Suppose we describe the following situation: major US financial institutions have badly overreached. They created and sold new financial instruments without understanding the risk. They poured money into dubious loans in pursuit of short-term profits, dismissing clear warnings that the borrowers might not be able to repay those loans. When things went bad, they turned to the government for help, relying on emergency aid and federal guarantees—thereby putting large amounts of taxpayer money at risk—in order to get by. And then, once the crisis was past, they went right back to denouncing big government, and resumed the very practices that created the crisis.

What year are we talking about?

We could, of course, be talking about 2008–2009, when Citigroup, Bank of America, and other institutions teetered on the brink of collapse, and were saved only by huge infusions of taxpayer cash. The bankers have repaid that support by declaring piously that it’s time to stop “banker-bashing,” and complaining that President Obama’s (very) occasional mentions of Wall Street’s role in the crisis are hurting their feelings.

But we could also be talking about 1991, when the consequences of vast, loan-financed overbuilding of commercial real estate in the 1980s came home to roost, helping to cause the collapse of the junk-bond market and putting many banks—Citibank, in particular—at risk. Only the fact that bank deposits were federally insured averted a major crisis. Or we could be talking about 1982–1983, when reckless lending to Latin America ended in a severe debt crisis that put major banks such as, well, Citibank at risk, and only huge official lending to Mexico, Brazil, and other debtors held an even deeper crisis at bay. Or we could be talking about the near crisis caused by the bankruptcy of Penn Central in 1970, which put its lead banker, First National City—later renamed Citibank—on the edge; only emergency lending from the Federal Reserve averted disaster.

You get the picture. The great financial crisis of 2008–2009, whose consequences still blight our economy, is sometimes portrayed as a “black swan” or a “100-year flood”—that is, as an extraordinary event that nobody could have predicted. But it was, in fact, just the most recent installment in a recurrent pattern of financial overreach, taxpayer bailout, and subsequent Wall Street ingratitude. And all indications are that the pattern is set to continue.

Jeff Madrick’s Age of Greed: The Triumph of Finance and the Decline of America, 1970 to the Present is an attempt to chronicle the emergence and persistence of this pattern. It’s not an analytical work, which, as we’ll explain later, sometimes makes the book frustrating reading. Instead, it’s a series of vignettes—and these vignettes are both fascinating and, taken as a group, deeply disturbing. For they suggest not just that we’re seeing a repeating cycle, but that the busts keep getting bigger. And since it seems that nothing was learned from the 2008 crisis, you have to wonder just how bad the next one will be.

The first thing you need to know about the cycle of financial overreach, crisis, and bailout is that it was not always thus. The United States emerged from the Great Depression with a tightly regulated financial sector, and for about forty years those regulations were enough to keep banking both safe and boring. And for a while—with memories of the bank failures of the 1930s still fresh—most people liked it that way. Over the course of the 1970s and 1980s, however, both the political consensus in favor of boring banking and the structure of regulations that kept banking safe unraveled. The first half of Age of Greed describes how this happened through a series of personal profiles.

To some extent Madrick covers familiar ground here. He recounts the economic turmoil of the 1970s, as the country was caught in the grip of stagflation. And as he points out, Nixon and Ford—like today’s Republicans—blamed the economy’s troubles not on the true culprits but on big government. Madrick stresses a key point that is often forgotten or misunderstood to this day: the surging inflation of the 1970s had its roots not in some general problem of “big government” but in largely temporary events—the oil price shock and disappointing crop yields—whose effects were magnified throughout the economy by wage-price indexation. Yet constant policy shifts by the Treasury and the Federal Reserve (remember wage-price controls?) under Nixon, Ford, and Carter, Madrick argues, made the American public lose faith in government effectiveness, creating within it a ready acceptance of the antigovernment messages of Milton Friedman and Ronald Reagan.

Advertisement

While we believe that there were deeper reasons for Reagan’s rise, Madrick is right that the economic malaise of the 1970s gave Reagan his big opening. As Madrick describes, Reagan’s enormous capacity for doublethink and convenient untruths enabled him, the front man for business interests, to convince a credulous public that “government had become the principal obstacle to their personal fulfillment.” In possibly the best chapter of the book, Madrick recounts the irony of how Reagan, the great moralizer, made unchecked greed and runaway individualism not only acceptable, but lauded, in the American psyche.

Madrick also does an especially persuasive job of demythologizing Milton Friedman, who provided intellectual heft for the antigovernment movement. As Madrick points out, although Friedman offered some important economic insights, he often shoehorned real-life data to fit into a one-sided narrative, gaining his theories wider acceptance than was ultimately justified. And Friedman, like Reagan, preferred “overly simple assertions of free market claims,” discarding the caveats.

In Friedman’s worldview, free markets were the solution to practically every problem—health care, product safety, bank regulation, financial speculation, and so on. And Friedman squarely blamed government for the Great Depression, a view that is at odds with the data. (Although it is almost certainly true that mistakes by the Fed made the situation worse.) As Madrick quotes him, “The Great Depression, like most other periods of severe unemployment, was produced by government management rather than by inherent instability of the private economy.” Replace “Great Depression” with “the financial crisis and its aftermath,” and it could be John Boehner today, rather than Friedman in 1962, speaking these words. Like Reagan, Friedman proclaimed a creed of greedism (our term)—that unchecked self-interest furthers the common good.

While 1970s inflation undermined confidence in government economic management and catapulted Friedman to fame, it also undermined the New Deal constraints on financial institutions by making it impossible to maintain limits on interest rates on customer deposits. To tell this part of the story, Madrick turns to an often-neglected figure: Walter Wriston, who ran First National City/Citibank from the 1960s into the 1980s. These days Wriston is best known among economists for his famous quote dismissing sovereign risk: “Countries don’t go out of business.”

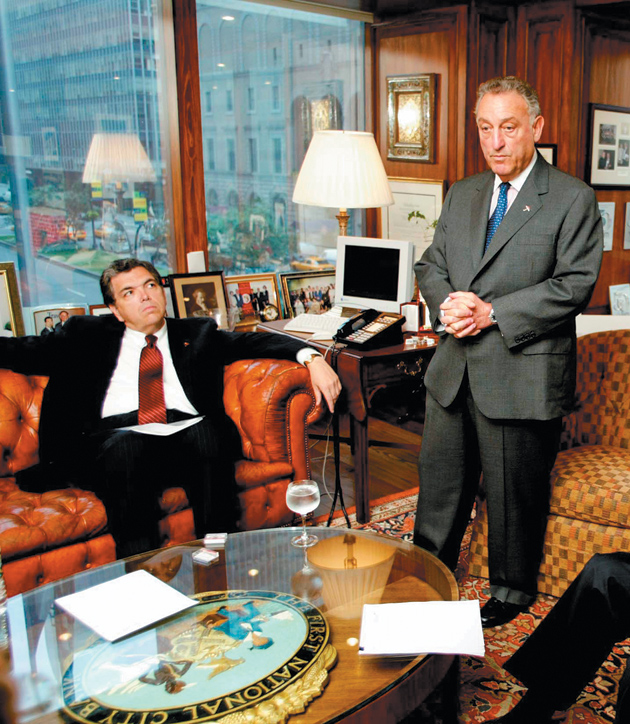

But as Madrick documents, there was much more to Wriston’s career than his misjudgment of the risks involved in lending to national governments. More than anyone else, he epitomized the transformation of banking from cautious supporter of industry to freewheeling independent profit center, creator of crises, and recurrent recipient of taxpayer bailouts. As Madrick deftly points out, “Wriston lived a free market charade,” strongly opposing the federal bailouts of Chrysler (1978) and Continental Illinois (1984) while his own back was saved multiple times by government intervention.

The transformation of American banking initiated by Wriston arguably began as early as 1961, when First National City began offering negotiable certificates of deposit—CDs that could be cashed in early, and therefore served as an alternative to regular bank deposits, while sidestepping legal limits on interest rates. First National City’s innovation—and the decision of regulators to let it stand—marked the first major crack in the system of bank regulation created in the 1930s, and hence arguably the first step on the road to the crisis of 2008.

Wriston entered the history books again through his prominent part in creating the late-1970s boom in lending to Latin American governments, a boom that strongly prefigured the subprime boom a generation later. Thus Wriston’s dismissal of the risks involved in lending to governments would be echoed in the 2000s by assertions, like those of Alan Greenspan, that a “national severe price distortion”—i.e., a housing bubble that would burst—“seems most unlikely.” Bankers failed to consider the possibility that all of the debtor nations would experience simultaneous problems—Madrick quotes the head of J.P. Morgan saying: “We had set limits, long and short, on each country. We didn’t look at the whole.” And in so doing they prefigured the utter misjudgment of risks on mortgage-backed securities, which were considered safe because it was deemed unlikely that many mortgages would go bad at the same time.

When the loans to Latin American governments went bad, Citi and other banks were rescued via a program that was billed as aid to troubled debtor nations but was in fact largely aimed at helping US and European banks. In that sense the program for Latin America in the 1980s bore a strong family resemblance to what is happening to Europe’s peripheral economies now. Large official loans were provided to debtor nations, not to help them recover economically, but to help them repay their private-sector creditors. In effect, it looked like a country bailout, but it was really an indirect bank bailout. And the banks did indeed weather the storm. But the loans came with a price, namely harsh austerity programs imposed on debtor nations—and in Latin America, the price of this austerity was a lost decade of falling incomes and minimal growth.

Advertisement

This was, then, an enormous bank-led crisis—soon followed by the savings and loan crisis, which Madrick treats only briefly, but which had a higher direct cost to taxpayers than even the current crisis. And the response of the political system to these crises was… to shower more favors on the financial industry, dismantling what was left of Depression-era regulation.

The second part of Madrick’s book surveys the wide-open, anything goes financial world that deregulation created. This was an era marked by two huge bubbles—the technology bubble of the 1990s and the housing bubble of the Bush years—both of which ended in grief, although the economic damage inflicted by the second bubble’s bursting was vastly greater.

Again, Madrick’s exposition takes the form of a series of personal vignettes. As in the first part of the book, some of these cover familiar ground. We learn about the career of Alan Greenspan and how he used his reputation as an economic guru—a reputation that in retrospect was entirely undeserved—to push his antigovernment, antiregulation ideology. We meet some of the architects of the 2008 crisis: Angelo Mozilo of Countrywide Financial Services, Jimmy Cayne of Bear Stearns, Dick Fuld of Lehman, Stan O’Neal of Merrill Lynch, and Chuck Prince of Citigroup (created by the merger of Travelers Insurance with—yet again—Citibank). Mozilo was the leading peddler of subprime and other risky mortgages, loans made to people who shouldn’t have been getting loans. The others were all involved in the process of slicing, dicing, and recombining these loans into supposedly safe financial instruments, AAA-rated investments that suddenly turned into waste paper when the housing bubble burst.

However, the real star is a figure who, if not exactly neglected, isn’t at the center of most crisis narratives: Sanford I.—Sandy—Weill. Weill’s personal rise paralleled the transformation of finance, as the genteel figures of the era of regulated, boring banking were replaced by aggressive outsiders. During the 1960s, old-school Wall Streeters mockingly referred to Weill’s brokerage—Cogan, Berlind, Weill & Levitt—as Corned Beef with Lettuce. By 2000, however, the old Wall Street was gone, and the former outsiders were in charge. Weill, in particular, had masterminded the merger of Citibank and Travelers, and after a power struggle emerged as the new Citigroup’s CEO.

What was truly remarkable about that merger is that when Weill proposed it, it was clearly illegal. Salomon Smith Barney, a Travelers subsidiary, was engaged in investment banking, that is, putting together financial deals. And New Deal–era legislation—the Glass-Steagall Act—prohibited such activities on the part of commercial banks (deposit-taking institutions) like Citibank. But Weill believed that he could get the law changed to retroactively approve the merger, and he was right.

Almost immediately, the new financial behemoth was wrapped in scandal. Nowadays it’s common to treat the technology bubble of the 1990s and the housing bubble of the decade following as having been very different stories. And in financial terms they were quite different: the tech bubble didn’t lead to a dramatic rise in debt the way the housing bubble did, and as a result the bursting of the bubble didn’t cause major defaults and a run on the banking system. Yet Wall Street—and Wall Street corruption—played a crucial role in both bubbles, as Madrick reminds us in a chapter titled “Jack Grubman, Frank Quattrone, Ken Lay, and Sandy Weill: Decade of Deceit.” As Madrick points out, Grubman, an analyst at Salomon Smith Barney who was effectively on the take, was central to some of the biggest accounting frauds. And Weill ended his reign at Citigroup immensely rich but under an ethical cloud.

There are a lot of villains in this story—so many that by the end of the book we were, frankly, suffering from a bit of outrage fatigue. But why have villains triumphed so repeatedly?

The proximate answer, clearly, is the abdication of regulatory oversight. From junk bonds to derivatives to sub-prime mortgages, regulators either turned a blind eye or were impeded by business interests and politicians—Democrat as well as Republican. Undoubtedly the most outrageous act—and the most economically damaging to the country—was Greenspan’s refusal to use regulatory powers at his disposal to rein in the exploding sub-prime market, despite being warned repeatedly that a catastrophe was brewing. Like Reagan and Friedman, Greenspan firmly believed in greedism; in his view, the financial markets could do no wrong.

Yet if the problem was lack of oversight, that leads to another question: Why did the regulators abdicate—and keep abdicating despite repeated financial disasters? This is perhaps the most frustrating aspect of Madrick’s otherwise excellent book: we get a lot of the what, but not much of the why. Madrick’s character-centered narrative makes it seem as if the triumph of greed was the result of a series of contingent events: the inflation of the 1970s, the exploitation of that inflation by Reagan and Friedman, the wheeling and dealing of the likes of Sandy Weill, and the diffidence of Jimmy Carter and Bill Clinton. Yet surely there must have been deeper forces at work.

We have argued elsewhere (and are not unique in doing so) that white backlash—especially Southern white backlash—against the civil rights movement transformed American politics, creating the opportunity for a major push to undermine the New Deal. Also, it’s hard to make sense of the growing ability of bankers to get the rules rewritten in their favor without talking about the role of money in politics, and how that role has metastasized over the past thirty years. There’s another book to be written here—perhaps less personality-centered and hence less entertaining than Madrick’s, but one that gets at the forces that made the reign of financial villains possible.

Whatever the deeper story, however, Madrick’s subtitle gets it right: what we have experienced is, in a very real sense, the triumph of Wall Street and the decline of America. Despite what some academics (primarily in business schools) claimed, the vast sums of money channeled through Wall Street did not improve America’s productive capacity by “efficiently allocating capital to its best use.” Instead, it diminished the country’s productivity by directing capital on the basis of financial chicanery, outrageous compensation packages, and bubble-infected stock price valuations.

And what has happened in the aftermath of the 2008–2009 crisis is still worse: all the evidence suggests that the United States is on track to spending the better part of a decade experiencing high unemployment and sub-par growth blighting millions of lives—particularly the old, the young, and the economically vulnerable.

Yet even now we don’t seem to have learned the lesson that unregulated greed, especially in the financial sector, is destructive. True, most Democrats are now in favor of stronger financial regulation—although not as strongly as is required by the continuing manipulations by large financial institutions. But today’s Republicans remain firmly attached to greedism. In their view, it’s still government that’s the problem. It has now become orthodoxy on the right—despite overwhelming evidence to the contrary—that Fannie Mae and Freddie Mac, not Angelo Mozilo and Countrywide Credit, are to blame for the subprime mess. While proclaiming themselves defenders of the little guy, Republicans are currently hard at work undermining the Obama administration’s consumer protections that would largely prevent a replay of rapacious subprime lending.

The Age of Greed is a fascinating and deeply disturbing tale of hypocrisy, corruption, and insatiable greed. But more than that, it’s a much-needed reminder of just how we got into the mess we’re in—a reminder that is greatly needed when we are still being told that greed is good.

This Issue

July 14, 2011

The Illusions of Psychiatry

The Variety of Movie Experience