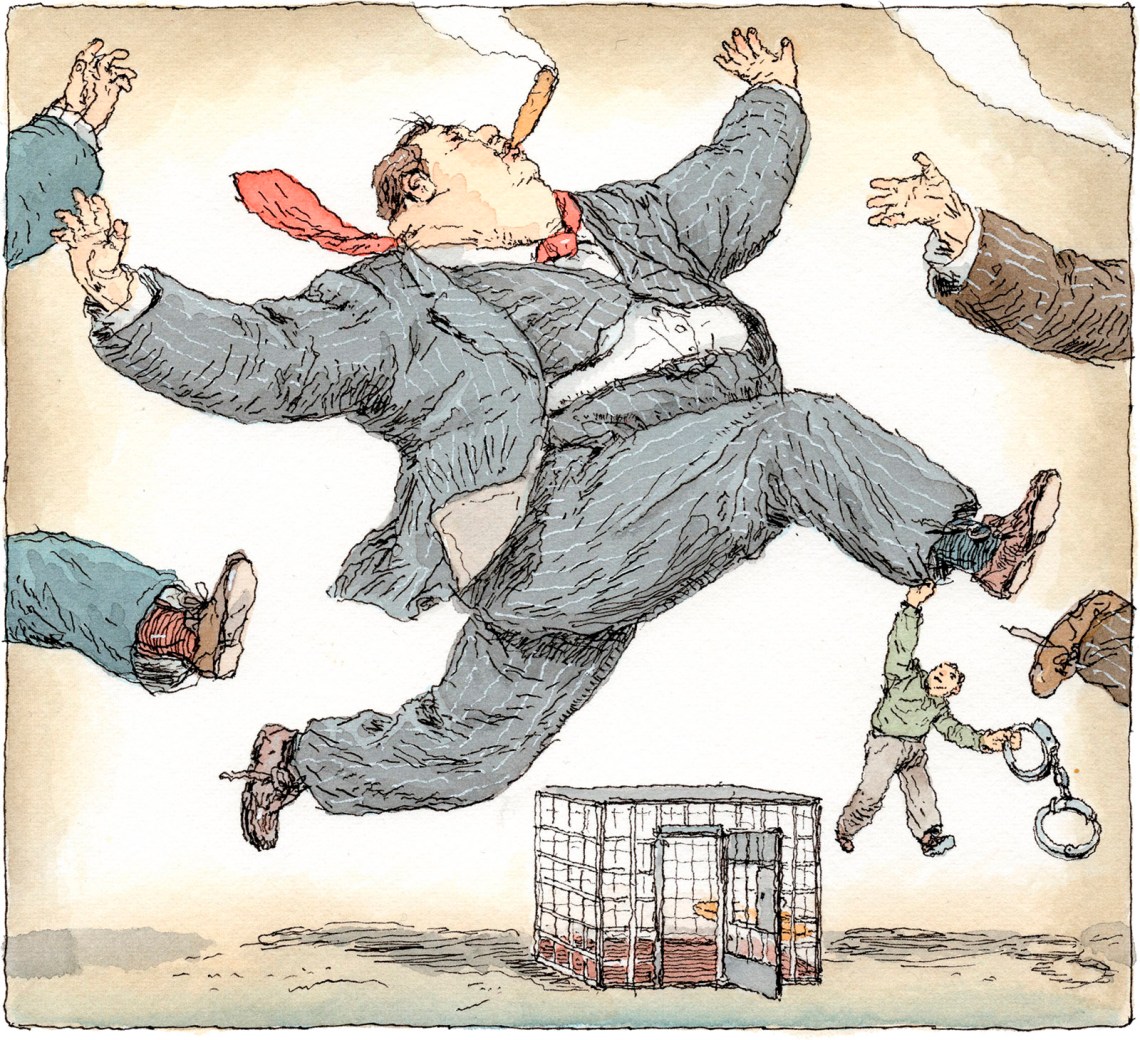

Criminal law and its enforcement are notoriously hypocritical. It is bad enough that, as Anatole France wrote in 1894, “the law, in its majestic equality, forbids the rich as well as the poor to sleep under bridges, beg in the streets, and steal loaves of bread.” But now, more than a century later, even the pretense of equality before the law receives little more than lip service. For instance, while the US sends hundreds of thousands of poor people to prison every year, high-level corporate executives, with only the rarest of exceptions, have become effectively immune from any meaningful prosecution for crimes committed on behalf of their companies.

In some cases, these executives have literally gotten away with murder, at least according to John C. Coffee Jr. in his new book, Corporate Crime and Punishment: The Crisis of Underenforcement. Coffee, a professor at Columbia Law School who is widely regarded as one of the premier US experts on both white-collar crime and corporate and securities law,1 argues that the steadily diminishing prosecutions of high-level corporate executives have reached new lows over the past dozen years or so, even as the crimes for which these executives are responsible have become, if anything, more egregious.

As evidence, Coffee offers, among others, the following examples. As early as 2007 the government recognized that Purdue Pharma, the maker of OxyContin, had fueled the opioid crisis by aggressively and unlawfully promoting widespread overuse of the drug, leading ultimately to tens of thousands of deaths. But even though the government found three of Purdue’s executives responsible for this misconduct, they were allowed to plead guilty to misdemeanors carrying no prison time, and the company was fined a paltry $600 million, a small fraction of its OxyContin profits. (On October 21, 2020, in further confirmation of Coffee’s point, Purdue pled guilty to three additional felonies, but no individuals were charged. And even though the government announced with much fanfare that Purdue had consented to an additional fine of over $8 billion, this was a sham, since the government agreed to “waive” payment of all but $225 million of the fine.)

In 2015 General Motors entered into a deferred prosecution agreement with the Department of Justice for having concealed from regulators its inclusion in more than 30 million cars of a faulty ignition switch that could shut off the engine while the car was being driven. The faulty switch had resulted in at least 124 documented deaths. Yet although the government alleged that various GM executives had known about the flaw for many years before its public exposure, not one was prosecuted.

The severe forest fires that have swept California since 2014, resulting in more than 175 deaths, have in many instances either been caused or made worse by Pacific Gas and Electric’s aging and defective equipment. Yet despite several reports from state fire authorities alleging that the deficiencies were known to many at PG&E for some time, and even though the company pled guilty to causing the deaths of eighty-four people in one of the fires, not a single executive has been prosecuted.

The continuing failure to hold senior executives responsible for crimes they committed in pursuit of corporate profits, dating back at least to the time of the economic collapse of 2007–2008, stands in stark contrast to the prosecutions that culminated only a few years earlier, when the CEOs of Enron, WorldCom, and Tyco were tried and convicted for the frauds they helped orchestrate at their companies. Between 2005 and 2006, each of them received a prison sentence of twenty-four years or more. Yet since then, despite the even larger financial frauds that helped cause the Great Recession, not to mention the seemingly homicidal actions described above, prosecutors have been content to simply charge the companies and let their executives off the hook.

Adding insult to injury, the prosecutions of the companies have been remarkably ineffective, mostly just adding ever larger fines to government coffers, ultimately at the expense of innocent shareholders. The companies invariably enter into plea bargains, most often in the form of deferred prosecution agreements (by which they escape any final judgment of conviction) or “non-prosecution agreements” (by which they also escape any judicial oversight). In addition to fines, these agreements almost always include promises by the offending companies to impose internal compliance programs that will prevent future misconduct. But the definitive study of these agreements, Too Big to Jail (2014) by Brandon Garrett, a law professor at Duke University, shows that many of these companies engage in criminal misconduct after the compliance programs are in place. As Coffee notes:

Professor Garrett was surprised at the high rate of recidivism that he found among large public companies. Even after receiving deferred prosecution agreements, they violated the law again and again.

Why do these companies commit new crimes despite their promises not to do so and their agreement to the enhanced compliance measures designed to prevent recurrence? In Coffee’s words, “Very probably because crime still pays.”

Advertisement

Although sometimes treated by courts as if it was a “person” (a classic example of a legal fiction), a company, obviously, is an impersonal legal and economic construct. The people who actually commit these crimes are its employees and, particularly in the case of the widespread and repeated criminality with which we are here concerned, its management. So why have prosecutors ceased to pursue executives and instead contented themselves with corporate pleas of limited effect? One view, persuasively set forth by the journalist Jesse Eisinger in The Chickenshit Club (2017), is that it is the result of a poisonous mixture of cowardice, coziness, and convenience. In Eisinger’s view, the top-ranking prosecutors making these decisions have, as a result of some highly publicized defeats in cases involving the accounting firm Arthur Andersen in 2005 and executives from the investment services firm Bear Stearns in 2009 (two cases that were widely, if unfairly, denounced as examples of government overaggressiveness), become afraid of the political fallout of losing such cases. A plea bargain with a company presents no such risks.

Also, Eisinger argues, the top prosecutors at the Department of Justice suffer “revolving door” bias. They are frequently former federal prosecutors who left the DOJ to work for big law firms that represent large corporations and high-level executives. Now they are back for a few years at the DOJ, knowing, however, that they will soon return to private practice. As a result, they are more than sympathetic to arguments for leniency that they themselves used to make and will make again in the near future. Given this combination of fear and sympathy, prosecutors often find it convenient to resolve cases of corporate criminality with a quick and simple plea bargain that gives the appearance of robust enforcement even if it has little long-term effect.

Coffee, however, while giving some weight to the problems identified by Eisinger, thinks the decline in individual executive prosecutions is more a result of scarce resources that leave prosecutors and their agents ill-equipped to delve into the ever more complex division of responsibilities that characterizes the modern corporation. To take an example from a recent case, while it may have been relatively easy to identify the low-level employees of Wells Fargo bank who were rewarded for creating millions of fictitious customer accounts, it would be much more difficult to determine whether the executives who created the incentives to do this knew they were inducing their employees to break the law. And even if these executives did know (or purposely shut their eyes to finding out), how high up in the bank’s hierarchy was this misconduct known? Problems of proving knowledge and intent—common to virtually all criminal cases—become devilishly difficult when you are investigating a multitiered company with thousands of employees and millions of transactions. Such companies have become, in Coffee’s words, “too big to investigate.”

It is easier to identify this problem, however, than to find a solution. It is highly unlikely that the white-collar investigative staffs of the DOJ, the FBI, and the Securities and Exchange Commission (where much of the initial investigation often occurs) can be enlarged, given Congress’s embrace of cost-cutting measures. As Coffee points out, in recent years the SEC has increasingly focused its attention on small and easy cases, so that it can present Congress with positive statistics (“we won 90 percent of our cases”) that help stave off further budget cuts.

One of the many strengths of Coffee’s book is that he offers not just one but several solutions that are original in their scope, though not entirely unprecedented in their features. The first solution seeks, somewhat ironically, to take advantage of the fact that it is much easier to prosecute a company than to prosecute its high-level executives. This is especially true in federal cases because, under the law, the criminal actions of even the lowest-level employee are automatically imputed to the corporation if they were undertaken for its benefit. When Wells Fargo functionaries created fictitious customer accounts, the company was automatically liable for their misconduct and subject to criminal prosecution. As a result, earlier this year, Wells Fargo entered into a deferred prosecution agreement with the government, but no executives were prosecuted.

Coffee proposes to use the threat of severe penalties to force culpable corporations to reveal the identities and actions of executives who helped perpetrate crimes. This proposal builds on several existing practices. In particular, when companies are accused of criminal misconduct, they usually hire outside law firms to conduct internal investigations. And because they can pay for the law firms to devote far more resources to these investigations than the government often can, prosecutors have been more than willing to delegate their corporate crime investigations largely or even exclusively to outside counsel.

Advertisement

But the outside counsel, who are typically hired on the advice of the corporation’s inside general counsel (to whom they report on an immediate basis, although ultimately reporting to the board of directors), have no incentive to push their investigations to higher levels, or even to identify which executives had knowledge of the criminal activity. Indeed, the ultimate responsibility of such counsel after they complete their internal investigation is to convince the prosecutor that even though low-level employees may have committed crimes, the company is basically law-abiding and should not be dealt with harshly. They may well let this bias influence (consciously or unconsciously) how they conduct their internal investigation. The company shares this bias, because identifying any culpable senior executives threatens to subject it to larger fines than it would otherwise face.

Coffee seeks to correct these biases and perverse incentives by, first, mandating that the prosecutor participate in the company’s selection of outside counsel as a condition of even entertaining a possible resolution of the case, and, second, imposing severe sanctions on the company if its outside counsel fails to pursue an internal investigation aggressively and to provide the prosecution with the names of and relevant evidence regarding any and all culpable executives.

The first component of this proposal—having the prosecutor involved in selecting the company’s outside counsel—is not without potential problems. Even if it can be structured so as not to infringe on a defendant’s qualified constitutional right to counsel of its choice, it may make the company less willing to be thoroughly candid with counsel so imposed. On the other hand, one might worry that a prosecutor could be insufficiently skeptical when evaluating the work of counsel she helped choose but who still owes undivided loyalty to the company.

But the more important component of the proposal, in Coffee’s view, is the second: threatening the company with truly severe sanctions, even dissolution, if it does not aggressively pursue its internal investigation “all the way up” and, at the end, turn over to the prosecutor all evidence it has unearthed regarding the knowledge and culpability of high-level executives for the crimes under review. This proposal is not without precedent. In late 2015 Deputy Attorney General Sally Yates—seemingly in reaction to widespread public criticism of the Department of Justice’s failure to prosecute senior management in connection with the frauds leading to the Great Recession—issued what became known as the Yates Memorandum. This memorandum, binding on all federal prosecutors, said that in the future a company would not receive credit for cooperation with the government (which is essential to qualifying for a deferred prosecution or non-prosecution agreement) unless it “completely disclose[d] to the Department all relevant facts about individual misconduct.”

The Yates Memorandum may have had some short-term positive effects. About a year after it was promulgated, federal prosecutors in Massachusetts, relying in part on information provided by the company, began criminal proceedings against seven executives of Insys Therapeutics, the manufacturer of the addictive and deadly opioid fentanyl—including John Kapoor, its founder and former CEO—accusing them of criminally mislabeling the drug. In the end, Kapoor pled guilty and was sentenced to five and a half years in prison.

But this positive impact was short-lived. In late 2018, under the Trump administration, the DOJ relaxed the Yates Memorandum and now requires cooperating companies to identify only high-level executives who were “substantially” involved in or responsible for the criminal conduct. This leaves companies free not to disclose criminal culpability of executives whose involvement in the underlying crimes was not, in their view, “substantial.”

Following this modification, the DOJ returned to its practice of not indicting high-level executives, only the corporate entities. Moreover, according to Coffee, the deferred prosecution agreements preferred by the Obama administration (supposedly because they would have fewer negative effects than full prosecutions on the then recovering economy) have largely been replaced under the Trump administration by the even less onerous non-prosecution agreements—in effect, little more than promises to do better in the future. “The implication,” he says, “is that the Yates Memorandum is being given little or no weight.”

Coffee, however, still believes that prosecuting corporations, for all its seeming futility, is something that should be strengthened, not abandoned—he proposes using it to extract information about culpable high-level executives. But are prosecutors really ready to play hardball? For example, existing law provides that a pharmaceutical company found guilty of a felony can no longer sell prescription drugs through Medicare and Medicaid. But in the Purdue Pharma case, and in numerous cases of criminal misconduct by the pharmaceutical manufacturer Pfizer, the companies were able to convince prosecutors to let their guilty pleas be made by shell subsidiaries to avoid this severe penalty, which might cause to company to fail. In effect, they were able to convince prosecutors that the draconian penalty of killing the companies would unfairly punish the innocent shareholders, the many equally innocent employees, and anyone who depended on regular doses of their medications, and therefore should not be pursued regardless of whether prosecutors were satisfied with the extent of the companies’ cooperation.

Coffee, however, believes that prosecutors who regularly hear such arguments about the effect of severe corporate punishments on innocent employees and shareholders should respond: Tell us about the culpable employees, or you will leave us no choice but to impose severe punishments, and the effect on innocent employees and shareholders will be entirely your fault. He thinks that in such a confrontation, the company will blink, but it is a pretty risky game. And the game is only necessary because the prosecution does not have the resources to do the kind of intensive and thorough investigation that would reveal misconduct by corporate management; in the absence of extreme pressure from the prosecution, the company has no incentive to push its own internal investigation very far.

The threat of putting a company out of business as a consequence of a guilty plea is not available to prosecutors in most cases that don’t involve pharmaceutical companies (though it is available in the case of banks that commit money laundering). Nevertheless, Coffee believes that prosecutors could apply intense pressure to get companies to offer up their senior executives by threatening them with what he calls an “equity fine” if they do not reveal high-level misconduct.

This creative device—the idea for which originated, as far as I know, with Coffee—would impose on a company that refused to provide evidence of its culpable executives’ wrongdoing the penalty of having to issue additional shares of stock—say, 20 percent of the total number. These new shares would initially belong to the government, which could auction them off, but the effect would be to dilute the value of each of the company’s shares. This would particularly affect top management, whose compensation typically includes large quantities of company stock. The result would be to pit those executives who did not want to cooperate because of their own culpability against those who had no such fears and wanted to avoid financial consequences. This conflict would then be resolved by the outside directors (many of whom also hold such shares), very likely in favor of providing the prosecution with the evidence they demand.

Unlike monetary fines, the equity fine would not have an effect on innocent employees or creditors. It would, of course, dilute the share value for everyone, but that might be one more reason independent board members might feel it was their fiduciary duty to hand over evidence of executive culpability to the prosecutor and thus avoid the dilution in share value.

There are, however, some problems with this approach. Most obviously, since current law only provides for monetary fines for companies, it might require new legislation, never an easy thing to pass. Less obviously, but for the reasons already identified by Eisinger, it is unclear whether prosecutors would be prepared to take the kind of unflinching tough-guy approach necessary to make the threat of an equity fine successful in getting the company to reveal high-level executive culpability. Such an approach might be effective if prosecutors were dealing with lawyers for drug cartels or mafioso families, but when negotiating with lawyers (usually former prosecutors themselves) who represent “legitimate” companies, they often feel the need to appear to be “reasonable,” which typically means acceding to the kinds of compromises that would make an equity fine unsuccessful.

Nevertheless, Coffee’s proposal has a great many potential advantages, most notably that it would solve the prosecutor’s need to outsource complex and time-consuming investigations of corporate malfeasance without thereby sacrificing the ability to hold culpable corporate executives personally responsible for their crimes. This is reinforced by several of Coffee’s other suggestions, such as doing away entirely with non-prosecution agreements (because they are not subject to any judicial oversight) and greatly limiting the use of deferred prosecutions (because they replace real punishment with a reduced profit). It is noteworthy that virtually every time a company has entered into a deferred prosecution and paid a fine, even in the billions of dollars, the price of its stock has risen the next day. The market recognizes, even if prosecutors do not, that the profits obtained through the misconduct were substantially greater than the fine that now has to be paid as a cost of doing business.

Coffee offers a number of other helpful suggestions, but two in particular merit further mention. The first is a great expansion of financial bounties for whistleblowers who provide proof of criminal misconduct by corporate officers. Whistleblower evidence already provides a major source of good leads (as well as some bad ones) for tax evasion and civil securities fraud. While the motives of the whistleblowers are sometimes repugnant, that should hardly matter if their evidence is good, i.e., independently corroborated—and provision of such evidence is the only way to qualify for the bounties.

Finally, Coffee recognizes that even if corporate criminal prosecutions are to be refocused on the responsible individuals, there is still a place for civil enforcement against the companies themselves, chiefly by the SEC, for such diverse purposes as obtaining compensation for the victims of financial frauds and reorganizing the company so as to avoid future frauds. Yet here again the trend has been toward cheap settlements, largely as a result of inadequate SEC budgets and resources that cause it to favor the quick compromise over the prolonged fight, but also because too many of the SEC’s enforcement attorneys are inexperienced in conducting complex trials against skilled opponents. Coffee’s solution is to have the SEC delegate its trials to private attorneys, mostly drawn from the plaintiffs’ securities bar, who would take the cases on a contingency basis, provide much-needed resources and experience, and charge the agency nothing if they lost. The record here speaks for itself: plaintiffs’ attorneys who bring private actions that parallel SEC enforcement actions typically obtain recoveries ten times or more what the SEC obtains.

To be sure, it might seem somewhat incongruous to delegate government enforcement to private lawyers. But as Coffee notes, several agencies, like the FDIC, already hire private attorneys for their enforcement actions, with very good results. Of course, the actions would still have to be supervised by SEC attorneys, who would make all final decisions. But the nitty-gritty of discovery, motion practice, and trials would be in the more experienced hands of the private attorneys.

While it has been said that “the business of America is business,”2 that does not begin to describe the extent of the current concentration of wealth and power in the hands of a small oligarchy of corporate executives and the companies they control. Fortunately, most US businesspeople are honest and law-abiding, a valuable and underappreciated asset in itself. But to allow those few executives who engage in fraudulent and even life-threatening criminal conduct to go unpunished is only to invite their proliferation, to the great detriment of all of us.