At the heart of the argument about how to revive a depressed economy is the question of debt. When political leaders and economists debate the subject, they refer mostly to public debt. To conservatives, the economy’s capacity for recovery is impaired by too much government borrowing. These escalating obligations, they claim, will be passed along to our children and grandchildren, leaving America a poorer country. Liberal economists, such as Paul Krugman and Joseph Stiglitz, have replied that only faster growth rates and higher gross domestic product will reduce the relative weight of past debts. Budget austerity, in their view, will shrink demand and slow growth, making the debt burden that much heavier.

As important as this debate is, there’s something missing. Public debt was not implicated in the collapse of 2008, nor is it retarding the recovery today. Enlarged government deficits were the consequence of the financial crash, not the cause.1 Indeed, there’s a strong case that government deficits are keeping a weak economy out of deeper recession. When Congress raised taxes in January at an annual rate of over $180 billion to avoid the so-called fiscal cliff, and then accepted a “sequester” of $85 billion in spending cuts in March, the combined fiscal contraction cut economic growth for 2013 about in half, according to the Congressional Budget Office. Moreover, some of the causes of public deficits, such as Medicare, reflect to a large extent inefficiency and inflation in health care rather than profligacy in public budgeting.

It was private speculative debts—exotic mortgage bonds financed by short-term borrowing at very high costs—that produced the crisis of 2008. The burden of private debts continues to hobble the economy’s potential. In the decade prior to the collapse of 2008, private debts grew at more than triple the rate of increase of the public debt. In 22 percent of America’s homes with mortgages, the debt exceeds the value of the house. Young adults begin economic life saddled with student debt that recently reached a trillion dollars, limiting their purchasing power. Middle-class families use debt as a substitute for wages and salaries that have lagged behind the cost of living. This private debt overhang, far more than the obsessively debated question of public debt, retards the recovery.

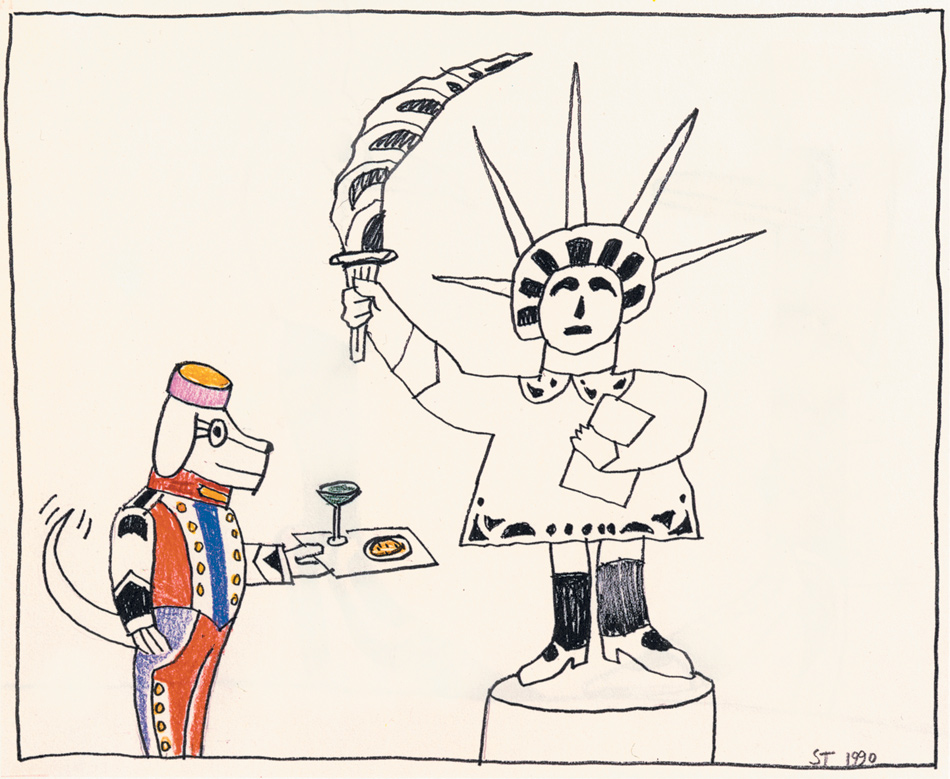

The debt debate is reminiscent of Tom Stoppard’s Rosencrantz and Guildenstern Are Dead. In a grand inversion, minor characters have usurped center stage, while the more important ones are out of sight. The quarrel about public debts is really a proxy for the argument about how to produce a strong recovery. To that end, we should be discussing how to relieve the burdens of private debts and prevent future abuses of the power of the financial industry to create debt and engage in speculation.

As the economic anthropologist David Graeber shows in his encyclopedic survey, Debt: The First 5,000 Years, since antiquity

the struggle between rich and poor has largely taken the form of conflicts between creditors and debtors—of arguments about the rights and wrongs of interest payments, debt peonage, amnesty, repossession, restitution, the sequestering of sheep, the seizing of vineyards, and the selling of debtors’ children into slavery.

He quotes the classical historian Moses Finley as saying that in the ancient world all revolutionary movements had a single program: “Cancel the debts and redistribute the land.”

Despite the implications of Graeber’s history for events since 2008, the present economic distress scarcely figures in his book. Rather, he has written an authoritative account of the background to the recent crisis. Both erudite and impertinent, his book helps illuminate the omissions of the current debate and the tacit political conflicts that lurk behind technical budget questions.

Graeber, an American teaching at Goldsmiths, a part of the University of London, begins his book with an anecdote. He is attending a garden party at Westminster Abbey. The guests are international activists and do-gooders, corporate liberals as well as antiglobalization radicals. He falls into a conversation with a lawyer for a foundation and explains his involvement in the campaign to stop the International Monetary Fund from imposing austerity on third-world nations. He mentions the biblical Jubilee, in which Hebrew kings periodically proclaimed debts forgiven.

“‘But,’ she objected, as if this were self-evident, ‘they’d borrowed the money! Surely one has to pay one’s debts.’”

Graeber reminds her that even in standard economic theory, “a lender is supposed to accept a certain degree of risk.” Indeed, the higher the anticipated return, the more likely the danger of default. Yet the premise that “surely one has to pay one’s debts” is so persuasive, Graeber writes, “because it’s not actually an economic statement: it’s a moral statement.” A debt, by definition, is something you owe that must be repaid.

Advertisement

In Graeber’s exhaustive, engaging, and occasionally exasperating book, three themes stand out. One is the “profound moral confusion” in our understanding of debt. A second is the perennial struggle over debt forgiveness, and who receives it. A third is the function of debt in the politics of social class and social control.

Despite extensive scholarly efforts to find an example, Graeber reports, there is no historical evidence of an actual primitive economy that ran on barter. Why is he making this point? In fact, two thousand years before kings began minting coins, there was credit. Before paper, accounts were kept on clay tablets. Landowners gave peasants provisions on promise of repayment. And where there is credit, there is of course debt. What appears to be a random excursion sets up a central discussion about debt and reciprocal obligation.

Graeber observes that debt is often conflated with sin. The version of the Lord’s Prayer drawn from Matthew (used by most Protestant denominations) asks God to forgive us our “debts,” while most translations of Luke (and the Catholic liturgy) ask forgiveness for our “trespasses” or “sins.” Graeber notes that in modern German, the same word, Schuld, means both debt and guilt. Likewise in several ancient languages. In market terms, he writes, a debt is “an exchange that has not been brought to completion.” One party received the goods; the other is owed a payment. To fail to honor a debt, therefore, is to be in a condition of guilt on both moral and economic grounds.

But though individual failure to repay a debt is considered ethically abhorrent, there are times when sound economics requires debt forgiveness. In the case of a broad downturn,2 debt ceases to be purely a moral question, and becomes a pragmatic one: Will it help the overall economy for the law to demand that debts always be paid in full? Was it economically sensible to throw debtors into jail? Is it sensible now to force troubled corporations or banks to liquidate? To compel sales of millions of homes in a depressed market? To destroy the economic potential of entire nations so that they can service old debts that were incurred corruptly by previous governments or banks? Society properly discourages borrowers from taking on imprudent burdens, and the prospective loss of property or even liberty functions as a deterrent. But in a general collapse, debt forgiveness may become necessary if the economy is not to sink further.

My own research explores a pivotal event in the history of debt—the invention of modern bankruptcy, in 1706, by ministers of Queen Anne. Before 1706, bankruptcy simply meant insolvency, and the bankrupt was packed off to debtors’ prison. It dawned on the reformers of the day that this practice was economically irrational. As the legal historian of bankruptcy Bruce Mann wrote, “it beggared debtors without significantly benefiting creditors.”3 Once behind bars, a debtor had no means of resuming productive economic life, much less satisfying his debts. In this insight was the germ of Chapter 11 of the modern US bankruptcy code, the provision that allows an insolvent corporation to write off old debts and have a fresh start as a going concern.

The British devised the concept of legal discharge from debt not out of a sudden attack of compassion but because the economic crisis of the 1690s had put much of the merchant class in jail. The cause was not improvident or immoral behavior on the part of debtors, but general economic dislocation beyond their control, caused by the confluence of bubonic plague, recent wars with France, and a storm that devastated the merchant fleet in 1703. The future novelist Daniel Defoe was a leading pamphleteer promoting the idea that debtors might settle with creditors at so many pence to the pound and then have their debts legally discharged. Defoe had himself spent some months in debtors’ prison in 1692 and 1693.

But when the law was finally enacted, allowing a magistrate to settle debts with partial repayment, only substantial merchants could qualify for relief. Common debtors still languished in jail, since their penury had scant wider consequences. Yet an important conceptual breakthrough had occurred. Canceling some debts was deemed economically efficient. Legal historians such as Bruce Mann have observed that, for capitalism to proceed, it was necessary to shift the economic thinking and legal policy governing debt from moral questions to instrumental ones.

Modern macroeconomics—the deliberate manipulation of interest rates and public deficits to smooth out cycles of boom and bust—dates only to the 1930s. But long before there was macroeconomics, there was the option of debt relief. In the first decade of the eighteenth century, British leaders did not comprehend that public borrowing and spending could be useful counterweights to private business slumps. But the government grasped that if the commercial class was kept in jail, the economy would collapse.

Advertisement

The struggles over what was called “the money issue” in nineteenth-century America were also about the terms of credit and debt. Farmers and artisans thrived when credit was plentiful; they suffered when financial panics caused bankers and merchants to call in loans and thus shrink the money supply. One remedy for credit scarcity was a central bank that could make more money available, but popular mistrust of concentrated wealth delayed creation of one for more than a century. When the Federal Reserve was at last legislated in 1913 after a succession of financial panics, Congress put it under the control of commercial bankers. Not until the Great Depression and the Franklin Roosevelt era did the US government became serious about debt relief, with a series of policies that refinanced distressed home mortgages, reformed and recapitalized banks, extended relief to bankrupt consumers, financed a huge war debt at below-market interest rates, and wrote off some of the international debts of allies and enemies alike. (Britain, America’s closest ally, received near-total forgiveness of wartime Lend-Lease debt.)

Germany, today’s enforcer of Euro-austerity, was the beneficiary of one of history’s most magnanimous acts of debt amnesty in 1948. The Allies in the 1920s made the catastrophic error of helping to destroy Germany’s economy with reparations and debt collection policies. In the 1940s, after a brief flirtation with World War I–style reparations, the occupying powers agreed to behave differently: they wrote off 93 percent of the Nazi-era debt and postponed collection of other debts for nearly half a century. So Germany, whose debt-to-GDP ratio in 1939 was 675 percent, had a debt load of about 12 percent in the early 1950s—far less than that of the victorious Allies—helping to produce postwar Germany’s economic miracle. Almost every German can cite the Marshall Plan, but this larger act of macroeconomic mercy has disappeared from the political consciousness of Germany’s current austerity police. Whatever fiscal sins the Greeks committed, the Nazis did worse.

The debt write-offs of the 1930s in the US and the 1940s in Germany were a short-lived interlude in a long history in which debt politics as applied to common people usually favored creditors. From biblical times through the nineteenth century, debt peonage—a state of servitude in which the debtor is stripped of rights—and debtors’ prisons were more the norm. The question of who gets debt relief reflects the distribution of political power—and power normally lies with large creditors such as banks. The Roosevelt era stands out as an exception.

The double standard in debt relief that favored large merchants, present at the creation of bankruptcy law in 1706, persists today in many different forms. It gets surprisingly little attention in the debt debates. Despite the tacit assumption that “surely one has to pay one’s debts,” the evasion of repayment is both widespread and selective. Corporate executives routinely walk away from their debts via Chapter 11 of the national bankruptcy law when that seems expedient. Morality scarcely enters the conversation—this is strictly business.

Even more galling is the fact that the executives who drove the company into the ground often keep control by means of a doctrine known as debtor-in- possession. A judge simply permits the company to write off old debts, while creditors collect so many cents on the dollar out of available assets. Every major airline has now been through bankruptcy, and US Airways has gone in and out of Chapter 11 twice. In this process, all creditors are not created equal. Since banks typically have liens on the aircraft, bankers get paid ahead of others. Major losers are employees and retirees, since Chapter 11 allows a corporation to break a labor contact or reduce pension debts. Shareholders also lose, but by the time bankruptcy is declared, the company’s share value has usually dwindled to almost nothing. Much of the private equity industry uses the strategy of acquiring a company, taking it into bankruptcy, thus shedding its debts, and then cashing in on its subsequent profitability. Despite the misleading term private “equity,” tax-deductible private debt is the essence of this industry, which relies heavily on borrowed money to finance its takeovers.

Homeowners, however, are explicitly prohibited from using the bankruptcy code to reduce their outstanding mortgage debt. White House legislation proposed in 2009 would have allowed a judge to reduce the principal on a home mortgage, as part of the effort to contain the economic crisis. Congress rejected the measure after extensive lobbying by the financial industry. Consumers may use bankruptcy to shed other debts, but a revision of the law signed by President Bush in 2005 subjects most bankrupt consumers to partial repayment requirements, while bankrupt corporations get a general discharge from their debts. Thanks to the influence of the same financial lobby, the rules of student debt provide that the obligations of a college loan follow a borrower to the grave.

Nor is there Chapter 11 for nations. The “relief” provided by the European Union or the IMF typically takes the form of additional loans that the debtor nation uses to pay interest on old debts. The government ends up deeper in debt. Ireland, with low public debt levels in 2008, became in effect a ward of Brussels because the Irish state assumed the debts of insolvent Irish banks that had irresponsibly funded bad debt. The European authorities used a similar double standard in the case of Cyprus, condemning ordinary savers to lose up to 60 percent of their assets, in order to pay for the speculative sins of financiers.

Large banks, meanwhile, have benefited from extensive debt forgiveness thanks to governments. In the fall of 2008, every major US bank was on the verge of insolvency because banks had recklessly incurred debts to finance speculative investments, often using derivative instruments such as credit default swaps that had been created by the same group of large banks. When their debts overwhelmed their assets, the government did not permit these banks to fail (except for Lehman Brothers), or even to use Chapter 11 (which would have wiped out shareholders). Government simply made the banks whole, through the Troubled Asset Relief Program (TARP). The Federal Reserve has continued relief through extensive purchases of dubious bonds from banks. The entire economy gains from the stimulus to demand, but bankers who would otherwise lose their jobs are the immediate beneficiaries.

Despite the shift in the thinking about debt from a purely moral question to at least partly an instrumental one where business is concerned, the earlier emphasis on sin lingers when it comes to common debtors. Proposals for debt relief for homeowners, college graduates, or Greece encounter resistance cloaked in the language of moral opprobrium and “moral hazard,” the danger that debt relief will reward and thus induce reckless behavior.

Public policy remains stymied on the question of how to clean up the two large, now nationalized entities that hold or underwrite most of America’s mortgages, Fannie Mae and Freddie Mac. The answer is not to conclude that the United States put too much faith in home ownership, which remains a fine way for the nonrich to accumulate financial equity. The original Federal National Mortgage Association (FNMA), nicknamed Fannie Mae, was a public entity. It used government borrowing to purchase mortgages and replenish the working capital of lenders. Public FNMA had no scandals, and when it was working effectively, from its founding in 1938 to its privatization in 1969, the US rate of home ownership rose from about 40 percent to over 64 percent. The trouble began when Wall Street invented complex, exotic, and easily corrupted mortgage bonds, and private Fannie began purchasing high-risk mortgages in order to protect its market share. The remedy is to restore Fannie to a public institution with high lending standards, not to kill it.

Thanks to a small number of insurgent voices and evidence from Europe and the US about the negative effects of austerity policies, the double standards of debt relief are beginning to command skeptical attention. Stiglitz and Krugman, both Nobel laureates, have long questioned the prevailing assumptions about the wisdom of austerity, and they have lately been joined by more orthodox economists.

Carmen M. Reinhart and Kenneth S. Rogoff, whose 2009 book, This Time Is Different: Eight Centuries of Financial Folly, was reviewed in these pages by Krugman and Robin Wells,4 are best known for demonstrating that the most severe downturns of the entire economy typically follow financial crashes. In passing, This Time Is Different mentioned a provocative concept, “financial repression.” The idea was that when debt is strangling an economy, it may make sense to hold down interest rates, and let inflation decrease debt, or otherwise constrain financial burdens on families and companies to help the rest of the economy realize its potential. The Federal Reserve, under Ben Bernanke, has kept interest rates exceptionally low, incurring criticism that it is risking inflation. Rogoff, formerly chief economist of the IMF, goes further. He would have the Fed deliberately set as a target an inflation rate of 4 or 5 percent as an open strategy of reducing debt burdens by inflating them away, an idea that horrifies the bond market.

Reinhart, in a subsequent paper co-written in 2011 with M. Belen Sbrancia,5 reviewed the experience between 1945 and 1980, and found that there had been continuing financial repression. Real interest rates (i.e., adjusted for inflation), they calculated, were negative on average for the entire period, helping to “liquidate” public debt, partly because the Federal Reserve had a policy of financing the large expenditures of World War II at low costs. During the same era, tight regulation limited speculation by large financial institutions and other investors, so that cheap credit could flow to the real economy without inviting financial bubbles. The 1933 Glass-Steagall Act, for example, prohibited commercial banks from underwriting or trading securities. Yet despite a controlled bond market whose investors suffered negative returns of -3 to -4 percent, the years between 1945 and 1980 were the era of the greatest boom ever.

These findings defy a core precept of conservative economics, the premise that economic growth requires financial investors to be richly rewarded, an idea disparaged by critics as trickle-down economics. The postwar era, by contrast, was an age of trickle-up. Some creditors lost in the short run, but broadly shared prosperity stimulated private business. Eventually, the rising tide lifted even the yachts.

Another former IMF official, Anne O. Krueger, an appointee of George W. Bush, recently reiterated her call for Chapter 11 bankruptcy for indebted countries. When she first proposed the idea as deputy managing director of the IMF in 2002, Krueger was fairly shouted down by officials of the US Treasury and leading bankers. In January 2013, she argued that “a clear mechanism [to allow nations to use bankruptcy] could have prevented all sorts of problems in the eurozone.” With a Chapter 11 law, Greece could have written off old debt and used new borrowing to finance new growth, just like a private corporation. Even acknowledging past bad behavior (as in the case of many corporate bankruptcies), a Chapter 11 for countries could sensibly combine incentives for honest bookkeeping with macroeconomic policies that write off old debt for the sake of recovery.

The discussion about relief of private indebtedness, however, is still mostly offstage. The particulars no longer involve the sequestering of sheep or the seizing of vineyards. But the ten million Americans at risk of losing their homes to foreclosure, or recent graduates who cannot qualify for mortgages because of their monthly payments on college loans, have become modern debt-peons. At the same time entire economies abroad, indentured to past debts, find themselves in a metaphoric debtors’ prison where they can neither repay creditors nor resume productive livelihoods.

These debt traps are not immutable. Government could refinance mortgages directly using the Treasury’s own low borrowing rate, as was done by Franklin Roosevelt’s Home Owners’ Loan Corporation. Fannie and Freddie, remade into true public institutions, could provide the refinancing. The Obama administration’s existing mortgage relief program, run through private banks, excludes the most seriously underwater homeowners. The terms largely prohibit significant reductions in mortgage principal owed, and these limitations should be liberalized by the administration.

For students, an Obama administration program permits about 1.6 million of the 37 million college borrowers to finance education costs by paying a small surcharge on their future income taxes, instead of incurring debt. This option could be made universal. The group Campus Progress proposes allowing college debtors, who currently pay an average of almost 7 percent interest, to refinance their debt at the ten-year Treasury borrowing rate of about 2 percent. This would save young adults $14 billion this year alone. The EU could refinance the debts of small, depressed nations using eurobonds, and the European Central Bank could make clear that it will buy as much sovereign debt as it takes to defend government bonds from speculative attacks.

The crack in the intellectual consensus on public and private austerity is the beginning of a more realistic national debate about debt. But such debt relief policies are a long way from being enacted. The sheer political power of creditors and the momentum of the austerity campaign suggest that more damage to the economy may be done before any large change takes place.

This Issue

May 9, 2013

On Anthony Lewis

Pinning Down Spartacus

-

1

The budget was in surplus as recently as 2001. The Bush tax cuts and the cost of two wars created new deficits, but these were only about 3 percent of GDP in 2008. ↩

-

2

The economist Irving Fisher defined a great depression as a condition of “debt deflation,” in which the value of debts broadly exceeded the value of their collateral. See Irving Fisher, “The Debt-Deflation Theory of Great Depressions,” Econometrica, Vol. 1, No. 4 (October 1933). ↩

-

3

Bruce H. Mann, Republic of Debtors: Bankruptcy in the Age of American Independence (Harvard University Press, 2002), p. 18. ↩

-

4

The New York Review, May 13, 2010. ↩

-

5

Carmen M. Reinhart and S. Belen Sbrancia, “The Liquidation of Government Debt,” National Bureau of Economic Research Working Paper 16893, March 2011; see www.nber.org/papers/w16893. ↩