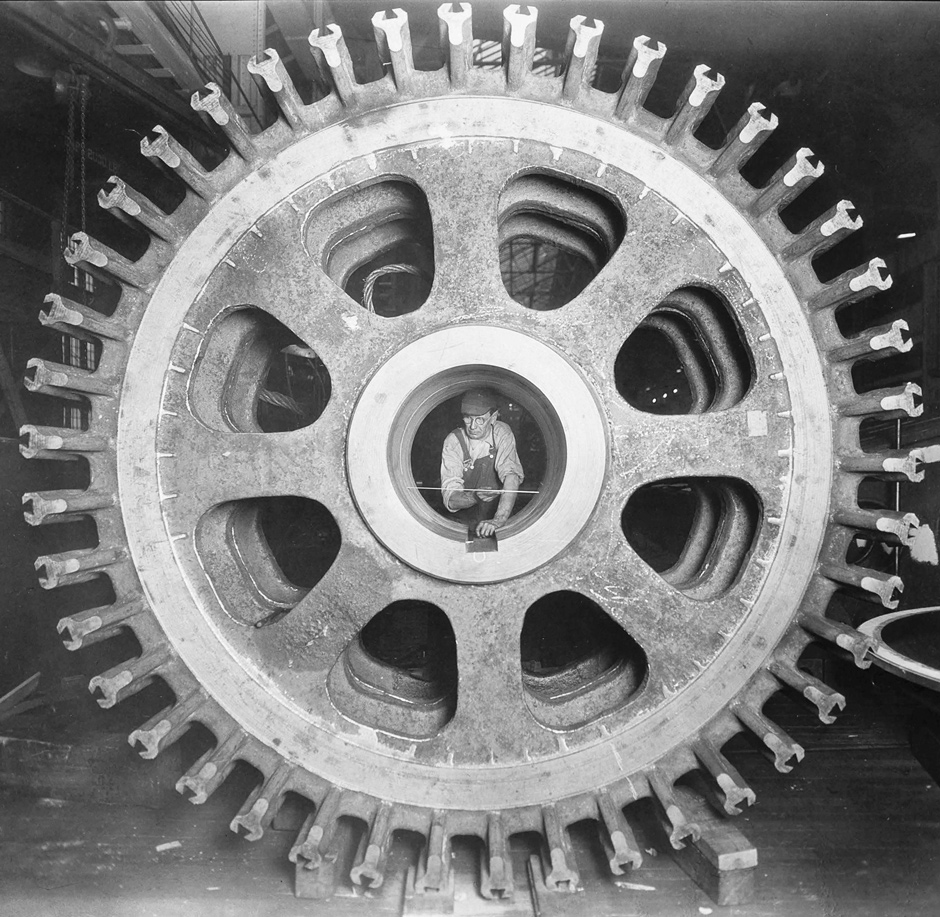

Photo League Lewis Hine Memorial Committee/George Eastman House

Lewis Hine: Measuring bearing in casting, General Electric Co., circa 1932; from his book Men at Work. A retrospective of Hine’s work is on view at the International Center of Photography in New York City from October 4, 2013, to January 19, 2014. The catalog, edited by Luis Miguel García Mora, is published by Fundación MAPFRE and TF Editores and distributed by DAP.

The Americans who first greeted The New York Review of Books in 1963 were a mostly prosperous lot. The US economy grew that year by nearly 4.5 percent, following 6 percent growth the year before, and with more than 6 percent growth to come on average over the next three years as well. By fall, when the new Review’s first regular pages appeared, the unemployment rate was just 5.5 percent, on its way to 4.5 percent by mid-1965 and almost to 3.5 percent by late 1966. Nor was there much inflation; consumer prices rose just 1.3 percent in 1963, the same rate that prevailed on average throughout the first half of the 1960s.

Best of all, most Americans’ incomes were outpacing inflation, as they had for a decade and a half before 1963 and would continue to do for another decade after. In 1948 the family just at the middle of the US income scale had earned $26,500 in today’s dollars. By 1963 the median family’s income was up to $41,000. By 1973 it would be $55,700.

Yet even then some worriers expressed concerns about the longer-term economic future and what it might mean for society. Writing at just that time James Meade, a British economist who later won the Nobel Prize, focused in particular on the threat presented by “automation.”1 Replacing human work by robots had been an aspiration—and also a source of fear—for centuries. But the idea had gained new currency with the work of the American mathematician Norbert Wiener, especially following publication of his Cybernetics in 1948. By the mid-1950s the prospect of substituting machines for human effort had captured the attention of popular culture too, with films like Fred Wilcox’s Forbidden Planet vividly imagining the wondrous possibilities but also potentially horrible consequences.

Meade’s vision was no less arresting than Wilcox’s. His concern was how the humans displaced by machines in the economy’s productive process would earn a living. “What of the future?” he asked.

There would be a limited number of exceedingly wealthy property owners; the proportion of the working population required to man the extremely profitable automated industries would be small; wage rates would thus be depressed; there would have to be a large expansion of the production of the labour-intensive goods and services which were in high demand by the few multi-multi-multi-millionaires; we would be back in a super-world of an immiserized proletariat of butlers, footmen, kitchen maids, and other hangers-on. Let us call this the Brave New Capitalists’ Paradise.

“It is to me,” he concluded, “a hideous outlook.”

Meade was hardly the first to think through the economic implications of an ever-increasing ability to substitute machines for working men and women. In the 1810s, handweavers under the banner of the perhaps mythical Ned Ludd rampaged through factories in the English Midlands, smashing the new automated looms that were allowing less skilled (and therefore lower-paid) workers to replace them. By mid-century, however, it was apparent that the economic growth made possible by technological advances, and the rising living standards that ensued, constituted not just another economic “long wave” but the onset of presumably unending improvement. Even then there were enthusiasts as well as detractors. The Great Exhibition at London’s Crystal Palace, in 1851, showcased the myriad wonders of the new Age of Progress. Marx and his followers saw instead the “immiseration” of a newly enslaved working class.

But at least in Britain and America, events turned out more favorably. By the turn of the twentieth century, Alfred Marshall and other British economists were mocking Marx’s prediction that the working class would miss out on the fruits of ever-improving productivity. To the contrary, Marshall concluded, “the hope that poverty and ignorance may gradually be extinguished derives much support from the steady progress of the working classes during the nineteenth century.” Indeed, “the growing demand for intelligent work has caused the artisan classes to increase so rapidly that they now outnumber those whose labour is entirely unskilled,” and “some of them [the artisans] already lead a more refined and noble life than did the majority of the upper classes even a century ago.”2

Perhaps the greatest expression of technological optimism came from John Maynard Keynes. Writing a generation after Marshall, and just before the Great Depression, Keynes predicted that the average income in Britain and America would continue to double every generation or two, and he went on to infer that in time most citizens would be sufficiently satisfied with their material circumstances to regard “the economic problem” as “solved,” and henceforth would take advantage of the ongoing increase in productivity mostly to achieve ends other than private consumption.

Advertisement

Following the tradition of many utopian thinkers of the nineteenth century, Keynes further speculated that in these circumstances society would deemphasize the link between people’s personal role in the production process and their claim on what gets produced, so that the typical individual would spend far less time working but would thereby enjoy no less ability to consume the usual goods and services. As a result, the chief problem Keynes saw—he called it “a fearful problem for the ordinary person”—would be how to occupy the great increase in leisure time.3

More than eight decades later, Keynes’s prediction of a four- to eight-fold increase in the economy’s total income per person, over the hundred years from 1929, looks remarkably on target. For America it may even turn out to have been too modest; extrapolation of the average increase since then gives somewhat more than an eightfold gain by 2029. But Keynes underestimated people’s desire to enjoy an ever higher material standard of living, and he also failed to foresee that our economy’s aggregate income would become more and more unequally distributed, while jobs would at times become scarcer. As a result, there is little sign of the consequences Keynes foresaw for private consumption, for work effort, or for society’s institutional arrangements.

Today it is Meade’s concerns that look the more prescient, at least in America. “Job creation” is the urgent economic issue of our time. Our cities and states compete with one another to attract work opportunities for their residents (but also for anyone who wants to move in from elsewhere), showering potential employers with tax holidays, low-rent land, and relaxed regulation.

Part of the problem is cyclical. The rebound from the 1990–1991 business downturn first popularized the label “jobless recovery.” Total US economic output surpassed the pre-recession peak within eighteen months, but total employment took more than two and a half years to recover. The pattern has worsened since. After the 2000–2001 decline, output recovered within just six months, employment not for four years. Following the 2007–2009 financial crisis, which set off the largest decline in total output the United States has experienced since World War II, output recovered after only nine months. But as of October 2013 it was estimated that there were still nearly two million fewer Americans at work than in January 2008.

America’s jobs problem, however, is more than a feature of business cycles in which output snaps back quickly while employment now takes longer. New technology that enhances the productivity of labor—organizing the production process in more efficient ways, giving workers new and better machines to use, replacing workers with machines altogether—means less labor input is needed to produce what was made before. How much decline workers will therefore see in the demand for their services depends, in the first instance, on how much more productive labor becomes, and on the extent to which society collectively chooses to take advantage of the opportunity to consume more goods than it did before.

But technological change is usually not just about producing more of the same goods with less labor. New technology also introduces new products, thereby eliminating some jobs (fewer openings for making saddles and stabling horses) but at the same time creating new ones (making cars and operating gas stations). Until fairly recently, the labor needed to make old goods in greater volume, plus that needed to meet the demand for newly emerging goods, has equaled if not exceeded the labor released by the enhanced ability to produce the old goods in unchanging quantity.

But there is no reason the balance of these opposing forces must come out this way, and both Keynes’s utopian vision and Meade’s “hideous outlook” stem from the assumption that it will not. Increasingly over the last quarter-century, the balance indeed appears to have shifted.

One reason may simply be that the pace of labor-saving technological change has accelerated. In the mid-1990s Jeremy Rifkin’s The End of Work highlighted a “Third Industrial Revolution.”4 More recently Erik Brynjolfsson and Andrew McAfee, two MIT economists, offered the familiar tale of the inventor of chess as a metaphor for where we now stand in this process. When the shah asked the inventor to name his reward, the clever man asked for one grain of rice for the first square on the chessboard, two for the second, four for the third, and so on, doubling each time until the sixty-fourth square. The shah agreed, not understanding that with the power of exponential expansion the entire world could never produce that much rice.

Advertisement

In Brynjolfsson and McAfee’s metaphor, with new advances like driverless cars and high-quality language translation, the process of labor-saving technical change is now entering the second half of the chessboard.5 Especially in America, which has led the way in investing in information technology, it will increasingly be possible to produce the goods and services that people want with little incremental labor input; production will expand, but employment won’t.

Technology matters for this purpose in a second way as well, one that neither Keynes nor Meade took into account. With new electronic communication technologies facilitating international trade in an ever wider array of services in addition to the traditionally traded goods, the “offshoring” of American jobs now includes not just staffing call centers but reading X-rays, preparing tax returns, and carrying out legal research. Hence even when the incremental production Americans consume requires additional labor, it often does not create job opportunities for Americans. And for many of the low-end tasks that must be done on site—Meade’s butlers, footmen, and kitchen maids, but in today’s setting more likely janitors, gardeners, and hospital orderlies—a steady inflow of mostly unskilled immigrants is eager to do such work at wages that most Americans find unacceptable. As a result, much of even the additional production that requires additional labor input in America does not present employment prospects—at least not ones that look reasonable—for Americans.

The increasingly evident consequence is not only the absence of employment opportunities but widening income inequality and increasing outright poverty—despite the fact that the underlying cause is a rapid and ongoing improvement in our productive capabilities. It is nearly a century and a half since the American economist Henry George wrote Progress and Poverty.6 Much of his analysis no longer fits but the contradiction highlighted in his title resonates today as much as then. Continually advancing technology makes possible expanding production, and for the most part that possibility is realized. But the fruits of the increased production increasingly accrue to only a small slice of the population, mostly consisting of those already at the top of the income scale.

Between 1973 and 1993, economic production in the United States increased in total by 73 percent, after allowing for rising prices, or by 42 percent per capita. But with increasingly unequal distribution, the median family’s income rose by not even 4 percent. After a welcome break in the mid- and late 1990s, the same pattern returned. From 2000 to 2007, the last year before the financial crisis, total production per capita rose in real terms by 10 percent, but median family income by less than one half of one percent: in today’s dollars, from $67,600 to just $67,900. By 2012 per capita production had almost regained the 2007 level. But the median family income had fallen to $62,200—a drop of more than 8 percent.

As Meade’s arresting image made clear, the issue is at bottom one of distribution of both income and wealth, and Keynes was wrong in thinking that by now our society would largely sever the link between what each family earns and what it is allowed to consume. Overall, from 1973 to 2012, per capita economic production in the United States expanded by 93 percent but the median American family’s real income rose by only 12 percent. For some, however—the “multi-multi-multi-millionaires” Meade predicted—it has risen a lot. The problem is not merely that, as economists are fond of pointing out, forces like advancing technology and international trade don’t necessarily make everyone better off, and so there can be some who lose out while everyone else gains. The majority of Americans have seen their incomes and living standards stagnate, and no end to the process is in sight.

There are also grounds for concern that the problem will continue to worsen. In addition to the widening wage premium earned by higher-skilled and more highly educated workers, the balance between income from work and income from wealth—whether through ownership of stocks, bonds, property, or other assets—is also shifting. The share coming from wealth now stands at a record high. But wealth-holding is far more highly concentrated than labor income, and so, over time, the growing share of income coming from wealth will bring wider inequality in total incomes even apart from whatever happens to the structure of wages.

Further, those with the most wealth are also typically those with the highest wages, and so the two trends compound one another. And to make matters worse, the US tax code levies higher taxes against wages than against dividends or capital gains. It was no surprise when new data released this August showed that 10 percent of Americans received fully one half of the country’s total income in 2012—the largest share on record—and that the top 1 percent received nearly half of that, or 23 percent of the total income.7

What, then, is the path forward? Appealing as the Luddites’ motivation may be to at least some among the myriad “losers” in this process, no one is going to halt the advance of technology. What can we do instead?

Meade’s “Hideous Outlook.” The simplest answer, as always, is the market solution: allow wages, especially at the low end, to fall to the point at which demand for labor finally absorbs everyone willing to work. This path would make inequality worse—in all likelihood, substantially so—but, in theory, everyone who wants to work would have a job. Moreover, the wage reductions needed would not be tolerated by America’s wage-earning public.

Tighter Borders. A variant of the market solution would be to slow—if possible, reverse—immigration of low-skilled workers. The familiar statement that Americans “won’t take” such and such a job rests on the unstated assumption that the job has to pay whatever it now pays. Without the inflow of foreign labor willing to mow lawns and paint houses, pay for those services would rise. Some homeowners would decide to mow their own lawns, and some houses wouldn’t get painted (at least not as often). But the wages of lawn mowers and house painters would rise, and as they did more Americans would take those jobs. Higher wages would also lend such jobs a more attractive image. Most evidence suggests, however, that the differential effect of immigration in depressing low-end wages has been modest: perhaps as much as 9 percent, but probably a good deal less.8

The “Mr. Micawber” Strategy. Americans have suffered periods of sustained economic stagnation before. None has proved permanent. Sometimes what turns the economy around has been technological—for example, the new gold finds and improved method of gold extraction that helped end the worldwide depression of the 1880s and early 1890s. By the nature of major technological breakthroughs, however, it is difficult to foresee them, especially one of sufficient magnitude to upset today’s perverse trends.

At other times, what ends the stagnation is something no one would wish for. After the economic debacle of the 1930s, US unemployment did not return to the pre-Depression level until 1943, when the country had nine million men and women in uniform. Whether through war or technological breakthrough, or some other dramatic development, the prospect—to an optimist, the inevitability—that “something will turn up” allows us to believe that even if today’s Luddites are right for a while, in time they may well be proved wrong as they always have so far. But the time involved could be long indeed, and there is no clear economic law proving that it will come.

Education. It has become a commonplace to point out that the technological changes of the last generation have rendered many traditional skills less valued in today’s labor market, and conversely have enhanced the value attached to others. Most economists believe that this process is the greatest single force underlying the worsening of US inequality; and the ever-widening wage advantage of college-educated workers over those with only a high school education, and of high school graduates over those who dropped out, is persuasive evidence.9 It is surely true that the route to economic success for many young Americans, and in parallel one way to make our economy as a whole more productive, is more and better education. But by now there are countless new college graduates (not to mention new graduates ranging from lawyers to beauty shop technicians) who also face poor job prospects, and who have little prospect too of ever repaying the loans that financed their education. An honest assessment is that we may have come to the end of the long era in which we could look to education, as we know it, as the all-purpose solution to problems of employment and productivity at both the individual and economy-wide level.

Income Sharing. Since the pressing issue is living standards—what people are able to consume—how about some system for pairing up those who work with those who don’t? After all, the fact that some people choose to work more than others, or that different people have different abilities, or even that some people have more wealth than others, is not a problem in itself. What is troublesome is the consequences that follow for different people’s living standards.

In fact, we have such a system today. Many individuals who work (usually called “adults”) are responsible for the support of others who don’t (usually called “children”). For the most part the system works fairly well, as far as it goes. In just the same way, Americans in the past lived with a significantly smaller fraction of the labor force engaged in paid labor than in recent decades. That system worked because there was an accepted way of pairing up those who worked for a wage (“husbands”) with those who didn’t (“wives”). But that arrangement is now gone, and it is not coming back. Today the rate at which adult women participate in the paid labor force, at 59 percent, is not much lower than the 71 percent for men.

A different take on income sharing is what Keynes explicitly assumed, and what Meade contemplated as well: significantly weakening the link between what each family earns and what it is allowed to consume. The tangle of welfare and social insurance programs in effect today, together with government services provided free to all citizens (most importantly, free public education through high school), already goes some distance to addressing these needs. But as the increasingly visible popular discontent makes clear, they have not kept up with the heightened strains created by stagnating incomes and widening inequality. At the same time, under America’s current politics there is little practical prospect of significant expansion of the welfare system, or even of wage subsidies for low-income jobs (“workfare” rather than welfare). Nor is there any interest today in the “demogrants”—government transfers to each person independent of income—once advocated by some economic conservatives.10

By whatever strategy, the urgent need is to restore the US economy to a trajectory—like that of the era in which The New York Review was born, or most recently in the mid- to late 1990s, but also in many periods before World War II—that would again deliver not only expanding total production but rising living standards for the majority of American families. The need is urgent not just on economic grounds but because experience both in this country and elsewhere shows that improving economic conditions usually bring advances in political and social conditions—and that the converse is true as well. Today’s constipated politics, the eroding civility of our public life, and the virtual disappearance of generosity from our policy debates are the predictable pathologies that emerge whenever most of the population loses its sense of getting ahead, and loses as well any optimism that renewed gains are on the horizon. But the manifestations visible today are likely just the beginning. Both here and elsewhere, protracted economic stagnation for the majority of citizens has often led to far worse.

Moreover, under any strategy other than Mr. McCawber’s for reversing this stagnation, the political stalemate makes it harder to undertake whatever measures we need. The danger, therefore, is a self-reinforcing equilibrium in which our economic stagnation fosters political dysfunction, which in turn prevents us from extricating ourselves from the economic morass. Further, for reasons wholly unrelated to political impediments, economists like Northwestern’s Robert Gordon expect a slower rate of productivity improvement than America has enjoyed in the past—and therefore slower growth of incomes in the aggregate and, by implication, even worse stagnation for the majority who are losing out in the competition over the distribution of aggregate income. What makes slower productivity gains likely is in part simply that nothing on the horizon matches the all-changing advances of the past like steam power, railroads, electrification, the internal combustion engine, powered air flight, and even such basics as running water and home sanitation. And, according to Gordon, we must confront looming “headwinds” such as the pressing need to address climate change and the other environmental side effects of the economic growth we already have.11

To be sure, technological optimists like Brynjolfsson and McAfee see what is on the horizon in a different way, looking to the digital revolution not only to accelerate innovation but to increase productivity as well. But neither view speaks to the hard problem of where Americans will find work, or how unequal their wages will be, or how much of our total income will accrue to those who own the capital rather than those who do the work—or any of the perverse political and social consequences that follow. However we resolve this pressing national dilemma, we first must openly and honestly recognize it for what it is.

This Issue

November 7, 2013

Love in the Gardens

Gambling with Civilization

On Reading Proust

-

1

See J.E. Meade, Efficiency, Equality and the Ownership of Private Property (Harvard University Press, 1964). Meade’s book was based on lectures that he presented in Stockholm in the spring of 1964. I am grateful to Anthony Atkinson for calling Meade’s book to my attention. ↩

-

2

See Alfred Marshall, Principles of Economics (London: Macmillan, 1890), p. 3. ↩

-

3

See John Maynard Keynes, “Economic Possibilities for Our Grandchildren,” in The Nation and Athenaeum (October 11 and 18, 1930). Keynes’s prediction looks even more prescient in light of the publication date, a year after the depression began. But he apparently wrote this paper two years earlier, at a time when Britain was experiencing protracted economic difficulties but nothing like the Great Depression had yet developed. ↩

-

4

See Jeremy Rifkin, The End of Work: The Decline of the Global Labor Force and the Dawn of the Post-Market Era (Putnam’s, 1995). ↩

-

5

See Erik Brynjolfsson and Andrew McAfee, Race Against the Machine: How the Digital Revolution Is Accelerating Innovation, Driving Productivity, and Irreversibly Transforming Employment and the Economy (Digital Frontier Press, 2011). ↩

-

6

See Henry George, Progress and Poverty: An Inquiry into the Cause of Industrial Depressions, and of Increase of Want with Increase of Wealth—The Remedy (Sterling, 1879). ↩

-

7

See Annie Lowrey, “The Rich Get Richer Through the Recovery,” The New York Times, September 10, 2013; see also Emmanuel Saez, “Striking It Richer: The Evolution of Top Incomes in the United States (Updated with 2012 Preliminary Estimates),” September 3, 2013, http://elsa.berkeley.edu/~saez/saez-UStopincomes-2012.pdf ↩

-

8

For a review of the evidence, see George Borjas, “Immigration and the American Worker: A Review of the Academic Literature,” April 2013, Center for Immigration Studies. ↩

-

9

The best summary of the evidence is Claudia Goldin and Lawrence F. Katz, The Race Between Education and Technology (Harvard University Press, 2008). ↩

-

10

See, for example, Milton Friedman, Capitalism and Freedom (University of Chicago Press, 1962). ↩

-

11

See Robert J. Gordon, “Is US Economic Growth Over? Faltering Innovation Confronts the Six Headwinds,” August 2012, National Bureau of Economic Research. ↩