1.

The Supreme Court’s hearings in the health care case, US Department of Health and Human Services v. Florida, over a nearly unprecedented three days of oral argument in late March, generated all the attention, passion, theater, and constant media and editorial coverage of a national election or a Super Bowl. Nothing in our history has more dramatically illustrated the unique role of courtroom drama in American government and politics as well as entertainment.

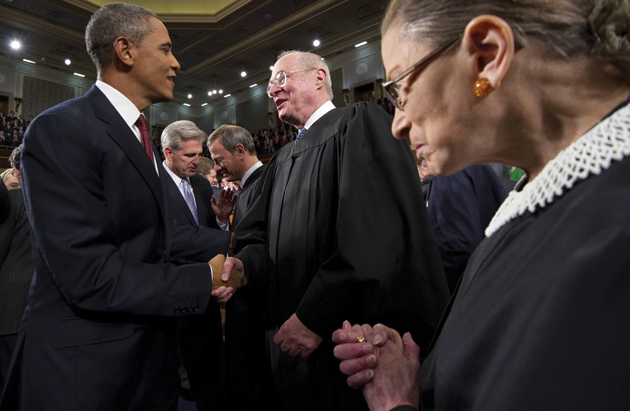

The plaintiffs have asked the Court to declare the Affordable Care Act unconstitutional. The political and social stakes are enormous. But the legal issues, most analysts think, are not really controversial: the Constitution’s text, the Supreme Court’s own precedents, and basic constitutional principle seem obviously to require upholding the act. Analysts at first predicted a 7–2 decision rejecting the challenge. But they apparently misjudged the dedication of the ultraconservative justices, whose questions in the oral argument have now convinced many commentators that on the contrary, in spite of text, precedent, and principle, the Court will declare the act unconstitutional in June, by a 5–4 vote. That prediction may be too swift. There is still reason to hope, as I discuss later, that Justice Anthony Kennedy, often the swing vote between liberals and ultraconservatives, will have sufficient respect for congressional authority to save the act.

The prospect of an overruling is frightening. American health care is an unjust and expensive shambles; only a comprehensive national program can even begin to repair it. One in six Americans lacks any health insurance, and the uninsured of working age have a 40 percent higher risk of death than those who are privately insured. Insurance is often unavailable even for those willing and able to pay for it: according to the Government Accountability Office, an average of 19 percent of individual applications for insurance are declined for a variety of reasons including the applicant’s being on a prescription medicine or being overweight.

If the Court does declare the act unconstitutional, it would have ruled that Congress lacks the power to adopt what it thought the most effective, efficient, fair, and politically workable remedy—not because that national remedy would violate anyone’s rights, or limit anyone’s liberty in ways a state government could not, or be otherwise unfair, but for the sole reason that in the Court’s opinion our constitution is a strict and arbitrary document that denies our national legislature the power to enact the only politically possible national program. If that opinion were right, we would have to accept that our eighteenth- century constitution is not the enduring marvel of statesmanship we suppose but an anachronistic, crippling burden we cannot escape, a straitjacket that makes it impossible for us to achieve a just national society.

The crucial constitutional challenge is to one central provision of the act. The act provides, among other benefits, health care insurance for the 16 percent of citizens who now lack it, and it forbids insurance companies to deny coverage or charge higher premiums to those who have a preexisting illness or risk. These obviously just benefits cannot be provided, however, unless all citizens—the young and healthy as well as the elderly and already sick—join the insurance pool. If only those likely to need treatment seek insurance, the insurance companies would have to charge astronomical premiums that most of those needing coverage could not afford. The premise of all social insurance plans, including the Social Security program, is that inescapable risks should be shared across a political community between those more and those less at risk. The act follows this principle; it provides that with few exceptions Americans who are not insured by their employers or by other government programs must purchase insurance themselves or, if they do not, pay what the act calls a “penalty” on their tax return amounting to the greater of $695 or 2.5 percent of their income. There is no other sanction for a failure to buy.

It is this so-called “mandate” that the plaintiffs in this case—twenty-six states, a group of businesses, and some private citizens—challenge as unconstitutional. They say that although the Constitution gives Congress the power to limit or forbid commercial activity that has a significant impact on the national economy, it denies Congress power to require commercial activity, like buying health insurance, even when that activity is crucial to the national economy. That distinction between negative and positive regulation—between dictating the terms of insurance and requiring people to buy insurance—is the heart of the constitutional challenge. It was treated as potentially decisive by all the conservative justices who spoke—Justice Kennedy, for instance, asked whether the mandate doesn’t “create” commerce rather than regulate it. Why is that difference between restricting and requiring activity so important?

Advertisement

2.

The Constitution’s text gives Congress the power to “regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes.” That provision cannot be read, just as a matter of what words mean, to make the distinction the conservative justices think crucial. A legislature certainly “regulates” behavior when it imposes taxes or conscripts armies or demands that we shovel snow off our sidewalks. A nation’s “commerce” is its overall system of economic transactions, and that includes its consumers’ decisions about what to buy or not to buy. The act regulates commerce by adopting a comprehensive structure of provisions and restrictions on health care distribution: it mandates insurance for all because otherwise that comprehensive structure cannot work.1

The political theory that underlies the Constitution’s overall allocation of power between Congress and the states does not require the distinction between restricting and requiring activity either. The Constitution’s architects were guided by a principle that makes that distinction irrelevant: the principle that Congress should be assigned only those powers that could not effectively be reserved to the states. They believed that if the effects of a particular political decision would be felt only or mainly within a particular state, that decision should be left to that state because decisions by state officials would be more sensitive to local needs and local opinion. But if some issue could only sensibly be settled at the national level, like decisions about foreign trade or the terms of trade among citizens of different states, then the principle requires that Congress have the power to decide it.

That is an old strategy for a federal constitution; it is now often called the “subsidiarity” principle. It provides, for example, a crucial constitutional axiom for the European Union: the European Commission is instructed to leave to the member nations decisions about matters that affect each of them locally and separately. Our Constitution reflects the same subsidiarity principle, and we should therefore read it to require the Supreme Court to limit Congress’s power over the economy to legislation that must be national to be effective.

But that constraint does not depend on whether Congress forbids or requires economic activity, so long as its regulation addresses a national problem. Of course other constitutional principles might make that distinction pertinent in some cases. Requiring citizens to buy a particular product from private companies might be thought, in some cases, to deprive them of liberty without the due process of law the Constitution demands. But of course forbidding them to buy that product—as, for example, the FDA frequently does—also limits their freedom and so might also, in some cases, deny them due process. Respect for liberty neither demands nor justifies a flat distinction between prohibition and requirement.

The conservative justices offer only one reason for thinking the distinction important. They say that if the Constitution permits Congress to make people buy insurance, then it permits Congress to make them buy anything it wishes. Why could Congress not make people buy electric cars to reduce pollution? Or join health clubs to improve the nation’s health? Or buy broccoli to keep broccoli prices high or because it is seen as healthy? All the conservative justices who participated in the oral argument pressed such questions. They said they could not uphold the insurance mandate unless they could find what they called a “limiting” principle and, they suggested, none can be found.

The government’s lawyer, Solicitor General Donald B. Verrilli, offered several ways to distinguish health care from electric cars and broccoli. He said, first, that people do not have to buy cars or broccoli but almost everyone, eventually, has to receive health care. No one doubts that Congress could require patients to pay for any medical service they require through insurance because it would then indisputably be regulating commerce. If it did, uninsured heart attack victims who wanted hospital treatment would have to buy insurance in the ambulance, perhaps from paramedics trained to sell it. Why can’t Congress avoid that ridiculous prospect by requiring people to have insurance in advance?

His second argument was even stronger. Every American already has health insurance, in one sense; the mandate only requires that he pay for his insurance rather than freeloading on those who do pay. A federal statute and several state statutes require hospitals to provide emergency medical care to people who cannot pay for it, and America’s traditions of compassion mean that doctors will not let people die in pain when they can easily save or help them. In practice, this means that the uninsured will go to costly emergency room facilities when they need medical help. Congress found that health care for uninsured patients cost almost $43 billion in 2008; these costs were eventually paid, through higher premiums, by those who do buy insurance. Congress surely has the power to make people pay for what law and practice provide for them out of human decency. Since it is impossible to predict who will suffer a grave accident or fall victim to a terrible disease, and since almost no one without insurance can pay for adequate care if he does, the only effective means of making people bear the actual costs of their own treatment is to require them to buy insurance in advance, or pay a tax to help defray their costs.

Advertisement

These are effective replies to the single conservative argument: they distinguish health care and insurance from broccoli and electric cars, and so offer a “limiting principle” of the kind the conservative justices say they want. There is, however, a deeper, more comprehensive objection to their argument: no limiting principle is necessary or desirable. The conservatives’ argument conflates two questions that must be kept distinct. First, what power does any American legislature have to coerce people to buy what they do not want? Second, if any such coercive power exists, how is that power to be allocated between the state and national legislatures? Once we distinguish these questions, we see that the conservatives’ distinction between dictating the terms of insurance and making people buy insurance is pointless.

The rhetorical force of their examples, about making people buy electric cars or broccoli, depends on a very popular but confused assumption: that it would be tyrannical for any government to force its citizens to buy what they do not want. In fact both national and state governments steadily coerce people to do just that through taxation: they make them buy police and fire protection and pay for foreign wars whether they want these or not. There is no reason in political principle why government should not make people pay directly for its services through insurance rather than indirectly through the mechanics of taxation: direct payment would be no greater compromise of freedom. In fact Massachusetts does make people buy health insurance: that mandate is at the core of that state’s apparently successful health care program, on which the national act was partly based. Almost no one suggests that the Massachusetts mandate is unconstitutional.

So we may ask: Is there a constitutional limiting principle that would allow Massachusetts to impose that mandate but prevent it from requiring its residents to join health clubs? There are of course constitutional limits to any power of government. Neither the indirect mandate of taxation nor any more direct mandate may be discriminatory or irrational: it must not deny due process of law and it must serve some proper purpose of government. But are there any other special limiting principles that would prevent a state from making broccoli purchase compulsory in a rational and fair way?

No. We are protected from silly state mandates not because the Constitution rules them out but because politics does. No state legislature would dare to make broccoli purchase compulsory unless, for some hard-to-imagine reason, this was plainly the only way to avert some economic or other catastrophe. The role of democratic politics in protecting citizens against legislative corruption or stupidity does not depend on whether the legislature wants to require or forbid economic activity, however. Voters would be no less outraged by a state legislature’s decision to ban automobiles altogether than by its decision to make them buy electric cars.

If we do not need a limiting constitutional principle to stop a state from outrageous economic legislation, we do not need any such principle to stop the national Congress, within its proper sphere, either. The Court can allow Congress, as it allows Massachusetts, to mandate health insurance without finding a constitutional barrier to a national compulsory broccoli purchase. Politics supplies the appropriate check in both cases. So we must turn to the genuinely important question, the second question I distinguished. What is Congress’s proper sphere of control in health care matters?

The principle I described—the principle of state control over local matters—dictates the answer. It requires that Congress show that the commerce it seeks to regulate has a profound impact on the national economy. National regulation of health care easily passes that test.

3.

So neither the Constitution’s text nor underlying principle nor fear of compulsory broccoli makes any sense of the distinction on which the conservative justices may rely to destroy America’s first—probably its only practicable—universal health care provision. Do the Supreme Court’s past decisions nevertheless force it to strike the act down out of respect for precedent? No, on the contrary the precedents emphasize that the Constitution’s allocation between national and state power rests only on the subsidiarity principle I described earlier—giving Congress power to deal with national issues—and so they confirm that the conservatives’ distinction is irrelevant.

Two great chief justices set out that principle in these often-quoted remarks. In 1824, John Marshall, in Gibbons v. Ogden, said:

The genius and character of the whole government seem to be, that its action is to be applied to all the external concerns of the nation, and to those internal concerns which affect the States generally; but not to those which are completely within a particular State, which do not affect other States, and with which it is not necessary to interfere, for the purpose of executing some of the general powers of the government.

In 1937, in the Jones & Laughlin Steel case, Charles Evans Hughes said:

Although activities may be intrastate in character when separately considered, if they have such a close and substantial relation to interstate commerce that their control is essential or appropriate to protect that commerce from burdens and obstructions, Congress cannot be denied the power to exercise that control.

The precedent most directly in point is the Court’s 1942 decision in Wickard v. Filburn. The Agricultural Adjustment Act of 1938, which was designed to protect the market price of American wheat by limiting production, was applied to limit the wheat a farmer could grow on his own land for his own consumption. Justice Robert Jackson, for a unanimous Court, said that restricting what farmers could grow for their own use was a valid exercise of congressional power because it meant they would have to buy the wheat they needed in the market and so helped to sustain the price of that commodity. Jackson treated forcing large farmers to buy some of the wheat they need as an important part of the act: he drew no distinction between forcing them not to sell wheat and forcing them to buy it: if either had a significant impact on the national economy, it was a proper subject for congressional regulation.

By the end of the twentieth century it seemed that because local, national, and indeed international economies had become so densely interwoven, there was almost no limit to the regulatory power the subsidiarity principle gave Congress. But in 1995 and 2000, in two 5–4 decisions, conservative justices called a halt to the extension of national authority over local matters. In United States v. Lopez they denied Congress the power to forbid handguns in or near schools and in United States v. Morrison they denied it the power to provide civil remedies to battered women. Liberals deplored these decisions because they denied needed powers to the national government. But they could be defended, at least plausibly if not persuasively, as an application of the subsidiarity principle.

Kennedy wrote an instructive concurring opinion in Lopez; in view of his potential swing vote in this case, we must pay particular attention to that opinion. He endorsed a dynamic, shifting application of Congress’s power to regulate commerce. He spoke of “the Court’s definitive commitment to the practical conception of the commerce power” and he quoted this from an opinion of Justice Sandra Day O’Connor in an earlier decision:

[The federal-state balance] has been sufficiently flexible over the past two centuries to allow for enormous changes in the nature of government. The Federal Government undertakes activities today that would have been unimaginable to the Framers in two senses: first, because the Framers would not have conceived that any government would conduct such activities; and second, because the Framers would not have believed that the Federal Government, rather than the States, would assume such responsibilities. Yet the powers conferred upon the Federal Government by the Constitution were phrased in language broad enough to allow for the expansion of the Federal Government’s role.2

Kennedy said that nevertheless the subsidiarity principle, even so broadly understood, would not permit Congress to forbid guns in school. “The statute now before us,” he said, does not have, in either design or purpose, any “evident commercial nexus.” Furthermore, it “forecloses the States from experimenting and exercising their own judgment in an area to which States lay claim by right of history and expertise, and it does so by regulating an activity beyond the realm of commerce in the ordinary and usual sense of that term.” None of that applies to either health care or health insurance. These are both very much caught up in a national nexus of commerce and, particularly through such programs as Medicare and Medicaid, Congress has a much greater experience in those areas than any state does.

In these passages Kennedy emphasized two cardinal ideas. The first is that when Congress regulates commerce in a new way, the novelty of its mode of regulation is not in itself an objection to its power to regulate. Changing economic structures require changes in regulatory strategy. He cited the Wickard decision I just mentioned, in which the Court upheld Congress’s then novel limit on growing wheat not for commerce but for home consumption. It would therefore be surprising if he thought that the novelty of the act’s mandate requiring people to buy health insurance is in itself a ground for constitutional objection.

Second, he insisted on a “practical” test of the proper distinction between federal and state power. It does make sense to place what he called, in the oral argument of the present case, a “heavy burden of justification” on those who defend a new mode of regulation. But that burden must be understood to require them to show convincingly, not that the mode is not new, but that it is necessary to meet a truly national demand. Congress met that heavy burden by establishing, in its findings, that a national program of health care for everyone is desperately needed and that a mandate is essential to the program it designed.

4.

Even the act’s opponents concede that since the Constitution explicitly gives Congress the power to “lay and collect taxes,” it could establish a single-payer national health care system, like the British National Health Service, by imposing a special health care tax and providing medical care itself. Congress relied on the taxing power to make the Social Security program constitutional, for instance. Solicitor General Verrilli noticed the irony: the conservative justices questioned the constitutionality of the Affordable Care Act, which relies on private insurance and traditional private medical practice, while admitting that a program that gave the national government much more control over doctors and patients would survive any constitutional challenge. Of course, as the conservatives know, a single-payer system would be politically impossible in the United States now, or in the foreseeable future.

Verrilli made a further argument, however. He said that the act was already, even as adopted, a form of taxation and therefore should be held constitutional in virtue of the explicit taxing power even if not under the interstate commerce clause. The oral argument over this issue seemed largely about a question of language. The act describes what eligible people must pay if they fail to insure themselves as a “penalty,” which suggests a criminal regulation rather than a tax, and President Obama once denied that the act counted as a tax increase. On the other hand the prescribed penalty is to be calculated and paid as part of income tax, and it would be silly to think that those who are excused from the penalty, which include the very poor, are nevertheless criminals. It makes more sense to regard them as falling below a tax threshold.

In the oral argument Justice Kennedy set out the important substantive question behind the semantics:

I’m not sure which way it cuts, if the Congress has alternate means. Let’s assume that it could use the tax power to raise revenue and to just have a national health service, single payer. How does that factor into our analysis? In one sense, it can be argued that this is what the government is doing; it ought to be honest about the power that it’s using and use the correct power. On the other hand, it means that since…Congress can do it anyway, we give a certain amount of latitude. I’m not sure which way the argument goes.

Kennedy’s question comes to this: Is the proper balance between congressional and state power better secured by limiting what Congress can do or what it can say it is doing? Can the fate of an ambitious piece of legislation really turn on how many times the word “tax” appears in its text or on the accident of how many senators actually say, as several of them did in this case, that they were exercising the tax power rather than the commerce power? True, the American public is allergic to tax increases so that any such labeling might make some difference to a statute’s reception. But the act hardly lacked opponents who decried it as a tax increase and, in any case, it seems reasonable to ask people to judge a statute by asking what it actually does to or for them, not how politicians for and against label it. Our politics would be much improved if more citizens did exactly that.

The act could easily be recast, with no change of substance, to make it look more like what it really is: a more conservative example of using the tax power to achieve social justice, just as the Social Security Act does. It would then obviously be a valid exercise of the tax power. It seems worse than perverse to punish the nation for what its legislators happened not to say. So the act the conservative justices threaten to strike down is doubly constitutional: it is a legitimate exercise of Congress’s power both to regulate the nation’s commerce and to require its citizens to contribute to the cost of vital national programs.

5.

We cannot ignore the political dimensions of this case. The Republican Party and the candidates for its presidential nomination relentlessly denounce the act, perhaps largely because it was one of President Obama’s main domestic achievements during his first term. They hope that the conservative justices will declare the act unconstitutional; they think that will help them defeat the president in November. But the act is plainly constitutional and it will be shaming if, as so many commentators now expect, those justices do what Obama’s enemies hope they will.

Our recent history is marred by a number of very badly reasoned Supreme Court decisions that, deliberately or not, had a distinct partisan flavor: Citizens United, for example, which, most critics agree, has already had a profound and destructive impact on our democratic process. These decisions soiled the Supreme Court’s reputation and they harmed the nation. We must hope, though perhaps against the evidence, that the Court will not now add to that unfortunate list.

This Issue

May 10, 2012

The Master of Bigness

How to Follow Our Weird Politics

-

1

The Constitution also provides that Congress has the power to do what is “necessary and proper” to make its regulations under other powers effective. The act’s supporters insist that even if the mandate is not within Congress’s power to regulate interstate commerce, it is clearly a necessary and proper measure to give effect to the act’s other, plainly constitutional, provisions. ↩

-

2

New York v. United States, 505 US 144 (1992). ↩