in a court of law,” said Ledley, “but it’s fraud.”

Ledley and Mai then undertook arguably the most brilliant investment strategy of the time. Rather than buy insurance on the triple-B-rated bonds for $2 or $2.50 per $100, as Burry did, they bought insurance on the high-rated tranches for only 20 cents or so. They believed that these tranches would fall in value almost as fast as the triple-B tier. Almost no one else realized that, with the market in effect rigged, the high-rated securities were as vulnerable as the low-rated ones, which is why the insurance—the credit default swap—was so cheap. Ledley and Mai made tens of millions of dollars, and most investors on Wall Street seemed stunned when the price of these senior tranches, parts of which many of the major Wall Street banks kept for themselves, began to plunge in 2007.

The Wall Street bankers were not finished, however. With so many mortgages having been written already, there was now a dearth of mortgage bonds available against which to assemble new CDO derivatives. “It didn’t require any sort of genius to see the fortune to be had from the laundering of triple-B-rated bonds into triple-A-rated bonds. What demanded genius was finding $20 billion in triple-B-rated bonds to launder,” Lewis writes, while also explaining that no regulatory agency would interfere with such machinations.

The bankers now realized that they could create “synthetic” CDOs—even more intricate derivatives—from the insurance that people like Burry were buying. The payments for the credit default swaps made by Burry and others were the equivalent of interest payments by homeowners, so you could construct a bond-like vehicle out of them. Again, the ratings agencies obliged by providing double-A and triple-A ratings on the highest tiers of the synthetic CDOs. These gave more investment options to investors, but the funds did not create any new mortgages and therefore made no contributions to the real economy. John Paulson bought the insurance that enabled Goldman to package the CDO known as Abacus 2007-AC1, for which Goldman is now charged with fraud for not telling investors of Paulson’s role. The ratings agencies assigned most of it a triple-A rating. The CDO collapsed only six months later. And Paulson made one billion dollars on his insurance.

In fact, a bond trader, Greg Lippmann, from Deutsche Bank, was actively encouraging investors to buy insurance on the CDOs. Eisman first learned how to short mortgage bonds this way from Lippmann, as did John Paulson. But why would Lippmann be telling Eisman and other investors to short the very same mortgage bonds his firm was trying to sell? He was even giving talks around the country called “Shorting Home Equity Mezzanine Tranches,” perhaps to as many as 250 investors. Eisman liked the odds too much to question Lippmann’s motives. A $2 to $10 investment could possibly result in a $100 gain.

But what Lippmann was doing was supporting the securitization department of Deutsche Bank. By getting Eisman and others to buy the insurance, Lippmann was enabling his bank to write more synthetic CDOs, and rake in huge fees from their sale to investors, even as far fewer mortgages were written. Lippmann had a leading part in this immorality play.

The banks at first did not take the risk of having to pay off the insurance. Burry originally went to Goldman and later Morgan Stanley because he thought they were rich banks that would meet their “counterparty” obligations to pay off the insurance should the market collapse. But Goldman actually transferred its obligations to naive traders at AIG, the insurance giant, by buying insurance far more cheaply from them to cover Goldman’s liability on the insurance it sold to Burry. As noted, it charged Burry 2.5 percent a year for insurance on the triple-B bonds, but it packaged most of those triple-B bonds into CDOs, turning them into triple-A securities. It then bought, according to Lewis, insurance from AIG on the supposedly less risky tranches for only 0.12 percent, or 12 cents per $100 of bond.

Of all the astonishing stories in Lewis’s book, AIG’s willingness to sell the insurance for such low prices is the most remarkable. According to Lewis, AIG did not realize that the CDOs on which it promised to sell insurance, though rated triple-A or double-A, were often all triple-B bonds; nor reportedly did Garry Gorton, the Yale professor who built the AIG insurance-pricing model. The result was that for income of several million dollars a year, AIG took on a risk of $20 billion if the allegedly triple-A securities it insured went bad. “In retrospect,” Lewis writes, “their ignorance seems incredible—but, then, an entire financial system was premised on their not knowing, and paying them for this talent.”

Lewis’s deep burrowing gets to the essence of Wall Street companies blinded by easy, short-term profit and uninhibited by any moral scruples or external government watchdogs. Even as defaults rose rapidly and the value of the underlying subprime mortgage bonds fell in early 2007, both the CDO and synthetic CDO derivatives held their price and firms like Merrill Lynch and Citigroup, pushed by their top executives, sold them aggressively, becoming the leading producers in the nation. Howie Hubler, a trader at Morgan Stanley, sold insurance on $16 billion worth of the highly rated tranches in early 2007, assuming that they would not fall.

Charlie Ledley was mystified why they didn’t begin to fall sooner. Rising defaults meant that interest paid on the triple-B tranches was not going to be adequate to pay off investors and the bonds could fall sharply, even to zero. “We were pretty sure one of two things was true,” said Ledley. “Either the game was totally rigged, or we had gone totally fucking crazy.”

But as the housing market sank further, the financial system began to unravel. In the second half of 2007, Merrill Lynch announced huge losses. Hubler lost Morgan Stanley $9 billion when it had to make good on the insurance he sold, easily the biggest trading loss ever. Ben Bernanke of the Federal Reserve, who up to then had insisted that the mortgage default problem was contained, changed tactics in August 2007, beginning a steep cut in interest rates.

Now, the credit default swaps that Eisman, Burry, Ledley, and Mai had bought were paying off as they rapidly rose in price. The new concern was that if the financial system completely failed, the banks that sold the insurance would not pay off. According to Burry, for example, Goldman Sachs and JPMorgan had at first refused to make payment, even as the bonds he bought insurance on started to fall in value. They priced his credit default swaps any way they wanted to, he said. “Given the massive cheating on the part of our counterparties,” Burry wrote in an e-mail, the idea of taking bets with credit default swaps was “no longer worth considering.” Then, as the market collapse was no longer deniable, the bankers finally priced the insurance accurately and Burry made millions. For two years, his investors had complained he was wrong, but he held on.

The Wall Street firms made many errors, not all of them discussed by Lewis. They financed enormous privatizations of heretofore publicly traded companies undertaken by firms like Blackstone, which reported large losses in 2008. They borrowed far too much against capital. Most damaging, the banks themselves took pieces of the CDOs in order to complete the sales and earn their handsome fees. Some of them, notably Citigroup, hid them, perhaps illegally, in off-balance sheet accounts, known as Structured Investment Vehicles, reminiscent of the Enron shenanigans in the late 1990s. (Abacus was not one of them.)

By September 2008, when Lehman Brothers, a leader in the mortgage market, went bankrupt, Lewis reports that Merrill Lynch had lost over $50 billion on subprime mortgages, Citigroup up to $60 billion, and Morgan Stanley at least $9 billion with Hubler’s bad trade. Bear Stearns had earlier been sold at distress prices to JPMorgan. “The big Wall Street firms, seemingly so shrewd and self-interested, had somehow become the dumb money,” Charlie Ledley said. Ledley and his partner Mai were now rich from having bought insurance on allegedly high-quality tranches that were in fact low-quality.

Wall Street was not the dumb money in one respect, however. Treasury Secretary Henry Paulson bailed out these and other companies. The US also bailed out AIG with $185 billion of taxpayer money. In the process, AIG—counting on the bailout—could assure Goldman Sachs that it would receive all of the nearly $14 billion of the insurance AIG had guaranteed it.

As Lewis once believed, proponents of CDOs claimed that, as with most derivatives, they would stabilize markets and even reduce interest rates by attracting more buyers and sellers. But few would now agree that these benefits, even if they had come to pass, outweighed the enormous risk the CDOs had created for the world financial system. And as Lewis and others argue, these investments made no direct contribution to the real economy, while their failure and the resulting drying up of bank credit was ruinous for the real economy.

Had CDOs been better understood and regulated, the extent of financial collapse would have been mitigated. Had credit default swaps been traded in plain sight and the counterparties like AIG been forced to put up capital, the crisis would have been far less costly. Had the conflicts of interest of credit ratings agencies been dealt with, the tranche system would not have been so abused.

In their new book, Crisis Economics,* Nouriel Roubini and Stephen Mihm would require that all derivatives, such as credit default swaps, be traded openly. They would consider prohibiting CDOs altogether on grounds that these derivatives are far too risky and complex. They would demand that investors pool funds to finance credit-rating agencies, removing the major conflicts of interest that derive from issuers paying for their ratings. They would also break up Goldman Sachs and the other big banks into relatively small pieces.

By comparison, the current finance reform legislation before Congress may well turn out to be tame. The provisions of the bill that is passed will probably provide for only a minor breakup of the banks and they may, for example, allow some derivatives not to be listed publicly. Moreover, the bill doesn’t adequately address the conflicts of interest and market-rigging that have discredited the ratings agencies.

So powerful is the tale Lewis tells of self-interest run amok that perhaps it will help awaken the nation to the basic truth that some individuals were indeed responsible for what happened, and had they been stopped by adequate regulation and enforcement, the speculative fires could have been brought under control. Lewis has written the best book I know of about the financial catastrophe by bringing us close to the deluded and duplicitous minds that caused it.

—May 11, 2010

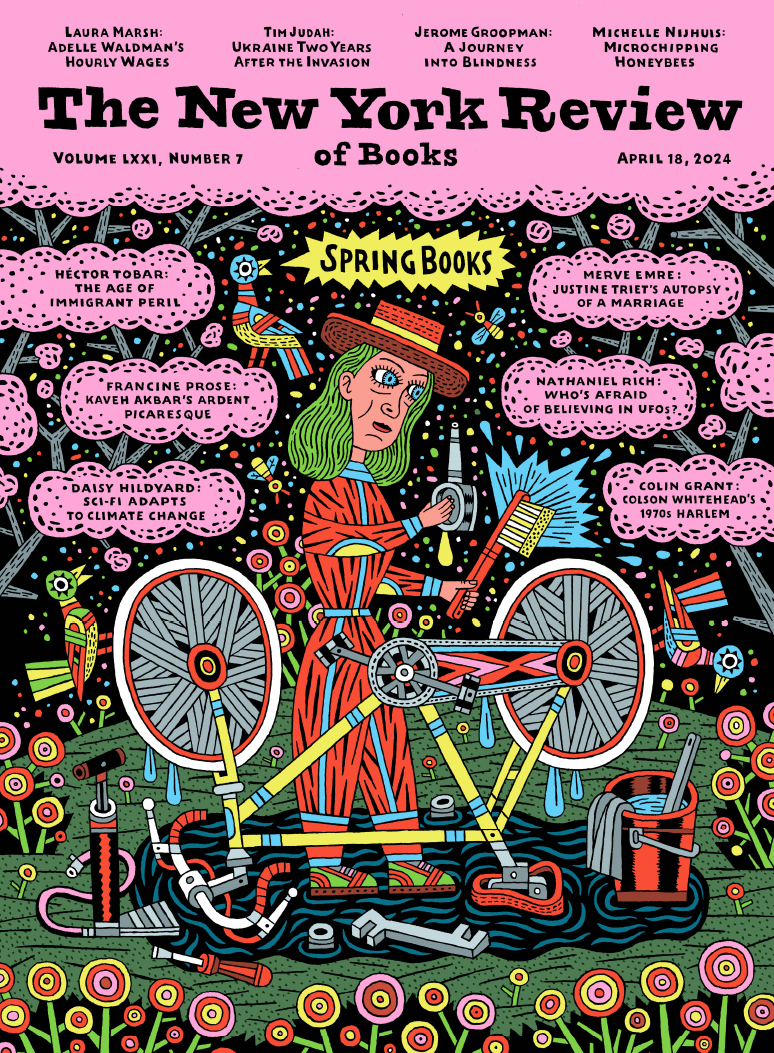

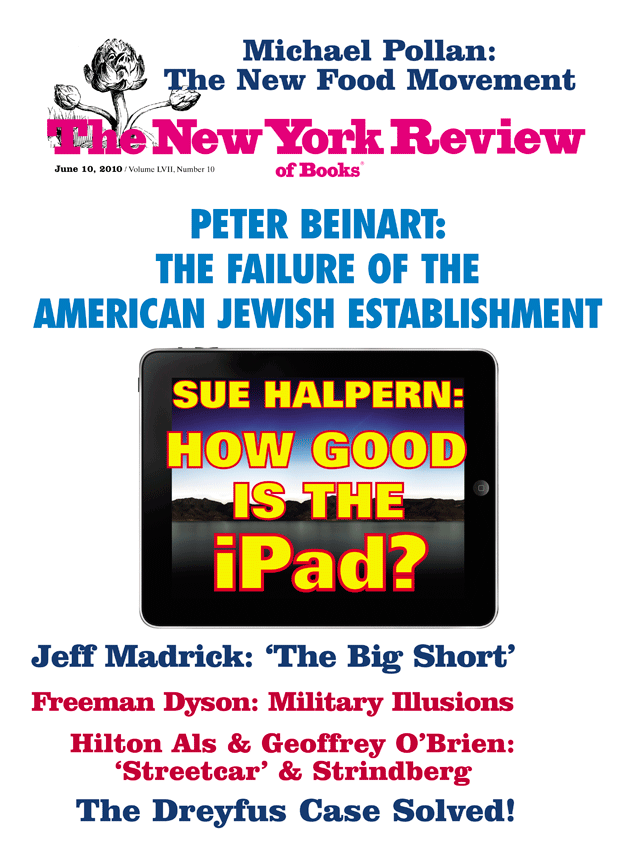

This Issue

June 10, 2010

-

*

Crisis Economics: A Crash Course in the Future of Finance (Penguin, 2010). ↩