Beginning with the presidency of Jimmy Carter, a succession of Democratic presidents joined Republicans in turning away from the New Deal model of regulated capitalism toward what has come to be known as neoliberalism. The neoliberal credo claims that markets work efficiently and that government attempts to constrain them via regulation and public spending invariably fail, backfire, or are corrupted by politics. As public policy, neoliberalism has relied on deregulation, privatization, weakened trade unions, less progressive taxation, and new trade rules to reduce the capacity of national governments to manage capitalism. These shifts have resulted in widening inequality, diminished economic security, and reduced confidence in the ability of government to aid its citizens.

The Republican embrace of this doctrine is hardly surprising. Given the lessons learned about the necessity of government interventions following the 1929 stock market collapse and the success of the Roosevelt administration as a model for the Democratic Party, the allure of neoliberalism to many Democrats is a puzzle worth exploring.

The term “neoliberalism” itself is confusing, because for at least a century “liberalism” in the United States has meant moderate left, not free-market right.1 Neoliberalism in its current economic sense draws on the older meaning of liberalism, which is still common in Europe and which holds that free markets are the counterpart of a free and democratic society. That was the claim of classical liberals like Adam Smith and Thomas Jefferson.

Only in the twentieth century, after the excesses of robber-baron capitalism, did modern liberals begin supporting extensive government intervention—the use of “Hamiltonian means” to carry out “Jeffersonian ends,” in the 1909 formulation of Herbert Croly, one of the founders of The New Republic.2 This view defined the ideology of both presidents Roosevelt and was reinforced by the economics of John Maynard Keynes. In Britain, the counterpart in the same era was the “radical liberalism” of social reform put forth by the Liberal prime minister David Lloyd George.

The term neoliberalism also gets muddled because some on the left use it as an all-purpose put-down of conservatism—to the point where one might wonder whether it is just an annoying buzzword. But neoliberalism does have a precise and useful meaning, as a reversion to the verities of classical economics, with government as guardian of unregulated markets.

In his new book, The Rise and Fall of the Neoliberal Order, Gary Gerstle, an American historian who has taught at Sidney Sussex College, Cambridge, since 2014, argues that neoliberalism needs to be understood as a “political order,” which he defines as an era in which a certain set of ideas and policies have become politically hegemonic. “A key attribute of a political order is the ability of its ideologically dominant party to bend the opposition party to its will,” he writes. “Thus, the Republican Party of Dwight D. Eisenhower acquiesced to the core principles of the New Deal order,” just as “the Democratic Party of Bill Clinton accepted the central principles of the neoliberal order in the 1990s.” Gerstle’s lens helps us appreciate the self-reinforcing power of neoliberalism. As government became a less dependable source of economic security, people were made to feel that they were on their own, thus internalizing an individualist rather than collectivist view of citizen and society.

What differentiates neoliberalism from the older ideal of laissez-faire is the recognition that a free market will not reemerge if the government simply gets out of the way. The neoliberal perspective, as first articulated in the 1930s by the Austrian economist Friedrich Hayek and by Henry Simons of the University of Chicago, holds that if we want entrepreneurs, financiers, and ordinary citizens to be liberated from state regulation, strong government rules must protect the market from the state. Milton Friedman, in a 1951 essay titled “Neo-Liberalism and Its Prospects,” agreed that this project went well beyond laissez-faire. Gerstle writes, “This strategy was built on a paradox: namely, that government intervention was necessary to free individuals from the encroachments of government.” The historian Quinn Slobodian, in his authoritative intellectual history of neoliberalism, Globalists (2018), goes further: “The neoliberal project was focused on designing institutions—not to liberate markets but to encase them, to inoculate capitalism against the threat of democracy.”

Leftist theorists had long appreciated the role of the state in defining the market. As Karl Polanyi famously wrote, relishing the paradox, “laissez-faire was planned.” And indeed it was. To function at all, even “free” markets require extensive rules defining property itself, the terms of credit and debt, contracts, corporations, bankruptcy, rights and obligations of labor, and so on. The difference between the New Deal or social-democratic view of markets and the neoliberal ideal is that progressives want the government’s rules to act as democratic counterweights to the abuses of capitalism, while neoliberals want them to protect market freedoms. But both accept that capitalism requires rules.

Advertisement

As a dissenting remnant of pre-Keynesian economics, neoliberalism languished until the New Deal model faltered in the 1970s with the improbable combination of inflation and stagnation. Classical economic liberals like Friedman, who had been politically marginal, got a fresh hearing. Carter, never much of a Roosevelt liberal and facing political fallout from stagflation, hoped that deregulation and market competition might restrain prices. Reduced government intervention was congenial to the business elites who were again ascendant during the Reagan presidency. Neoliberalism became the ideological underpinning of a relentless turning away from a managed form of capitalism.

Gerstle explains how the cultural left also found the libertarian and antibureaucratic aspects of neoliberalism appealing, weakening the New Deal order and its political coalition in yet another way. In the culture wars of the 1960s, the New Left rejected corporate cold war liberalism and unresponsive big government in favor of a wished-for “participatory democracy.” Some of this entailed challenging public institutions. “Both left and right, in their new incarnations, shared a deep conviction,” Gerstle writes, that the bureaucratized system “was suffocating the human spirit.” A few years later, Ralph Nader became convinced that several regulatory agencies had become hopelessly captured by the industries that they regulated and helped persuade Carter that the remedy was deregulation.

Despite neoliberals’ embrace of economic liberties, they can be cavalier about political liberties. As theorists such as Isaiah Berlin appreciated, people depend on positive as well as negative rights. The freedom to get an education or receive medical care regardless of one’s income exists in the realm of citizenship. These are freedoms that markets don’t provide and that proponents of neoliberalism ignore. When the dictator Augusto Pinochet needed advice on privatizing and deregulating the Chilean economy, he turned to “los Chicago Boys,” who assisted him without embarrassment. Ironically, neoliberalism undermines liberalism in its oldest sense—the human liberties of the Enlightenment.

Neoliberalism not only protects the market from the regulatory state; more radically, it expands market principles to realms thought to be partially social. Whereas Polanyi, for instance, warned about the tendency of a market society to relentlessly “commodify” social relations, neoliberal theorists embrace this as a virtue, arguing that market measures can be efficiently applied to value everything from human life to the environment.

In the neoliberal view, labor is better understood as “human capital,” a concept associated with Friedman’s University of Chicago colleague Gary Becker. According to Becker, markets pay workers precisely what they deserve, even though in some cases wages are insufficient to sustain a decent life. Conversely, even rapacious billionaires merit their earnings, by definition, because markets are presumed perfectly efficient when protected from government interference.

In the absence of counterweights such as government regulation and strong unions, these dynamics become more intense over time. Since labor is just another commodity, production can be offshored to countries where it is cheapest. More recently, with computer-aided innovations such as ride-sharing platforms like Uber, delivery services such as Instacart, and odd-jobs bidding sites like TaskRabbit, workers compete directly against one another as vendors in an open marketplace while being monitored minute by minute for efficiency. This was the sort of pure “spot market” in labor celebrated by Friedman and abhorred by Karl Marx.

Corporations, though creations of the democratic state, are said by neoliberal theorists to have no reciprocal responsibility to communities or employees, only to shareholders. Public education is not a public good but another marketplace with mechanisms such as vouchers, which give families money toward tuition at the school of their choice. In health care, cost disciplines are deemed to operate best with the use of market incentives and for-profit vendors. Retirement income is better served by private accounts rather than by public social security. Environmental goals are to be achieved with marketlike measures, such as auctioning the right to pollute, not “command and control” regulation. Taxation rates should be low and consistent across all income levels, rather than redistributive. Antitrust enforcement is gratuitous and even perverse, because markets police themselves through supply and demand.3 Government’s role should be largely reduced to maintaining physical security and protecting markets from state interference—the “night-watchman state.”

This has indeed been the dominant set of beliefs behind the policies of the past four decades. Was it a success or a failure? That depends on who you are. For economic elites and the Republican Party, it has been a splendid success. For the Democratic Party, the neoliberal order has been a catastrophe, eviscerating the core claim of progressives since FDR that government can serve the common people. Neoliberalism has thus been both antidemocratic and anti-Democratic.

As economic policy, neoliberalism largely failed to improve economic performance. Growth rates were far higher between the 1940s and early 1970s, when the economy was governed by principles of managed capitalism. However, neoliberal policies did drastically increase income inequality, with virtually all economic growth benefiting the top few percent, while earnings and job security for most people stagnated or declined.4 With concentrated wealth came concentrated political power to promote even more neoliberalism, as countervailing institutions such as labor unions were weakened and direct public programs like Medicare were partly privatized.

Advertisement

Notwithstanding the ubiquity of computers during the neoliberal era, productivity growth has been no better than it was in the postwar period. Health insurance became more costly and less reliable as both insurance companies and hospitals were increasingly transformed into for-profit institutions, avoiding unprofitable patients. Retirement security was weakened, as guaranteed pensions were shed by corporations in favor of marketized 401(k) accounts that shifted all the risk and most of the cost to workers. The deregulation of financial markets led to innovations, but they mainly served speculation by insiders and resulted in the financial collapse of 2008.

Politically, the consequence was a broad loss of confidence in Democrats as the party that championed the interests of working people, and in government as an instrument of broad public benefit. The inheritors of this partisan alienation were first the Tea Party–era Republicans, and then Donald Trump. As late as the 1996 presidential election, counties that were at least 85 percent white and earned less than the national median income split about evenly between Democrat Bill Clinton and Republican Robert Dole. In the 2016 election, such counties went 658 for Donald Trump and two for Hillary Clinton.

Why, then, did Democratic presidents embrace an economic credo that annihilated their own public philosophy and its appeal to the electorate? As Gerstle recounts, it was Bill Clinton who turned the Democrats to full-on neoliberalism. Clinton, who had been attracted to the New Left in his youth, began as more of an economic progressive, espousing New Deal–scale programs such as universal health insurance. The early Clinton presidency was a tug-of-war between more left-wing advisers such as Robert Reich and Joseph Stiglitz and free-market conservatives like Robert Rubin (formerly co-chair of Goldman Sachs), the economist Lawrence Summers, and the former Texas senator Lloyd Bentsen.

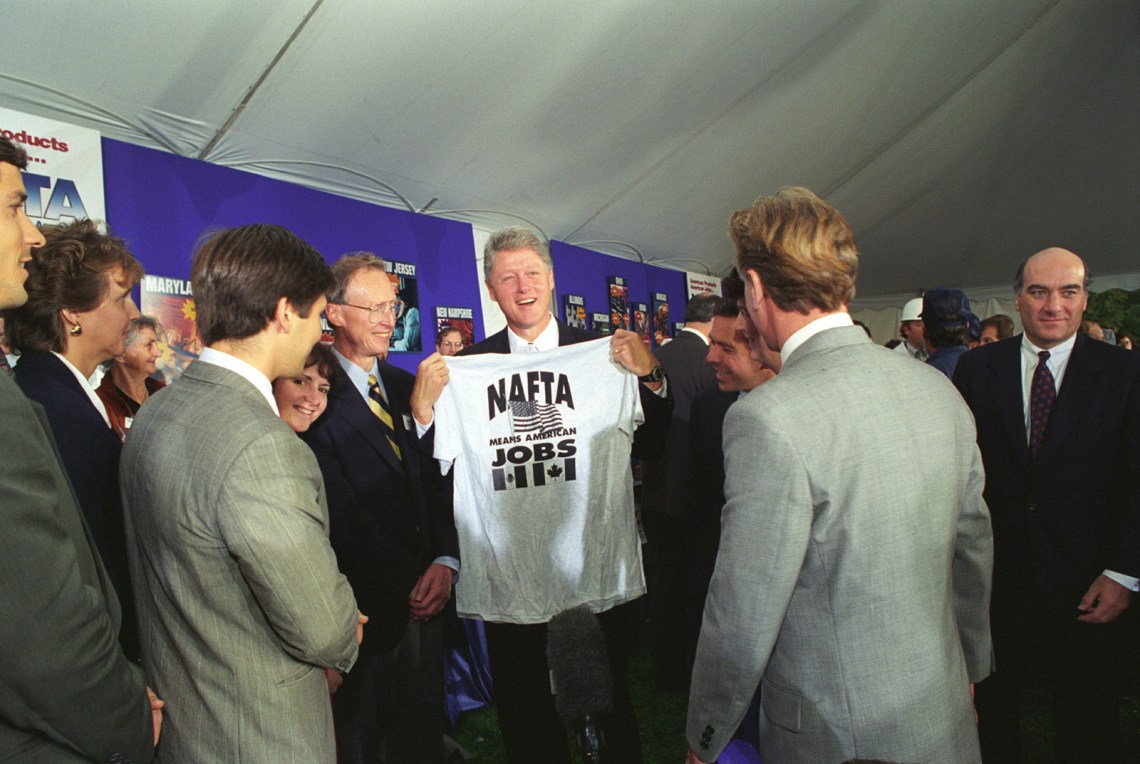

But Clinton was unable to get major progressive legislation through Congress, and Republicans became the congressional majority after 1994. A centerpiece of Clinton’s early program was NAFTA, a “free trade” initiative whose fine print yoked Mexico more closely to US financial markets and gave corporations new rights to file complaints against domestic health, safety, and environmental regulation as supposed barriers to trade. Clinton also made common cause with Republicans in Congress to “end welfare as we know it,” repealing the New Deal’s Aid to Families with Dependent Children program in favor of a stingier and more punitive alternative, called Temporary Assistance to Needy Families.

With major spending programs stymied, Federal Reserve chair Alan Greenspan offered Clinton a grand bargain: the Fed would cut interest rates if Clinton cut the federal budget deficit. The economy would be stimulated not in Keynesian fashion by public investment but by the private sector taking advantage of cheap money. Budget balance, a core neoliberal principle, became an article of faith for Clinton. Rubin designed a fiscal program that reduced federal spending to its lowest share of GDP in decades.

Gerstle characterizes these shifts as mainly opportunistic, and he’s not wrong. Neoliberalism also allowed Democrats to compete with Republicans for business support and campaign money. By the end of his two terms, Clinton, guided by Rubin and Summers, had sponsored more financial deregulation than Reagan or Bush, allowing the growth in speculative credit derivatives and subprime mortgages that set the economy up for a crash. Clinton also made budget balance the centerpiece of his economic program, at the expense of social spending and needed fiscal stimulus. Obama then pursued deficit reduction instead of economic recovery in 2010, when unemployment was still far too high. Gerstle quotes Lawrence Summers: “Not so long ago, we were all Keynesians…. Equally, any honest Democrat will admit that we are now all Friedmanites.”

While the economic crisis brought on by laissez-faire in the 1920s produced a repudiation of free-market policies and the ascendance of the New Deal political order, the crash of 2008 and the Great Recession that followed produced only ideological ambiguity. Franklin Roosevelt had told the 1936 Democratic National Convention that the bankers hated him and he “welcomed their hatred.” Obama settled for imploring a group of leading bankers to support his moderate reform program by saying, “My administration is the only thing standing between you and the pitchforks.” As Gerstle observes, Obama was “a captive of the moment…. Obama would also prove captive to his own inexperience and resulting caution.”

An important aspect of the neoliberal capture of Obama was his reliance on the Clinton economic team. “The return of the Rubin group to power revealed how strong the bonds forged by Clinton with America’s Wall Street elite remained,” Gerstle writes. The financial reform program championed by Obama’s advisers propped up the big banks that had caused the 2008 collapse rather than breaking them up. By early 2010, with the economy far from full recovery, Obama’s economic team was already giving priority to deficit reduction over employment growth.

While Gerstle offers many insights, some of his choices of emphasis are puzzling. At least half the book is political history. He includes sections on the New Deal, the Eisenhower presidency, and Lyndon Johnson’s sacrifice of domestic policy goals in favor of pursuing the ruinous Vietnam War, as well as Clinton, Obama, and Trump. This material is well told, but much of it is familiar. Other strands of the neoliberal saga get short shrift. Gerstle spends just a few pages on the intellectual origins of neoliberalism and its ideological development beginning in the 1930s. These passages are spot-on as summaries, but insufficient given the book’s broad subject. For readers who want to go deeper, Slobodian’s Globalists is the right companion.

Another blemish in this valuable book is that Gerstle tends to exaggerate the role of communism as a driver of the rise and fall of the New Deal order and then of the neoliberal one. He contends that “the fear of communism made possible the class compromise between capital and labor that underwrote the New Deal order.” That seems overstated. The New Deal was mainly about surmounting the Great Depression. Soviet communism was a remote threat, and some of the militant labor organizing that made possible what could later be characterized as a class compromise was in fact done by socialists as well as communists.

Gerstle also puts “the fall of communism at the center of the story of neoliberalism’s rise,” but the timing isn’t quite right. Neoliberalism was ascendant well before 1989, and Clinton’s embrace of neoliberal ideas and policies reflected almost entirely domestic factors. The collapse of communism did reinforce the idea that there was just one reigning global ideology—capitalism. Yet different brands of capitalism—social democratic, neoliberal, and lately kleptocratic—remain in contention.

A more serious problem is the book’s lack of attention to globalization as both emblem and vector of neoliberalism. Gerstle treats the subject only in passing and not in any depth. The era between Roosevelt and Reagan was one in which capitalism was substantially national. This was a deliberate legacy of the Bretton Woods system, which was established in 1944 and provided for fixed exchange rates and controls on the movement of private capital. Those rules made it more feasible to regulate capitalism, both politically and structurally, because capitalists could not do an end run around the nation-state through tax dodges or trade agreements that undermined regulation, and because governments could pursue full employment without pressure from financial markets to pursue austerity—the favorite neoliberal remedy for loss of investor confidence. National capitalism was also more amenable to trade unionism because it could create enforceable collective bargaining rights.

In the 1980s and 1990s, what the Harvard economist Dani Rodrik has termed “hyper-globalization” became an important neoliberal instrument for weakening the nation-state in favor of a global market that would be much more difficult to control. Under the auspices of the relatively weak General Agreement on Tariffs and Trade (GATT), the main goal of trade talks until the 1980s was mutual reductions in tariffs. Governments retained the right to have industrial subsidies, policies that favored domestic banks and insurance companies, and other affronts to global free markets.

In the Uruguay Round of trade talks (1986–1994), more radically libertarian trade policies were proposed by multinational corporations and banks, and embraced first by George H.W. Bush and then by Clinton. These negotiations successfully promoted a much deeper form of globalization, shifting the balance of power between the state and the market. Corporations were given new international rights over intellectual property, allowing them to countermand national laws on patents. Many forms of financial regulation were defined as improper barriers to free trade.

The new regime was codified in the World Trade Organization (WTO), which has far greater enforcement powers than the GATT. As Rodrik has written, this new form of globalization has made capitalism more impervious to regulation and to national democratic accountability. Globalization has become a prime instrument of neoliberalism, both ideologically and institutionally. Gerstle omits this aspect of the story almost entirely.

Slobodian’s Globalists connects the ideological roots of neoliberalism with the policies carried out more than fifty years later to accomplish it. As early as 1939, Slobodian recounts, Hayek was already calling for a “free-trade world federation” that would be “the antidote to planning” and would protect markets from regulation. With the creation of the WTO in 1995, Hayek got his wish. Slobodian describes the interplay of neoliberal ideological development with the creation of global institutions to serve and reinforce the neoliberal order. This included a strategic alliance between senior officials of the GATT and US corporations to constrain national regulation of financiers and industrialists.5

Free trade is widely prized as a good thing, so the morphing of an organization committed to tariff reduction into one used to generally dismantle managed national capitalism has largely escaped public understanding. International trade tends to get a free pass from the broad recognition that modern democracies must regulate the anomalies and inefficiencies of their markets in multiple respects—conventionally, you are either a virtuous free-trader or a foolish protectionist.

It has taken no small amount of nerve on the part of Joe Biden and his administration to pull back from neoliberalism’s radically expansive use of trade, such as his limiting US cooperation with WTO dispute panels. Biden has been helped in this effort by supply chain shocks that impeach naive assumptions about the greater efficiency of globalism, and by the need to contain the rise of mercantilist China, which benefits from the open access of the WTO system but flouts WTO rules with subsidies, protection of domestic industries, and theft of trade secrets.

With the Biden presidency, we have seen a welcome turning away from neoliberal ideas more generally. His administration has sought to move back to something closer to the New Deal, with greater public investment, more regulation, progressive taxation, skepticism about free trade, and increased support for labor unions. But unlike FDR and LBJ, Biden does not have a working legislative majority. In a strong final chapter, Gerstle effectively describes why Biden turned left—both the failure of neoliberalism in practice and “the integration of a revived left into the Biden administration.” He also lists the multiple obstacles to Biden’s success: the climate calamity, racial divisions that the right deftly exploits, the lingering political power of liberated finance, the continuing appeal of Trumpism, and a gridlocked Congress.

Gerstle’s title refers to the “fall” of neoliberalism. But as he acknowledges in his assessment of obstacles to Biden’s success, that characterization may be premature. Neoliberalism has indeed been discredited, as both theory and practice. With the efforts to contain China, the economic sanctions on Russia, and the supply chain shocks, the globalist aspect of neoliberalism will never be the same. Yet because of the residual power of financial elites and their intellectual allies, the appeal of market fundamentalism is far from dead.

This political moment is not necessarily a turning point. It could be an inconclusive stalemate that will produce even more mass disaffection from democratic government and politics (and from the Democratic Party), along with more support for autocrats. As the Italian Marxist Antonio Gramsci wrote of an earlier period, “The crisis consists precisely in the fact that the old is dying and the new cannot be born; in this interregnum a great variety of morbid symptoms appear.”

-

1

The word is doubly confusing because in the 1970s some Democratic intellectuals and politicians seeking a less bureaucratic and technical form of liberalism—including Charles Peters of the Washington Monthly—took to calling themselves “neoliberals.” The term was also used to describe Senators Gary Hart and Paul Tsongas, among others. See Peters, A New Road for America: The Neoliberal Movement (Madison, 1985). ↩

-

2

One might argue that Lincoln, who used strong national government both to defend rights and to develop the economy, prefigured this shift. ↩

-

3

See Robert Bork, The Antitrust Paradox: A Policy at War with Itself (Free Press, 1978). ↩

-

4

See Jacob Hacker, The Great Risk Shift: The New Economic Insecurity and the Decline of the American Dream (Oxford University Press, 2006; revised and expanded edition, 2008). ↩

-

5

The most detailed account of the role of US elites in the creation of the WTO is Lori Wallach and Patrick Woodall, Whose Trade Organization? A Comprehensive Guide to the WTO (New Press, 2004). ↩