If he were not the second-richest person in the world, Warren Buffett’s other well-known attributes—an Omaha address, a five-bedroom house where he’s lived for fifty-two years, an annual $100,000 salary, and a phone he answers himself—would be unremarkable. But we have certain expectations for the fabulously wealthy, encouraged in no small measure by the fabulously (and former fabulously) wealthy themselves: the 66,000-square-foot house with six kitchens (Bill Gates) or the house with twenty-six bathrooms (Prince Bandar); the Mercedes, Lexus, Range Rover, and Cadillac fleet (Bernard Madoff); the Gulfstream V jet (Mark Cuban); the $50,000 bespoke vicuña suits (the King of Morocco). Though he is not without his indulgences—as one of the owners of NetJets, which sells fractional shares of private planes, he uses his company’s services—Buffett’s frugality is part of what marketers would call his brand identity. His apparent personal disregard for the money he so excessively accumulates reinforces his credibility: he’s not greedy, he’s just good at what he does.

According to Alice Schroeder, his devoted biographer, Buffett’s career in wealth accumulation began early, around the age of six, when he started buying packs of gum and selling them to the neighbors for a few pennies’ profit. He then switched to Coke, which he peddled door-to-door in the summer; then “pre-owned” golf balls. The Buffetts weren’t poor—his father, who eventually went on to represent Omaha for four terms in Congress before being considered too right-wing for even conservative Nebraskans—started out as an insurance salesman and switched to selling stocks during the boom right before the 1929 bust. By the time Warren was born in 1930, stocks were a hard sell and money was tight.

Buffett first visited Wall Street at the age of ten, where he was given an audience with Sidney Weinberg, the head of Goldman Sachs. (That may help explain Buffett’s long-standing attachment to the firm.) It was around that time, too, that he purchased his first stocks, three shares each for himself and his sister Doris, which he bought at $35 and sold at $40, which was good, except that not long after that the stock was trading at $200. At eleven he read a book that suggested a hundred ways to make a thousand dollars, which gave him a goal: to make a million dollars by the age of thirty-five. Twenty-four years later Warren Buffett was a millionaire five times over.

Buffett, it is safe to say, has a different relationship to money than you and me. For us it’s a means to an end. For him, it’s a vocation. He is called to it. If it’s for anything, it’s for getting more of. The man is a collector. He just happens to collect dollars.

Getting money interests Buffett more than having money or spending money. It’s an intellectual and moral pursuit: how do companies make money, how should their assets be valued, what are the undervalued businesses that others haven’t noticed, what does ownership require, what’s the relationship of directors to shareholders? Rejected by Harvard Business School after an undistinguished undergraduate career at the University of Nebraska that followed a short stint at Penn’s Wharton School, Buffett landed at Columbia Business School, where he fell under the spell of Professor Benjamin Graham. Graham was a cigar-chomping, womanizing, physically unprepossessing man with an outsized talent for making money. He was also a well-regarded financial writer, the coauthor, with another Columbia professor, of a mammoth and arcane volume called Security Analysis, which became Buffett’s bible.

According to Schroeder, Buffett learned three main lessons from Ben Graham that influenced him profoundly:

A stock is the right to own a little piece of a business…. Use a margin of safety…[and] Mr. Market is your servant, not your master. Graham postulated a moody character named Mr. Market, who offers to buy and sell stocks every day, often at prices that don’t make sense. Mr. Market’s moods should not influence your view of price.

In a long career of buying and selling stock, this advice was especially helpful during the dot-com bubble, when Buffett’s refusal to jump on the tech-stock wagon and his public declaration that it was smoke-and-mirrors earned him public derision. (“Approval…is not the goal of investing,” he wrote recently. “In fact, approval is often counter- productive because it sedates the brain and makes it less receptive to new facts or a re-examination of conclusions formed earlier. Beware the investment activity that produces applause; the great moves are usually greeted by yawns.”)

Ben Graham, in addition to teaching, ran an investment company, Graham-Newman, whose moves Buffett took to studying like a baseball scorecard. When, as a first-year business student, he learned that Graham-Newman had purchased a majority stake in a little-known insurance company called GEICO, Buffett got on a train from New York on a weekend morning and made a cold call on the company headquarters in Washington, D.C. After introducing himself to the security guard as a student of Ben Graham’s who was hoping to find someone there who could explain GEICO’s business, he was eventually ushered into the office of the financial vice-president, a man named Lorimer Davidson. Davidson, who expected to spend a few minutes with Graham’s student, found himself still talking with Buffett four hours later:

Advertisement

The questions he was asking me were the questions that would have been asked by an experienced insurance-stock analyst. His follow-up questions were professional. He was young, and he looked young. He described himself as a student, but he was talking like a man who had been around a long time, and he knew a great deal…. I began asking him questions.

Buffett went home, liquidated half his worldly assets, and invested them in GEICO. In 1996 he bought the company outright.

People hoping to emulate Buffett’s success study his every move the way he studied Graham’s. There’s a not-so-small industry of Buffett books, DVDs, and apparel; Amazon.com has its own Warren Buffett store where it’s possible to buy the latest edition of Security Analysis with a foreword by Warren Buffett, or download The Warren Buffett Investing Strategy to your iPod, which you can listen to while lounging in a Warren Buffett pop-art T-shirt and savoring a collection of See’s (a company owned by Buffett) truffles.

Buffett’s annual letter to the shareholders of Berkshire Hathaway, the textile company he bought for $7.50 a share in 1962 that he turned into a holding company comprised of insurance, candy, vacuum cleaner, furniture, jewelry, prison uniform–manufacturing, food, paint, encyclopedia, and other companies that now trades for about $90,000 a share, down from a high of $150,000 in December 2007, is read by millions of investors and money managers and market neophytes alike looking for any bits of advice they can glean to increase their net worth. It is not unusual for the company’s annual meeting, hosted in Omaha by Warren Buffett himself, to attract tens of thousands of shareholders (and those who score tickets on eBay) eager to learn from the master.

Even now, with the recent downgrading of Berkshire Hathaway from the coveted triple-A rating by Moody’s Rating Service (which is owned in part by Buffett) to the less desirable AA2, and an annual letter that served as a disarming mea culpa to explain the company’s unprecedented 62 percent drop in net income last year—Buffett’s worst loss ever—the Buffett brand and Buffett’s reputation as the world’s greatest investor remain intact. This may be because despite some bad trades, like buying gas and oil stocks when they were trading at their peak and investing in a couple of banks that went belly-up, Berkshire Hathaway stock still managed to decline less precipitously than the market itself. (About his bad investment in ConocoPhillips stock, he writes, “Even if prices should rise…the terrible timing of my purchases has cost Berkshire several billion dollars.”)

How Warren Buffett became Warren Buffett turns out to be a fascinating story, at least as told by Alice Schroeder. Schroeder, a certified public accountant and insurance industry analyst who met Buffett when she covered Berkshire Hathaway for Morgan Stanley, is the first writer to have complete access to the man, whose unconventional home life might have made him more wary of giving a writer carte blanche. But Buffett has a reputation for transparency and integrity, as well as idiosyncrasy, and in Schroeder’s hands the oddities of his fifty-two-year marriage to his wife Susan, which included twenty-six years in which she chose to live apart from him in San Francisco while he stayed at home with the “housekeeper” she hired and maybe, also, had an affair with Washington Post publisher Katherine Graham, are almost beside the point. He loved his wife, she got tired of waiting around while he was at the office, she took off (with her tennis coach), and even so, they stayed married and vacationed together and celebrated holidays together, and were together in 2004 as she was dying. It’s just too sweet a story to be serious tabloid material, and anyhow, the majority of Buffett’s acolytes are interested in copying his portfolio, not his lifestyle.

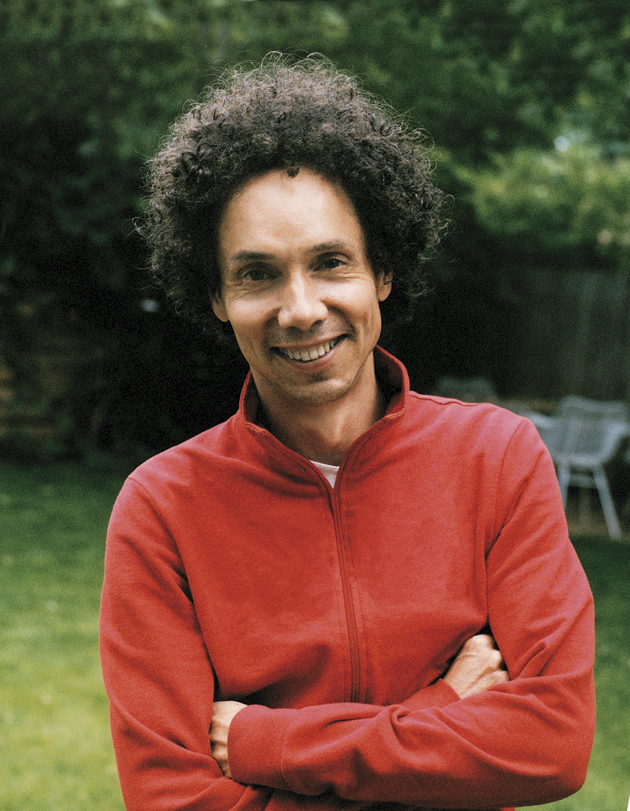

So what’s the chance of that happening? For those who invested early with Buffett, very good. It is estimated that the original $10,000 stake he collected from his earliest “partners” is now worth hundreds of millions of dollars. But there’s a great difference between relying on Buffett’s skill and expertise to amass great wealth and amassing great wealth by developing the skills and expertise that let Buffett be Buffett. “Fat chance?” you say. “That guy’s genius, the Tiger Woods, the Lennon and McCartney, the Bill Gates of the New York Stock Exchange.” Possibly—but if Malcolm Gladwell is right, his success—and theirs—has little to do with genius.

Advertisement

Gladwell, of course, is the clever master of the anecdote who owns the franchise on high-concept books with pithy titles— The Tipping Point, Blink, and now Outliers—that repurpose scraps of academic research into slinky intellectual lamé. These books have made him a fixture on the best-seller list and the envy of his peers—if he has any. In his own somewhat ill-defined terms, Gladwell is an outlier, a statistical anomaly, one who “is markedly different in value from the others of the sample” and doesn’t “fit into our normal understanding of achievement.” In addition to him, the Beatles, Robert Oppenheimer, and Asian math students, for instance, all make the cut. Still, it is not clear, when talking about human endeavors, which variables or combination of variables needs to be outside the norm to achieve outlier status: If it’s money in the bank, how much? If it’s books sold, how many? It’s as if success is a corollary of obscenity: you know it when you see it.

And “seeing” may be the most crucial variable of all. Is it the quality of the literary work, for example, that makes someone an outlier—“men and women who do things that are out of the ordinary”—or is it the size of the advance? Consider the case of Susan Boyle, the unemployed, forty-seven-year-old spinster from Scotland who became a global sensation recently after her remarkable audition for the reality show Britain’s Got Talent. Boyle’s singing voice was no less extraordinary the day before she appeared on TV, yet until that happened, no one would have thought her anything but ordinary, including herself. When Gladwell says, in his subtitle, that Outliers is “The Story of Success,” he assumes that recognition is a necessary, and maybe sufficient, condition.

Consider, as well, Chris Langan, whose astronomically high IQ—around 195, 45 points higher than Einstein’s—does actually make him a statistical anomaly. In Gladwell’s estimation, though, the poor fellow—who lives in relative obscurity on a midwestern horse farm—is a great failure:

He’d been working for decades now on a project of enormous sophistication—but almost none of what he had done had ever been published much less read by the physicists and philosophers and mathematicians who might be able to judge its value.

Gladwell writes:

Here he was, a man with a one-in-a-million mind, and he had yet to have any impact on the world. He wasn’t holding forth at academic conferences. He wasn’t leading a graduate seminar at some prestigious university. He was living on a slightly tumbledown horse farm in northern Missouri, sitting on the back porch in jeans and a cut-off T-shirt. He knew how it looked: it was the great paradox of Chris Langan’s genius.

“I have not pursued mainstream publishers as hard as I should have,” he conceded. “Going around, querying publishers, trying to find an agent. I haven’t done it and I am not interested in doing it.”

It was an admission of defeat.

Really—says who?

Gladwell’s explanation for what he believes is Langan’s epic failure goes to the heart of his main thesis about success—that it cannot be explained by understanding what a person is like but only by where he or she is from. It’s not clear, precisely, why Gladwell considers this is a revelation, not a tautology, but he does. The social science bookshelf is filled with studies linking achievement to background. Most recently, the economic mobility project of the Pew Charitable Trusts found, for instance, that nearly half “of those born to parents in the top quintile [income] who have a college degree remain at the top, [which is] nearly triple the percentage of college graduates born to parents at the bottom that make it to the top of the income distribution.” In any case, all stories of success or failure are construed after the fact and the same set of circumstances often leads to fundamentally different outcomes, the explanation for which typically invokes those circumstances. (For example, one man’s inherited wealth leads to the revolving door of the Betty Ford Clinic, while another’s leads to the Pulitzer Prize in Poetry.) To claim, as Gladwell does, that “extraordinary achievement is less about talent than opportunity” overstates the obvious while letting the rest of us, who are not overachievers, off the hook. “People don’t rise from nothing,” he writes.

We owe something to parentage and patronage. The people who stand before kings may look like they did it all by themselves. But in fact they are invariably the beneficiaries of hidden advantages and extraordinary opportunities and cultural legacies that allow them to learn and work hard and make sense of the world in ways others cannot.

Chris Langan, the oldest son of a woman who had four boys, each with a different father, the last of whom was an abusive alcoholic, was raised with none of the advantages that might have allowed him to prosper. Though he won full scholarships to the University of Chicago and to Reed College, and enrolled at Reed, he left before the end of freshman year, a crew-cut kid among long-hairs whose mother forgot to fill out the financial aid forms. Then he went to Montana State, and his car broke down and a professor wouldn’t let him change a morning class for an afternoon class, and Langan left there, too.

If Langan had had what Gladwell, citing the psychologist Robert Sternberg, calls “practical intelligence”—knowing what to say and who to say it to—he might have graduated from college, gone to graduate school, become an academic, written peer-reviewed articles, sat on innumerable committees, and made something recognizable out of his life. But lacking the kind of family background from which, Gladwell says, such knowledge comes, he was doomed to failure.

For some reason, the Langan story makes Gladwell think of the physicist Robert Oppenheimer, another young prodigy (“Ask me a question in Latin and I will answer you in Greek,”) who was also a depressive and a miscreant: at Cambridge he tried to poison his tutor. Rather than being sent home or to jail, Oppenheimer was set up with a psychiatrist and allowed to continue his studies, a turn of events that Gladwell attributes to his practical intelligence:

Would Oppenheimer have lost his scholarship at Reed? Would he have been unable to convince his professors to move his classes to the afternoon? Of course not. And that’s not because he was smarter than Chris Langan. It’s because he possessed the kind of savvy that allowed him to get what he wanted from the world.

However, Chris Langan does not make me think of Robert Oppenheimer but of William James Sidis, the youngest student ever to matriculate at Harvard University, at age eleven. By all accounts, including that of his namesake and godfather, William James, Sidis was a boy genius, considered to be the smartest undergraduate ever to attend Harvard College. Sidis knew at least eight languages that, apparently, he had taught himself. He was also a gifted mathematician who lectured the Harvard Mathematical Club soon after arriving at the college. After graduation in 1914 at the age of sixteen, he had a brief stint as a graduate student, then went on to teach math at what would become Rice University. All looked on track for Sidis, the son of two intellectually and socially well-connected physicians, one of whom, his father Boris, was also a psychology professor at Harvard. At seventeen, young Sidis was well along the road to fulfilling his early promise.

It never happened. The Rice job was a bust—after less than a year, Sidis was asked to leave. Back in Cambridge, he enrolled in Harvard Law School but never graduated. He became involved in radical politics, got arrested, was sent to a sanatorium. He cut off ties with his parents and took a series of menial jobs while pursuing his hobby of collecting streetcar transfers. It is safe to say that despite parentage and patronage, Sidis, who lived out his adulthood in relative obscurity and penury, was a failed man.

So what does the sad tale of William James Sidis say about how natural genius needs the soil of practical intelligence to prosper? Not a whole lot. Not any more than the supposedly sad tale of Chris Langan. As any statistician will tell you, you can’t learn anything about populations from an n of 1. It’s not a sample, it’s an amusement.

If one looks for a common denominator in the success stories of Warren Buffett, Tiger Woods, Bill Gates, and even the young William Sidis (when his promise was a proxy for success), it’s that they headed out on their path to greatness well before their peers. Woods was two when his father put a golf club in his hands. Bill Gates started programming in high school at a time when no one had computers at home because he himself had yet to have the vision of the PC. Buffett began investing before he was in long pants. Sidis was ready to enter Harvard as a nine-year-old.

Following the research of the psychologist Anders Ericsson and colleagues who wanted to know why some conservatory students went on to solo and orchestral careers while others ended up as workaday music teachers, Gladwell invokes “the 10,000 hour rule”:

The striking thing about Ericcson’s study is that he and his colleagues couldn’t find any “naturals,” musicians who floated effortlessly to the top while practicing a fraction of the time their peers did…. And what’s more, the people at the very top don’t work just harder or even much harder than everyone else. They work much, much harder.

The idea that excellence at performing a complex task requires a critical minimum level of practice surfaces again and again in studies of expertise. In fact, researchers have settled on what they believe is the magic number for true expertise: ten thousand hours.

The Beatles, Bill Gates, Bill Joy (of Sun Microsystems), Tiger Woods—Gladwell does the math and points out that all had logged the requisite 10K before “bursting” onto the scene. For Warren Buffett (who is not one of Gladwell’s outliers), the clock started ticking when the six-year-old began buying packs of gum and selling them to the neighbors. (When one of them wanted to buy an individual stick, Buffett refused, since he knew that if he sold each piece for exactly what he’d paid for it he’d make no profit, a point of view that remains one of his most successful investment strategies.) Add to that Buffett’s high school pinball machine business, his three extensive paper routes as a teenager, and his earliest stock trades, and Buffett’s first million probably coincided with his ten thousandth hour. After that his accumulation of wealth was, seemingly, meteoric.

Gladwell is not saying that ten thousand hours guarantee success, but rather that ten thousand hours are what it takes to be successful. The reason the Beatles are the Beatles, he says, is because as luck would have it, they cut their musical teeth playing back-to-back sets eight hours a day, seven days a week, in Hamburg bars and strip clubs. Without that time, they might have gone the way of Derry Wilkie and the Seniors, another Liverpool band popular in Hamburg at the same time. Of course, it does not explain why that band, which presumably was required to play the same marathon hours in the same establishments, did not, instead, become the Beatles. Genius does find a way of rising to the surface. Culture, zeitgeist, family, genes, history, and chance help carry it along.

But is that why most writers don’t become Tolstoy or most NASCAR drivers don’t become Dale Earnhardt once they’ve put in their ten thousand hours? Possibly; human variability ought to count for something. But maybe, too, the magic inherent in the magic number does not inhere to the number itself. Most of us will eventually clock more than ten thousand hours doing the things we like to do a lot—playing tennis or swimming or cooking or writing poetry or writing code—reach some level of competence, and stay there. Practice does not overcome mediocrity and may even reinforce it. That is because, as Geoff Colvin points out in his book Talent Is Overrated: What Really Separates World-Class Performers from Everybody Else, this notion of 10,000 hours of practice is too vague and misconstrues Ericsson’s conclusion, which is that practice has to be “deliberate.” As Colvin describes it:

Deliberate practice is characterized by several elements, each worth examining. It is activity designed specifically to improve performance, often with a teacher’s help; it can be repeated a lot; feedback on results is continuously available; it’s highly demanding mentally, whether the activity is purely intellectual, such as chess or business-related activities, or heavily physical, such as sports; and it isn’t much fun.

That’s where the magic resides.

So how to account for the apparent outlying success of Asian high school students on tests of math skills? Is it coaching or concentrated application to math problems, or is it innate, and if it’s innate, does it derive from genes? It is well known that at least a portion of intelligence is heritable, and when there is a particular ethnic or racial group that outperforms consistently in one of the fields of intelligence, it would seem at least worth exploring whether performance is linked to genetics.

Surprisingly, Gladwell doesn’t go near the genetics argument, even though recent brain-scanning studies at UCLA, for example, suggest a strong link between the thickness of the myelin sheath, which is genetic, and superior math processing. Instead, he focuses on that other accident of birth, culture, to account for the dramatic differences in math performance between students from Japan, Singapore, South Korea, Hong Kong, and Taiwan and those from the United States, France, Germany, and the UK, arguing that a long tradition of wet-rice cultivation, which is labor-intensive and mentally demanding, is the best way to understand Asian students’ prowess.

It is not that they are smarter than anyone else, he says, it’s that it’s in their tradition to work hard, so they do, even at something unfun, like math. “Working really hard is what successful people do,” Gladwell writes,

and the genius of the culture formed in the rice paddies is that hard work gave those in the fields a way to find meaning in the midst of great uncertainty and poverty. That lesson has served Asians well in many endeavors but rarely so perfectly as in the case of mathematics.

This is a pretty neat argument. If you’re crummy at math you can thank your slothful wheat- and corn-growing ancestors who slept through the long, cold winter.

But what if, instead, you come from a long line of tobacco-growing stock? Until the 1950s, tobacco farming was even more labor-intensive than wet-rice agriculture. The average tobacco farmer cultivated about six acres of land, and each acre demanded around nine hundred man-hours of labor, and like wet-rice farming, it was a year-round occupation. If Gladwell’s argument holds, one would expect our highest-producing tobacco states, North Carolina, Kentucky, and Tennessee, to produce our highest-performing math students. But of course that’s not the case. Nor is it the case that all wet-rice cultures have a lock on high math performance: Burma, the Phillipines, and Bangladesh come to mind. Indeed, contrary cases abound and so do other similar, culturally determined arguments, like the one that credits a tradition of Confucianism and deference to excellence in a subject that has but one right answer.

Depending on your point of view, these sorts of blanket explanations may strike you, at best, as speculative and interesting or, at worst, unprovable, silly, and, possibly, offensive. Either way, getting embroiled in questions of validity distracts from the larger, obvious, and unoriginal notion that when talking about anyone’s success or failure, culture and history count. (Isn’t this where the argument for affirmative action begins?) Everybody comes from somewhere.

Warren Buffett comes from Nebraska. His grandfather owned a grocery store. His father was a stockbroker and politician. His mother’s mother was mentally ill and lived out her days in an asylum. His mother was emotionally unstable as well. There’s little in his family history to suggest that he’d be so phenomenally skilled at making money or creating and running one of the biggest conglomerates in the world.

In the supposed tug-of-war between parentage and patronage on one side and genius and talent on the other, both push and pull. Still, if you were to ask Buffett what contributed most to his success, he’d agree with Malcolm Gladwell. “I had the advantage of a home where people talked about interesting things,” he told Alice Schroeder, “and I had intelligent parents and I went to decent schools…. I didn’t get money from my parents, and I really didn’t want it. But I was born at the right time and place. I won the ‘Ovarian Lottery.’ ”

In Buffett’s case—and it is only a single narrative from which no larger meaning can be derived—what he’s like is illustrated by this claim of patrimony. It is a measure of his character that he would never call himself a self-made man, and that might be the most important thing you need to know about him to understand his success.

This Issue

May 28, 2009