It would be interesting to trace the development of John Kenneth Galbraith’s ideas, beginning with American Capitalism (1952) and culminating (so far at any rate) with Economics and the Public Purpose, which has just been published. Such a survey would show, I think, that Professor Galbraith is very sensitive to the moods of the moment, moving with but little resistance and even less acknowledgment from a kind of Panglossian optimism in American Capitalism (and the same year’s famous New York Times Magazine article “We Can Prosper Without War Orders”), through increasing skepticism in the middle books (The Affluent Society and The New Industrial State), to something which now displays what is at times ill-concealed alarm. That all this goes along with, and in Galbraith’s mind no doubt stems from, a basically not much changed vision of the American economy and American society, is a noteworthy fact which may tend to suggest that the correspondence between this vision and the reality is not altogether perfect. It is to this aspect that I should like to direct attention.

To begin with, Galbraith’s newest critique of neoclassical (or orthodox or received) economics contains little that is new. It has been repeated, with variations and changing emphases, in all his works. And for the most part it is entirely justified. Economics as the subject is taught in establishment educational institutions has little relevance to reality and is thoroughly apologetic in effect if not in intent. I will not dwell on this: those who are not already familiar with Galbraith’s critique will find it well presented, with some new angles (Galbraith emerges this time as something of a middle-class women’s liberationist), in Economics and the Public Purpose. What I wish to focus attention on is the “model” (the term is almost de rigueur these days) which he puts in the place of his version of the neoclassical picture of a consumer-dominated and producer-powerless self-adjusting market system which fails to perform satisfactorily only when deluded intellectuals and ignorant politicians meddle with it.

Galbraith’s present model differs from his earlier versions in that he now divides the economy into two parts which he calls the “planning system” and the “market system.” The planning system, as he acknowledges on page 217, is merely a new name for what is traditionally called the “monopolistic or oligopolistic sector.” It comprises a thousand or so giant corporations which produce three-quarters or more of the country’s industrial output. The market system is the rest of the private economy, with agriculture, services, and retailing as its principal subdivisions. Having identified these two “systems,” Galbraith proceeds to analyze the functioning of the economy as a whole as it is affected by their interaction with each other and with the state or public sector.

According to this analysis, the dominant part is the planning system. It is here that the driving force of the economy (the savings-and-investment process) is centered. Given its over-whelming monopoly power, the planning system is able to exploit the largely competitive market system, enforcing on it unfavorable terms of trade in the manner of a metropolis and its colonies. This disparity in power is also reflected in the relations of the two systems to the state: the planning system has easy access to all branches of government and establishes effective control over most of them, while the market system is for the most part left out in the cold.

“The modern state,” he tells us on page 172, “is not the executive committee of the bourgeoisie, but it is more nearly the executive committee of the technostructure.” (The “technostructure” is Galbraith’s term for the controllers of the large corporations: we shall return to this presently.) The result of this lopsided distribution of power is that the planning system gets what it wants, especially money, from the state, while the market system is starved. This sets up a process of growing inequality between the two systems.

Here we may note the striking change in Galbraith’s view as compared to those in his earlier books, most notably The Affluent Society. In that work he contrasted private affluence with public squalor, and treated inequality as a problem of diminishing importance no longer worth seriously worrying about. Now his argument is not that the public sector as such is starved (armaments and highways do very well for themselves), but that the allocation of resources going to the public sector is contrary to the “public purpose.” And inequality is now seen as one of the greatest and most pervasive evils of the society. It would have been gracious of the author to acknowledge that those who have been saying so all along were right and he was wrong. But that would require a modicum of humility, which is not exactly Galbraith’s specialty.

Advertisement

Compared to neoclassical theory, this two-systems model is undoubtedly an improvement. It integrates monopoly and state power, the dominant forces in the US economy today, into the analysis of the system as a whole (neoclassical theory is artfully designed to avoid doing precisely this), and it succeeds quite well in offering plausible diagnoses of some of the system’s major problems. One of these is the already mentioned allocation of resources to and within the public sector. Another is inflation, which Galbraith recognizes to be endemic to the system, impervious to control through fiscal and monetary policies, and compatible with persistent high levels of unemployment.

I believe, however, that in many respects Galbraith’s model is seriously flawed and ends up as a kind of new, streamlined apologetic for monopoly capitalism. Since to develop this theme satisfactorily would require much more than a brief review, I will confine what follows to highlighting what seem to me to be some of the gravest weaknesses of his analysis.

The Planning System. Every economic enterprise, from the smallest to the largest, of course has to do a certain amount of planning. But as a group the large corporations do not do any planning together, and do not constitute a system in the usual sense of a collection of entities strongly interrelated among themselves and more weakly related to their environment. Galbraith as much as admits all this in numerous passages, as for example when he speaks of the need for measures “to ensure the inter-industry coordination of which the planning system is incapable” (p. 251), or treats the energy “crisis” as precisely a symptom of the planning system’s inability to plan (Ch. 31). Apart from in-firm planning, which is real enough but not peculiar to Galbraith’s planning system, what he seems generally to mean by “planning” is the power of the big corporations to throw their weight around in their relations with consumers and government, something which of course is emphasized by all theories of monopoly capitalism without any need to invoke the language of planning.

Why, then, is Galbraith so wedded to the notion of the planning system? The reason, I think, is that it gives him one of the tools he needs for conceptualizing the US power structure in a manner convenient to his own predilections and reform program. To explain this we need first to understand another of Galbraith’s key concepts.

The Technostructure. It is pretty generally accepted by now that the typical big corporation is not controlled by majority vote of its shareholders or even by its board of directors but by what it is usual to call its management, i.e., its top officers, who (except in time of financial trouble) are normally a self-perpetuating; group which selects the board of directors rather than vice versa. It is important to recognize that this does not mean what it is often taken to mean, that ownership and control are separated in the large corporation. Quite apart from cases in which management is picked by and represents large stockholders (majority or minority), executives of large corporations are with few exceptions wealthy men, owners of substantial amounts of stock in their own, and other corporations. Far from being separated from ownership, they are simply the most active echelon of what C. Wright Mills called the corporate rich who own a large part of the country’s wealth. This being the case, one would naturally expect them to run their corporations with an eye out for maximum profit and the most rapid feasible accumulation of capital.

For reasons which will become clear as we proceed, however, this conclusion does not suit Galbraith’s purposes at all. He would like to abolish the capitalist altogether, but since this is impossible, the next best thing is to transform him into a functionless (and relatively powerless) rentier. But this, as we have already seen, is not accomplished by the theory of managerial control: the managers are in fact capitalists in the fullest sense of the term. So Galbraith is driven to invent a new theory, the theory of the techno-structure.

The gist of his argument is that corporate managements, in the sense defined above, are not really in control at all. They lack the necessary knowledge, and knowledge is the basis of power. This knowledge is possessed by a large group of specialists. “To perfect and guide the organization in which the specialists serve,” Galbraith writes,

also requires specialists. Eventually not an individual but a complex of scientists, engineers and technicians; of sales, advertising and marketing men; of public relations experts, lobbyists, lawyers and men with a specialized knowledge of the Washington bureaucracy and its manipulation; and of coordinators, managers and executives becomes the guiding intelligence of the business firm. This is the technostructure. Not any single individual but the technostructure becomes the commanding power. [P. 82]

In this way management is buried in and subordinated to the much larger technostructure, which derives its power from specialized knowledge and is in no way beholden to ownership.

Advertisement

The next step is to endow the technostructure with a set of purposes, which Galbraith divides into “protective” and “affirmative.” The protective purposes are security and freedom from outside interference such as by creditors or trade unions; the affirmative purposes boil down to increasing the power of the technostructure as such. To achieve these goals the technostructure strives for 1) “a certain minimum (though not necessarily a low) level of earnings” (p. 94), sufficient to pay “reasonable” dividends to stockholders, avoid pressure from creditors, and finance growth; and 2) a maximum rate of growth measured in sales, resulting in steady expansion of the power base and job opportunities for the technostructure. Galbraith is emphatic and repetitive that profit maximization in the manner of what at one point he calls the “original capitalist” (p. 247) is not an aim of the technostructure. We shall return to this.

It is only necessary to add that the technostructure is in charge of the planning system (the two terms indeed are often used interchangeably), and that to achieve its purposes it mobilizes all the power of the planning system to control prices, manipulate the consumer, and dominate the state. Since, as we already know, the planning system also dominates and exploits the market system, it appears that we have here a complete picture of the power structure of American society. The technostructure sits at the center and runs the whole show.

In Galbraith’s view, however, this is a pretty shaky arrangement. The technostructure doesn’t really represent anyone but itself, and its power derives largely from its ability to hoodwink or brainwash most other people into believing that its purposes are identical with the public purpose. (It is in this connection that Galbraith attributes great, and sometimes it even seems decisive, importance to the role of neoclassical economics in persuading people that the greatest of all sins is interference with the natural workings of the economy.) If the public, or sufficiently large segments of it, could be disabused of this way of looking at things, it should be relatively easy to break the society’s thralldom to the technostructure. The state could then be “emancipated” and transformed into a “public state,” and a whole series of reforms adding up to a “new socialism,” or maybe several new socialisms, could be enacted and carried through.

Everyone is of course entitled to his or her utopia, and many are worth discussing for their intrinsic interest as well as for what they reveal about their authors. I confess that Galbraith’s does not attract me, though it does undoubtedly contain improvements over what we have, which to be sure is not saying much. Though he talks about socialism, there is little in Galbraith’s proposals that resembles what I suppose most people understand by the term. He would nationalize a few sectors of the private economy, most notably the armament industries, but he is not naïve enough to imagine that this by itself would change very much. For the rest, the ownership and organization of economic activity would be left as they are, with one exception. Every group would be encouraged, assisted, and in some cases perhaps even forced to organize to pursue its own economic interest.

Since we can’t have universal competition, he seems to be saying, let us universalize monopoly. And if one were to object that, to judge from past experience, this seems a somewhat dubious method of achieving the “public purpose,” Galbraith would probably reply that we have never had a “public state” presiding over the whole economy and imposing its benevolent dictates on all the conflicting but (in the new dispensation) relatively powerless groups and interests that make up the economy. The public state presumably embodies the public purpose, and Galbraith is the prophet of both.

But why call this a utopia rather than what Galbraith doubtless believes it to be, i.e., a hard-headed, realistic, and realizable program of social reform? The reason quite simply is that his conception of the power structure is light years away from the reality of monopoly capitalist society.

The technostructure does not dominate the planning system, or anything else for that matter. Galbraith’s contrary opinion is based on a confusion between making decisions within a given frame and deciding what goals are imposed by this frame on those operating within it. I do not think he is correct in maintaining that the technostructure rather than the management makes all the operating decisions—whether to build a new factory, how next year’s model will differ from this year’s, etc., etc.—but even if he were correct it would have no bearing on the ultimate purpose of the enterprise. This is determined not by any individual or group but by the very nature of the business system, or, as Marxists would say, the nature of capital as self-expanding value.1

In concrete terms, this purpose is and has to be twofold: to make as much profit as possible and to grow as rapidly as possible. Objectively determined, this becomes the subjective aim of management; and it suffuses the entire ideology and value system of the business world. Personnel (technostructure) are hired accordingly, and any who take it into their heads to pursue some other aim are promptly fired. Real power in the enterprise is held by those who have the power to hire and fire, and it is precisely this power which inheres in management. In exercising it, management acts as capitalists and on behalf of capitalists.

It might seem that this argument is really not so different from Galbraith’s position. To be sure, he denies that maximizing profit is any part of the corporate purpose; but in so far as he insists that growth is central to that purpose, this might seem to be a distinction without a difference. For after all, as any businessman will tell you, profits are the key to growth whether it is financed by internal savings or by resort to the money markets. The more profitable a corporation, the faster it can grow. So Galbraith’s rejection of maximizing profit might be brushed aside as a mere quibble without any real significance. It is important to understand why Galbraith could not admit that this is so.

Maximizing profit is unequivocally in the interest of the owners of industry. If it is also a central aim of corporate managements, then there is an identity of interests between owners and managers. But if corporations are not controlled by their managers, but by their technostructures, which in turn are more interested in self-aggrandizement than in increasing profits, then corporations are not being run in the interests of owners. In that case, control over the key sector of the economy has slipped out of the grip of the owning or capitalist class and into the relatively weak hands of a new technocratic stratum. And, as noted above, this same stratum is also supposed to have gained control over the state. According to this view, the task of the reformer has been vastly simplified and eased compared to what it used to be. No more need for class struggle or related unpleasantness. Just enlighten the public, emancipate the state, and downgrade the technostructure to its proper subordinate role.

Once we realize that this is all an illusion, that the capitalists dominate the giant corporations of today as completely as they did the smaller enterprises of a hundred years ago, we can hardly help wondering if Galbraith’s theory is any more reliable in other respects. And the answer, not surprisingly (to use one of his favorite expressions), is that it is not.

For one thing, the picture of a more or less homogeneous “market system” confronting a handful of giant corporations is fanciful in the extreme. Not that the small, exploited, and self-exploiting enterprise doesn’t exist in such areas of the economy as agriculture, retail trade, and services: it does exist and it is victimized by the system, just as Galbraith says. But there are also plenty of winners who are by no stretch of the imagination in Galbraith’s planning system. To name only a few of the more important categories is to reveal how extensive and significant the phenomenon is: small and medium-sized corporations in manufacturing and trade, locally based construction firms (nearly the whole construction industry), large farmers and ranchers, real estate owners and operators, owners of radio and TV stations, local bankers, professionals (especially doctors and lawyers).

Not all of those included in these categories are winners, of course. But literally millions of them are in no sense victims of the system: on the contrary, many are among its chief beneficiaries. To put them in the same bag with the owner of the corner grocery store makes so little sense that one must assume it has an ulterior motive. And in Galbraith’s case, I believe the ulterior motive, probably unconscious on the part of the author, is further to confuse the picture of the power structure in US society. Many of the people in the categories listed (and others not listed) are wealthy in their own right, with incomes and capital assets well above the average of the technostructure, and they are intertwined in many ways (e.g., through stock ownership) with the corporate rich. Politically, they dominate the communities and the electoral districts, often right up to the state level, in which they live and operate. Socially, they belong to the same class as the corporate rich, sharing the same life style, the same values, the same ideology. They thus constitute what is in number and geographical spread by far the largest part of a relatively homogeneous class which derives its enormous wealth and privileges from the economic status quo.

But is this also a ruling class in the sense of dominating the state? According to Galbraith’s theory, the answer would have to be no. He makes a rather sharp distinction between the bureaucratic and elective branches of the government. The bureaucracies are similar in composition and outlook to the technostructure, with which they have a strong tendency to develop what he calls a symbiotic relationship. This indeed is the source of the technostructure’s power over the state. The elective branches, Congress and the presidency, on the other hand, are not necessarily tied to any power group. To be sure, the Republican party and up to now a large part of the Democratic party have bought the technostructure’s line that what is good for it is good for the country. But these alliances are not unbreakable. As we have already seen, Galbraith believes that, beginning with the elective branches, the state can be emancipated from the technostructure and turned into the instrument of the “public purpose.”

From the standpoint of class analysis, things look rather different. The higher reaches of the government bureaucracies (including the judiciary) are overwhelmingly staffed by members of the dominant economic class and/or people dependent on them, and the political party organizations are controlled at every level by the vested interests which stand to gain most from the protection and favors which the local, state, and federal governments are in a position to hand out. These are facts which have been confirmed by innumerable empirical studies of cities, towns, and political institutions, though it is true that not all of the authors of these studies draw the logical conclusion that government in the United States is owned lock, stock, and barrel by exactly the same interests that own most of the country’s wealth and control its economic life. These interests, taken together, constitute a ruling class in the fullest sense of the term, the richest and most powerful class in the history of the world.

The implications of this for Galbraith’s strategy of reform are of course devastating. If the enemy is a rootless, upstart technostructure which maintains itself in power mainly by selling a phony ideological bill of goods, then it makes sense to rely on an ideological counterattack followed by an effort to win the Democratic party over to Galbraith’s new brand of populism. But if the enemy is in fact an enormously powerful bourgeoisie with two centuries of experience in ruling behind it and absolutely no scruples about using every and any available means to achieve its ends,2 then a rather different strategy seems called for.

Above all, one had better look around for possible allies who could enter upon a struggle to unseat the class now in power with a reasonable prospect of success. And I challenge Galbraith, or anyone else, to say where such allies might conceivably be found except in the working class, if we use the term in a broad sense to include the great majority of those who must work for a living regardless of the color of their collars. Workers have potential power not because they are in the majority—when the chips are down no ruling class cares for the arithmetic of minorities and majorities—but because they are indispensable to the process of production and hence to the very life of society.

Like most liberals, Galbraith sees little hope in the workers. If he is right, things will continue to deteriorate, as Galbraith now recognizes they have been deteriorating for a long time. But it might be more constructive to work on the assumption that at some stage in this process American workers will experience a political awakening similar to that of the 1930s only next time on a scale appropriate to the seriousness of the developing crisis of world capitalism. I would like to pay Galbraith the compliment of believing that should this happen he will be flexible enough to write another book explaining how and why he expected it all along.

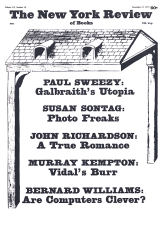

This Issue

November 15, 1973

-

1

The concept of capital as self-expanding value is crucial to the entire structure of Marxian economics. It is lucidly explained in the short (thirty-four pages). Part II of Volume I of Capital. ↩

-

2

So far as I can recall, Vietnam is mentioned only once in a footnote and it does not occur at all in the index. Before he writes another book, Galbraith would do well to ponder what US conduct in Vietnam implies about the lengths to which the American ruling class will go when what it considers to be its vital interests are threatened. A full review of Economics and the Public Purpose would have to deal with the author’s treatment of imperialism and America’s over-all role in the world. I will only say here that this treatment is so brief, superficial, and unenlightening as to suggest that Galbraith is unfamiliar with recent work in this area, especially by a younger generation of social scientists in the third world. This is not surprising since most of this work is either Marxist or strongly Marxist-influenced, and in his references to Marxism Galbraith shows that he is following in a well-established tradition of bourgeois social science: he simply refuses to take it seriously. ↩