In a fast-moving situation, significant changes have occurred since this article went to press. On August 1, as I write below, Bundesbank President Jens Weidmann objected to the assertion by Mario Draghi, the president of the European Central Bank, that the ECB will “do whatever it takes to preserve the euro as a stable currency.” Weidmann emphasized the statutory limitation on the powers of the ECB. Since this article was published, however, it has become clear that Chancellor Merkel has sided with Draghi, leaving Weidmann isolated on the board of the ECB.

This was a game-changing event. It committed Germany to the preservation of the euro. President Draghi has taken full advantage of this opportunity. He promised unlimited purchases of the government bonds of debtor countries up to three years in maturity provided they reached an agreement with the European Financial Stability Facility and put themselves under the supervision of the Troika—the executive committee of the European Union, the European Central Bank, and the International Monetary Fund.

The euro crisis has entered a new phase. The continued survival of the euro is assured but the future shape of the European Union will be determined by the political decisions the member states will have to take during the next year or so. The alternatives are extensively analyzed in the article that follows.

—September 7, 2012

I have been a fervent supporter of the European Union as the embodiment of an open society—a voluntary association of equal states that surrendered part of their sovereignty for the common good. The euro crisis is now turning the European Union into something fundamentally different. The member countries are divided into two classes—creditors and debtors—with the creditors in charge, Germany foremost among them. Under current policies debtor countries pay substantial risk premiums for financing their government debt, and this is reflected in the cost of financing in general. This has pushed the debtor countries into depression and put them at a substantial competitive disadvantage that threatens to become permanent.

This is the result not of a deliberate plan but of a series of policy mistakes that started when the euro was introduced. It was general knowledge that the euro was an incomplete currency—it had a central bank but did not have a treasury. But member countries did not realize that by giving up the right to print their own money they exposed themselves to the risk of default. Financial markets realized it only at the onset of the Greek crisis. The financial authorities did not understand the problem, let alone see a solution. So they tried to buy time. But instead of improving, the situation deteriorated. This was entirely due to the lack of understanding and the lack of unity.

The course of events could have been arrested and reversed at almost any time but that would have required an agreed-upon plan and ample financial resources to implement it. Germany, as the largest creditor country, was in charge but was reluctant to take on any additional liabilities; as a result every opportunity to resolve the crisis was missed. The crisis spread from Greece to other deficit countries and eventually the very survival of the euro came into question. Since breakup of the euro would cause immense damage to all member countries and particularly to Germany, Germany will continue to do the minimum necessary to hold the euro together.

The policies pursued under German leadership will likely hold the euro together for an indefinite period, but not forever. The permanent division of the European Union into creditor and debtor countries with the creditors dictating terms is politically unacceptable for many Europeans. If and when the euro eventually breaks up it will destroy the common market and the European Union. Europe will be worse off than it was when the effort to unite it began, because the breakup will leave a legacy of mutual mistrust and hostility. The later it happens, the worse the ultimate outcome. That is such a dismal prospect that it is time to consider alternatives that would have been inconceivable until recently.

In my judgment the best course of action is to persuade Germany to choose between becoming a more benevolent hegemon, or leading nation, or leaving the euro. In other words, Germany must lead or leave.

Since all the accumulated debt is denominated in euros it makes all the difference who remains in charge of the euro.1 If Germany left, the euro would depreciate. The debt burden would remain the same in nominal terms but diminish in real terms. The debtor countries would regain their competitiveness because their exports would become cheaper and their imports more expensive. The value of their real estate would also appreciate in nominal terms, i.e., it would be worth more in depreciated euros.

Advertisement

The creditor countries, by contrast, would incur losses on their investments in the euro area and also on their accumulated claims within the euro clearing system. The extent of these losses would depend on the extent of the depreciation; therefore creditor countries would have an interest in keeping the depreciation within bounds.

The eventual outcome would fulfill John Maynard Keynes’s dream of an international currency system in which both creditors and debtors share responsibility for maintaining stability. And Europe would escape from the looming depression. The same result would be achieved, with less cost to Germany, if Germany chose to behave as a benevolent hegemon. That would mean (1) establishing a more or less level playing field between debtor and creditor countries and (2) aiming at nominal growth of up to 5 percent, in other words allowing Europe to grow its way out of excessive indebtedness. This would entail a greater degree of inflation than the Bundesbank is likely to approve.

Whether Germany decides to lead or leave, either alternative would be better than to persist on the current course. The difficulty is in convincing Germany that its current policies are leading to a prolonged depression, political and social conflicts, and an eventual breakup not only of the euro but also of the European Union. How to persuade Germany to choose between either accepting the responsibilities and liabilities that a benevolent hegemon should be willing to incur or leaving the euro in the hands of debtor countries that would be much better off on their own? That is the question I shall try to answer.

How We Got Here

When it was only an aspiration, the European Union was what psychologists call a “phantastic object,” a desirable goal that captured many people’s imagination, including mine. I regarded it as the embodiment of an open society. There were five large states and a number of small ones and they all subscribed to the principles of democracy, individual freedom, human rights, and the rule of law. No nation or nationality was dominant. Although the Brussels bureaucracy was often accused of a “democratic deficit,” elected parliaments had to give approval of the major steps.

The process of integration was spearheaded by a small group of farsighted statesmen who practiced what Karl Popper called piecemeal social engineering. They recognized that perfection is unattainable; so they set limited objectives and firm timelines and then mobilized the political will for a small step forward knowing full well that when they achieved it, its inadequacy would become apparent and require a further step. The process fed on its own success, very much like a financial bubble. That is how the Coal and Steel Community was gradually transformed into the European Union, step by step.

France and Germany used to be in the forefront of the effort. When the Soviet empire started to disintegrate, Germany’s leaders realized that reunification was possible only in the context of a more united Europe and they were prepared to make considerable sacrifices to achieve it. When it came to bargaining, they were willing to contribute a little more and take a little less than the others, thereby facilitating agreement. At that time, German statesmen used to assert that Germany has no independent foreign policy, only a European one. This led to a dramatic acceleration of the process. It culminated with the signing of the Maastricht Treaty in 1992 and the introduction of the euro in 2002.

The Maastricht Treaty was fundamentally flawed. The architects of the euro recognized that it was an incomplete construct: it had a common central bank but it lacked a common treasury that could issue bonds that would be obligations of all the member states. Eurobonds are still resisted in Germany and other creditor countries. The architects believed, however, that when the need arose, the political will could be generated to take the necessary steps toward a political union. After all, that is how the European Union was brought into existence. Unfortunately, the euro had many other defects, of which neither the architects nor the member states were fully aware. These were revealed by the financial crisis of 2007–2008, which set in motion a process of disintegration.

In the week following the bankruptcy of Lehman Brothers the global financial markets broke down and had to be put on artificial life support. This involved substituting sovereign credit (in the form of central bank guarantees and budget deficits) for the credit of the financial institutions that was no longer accepted by the markets. The central role that sovereign credit was called upon to play revealed a flaw in the euro that had remained hidden until then and that has still not been properly recognized. By transferring what had previously been their right to print money to the European Central Bank, the member states exposed their sovereign credit to the risk of default. Developed countries that control their own currency have no reason to default; they can always print money. Their currency may depreciate in value, but the risk of default is practically nonexistent. By contrast, less developed countries that borrow in a foreign currency have to pay premiums that reflect the risk of default. To make matters worse, financial markets can actually drive such countries toward default through “bear raids”—-short-selling the bonds of these countries, driving their cost of borrowing higher, and reinforcing the fear of impending default.

Advertisement

When the euro was introduced, government bonds were treated as riskless. The regulators in the various countries allowed banks to buy unlimited amounts of government bonds without setting aside any equity capital, and the European Central Bank accepted all government bonds at its discount window on equal terms. This made it advantageous for commercial banks to accumulate the bonds of the weaker member countries, which paid slightly higher rates, in order to earn a few extra basis points.

In the aftermath of the Lehman Brothers crisis, Angela Merkel declared that the guarantee that no other systemically important financial institution would be allowed to fail should be given by each country acting separately, not by the European Union acting jointly. That was the first step in a process of disintegration that is now threatening to destroy the European Union.

It took financial markets more than a year to realize the implications of Chancellor Merkel’s declaration, demonstrating that they operate with far-from-perfect knowledge. Late in 2009, when the newly elected Greek government announced that the previous government had cheated and the deficit exceeded 12 percent of GDP, the financial markets began to realize that government bonds, which had been considered riskless, carried significant risks and could actually default. When they finally discovered it, risk premiums in the form of higher yields that governments had to offer so as to sell their bonds rose dramatically. This rendered commercial banks whose balance sheets were loaded with those bonds potentially insolvent. That created both a sovereign debt problem and a banking problem, which are linked together in a reflexive feedback loop. These are the two main components of the crisis confronting Europe today.

There is a close parallel between the euro crisis and the international banking crisis of 1982. Then the IMF and the international banking authorities saved the international banking system by lending just enough money to the heavily indebted countries to enable them to avoid default but at the cost of pushing them into a lasting depression. Latin America suffered a lost decade.

Today Germany is playing the same role as the IMF did then. The details differ, but the effect is the same. The creditors are in effect shifting the whole burden of adjustment onto the debtor countries and avoiding their own responsibility for the imbalances. Interestingly, the terms “center,” or “core,” and “periphery” have crept into usage almost unnoticed, although it is obviously inappropriate to describe Italy and Spain as periphery countries. In effect, however, the introduction of the euro relegated some member states to the status of less developed countries without either the European authorities or the member countries realizing it. In retrospect, that is the root cause of the euro crisis.

Just as in the 1980s, all the blame and burden is falling on the “periphery” and the responsibility of the “center” has never been properly acknowledged. In this context the German word Schuld is revealing: it means both debt and guilt. German public opinion blames the heavily indebted countries for their misfortune. Yet Germany cannot escape its share of the responsibility. As I shall try to show, the Schuld or responsibility of the “center” is even greater today than it was in the banking crisis of 1982. In creating the euro, the “center” was guided by the same false economic doctrines that were responsible for the financial crisis of 2007–2008.

The Maastricht Treaty took it for granted that only the public sector can produce chronic deficits. It assumed that financial markets would always correct their own excesses. Although these market fundamentalist assumptions have been refuted by the 2007–2008 financial crisis, European authorities continue to abide by them. For instance, they treated the euro crisis as if it were a purely fiscal, i.e., budgetary, problem. But only Greece qualified as a genuine fiscal crisis. The rest of Europe suffered largely from banking problems and a divergence in competitiveness, which gave rise to balance of payments problems. The authorities did not understand the complexity of the crisis, let alone see a solution. So they tried to buy time.

Usually that works. Financial panics subside and the authorities realize a profit on their intervention. But not this time, because the financial problems were combined with a process of political disintegration. When the European Union was being created, political leaders kept taking the initiative for further steps forward; but after the outbreak of the financial crisis they became wedded to the status quo. They realized that the public had become skeptical about further integration. Under duress, every country was preoccupied with protecting its own narrow national interests. Any change in the rules would transfer power away from the European authorities based in Brussels back to the national authorities.

Consequently, the words of the Maastricht and Lisbon treaties were treated as if they were cast in stone, including for example Article 123, which forbids the European Central Bank to lend money to governments. This has pushed a great many of those who consider the status quo unsustainable or intolerable to adopt anti-European attitudes. Such is the political dynamic that has made the disintegration of the European Union just as self-reinforcing as the process of its creation had been.

Angela Merkel read German public opinion correctly when she insisted that each country should look after its own banking system. In fact, Germany has reversed itself since reunification. Just as it had been willing to make considerable sacrifices for the sake of reunification, now that it had to pay the costs of reunification it was focused on keeping its budget balanced. Far from always contributing a little bit more than others, Germany did not want to become the deep pocket for the rest of Europe. Instead of proclaiming that Germany has no policy other than a European one, the German media started vilifying the European Union as a “transfer union” that would drain Germany.

To make matters worse the Bundesbank remains committed to an outmoded monetary doctrine that is deeply rooted in German history. Following World War I, Germany had a traumatic experience with inflation; consequently it recognizes only inflation as a threat to stability and ignores deflation, which is the real threat today.

After reunification caused Germany’s debt burden to balloon, it introduced far-reaching labor market and other structural reforms and adopted a constitutional amendment requiring the federal budget to be balanced by 2016. This worked like a charm. Germany enjoyed an export-led recovery, helped by housing and consumption booms in the rest of Europe. Germany now advocates fiscal austerity and structural reforms as the cure-all for the euro crisis.

Why shouldn’t it work for Europe now, if it worked for Germany then? For a very good reason: economic conditions are very different. The global financial system is reducing its excessive leverage and exports are slowing down worldwide. Fiscal austerity in Europe is exacerbating a global trend and pushing Europe into a deflationary debt trap. That is, when too many heavily indebted governments are reducing their budget deficits at the same time, their economies shrink so that the debt burden as a percentage of GDP actually increases. Monetary authorities worldwide recognize the danger. Federal Reserve Chairman Ben Bernanke, Bank of England Governor Mervyn King, and even Bank of Japan Governor Masaaki Shirakawa have all engaged in unconventional monetary measures to avoid a deflationary debt trap.

The German public finds it extremely difficult to understand that Germany is foisting the wrong policy on Europe. The German economy is not in crisis. Indeed, until now Germany has actually benefited from the euro crisis, which has kept down the exchange rate and helped exports. More recently, Germany enjoyed extremely low interest rates, and capital flight from the debtor countries has flooded Germany with capital, at the same time as the “periphery” has had to pay hefty risk premiums for access to funds.

This is not the result of some evil plot but an unintended consequence of an unplanned course of events. German politicians, however, have started to figure out the advantages it has conferred on Germany and this has begun to influence their policy decisions. Germany has been thrust into a position where its attitude determines European policy. So the primary responsibility for a policy of austerity pushing Europe into depression lies with Germany. As time passes, there are increasing grounds for blaming Germany for the policies it is imposing on Europe, while the German public is feeling unjustly blamed. This is truly a tragedy of historic significance. As in ancient Greek tragedies, misconceptions and the sheer lack of understanding have unintended but fateful consequences.

If Germany had been willing at the outset of the Greek crisis to extend the credit that was offered at a later stage, Greece could have been rescued. But Europe did only the minimum necessary to avoid a collapse of the financial system and that was not enough to turn the situation around. The same happened when the crisis spread to the other countries. At every stage the crisis could have been arrested and reversed if Germany had been able to look ahead of the curve and been willing to do more than the minimum.

At the onset of the crisis a breakup of the euro was inconceivable. The assets and liabilities denominated in the common currency were so intermingled that a breakup would have led to an uncontrollable meltdown. But as the crisis progressed the financial system has been progressively reoriented along national lines. Regulators have tended to favor domestic lending, banks have been shedding assets outside their national borders; and risk managers have been trying to match assets and liabilities within national borders, rather than within the eurozone as a whole. If this continues, a breakup of the euro would become possible without a meltdown, but it would leave the central banks of the creditor countries with large, difficult-to-collect claims against the central banks of the debtor countries.

This is due to an arcane problem in the euro clearing system called TARGET2. In contrast to the clearing system of the Federal Reserve, which is settled annually, TARGET2 accumulates the imbalances between the banks in the eurozone. This did not create a problem as long as the interbank system was functioning because the banks settled the imbalances among themselves through the interbank market. But the interbank market has not functioned properly since 2007 and since the summer of 2011 there has been increasing capital flight from the weaker countries. When a Greek or Spanish customer makes a transfer from his account at a Greek or Spanish central bank to a Dutch one, the Dutch central bank ends up with a TARGET2 credit, offset by a TARGET2 claim against the Greek or Spanish bank. These claims have been growing exponentially. By the end of July this year the Bundesbank had claims of some €727 billion against the central banks of the periphery countries.

The Bundesbank has become aware of the potential danger and the German public has been alerted by the passionate if misguided advocacy of the economist Hans-Werner Sinn. The Bundesbank is increasingly determined to limit the losses it would sustain in case of a breakup. This is acting as a self-fulfilling prophecy. Once a central bank starts guarding against a breakup everybody has to do the same.

So the crisis is getting ever deeper. Tensions in financial markets have risen to new highs as evidenced by the historic low yield on German government bonds. Even more telling is the fact that the yield on the British ten-year bond has never been lower in its three-hundred-year history, while yields on Spanish bonds have set new highs.

The real economy of the eurozone is in decline while Germany is doing relatively well. This means that the divergence is getting wider. The political and social dynamics are also working toward disintegration. Public opinion, as expressed in recent election results, is increasingly opposed to austerity and this trend is likely to grow until the policy is reversed. So something has to give.

Where Are We Now?

The June Summit seemed to offer the last opportunity to preserve the euro within the existing legal frame. In preparing for it, the European authorities under the leadership of Herman Van Rompuy, president of the European Council—which includes all the heads of state or government of the EU member states—realized that the current course was leading to disaster, and they were determined to explore the alternatives. They also understood that the banking problems and the sovereign debt problems are tied together like Siamese twins and cannot be solved separately. They were trying to develop a comprehensive program but of course they had to consult with Germany at every point along the way. They received positive reinforcement from Germany on developing plans for a banking union because Germany was concerned about the risks that capital flight from the “periphery” countries posed to the Bundesbank. So that part of the program was much better developed than a solution to the sovereign debt problem, in spite of the reflexive feedback loop between the two.

The cost of refinancing the national debt was of critical importance to Italy. At the outset of the June summit, Prime Minister Mario Monti declared that Italy would not agree to anything else unless something was done about it. To avoid a fiasco, Chancellor Merkel promised that Germany would entertain any proposal as long as it was within the existing legal framework. The summit was salvaged. It was decided to finalize the plans for a banking union, allowing the European bailout funds, the ESM and the EFSM, to recapitalize the banks directly and, after an all-night session, the meeting was adjourned.2 Monti declared victory.

But in subsequent negotiations it turned out that no proposal for reducing risk premiums fit into the existing legal framework. The plan to use the ESM to recapitalize the Spanish banks was also weakened beyond recognition when Chancellor Merkel had to assure the Bundestag that Spain would still remain liable for any losses. The financial markets responded by pushing risk premiums on Spanish bonds to record highs, with Italian yields rising in sympathy. The crisis was back in full force. With Germany immobilized by its constitutional court, whose decision on the legality of the ESM will be announced on September 12, it was left to the European Central Bank to step into the breach.

Mario Draghi, the current president of the ECB, announced that it will do whatever it takes to preserve the euro within its mandate. Bundesbank President Jens Weidmann has since been vocal in emphasizing the legal limitations on the ECB ever since, but Jörg Asmussen, the representative of the German government on the ECB’s board, came out in support of unlimited intervention on the grounds that the survival of the euro was at stake. This was a turning point. Chancellor Merkel was backing Mario Draghi, leaving the Bundesbank president isolated on the board of the ECB. President Draghi made the most of this opportunity. Financial markets took heart and rallied in anticipation of the ECB’s decision on September 6. Unfortunately, even unlimited intervention may not be sufficient to prevent the division of the euro area into creditor and debtor countries from becoming permanent. It will not eliminate the risk premiums, only narrow them and the conditionality imposed on the debtor countries by the EFSF is likely to push them into a deflationary trap. As a consequence, they will not be able to regain competitiveness until the pursuit of debt reduction through austerity is abandoned.

The line of least resistance leads not to the immediate breakup of the euro but to the indefinite extension of the crisis. A disorderly breakup would be catastrophic for the euro area and indirectly for the whole world. Germany, having fared better than the other members of the euro area, has further to fall than the others—therefore it will continue to do the minimum that it considers necessary to prevent a breakup.

The European Union that will emerge from this process will be diametrically opposed to the idea of a European Union that is the embodiment of an open society. It will be a hierarchical system built on debt obligations instead of a voluntary association of equals. There will be two classes of states, creditors and debtors, and the creditors will be in charge. As the strongest creditor country, Germany will emerge as the hegemon. The class differentiation will become permanent because the debtor countries will have to pay significant risk premiums for access to capital and it will become impossible for them to catch up with the creditor countries.

The divergence in economic performance, instead of narrowing, will become wider. Both human and financial resources will be attracted to the center and the periphery will become permanently depressed. Germany will even enjoy some relief from its demographic problems by the immigration of well-educated people from the Iberian Peninsula and Italy instead of less qualified Gastarbeiter from Turkey or Ukraine. But the periphery will be seething with resentment.

Imperial power can bring great benefits but it must be earned by looking after those who live under its aegis. The United States emerged as the leader of the free world after the end of World War II. The Bretton Woods system made it the first among equals, but the United States was a benevolent hegemon that earned the lasting gratitude of Europe by engaging in the Marshall Plan. That is the historic opportunity that Germany is missing by holding the heavily indebted countries to their Schuld.

It is worth recalling that the reparations payments demanded of Germany after World War I were among the factors giving rise to National Socialism. And Germany had its own Schuld reduced on three separate occasions: the Dawes Plan in 1924, the Young Plan in 1929—too late to prevent the rise of Hitler—and the London Debt Agreement in 1953.

Today Germany does not have imperial ambitions. Paradoxically, the desire to avoid dominating Europe is part of the reason why Germany has failed to rise to the occasion and behave as a benevolent hegemon. The steps taken by the ECB on September 6 constitute the minimum that is necessary to save the euro but they will also take us a step closer to a two-tier Europe. The debtor countries will have to submit to European supervision but the creditor countries will not; and the divergence in economic performance will be reinforced. The prospect of a prolonged depression and a permanent division into debtor and creditor countries is so dismal that it cannot be tolerated. What are the alternatives?

The Way Out

Germany must decide whether to become a benevolent hegemon or leave the euro. The first alternative would be by far the best. What would that entail? Simply put, it would require two new objectives that are at variance with current policies:

- Establishing a more or less level playing field between debtor and creditor countries, which would mean that they would be able to refinance their government debt on more or less equal terms.

- Aiming at nominal growth of up to 5 percent so that Europe can grow its way out of its excessive debt burden. This will necessitate a higher level of inflation than the Bundesbank is likely to countenance. It may also require a treaty change and a change in the German constitution.

Both these objectives are attainable, but only after considerable progress toward a political union. The political decisions taken in the next year or so will determine the future of the European Union. The steps taken by the ECB on September 6 could be a prelude to the creation of a two-tier Europe; alternatively they could lead to the formation of a closer political union in which Germany accepts the obligations that its leadership position brings with it.

A two-tier eurozone would eventually destroy the European Union because the disenfranchised would sooner or later withdraw from it. If a political union is not attainable the next best thing would be an orderly separation between creditor and debtor countries. If the members of the euro cannot live together without pushing their union into a lasting depression, they would be better off separating by mutual consent.

In an amicable breakup of the euro it matters a great deal which party leaves, because all the accumulated debts are denominated in a common currency. If a debtor country leaves, its debt increases in value in line with the depreciation of its currency. The country concerned could become competitive; but it would be forced to default on its debt and that would cause incalculable financial disruptions. The common market and the European Union may be able to cope with the default of a small country such as Greece, especially when it is so widely anticipated, but it could not survive the departure of a larger country like Spain or Italy. Even a Greek default may prove fatal. It would encourage capital flight and embolden financial markets to mount bear raids against other countries, so the euro may well break up as the Exchange Rate Mechanism did in 1992.

By contrast, if Germany were to exit and leave the common currency in the hands of the debtor countries, the euro would fall and the accumulated debt would depreciate in line with the currency. Practically all the currently intractable problems would dissolve. The debtor countries would regain competitiveness; their debt would diminish in real terms and, with the ECB in their control, the threat of default would evaporate. Without Germany, the euro area would have no difficulty in carrying out the U-turn for which it would otherwise need Chancellor Merkel’s consent.

To be specific, the shrunken euro area could establish its own fiscal authority and implement its own Debt Reduction Fund along the lines I shall describe below. Indeed, the shrunken euro area could go much further and convert the entire debt of member countires into eurobonds, not only the excess over 60 percent of GDP. When the exchange rate on the shrunken euro stabilized, risk premiums on eurobonds would fall to levels comparable to those attached to bonds issued in other freely floating currencies, such as the British pound or Japanese yen. This may sound unbelievable; but that is only because the misconceptions that have caused the crisis are so widely believed. It may come as a surprise, but the eurozone, even without Germany, would score better on standard indicators of fiscal solvency than Britain, Japan, or the US.3

A German exit would be a disruptive but manageable onetime event, instead of the chaotic and protracted domino effect of one debtor country after another being forced out of the euro by speculation and capital flight. There would be no valid lawsuits from aggrieved bond holders. Even the real estate problems would become more manageable. With a significant exchange rate differential, Germans would be flocking to buy Spanish and Irish real estate. After the initial disruptions the euro area would swing from depression to growth.

The common market would survive but the relative position of Germany and other creditor countries that may leave the euro would swing from the winning to the losing side. They would encounter stiff competition in their home markets from the euro area and while they may not lose their export markets, these would become less lucrative. They would also suffer financial losses on their ownership of assets denominated in the euro as well as on their claims within the TARGET2 clearing system. The extent of the losses would depend on the extent of the euro’s depreciation.4

Thus they would have a vital interest in keeping the depreciation within bounds. Of course there would be many transitional difficulties, but the eventual result would be the fulfillment of Keynes’s aspiration for a currency system in which the creditors and debtors would both have a vital interest in maintaining stability.

After the initial shock, Europe would escape from the deflationary debt trap in which it is currently caught; the global economy in general and Europe in particular would recover and Germany, after it has adjusted to its losses, could resume its position as a leading producer and exporter of high-value-added products. Germany would benefit from the overall improvement. Nevertheless the immediate financial losses and the reversal of its relative position within the common market would be so large that it would be unrealistic to expect Germany to leave the euro voluntarily. The push would have to come from the outside.

By contrast, Germany would fare much better if it chooses to behave as a benevolent hegemon and Europe would be spared the upheaval the German withdrawal from the euro would cause. But the path to achieving the dual objectives of a more-or-less level playing field and an effective growth policy would be much more tortuous. I will sketch it out here.

The first step would be to establish a European Fiscal Authority (EFA) that would be authorized to make important economic decisions on behalf of member states. This is the missing ingredient that is needed to make the euro a full-fledged currency with a genuine lender of last resort. The fiscal authority acting in partnership with the central bank could do what the ECB cannot do on its own. The mandate of the ECB is to maintain the stability of the currency; it is expressly prohibited from financing government deficits. But there is nothing prohibiting the member states from establishing a fiscal authority. It is Germany’s fear of becoming the deep pocket for Europe that stands in the way.

Given the magnitude of Europe’s problems, this is understandable; but it does not justify a permanent division of the euro area into debtors and creditors. The creditors’ interests could and should be protected by giving them veto power over decisions that would affect them disproportionately. That is already recognized in the voting system of the ESM, which requires an 85 percent majority to make important decisions. This feature ought to be incorporated into a new EFA. But when member states contribute proportionately, for instance by providing a certain percentage of their VAT, a simple majority should be sufficient.

The EFA would automatically take charge of the EFSF and the ESM. The great advantage of having an EFA is that it would be able to make decisions on a day-to-day basis, like the ECB. Another advantage of the EFA is that it would reestablish the proper distinction between fiscal and monetary responsibilities. For instance, the EFA ought to take the solvency risk on all government bonds purchased by the ECB. There would then be no grounds for objecting to unlimited open-market operations by the ECB. (The ECB may decide to do this on its own on September 6, but only after strenuous objections by the Bundesbank.) Importantly, the EFA would find it much easier than it would be for the ECB to offer public-sector participation in reorganizing the Greek debt. The EFA could express willingness to convert all Greek bonds held by the public sector into zero-coupon bonds starting to mature ten years out, provided Greece reached a primary surplus of, say, 2 percent. This would create a light at the end of the tunnel that could be helpful to Greece even at this late stage.

The second step would be to use the EFA to establish a more level playing field than the ECB will be able to offer on its own on September 6. I have proposed that the EFA should establish a Debt Reduction Fund—a modified form of the European Debt Redemption Pact proposed by Chancellor Merkel’s own Council of Economic Advisers and endorsed by the Social Democrats and Greens. The Debt Reduction Fund would acquire national debts in excess of 60 percent of GDP on condition that the countries concerned undertook structural reforms approved by the EFA. The debt would not be canceled but held by the fund. If a debtor country fails to abide by the conditions to which it has agreed the fund would impose an appropriate penalty. As required by the Fiscal Compact, the debtor country would be required to reduce its excess debt by 5 percent a year after a moratorium of five years. That is why Europe must aim at nominal growth of up to 5 percent.

The Debt Reduction Fund would finance its bond purchases either through the ECB or by issuing Debt Reduction Bills—a joint obligation of the member countries—and passing on the benefit of cheap financing to the countries concerned. Either way the cost to the debtor country would be reduced to 1 percent or less. The bills would be assigned a zero-risk weighting by the authorities and treated as the highest-quality collateral for repurchase agreements (repos) used in operations at the ECB. The banking system has an urgent need for such a risk-free liquid asset. Banks were holding more than €700 billion of surplus liquidity at the ECB, earning 0.25 percent interest at the time that I proposed this scheme. Since then the ECB reduced the interest rate paid on deposits further, to zero. This assures a large and ready market for the bills at less than 1 percent. By contrast, the plan announced by the ECB on September 6 is unlikely to reduce the cost of financing much below 3 percent.

The scheme I proposed was rejected out of hand by the Germans on the grounds that it did not conform to the requirements of the German constitutional court. In my opinion their objection was groundless because the constitutional court ruled against commitments that are unlimited in time and size, while the Debt Reduction Bills would be limited in both directions. If Germany wanted to behave as a benign hegemon it could easily approve such a plan. It could be introduced without any treaty change. Eventually the Debt Reduction Bills could provide a bridge to the introduction of eurobonds. That would make the level playing field permanent.

That leaves the second objective: an effective growth policy aiming at nominal growth of up to 5 percent. That is needed to enable the heavily indebted countries to meet the requirements of the Fiscal Compact without falling into a deflationary debt trap. There is no way this objective can be achieved as long as Germany abides by the Bundesbank’s asymmetric interpretation of monetary stability. Germany would have to accept inflation in excess of 2 percent for a limited period of time if it wants to stay in the euro without destroying the European Union.

How To Get There

What can bring Germany to decide whether to stay in the euro without destroying the European Union or to allow the debtor countries to solve their problems on their own by leaving the euro?

External pressure could do it. With François Hollande as the new president, France is the obvious candidate to advocate an alternative policy for Europe. By forming a common front with Italy and Spain, France could present an economically credible and politically appealing program that would save the common market and recapture the European Union as the idealistic vision that fired people’s imagination. The common front could then present Germany with the choice: lead or leave. The objective would not be to exclude Germany, but to radically change its policy stance.

Unfortunately, France is not in a strong position to form a united front with Italy and Spain in the face of determined opposition from Germany. Chancellor Merkel is not only a strong leader but also a skilled politician who knows how to keep adversaries divided. France is particularly vulnerable because it has done less than Italy or Spain to accomplish fiscal consolidation and structural reforms. The relatively low risk premium that French government bonds currently enjoy is due almost entirely to France’s close association with Germany. Asian central banks have been buying French bonds, especially since German Bunds have started selling at negative yields. Should France ally itself too closely with Italy and Spain, it would be judged by the same yardstick and the risk premium on its bonds may rise to similar levels.

Admittedly, the advantages of being in the same boat with Germany are liable to become illusory once a prolonged depression descends upon Europe. As the fault line between Germany and France becomes more apparent, financial markets are liable to reclassify France with Italy and Spain whether or not it remains faithful to Germany. So France’s real choice is, on the one hand, between breaking with Germany to save Europe and restore growth or, on the other, pretending to be in the hard currency boat for a limited time, only to be thrown overboard later. Taking the side of the debtor countries and challenging the policy of austerity would allow France to resume the position of leadership it held during Mitterrand’s presidency. That would be a more dignified position than being a passenger with Germany in the driver’s seat. Still, it would take great courage for France to part ways from Germany in the short run.

Italy and Spain have other weaknesses. Italy has proven itself incapable of maintaining good governance on its own. Its current debt problems were accumulated before it joined the euro; as a member it actually had a better record of primary budget surplus than Germany—even during much of the time when Berlusconi was in power. But Italy seems to need an outside authority to rid itself of bad governance. That is what has made Italians so enthusiastic about the -European Union. Spain is much healthier politically but the current government has become far too subservient to Germany for its own good. Moreover, the reduction in risk premiums as a result of the ECB’s bond purchases will be significant enough to remove the incentive to rebel against German domination.

The campaign to change German attitudes will therefore have to take a very different form from the intergovernmental negotiations that are currently deciding policy. European civil society, the business community, and the general public need to mobilize and become engaged. At present, the public in many eurozone countries is distressed, confused, and angry. This finds expression in xenophobia, anti-European attitudes, and extremist political movements. The latent pro-European sentiments, which currently have no outlet, need to be aroused in order to save the European Union. Such a movement would encounter a sympathetic response in Germany, where the large majority is still pro-European but under the spell of false fiscal and monetary doctrines.

Currently, the German economy is doing relatively well and the political situation is also relatively stable; the crisis is only a distant noise coming from abroad. Only something shocking would shake Germany out of its preconceived ideas and force it to face the consequences of its current policies. That is what a movement offering a workable alternative to German domination could accomplish. In short, the current situation is like a nightmare that can be escaped only by waking up Germany and making it aware of the misconceptions that are currently guiding its policies. We can hope Germany, when put to the choice, will choose to exercise benevolent leadership rather than to suffer the losses connected with leaving the euro.

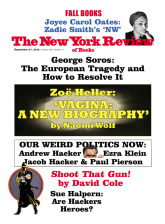

This Issue

September 27, 2012

Pride and Prejudice

Cards of Identity

Are Hackers Heroes?

-

1

Debt issued under domestic law can be redenominated into the domestic currency; debt issued under foreign law cannot. The implications have been extensively analyzed by Jens Nordvig in his Wolfson Economic Prize paper. ↩

-

2

The European Financial Stability Mechanism, the EFSM, was set up in 2010 as a temporary organization based in Luxembourg to give financial assistance to eurozone member states; it will be replaced by the permanent ESM if Germany ratifies it; fifteen other members of the eurozone have already done so. ↩

-

3

General government deficit as percent of GDP: eurozone excluding Germany 5.3; UK 8.7; Japan 10.1; US 9.6; eurozone including Germany 4.2. Gross Public Debt as percent of GDP: eurozone excluding Germany 91; UK 82; Japan 230; US 103; eurozone including Germany 88. ↩

-

4

As interbank lending is resumed, Germany may even prefer to remain a member of the TARGET2 clearing system and allow balances to wind down gradually rather than taking an immediate loss. ↩