Versions of liberal democracy have spread into parts of the former Soviet bloc, but in Iraq democracy is producing a type of elective theocracy not unlike that which exists in Iran. China has abandoned central economic planning for a type of state capitalism closely linked with nationalism. Some countries are moving toward market reform and others in the opposite direction. Europe has opted for a combination of social democracy with a neoliberal economic system, while under the Bush administration the United States has tilted toward a mix of protectionism, an unsustainable federal deficit, and crony capitalism.

Though the world’s diverse societies are continuously interacting, the process is producing a variety of hybrid regimes rather than convergence on a single model. Yet a belief that a universally accepted type of society is emerging continues to shape the way social scientists and public commentators think about the contemporary condition, and it is taken for granted that industrialization enables something like the way of life of rich countries to be reproduced everywhere.

The assumption of convergence is evident in theories of globalization. In The Borderless World (1990), the influential management theorist Kenichi Ohmae declared:

[The global economy] is becoming so powerful that it has swallowed most consumers and corporations, made traditional national borders almost disappear, and pushed bureaucrats, politicians, and the military toward the status of declining industries.1

Ohmae’s work embodies what may be called the business-utopian model of globalization, but the idea that national systems of government are becoming marginal is shared by theorists of cosmopolitan governance who believe that powerful new supranational institutions are emerging—a view that is no less unreal. Similarly anticapitalist movements are based on the premise that the divergent patterns of development of the past have been replaced by a new, repressive global system. Supporters of globalization and many of its critics assume that it creates similar conditions wherever it spreads. Whether they welcome the prospect or resist it, both accept that global market forces are forcing societies onto the same path of development.

In Globalization and Its Enemies, Daniel Cohen, a professor of economics at the École Normale Supérieure in Paris, provides a refreshing antidote to some of the most misleading features of this consensus. His starting point is the seemingly paradoxical claim that for most people in the world it is not a reality but a mirage. As Cohen sees it, the ongoing wave of globalization—the third in a series that began in the sixteenth century with the conquistadors and continued in the nineteenth with British imperial free trade—occurs largely in a realm of virtual reality and leaves much of everyday life untouched. Nineteenth-century globalization involved large-scale movements of population to new lands, while the present phase involves mainly commodities and images.

“Today’s globalization,” he notes, “is ‘immobile.'” Goods are produced and marketed on a planetary scale but those who live in rich countries encounter other societies chiefly through television and exotic vacations. There are politically controversial migrations of poor people from the Middle East and Africa to Europe and from Mexico to the United States, but immigrants still make up only around 3 percent of the world’s population today, whereas in 1913 it was about 10 percent. Again, trade has expanded greatly in the past thirty years but a great deal of it occurs between rich countries. The fifteen longstanding members of the European Union make up around 40 percent of global commerce, but two thirds of their imports and exports are traded within Europe itself. As Cohen puts it, “in wealthy countries globalization is largely imaginary.”

The belief that financial globalization is promoting economic development in poor countries is also delusive. Global financial markets have few incentives to equip poor countries to be globally productive. It may be profitable to computerize a grocery store in New York, but in Lagos customers are too poor to pay the prices required by such investment. The result is that technology is very unevenly diffused, and the poor stay poor.

However, the reason is not that rich countries are victimizing poor countries. The poverty of developing countries is often blamed on unfair terms of trade, and there can be little doubt that protectionist practices in agriculture both within the EU and in the US, for example, have hindered poor countries; but Cohen argues that on the whole trade is not as unequal as has been widely thought. The basic reason that poor countries stay poor is that they have little that rich countries want or need.

“To understand today’s globalization,” he observes dryly, “requires that one renounce the idea that the poor are stunted or exploited by globalization.” The poor of the world are not so much exploited as neglected and forgotten. At the same time the press and television are drenching them with images of the riches they lack. For the poor, globalization is not an accomplished fact but a condition that remains to be achieved. The irony of the current phase of globalization is that it universalizes the demand for a better life without providing the means to satisfy it.

Advertisement

Globalization and Its Enemies is one of the most original and incisive inquiries into the subject I have seen. No one who reads and understands it can come away believing that the current phase of this complex and uneven process is leading to the peaceful universal market of business utopians, or accept the simple narrative of anti-capitalist movements in which underdevelopment is a consequence of the wealth of advanced countries. There is more wisdom in Cohen’s short book than in dozens of weightier tomes; but there are some disconcerting lacunae in the analysis.

Cohen is far more conscious of the material environment in which industrial production takes place than most other economists. Globalization and Its Enemies has some fascinating discussions of the geographical and climatic conditions favoring or retarding economic development and the continuing importance of population growth. For example, Cohen notes the worsening relationship between fast-growing human numbers and available arable land. In 1913 Egypt had only 13 million inhabitants, today it has 70 million, and in 2025 it is expected to have over 100 million; but only 4 percent of Egypt’s land is arable.

It is all the more surprising, then, that Cohen gives very little attention to globalization’s environmental limits. In a number of asides he acknowledges that the current phase may be endangering the planet’s ecological equilibrium. “One cannot continue for long,” he observes, “leaving to private regulation the question of global warming, the opening of the ozone layer, or the disappearance of species.” Yet Cohen seems not to see clearly that ecological instability is an integral part of the vast economic change that is currently underway. As an example, China is undergoing the largest and quickest industrialization in history. At the same time it is suffering unprecedented levels of pollution. Environmental crisis and the present phase of globalization are different sides of the same process.

Cohen argues that the present phase of the world economy involves a shift from an industrial to a post-industrial economy: while around 80 percent of global trade is in industrial and agricultural products, industry and agriculture account for only around 20 percent of employment in rich countries with the service sector providing about 80 percent. For developing countries, however, the current wave is simply another phase in the worldwide process of industrialization that began some centuries ago. The disturbance in the planetary environment we are currently witnessing is a by-product of this process, whether in rich countries or poor.

There can no longer be any reasonable doubt that the global warming the world is experiencing today is a side effect of fossil fuel use. The extraction and consumption of hydrocarbons has been integral to industrialization and remains so; but it is also the chief human cause of planetary overheating. A clear correlation exists between industrialization over the past 150 years and rising greenhouse gases. There is some uncertainty in estimates of when climate change will begin to disrupt the industrial civilization that has spread, in different forms, throughout much of the world; but observation of rapid melting in the Antarctic ice cap and the worsening prognosis of the Intergovernmental Panel on Climate Change suggest that a major climate shift is underway that could have a severe impact on the way we live. It is easy to dismiss projections of looming environmental disaster as apocalyptic doom-mongering, and carry on with business as usual. Mounting evidence, however, suggests a growing possibility of an abrupt climate change in which rising sea levels will flood many of the world’s coastal cities and damage large areas of arable land. In such conditions there would be serious conflicts over dwindling resources of food, water, and energy supplies together with large-scale population movements as millions flee areas that are no longer humanly habitable.

Until very recently these have been worst-case scenarios. When an analysis of the consequences of abrupt climate change commissioned by the Pentagon and completed in October 2003 was leaked to the British press in February 2004, it was criticized as being based on unreasonably pessimistic assumptions about the scale of the climatic shift that is underway.2 The report suggested that impending climate change threatens to reduce the planet’s capacity to sustain its present human population and trigger acute resource wars, and recommended that the challenge this presents be treated as a matter of US national security. Both the analysis and the recommendation were shelved by the Bush administration. However, only a few years later accumulating scientific research leaves predictions of large-scale disruption of economic activity and intensifying geopolitical conflict of the kind the Pentagon report envisaged looking increasingly realistic.3

Advertisement

The global warming we are experiencing today is a byproduct of globalization, and so is rivalry among states for control of natural resources. Advancing industrialization means increasing emissions from power plants and automobiles; it also means increased competition for the fossil fuels that make industrialization possible. Cohen writes that until World War I industrial countries themselves produced most of the raw materials they needed, and until the 1930s they were more or less self-sufficient in energy. “It was only due to the role played by Middle East petroleum after World War Two,” he writes, “that the scheme was reversed.” It is a decisive caveat. The Gulf War of 1990–1991 demonstrated unequivocally the continuing pivotal role of Middle Eastern petroleum in the global economy. Despite moves in some countries to develop a broader mix of energy supplies, industrial societies everywhere are dependent on depleting reserves of oil and natural gas.

Moreover, demand is inexorably increasing as globalization advances in China, India, and elsewhere. States are competing for dwindling resources, with the result that classical geopolitics is once again central in international relations. In the nineteenth and twentieth centuries, social theorists and economists believed that industrialization made possible a new global system in which scarcity in the basic requirements of life would no longer exist. Instead worldwide industrialization is reproducing the resource conflicts of the past on a larger scale.

The conjunction of intensifying scarcity in energy supplies with accelerating climate change is the other face of globalization. It poses a large question mark over Cohen’s belief that the main problem with globalization is that it is incomplete, for it suggests that completing it may not be feasible. The current phase is only the extension to the wider world of the industrial revolution that began in England a couple of centuries ago, but already it is destabilizing the environmental systems on which all industrial societies depend. Extending the energy-intensive lifestyle of the rich world to the rest of humankind would have an even more destabilizing impact.

At the same time—and contrary to some antiglobalization theorists—there is no prospect of humanity opting to revert to a pre-industrial way of life. Such a choice would run counter to the aspirations of billions of people, and industrialization in China and India has an impetus that no government can resist. In any case it is doubtful that a human population of around eight or nine billion—the figure that is commonly projected for the middle of the present century—could be sustained by pre-industrial methods. Even if the present human population could be supported for a time by such methods, it would only be by devouring what remains of wilderness in the world and further destabilizing global climate systems.

As the reverse side of globalization, environmental crisis could well derail it. If there is a way forward it lies in the intelligent use of science and technology to develop less dangerous sources of energy; but it is a mistake to think that a large change in the way we live can now be avoided. Climate change cannot be prevented, only mitigated, and whatever is done to deal with its effects there is sure to be large-scale disruption and conflict. The defining feature of the industrial civilization that is spreading everywhere is exponential growth; but such growth is eventually self-limiting.

Cohen’s analysis is refreshingly heretical, but like nearly all economists he resists this conclusion. He distinguishes two kinds of economic growth—the “Smithian” variety that reflects Adam Smith’s vision in The Wealth of Nations, in which growth is achieved by utilizing the benefits of the division of labor, and a “Schumpeterian” variety that is driven by continuous technological innovation. In an unexpected lapse into economic orthodoxy Cohen maintains that while growth of the first kind ends by exhausting itself, “Schumpeterian growth is apriori without limit.”

However, while these types of growth differ in important respects, they are similar in requiring large inputs of energy that in present conditions can only come from oil and its derivatives—resources that are not only finite but whose large-scale use has the effect of stoking up greenhouse gases. (The use of nuclear fusion to supply energy would avoid that outcome but there seems no clear prospect that it will be developed anytime soon, and it would not prevent the climate shift that is already underway.) An economy based on technological innovation is better placed than others to respond to these challenges but it cannot detach itself from the material environment of the planet. Both sorts of growth rely on fast-depleting resources and face the ecological backlash of climate change. The irony of globalization runs deeper than Cohen has perceived. Not only is it at present more imaginary than real, it can never be fully achieved.

2.

One of the many valuable features of Suzanne Berger’s book How We Compete is its healthy skepticism regarding claims that different models of economic development ultimately converge. As Berger writes, there is broad agreement on the fundamental forces driving globalization:

a great freeing up of trade and capital flows; deregulation; the shrinking cost of communication and transportation; an [Information Technology] revolution that makes it possible to digitize the boundaries between design, manufacturing and marketing and to locate these functions in different places; and the availability of large numbers of workers and engineers in low-wage countries.

Convergence models assume that once globalization is in place, the only way companies can adapt is by adopting the same business practices. In this view globalization is self-reinforcing. But as Berger notes, it is not a view borne out by history. The global economy that existed prior to World War I was in many respects more open and borderless than the one that exists today. Even so it collapsed, and in a process culminating in the US in the Smoot-Hawley tariff law of 1930 was replaced by the semi-autarchic closed economies of the interwar years. However securely established it may seem, globalization is not irreversible. Indeed, over time its disruptive effects tend to result in deglobalization.

Standard models assume that globalization means that one way of doing business will be imposed on everyone, but this is not supported by Suzanne Berger’s research on many companies in different parts of the world. She writes that the common belief is that “globalization forces everyone onto the same track. But that’s not what our team found.” Drawing on a five-year study by the MIT Industrial Performance Center, Berger presents a wealth of evidence about the different strategies adopted by five hundred international companies to survive and prosper in the global market. The result is a consistently enlightening analysis that explores the many different ways in which companies respond successfully to global competition. The computer company Dell is strongly focused on distribution and outsources all manufacturing of components overseas, for example in India, while Samsung makes almost everything itself; but both are rapidly growing, profitable businesses. General Motors is finding it difficult to adjust to high-wage labor, while Toyota—which has kept production at home or in other advanced countries—is doing well. Faced with similar challenges, companies can thrive or fail in different ways.

Devoting a significant part of her analysis to the dilemmas surrounding outsourcing, Berger concludes that the threat of continuing job losses in the US is at least partly real. Many economists insist that as old jobs are lost, new technologies and industries will appear to replace them. Berger does not entirely reject this view, but suggests that the experience of those who have been laid off and cannot find jobs without accepting large reductions in pay may point to a trend that mainstream economics has missed: “After crying wolf so often, perhaps this time the pessimists about technological advance and employment have really spotted one.” Outsourcing poses a real risk to employees; but Berger believes a “race to the bottom” can be avoided if companies accept that employing cheap labor is not the most effective way of responding to global competition. The activities that succeed over time are those that involve conditions—such as long-term working relations with customers and suppliers and specialized skills—which companies whose main asset is cheap labor cannot match. A company policy of forcing wages down is not a recipe for long-term corporate success.

Berger is clear that acting on their own, companies cannot make all the needed adjustments. Governments have a major part in creating an environment in which businesses can plan for the future, but how governments do this will depend on the type of capitalism they must deal with. As she acknowledges in a lucid discussion, capitalism comes in several varieties reflecting different cultural traditions and political systems. Within this wide variety two different kinds of market economy can be distinguished:

liberal market economies, like Britain’s and the United States’, in which allocation and coordination of resources takes place mainly through markets; and coordinated market economies, like Germany’s and Japan’s, in which negotiation, long-term relationships, and other nonmarket mechanisms are used to resolve the major issues.

These divergent capitalisms are competing and they learn from one another but the result is cross-fertilization, not evolution toward a single model. What works well varies not only from company to company but also from country to country. There is no one set of policies or institutions that can yield prosperity in all societies—or for all companies. The belief that globalization means the triumph of one way of doing business is not only historically false. It is a dangerously mistaken basis for corporate strategy. As Berger puts it, summarizing the results of the years of research conducted by her team:

Succeeding in a world of global competition is a matter of choices, not a matter of searching for the one best way—we discovered no misconception about globalization more dangerous than this illusion of certainty.

The belief that nation-states remain pivotal in global society is one of the central theses of Barry C. Lynn’s powerful polemic, End of the Line. In a wide-ranging and thoroughly researched argument, Lynn challenges the belief that by increasing interdependence among the world’s economies globalization thereby enhances their stability. On the contrary, it is having the effect of reducing stability—not least in the United States. “Fifteen years of turbo-charged ‘globalization’ of industry, unchecked by any American state strategy or vision, has left the American people relying on a global industrial ‘commons,'” Lynn declares, “that is largely out of their control and that is riven by fundamental structural flaws.”

For Lynn the core of globalization is not a global market, which has long existed in many commodities. It is the global organization of production, which now takes place in far-flung networks that no one controls or really understands. A company such as Wal-Mart has become highly successful by outsourcing, buying billions of dollars of goods from China, for example. It “perceives no need even to understand the processes of supply and of production, let alone manage them carefully for the long term.” When production is globally outsourced, more and more companies become trading and retail vehicles, with neither the ability nor the interest needed to manage the process of production. Not only production but management has been devolved, with the result that no one has an overall view. It is this feature of the global economy—lauded by those who value the market for its ability to achieve results no one has planned—that Lynn finds most alarming. Because the global production system transcends national boundaries, no one is responsible for ensuring that it is safe: “Nobody looks for risk in the system…nobody accepts any liability for risk in the system.”

As Lynn notes, the failure to confront the risks of global production is partly owing to the anachronistic revival of classical liberal ideologies in which it is believed that free trade promotes peace. In his celebrated book The Great Illusion, Norman Angell argued that growing economic interdependence made war unprofitable and improbable—a view that had been advanced in the nineteenth century by enthusiasts for free trade such as Richard Cobden. Angell’s tract was published in 1909 and its argument was overturned five years later by the outbreak of the most destructive war in history. But the belief persists that as the economies of different nations become more integrated with one another their political systems will become more democratic, with the result that the world becomes more peaceful.

In practice, increasing global economic integration often works the other way. Lynn observes that because of the strong economic links between the two countries, a democratic upheaval in China would be highly destabilizing for the American economy. If ports in China were shut down or production plants closed—whether by the Chinese government or as a result of popular dissent—the flow of goods to the American economy would be severely disrupted. In such circumstances the US could well find itself propping up the current regime in Beijing: “If anything, to protect our supply lines, we may find ourselves cooperating with Beijing hard-liners to suppress the will of the Chinese people.”

The long supply lines of the global production chain extend into many countries ruled by authoritarian regimes. Any serious threat to these regimes will have global repercussions, and it will not be easy for democratic states to side with dissident movements. Free trade requires stability more than democracy, and this is especially true when production is globally dispersed. At the same time, stability is not ensured in the current state of international affairs. As in the past, states have divergent strategic objectives; they prize their own security highly and will seek to thwart global market forces if they seem to threaten what are seen as vital national interests. It is only reasonable to expect that these differences will sometimes lead to conflict.

Insofar as it is a prescription for policy, End of the Line is a plea for a reassertion of American national interests. Unlike many analysts in America and other countries, Lynn—a senior fellow in the New America Foundation—recognizes that the present global economic regime is not a spontaneous growth. It is largely an artifact of American power, which was constructed in the belief that it would serve American interests. But the system that has been established does not always work to America’s advantage, nor is it self-stabilizing:

The global economy was created by the American state. Absent a clear-minded effort by the United States to manage this system—in ways amenable to the large majority of the peoples around the world who now depend on it—it will slowly fall to pieces.

Lynn’s proposals for policy change are wide-ranging, but their common feature is that they represent a clear shift from the naive faith in the benign effects of global market forces that has shaped American policy since the end of the cold war. Here his analysis is symptomatic of an ongoing shift in opinion. The steadily deteriorating prospect in Iraq and the negative impact of outsourcing are undermining public faith that globalization works overall in the American interest. In conjunction with the spiraling cost of the war, this change in mood could well shift US policies in a more inward-looking direction. Having led the world to globalization, the US may not be far from taking the lead in retreating from it.

Models of economic development that anticipate societies converging in a harmonious universal system have deep roots in Western thinking. It is not surprising that they should have been revived in theories of globalization in the aftermath of the cold war; but they reflect the conditions of the nineteenth century, when the environmental limits of industrial expansion were hardly suspected. They fail to take account of the fact that industrialization on a global scale intensifies scarcity in vital natural resources while triggering a powerful ecological backlash. These developments, which form the other side of globalization, will shape its future course.

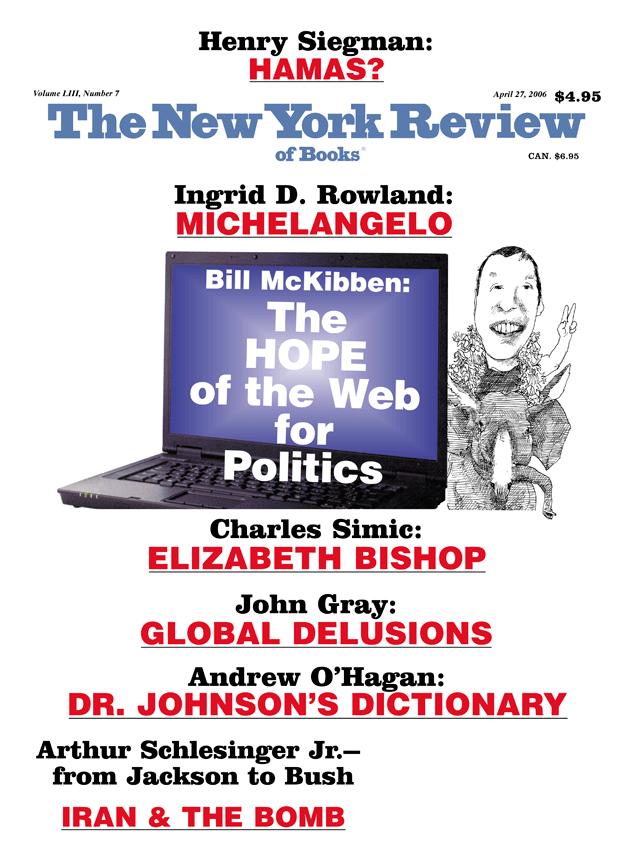

This Issue

April 27, 2006

-

1

The Borderless World: Power and Strategy in the Interlinked Economy (HarperBusiness, 1990), p. xi. ↩

-

2

An account of the contents of the report appeared in The Observer, London, February 22, 2004. The report, “An Abrupt Climate Change Scenario and Its Implications for United States National Security,” by Peter Schwartz and Doug Randall, is widely available on the Internet. ↩

-

3

See Jonathan T. Overpeck and Bette L. Otto-Bliesner et al., “Paleo-climatic Evidence for Future Ice-Sheet Stability and Rapid Sea-Level Rise,” Science, Vol. 311, No. 5768 (March 24, 2006), pp. 1747–1750. The authors summarize their findings by stating: “Recent scientific research suggests polar warming by the year 2100 may reach levels similar to those of 130,000 to 127,000 years ago that were associated with sea levels several meters above modern levels.” Using a computer model, the authors found that climate change is likely to make the world between 3 and 5 degrees centigrade warmer later this century. Professor Overpeck, director of the Institute for the Study of Planet Earth at the University of Arizona, has stated that with a one-meter rise in sea level, the Maldives would disappear, most of Bangladesh would be uninhabitable, and cities such as New Orleans would be “out of business.” The Guardian, March 25, 2006. ↩