In mid-May, The New York Times reported on appalling labor conditions in the construction of NYU’s new satellite campus in Abu Dhabi. NYU said it had a commitment from both the government of Abu Dhabi and the contractor, the BK Gulf corporation, that workers would be treated decently. But the Times found that migrant workers from South Asia were crammed fifteen to a room, paid as little as $272 a month for an eleven- or twelve-hour workday six or seven days per week, and were roughed up, fired, jailed, or deported if they complained. Embarrassed NYU officials issued pained statements of dismay, but the university’s position boiled down to “Who, me?” NYU could disclaim responsibility because the contractor, not the university, was the employer.

A year earlier, in Bangladesh, more than 1,100 garment workers were killed in a factory fire at Rana Plaza. The fashion brands for whom the clothes were ultimately made, companies like Benetton and Tommy Hilfiger, issued similar denials of responsibility. The clothes carrying their labels were produced at three or four levels of remove from corporate management. In the new economy of “supply-chain” production, a fashion company typically hires a logistics firm such as the Hong Kong–based Li & Fung, which in turn finds factories to manufacture the goods. Profit margins are thin and competition for orders is fierce. The factories often turn to subcontractors. While the brand is relentless about design specifications and quality control for the product, wages and working conditions are somebody else’s problem. After the fire, some European fashion houses took the lead in negotiating an accord that addresses safety, but not wages.

The same system of outsourced employment increasingly operates at home. In the past generation, there has been a drastic change in how work is organized. Regular payroll employment is becoming the exception. The employer of record is no longer the corporation, but a web of intermediaries. The outside contractor demands stringent worker performance, even as it drives down wages, job security, and benefits.

David Weil writes in his authoritative new book, The Fissured Workplace:

As major companies have consciously invested in building brands and devoted customers as the cornerstone of their business strategy, they have also shed their role as the direct employer of the people responsible for providing those products and services.

This system, which began in peripheral occupations such as janitors or security guards, has become pervasive. FedEx workers wear the company’s uniforms, drive its trucks, and adhere to stringent rules; but they are independent contractors, not company employees. At many leading hotels, room cleaners and desk clerks actually work for management companies, not for Marriott or Hilton. The technician sent by Comcast to fix your cable may well be a freelancer, not an employee. When you go into a government building, the receptionist/guard is likely not a civil servant, but the low-wage hire of a security firm. That firm, in turn, is likely to be owned by a private equity company. Apple employs some 63,000 workers directly, and more than 750,000 in a variety of contract relationships. When horrific working conditions were revealed in a Chinese plant that made iPhones and iPads, Apple—one of the world’s most exacting companies when it comes to technical quality—could blame the contractor.

By “fissured,” Weil means fragmented, as in the fissuring of a rock or an atom. The term may strike some readers as an odd usage, but the metaphor is exact. Weil points out that the fissuring mechanisms include not just the familiar categories of temp and part-timer, but “subcontracting, franchising, third-party management, outsourcing” that allow a corporation to fragment employment yet maintain standards.

Half a century ago, at the peak of the postwar boom, large employers took direct responsibility for their workers. Today, Weil reports, about one worker in three is hired not by the corporation identified with the product but by someone else, and the connection between employer and employee is fractured. Large corporations “have it both ways,” Weil writes:

While a major restaurant brand may set out standards and guidelines that dictate to a minute degree the way that food is prepared, presented, and served, and specify cleaning routines, schedules, and even the products to be used, it would recoil from being held responsible for franchisees’ failure to provide overtime pay for workers, for curbing sexual harassment of workers by supervisors, or for reducing exposure to dangerous cleaning materials.

This new system frees corporations from the obligations of a tacit social compact in which employee loyalty is reciprocated, companies have an incentive to invest in workers, and people can look forward to predictable careers. Moreover, the entire structure of worker protections and benefits legislated beginning in the New Deal is predicated on the assumption that the employee is on the payroll of the company that makes the product.1 A casual worker has fewer rights, and those that carry over are harder to enforce. A contract worker or temp pays his or her own Social Security taxes, can seldom collect unemployment compensation, rarely receives company-provided health insurance or pension benefits, and has scant opportunity to organize or join a union. Such workers are more likely to experience wage theft, sub-minimum wages, overtime violations, working conditions that violate health and safety laws—and have less practical recourse to legal remedies. “The modern employment relationship,” Weil writes, “bears little resemblance to that assumed in our core workplace regulations.”

Advertisement

As inequality has drawn increased public debate, most recently thanks to Thomas Piketty’s influential work, the changing conditions of employment have gotten far too little attention. Work remains the prime source of income for most people. The fissuring of work, Weil finds, is one of the main factors in the widening gap between productivity and earnings because it allows corporations to batter down labor costs—people’s paychecks.

In explaining inequality, many economists emphasize the importance of education and technology, contending that widening gaps reflect shifts in the demands for skills and the failures of America’s educational system.2 Yet the old postwar social compact calling for far greater equality was respected at a time when most Americans did not go to college and many factory workers had not completed high school. Since 1980, college graduation rates have soared yet inequality has increased. Generally, it has widened among college graduates, not just between those with college degrees and those with only high school diplomas or less.3

In analyzing the exceptional mid-century period when incomes became more equal, Piketty emphasizes the destruction of concentrated wealth in the Great Depression and two world wars. But he has little to say about how diminished wealth resulted in reduced political power for owners of capital, which in turn made possible egalitarian workplace policies and practices. The two books under review shed important new light on the resurgence of the power of finance and its connection to the debasement of work and income distribution.

How did “fissuring” become the new employment norm, and why do workers accept it? Weil cites two main factors. First, “capital markets demanded it,” as investors and traders gained power over managers in the era of financial deregulation that began roughly in 1980. Second, new technologies created new ways “of designing and monitoring the work of other parties,” making it easier to outsource work while retaining and even intensifying control over worker performance.

Yet this is primarily a story of shifting political power. Long before the digital economy, employers regularly sought to lower labor costs by turning payroll employment into casual work. Weil recounts a 1902 strike of 30,000 Italian immigrant workers hired to build New York’s first subway. The prime city contract was held by a bankers’ syndicate, which in turn used padroni to recruit and pay laborers. The workers, savvy about the dynamics of pay and power, were striking to be paid as employees directly by the syndicate, and not as casual labor by middlemen.

Similarly, in the garment industry, for more than a century employers have undercut wages by contracting work via outside middlemen known as jobbers. The subcontracting forced workers to compete with one another over who could offer the lowest piece rates.4 Only during the peak influence of garment workers’ unions was this system rejected in favor of direct payroll employment. These struggles had nothing to do with technology and everything to do with power.

Weil is right, however, that the latest round of work degradation was set off by financial deregulation. The extreme case is the private equity industry. Economists Eileen Appelbaum and Rosemary Batt provide a comprehensive examination of this shadowy sector in Private Equity at Work: When Wall Street Manages Main Street. Though the authors concentrate on work and workers, they offer a thorough exploration of how private equity operates by explaining how actual businesses are financed, as well as producing extensive data. Their sources range from regulatory filings and court records, econometric analyses, and the business school literature, to their own original interviews and case studies. Their book can be read as a complement to Weil’s, because it explains how the business strategies of these investment companies logically destroy and degrade jobs, not for economic efficiency or better management but to transfer wealth from workers to financial engineers.

Private equity is a sly misnomer—a rebranding of what used to be called leveraged buyouts (LBOs) or, more coarsely, corporate raids. When raiders began the practice of purchasing majority control in a company using borrowed money collateralized by the target company’s own assets, some federal and state regulators wondered if such so-called “tender offers” were legal, but quickly acceded to the anything-goes ethic of the 1980s. The sponsors (general partners) of a private equity company seldom contribute net equity capital like their distant cousins, venture capitalists. Mainly, they incur debt, invariably collateralized by the assets of the target company itself.

Advertisement

Contrary to the industry’s claims about being experts in turning companies from losers to winners, private equity typically targets healthy companies rather than underperforming ones, the better to extract cash reserves. Having loaded the balance sheet of the company with debt—debt incurred in the purchase of that very company—they hire managers to run as lean and ruthless an operation as possible. They borrow even more money to pay themselves “special dividends,” to recoup their initial small equity outlay many times over even if the operating company goes broke. The big losers in this game are the company’s workers.

In case studies, Applebaum and Batt describe how the general partners of a private equity firm strip assets and extract money from the target company, leaving it hobbled with debt. Private equity executives further enrich themselves by charging the company management fees. Since so many target companies eventually go broke after the private equity engineers cash out, it’s impossible to know how much better conventional ownership might have done, but it could hardly have done worse.

When Bain Capital took over KB Toys in 2000, it put up just 6 percent and borrowed the rest using KB Toys’ assets as collateral. Before KB went bankrupt, costing ten thousand jobs, Bain realized a gain of 360 percent on its original investment. Sun Capital, purchaser of the ice cream chain Friendly’s, loaded the company with debt, extracted dividends, laid off workers, and took Friendly’s into bankruptcy. But then “a second Sun Capital affiliate announced its intention to acquire the restaurant chain. A third Sun Capital unit came forward to provide a loan to finance the chain’s operations while it was in bankruptcy.” Such maneuvers enabled Sun to strip assets from the operating company and shed debts including pension obligations—yet retain control.

Appelbaum and Batt are scrupulously fair in reporting the exceptional cases where private equity firms do contribute to the successful rescue of failing or underperforming companies. But even in these instances, the divisions of the spoils are often revealing. In one such case, the investment banker Wilbur Ross, a man with a reputation for working with unions, joined forces with the United Steelworkers in 2002 to buy several shuttered steel mills out of bankruptcy. Ross persuaded the unions to cut wages and benefits, and restored the mills to profitability.

Ross himself contributed only $90 million in cash; the rest of the multibillion-dollar purchase and upgrading was financed by debt and investment capital contributed by limited partners. Thousands of jobs were saved at reduced wages, but when Ross cashed out in 2005, his personal profit was fourteen times the money he’d invested. Appelbaum and Batt note that “his three year investment netted him $4.5 billion—just equal to what retirees lost in their health and pension plans.”

Ross’s story, it should be made clear, is private equity at its best. More typical are the dozens of cases recounted by the authors where private equity has no interest in preserving a potentially profitable company or workers’ jobs, but simply seeks to extract as much profit as quickly as possible.

Because private equity firms are not publicly traded on stock exchanges, they escape most of the system’s regulatory requirements. The securities regulations dating to 1933 are premised on the assumption that disclosures are needed to protect investors. But since private equity companies are not traded on the market, they are exempt. However, these firms do in fact sell shares to investors, who are technically considered “limited partners,” thus evading disclosure requirements.

Since the general partners of private equity firms make such outsized returns, investors want a piece of that action. But Appelbaum and Batt cite data showing that most of the returns to limited partners do not beat the performance of the S&P 500. Even more peculiar is the fact that some 35 percent of the investment capital put up by limited partners comes from pension funds—which represent the deferred wages of workers. So workers’ own funds become part of the financial system that drives down workers’ wages and often plunders other pension systems.

While new technology does not explain the rupture of the old social compact, it does facilitate the shift to an economy of casual work. Elements of the new digital economy are well suited to fissuring. Many corporations in Silicon Valley like to think of themselves as “virtual,” not engaged in direct hiring or direct management of services or product sales. Some billion-dollar start-ups have fewer than a hundred salaried employees. Web-based companies such as Uber (an application that links passengers to part-time drivers) or Airbnb (which connects short-term landlords to tourists) or TaskRabbit (a matching service for odd jobs) reflect an economy in which more and more people feel like freelancers.

The insecurity of the new labor market gets internalized in the expectations of young workers. If there are few regular jobs out there, one might as well make the best of it. If your Web start-up fails, there is always work as a temp. On the other hand, if macroeconomic policy produced something closer to full employment and national policy favored regularized employment, fewer college graduates would have to enlist as TaskRabbits or Uber drivers.

In fact, for reasons unrelated to education or technology, a great many jobs can be configured either as casual labor or as normal payroll employment. In many states, for example, home health aides are individual contractors with low wages and insecure employment to match. But in states with strong unions such as California, home health aides have won the right to form bargaining units and are compensated as payroll employees. Warehouse workers for Walmart are hired and employed by logistics contractors; they are low-paid, and subject to arbitrary dismissal. Elsewhere, however, many warehouse workers are salaried employees and receive middle-class compensation.

In cities with strong hotel unions such as New York and Las Vegas, hotel employees are salaried and receive good wages and benefits. The union successfully resists management’s efforts to turn employees into “on-call” casual labor. In other cities, hotel workers performing the same jobs for the same brands work at barely more than minimum wage, often for contractors who supply personnel. The general trend to lower-paid work has little to do with education, technology, or management “efficiency.” It is a pure transfer from labor to capital.

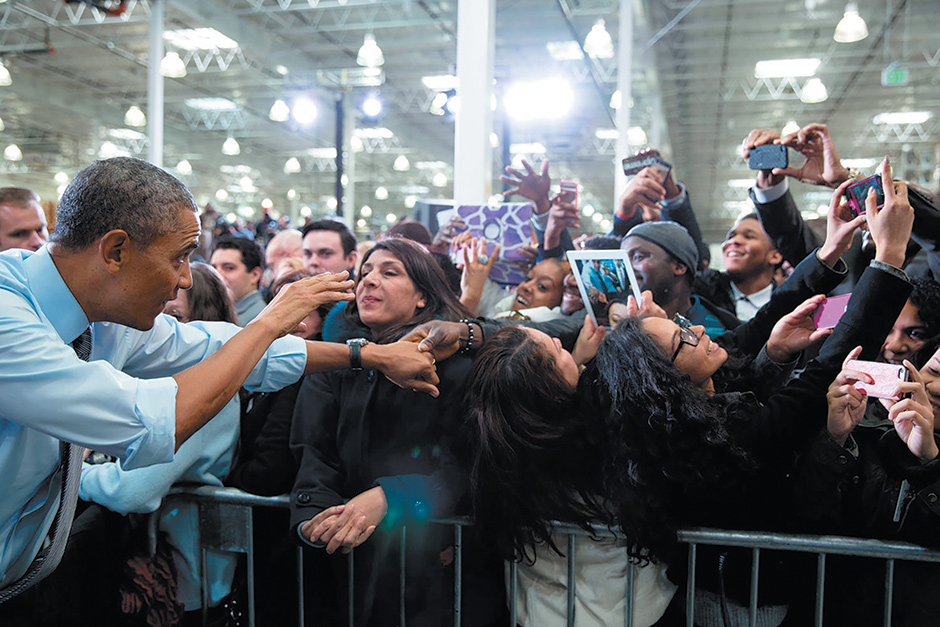

Both books conclude with recommendations for reform. The easiest remedy for plain illegality is better enforcement of laws already on the books, though many of these are an imperfect fit with fissured employment. David Weil, who spent his previous career as a professor and researcher on labor economics at Brown, Harvard, and Boston University, was sworn in on May 5 as the Labor Department subcabinet official in charge of wage and hour enforcement; he may get the chance to act on his own recommendations. Weil narrowly won Senate confirmation only thanks to this year’s relaxation of filibuster rules. The last person to hold this job on other than an acting basis was confirmed in 2001. This Republican opposition to regulation of workplaces suggests how difficult it will be to alter these employment trends.

One of Weil’s recommendations is that the government follow a strategy of targeting the worst corporate offenders. A second is that workers’ rights to join unions be considerably strengthened, since unions remain the best defense against gratuitous job-degrading. For their part, Appelbaum and Batt have an extensive list of proposals to rein in the abuses of private equity. They would end the tax-favoritism for debt, limit the payout of debt-financed special dividends, restrict asset-stripping, require far greater disclosure, and provide severance payments to employees. All of these ideas would slow down the financial engineering that supercharges the fissuring of work. But a restoration of the employment security of the postwar era would take a political power shift on the scale of the 1930s and 1940s.

Weil, Appelbaum, and Batt are accomplished technical economists. They belong to an economics tradition known as institutionalism, one that pays close attention to economic history, organizational forms, and changing political power; yet these authors also display mastery of a wide range of economic data. Like the workplace, today’s economics profession is fissured. Those who explore inequality by emphasizing education and technology, while paying no attention to the drastically altered social contract that is now becoming dominant, are missing much of the story.

This Issue

October 23, 2014

How Bad Are the Colleges?

Find Your Beach

Law Without History?

-

1

See Katherine V.W. Stone, From Widgets to Digits: Employment Regulation for the Changing Workplace (Cambridge University Press, 2004). ↩

-

2

See Claudia Dale Goldin and Lawrence F. Katz, The Race Between Education and Technology (Belknap Press/Harvard University Press, 2008). ↩

-

3

Josh Bivens et al., “Raising America’s Pay: Why It’s Our Central Economic Policy Challenge,” Economic Policy Institute, Washington, D.C., June 2014. ↩

-

4

See the discussion in Robert J.S. Ross, Slaves to Fashion: Poverty and Abuse in the New Sweatshops (University of Michigan Press, 2004), especially chapters 2 and 3. ↩