Back in the 1920s, Charles Beard called America a “business civilization.” Is this still the case? Even today, most Americans spend their working lives in the employ of profit-making enterprises. Yet we lack anything like a literature on the subject. We have had no chroniclers like Balzac or Arnold Bennett. Dreiser’s Frank Cowperwood is memorable mainly for his personal problems; whereas Lewis’s Babbitt was a buffoon, and we saw Dodsworth only on holiday. About the only businessmen who can carry a plot are in advertising or entertainment. Our captains of steel, chemicals, finance are seldom very interesting people.

Even so, analysis of who succeeds in business can reveal a good deal about where our country is moving. Historical conditions dictate which kinds of people will fill the presiding positions. The period immediately after World War II required industrial efficiency to satisfy a demand for appliances. So men from manufacturing rose to the top. The two Wilsons—“Engine Charlie” at General Motors and “Electric Charlie” from General Electric—were typical. Stolid products of places like Penn State and Purdue, they were the corporate wing of the Eisenhower era.

In the Sixties, business began to get sexier. Manufacturing was well under control, or so at least we were told. So verbal facility came into favor. Executives became more talkative. A lot was said about professional management and the responsibilities of the modern corporation. Companies diversified and conglomerated. They even rechristened themselves so as to dissolve ties to a single product: Esmark, Tenneco, Amstar, Uniroyal. Executives became experts in “synergy,” an industrial gestalt which turned two and two into five. RCA, for example, had to be more than the sum of NBC, Hertz, Random House, Banquet Foods, and Coronet Carpets. The men who ran Textron moved easily among helicopters and hearing aids, watchbands and writing paper, snowmobiles and bathroom scales. Indeed, more money could be made from exotic price-earnings ratios than from marketing a better product. Since 1969, most of these companies have tumbled in the Fortune listings. Textron and Raytheon and Litton, TRW and LTV and FMC, had been more cooked up than their pronouncements suggested. Spokesmen for “synergy” no longer get invitations to business school seminars.

In The Gamesman, Michael Maccoby wants to tell us what will happen next. After several years in Mexico, where he studied the local villagers, he has diversified into corporate executives. But Maccoby is also a lay analyst, an apprentice of Erich Fromm. So his subject is really the corporate psyche, within the setting of the “corporate psychostructure.” He explains why he is better qualified, for example, than the late Oscar Lewis when it comes to the art of interviewing. “The process by which one becomes a psychoanalyst [entails] a long period of self-study…where his goal is to develop himself as the instrument of investigation,” he writes. “The psychoanalyst is sensitized [by a psychodynamic theory of character] to listen to contradictions between what is said or what is communicated by body movements, facial expressions, etc.”

This combination of sensitizing self-study and psychodynamic theory clearly impressed a lot of people. For Maccoby was soon laden with foundation grants, a Harvard connection, and associates named Kathy, Cindy, and Mac. Entrance to companies was easy once the team said it came from Cambridge. Moreover they got full cooperation from the top. (“No one below corporate vice president or division president.”) In all, 250 executives in a dozen firms were interviewed. Maccoby glosses the names; but “Business Data Corporation” is obviously IBM, and “Rutherford Instruments” has to be Texas Instruments. Most of the people he met were “creative,” “gifted,” or “brilliant.” Apparently Maccoby got on very well with his subjects. Several, he tells us, asked his advice on how to run their companies.

Central to the study was what social scientists call an “instrument,” this one containing 229 questions with about 300 further sub-items. In addition to age, education, and marital status, executives were also asked, “Do you think Scouting is good for children?” “Do you take an interest in wine?” “What should a man do if his wife is unfaithful?” Sad to say, we never learn the answers to these questions, although answering them consumed three hours, even allowing for some Rorschachs and reports on recent dreams. Interviews of this length, Maccoby claims, were “sufficient for sociopsychoanalytic study.”

The upcoming corporate captain, in Maccoby’s view, is “The Gamesman.” This is especially the case in “high technology” companies at the “cutting edge” of America’s industrial future. (Maccoby likes that phrase. The men he interviewed represent “the cutting edge of excellence.”) Although there were 250 interviews, we meet only five of his subjects on these pages; and only two turn out to be ordinary Gamesmen. There are Bill Steward (“The Gentle Craftsman”) and Phil Bass (“The Jungle Fighter”). But the hero is Jack Wakefield (“The Creative Gamesman”), who “likes to take calculated risks and is fascinated by techniques and new methods.”

Advertisement

The contest hypes him up and he communicates his enthusiasm, thus energizing his peers and subordinates like the quarterback on a football team. The gamesman competes not to build an empire or to pile up riches, but to gain fame, glory, the exhilaration of victory.

Unfortunately we learn very little about what these Gamesmen do in their daily work. They are described, vaguely, as being associated with electronics. However hardly anything is said about how (or whether) they make money for their companies. This is largely because Maccoby’s findings derive almost entirely from conversing with his subjects, in those three-hour “sociopsychoanalytic” sessions in their offices or some other secluded place. (One can’t very well administer a Rorschach test out on a shop floor.) When we once or twice see them in action, it is at meetings of which we are never informed of the results.

An analysis of business behavior based on interviewees’ own accounts of what they do might not be so bad if those conducting the research had some prior knowledge of the corporate world. In that case they could winnow reality from the wishful thinking that so often occurs in interviews. But there is no evidence in this book of any such knowledge: which perhaps explains why everyone turns out to be so gifted or creative or brilliant. Here is a book about businessmen in which no one closes a sale, explores ways to get financing, or frets about foreign competition. Instead, answering Maccoby’s questions, they give their opinions on overeating, low-cost housing, and how they would react if they were to “buy a new car and soon afterward found a scratch on the door.” (Very upset. Somewhat upset. A little upset. Not upset.)

Of course Maccoby might argue that his book is about businessmen as human beings rather than about how they earn their livings. But to make such a distinction is like forgetting that Antonio was, after all, a merchant. Thus the men we meet could as easily work for Stanford University, the Rockefeller Foundation, or the Federal Energy Administration. If the Gamesman has specific business characteristics, these are never made clear.

The concluding theme of the book is that the Gamesman “develops his head, but not his heart.” All those questions about wine and low-cost housing reveal our cutting-edge executives as electrified Tin Woodsmen. They cannot love, express emotion, or envisage a world based on humane principles. “There is a shell around my heart,” one respondent admitted. This especially unsettled the interviewer, for “psychoanalysis is a therapy of the heart.”

The desire to make businessmen human is hardly new. Alexis de Tocqueville entitled one of his chapters “How an Aristocracy May Be Created by Manufactures.” More sanguine than Marx, he held out the hope that as technology advanced, those presiding over industry would be freed for higher pursuits. Tocqueville was thinking of the arts. Maccoby wants his managers to regain their hearts so they will join in attempts to achieve nuclear disarmament and curb “the state’s technological greed.” Moreover, he argues that “a more rational national security” policy would be in business’s best long-run interests.

Enlightened businessmen have always been an American will-‘o-the-wisp. It is one thing to proselytize people who have built up enterprises of their own. They have personal fortunes, and can afford to play the patron or take unpopular positions. (Cyrus Eaton and Norton Simon are the usual cases in point.) But it is quite another matter to approach careerists embarked on a corporate climb. Maccoby’s own heart is in the right place. However his campaign for compassion must start with the work his executives do, the organizations that hire them. If they are as ambitious as he says, then we have to know more about what it takes to get to the top.

Perhaps the chief selling point of Maccoby’s study is that the men he describes are “rising to the top in American industry.” But will his Gamesmen in fact be the chief executives of tomorrow? The closer one looks, the more they seem like second stringers. For example, the typical interviewee puts in only forty to forty-five hours a week, hardly a load for someone eager to run the big show. In fact, his subjects are the current counterparts of William Whyte’s organization men of twenty years ago: people who staff a company’s middle reaches, and will probably never move higher. Indeed, Jack Wakefield, the Creative Gamesman who gets most of a chapter to himself, talks of quitting and returning to law school, to start a consumer protection practice centering on “computers and privacy.” Hardly the plan of a man in his mid-thirties destined for a high executive office.

Advertisement

Still, Maccoby seeks to distinguish his people from Whyte’s amiable company loyalists. In fact the only real difference is demeanor. Back in the 1950s no one was sure what the rules were, so caution tended to prevail. The Gamesman came through the swinging Sixties, when a playful style was in favor. As it happens, Maccoby has misread Whyte. The latter never claimed that his organization men “would inevitably take over large businesses,” as Maccoby makes out. (Indeed, Whyte had a separate chapter on those few who do get to the top.) In fact, it is just about impossible to pick out which of today’s middle managers will be tomorrow’s board chairmen. One large company closed down its “executive development center” several years ago. It had been incurring great expense bringing in putative comers to groom them for life in the higher reaches. However the firm found out that at least half of those who ultimately rose to the top had never been asked to the center. Invitations went to types who talked a good game in their thirties, but subsequently failed to produce.

The thought arises that the brass who set things up for Maccoby didn’t want their useful people being pestered (“Do your children play any musical instruments?” “Do you think about how you want to be buried?”). So they sent him to men who were marking time. The very naming of businessmen as “Gamesmen” invites a second look. The term comes of course from Stephen Potter, and refers to adeptness in the art of the ploy. Can it be that corporate America is falling into the hands of practical jokers? One can imagine pranksters taking over at Exxon, erasing computer tapes and sending out gas that won’t start a car.

Success in business can come in varied guises. Robert McNamara could rise to head Ford, even with rimless glasses and with no country club manner. The DuPonts chose a man named Shapiro, even if they wouldn’t want their daughters to marry one. Most executives seem fairly quiet and bland men; a few show some signs of flamboyance. All in all, though, the men chosen for the top tend to reflect the needs and conditions of a particular time. At one stage, a firm may want a salesman to run it; at another, an expert in finance. You may be a whiz at the latest in electronics, just when the company needs a man to sort out unprofitable subsidiaries. Indeed a typical large modern corporation has a large enough personnel pool (AT&T has 16,000 middle and upper managers) so that it can usually count on promoting from within.

That at least is the theory on which most companies work, a theory that may now be in difficulty because of the very men Maccoby tries to describe. To put it simply, there are too many game-players on corporate payrolls and not enough businessmen who make profits. What we call executive and managerial ranks have become filled with people whose jobs cannot easily be correlated with earnings. While everyone connected with a company will claim they contribute to its profit margin, in many cases that contribution is sheer speculation. This is most graphic in the case of employees who see themselves as “professionals.”

Between 1950 and 1975, the male white-collar work force rose by about 7.5 million persons. Well over half of that increase came from the creation of over 4.7 million new professional and technical positions. During that same period, the nation’s force of salesmen rose by less than 850,000, which is tantamount to standing still. Back in 1950, we had just about as many salespeople as so-called professionals. By 1975, salesmen comprised only 30 percent of the total. Arthur Miller wrote better than he knew: the statistics were on his side.

Of course many of these new “professionals” entered nonbusiness occupations, in public or non-profit organizations. Even so, the census relies on people to give their own descriptions of what they do; and we have evidence that a lot of business employees who once saw themselves as salesmen or supervisors now prefer a loftier title. For example, most of the so-called “information explosion” comes from computer specialists, systems analysts, and economists, who construe their jobs as work peculiar to their professions rather than as increasing corporate earnings.

Thus AT&T prides itself on having more scientists and engineers than the entire Ivy League put together. And its technological record is by no means unimpressive. Yet as a business operation it has turned into something of a dinosaur. In spite of its size and wealth and facilities, it is being outpaced by independent firms. Many small companies can now provide switching equipment and other gear of higher quality, at lower prices and with better delivery dates. Bell makes high profits; but being a monopoly accounts for much of its earnings. (Plus the fact that no one has the staff to question the company’s bookkeeping.) True to form, AT&T is now asking Congress to choke off its competitors, with a new network of regulations blithely called the “Consumer Communications Reform Act.” Political protection is the last refuge of superannuating enterprises.

So long as we have capitalism, a case can be made for running that system efficiently. (One can criticize private property on moral grounds. But it is hard to find a rationale for encouraging its incompetence.) The Germans and Japanese still take pride in a business mentality; as do, interestingly, the Swedes. What has happened is that our nation’s success with technology has brought into being a class of people who find business objectives beneath them. There is nothing surprising in this. The recruitment of specialists became necessary as the edifice they built got more intricate. It goes without saying that industry needs research, development, and allied activities of that sort. But such activities are now approaching the point where they form a top-heavy structure of their own, unrelated to profits or even production.

American capitalism has a higher white-collar (and white-coated) overhead than similar economies elsewhere. Nor is there much chance we will reduce that excess capacity. After all, these new occupations seem more fun; they certainly beat selling hair tonic to overstocked druggists. Maccoby’s title makes the point. Work has become play. If the system ever collapses, it will come not from the rise of downtrodden masses but because no one was minding the store. At this very moment, a party of Japanese salesmen are snaking a rented launch up the Zambezi River to install Datsun agencies in Mongu and Senanga. Rather than risk tsetse bites for a few more orders, their opposite numbers in America are describing their dreams to Cindy and Kathy and Mac.

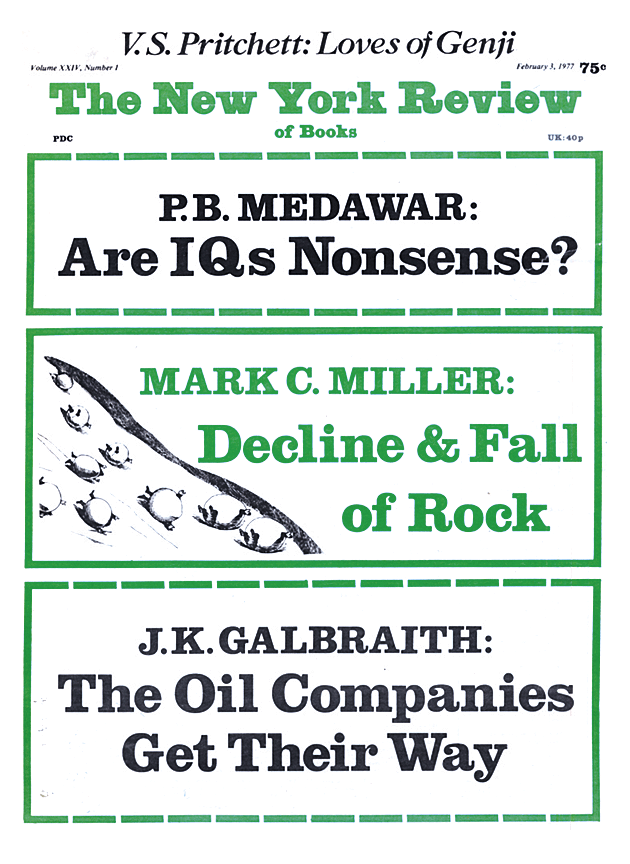

This Issue

February 3, 1977