Say what you like about Russia in the 1990s, at least it was never boring. Anything was possible, and, indeed, most things happened. Laws and institutions crumbled before an onrush of greed and desperation. As David Hoffman and Stephen Kotkin recount, the events of the period included hyperinflation, a financial boom, a catastrophic bust, the looting of national wealth through privatization, a civil war, the unseating of four prime ministers in eighteen months, a president at death’s door, and the shelling of a parliament.

It all got rather wearying toward the end, whether you were winning or losing. By the close of the decade even the winners were ready to call a truce, so they could have some relative peace in which to consolidate their gains. They welcomed Vladimir Putin to power and let him calm things down. The federal parliament, the regional governments, even the business tycoons accepted a new and more restrictive regime in which the Kremlin set the rules. Two tycoons who could not or would not adjust to the new order, Boris Berezovsky and Vladimir Gusinsky, were hounded out of the country.

For David Hoffman, the emergence of such tycoons at the start of the 1990s was one sign of a transformation sweeping Russia, when it became in many respects a new country and the ways to power and wealth were opened suddenly to new people. Stephen Kotkin places his emphasis differently. He believes the new Russia can best be understood by recognizing the extent to which its determining characteristics have been those inherited from the old Soviet Union—essentially, obsolete industry and thieving government. This calls for treating the period from 1970 to 2000 as “an integrated whole,” he says, during which the “death agony of an entire world comprising non-market economics and anti-liberal institutions” was played out.

These two approaches may be more complementary than contradictory. They both support the proposition that little changed for most people when Russia staggered free of the Soviet Union. Most remained the victims of a long-term national decline. But for a relatively few people, everything changed. If you had strong nerves, quick wits, and good connections, then bliss was it in that dawn to be alive.

1.

Hoffman tracks six Russians as they rise, through the perestroika and the Yeltsin years, toward the heights of financial and political power. One of them, it cannot be otherwise, is Boris Berezovsky, the most daring, extravagant, and outspoken of all the new Russian tycoons. “He is one of those people,” a Berezovsky associate accurately tells Hoffman, “who can exist calmly and comfortably only in extreme situations, in which not a single other person would feel comfortable.”

Berezovsky was a relatively obscure figure, even in Russia, until the middle of 1996, when he announced himself as leader of a team of tycoons backing Boris Yeltsin’s reelection campaign. Intoxicated by Yeltsin’s victory, the tycoons began publicly claiming state power as their reward.

They were called “oligarchs” first by their critics, but they adopted the name themselves even while professing to use it ironically. It was a successful move, suggesting a grandeur and lineage that, almost without exception, the tycoons otherwise lacked. Its lingering usage today still gives them an extra dose of zest and mystique, even though they have variously failed, fled, or become respectable.

Berezovsky’s genius for wheeling and dealing helped him to make his first fortune from selling cars, a second from oil, and a third—or so the Russian government alleges—from dipping into the cash flows of Aeroflot, the Russian airline, a charge that Berezovsky denies.1 With a Russian arrest warrant outstanding against him, Berezovsky now lives in London, where he denounces Putin’s government, most recently by sponsoring a film accusing the Russian secret services of complicity in the wave of terrorist bombings in Moscow in 1999 that helped bring Putin to power.

Nor could Hoffman easily have avoided taking Vladimir Gusinsky as another of his six. Gusinsky also made himself a highly visible public figure by building up a banking and media empire centered on NTV, the television station he created from nothing. He lost it all in 2001 in a battle with Putin, who visibly hated him to a point of obsession. He fled to Spain, where he managed to fight off a Russian extradition warrant, and he remains a leading shareholder in the Israeli newspaper Ma’ariv.

To these Hoffman adds two lower-profile oligarchs, one of whom failed as spectacularly as the other succeeded. The failure is Alexander Smolensky, whose bank, SBS-Agro, the second-biggest in the country, crashed in the financial crisis of 1998, taking depositors’ money (but not his own) with it. The success is Mikhail Khodorkovsky, whose bank, Menatep, also went under in the crash of 1998, but who managed to hang on to his oil company, Yukos, and who by virtue of his controlling stake in Yukos is probably the richest man in Russia today.2

Advertisement

Hoffman’s final two choices are politicians. One is Yuri Luzhkov, mayor of Moscow since 1992, who emerges here as a sympathetic but fairly lim-ited man. “Luzhkov is not Yeltsin. If he says he will do it, he will,” says one admirer, catching the essential difference between Luzhkov and not only Yeltsin but almost every other politician in Russia then and now.3

The last is Anatoly Chubais, the economist-turned-politician from St. Petersburg whose sweeping privatization program made the riches of the Russian state available for the oligarchs to grab, and who now runs the national power company, UES. Chubais is commonly criticized for having privatized Russian factories and natural resources too cheaply, too quickly, and only to a favored few. Those charges can be amply justified, as Chubais himself would be the first to agree. In defense he refers to the political conditions of the time, and the absence of available alternatives. As Chubais tells Hoffman:

Every enterprise ripped out of the state and transferred to the hands of a private owner was a way of destroying Communism in Russia. This is how we understood the situation…. And at that stage, it didn’t matter at all to whom these enterprises went, who was getting the property. It was absolutely unimportant whether that person was ready for it.

The more time that has passed, the stronger this defense has come to look. During the past three to four years Russian industry has become more profitable, thanks in part to a weaker ruble. Big companies are improving their quality of management; they are treating their shareholders and workers better, and they are reinvesting profits in their business. As Chubais said in another recent interview:

What we finally have is what we were thinking about then…. But it took much more effort, it brought much more pain, it cost far more than we had hoped.4

2.

From 1996 onward, when they had declared themselves and their ambitions, the oligarchs were much discussed in the Russian and Western press.5 Hoffman’s book takes in this later phase, but its originality and main value lie in its exploration of the early careers of his subjects, before their names were so widely known. Hoffman spent almost six years writing from Moscow for The Washington Post (where he is now foreign editor), and he interviewed more than two hundred people for this book. He has made many discoveries.6 And, knowing something of the difficulties of researching the recent past in Russia, I sympathize with his occasional dead ends.

His book may well be the most authoritative account we will ever get of the early days of the four true “oligarchs” among Hoffman’s subjects—Berezovsky, Gusinsky, Khodorkovsky, and Smolensky. The more time that passes, the more difficult it will get for anybody else to sift out further truths from the contemporary debris of conspiracy theories, propaganda wars, and double-bookkeeping left behind by the oligarchs themselves.

As Hoffman notes, the oligarchs owned and used the Russian media, including newspapers and television stations, making them unreliable sources. They and the Russian security services trafficked feverishly in kompromat, or compromising materials, mixing real and fake documentary evidence, whose purpose was to make scandalous claims that could never be authenticated. By lowering his standards of evidence, Hoffman could easily have written a racier book. It stands to his credit that he has resisted the temptation.

Instead, he acknowledges preemptively that

even the most aggressive research on my part often ended in disappointment. The reader will notice moments when the inexplicable happens—when a bank suddenly inherits a windfall, when a factory is given away for nothing, when a tiny company explodes from zero to $1 billion. What occurred at these critical junctures was often impossible to reconstruct, and it remains part of the mystery of the new Russia.

This rings true, and it is a generous admission for a writer to make about his own work. But if anything Hoffman is a touch hard on himself. He describes and analyzes so well the methods by which money and power were grabbed in the new Russia that the absence of a concrete detail here or there is rarely troubling.

In particular, Hoffman is unduly modest about his portrait of Khodorkovsky—one of the most elusive of the oligarchs in the 1990s, yet now the one most likely by far to count for something more in the future. His Yukos oil company is developing into what may well prove to be Russia’s first world-class, internationally diversified business group. Bankers and investors will have to read Hoffman’s account of Khodorkovsky’s formative years in business and decide for themselves whether they can quite feel at ease with him, even now. It will be a very difficult question to answer.

Advertisement

Hoffman writes that he talked with “dozens of people who worked with Khodorkovsky, but the kernel of his success was always elusive.” I am not sure there is much more to be found. Hoffman describes persuasively a young Khodorkovsky whose method was to study the political system, know its rules, adopt its camouflage, learn its weaknesses, and work it from the inside. Thus he continued with a part-time law course even when his business was already flourishing, “telling friends that it was necessary to be able to understand and exploit decrees issued by government.” He told an early interviewer: “It is possible to find loopholes in every law, and I will use them without an instant of hesitation.”

Which he did. His first object of study, in the perestroika years, was Soviet-era currency laws and regulations. These segregated the budget funds of state companies and institutions (notional money which existed only on paper, as bank balances and transfers) from cash rubles, and both from foreign currency. Khodorkovsky’s aim was to find ways of turning non-cash budget funds, with limited use and value, into cash that he and his partners in a transaction could spend however they wanted.

As a student, Khodorkovsky found his first loophole in a special privilege allowing organizations of the Young Communist League, to which he belonged, to mix budget funds and cash. He found a second loophole in a law allowing “temporary creative collectives” to offer their services to state companies and institutions, and to be paid in cash converted from those enterprises’ budget funds. By his own recollection, he was soon conducting “up to five hundred contracts for scientific research simultaneously,” employing up to five thousand people, all of them turning non-cash from the government into cash for Khodorkovsky.

In 1988 Khodorkovsky formed his own “bank,” Bank Menatep, which opened up new possibilities. Much as the celebrated bank robber Willie Sutton explained that he robbed banks “because that’s where the money is,” Menatep and other Russian banks immediately sought out deposits of government funds: in those days, the state budget was where the money was.

To say Russian banks robbed the government would be technically incorrect, since most of the time what they did broke no law. You would “have a banya [Russian sauna] session with your buddy at the Finance Ministry and they would put in $600 million,” one Menatep executive explained to Hoffman. Until the finance ministry asked for its money back a few months later, you parked it in dollars or high-yielding ruble bonds, collected the exchange-rate gain or the interest, and watched inflation erode the ruble value of the principal you owed. There was no law against that. There was a law against the bribes you paid your buddy and his boss, but what was the government going to do: lock up the whole civil service?

Hoffman records the commonly held suspicion that when Khodorkovsky formed Menatep, or even before, he got some seed capital from the Communist Party or KGB. Nobody has documented that suspicion. But it has probably come to matter relatively little now, unless one thinks Khodorkovsky still to be secretly in hock to those first financiers, which is unlikely. As Hoffman himself puts it, Khodorkovsky was

more ambitious and ruthless than the Communist Party apparatchiks who wanted to dabble in capitalism, and he was more clever than the KGB bosses in a position to help him. They never went as far as he did in the new world.

And, to bring the story up to date, nobody else in Russia has gone as far as Khodorkovsky, even now. His oil company, Yukos, acquired for peanuts in the infamous “loans for shares” deals of many public companies of 1995–1996, is valued on the Russian stock market at about $15 billion, the highest figure for any Russian company.7 It will be worth far more if Khodorkovsky can persuade international investors that Yukos is as reliable an investment and as well managed a company as the best of its foreign competitors.

The trouble here is that Yukos has enough skeletons in its closets to fill a country graveyard, many dating back to Russia’s financial crisis of 1998. When the markets and the ruble crashed, a government-imposed moratorium on payments caused Russian banks—including Khodorkovsky’s Menatep—to default on foreign obligations. But three of Menatep’s creditor banks presented Khodorkovsky with a particular problem. They held 30 percent of the stock of Yukos, Khodorkovsky’s oil company, as security for their loans.

At the same time, tensions were rising between Khodorkovsky and a US private investor, Kenneth Dart, who had bought stock in some of the subsidiary companies through which the Yukos holding company owned and controlled its oilfields. Dart felt Kho-dorkovsky was abusing his controlling position to siphon value out of these subsidiary companies by transferring their oil and title to their oilfields cheaply to other companies under his control.

The 1998 crash was a disaster for Khodorkovsky in one sense: the paper value of his assets plunged. But it also gave him a new set of opportunities and incentives. In the immediate aftermath of the crash there was, he felt, no point in behaving well toward bankers or outside investors already burned so badly as to be writing off Russia for years to come. With so little to lose, Khodorkovsky could risk “a scorched earth approach” (Hoffman’s phrase) to his creditors and his minority shareholders—shaking them off and reclaiming ownership of all, or at least most, of Yukos.

To squeeze out Dart and to frighten the banks, Khodorkovsky proposed issuing millions of new shares in the subsidiary companies. These would be sold to a maze of offshore companies of undisclosed ownership, but doubtless controlled by Khodorkovsky himself, with payment being made in IOU notes. The effect would be to dilute the value of the shares held by Dart on the one hand, and on the other to shift ultimate control of the oilfields away from the Yukos holding company, so that if the banks foreclosed on their Yukos shares, they would find themselves taking possession of a “shell.”

This was hardball corporate finance even by the demanding standards of post-crash Russia. One Moscow brokerage office wrote about it in a research note called “How to Steal an Oil Company.” And Khodorkovsky won. Dart sold out, on undisclosed terms. The banks settled for less than half the value of their loans. Whatever else he had lost, Khodorkovsky came out of the crash with undisputed personal control of the second-biggest oil company in the second-biggest oil producing country in the world.

Even this turn of events paled beside what came next. Khodorkovsky decided to reinvent himself, and Yukos as well, as model corporate citizens. Yukos began hiring public relations and investor relations managers. It began consolidating the myriad producing and trading and intermediate companies, onshore and offshore, into a comprehensible and reasonably transparent corporate structure. It produced accounts that met international standards. It endowed social and educational projects. Khodorkovsky himself shaved off his moustache, which did wonders for his looks, and became a tireless public speaker. He argued that he, as main proprietor, had the biggest interest of anybody in improving Yukos’s finances and its reputation, thereby raising its market value. Whatever he had done in the past, he argued, in effect, he could be trusted to play straight in the future.

Since Khodorkovsky changed his spots, the value of Yukos has risen tenfold in two years. It is probably the most praised and respected company in Russia (which is, to be fair, not saying all that much). Its shares are traded in the US and in Europe. To the extent that investors have their doubts, it is not so much about Yukos as a company as about Russia as a country and the risks of doing any sort of business there. So long as contracts and property rights remain difficult to enforce, because legislation is riddled with loopholes, and because courts and police are easily bought, Russian companies will always be valued well below their Western equivalents.

That, in turn, helps to explain the greatest change of all among the oligarchs since this period covered by Hoffman. Where once they were undermining the Russian state, now they have become—in principle, if not always in practice—supporters of stronger, law-based government. They got their property by questionable means; now they want their ownership of it protected. Of course it flies in the face of all natural justice that they should be in that happy position. A dozen people grabbed the wealth of a country, while nearly 150 million others got nothing. But Hoffman goes a long way toward explaining why, at any rate, it was these people and not others who positioned themselves to do the grabbing.

3.

Hoffman traces his story mainly from the oligarchs’ side. The other side of the story lies with the failings of the Russian state, which allowed and even encouraged the oligarchs to act. Why the state failed, and how, is one theme of Stephen Kotkin’s concise and persuasive book Armageddon Averted.

Kotkin sees the problems of the new Russia as being a continuation of, and in some ways a concentration of, the problems of the Soviet Union. One could trace the origin of those problems back much further still, given the striking consistency with which Russia has been misgoverned down the centuries, but Kotkin does make a strong case for taking the early 1970s as a watershed. That was when Soviet and Western industry were pushed in fatally different directions by rising oil prices. The high cost of energy forced Western industry to grow more efficient, but in the Soviet Union high oil revenues were used to subsidize inefficient plants. The need to make Soviet industry more efficient only became compelling when oil prices fell in the mid- to late 1980s, leading to the attempts at economic reform which, combined with generational change in the Soviet leadership, led quickly if not inevitably to the whole system’s collapse.

The mystery, for Kotkin, is not so much why the Soviet Union collapsed as why it did so with so little collateral damage. There were, as he notes, many local conflicts, some of them violent and ferocious—in Azerbaijan, in Georgia, in Lithuania and Latvia, in Chechnya. But there was not the “all-consuming conflagration” which he thinks might easily have followed from conflict, malice, or sheer accident. His explanation is that the tensions and the frustrations of the Soviet Union were largely absorbed by Russia. As he nicely puts it, Russia “inherited everything that had caused the Soviet collapse, as well as the collapse itself.”

Kotkin’s insistence on the Soviet legacy and its determining role in post- Soviet Russia allows him to cut briskly through the still-heated arguments about the failure of economic reforms during the Yeltsin era and the role of Western advisers. In fact, he argues:

The underlying cause of Russia’s difficulties was not policy. Rather, the fundamental factor was the Soviet bequeathal, one side of which was a socio-economic landscape dominated by white elephants…. The other side, remarkably, was even more ruinous: unfettered state officials whose larceny helped cashier the Soviet system.

Given those conditions, “carrying out comprehensive economic ‘reform’ was an illusion. And therefore Western advice, whether misguided or sensible, was largely inconsequential.”

He sees the new Russian state as facing the same sort of difficulty, in attempting reform, that undid Gorbachev in the previous decade. The problem for Gorbachev was that “somehow the Communist Party was supposed to be both the instrument and the object of perestroika.” In Yeltsin’s Russia, the question was how “the incoherent…state [was] going to solve the country’s problems, when the state was the main problem.”

Yeltsin never really tried to answer the question—partly because he was an incoherent thinker and politician himself, and partly because an “incoherent state” was an inevitable consequence of a privatization policy that he broadly if ignorantly supported. That policy pursued the destruction of the old Soviet economic order as a precondition for the construction of a new Russian one, which was painfully slow to emerge. Kotkin has a powerful summary of this failure:

Privatization in Russia was supposed to create a dynamic society and reduce the inordinate number and power of state officials. But it was precisely the members of Russia’s arbitrary, unencumbered executive branch, at all levels, who assumed responsibility for history’s most extensive privatization (which as of 2001 still had a considerable way to go), and over other key economic nodal points. Far from being snapped, the nexus between holding executive office and exercising control over property and resources was in some ways fortified. This circumstance enabled the executive power to eclipse legislatures, despite the latter’s formal budgetary responsibilities, and it reduced Russian politics to a scrum to acquire and benefit from executive office, irrespective of ideological tilting. As individuals elected or appointed to positions of state authority pursued private gain to a greater degree, the commitment to the public good that had existed in the Soviet Union—for health care, education, children’s summer camps—eroded much more deeply, demoralizing rather than empowering society.

Only now, under Putin, is the Russian state trying to reform itself. That possibility has arisen because Putin enjoys a real power base outside the state machinery, in the form of his overwhelming popularity with the Russian public, and he can pit that authority against the opposition of his ministers, bureaucrats, and generals.

But quick results are out of the question. To make basic improvements in the way the Russian state works, and to raise living standards to the lowest Western levels, will take decades, not years. Putin has suggested trying to match the current prosperity of Portugal—which may sound a modest objective, but Russia would need eighteen years to get there, even at last year’s relatively robust 5 percent growth rate.

Kotkin characterizes the Russia he sees in 2001, at his time of writing, as a “stable mess.” But that was before September 11, and before the outward transformation in Russian foreign policy toward a much more pro-Western position. Thus he describes Putin as “harbouring no illusions about ‘partnership’ with the US.” He sees Russia lying “outside processes of world integration,” and with “no prospect” of joining any of the three main blocks of countries—which he defines as NAFTA, the Pacific Rim/US–Japan alliance, and the European Union/ NATO.

These judgments have to be revised in the light of new information about Putin’s intentions, and the evident US desire for Russian support for its policies in Central Asia, the Middle East, and the Balkans. Russia now openly hopes for a “partnership” with the US, whether or not that hope proves illusory. And close relations with NATO seem almost inevitable: the question now is not so much whether Russia should join NATO in its present form, but how NATO can evolve in order to best accommodate Russia.

As to Putin’s overriding aim, it is not clear, to me at least, whether he wants to integrate Russia with the West in ways that will require Russia to become more and more like the West; or whether he wants to see how close a relationship he can develop with the West while maintaining what Grigory Yavlinsky, a leading liberal politician, calls a “managed democracy” within Russia. By “managed democracy” Mr. Yavlinsky means a regime where people vote for president and parliament, but where all political institutions save the presidency are void of real power, national television is under state control, other critical media are harassed, and the legal system bends itself to the Kremlin’s wishes.

The optimistic view would be that, whether Mr. Putin likes it or not, Russia is reappraising its relations with the West in ways that can only encourage liberal trends in society, however weak they may be, as well as increasing the incentives and opportunities for market reform. There is something to be said for this hope. Perhaps Mr. Kotkin would allow a slight upgrade in Russia’s rating for 2002. I would suggest: “a slowly improving mess.”

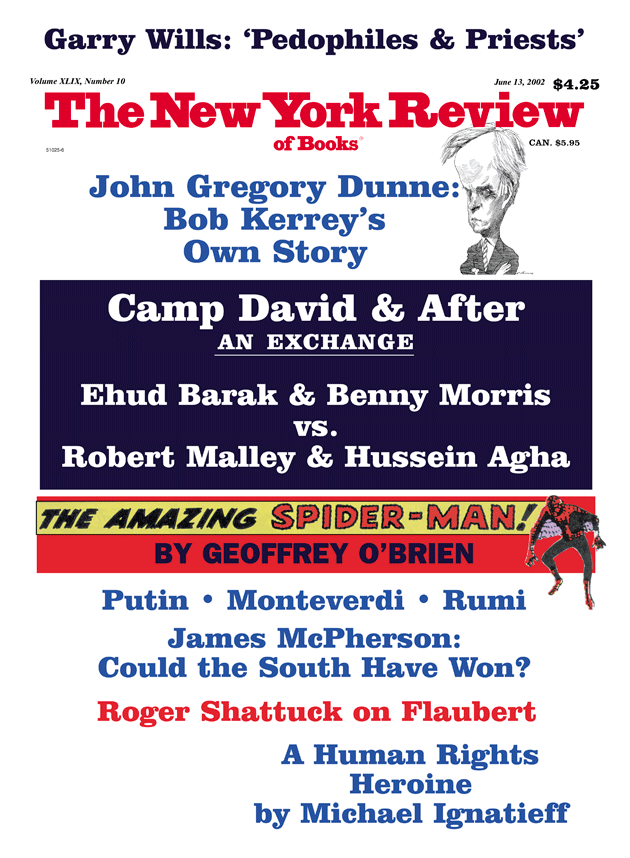

This Issue

June 13, 2002

-

1

The fullest account of Berezovsky’s business career remains Paul Klebnikov’s book, Godfather of the Kremlin: Boris Berezovsky and the Looting of Russia (Harcourt, 2000), reviewed in these pages on October 19, 2000. ↩

-

2

In its issue of March 18, 2002, Forbes magazine ranked Khodorkovsky 101st by wealth in a list of the world’s billionaires. It estimated his fortune at $3.7 billion. ↩

-

3

The speaker is a priest commenting on Luzhkov’s promise to reconstruct Moscow’s Cathedral of Christ the Savior, destroyed by Stalin in 1931. The cathedral was indeed completed in 1997, a monument both to its dedicatee and to Luzhkov’s system of “persuading” firms doing business in Moscow to donate generously to his pet projects. Smolensky, for example, gave fifty-three kilos of gold for gilding the domes. One wonders whether he knew that only twenty kilos were actually used, or so Hoffman reports, because the patriarch of the Russian Orthodox Church approved a new and cheaper method of gilding. ↩

-

4

Financial Times, February 16, 2002. ↩

-

5

Besides Berezovsky, Gusinsky, Khodorkovsky, and Smolensky, the inner circle of “oligarchs” included Vladimir Potanin, boss of Uneximbank, and Mikhail Friedman, boss of the Alfa banking and investment group. ↩

-

6

Including some amusing trivia. I did not know that Smolensky spent eight years studying Hindi, for example. Or that Gusinsky made his first fortune in copper bracelets. ↩

-

7

The “loans for shares” deals were so called because the oligarchs lent the government relatively small sums of money secured on state property worth many times as much, then were allowed to foreclose on the property when the government failed to repay the loans. This scheme, devised by Vladimir Potanin and blessed by Chubais, was used to win the oligarchs’ support for Yeltsin in the 1996 presidential election. ↩