I

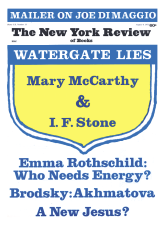

Alternative energy is, after inflation in oil prices and profits, the major subject of present “energy crisis” rhetoric. But new energy supplies may not provide the relief that they now seem to offer, although President Nixon promised, in June, in the latest version of his energy strategy, “intensive effort,” and $10 billion, for alternative energy development.

Coal, shale oil, Alaskan oil, and nuclear fuels will, according to the Administration’s policy scenario, prevent the “serfdom” of oil imports. Energy experts from Wall Street to the Iranian government, and from Mobil to groups in the environmental movement, eagerly endorse the development of domestic energy. The corporate search for a “clean” coal technology resembles a modern gold rush, while oil industry stock analysts find “enormous” potential in a “coal [stock] play.” Professor Carroll Wilson of MIT expressed this general enthusiasm when, writing in Foreign Affairs, he urged an emergency “Decade Program” of publicly financed coal and nuclear development. Coal expansion, he wrote, was “a big job, but no bigger than the Manhattan and Apollo projects,” and, “On the whole we do very well in dealing with national emergencies.”1

A boom in coal and domestic fuel is certain in the next ten years. Unlike energy conservation, or negotiations with oil exporting countries, alternative energy development offers an opportunity for action, for government spending. Yet the unanimity with which this prospect is greeted conceals vast economic and political difficulties which the brisk optimism of, for example, Professor Wilson may not overcome. These difficulties may derive in fact from the basic tenet of present energy policy—a huge commitment to spend national resources on energy production and consumption.

One difficulty of official fuel policy has to do with the value of energy use. Current policy assumes that increased energy use is desirable, as well as inevitable. The confusion and alarm that surround energy policy are compounded by a figurative interpretation of the physicists’ definition of energy as “the capacity to do work.”2 (In the “crises” described in recent advertising, lights fail and work is not done.) Yet national energy is distributed most unevenly among different uses, different fuels, different ways of doing economic work. Driving an automobile for three hours, for example, uses more purchased energy than operating a color television set for a year of normal viewing. Public support for increased energy use, as will be seen, favors certain energy-intensive industries. Energy consumption may not be an absolute good. It may, rather, be more like transportation than like progress—a good which depends on particular social and economic arrangements.

A second difficulty has to do with the extent to which energy policy encourages increased energy use. Government predictions about future energy demand have the force of self-fulfilling prophecy. By sponsoring long-term investment to meet expected needs, government policy will reinforce the existing pattern of energy demand. The commitment to provide for future demand will itself create extra demand. The commitment to provide fuels in a particular form will perpetuate demand for those fuels.

This is the same contradiction of government intervention that troubles, for example, transportation policy. By building roads, which are “needed” to avoid traffic jams, public policy makes driving easier, supports automotive power, and encourages extra auto travel. The identical effect was illustrated in President Nixon’s most recent energy message, urging development of a synthetic oil derived from coal. Public subsidy for such development would help to reduce oil shortages, but would reinforce the power of dominant American businesses—of companies which distribute liquid fuels, including petroleum marketers and oil pipeline operators, of aircraft producers, of conventional auto manufacturers.

A third problem concerns the prospects for energy conservation. Most alternative energy projects endorse energy saving. Their conservation proposals range from the serious if brief suggestions of such experts as Professor Wilson to the arbitrary exhortations of Nixon’s energy messages, urging, for example, the “relaxation of dress standards,” so that those who dress more lightly will use less air conditioning. Selective energy conservation, as Professor Wilson writes, is at least as important as discovering new possibilities for fuel production. But new production may become, in practice, a substitute for energy saving. The coming emphasis on energy investment will probably detract from the urgency of conservation attempts: in particular, of those more radical projects which demand industrial reorganization as well as consumer frugality.

Further problems have to do with the costs of alternative energy projects. The environmental costs of fuel development are suggested by present concern about, to take just a few examples, offshore oil production, strip mining, the Alaska pipeline, the hazards of nuclear power. A publicly supported energy boom will provide a lasting bonanza for powerful energy users—and for the US oil business, which, with its “total energy” corporations, now dominates the coal, oil shale, and uranium industries. Economic costs are at least as alarming. According to government estimates, and allowing for only modest development of “alternative energy,” capital investment in the US energy industries will cost some $100 million a day for the next twelve years.3 This money will be diverted, of course, from other needs and emergencies.

Advertisement

The costs and difficulties of alternative energy will attend fuel development for at least the next ten to fifteen years. Projects for using solar power on a large scale, or for fusion power, belong to the 1990s and later. These difficulties suggest that “emergency” energy programs are able to respond only to quite limited national needs. They will bring horrifying costs to some regions and some people, while favoring a few privileged industries. Unlike, for example, New Deal programs, they will provide few jobs. Their value, in fact, may be depressingly similar to that of the Apollo space programs.

II

More Oil. Petroleum is still the favored source of “new” domestic energy. Expectations about a coal boom notwithstanding, President Nixon has chosen the traditional US oil industry for his most immediate support. His recent tax proposals offer incentives for drilling exploratory oil wells. He urges fast construction of the Alaska pipeline and fast expansion of offshore oil production. New domestic production is unlikely, according to the US Geological Survey, to “make the US ever again economically self-sufficient in oil and gas.” But in the predictions of the National Petroleum Council, oil and gas investment will account directly for $250 billion, or almost half of the money to be invested in US energy between now and 1985.

Petroleum is the most convenient fuel for the US oil industry and for its leading clients. The costs and conflicts of new petroleum production will apply, in much more intense form, to other “new” fuels. Much of the conflict will be economic. Newly discovered oil will be more expensive than oil from older fields. (Even Alaskan oil, although cheap to produce, will be costly to transport.) By subsidizing domestic production, the US will lose the benefits of imported oil—which is likely to remain cheaper than new (or old) US oil for much of the next ten years. The national economy will pay a gigantic premium, for geopolitical security, but also for the safety of oil expansion.

New oil production will also bring the “inconvenience” of regional inequity. US oil consumption has followed the general shape of world oil use, with an advanced metropolitan region importing fuels produced in national and international backlands. The US East Coast, for example, has a role comparable to that of Japan in the world oil economy, using, recently, 40 percent of all oil consumed in the nation, and producing 0.3 percent of crude oil production.4 Oil (or gas) production is less destructive than, say, coal mining. But privileged US regions may find political problems in importing oil from poorer areas. Alaskans now demand increased compensation for bearing the social and environmental costs of national oil consumption. Even the New Mexico State Legislature has passed a so-called “energy crisis” bill, allowing the state to buy back locally produced minerals, and introduced, according to the Wall Street Journal, “after El Paso Natural Gas put some New Mexico cities on quotas while it moved New Mexico gas to California.”

Oil production will bring many new environmental costs. Much new US oil will be discovered under the oceans—and for US consumers, offshore oil production is more alarming in Santa Barbara or Southampton than in Venezuela, Borneo, or the Gulf of Alaska. The East Coast Outer Continental Shelf, from Montauk to Cape Hatteras, may itself offer enormous oil potential. According to the US Geological Survey, one local formation has “much in common geologically” with the world’s largest oil field, at Ghawar in Saudi Arabia. Yet the recent announcement of the mineral potential of these waters stimulated a storm of local protest. Officials of Suffolk County, Long Island, called for an injunction against any offshore drilling, supported by, among many groups, the New Jersey Department of Environmental Protection, the New England Sierra Club, and representatives of the regional fishing industry. The offshore technology that’ could satisfy Southampton would be enormously more elaborate than any yet imagined by the world oil industry.

The political problems of oil and gas development will be particularly intense when “new” North American fuels are discovered in Canada. The Canadian Arctic and offshore waters are the least explored fuel regions in North America. Alberta probably contains more oil, embedded in tar sands, than has been produced in the history of the American oil business. These resources promise exciting opportunities to US oil corporations and their Canadian subsidiaries. Yet Canadians are becoming, in the words of a Wall Street oil analyst, a nation of “blue-eyed Arabs.”5 In the last few months, Canada has imposed new controls on oil exports. The New Democratic provincial government of British Columbia (the “Chile of the North,” to oil investors) this spring boosted and in some cases doubled its royalty taxes on oil and gas. Meanwhile, Canadian regions share the life of an oil-exploration civilization. The North-west Territories are learning the hazards of what the Wall Street Journal describes, familiarly, as the “antifreeze problem,” where Eskimos living near Arctic mining camps learn to drink, and die from, such substances as antifreeze and the alcohol in cans of hair spray.

Advertisement

Alaska. Alaskan oil production now seems likely, but expensive, and less of a panacea than government pronouncements imply. It will make only a modest contribution to national energy requirements. According to the National Petroleum Council, oil from the Alaskan North Slope will in 1985 supply between 7 percent (the worst scenario) and 13 percent (with “maximum feasible” progress on all energy fronts) of US oil demand. The Economist estimates that eventual production could be twice as great as the Petroleum Council expects. Yet in each case, the physical and social costs of production will show most clearly the hazards of free enterprise in energy supply.

Environmental disruption is not the only cost of Alaskan oil production, or of the pipeline project. Even opponents of construction concede that corporate planning and behavior have improved since the early Arctic boom. Yet expensive public supervision will still be required throughout the lifetime of an Alaskan oil industry. (Mean-while, corporate privacy conceals the state of the technological arts in production and transportation. In the case of the Alaska pipeline, it is difficult for government agencies to judge the claims of private business—about the avoidability of oil spills, for example, or about the pliability of the pipeline, which according to its developers would “bend” but not break when subject to a severe earthquake in one of the several susceptible zones that it will cross.)

Such precautions will increase the capital and operating costs of Alaskan oil production. The delay and expense caused by environmentalist protests do not however displease local oil operators. It is less than alarming to those oil corporations who see the value of their unproduced Alaskan oil growing year by year, as the “energy crisis” accelerates, and the national and international price of crude oil increases. One common explanation for the high Wall Street price of such companies’ shares is that “crude oil resources in the ground in the North Slope are increasing in value at a substantially faster rate than the basic rate of inflation.”6

The political costs of Alaskan oil production are less celebrated, but also less tractable, than its environmental costs. Production will bring the social exploitation of present and future people. Alaska, with desperate poverty and unemployment, now welcomes oil production, and the state legislature has endorsed, repeatedly, the millions of dollars’ worth of annual revenue that oil expansion will bring. Yet even the financial arrangements are of dubious fairness. The original agreement on oil taxation provided the state of Alaska with a royalty paid on the wellhead price of oil, although lower than royalties received in California or Texas, Kuwait or Iran. This limited royalty turned out to be dependent on the oil companies’ complex accounting practices. In 1972, the state government passed and attempted to sustain new, tougher laws: the governor of Alaska said that under the initial agreement the state’s royalties until 1980 could have been calculated on a wellhead price of zero.

The oil corporations have been less munificent still in their plans for Alaskan economic development. In 1970, while oil investment continued, more than 10 percent of all Alaskan adults were unemployed, the highest proportion in any state. Jobs will become available when the pipeline and oil wells are being constructed, but subsequent production will provide minimal work for local citizens. A study commissioned by the consortium of companies planning the pipeline found that 18,000 jobs will be created during the year when most construction takes place, but that “following this peak, growth in employment will be very slow until it resumes its normal [depressed] long-term pattern.”7 Oil operations are capital-intensive and use a high proportion of technically qualified and usually out-of-state labor: the economic impact of oil production will be shaped more by the technological needs of oil companies than by the social needs of Alaska.8

The consortium study expects, during construction, an increase in “victimless” crimes, such as “prostitution, gambling, con games, etc.,” with 50 percent of the temporary increase in “trade and service” employment concentrated in Anchorage. After construction, native workers will “presumably” return to their villages “converted to a cash economy philosophy and may have problems adjusting.” Productive work, and capital, will be isolated eventually in the North and at the pipeline terminal in Valdez. The Alaskan population centers will operate a few hotels for a few hundred oil technicians, and will cash their royalty checks—cities on welfare.

These costs of resource development are intensified by private competition. It is conceivable that work, and living cities, could follow oil royalties to Alaska. But corporate policy militates against such a possibility. Oil companies use a well-established labor-saving technology. They are not in business for social generosity. They prefer an easy life—how many thousands of Atlantic Richfield managers would welcome relocation to the suburbs of Fairbanks? (Climate helps to explain the deprivation not only of tropical underdeveloped countries but also of the US or Canadian Arctic, and of Alaska throughout its economic and military history.) This political exploitation of Alaska may seem inevitable. But it is part of the cost side of US energy “equations.”

Oil Shale. The oil shale business is of present interest more for its rhetorical importance than for its likely role in supplying US energy oil requirements. (Oil shale is a form of rock, described by the US Geological Survey as a “dense, tough marlstone,” which when processed yields oil.) Prophets of alternative energy look forward with rapt optimism to the pulverizing of Colorado’s shale mountains. President Nixon urges leasing of shale lands. The leading shale consortium employs as head of its program a recently resigned Assistant Secretary of the Interior—Hollis Dole, who in July, 1972, helped to found the publicized energy crisis by telling a House subcommittee that US energy supplies were in “trouble, trouble, trouble.”

The expected scale of shale production is revealed, however, in recent National Petroleum Council calculations. The council, itself an enthusiastic supporter of shale development, shows that with “maximum feasible” development, shale refineries would by 1985 supply between 2 1/2 and 3 1/2 percent of national demand for oil. This modest achievement would require a capital investment of $4 billion. It would also use large amounts of energy, and water, for mining, crushing, boiling, and reclaiming mountains of rock. Each year it would generate around 360 million tons of waste rock—or enough to cover Manhattan to a depth of some ten feet.9

US shale resources could be used on a greater scale after 1985, particularly if a new technology is developed for processing the shale in place. One shale executive has said, hopefully, that “we can even make the desert bloom” by turning waste rock into pasture or woodland. Yet the most immediate lesson of shale development has to do with corporate preferences.10 Oil shale now seems an exciting fuel not because of its immediate cheapness, particularly relative to coal, but because it is convenient for oil sellers and users. It looks like and can be used interchangeably with conventional petroleum. The New York Times writes that “since it is chemically more like petroleum [than other oils], many industry engineers prefer shale oil.” One such engineer, supporting shale production, argues (not very imaginatively, in the light of German military experience in the Second World War) that “you can’t fly coal-powered airplanes or drive coal-powered cars.”

Coal. Coal business offers, in the words of a Wall Street expert, “the premier energy play of the late Seventies.” Professor Carroll Wilson, looking beyond the 1970s, and beyond the year 2000, writes that “inevitably, we are drawn to coal.” President Nixon’s April energy message urged “highest national priority” for coal development, and his June message followed through with the promise of support worth $50 million next year, and several billion dollars over five years. Nixon called for particular emphasis on coal conversion, and on “producing clean liquid fuels from coal.”

The coming coal bonanza is anticipated eagerly by the US oil business, with its “total energy corporations.” Business Week, in a recent discussion of the coal industry, quotes the opinion of a “gas company official” that “when it comes to solving the energy crisis, the major integrated oil companies have all the bases covered.” James Ridgeway shows that two out of the three largest, and five out of the ten largest, US coal companies are subsidiaries of oil corporations. 11 Such companies as Continental Oil (which owns Consolidation Coal), Occidental Petroleum (which owns Island Creek Coal), Gulf Oil, Standard Oil of Ohio, and Exxon own huge coal reserves, particularly in the western states. The chairman of the Continental Oil Company (a leading corporate exegete of the energy crisis, who was chairman of the National Petroleum Council’s committee on the US energy outlook) has said, rapturously, that “one of the quickest and best things we can do in the US is to mine more surface [i.e. stripping] coal.”

Of the US fossil fuels—oil, natural gas, coal, and oil shale—coal is by far the most ample. National coal reserves would last for 300 years at present levels of consumption, and identified coal resources for 3,000 years. (Coal resources are distributed around the world in a pattern that favors advanced industrial countries—from Scientific American’s estimates, 11 percent of world coal resources are in underdeveloped countries of Africa, Asia [including China], and Latin America, compared to more than 60 percent of world oil resources.12 )

Coal conversion technology is a boom area of international science. It attracts the high technology luminaries of US business, from pipeline companies to power plant manufacturers. General Electric, for example, proposes a joint venture with the German Lurgi corporation, which sponsored coal gasification during the Second World War. Like alchemists, but with every chance of success, technologists now race to turn carbons into “gold,” or profit—familiar old coal into new convenient fuels, synthetic crude oil, consumer gas, clean solids, power plant gas.

Like other “new” energy sources, future coal production will be socially and environmentally expensive. It will require a huge commitment of national resources, with a corresponding commitment to energy use in general. According to the National Petroleum Council, coal “oil” could be sold profitably for between $6.25 and $8.25 per barrel (of 42 gallons)—or at least twice the present price of crude petroleum—and coal “gas,” also, at about twice the present price. In Professor Wilson’s “emergency” scenario, annual coal production will increase four times by 1985, to supply 50 percent of a much expanded national energy demand. Such a program, according to Professor Wilson, would require at least $60 billion of capital expenditure, which may prove “not attractive to private capital.” 13

Coal now provides only 20 percent of US energy supplies, used mostly by electric utilities. This proportion has fallen fairly steadily since the first quarter of the century, when coal supplied more than 60 percent of national energy. One reason for the decline in the use of coal is its environmental cost, in use and in production. Yet for most of the last fifty years, coal technology, including antipollution technology, received scant corporate attention. Competing fuels, oil and natural gas, enjoyed the benefits of political subsidy and capital expansion. The coal industry was an “un-modern” area of recent US business, associated with such depressed industries as rail-road transportation. When The New York Times investigated energy crisis advertising, it was told by the National Coal Association, “We don’t have an advertising budget, the industry doesn’t have that kind of money.”

US oil corporations barely intervened, until very recently, in the operations of their coal subsidiaries. Oil companies without coal interests lobbied against coal expansion. The industry lost its economic momentum and some of the lavish fiscal privileges it enjoyed fifty years ago—relative, at least, to newer energy industries. The coal depletion allowance, for example, is 10 percent, compared to 15 percent for oil shale, and 22 percent for petroleum. Coal will be rescued from this political perdition only by the prospect of conversion into the “modern” forms of imitation oil or substitute gas.

The political and environmental costs of new coal production are likely to be even greater than is now expected. Like shale production, coal projects would devastate, at least temporarily, thousands of square miles of western land. Like Alaskan oil production, they would violate regional fairness, as Montana is wasted for the convenience of New York and the mobility of California. Most new coal will be mined, by stripping, in the western fields of North Dakota, Montana, and Wyoming.14 The coal could be transported for processing to factories near the cities where the coal will be used. More probably, it will be converted and cleaned near the mines. It may even be burned near the mines, in new power plants whose electricity would be transmitted across the country to centers of demand.

The issue of regulating mining and land reclamation has already, according to The New York Times, “sharply divided” the Montana State Legislature. Northern Cheyenne Indians, on whose land Peabody Coal plans to build a $700 million strip mining and coal gasification complex, demanded this spring that all coal leases be canceled. Coal processing will bring the costs of heavy industry and relatively few manufacturing jobs.15 Mining work is neither safe nor welcome—in the bleak phrases of the National Petroleum Council, “Attraction of adequate numbers of capable young workers into mining has been a problem and may become a greater one.”

The new coal business will require new aqueducts of water, 5.3 barrels of water for every barrel of synthetic crude oil. (The Petroleum Council demands “massive government expenditures” to supply this water.) Water may also be diverted from “agricultural uses” in the mountain coal region which is already among the most arid areas of the US. Meanwhile, the reclaiming of strip mined land for cultivation and other uses will itself use water, energy, capital. The Petroleum Council expects that reclamation, which now costs 2 cents per ton of coal, will cost 34 cents per ton by 1985, but concedes that “this item alone can exceed $1.00 per ton.” The technology of revegetation—much less an energy-saving or labor-intensive version of such technology—does not yet seem a high priority for corporate planning.16

These costs make coal development expensive, but not impossible. A publicly directed coal industry could enhance Montana, and make the western deserts bloom. Yet every improvement will increase the commitment of national resources to coal, to energy, to energy business. Coal conversion, which is by far the most important of all alternative energy fossil fuel programs, illustrates this commitment in particularly intense form. Coal liquefaction, ignored (or suppressed) in the 1930s and 1950s, will now be decked with government subsidy, in the interest of industries and consumers who now use liquid fuels. Mine construction will begin, for operation in the 1980s. Energy expansion will be sustained—with aqueducts, strip mines, revegetation programs, national sacrifice.

Nuclear Power. New forms of nuclear power are, with solar power, the “residual” energy source for the 1990s, the twenty-first century and beyond. Present nuclear power stations supply only 1 percent of US energy demand. This proportion will not increase, by 1985, to much beyond the 10 percent of energy demand projected in Professor Wilson’s “Decade” program. Such an increase would require the construction of at least 200 new nuclear power stations—and a corresponding increase in present nuclear troubles.

The problems of existing and imminent nuclear power production in-include problems of transporting and storing radioactive waste, of transporting and guarding plutonium, of possible leakage of radioactive material, of disposing of waste heat into nearby air or water. The most serious problem concerns the possibility of catastrophic plant failure. Like airplanes, automobiles, or fossil fuel power plants, nuclear plants are only as safe as manufacturing diligence can make them. Controls will be stringent—although a US government agency complained recently that delays in the construction of non-nuclear and nuclear plants have been caused by “manufacturing quality control problems.” There is scope for technical improvement, and Professor Wilson suggests, for example, that all new nuclear plants be built 500 feet underground. Plants may also be built in underpopulated regions—in the “empty” West, perhaps, with its strip mines and shale factories.

In general, nuclear development will require calculations of an unpleasant sort—about the remote but finite possibility of nuclear meltdown, about the value of safety to 300 people living near an Idaho power plant, or to three million people living near a plant in San Francisco. A nuclear electric economy of the 1980s will face decisions about such values. It will be highly centralized, and will employ a large and powerful security establishment.

Such an economy will also experience the more mundane difficulties of electrification in general. An electric economy consumes more energy and generates more waste heat than a comparable economy which uses fossil fuels directly. Meanwhile, a shift toward electrification would require enormous changes for industry, which now relies on electricity for less than a quarter of its energy—and for transportation, as highway industries confront the prospect of using electric trucks and automobiles. In the next twenty years, these considerations will constitute a limit to nuclear development at least as firm as that set up by technical and environmental difficulties. As in the case of “new” fossil fuels, energy investment will be shaped by the constraints of business and institutional convenience.

III

The worst problems of government energy policy have to do with judging energy use. If it was difficult for George Shultz, John Ehrlichman, and Nixon’s other recent energy advisers to weigh shale production against Kuwaiti oil imports, nuclear risks against social destruction in Alaska, how much more troublesome to evaluate such “items” against the growth of air conditioning, airline policies, automotive acceleration, the synthetic fiber industry, the organization of urban transport.

Nixon’s policies for conserving energy use are dismally weak. The first energy message, in April, was criticized for relegating conservation to vague exhortations and a voluntary labeling of appliances. The second message, in June, offered exhortations of a slightly more urgent sort. The federal government was “ordered” to reduce energy use. Industry, and consumers, were asked or urged to develop a “conservation ethic,” to cut down on heating, to drive more efficient cars. Governors were “asked” to “work” on reducing speed limits. Automotive recommendations revealed the spirit of government proposals. According to the Wall Street Journal, “Nixon energy men had considered proposing a tax on auto horse-power to discourage fuel consumption, but abandoned it and similarly strong steps for several reasons, including their unpalatability to the President himself.” Treasury Secretary Shultz expressed this same government attitude most eloquently, during the press conference which followed the first energy message:

Q: Mr. Secretary, did you consider making any stronger recommendations than you did to limit the consumption of energy, such as smaller cars, or less horsepower, rather than just these labeling proposals and insulation of homes? Secretary Shultz: There is a combination of ongoing things that are beefed up here. There is an Office of Energy Conservation proposed in the Department of the Interior, and I think what we are trying to give is a sense of an ongoing effort to address this problem. And no doubt there will be further things. The question of horsepower of cars is one that we have thought about and have been working on and we do not have a proposal on that at this point….

Energy conservation should be the most important part of fuel policy. Alternative fuel projects, as seen earlier, are shaped by the requirements of major industrial users—for subsidized energy, and for particular fuels such as synthetic oils. Yet energy saving, reducing demand instead of increasing supply, may be achieved at surprisingly low cost. It can be a positive and selective endeavor, although the phrase “energy conservation” has an unfortunate connotation of indiscriminate thrift: of saving 5 percent of the energy in transportation (which uses 25 percent of national energy), 5 percent of the energy in domestic air conditioning (using 1 percent of national energy), 5 percent of the energy in electric blender use (which accounts for 0.002 percent of national energy).

Recent government policy has emphasized, tendentiously, the role of consumer sacrifice in energy conservation. Secretary Shultz, for example, pronounces that in conservation, as “the environmentalist groups have brought forward,” “we have met the enemy and it is us.” Yet personal frugality contributes relatively little to national energy efforts. Many of the benefits of increased energy use would accrue to a few industries rather than to consumers in general, as comparable energy benefits have done in the past.

In 1970, Secretary Shultz, then Secretary of Labor and a chief opponent of oil import quotas, said of the quota system that supported domestic oil prices: “I doubt whether the cost of carrying such a subsidy for a single favored industry has ever been imposed on consumers by any government, anytime, anywhere.”17 This tirade may seem hyperbolic in denouncing a particular trade regulation, but describes aptly the pattern of political and fiscal subsidy for the US energy business.18

Like transportation, energy consumption is a partial benefit, identified by its apologists with social progress. Transportation was sustained by political favors, by highway construction, by the growth of the automobile and trucking industries, by the dispersal of cities and jobs. Energy use was sustained by fuel depletion allowances, by historical environmental policies, by the power of energy-dependent industries (including the auto and trucking businesses), by the permissive regulation of electric utilities—and further subsidy is urged in recent alternative energy projects. Much of the transportation we use now seems of doubtful social value, particularly in large American cities. But the coming effort to reduce and reform transport will have appallingly disruptive consequences. Energy consumption may soon appear at least as questionable as transportation. Conservation projects could save a future energy economy from overinvestment and subsequent dislocation comparable to that which transportation policy now faces.

Domestic or household energy use, which is the major object of the current exhortations to be frugal, accounts directly and indirectly for less than 20 percent of all US energy consumption. Industry uses more than 40 percent, and transportation 25 percent. The White House Office of Emergency Preparedness (or OEP) has argued in a study of energy conservation that US energy demand could by 1980 be reduced by one sixth of its currently estimated level.19 The study, one of the most valuable but least acknowledged of recent government reports on energy, describes ways of saving energy in residential, commercial, transportation, and industrial uses. Of the OEP’s suggestions, those to do with industrial energy conservation are the least specific and radical. Yet even without proposing major industrial changes, the study indicates the possibile scale of conservation projects. A saving of one sixth of estimated energy demand would save as much energy as could be supplied by doubling present coal production, and more than three times as much as would be supplied by likely Alaskan oil production.

The residential sector, which the OEP emphasizes, would provide few savings in the short term. Even if the government encouraged “the adoption of good energy conservation practices in the ‘operation’ of the house,” for example, the “amount of energy to be saved is modest.” The small domestic appliances which have been made such symbols of electric profligacy could provide only a minute contribution to energy savings. In 1968, according to another government report, the 15 million electric toothbrushes and 16 million blenders used in the US consumed rather less than 0.003 percent of all energy, or enough for one hour of national auto travel. Even domestic air conditioning used only 5 percent as much energy as was consumed by automobiles alone.20

Almost all longer term measures for conserving domestic energy consumption require improvements in the efficiency of furnaces and appliances, better housing insulation techniques, new heating systems—changes which consumers are largely powerless to affect. Conservation by increasing the price of domestic energy fuels and electricity would, of course, discriminate in favor of rich consumers. Meanwhile, electric utility rates already favor large users. In 1970, US utilities sold electricity to domestic consumers for an average revenue of $21 per thousand kilowatt hours, and to “large” commercial and industrial customers for $9 per th. kwh, with electricity costing $41 per th. kwh to small domestic users, and $18 per th. kwh to large domestic users.

Energy use in the “commercial sector” of offices, stores, other service establishments, and government buildings accounts for 14 percent of all energy, and is determined largely by business convenience. The wastefulness of recent architecture is notorious, with most commercial buildings overcooled, overheated, overlit, and underinsulated. President Nixon’s injunctions about “turning out lights” seem directed at consumers more than at real estate proprietors. The World Trade Center in New York, whose lights blaze twenty-four hours a day, requires the same generating capacity as Schenectady, a city of 100,000 people. As one group of concerned architects puts it, “operable windows deserve wider consideration,” while “natural light is pleasant, and often perfectly adequate to the task.”

Commercial energy conservation would, however, challenge the most hallowed relationships of private enterprise. The concerned architects note, for instance, that wasteful “over-engineering” is due in part to “using more material to save labor.” The OEP, expecting less scope for conservation in commercial than residential uses, complains that business often buys “inefficient equipment because it is interested in a “quick payout” on its capital expenditures.”

Transportation uses more than half of all petroleum consumed in the US. It will in the future demand substitute liquid fuels. It now uses fuels with what the OEP describes as “a continuing drop in modal energy-efficiency,” and “a continuing shift toward the use of less efficient modes.” This energy is usually taken as a prime example of the profligacy of consumers, speeding on unnecessary journeys in air-conditioned cars. In facts, even the waste of energy in automobiles, which consume 55 percent of transportation energy, is not unambiguously the “fault” of consumers. The gasoline mileage of American cars has declined more or less continuously for the last twenty-five years—in large part because of such improvements as high horsepower engines, heavy bodies, power equipment, and air conditioners. (According to a report in the Washington Post, “the air-conditioned 1973 Vega burns as much gasoline as a 1966 Cadillac without air-conditioning.”) It could be said that these refinements have been demanded by consumers. Yet it is also clear that automobiles have been designed with minimal concern for energy conservation, that small cars, and small electric cars, have been neglected by auto corporations.21

The major waste of transportation energy comes, of course, from auto use rather than from the ownership of large automobiles. Auto use is often determined by social and economic factors beyond the control of consumers. More than half of all automotive energy is consumed in urban areas: half of all auto trips are for less than five miles, and almost three quarters for less than ten miles, usually trips to work or to stores, often with only the driver in the car. It is this urban auto use that is particularly wasteful, with an energy-efficiency in moving people of about a sixth that of city buses, and a seventeenth that of commuter trains. Yet for consumers such use is very often a matter of necessity in the thousands of American cities where public transportation is decayed and inadequate, and where jobs are accessible only by automobile.

National energy expenditure on truck and air transport, some 29 percent of all transportation energy, is shaped, even more apparently, by business and institutional constraints. Freight trucking, supported by the highway system, has increasingly replaced much more efficient railway freight transport. Air travel replaced similarly underprivileged rail travel.22 The OEP report estimates that measures to consolidate trucking and to encourage railroad freight transport could save 4 percent of expected transport energy. These freight reforms would save as much energy as would be saved by all suggested measures to conserve energy in domestic water heating, cooking, refrigeration, lighting, and “miscellaneous” appliance use.

Railroad expansion measures in general, for passengers and freight, stimulate the OEP’s most optimistic evaluations of very large “pay-offs” for “minimal cost.” The Nixon Administration’s attitude to this judgment was revealed abruptly when, a few weeks after the April energy message, Transportation Secretary Brinegar announced his plan to reorganize the Northeast railroads: with (derisorily) “modest federal funds,” a “careful look at liquidation,” and probable abandonment of many freight lines, notably those which are held, on grounds that are surely narrow ones, not to be “competitive” with truck services.23

American industry is by far the largest user of national energy. The scale of this appetite is suggested by a recent boast of the Dow Chemical Company. When the company, at its latex factory in Midland, Michigan, rearranged industrial heating processes to cut energy consumption by 20 percent, it saved enough energy for “New York City [to] operate its subway system for two years.”

Government energy policy has already brought bitter conflict among different industrial interests. According to the Wall Street Journal, chemicals corporations (and especially producers of petrochemicals, who use petroleum as a raw material or “feedstock” as well as for energy) have in 1973 “mounted a massive lobbying effort in which they charge that the nation’s energy policies favor big oil companies at the chemical industry’s expense.” A subsidized program for providing cheap alternative energy would, of course, help to satisfy industrial fuel needs.

Energy-intensive industries, such as the aluminum or the newly apprehensive petrochemical business, were among the most expansionary of all US businesses in the 1950s and 1960s. In the technology of the last seventy years, the main industrial imperatives of saving labor and saving raw materials have required a more or less continuous increase in energy use. According to one government report, more than 40 percent of the 500 largest US corporations now manufacture or sell chemicals: the chemical business uses enough energy to heat three quarters of all homes in the US, and more than any other industry except basic metal production. (The third largest user is the petroleum industry itself, largely in its fuel refining operations.)

The chemical business and other expansive energy-intensive industries have contributed enormously to the growth of the US economy, to the provision of beneficial new products and technologies, to the eradication of hard and oppressive work. Yet a serious long-term effort at energy conservation must evaluate the position of these industries in the structure of the economy. The social and financial benefits of such industrial development are often distributed quite unevenly: the chemical industry, with 10 percent of all industrial profits, and using 20 percent of industrial energy, provides only 5 percent of industry jobs.

Some of the most noted and energy-profligate of recent technological substitutions offer only minor benefits to consumers—as when tin cans are replaced by aluminum cans, natural by synthetic fibers, rail-delivered by truck-delivered groceries, or in the increased use of concrete and cement in construction, of synthetic materials in food processing. (Synthetic fiber production, according to the National Cotton Council, uses five times as much energy per yard as cotton production. Aluminum manufacturing, which according to the OEP has “vast room for improvement” in energy-efficiency, uses six times as much energy per ton as steel manufacturing.)

New trends in industrial growth may reduce the increase in energy demand without a political attack on, say, the chemical business. Future automation, particularly in service industries, will use relatively little mechanization (which consumes much energy) and relatively much computer control (which consumes little energy). The coming substitution of telecommunications for transportation, as shopping or banking or moviegoing take place over television cables, will also reduce energy needs. The transmission and receiving of television signals uses a negligible proportion of national energy—the energy consumed on a ten-mile round trip by car to a shopping center would keep a color television set operating for a month of normal viewing. (Other likely trends, perhaps toward mining material resources in ever poorer ores, or toward desalting sea water, would require increased energy use.) These trends are not necessarily desirable. Computerized automation and increased telecommunication may amount, in fact, to a replacement of physical by mental exploitation. Yet they suggest that accelerating energy use is not essential to industrial growth—that it is associated with specific industrial sectors, which are no longer, perhaps, the most expansionary part of the US economy.

IV

Energy conservation is possible, and it will even be profitable for some corporations. Mobil notes that saving electricity bills will “send business managers running for the light switches.” A Westinghouse advertisement proclaims, “Another way to skin an energy crisis: products that use less energy.” It mentions efficient air conditioners, commuter trains, a system for recycling the waste heat produced in lighting an office building. Such innovations will become more and more important. There is no contradiction between conservation and private enterprise, when conservation requires new products, or when the material to be conserved is not free.

A major difficulty of energy conservation, and of energy policy, has to do with conflict among business interests. Many corporations will prove less adaptable than Westinghouse to future demands for energy-saving products and processes (or to future demands for, say, antipollution equipment, for products which save material resources, for clean air as a salable commodity). Few US oil corporations go as far as Mobil in endorsing energy-saving practices. The trucking industry seems threatened by even the rhetoric of energy conservation. The Aluminum Association devotes much effort to attacking environmentalist writings. The chairman of General Motors, not surprisingly, opposes taxation of automobile horsepower.

Serious energy conservation would wound, perhaps mortally, some of the most powerful, if mature, of US industries. Eventually it would also damage the position of energy-producing industries in the US economy. In doing so, it would bring real, deathly conflict. The prospect of such conflict makes the capitulations of present government policy appear inevitable. A more radical policy would deny the claims of certain industrial interests, would count the fifteen-year implications of present strategies, would weigh the diverse benefits of energy use against the diverse and often appalling costs of energy production. None of these endeavors is a plausible objective for contemporary policy makers.

A policy of alternative energy development, with heavy investment and modest conservation, will, at the least, support increased energy use. It will sustain increased demand for particular fuels, including the liquid fuels used in transportation. Government policy is concerned, reasonably, to prevent interruptions in the supply of energy, including blackouts and the disruption of essential services. But continuity of supply does not imply a high level of supply. Subsidized energy development is no more beyond question than other public expenditure programs. It is one way among others, and sometimes a particularly costly way, of assisting American industries, and of spending national resources.

At the worst, such an alternative energy policy could appropriate the projects of future governments. It would bequeath to them responsibilities for energy conservation even more arduous than the responsibility for used coal lands and for salt mines full of radioactive waste. Energy planning, like transportation policy, requires the most troublesome political choices. But like the city planning and highway construction and aviation policies of the 1940s and 1950s, present energy decisions could leave a dismal heritage for the twenty- and fifty-year future.

(This is the second part of a two-part article.)

This Issue

August 9, 1973

-

1

Foreign Affairs, July, 1973. ↩

-

2

The National Commission on Materials Policy, for example, in its Final Report (June, 1973) begins a discussion of “Energy and Materials” with the assertion that “energy is the capability to do work essential to social and economic welfare, productivity, and standards of living.” ↩

-

3

The White House Office of Emergency Preparedness estimates, based on figures supplied by electric utilities and by the National Petroleum Council, that total capital investment in the US energy industries will cost $566 billion between 1971 and 1985. (The Potential for Energy Conservation, October, 1972.) This amounts to an expenditure of $111 million a day for 14 years, or 5,110 days. ↩

-

4

The Role of Petroleum and Natural Gas from the Outer Continental Shelf, US Department of the Interior, May, 1970. ↩

-

5

Alberta tar sands could yield, according to the National Petroleum Council, 174 billion barrels of synthetic crude oil. US petroleum production, to date, is a little over 100 billion barrels. ↩

-

6

Barron’s, June 11, 1973. ↩

-

7

The New York Times, December 17, 1972. ↩

-

8

Among the proposals for transporting oil rejected summarily by the oil industry was a Canadian-sponsored plan to ship the oil by rail—an adaptable project which would provide perhaps ten times as many jobs as a competing pipeline, but which would use an “unmodern” and labor-intensive technology. The oil companies’ position on Alaskan transportation has been uncompromising: as expressed by a vice president of Standard Oil of New Jersey, in mid-1972, “We’re now committed to the pipeline and nothing else. It is not a situation with a first choice and a list of alternatives.” ↩

-

9

With present technology, shale oil, unlike conventional petroleum, must be extracted from mined rock by a process known as “destructive distillation.” A shale industry of the scale envisaged by the National Petroleum Council would each year produce 274 million barrels of oil. According to the estimates of the US Geological Survey, such production would generate 360 million tons of “spent” shale rock, with a volume of somewhere over 7 billion cubic feet. ↩

-

10

Shale was studied eagerly in the early 1950s and in the 1960s. Like other alternative fuel sources, it was developed by oil companies. Yet these developers were minor, domestic operators, or “have-not” oil corporations, as described in Scientific American in 1965. Their hopes failed at least in part because of political weakness: they complained, for example, that shale oil received a less generous depletion allowance than conventional petroleum. ↩

-

11

James Ridgeway, The Last Play (Dutton, 1973). ↩

-

12

M. King Hubbert, “The Energy Resources of the Earth,” Scientific American, September, 1971. ↩

-

13

The estimate of $60 billion covers plant investment in coal mining and processing, but not the costs of providing pipeline and railroad transportation. ↩

-

14

According to the US Geological Survey, two thirds of all US identified coal resources, and an even larger proportion of relatively clean low-sulphur coal, are in Western states. Resources in the traditional coal states of West Virginia, Pennsylvania, and Kentucky are one third as great as resources in North Dakota, Montana, and Wyoming. ↩

-

15

California utilities already produce electricity in desert states. Despite increasingly restrictive regulations, Montana and Wyoming may experience some of the pollution found in the Black Mesa, Four Corners coal region of Arizona. In 1971 it was estimated in the Wall Street Journal that the finished coal and electricity complex at Black Mesa would produce each day more tons of three major pollutants, sulphur dioxide, nitrogen oxides, and fly ash, than was produced daily in Los Angeles County and New York City together. ↩

-

16

Some reclamation and revegetation projects are under way in Montana and Eastern coal states. One corporation, Allis-Chalmers, advertises its “HD-41,” or “world’s largest crawler tractor,” with the slogan “Back to Nature,” and a drawing of five 41s reclaiming strip-mined land. ↩

-

17

Quoted by Fred C. Allvine and James M. Patterson in Competition, Ltd.: The Marketing of Gasoline (Indiana, 1972). ↩

-

18

Energy privileges were perfected through the political and lobbying power of oil corporations, undisputed since the 1900s, when Ida Tarbell wrote of John D. Rockefeller: “Every measure looking to the freedom and equalization of transportation has met his opposition, as have bills for giving greater publicity to the operations of corporations. In many of the great State Legislatures one of the first persons to be pointed out to a visitor is the Standard Oil lobbyist .” ↩

-

19

The Potential for Energy Conservation, October, 1972. ↩

-

20

Patterns of Energy Consumption in the United States, Office of Science and Technology, January, 1972. ↩

-

21

Electric cars would require greater total energy consumption than comparably powerful gasoline-driven cars. But they would save petroleum, and would centralize both pollution and its control at power stations. ↩

-

22

According to the OEP, air transportation is booming, but “shows a steady decline in energy efficiency” for moving passengers, although “enormous increases” are possible. Air loading and fare policies are profitable yet wasteful, because, for example, they allow fares on long flights to subsidize those on short flights (for example, between Boston, New York, and Washington), where other, more efficient, and often equally convenient modes of surface transportation are competitive. President Nixon’s latest energy policy directs the Secretary of Transportation to “work with” airlines in reforming energy use. Such reforms will affect the 3,000 or so aircraft operated in the US by scheduled carriers. The 200,000 other (smaller) civil aircraft and 15,000 military planes are further from regulation, although the Pentagon has directed recently that in the interests of energy conservation the military should substitute ground simulation for some training flights. ↩

-

23

Wall Street Journal, May 2, 1973, and The New York Times, April 14, 1973. The Administration’s rail policies have become slightly more conciliatory during very recent negotiations with Congress (Wall Street Journal, July 12, 1973). These policies now offer $85 million of support for the Northeast railroads, more than twice the original sum, but one fiftieth as much as is spent on highway construction each year. ↩