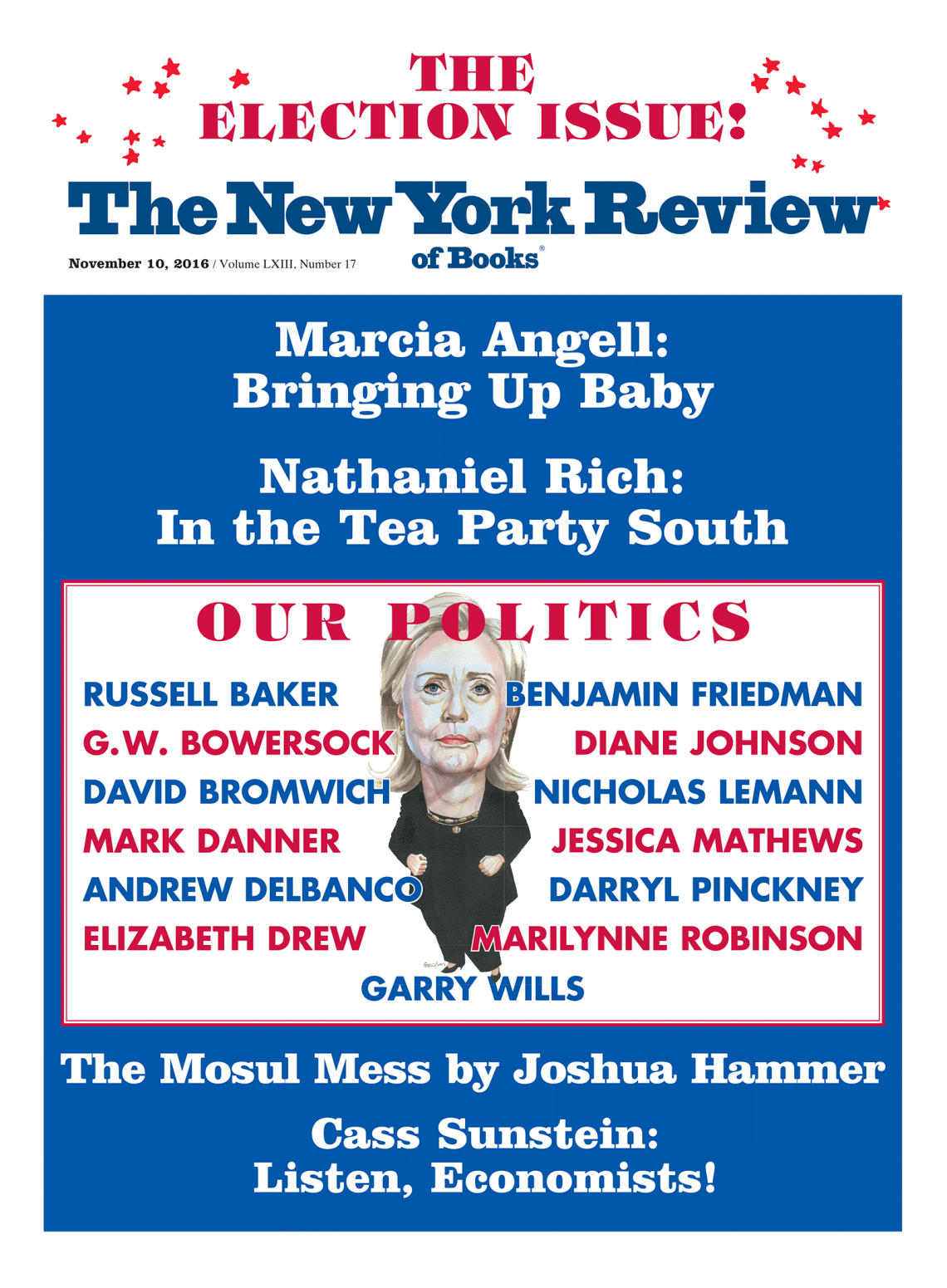

Dmitry Astakhov/Sputnik/Kremlin/Reuters

The cellist Sergei Roldugin, left, with Vladimir Putin and Dmitry Medvedev at the St. Petersburg House of Music, November 2009. The Panama Papers show that Roldugin, one of Putin’s old friends, is linked to a number of offshore companies worth hundreds of millions of dollars.

The publication of the Panama Papers on April 3 caused a huge stir.1 Much outrage was expressed. In Britain the revelations chimed with a political mood that seemed sickened by growing financial inequality. Thousands of headlines focused on the names caught in the headlights. The prime minister of Iceland was forced out of office. Vladimir Putin, strangely, confirmed the accuracy of the reports, while stressing that they showed no illegality. Assorted celebrities came up with varying responses explaining away their investments—with varying degrees of plausibility. The question that arises over the 11.5 million Panama Papers—all from the Mossfon law firm in Panama City—is whether they will lead not only to prosecution but to effective prevention of attempts to avoid paying billions in taxes. Under current law, many of the dummy corporations are legal, as is the establishment by large US companies of branches in countries with lower taxes.

I asked Gabriel Zucman, author of The Hidden Wealth of Nations: The Scourge of Tax Havens (2015)2 and assistant professor of economics at the University of California at Berkeley, what new things he had learned from the Panama Papers.

“In terms of the structures or mechanisms, nothing,” he told me. “That doesn’t mean that these types of revelations are not important or useful. I think they are very important and critical in generating change, in forcing governments to think harder about this problem of tax havens and to improve their policies. But there’s nothing that’s particularly new.

“You can’t learn anything about the magnitude of the problem from just leaks from one firm, or even a couple or three or four firms—you know, it’s just too limited. And even if you have gigabytes of data, since they only involve one particular firm in one particular country that’s involved in one particular form of tax haven activity, there’s no way to make meaningful inference from that as to what’s the scale of the global problem, the magnitude of tax avoidance and tax evasion, the costs for governments.”

For Zucman, the significance of the publication lay in the response: “I was more interested in seeing the reaction, the global outrage that these documents generated. I think it’s the first time that there is public outrage on such a scale. At the global level people felt very strongly that something is wrong.

“I felt that there was a change in public opinion on these questions—particularly in the US—and that, I think, is an interesting development itself. For many years there’s been a big gap in this area between what governments say and what they do. There’s much less that’s actually being done [to prevent tax havens] than was promised. I think that’s what generated such a strong reaction. These leaks go up to at least the end of 2015, and so what appeared very clearly is that the current system of wealth concealment and tax evasion is continuing to this day in spite of promises to actually tackle the problem.”

Richard Brooks, a former British tax inspector who wrote The Great Tax Robbery (2013) and who now writes about tax avoidance for the British satirical magazine Private Eye, also learned nothing new from the Panama Papers. “Obviously there were a lot of new names,” he told me, “but there was nothing happening that was new. We knew that all the things that you could see were going on. It was just the scale of it that made the difference.

“In a way, it’s slightly depressing that it takes this kind of blockbuster journalism before anything gets done but it does seem to, because governments have known that these things have been happening, for a long time, on a sufficient scale to demand some action, but it’s only when you get this kind of coordinated media coverage that they are forced to do something.” He added: “or forced to look like they’re doing something.”

Zucman, one of the few academic economists to have made an extensive study of offshore tax avoidance, emphasizes that the extent of the data—though enormous in itself—relates to only a tiny fraction of the total tax management industry and that the Panama Papers only cover one small subsection of tax avoidance. “It’s a lot but, compared to the hundreds of thousands of offshore companies in those tax havens, that’s only 5 percent of the overall market, and creating shell companies is just one element of this big concealment industry. There’s the whole banking aspect to it—you know, bankers in Switzerland and Luxembourg and everywhere who are creating shell companies, or trusts, or foundations, and so on; or who are actively helping some of their clients to hide assets; who are investing their funds on their behalf, and so on and so on. So the Panama Papers were only part of the chain.”

Advertisement

Zucman started work on the subject for his Ph.D. in 2009, surprised at how little serious research was being done by fellow economists—it had been a field more tilled by political scientists and sociologists. He set to work by looking at the data published by central banks on the amount of wealth managed by domestic banks on behalf of foreign customers.

“For instance,” he said, “the Swiss National Bank publishes the values of the assets managed by Swiss banks on behalf of foreigners every month. Today, there’s $2.4 trillion in Swiss banks that belong to foreigners. And also Luxembourg has similar data. That’s one starting point. The Swiss Central Bank also publishes information on who owns these $2.4 trillion, and you see that a huge fraction—more than 60 percent—belongs, on paper, to shell companies.

“More than 60 percent of these $2.4 trillion are assigned to the British Virgin Islands, Panama, the Cayman Islands, Jersey, and so on. Through their shell companies, the owners of offshore accounts invest in US securities or in New York real estate, and so on.

“Then for the global picture I analyzed inconsistencies in the international statistics of countries. One of these is that, at a global level, you find more liabilities recorded in the world’s balance sheet than you find assets. And that’s due to all the assets that people own offshore. US equities or bonds that people have in their Cayman Island accounts or Swiss accounts—these forms of wealth are going to be well recorded as liabilities but they are nowhere recorded as assets.

“And so you see this big anomaly, this big imbalance, and by analyzing that I estimated there’s about $7.6 trillion of wealth, of household wealth, in tax havens globally. That’s about 8 percent of the world’s financial wealth.”

How much of the tax being avoided globally is for the benefit of individuals and how much for the benefit of companies? “Well, I don’t have a good number globally,” he says. “I have a good number for the United States in the sense that US individuals, by my estimate, are evading $30 billion a year through unreported offshore assets, and that’s to be compared to the $120 billion that US multinational companies are avoiding by artificially shifting their profits to Bermuda and similar places. So for the US, the revenue costs of multinational corporate tax dodging are bigger.

“It’s not necessarily true for other countries,” Zucman told me. “I think, for many countries, it’s the opposite. There is, especially for developing countries, a very large amount of wealth held offshore by individuals and the revenue losses are of the first order.”

The public impact of the Panama Papers has been big. But most of the tax experts I talked to seemed highly skeptical whether there would be many arrests, still less immediate political change, as a result of the publication. Several emphasized that many of the activities described in the Panama Papers are not illegal. Indeed, as Nicholas Shaxson argues in Treasure Islands, the point of the havens is to offer “politically stable facilities to help people or entities get around the rules, laws, and regulations of jurisdictions elsewhere.” He calls for blacklists of financial havens that escape regulation.

Shaxson’s chapter on reforming the system is titled “Reclaiming Our Culture”—a pointer to the need for a far wider public awareness of how the offshore world works before there can be sufficient political will to force change. (The following is from the UK edition.)

We must first understand the sickness…. The offshore system…helps rich people, companies and countries stay on top, for no good economic or political reason. It’s the battleground of the rich versus the poor, you versus the corporations, the havens against the democracies—and in each battle, unless you’re very rich, you are losing.

The German reporters Bastian Obermayer and Frederik Obermaier advocate automatic data matching and transparent registers of the real owners of companies—their names, date of birth, a business address, and the number of shares they hold. “That’s all that is needed,” they write. “And if that’s too much for some—well, no one is forcing them to use an offshore company.”

Advertisement

Zucman similarly advocates a world financial register. He says, “It already exists in the sense that, in each country, there is already an organization that de facto plays the role of a financial registry. In each country, they always have a central securities depository that keeps the book of, say, all the US equities that have been issued, here is who owns them. So you could start from these central securities depositories and use the data, not only as they are used today for the functioning of the financial market, but also for statistical purposes—for fighting money laundering, tax evasion, or the financing of terrorism.

“Countries have had real estate and land registries for a very long time, for centuries in many cases. We could do for financial wealth what we do for land and real estate—just trying to identify who owns this wealth. That would be the most important way to make concrete progress in this area of financial transparency.”

With corporate tax avoidance Zucman is an advocate of “formulary apportionment”—allocating profit or losses to a particular tax jurisdiction—a subject it appears impossible to discuss without reference to the West Coast tech giants. Zucman describes how the present system enables vast wealth to be accumulated by these companies beyond the reach of any country, which could otherwise use the taxable receipts to build schools or hospitals or bridges: “Apple has subsidiaries all over the world—they have Apple US and then they have Apple Germany and Apple Cayman Islands. The profits made by Apple Cayman Islands are taxable in the Cayman Islands, they are not taxable in the US, they are not taxable in Germany. And that’s a very bad idea because what firms do is shift as much of the profits as they can to their offshore subsidiaries. They artificially put billions and billions of dollars in the Cayman Islands or similar places. So Google, for instance, made $13 billion in profit in Bermuda in 2014.”

I blink at this figure and subsequently check it out. Zucman is right—though the money takes such a circuitous route that one can only marvel at the ingenuity of the tax specialists who devised it. By studying filings in the Netherlands, Ireland, the US, and Bermuda, Jesse Drucker, a reporter for Bloomberg News, managed to work out that Google Inc. has saved 3.1 billion dollars since 2007 by moving most of its foreign profits from Ireland. It did so via Google Netherlands Holdings to Bermuda, where there is no corporate income tax. The ruse is known as the “Double Irish” and the “Dutch Sandwich.”3

How would Zucman address that problem? The simplest way would be to say, “Well, rather than having firms pay corporate taxes separately for each subsidiary, what you do is that you take the global consolidated profits of Apple, for instance. You start from there, and then you say, ‘Well, if Apple has made 20 percent of its sales in the US, for instance, then 20 percent of its global conciliated profits are taxable in the US.’ Right now, it’s very easy to send your profits to Bermuda, but you cannot send your customers to Bermuda: they are in the US, in Germany, and so on. That way, it would not be possible for big multinational firms to avoid so much in corporate taxes.”

Apple’s tax affairs will certainly come under greater scrutiny after it was ordered to pay E13 billion in taxes when the European Commission ruled that Ireland’s effective 2 percent corporate tax rate amounted to illegal state aid. Richard Brooks, with his experience as a UK government tax inspector behind him, is not convinced that transparency on its own is sufficient. “The approach at the moment,” he told me, “is to keep the [tax havens] firmly in place but just improve transparency a little bit, and it’s just not going to work. Nothing that’s being suggested by any country in response to the Panama Papers stuff is going to stop any of that.”

He may be right about governmental inertia. But will the kind of transparency represented by exercises such as the Panama Papers have an effect on individuals and corporations that will have witnessed the intense embarrassment of those whose tax arrangements were outed by the media? Will naming and shaming still act as a powerful tactic for all but a few of the new masters of the universe?

“The Googles, Amazons, and Microsofts, the huge ones, there’d be nothing in it for them,” says Brooks. “Google doing what they do, it’s a difference between paying 35 percent tax and 19 percent or something. It’s a huge difference; it’s billions a year. So they’re sticking two fingers up because it’s worth it, and people aren’t going to stop using Google.

“But if you are Starbucks it’s a bit different because, if it’s five million or ten million a year [that you are not paying in taxes] and people are stopping going in your shops, then you probably are going to stop. From what I hear from people I know who work in this area there are lots of companies who are just deciding it’s not worth it, avoiding tax.”

One question left hanging as the journalists went back to their normal beats is: What should happen to the unique archive of the Panama Papers? Journalism has largely done what it could with them (though there are rumors of a Panama Series Two to come)—but the material would surely be of huge interest to economists, NGOs, tax authorities, and law enforcement agencies. In September it was reported that the Danish government had paid £1 million for some of the data from the Panama Papers relating to Danish citizens.

I e-mailed Bastian Obermayer to seek his thoughts. “The question is a very complex one,” he replied. “We try to help all colleagues and NGOs who come up to us with clear requests, but our hands are bound if government comes. We are not their helpers. The best solution would be if some government makes a deal with John Doe [i.e., the still-unidentified source of the Panama Papers]. But before that, there ought to be change in whistleblower legislation. And I don’t see that.”

Certainly if more whistleblowers were to emerge with this kind of treasure trove in future, the issue of protection for them is one that needs to be sorted out—a point addressed by “John Doe” in the manifesto:

I have watched as one after another, whistleblowers and activists in the United States and Europe have had their lives destroyed by the circumstances they find themselves in after shining a light on obvious wrongdoing. Edward Snowden is stranded in Moscow, exiled due to the Obama administration’s decision to prosecute him under the Espionage Act. For his revelations about the NSA, he deserves a hero’s welcome and a substantial prize, not banishment….

Legitimate whistleblowers who expose unquestionable wrongdoing, whether insiders or outsiders, deserve immunity from government retribution, full stop. Until governments codify legal protections for whistleblowers into law, enforcement agencies will simply have to depend on their own resources or on-going global media coverage for documents.

John Doe—who apparently had failed to interest other media organizations in the material before getting Süddeutsche Zeitung to bite—expressed some frustration at the mainstream media’s inability to come to grips with these issues:

Many news networks are cartoonish parodies of their former selves, individual billionaires appear to have taken up newspaper ownership as a hobby, limiting coverage of serious matters concerning the wealthy, and serious investigative journalists lack funding.

But both Doe and the journalists involved in the collaboration agree on two things: that the digital age is going to make more such leaks inevitable and that the power of vast databases of previously secret information will have its own momentum. “We live in a time of inexpensive, limitless digital storage and fast internet connections that transcend national boundaries,” wrote Doe. “It doesn’t take much to connect the dots: from start to finish, inception to global media distribution, the next revolution will be digitized.”

The Obermay/ier colleagues agree: “No one, anywhere, who conducts secret transactions and leaves a digital trace is safe any more,” they write in The Panama Papers.

Whatever they do, wherever they do it. Anyone who acquires an anonymous shell company should know that, in this digital age, secrecy is an illusion.

Somewhere there will always be employees who have had enough of watching these goings-on. Somewhere there will always be activists who find holes in databases. Somewhere there will always be engineers who occasionally help themselves to a few gigabytes of data.

This leak is not the first leak. Nevertheless, it does perhaps mark the start of something.

The start of the end of the tax havens.

—This is the second of two articles.

This Issue

November 10, 2016

Inside the Sacrifice Zone

Why Be a Parent?

Kierkegaard’s Rebellion

-

1

See my previous article, “Panama: The Hidden Trillions,” The New York Review, October 27, 2016. ↩

-

2

Reviewed by Cass R. Sunstein in these pages, January 14, 2016. ↩

-

3

See Jesse Drucker, “The Tax Haven That’s Saving Google Billions,” Bloomberg Businessweek, October 21, 2010. ↩