It’s a summer afternoon in Manhattan, and Vivian Gornick is trying to fasten a spray attachment to the faucet of her sink. She can get the attachment inside the faucet, but it won’t stay in place. Her super says that the attachment’s threads are worn. Gornick detaches the faucet and heads to the hardware store to buy a new attachment, anxious that she won’t be able to get what she needs. The man behind the counter tells her the problem is not the threads; it’s the washer, which is plastic. He drops a metal washer into place inside the attachment and screws it into the faucet. Gornick is ecstatic. “You’ve done it!” she cries. He charges her $2.15, which she happily pays: “It is such a pleasure to have small anxieties easily corrected. Now you’ve freed me for large anxieties.” “What you just said,” he replies. “That’s a true thing.” Later that night her friend Leonard tells her she paid too much.

Like many of Gornick’s set pieces, this one, from Approaching Eye Level (1996), is a memoir of attachments—our delight upon their achievement, our distress over their failure. What sets this story apart from her others is that the attachment happens through an exchange of money for parts and labor. Most stories of connection are like Howards End, in which money and property hinder the intimacy of two souls. So heavy is the weight of that tradition that even Gornick, the most self-reflective of writers, doesn’t note the economics of her tale. The market is the setting for that shared wisdom across the counter; her needs are recognized and met through an act of exchange.

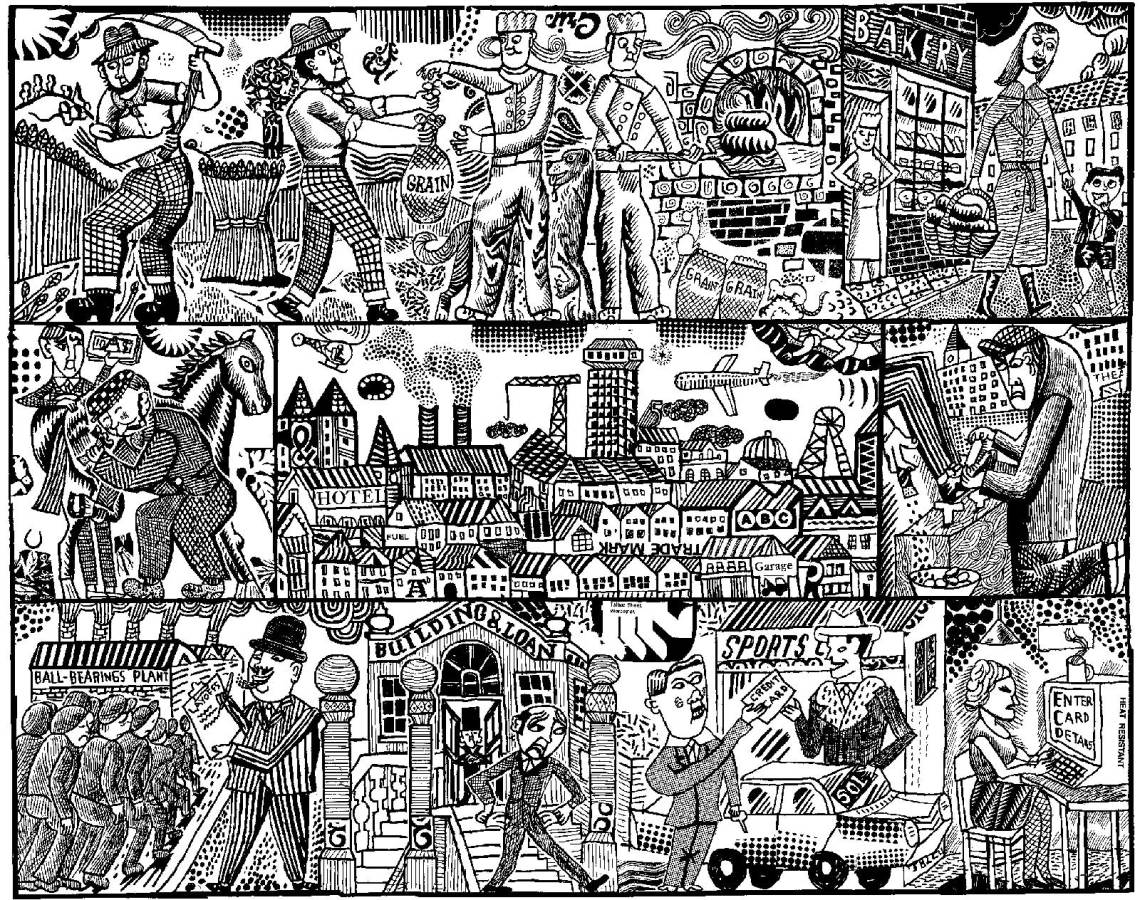

The idea of the market as a communion of souls was once the lingua franca of European culture, helping to midwife the birth of economics from the seventeenth to the eighteenth centuries. Commerce was seen as a source of sociability, pulling solitary selves out of isolation, drawing far-flung communities into contact with each other. God wishes “human friendships to be engendered by mutual needs and resources,” wrote the Dutch political philosopher Hugo Grotius, “lest individuals deeming themselves entirely sufficient unto themselves should for that very reason be rendered unsociable.” According to Kant, it was through the trade in salt and iron that people first “achieved mutual understanding” with one another and “the most distant of their fellows.” The multiplication of needs and the expansion of markets bring increase—not just of products but also of perspective, conversation, and views. The more developed the economy, wrote David Hume, “the more sociable men become.” So many and so various are the goods being exchanged in any one transaction that “commerce” came to be defined, in Samuel Johnson’s Dictionary, as “interchange of any thing.”

It’s no accident that Adam Smith was the first great economist as well as our most acute psychologist of the enlarged form of “fellow feeling” that went, in the eighteenth century, by the name of sympathy. Once upon a time, economics and sympathy were one and the same. Yet something got lost on the way to the market. Smith’s An Inquiry into the Nature and Causes of the Wealth of Nations (1776) opens with pleasant stories of workers cooperating in a pin factory and quick-witted boys scrambling over steam engines, inventing labor-saving devices for pistons and boilers, so they can leave the machines unattended and rush off to play with their mates. It closes with scenes of stunted and stupefied laborers, colonial slavers, premonitions of violent revolt from indigenous peoples dispossessed of their lands, and a monstrous and modern form of sovereignty called the East India Company. Sympathy is nowhere to be found; profit occludes all.

If one terminus of commercial society was the blinding of the self to the other, a second was the engulfment of the self by the other. An isolate on a desert island, Smith observes, thinks clearly about the contribution of material goods to his enjoyment and ease. Lacking the mirror of society, in which a bauble is reflected back to us as a useful good, the castaway is less likely to forsake the convenience of a toothpick or a nail clipper for the prize of wealth. Only in society do riches take on value and become an object of our labors—not because they bring us greater material satisfaction but because “they more effectually gratify that love of distinction so natural to man.”

That pendulum swing, between the pathologies of insufficient and excessive feeling for the other, haunts modern economics. Too little feeling gives rise to dispossession. Too much feeling warps the self’s relationship to material goods. Smith and John Maynard Keynes are the great theorists of this dynamic. Karl Marx, W.E.B. Du Bois, Charlotte Perkins Gilman, and Thorstein Veblen wrote about it, too. But Smith and Keynes are unique. Conscious of the pathologies of sympathy, they still retain the ideal of the market as a sphere of sociability. That lends their work a special poignancy today, when we are again asking the question that once agitated so many: What is the purpose of the economy, and to what extent does it reflect our social selves?

Advertisement

As the author of numerous books and articles on economic and moral concerns, the philosopher Samuel Fleischacker is well positioned to make sense of Smith’s theory of sympathy and its place in his system of thought. In On Adam Smith’s “Wealth of Nations” (2004), he traces the idea throughout Smith’s analysis of the economy. In his recent Being Me Being You, he injects Smith’s theory of sympathy into debates about moral psychology and multiculturalism. Like many contemporary philosophers, Fleischacker refers to Smithian fellow feeling as “empathy” rather than “sympathy.” While sympathy entails caring or showing concern for others, empathy requires a more exigent identification. It asks us to walk in the shoes of the other. Though it didn’t enter the English language until 1909, “empathy” better captures Smith’s interest in how we feel with others.

If empathy gets us closer to the feeling of the other, it does not shield that feeling from scrutiny. Fleischacker usefully distinguishes here between Smith’s theory of empathy and Hume’s. Hume relies upon a “contagion” model of empathy in which we involuntarily catch the mood of another much as we might catch a cold. When we are physically proximate to a person, their distress becomes our distress, their bliss our bliss. That is why Humean empathy tends not to breach the boundaries of family and neighborhood. Smithian empathy entails a more complex act of imagination, deliberation, and judgment, in which we simultaneously are drawn toward and pull back from the experience of the other.

To feel empathy for a friend, I must know the details of her situation. I observe what she appears to be feeling. Because sensory evidence can be misleading—my friend may not have an expressive face or tone—I speculate on what she might be feeling, given what I know about her character and situation. I imagine how I would feel. I reflect upon what Smith calls the “impartial spectator”—a wise and benevolent superego that teaches us what is appropriate to feel in each situation. Out of that complex of imaginative acts, I experience a feeling that seems right.

If my feeling aligns with that of my friend, we will share a sense of concord, either a solidarity of suffering or a camaraderie of joy. If our feelings do not align, each of us experiences a terrible desolation. This presses us to take a second look at our responses to the situation, if for no other reason than to restore our connection to the other. Maybe we overlooked some fact of the situation that would help us understand each other better.

Misalignments of feeling prompt modulations of feeling. To gain the empathy of others, Smith says, we “flatten…the sharpness” of our feeling, “lowering [our] passion” to such a “pitch” that the other is “capable of going along” with us. Smith could be narrating the dance of Elizabeth Bennet and Mr. Darcy. He also could be describing negotiations over the price of bread. Both are born of a difference that moves, through sense and sensibility, to concert.

In The Wealth of Nations, Smith writes, “It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest.” Far from being a description of egoism or selfishness in the market, which is how this passage is often read, Smith’s statement is an injunction to orient ourselves toward others. The market requires us to talk to other market participants not “of our own necessities but of their advantages.” It forces a change in our perspective, pressing us to look upon the world through their eyes. If we fail at that task, we will fail to get what we want out of the market. Thus does the market impose on us the rule of empathy.

The last twenty years have seen the rise of a rich scholarship on Smith’s ideas about empathy, commercial society, and the burgeoning global economy of the modern era. Much of this scholarship is focused on the colonial background of his argument—that vast assemblage of monopolies, corporations, settlers, and dispossessed peoples that went under the banner of the British Empire. While the promise of commerce had been to lure isolated communities to a greater mutuality with peoples across the globe, the practice of international trade produced the opposite: the degradation, domination, and murder of non-Europeans. According to the political theorist Sankar Muthu, that practice “created a deep ambivalence” about global commerce among Smith and other Enlightenment thinkers.1

Advertisement

Though political economy–minded scholars such as Onur Ulas Ince question the probity of that ambivalence, theorists like Jennifer Pitts show that Smith’s appreciation of the view of the other, and his incorporation of that view into his understanding of the impartial spectator, lend him a vantage from which to criticize many, if not all, colonial practices.2 Like Pitts, Fleischacker argues that Smithian empathy can encompass a wider appreciation of difference, including differences of culture, gender, race, and class.

Much of this scholarship hinges on what Emma Rothschild calls “the politics of distance,” according to which the communion of markets is thought to be disrupted by far-off adventures of conquest and empire. The thesis makes three assumptions. First, injury or harm follows from the failure to see or to feel with the other. Second, the fact of distance—physical or cultural—creates the conditions of that failure. Last, such failures are made manifest when men of commerce swap the arts of trade for the weapons of rule, when the calculations of commercial society are perverted by the ambitions and vices of political life. Because global markets require political institutions for their protection, the warping effects of politics are sown into the practice of international trade. In addition to aiding our understanding of Smith and the eighteenth century, the politics-of-distance thesis is meant to anchor contemporary commentary on the global economy. The “dilemmas of empire,” writes Rothschild, “or of the insecurity of long-distance commerce and long-distance imagination, are very similar to the dilemmas, still, of our own times.”3

Yet Smith’s interpretation of commercial society and its flaws cannot be accounted for by failures of vision, the introduction of physical or cultural distance, or the intrusion of political vices and imperial concerns. A close reading of Smith shows that those flaws and vices are woven into all commercial transactions, arising from the moment that empathy becomes the companion of exchange. What makes it possible for the isolate on the desert island to think so lucidly and peaceably about material goods and their contribution to his well-being? Smith is clear: it is the absence of other people. Only in an economy of one, where there is no exchange at all, do we make decisions like the rational actor of economics textbooks—which is why Robinson Crusoe is such a fixture of them.

Once we enter society and start trading with one another, Smith thought, material goods take on a social meaning. Now we are as concerned with how those goods make us appear to others as we are with the goods themselves. Once we enter an economy with others, which is the only economy there is, we cease to think and act in a strictly economic sense. When “everyone began to look at everyone else and to wish to be looked at himself,” wrote Rousseau, “public esteem acquired a price.” Smith’s theory is an attempt to make sense of that price.

Recent scholars have shown how indebted Smith was to Rousseau, whose work he translated and reviewed.4 Central to Rousseau’s theory, the intellectual historian István Hont argues, is the phenomenon of “lookism,” the tendency of human beings to notice one another, to see themselves in comparison to others, to measure themselves by the regard in which they are held.5 Like Rousseau, Smith thought that lookism was a fact of the human condition, and like Rousseau he thought it was bound up with the facts of our material life. All of us are lookers because all of us are materially dependent upon one another for the provision of our needs.

That makes us the most socially attuned of beings, but attunement is a double-edged sword. It can be a cause of elevation, whereby we address the needs of others in a spirit of cooperation, mutuality, and collective labor. That sort of empathy finds its level for Rousseau in political life and for Smith in the economy. It can also be a source of misery. We compete for attention, desperate to ensure that we get seen and our needs are attended to and that those of others come after ours. That, too, finds its expression in our collective life—not just in politics but also in the economy.

Because our material life is caught up in our social life and vice versa, the politics of distance is merely one of a larger set of commercial pathologies. There can be no economic undertaking that is not touched by our quest for the respect and recognition of others. Ideally that creates the possibilities for an economic democracy of mutuality and cooperation; that will be the path of the socialist left. But that is not the world of Adam Smith. Nor is it ours.

With one group of Smith readers warming to his empathy economics and another appreciating the coolness of his critique of colonialism, we might think that, but for slavery and imperialism, markets could fulfill their promise of empathy. Smith offers little support for that view. Long before he gets to the entanglements of slavery or colonialism, Smith mounts an analysis of money, poverty, and the labor market that makes it impossible to separate progress from regress in a commercial society. Commercial society both closes and creates distance between people. It prevents us from seeing one another; it is also the condition of our being seen. Not seeing one another, in some economic circumstances, is the condition of our being seen. In other circumstances, it doesn’t matter whether we are seen or not; we still do harm.

Consider the transition from a barter economy to a money economy in The Wealth of Nations. The book’s opening chapters depict scenes of cooperative labor in which individuals trade items they have hunted, grown, or made. This is a society of transparency and particularity. From the point of view of empathy and economics, however, it is severely limited. What happens when one trader has no need for the item of the other? There can’t be a trade, so neither of their needs will be met. When enough people find themselves in that situation, they will realize that they need some commodity that “few people would be likely to refuse in exchange for the produce of their industry.” That commodity is money, which is settled upon, over time, as the medium of exchange.

This is a moment of genuine progress, allowing for a greater number of desires and needs to be met. But along the way, butchers, brewers, and bakers are replaced by a generic “people” whose specific needs other people know little about. “When a buyer comes to the market,” Smith says in his Lectures on Jurisprudence (1762–1763), “he never asks of the seller what expenses he has been at in producing” his wares. Money makes it possible for us to dispense with that knowledge of the other, yet money also makes it possible for us to meet the other’s needs.

Money also introduces the possibility of fraud and deception between nearby traders of the same culture. Precious metals can be mixed with baser materials, enabling people to take advantage of one another in a way not countenanced by Smith’s barter economy. This leads people to demand that trade be conducted in coins with a “publick stamp” guaranteeing their worth.

We began with a barter economy that was open and transparent, each of us responding to the particularity of others’ needs. Now we conduct our trades through a state-created system of money that is “in its own nature extremely abstracted” and the explanation of which will likely remain “in some degree obscure.” Yet that, too, is progress.

The ancient Greeks believed that the political realm was “the space of appearance,” wrote Hannah Arendt. Through political action, men acquired a public identity that was visible to other men; in the polis, they saw and were seen by others. Smith’s innovation was to locate that space of appearance in the economy. Why do we seek wealth, he wondered, losing ourselves in “all the toil and bustle of this world?” It is not to supply us with necessities, for “the wages of the meanest labourer can supply them.” What we want from wealth is “to be observed, to be attended to, to be taken notice of with sympathy.” The reason the rich man “glories in his riches” is that “he feels that they naturally draw upon him the attention of the world.” He is “fonder of his wealth, upon this account, than for all the other advantages it procures him.” The poor person, by contrast, lives “out of the sight of mankind.”

While a commercial society offers opportunities for new participants to appear in the world, Smith’s economic theory of “effectual demand” is a devastating account of what those opportunities cost the rest of us. Markets don’t respond to the needs of everyone, neatly aligning supply and demand. Markets respond to “effectual demanders,” those willing and able to pay for a good’s production. The wishes of the less well-off are not always registered by the market. Smith is thinking here of the market in luxury goods, imagining a poor person who desires to own a coach drawn by six horses. The wish of that man is so far from being satisfied that it cannot pierce the veil of prices. He may envy the man who has such a coach, as Bernard Mandeville wrote in The Fable of the Bees (1714), but “it will never be with that Violence, or give him that Disturbance which it may to a Man, who keeps a Coach himself, but can only afford to drive with four Horses.” The flimsiness of the poor man’s envy, the weakness of his wish, ensures that his desire never makes an appearance in the market.

We might see here a salutary kind of Smithian empathy at work. The gap between the poor man’s wants and the market’s rewards is like the gap between what a too-sensitive person may feel and how her sensible friend responds to her feeling. Just as that gap pushes the sensitive person to revise her feeling to secure the sympathy of the sensible, so will the gap between the poor man’s wants and the market’s requirements temper his desires, forcing him to revise his wishes in accordance with the market’s reality. Perhaps the poor man will develop a desire more capable of satisfaction. When that satisfaction is achieved, he will experience the concord between himself and the world that we all seek.

In his Lectures on Jurisprudence, however, Smith extends his theory of effectual demand to any item that is scarce, no matter how necessary it is to our well-being. It could be water, shoes, or bread. In situations of scarcity, “the fortune of the bidders is the only regulation of the price.” People with fewer resources are priced out. Markets eventually may adjust to meet their need for simple commodities, but with more complex goods like health care or education, the distance of lower-income people from a decent hospital or school may remain as great as that which keeps them apart from a six-horse coach.

The fraught relationship between empathy and economics is not always a question of distance, whether it be the distance of abstraction, invisibility, or obscurity. Sometimes, as in exchanges between employers and laborers, the needs of both parties are all too visible, yet empathy does not obtain. Wealth is the “power of purchasing,” says Smith, including the power to purchase the labor of another. While not identical to political power, the power to purchase labor gives the employer a right to govern other people, to contract their submission to his rule. The aims of the employer and the laborer are transparently in conflict: “The workmen desire to get as much, the masters to give as little, as possible.”

The problem is that their power is unequal. In any exchange of wages for work, the employer has the advantage. Because of his wealth, he can hold out longer than the workers, who need the wages more immediately than he needs their work. Workers are forced “into a compliance” with his terms. Only changes in the law, which are unlikely because the government’s “counsellors are always the masters,” or the contingency of a growing economy, in which the need for more labor gives workers a negotiating edge, can mitigate their powerlessness, making it possible for their needs to be met. As the Federal Reserve’s decision to raise interest rates to reduce inflation—which decreases the demand for products and workers—indicates, the tolerance under capitalism for tight labor markets and bargaining power for workers is limited.

Fleischacker might chalk up these failed attempts at finding empathy in economics to the distinction between what he calls “cognitive” and “affectional” empathy. The first is a way of knowing, the second of feeling. It’s possible to be a talented empath lacking in empathy. Think of the actor, the poet, or the con artist. Each has a deep appreciation of the experience of other people. An actor puts herself, with equal facility, into the shoes of the wicked (Goneril and Regan) or the good (Cordelia). The poet, as Keats says, “has as much delight in conceiving an Iago as an Imogen.” Neither need care about the fate or well-being of their creations. The con artist does not care about his mark; he seeks to fleece her. As Fleischacker acknowledges, empathy may help us to care better for those we already care about or to extend the circle of our care, but it cannot create in us a desire to care. Knowing and feeling with the other can just as easily serve the selfish or instrumental purposes of the knower and the feeler.

Fleischacker’s distinction between cognitive and affectional empathy is well posed. But it undermines the claim that a commercial society—or what we call capitalism—entails the kind of empathy economics that Smithians want to find there. “Empaths without empathy,” after all, is a pretty good description of successful market participants under capitalism.

Smith hoped that the market might discipline our lookism, making us attuned to others without losing ourselves in status games or destroying other people through acts of predation. The Wealth of Nations attempts to show how commercial society produces self-regulating and other-regarding beings, the economic corollaries to the virtuous citizens of Rousseau’s republic, prone to neither domination nor servitude, ready for cooperation and conversation. Price, for Smith, is the mechanism of material and moral progress. To achieve recognition in society, we compete in the economy, amassing wealth and property. But to maintain our economic position, we must modulate our need for recognition. We must eschew vanity and easy approbation, relying on our inner compass and prudent calculation to meet the needs of others, honestly and honorably.

In Smith’s view, the fall of feudalism is an instructive tale, explaining what happens to wealthy people who fail to honor the economic rules that underpin their social standing. The feudal lord possessed extensive lands, which he saw less as an economic resource than an instrument of power. “A sort of petty prince,” he made law, waged war, and settled disputes. Yet the foundation of his power was economic. His lands generated surpluses, which he used to hire servants and retainers, who gave him their obedience. From that obedience, he amassed power.

With the creation of global markets, the lord had something new to spend his surplus on: “frivolous and useless” items such as gold jewelry and diamond buckles. The expense of these items was great; their shine was greater. For the sake of them, the lords sold their lands and lost their surplus. They “bartered their whole power and authority,” and the members of a once-great ruling class were significantly reduced.

The moral of the story is clear. Social standing depends on economic position. “Such effects” of power and authority “must always flow from such causes.” Smith’s intended audience is the merchants and imperial states of Europe, particularly Britain. He feared that the merchants and the British state would forgo their standing by squandering their economic resources in a misbegotten quest for prestige. If the market didn’t discipline them to reality, he hoped his writing would.

The failure of that project spills out as readily from Smith’s pen as the failed republic of virtue does from Rousseau’s. According to Smith, slavery is less profitable than free labor. Yet slavery persisted across the world, including the American colonies. Why doesn’t the slave master realize how precarious his economic position is, relative to that of employers of free labor, and draw the appropriate conclusion in favor of emancipation? Because “the pride of man makes him love to domineer, and nothing mortifies him so much as to be obliged to condescend to persuade his inferiors.”

Slavery offered a clear choice between economic profitability and social standing. Colonialism involved a murkier mingling of motives. The Wealth of Nations was published in 1776, and the freedom of the North American colonists looms over its pages. Smith’s position is straightforward. The costs of defending the empire are high; the returns are low; the colonists should be freed or given equal rights of representation within the British system. If they are freed, Britain will be able to negotiate the terms of free trade with them, which would be “more advantageous to the great body of the people…than the monopoly which she at present enjoys.”

What prevents Britain’s leaders from reaching this conclusion? In part, they are inspired by the same pride of domination that prevents the slavers from adopting free labor. But the economics of colonialism are also trickier than those of slavery. Though the British people and the British state would benefit from free trade with an independent nation, merchants and manufacturers profit from Britain’s control over the colonial trade. Like Britain’s employers, they have the ear of Britain’s leaders. Unlike the profits of domestic trade, moreover, colonial profits offer so “many opportunities of acquiring wealth and distinction, which the possession of the most turbulent, and, to the great body of the people, the most unprofitable province, seldom fails to accord.” The more difficult and uncertain the profit, the more distinctive and glorious is its achievement. Colonies offer a place where money might make its mark, garnering profit, pride, and place.

These clouds of slavery and colonialism, which darken the horizon of The Wealth of Nations, suggest that profit and pride cannot be so easily extricated from each other. Amid that welter of motives, how is the market to achieve empathy at all?

If markets cannot be trusted to impose the rules of empathy upon their participants, markets will need masters—not slavers but government officials. Slavery may have been less profitable than free labor, but Smith also claimed that more humane and less violent governance on the plantation could make for greater profitability. French slavers in the Caribbean, he thought, were more likely to soften their treatment of the enslaved than slavers in the North American colonies. The fact that France was a despotic monarchy, and that the planters were used to being regulated, made it easier for the government to constrain them and to teach them the rules of profitable management. That was not the case in the less regulated and freer British colonies of North America.

Governors also would have to tame the merchants and manufacturers who privileged their profits over the nation’s power. The extraordinary returns these men reaped from Britain’s monopoly over colonial trade harmed their character and jeopardized their economy. The parsimony and thrift they had learned in the course of their accumulation threatened to dissolve into a frenzy for luxuries and display. Their employees followed their example, forgoing saving for spending. Unless the state intervened, everyone would be swept away in a landslide of disappearing wealth.

In both cases—that of the proud slaver and the profit-minded businessman—Smith thought it was the job of the state to create the conditions for empathy that the market was supposed to instill. And not necessarily a benign night watchman state but, as the case of France suggests, perhaps a despotic state, too. That it was not the market but the state that was to teach these rules of empathy makes Smith’s contribution more like Rousseau’s than we usually think.

And if the state failed? At the other end of that chain of colonial domination stood the indigenous peoples of the Americas, Africa, and Asia, for whom commercial society was a disaster. How might they achieve the empathy of the European world? Smith hoped it might come from the equalizing force of commerce itself, from the accumulation of wealth by indigenous peoples. But he also foresaw a different, more violent path to empathy, which Hegel and Frantz Fanon would theorize in the decades to come. He writes in The Wealth of Nations:

Perhaps, the natives of those countries may grow stronger, or those of Europe may grow weaker; and the inhabitants of all the different quarters of the world may arrive at that equality of courage and force which, by inspiring mutual fear, can alone overawe the injustice of independent nations into some sort of respect for the rights of one another.

Writing in a similar vein, the French philosophes of commerce prophesized the coming of a “Black Spartacus” in the colonies as the liberating answer to the deformations of global commerce.

Whether it required the hard hand of the state to restrain or eliminate the slaver or the violent blow of the colonized to tutor the colonist, empathy could not, it turned out, be left to the economy. It was not doux commerce that created the conditions for mutual recognition and understanding between individuals, classes, and peoples. It was hard power, not simply abroad and at a distance but also near and at home.

For the past thirty years, the left has argued endlessly over which value is more important: recognition of our identities, often framed as a change in language or representation, or redistribution of material goods. Smith ended that argument before it began. In a commercial society, the possession of goods and wealth is the primary source of identity and respect. How we produce, exchange, distribute, and consume is not just an economic question of efficiency or living standards. It’s also a matter of culture and recognition, how we relate to one another and create ourselves. The economy is to the moderns what the polis was to the Greeks: a way of being and appearing in the world, a place to do something “grand and beautiful and noble” that will be recognized now and remembered later.

That we continue to pit recognition against redistribution, identity against economics, indicates how much we still have to learn from Smith, including the lesson of his failure. Smith hoped that capitalism might tame our quest for recognition, sublimating the distemper and desire for domination that threatened the politics of the ancient and medieval worlds. As he came to realize, capitalism instead offered people a new way of doing that old politics.

Smith is not alone in that realization. According to Frank Knight, one of the founders of the Chicago School of economics, “the real motive” of the capitalist is a restless “desire to excel, to win at a game”—to outshine one’s rivals on the Homeric plains of the economy. The intensity of that desire often exceeds the agon of the ancients, making for “the biggest and most fascinating game yet invented, not excepting even statecraft and war.” Under capitalism, the economist Joseph Schumpeter wrote, individuals still possess “the dream and the will to found a private kingdom, usually, though not necessarily, also a dynasty.” The only way to fulfill that dream is through “industrial and commercial success,” which offers “the nearest approach to medieval lordship possible to modern man.”

Like the political conflicts it was supposed to leave behind, capitalism is built on the exclusivity of certain goods—in this instance, the ability to matter, to be seen, in the world. If economic success is the condition of appearance, economic failure threatens existential eclipse. That was Smith’s verdict on commercial society. Across the centuries and the ideological spectrum, it was also Brecht’s:

For some are in darkness

And others are in light

And you see the ones in brightness

Those in darkness drop from sight.

Unless those in darkness seize the light for themselves, obscurity will remain the lot of the many; recognition, the privilege of a few. That, too, is a lesson from Smith.

—This is the first of two articles.

-

1

Sankar Muthu, “Conquest, Commerce, and Cosmopolitanism in Enlightenment Political Thought,” in Empire and Modern Political Thought, edited by Sankar Muthu (Cambridge University Press, 2012), p. 205. ↩

-

2

See Onur Ulas Ince, “Adam Smith, Settler Colonialism, and Limits of Liberal Anti-Imperialism,” The Journal of Politics, Vol. 83, No. 2 (July 2021); and Jennifer Pitts, A Turn to Empire: The Rise of Imperial Liberalism in Britain and France (Princeton University Press, 2005), p. 43. ↩

-

3

Emma Rothschild, “Adam Smith in the British Empire,” in Empire and Modern Political Thought, pp. 188–189, 197; also see Muthu, pp. 208–210; Pitts, p. 275n96. ↩

-

4

See Smith, “A Letter to the Authors of the Edinburgh Review,” The Edinburgh Review, No. 2 (July 1755–January 1756); István Hont, Politics in Commercial Society: Jean-Jacques Rousseau and Adam Smith, edited by Béla Kapossy and Michael Sonenscher (Harvard University Press, 2015); Dennis C. Rasmussen, The Problems of Commercial Society: Adam Smith’s Response to Rousseau (Pennsylvania State University Press, 2008); Pierre Force, “Rousseau and Smith: On Sympathy as a First Principle,” in Thinking with Rousseau: From Machiavelli to Schmitt, edited by Helena Rosenblatt and Paul Schweigert (Cambridge University Press, 2017); and Force, “Self-Love, Identification, and the Origin of Political Economy,” Yale French Studies, No. 92 (1997). ↩

-

5

Hont, Politics in Commercial Society, p. 59. ↩