1.

For a long time after World War II the middle-class American family, consisting of a working husband, a housewife, and their children, seemed to be moving on a steady, upward economic course. But in the early 1970s, at about the time of the OPEC embargo, family income leveled off. Partly to maintain their standard of living while inflation was high and earnings were stagnant, millions of married women went to work. In 1970, in 40 percent of families both husband and wife worked. By 1990, the percentage had increased to 60. Women began to marry later: 62.5 percent of women in their early twenties were already married in 1975, but only 38.5 percent in 1990. Birth rates fell. There were more divorces: for every 1,000 who were married in 1970 there were only 47 who were divorced, while in 1990 there were 152. Seventy percent of households in 1970 included a married couple; twenty years later the percentage had dropped to 56.

Recent government statistics tell us that this process may have run its course. The divorce rate seems to have peaked and to be modestly declining;1 economic productivity is rising slightly. Yet we are still reacting to the dramatic changes in American family life of the 1970s and 1980s. These changes were, of course, central to the 1992 presidential campaign: Dan Quayle’s attacks on single motherhood and Bill Clinton’s promises to provide working families with increased economic support while ending “welfare as we know it” are only two instances, and politicians lamenting the decline of the middle class—Pat Buchanan, Paul Tsongas, Ross Perot—did far better than had been expected. Clinton himself, albeit more cheerfully, also ran on the theme that something had gone wrong in the lives of middle-class Americans.

To set Clinton’s inaugural address next to John Kennedy’s, which it was plainly intended to echo, is instructive. The language in Kennedy’s speech is active, optimistic, forward-looking; words like “new” and “begin” occur frequently. Clinton’s address looks back: we must “renew,” be “reborn,” “reinvent,” “revitalize,” “rebuild,” and “rededicate” ourselves, the implication being that the best future imaginable would be one that repeats the past. Compared to Kennedy’s broad, outward-looking rhetoric (“Together let us explore the stars, conquer the deserts, eradicate disease, tap the ocean depths and encourage the arts and commerce”), Clinton’s is inward, his mission one of healing a sick nation: “We have drifted, and that drifting has eroded our resources, fractured our economy and shaken our confidence.”

Of course the middle class in America is well off by the standards of the rest of the world, and its economic condition, in spite of widespread reports of layoffs in white-collar jobs, the menacing federal deficit, bad schools, neighborhood violence, and the economic might of the Japanese, hasn’t deteriorated as drastically as that of the working class or the poor. Perhaps what makes the middle class seem so imperiled today is that the buoyant years between the end of World II and the 1970s are being used as a point of comparison. Isabel Sawhill and Mark Condon of the Urban Institute calculated last year that if economic productivity had grown as rapidly between 1973 and 1990 as it did from 1948 to 1973, the average family’s income today would be 35 percent higher than it is now.2 Many members of the middle class became middle class only a generation or two ago, thanks precisely to the post-World War II boom—in polls, only 37 percent of Americans identified themselves as middle class in 1952, and only 44 percent in 1964. Today more than 80 percent do. The newness of the status only makes the possibility of slipping back to the socio-economic status of one’s immigrant or Okie grandparents seem greater and more frightening.

Katherine Newman’s Declining Fortunes is largely a straightforward account of the anxiety of the middle class as it confronts its current domestic and economic uncertainty—and, perhaps more keenly, the pain of unmet expectations. Newman, a social anthropologist, spent two years interviewing people in a suburban town in New Jersey that she calls “Pleasanton” (Teaneck? Leonia? Englewood? Academic convention keeps her from using its real name.) The book aspires to the universality of Robert and Helen Lynd’s Middletown—Newman calls Pleasanton “a town the likes of which could be found in almost any state of the union”—but doesn’t attempt to provide an exhaustive catalog of the town’s social structure as the Lynds did. Instead Newman uses the material of her interviews to describe the different attitudes of two generations living there: the “children of the post—World War II economic boom” who “entered adulthood in an era of economic uncertainty, where news of shuttered factories, bankruptcies, junkbond nightmares, and white-collar unemployment is the stuff of daily headlines,” and “the generation that entered adulthood in the affluent years following World War II,” to whom “opportunity seemed limitless.”

Advertisement

The resolutely non-quantitative nature of her research, the location near New York City, and the emphasis on the differences between generations all contribute to a point of view whose broad outlines will be familiar to anyone who reads the weeklies or watches network news. (Some of the language will be familiar, too: Newman has a weakness for phrases like “the tumultuous era that has come to be known as the Sixties.”)

The World War II generation, in Newman’s view, had a lucky history. Substantially helped by government programs like the GI Bill, Veterans’ Administration loans, and the home mortgage interest deduction, many left the urban enclaves where they had grown up, married young, went to college, got white-collar jobs, and moved to the suburbs. They had large families, but they were doing so well economically that mothers were able to leave the work force and spend full time with their children.

The next generation, the “baby boomers” (a phrase Newman uses to grating excess), born during the late Forties and Fifties, grew up thinking that they would automatically inherit their parents’ prosperity. Instead, they were surprised to find economic conditions deteriorating as they came of age. As Newman puts it:

Four related phenomena typically crop up when they explain the erosion of their slice of the American dream: escalating housing prices, occupational insecurity, blocked mobility on the job, and the cost-of-living squeeze that has penalized the boomer generation, even when they have more education and better jobs than their parents.

The result is that the younger generation, and presumably the generations succeeding them, have “ever declining prospects of social mobility.” (In the literature of the generation now in their twenties, one hears the complaint that they are being relegated to dead-end jobs, while the generation just ahead of them are hanging onto the good ones.) Many members of the World War II generation had de facto tenure in white-collar jobs: now executives are being laid off even at the largest corporations. Among younger couples, both husband and wife work, and even then they can’t match the standard of living of their single-earner parents; some are finding that “children are a luxury that will be hard to afford.” According to a report by the National Commission on Children, which Newman cites, the cost of housing nationally went from 28 percent of the average family’s budget in 1970 to 44 percent in 1990. Many of the people who grew up in Pleasanton have found they can’t afford to live there as adults. Newman somewhat melodramatically writes:

The experience of downward mobility is terrifying. The economic experience of the late 1980s and early 1990s is a recipe for frustration, envy, fury, and a growing sense of helplessness. No amount of waiting,…no amount of hard work is going to make it possible for these young boomers to lay claim to their birthright.

Newman touches lightly on the larger issues underlying the situation she describes—mentioning, for example, the national debt and the quality of education and health care—but she doesn’t attempt to identify the causes of the baby boomers’ disaffection or propose ways to solve it. She assumes that the economic conditions of the 1950s are impossible to recapture, and that the best we can do is adjust, by reducing our expectations. “Sympathy is in order,” she says, for the disappointed generation—rather than admonitions against self-pity, as they often get from their parents. She would like us to adopt an ethic of “social responsibility,” as opposed to the pursuit of individual gain. This would mean more social spending (presumably on child-care allowances, unemployment insurance, and health insurance) to cushion the economy’s blows, as well as more mutual respect and understanding between those who are doing well and those who aren’t.

Declining Fortunes is commonsensical, sympathetic, and based on fieldwork at a time when most academic research on social mobility consists of computer-generated multiple-regression analyses of census and survey data. Having been in the field, Newman can pick up nuances that statistics wouldn’t have yielded, such as the tension between working and nonworking mothers and between highly educated professionals, who are doing relatively well, and the rest of the white-collar population, who aren’t.

But her method has serious short-comings. The main benefit of fieldwork is the richness of detail and sense of character it can yield, but since Newman disguises the identities of her subjects, they emerge only as talking heads. What they say is often interesting, but they are not individually memorable. On the other hand, dull as a statistical work on the same subject might be, it would have to answer precise questions that Newman doesn’t raise: Is her account peculiar to the Northeast, or typical of suburban conditions across the country (which, according to the 1990 census, is 47.5 percent suburban)? What is the real extent today of downward mobility among generations—that is, how many children have lower socio-economic status than their parents?

Advertisement

I suspect that most American suburbs, especially in newer cities like Houston, Dallas, Phoenix, and Atlanta, do not present nearly so gloomy a cast of mind as Pleasanton. Moreover, what sociologists call “circulation mobility” (some people moving up, others moving down) is not as dramatically new in this country as Newman makes it out to be. Tocqueville, for example, reported in the 1830s that

the families of the great landowners have almost mingled with the common mass…. Most of them have fallen into the most complete obscurity…. Wealth circulates [in the United States] with incredible rapidity, and experience shows that two successive generations seldom enjoy its favors.

Newman is right to say that during the period between the end of the Great Depression and the early 1970s, comparatively few families—especially among the descendants of the turn-of-the-century Great Immigration to New York City—suffered economic or social decline, but she doesn’t make it clear how much of a departure the contemporary situation she is describing is from the rest of American experience.

In Silent Depression, Wallace C. Peterson gives a clearer account of the same phenomenon that Newman writes about, but he does not bring it to life: he has done no fieldwork, and his personal examples all come from newspaper and magazine clippings. Peterson’s “silent depression” is the period since 1973, when productivity growth and average weekly wages leveled off, after their consistent rise since the end of World War II. From his energetic summary of the leading recent studies of income and wealth distribution and of economic mobility, he makes a convincing case that the middle class (which he defines as members of families with incomes between $25,000 and $75,000 a year) has shrunk during the past two decades, and that beginning in 1980, more people have fallen out of it than have risen into it. Most of his material is well known in the social sciences.3 His statistics for downward mobility come from the University of Michigan’s Panel Study on Income Dynamics, and they would support a narrow version of Newman’s assertions about the middle class.

But Peterson is more convinced than she is that the trend can be reversed. In fact Silent Depression is practically a letter to the Clinton Administration, praising it for its first economic plan and urging more action in the future. Peterson is an unreconstructed New Dealer, untroubled by the size of the federal deficit or the growth in entitlements (“the Social Security system is the crown jewel of the American welfare state, the most widely respected and supported program of the federal government”). He wants the administration to undertake a $100 billion a year program to build up the nation’s infrastructure, to be financed by cuts in the defense budget and the institution of a 27 percent flat income tax, with no deductions beyond a $15,000 personal exemption. Peterson supports more spending on education, but on the whole he’s a Keynesian and a public-works man who does not appear to share Robert Reich’s vision of a nation of college graduates who live by providing highlevel services to the world. He wants to pump up the economy and put lots of blue-collar people back to work at good wages—and re-create the situation that obtained in the Golden Fifties.

While Newman and Peterson are implicitly in agreement with most politicians and journalists about the state of the middle class, in The Way We Never Were Stephanie Coontz explicitly says that it is misleading to treat the conditions of the postwar boom period as normal, and that the American household of the Fifties was an aberration. But Coontz does not see the situation of middle-class Americans today as particularly worrying. Using such indices as age at first marriage, number of children per family, and percentage of married women in the work force, she finds that the middle-class family of the immediate postwar period was unlike anything before or since:

The family arrangements we sometimes mistakenly think of as traditional became standard for a majority of Americans, and a realistic goal for others, only in the postwar era.

You could substitute “economic” for “family” in that sentence and have an excellent argument to use against Katherine Newman and William Peterson.

The Way We Never Were is not based on original research but is essentially a review of the current literature on family life, refuting various popular “myths”: first the myth of the traditional American family, but also the myth of pioneer self-reliance, the myth of nineteenth-century limited government, and the myth that originally stable African American families have descended into a state of pathology. Coontz is very good at synthesizing dozens of probably unreadable journal articles into clear and coherent summaries. Her tone is so down-to-earth, so cheerily reasonable, that it isn’t initially apparent how strongly she is pressing her own myth of the family.

Intellectually Coontz is working along the revisionist line that descends from Philippe Ariès, who saw the basic social unit of husband-wife-children as a fairly recent and not especially successful invention. The “decline in the centrality of marriage and parenthood for adults,” Coontz writes, has been going on “for 150 years, with only a partial and temporary interruption during the 1950s.” On the other hand her real concern is not the nuclear family itself but the notion of the nuclear family as a bourgeois ideal, and this notion has been gaining strength for 150 years. Coontz insists that from Victorian times onward, only a privileged few, living on the fruits of their exploitation of the lower classes, have actually been able to live in “traditional” families—otherwise, apart from the period of the Fifties, self-enclosed families with working husbands and non-working wives prevailed more in theory than in practice.

The Fifties present conservatives with a usable past for family life. Coontz is looking for a usable past too, and she would probably find it in some pre-industrial time, when people lived in tight-knit communities in which extended families, local government, and such “intermediate structures” as churches and voluntary associations were far more important than they are today, and the nuclear family would presumably have been less important.

As amusing and tough-minded as Coontz is about attempts to mythologize the family (for example, she repeats a recent charge that the Little House books were rewritten by Laura Ingalls Wilder’s daughter, an opponent of the New Deal, in order to stress the self-reliance of the family4 ), she is herself an incorrigible romantic when it comes to alternative family structures. She repeatedly praises such people as members of “kinship-based foraging societies of the past,” sixteenthcentury Naskapi Indians, African American slaves, and Colonial Americans for their handling of social organization, which, in the latter case, “buckled under the weight of population growth and increasing economic stratification.” Coontz, in other words, is a pre-modernist at heart: she blames the Industrial Revolution for the privatization of the family and the increasing specialization of men and women within marriage (work: men; emotions: women). The legacy of this, she says, is that we put an unhealthy emphasis on lasting romantic love and on private life, and starve the public sector.

Coontz is so relativistic about family structures, and makes the nuclear family seem so ephemeral, that it comes as something of a surprise to put down The Way We Never Were and read in recent reports from the Census Bureau that nearly three quarters of American children are living with two parents5 Coontz says it is “difficult to make pat historical judgments about what kind of family is best for children,” but she seems to regard one kind of family, the kind with a pair of married parents and a non-working mother, as the worst, at least where the welfare of women and children is concerned. Incest, anorexia, wifebeating, and child abuse, she argues, are merely extreme manifestations of patriarchy. Indeed, “No identifiable pathology or unique value system separates the rapist from the respectable married man next door.” To judge from her acknowledgments Coontz is a single mother herself, and she brings to the subject of families a strong urge to refute the idea that “conditions I either cannot or will not create are essential to my child’s adjustment.”

The strength of her sympathies leads Coontz repeatedly to be drawn into chicken-and-egg disputes over where the fault for social maladies lies. Disorganization in ghettos is “not the cause but the result of long-term experience with defeat and brutalization”; the “individualist excesses attributed to” the Sixties “actually stemmed from the advertising industry.” She explains away people’s behavior by externalizing it: “government” or “industry” is the cause, as in “The private, autonomous family of mythical tradition was…largely a creation of judicial activism in the nineteenth century and state regulation in the twentieth century.” This makes people helpless victims, which is hard to reconcile with the American government’s nearly paralytic fear of departing from what it thinks people want.

Still, The Way We Never Were is important and useful in its insistence that thinking about the current state of American life shouldn’t revolve around the fantasy that the 1950s can somehow be recaptured. The economic conditions of the postwar quartercentury, when GNP rose by a reliable 4 or 5 percent every year instead of the current 2 or 3 percent, are probably gone forever. While it shouldn’t be surprising that nostalgia for the good old days has pervaded American politics psychologically for the last couple of years, it is surely necessary that we begin to adjust to the present state of things in some other way.

2.

Coontz’s mistrust of individualism (including the individualism of the family unit) is widely shared among social thinkers who are trying to figure out how the country should respond to a currently less dynamic, more uncertain, and troubled reality. The standard liberal-to-left view is that we should become more like Sweden or France: less materialistic, less ambitious, more committed to public and community life, and more generous with social services. To put it broadly, we’d be much better off as a society if we could drop the national preoccupation with dividing the country into fawned-over winners and reviled losers.

Robert Bellah and the other decent, high-minded authors of Habits of the Heart (1986) call in its successor volume, The Good Society, for shoring up American institutional life as a way of pulling ourselves back from the excessive individualism into which we’ve slipped. In the 1950s social critics like David Riesman and C. Wright Mills worried that institutions were becoming too powerful and individualism was threatened. Now the dominant concern is the opposite: that, to quote Bellah et al., “individual competitive success” and “unrestricted individual mobility” have become far too important to us. As an example of the way the founders’ concern with liberty has been misdirected, they cite with disapproval President Reagan’s maxim, “What I want to see above all is that this country remains a country where someone can always get rich.” (This is hardly new: “I know no other country,” Tocqueville wrote, “where love of money has such a grip on men’s hearts”; and, “Every American is eaten up with longing to rise.”)

Bellah and his colleagues don’t say precisely how institutional life could be restored, but, like Coontz, they tend to yearn for the simplicity of a village life in which people knew their neighbors and went to town meetings, where impersonality didn’t exist, and where at the family dinner table “children learned the terms of civil discourse.” But, inescapably, the location of such a society seems to be in the past, not the future:

Making the fire in the kitchen stove is no longer a daily ritual that involves all members of the family in a familiar routine of tasks: chopping the wood, carrying it in, lighting the fire, coming down to finish dressing in the only warmth the house is able to supply. Instead we turn up the thermostat and turn on the gas or electric kitchen range.

As I read through the many recent books reflecting on the state of the American soul, I began making a collection of such passages. Gilbert Brim, whose book Ambition6 calls on people to adjust themselves to “the right [i.e., a lower] level of challenge,” singles out for praise an unnamed tribe in Ethiopia:

They live at the edge of survival; they can be attacked at any time and have a constant fear of being ambushed. They essentially live on camel milk and goat milk and rarely eat meat. The women are beautiful; the men, skinny, hard, and wiry. They do not have the gloomy apprehensions of modern life.

Philip Slater’s A Dream Deferred (1991), which puts forth the grand theory that the human race is ending a 5,000-year era of “authoritarianism” and embracing “democracy,” holds up as models of the latter members of hunter-gatherer tribes:

Hunter-gatherer tribes are not warlike. Quarrels are more apt to result in separation than in battle, and no one would think of conquering anyone else, since no one owns anything and there are no fields for slaves to till. Hunter-gatherers live off the land—it would never occur to them to try to control or coerce it. They do not see themselves as separate from the rest of life. They take what nature offers, and don’t try to squeeze more out of it by planting or breeding.7

Such glorifications of the primitive and pre-modern may sound rugged and daring, but the truth is that they are, finally, genteel: they arise less from serious thought about what course American life ought to follow than from a squeamishness about, or an unwillingness to face, the reality that we now inescapably live in the midst of cars, television, and super-highways, and any notion of the good society will have to include them.

Daniel Yankelovich, the public opinion expert and social critic, delivered a paper at the Brookings Institution in Washington two years ago called “The Affluence Effect,”8 in which he outlined three steps in the country’s reaction to a time of prosperity. When a boom begins, “the majority of the public suspects that their new economic well-being won’t last”; in the US, he says, this phase lasted until the late 1960s. The next stage is an “abrupt and startling” psychological change in which people “leap from doubting their affluence years after it is a reality to assuming, with equal lack of realism, that it is a permanent fixture”—and “the quest for self-expression and self-fulfillment grows less inhibited.” This mood prevailed during the 1970s and 1980s. “The third stage is the fear of the loss of affluence and hence the loss of choice…a quick glance at the current mood of the United States as of 1991 shows Stage III at work.” The pervasive hunkered-down, soulful nostalgia of so many of these recent books would seem more a manifestation of Stage III than a real program for social changes.

3.

Dan Morgan’s Rising in the West, however, is an altogether different matter, a detailed work of reporting whose picture of American life is far more complex and convincing than these permutations of recent liberal thought. Morgan (with whom I worked in the late Seventies) has been a reporter at The Washington Post for thirty years. Driven by curiosity to find out what had become of the people John Steinbeck had written about in The Grapes of Wrath, he began this book in 1984. He started out in Sallisaw, “the eastern Oklahoma town where Steinbeck’s fictional Joads begin their journey,” where he observed land that was

rolling and wooded, hardly the “dust country” described in the novel. But I soon learned that hundreds of families from around Sallisaw had indeed gone out to California in the great Okie migration of the 1930s. They had not been “dusted out” or even “tractored out” by the arrival of labor-saving farm equipment. They had simply drifted out, a family or a community at a time, often thinking it would be just temporary because they were poor and desperate.

He found himself having to revise Steinbeck’s picture throughout his research, and in doing so has produced a rich social portrait of his own.

Morgan selected one family, the Tathams, as the center of his narrative:

The Tathams were not migrant “fruit tramps” who followed the crops year in, year out….Rather, they were more like the Joads and majority of those who left the Southern and Southwestern states during the hard times. Properly speaking, they were immigrants, with a good deal in common with the Europeans who flocked to the United States in the nineteenth and twentieth centuries. They wanted permanent jobs and homes, and California simply seemed like the best opportunity for getting them. When the same chance presented itself in the improving postwar economy of Oklahoma, a good many Tathams went right back home and stayed.

Oca Tatham, the patriarch of the family, son of “a restless drifter who moved from smelter to mine and back to the prairie,” left the remote hamlet of Drake’s Prairie, Oklahoma, in August 1934, and struck out for California. He bought a 1929 Chevrolet truck for $50 and organized a traveling party of sixteen friends and relatives. He was twenty-three years old. In the New Mexico desert, when the truck’s engine gave out and it rolled off the road into a ravine, the family literally hit rock bottom: they were penniless, and some of them were seriously hurt. Oca’s arm was badly broken. But somehow they got the truck moving again, and they arrived at last in Los Angeles. After driving out to the end of Santa Monica Boulevard and giving themselves a secular baptism in the Pacific Ocean, the Tathams headed for the fruit-and vegetable-growing country of the Central Valley and immediately found work as grape pickers on a ranch near Delano.

The Valley, as Morgan describes it, was in the Thirties a magnet for strong, unskilled immigrants: not only internal ones like the Okies, but also “Armenians, Swedes, Danes, Italians, Portuguese, ‘Volga River’ Germans, Russians, Croats, and Serbs,” who set up close networks of their own people. Like most Depression-era newcomers to the Valley, the Tathams lived through terrible hardship and poverty. Morgan describes Oca painfully picking grapes with his crippled arm; his wife, Ruby, working long hours in the fields in the ninth month of pregnancy; one of their children dying in infancy. But they were better off than they had been in Oklahoma. In California they could make as much as eight dollars a day (far above the average daily wage for farm laborers, which in 1937 was $2.80), and the farmland was so rich that they got a secondary income in free fruits and vegetables.

They were deeply religious. For generations the Tathams and most of the other Okies had belonged to Pentecostal denominations, poor folks’ sects that

followed the distinctive teaching that all Christians should seek a mystical religious experience after conversion, called Baptism in the Holy Spirit, and that the believer might then receive one or more of the supernatural powers known in the early church, including instantaneous purification from sin, the ability, as God’s intermediary, to cast out demons, discern evil spirits, sense the presence of disease in others, heal through the power of prayer, resuscitate the dead, and speak in tongues (glossolalia).

In the Valley the Tathams began attending an Assemblies of God church; although that is a Pentecostal denomination (the largest, in fact), it was far more restrained than the back-country Oklahoma churches they were used to. Oca was amazed, for example, to see the preacher order a woman speaking in tongues to sit down and listen to the service. Within a few years the family helped to found a new church, the Pentecostal Church of God, where they felt more comfortable. Theirs was a strict, fundamentalist faith with a set of strictures elaborate enough to dominate daily life: no drinking, smoking, dancing, going to the movies, gambling, dressing stylishly, or joining any political organization.

The Okies had their own churches, honky-tonks (for those who strayed from religion), and neighborhoods in the Valley, but the lives of the people in the Tathams’ circle were far from settled. Throughout Rising in the West they are constantly moving back and forth from Oklahoma to California; they get sick, lose their jobs, drift. In 1938 Oca’s father, Walter, who had moved to California with his wife in the family caravan, simply decamped. As the years passed,

Nearly every extended Okie family had stories to tell of the ruin and heartbreak wrought by alcohol, womanizing, divorce, and violence. Lonnie and Opal Rogers hadn’t coped at all. Herman Morgan…waged a lifelong battle against the booze and the women. He tried hard to steer to the straight and narrow path, but time and again he fell back over the edge. His remarriage to Clara… broke up again. The 1960s were a hard time for them. Norman, their son, wrestled with a drug problem, and Herman wouldn’t give up his trademark Camel cigarettes, despite his war wounds; he was in and out of VA hospitals with lung problems….

But Oca, a man of remarkable canniness and drive, got rich. A year after arriving in California, while picking cotton, he heard a rumor that somebody a few towns away was selling potatoes at a very low price. He quit his job on the spot, drove there, bought 800 pounds of potatoes for four dollars, returned to the cotton field with potato sacks strapped to his fenders, and resold the potatoes in small lots to the pickers. He branched out into buying, reconditioning, and reselling discarded kerosene stoves. Pretty soon he was a full-fledged junk dealer, with the shed behind his rented house full of scrap metal (and the second floor of his house full of boarders). He opened a used tire shop. He bought a small fleet of old trucks that he used to scavenge the Valley for anything cheap and resalable. When the war came he began trucking material around for military bases and defense industries, which got him a draft deferment and made him his first real money. For a time he moved the family to Washington state and trucked water for the installation that produced the plutonium for the atomic bomb. In 1943 he bought a dairy farm outside Fresno, but instead of farming he bought more land and subdivided it into building lots. Soon he was developing suburban real estate to meet the postwar demand.

Oca’s fortune came from his purchase, for $15,000 at a government auction, of an abandoned tuberculosis sanatorium that he converted to a nursing home. Dealing with cast-off human beings proved to be far more lucrative than selling cast-off appliances, because it gave him access to an uninterruptible stream of government funding. Oca’s son Bill, who seems to have inherited Oca’s business talent, wound up making many millions of dollars running a related business, a chain of convalescent hospitals (while losing a few million on two short-lived professional football teams).

The Tathams have remained deeply attached to Pentecostalism, which has grown from about two million members in the US twenty-five years ago to about ten million today. (There are more members of the Assemblies of God than Episcopalians in the US.) Oca’s eldest son, Dick, is a Pentecostal minister in Arizona. Oca himself underwrote the construction of a Pentecostal church in Mexico, and he moves in wider evangelical circles. Photographs in Rising in the West show Oca and Bill posing recently with Jerry Fal-well and Pat Robertson.

In 1964, thirty years after Oca and Ruby limped into California, the Fresno Bee devoted a three-column picture and a lengthy article to the wedding of their daughter Brenda, which was conducted “in keeping with a wedding tradition of European royalty.” Oca and Ruby were living in “a sprawling ranch house” in the city of Fresno. Bill had built a mansion on Fresno’s millionaires’ row and, as the years passed, became famous locally, and a powerful member of the national conservative political and religious movements.

At the end of The Grapes of Wrath, Steinbeck gives the Joads two options: to be ground beneath the wheels of capitalism or be provided with dignity and decency through the good offices of the federal government and organized labor. It is true that Oca, religious fundamentalist, political conservative, and passionate free enterpriser that he is, depended on government help at every step of his rise. Relief payments kept the Tathams from going hungry in the 1930s. Government water projects and crop-support payments created the Central Valley economy in which Oca did so well. Government auctions and government surplus were essential to his early business career as a free-lance trader. He profited during the war as a defense contractor. The nursing home business, too, is substantially subsidized by exactly the kind of government programs that Oca, an ardent supporter of Goldwater and Reagan, politically opposes. (These are not the only paradoxes that Morgan discovered. Although Oca is a teetotaler and a sexual Puritan, he briefly worked for a bootlegger, and when he married Ruby she was pregnant.) California, and indeed much of the West, with numerous military bases, defense contracts, federal land and water management, and agricultural subsidies, is the most government-dominated region in the United States, but the prevailing hostility to government is also very deep.

As I read his book, I marveled at how well Morgan conveys the texture of a part of the country that is rarely understood by many people who don’t live there. At one point he refers to the Tathams as part of “a vast non-Freudian America.” This seems exactly right. His book is a report from an unexplored world—at least by the national press. In this sense Rising in the West can also be read as a social portrait of the Sunbelt, which spreads from the new Virginia suburbs all the way across to the West Coast (Morgan calls Interstate 40, running from Raleigh, North Carolina, to Barstow, California, the Sunbelt’s “main street”). While Morgan concentrates on the Central Valley he also describes (in the course of a work that is perhaps over-long) other Sunbelt subcultures, such as the clique of millionaire sports fans who buy ball teams as a way of gaining status, in the way that East Coast millionaires support cultural projects; the half dozen “super-churches” of Orange County, California, which “routinely attracted five to ten thousand worshipers every Sunday morning” with their blend of religion and feel-good psychology; and the newly prosperous eastern Okla-homa, which has been transformed by “pork-barrel politics”—in particular, the government’s construction of a “seaport” in the town of Muskogee.

The most important of these subcultures is Pentecostalism, which Morgan sees as having served as “a stepping-stone into organized America” for the poor and uneducated. Among people to whom, as Morgan puts it, “life seldom ‘made sense,”‘ a religion that views life as chaotic and the human character as a battleground between good and evil has immense appeal. Yet while Pentecostalism now claims 500 million members worldwide, prosperity almost inevitably erodes people’s ties to it, even though by keeping them sober, faithful, and diligently working, Pentecostalism helped get them there. Today many of the younger Tathams prefer TV evangelists to the more rough-hewn Pentecostals.

Still, Oca Tatham himself has retained his Manichaean sense of the world—which helps to explain his militant adherence to anticommunism and the right-to-life movement. Morgan is very good at catching the nuances of religious attitudes that might seem to a less subtle observer to be merely hypocritical:

To those outside the fold, the adultery of Jim Bakker, the peccadilloes of [Jimmy] Swaggart, the financial difficulties of [Oral] Roberts, and [Pat] Robertson’s political self-destruction seemed bizarre and outlandish. But for those within the fold, it was part of a natural cycle in which God cut down to size those who had lost track of their place and their mission. Periodic public displays of the Devil knocking the powerful off their high horses were a kind of rite, an essential sacrament reminding all, once again, that Satan was Lord of the world—an enemy who could raise his flag in the very center of the earthly kingdom. Witnessing the fall of Swaggart was like having the Lord at one’s elbow saying quietly, “You see, you see.”

At the conclusion of Rising in the West Morgan finds the domestic problems facing the Okies not much different from those of secular Americans. Of the women in the third generation of California Tathams, Morgan writes:

By the summer of 1985 six of their eleven marriages were ending or had ended in divorce. And one unmarried granddaughter was about to have a child out of wedlock. No one in the family had experienced more sorrow with children than Pastor Dick Tatham and his wife, Grace. Donna’s marriage in 1975 had been the family’s first shock. She was several months pregnant, and to avoid “scandalizing” Dick’s congregation, the wedding took place at Renee’s in San Francisco. That marriage lasted nearly a decade. By the time Donna and her husband had split up, her twin younger sisters had divorced their husbands and a second marriage of one of the twins was coming apart. All the girls strayed from attendance at their father’s church.

But this can be seen as the side effect of cultural assimilation into the middle class. The means of this transition is mainly higher education. To Oca, the first-generation immigrant, college was irrelevant:

Oca Tatham was not a parent who dreamed of “my son the doctor.”…The acid test was how [his sons] handled money and what kind of businessmen they were….To Oca, a formal education was not seen as a particularly valuable asset. He was fond of reminding people that he had gone to “Knocks University” and that none of his children had earned a bachelor’s degree.

By the generation of his grandchildren, the Tathams, like so many others in the middle class after World War II, began using universities as personnel offices which now are directing them into lives very different from Oca’s:

Gina…had an accounting degree and was helping to manage a small Bay Area computer company….Her youngest sister, Lisa, who had a 4.0 grade point average at San Leandro High School, was doing research at Stanford. Her cousin Renee, an accounting major, had been on the dean’s list and a tennis star at Fresno State….Gerald and Cora’s daughter, Caprice, worked at the Bank of America….Patricia, the oldest of Dick and Grace’s six daughters, was getting a job driving a Federal Express truck hundreds of miles over the Arizona desert. Donna, now separated from her husband, had headed off to college in Eureka with her three children to study biology and water quality.

It would be a mistake, though, to assume that, as later generations of the Tathams move through higher education into the corporate and professional world, the family is going to lead the more settled and communitarian life that Robert Bellah and other liberal social critics see as an American ideal. Indeed, a different picture emerges from Morgan’s report, that of a churning, almost chaotic country in which nobody stays settled economically or geographically for very long. Perhaps this picture is merely true of the Okies Morgan describes, or of the Sunbelt, or of the members of the Pentecostal churches. But Morgan’s report nevertheless suggests that many of the notions we have about the current national mood shouldn’t be fully trusted. According to these notions, the American middle class is in an angry and volatile state as its postwar prosperity erodes, and the only alternative for the near future is resignation, and a recognition of limits. Yet the Tathams seem neither angry nor resigned: they just keep moving.

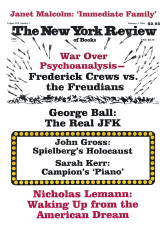

This Issue

February 3, 1994

-

1

Arthur J. Norton and Louisa F. Miller, “Marriage, Divorce, and Remarriage in the 1990’s,” US Bureau of the Census, 1992, p. 12. ↩

-

2

“Bidding War—or Growth?” The Washington Post, February 27, 1992, p. A19. ↩

-

3

Actually, the freshest and subtlest work I’ve read on the subject of family economics since 1973 is an unpublished paper called “Incomes and Inequality Since 1970” by Frank Levy, a professor at MIT and author of Dollars and Dreams: The Changing American Income Distribution (Russell Sage Foundation, 1987). Levy says the middle class has undergone a modest “hollowing out,” rather than a devastation, and he then teases out a more interesting story by looking at subgroups of the middle class. Middleclass women have been dramatically upwardly mobile; most middle-class families have stayed abreast because of the wife’s increasing earnings; and there is an “increasing association between education and earnings.” Therefore, “a large part of the story of the vanishing middle class jobs is a story about men who have not gone beyond high school.” ↩

-

4

Linda Kerber, “Women and Individualism in American History,” The Massachusetts Review (Winter 1989), see especially pp. 604–605. ↩

-

5

Bureau of the Census, Household and Family Characteristics: March 1991 (Current Population Reports, Series P-20, No. 458), p. 9. ↩

-

6

Basic Books, 1992. ↩

-

7

Beacon Press, 1991. ↩

-

8

August 25, 1991. The speech is being published as a chapter in Henry J. Aaron, Thomas E. Mann, and Timothy Taylor, editors, Values and Public Policy (Brookings Institute, 1994). ↩