In some circles, “redistribution” of wealth has become a dirty word, and recent efforts to make the tax system more progressive have run into serious political resistance, above all from Republicans. But whatever your political party, you are unlikely to approve of the illegal use of tax havens. As it turns out, a lot of wealthy people in the United States, Europe, and elsewhere have been hiding money in foreign countries—above all, Switzerland, Luxembourg, and the Virgin Islands. As a result, they have been able to avoid paying taxes in their home countries. Until recently, however, officials have not known the magnitude of that problem.

But people are paying increasing attention to it. A vivid new documentary, The Price We Pay, connects tax havens, inequality, and insufficient regulation of financial transactions. The film makes a provocative argument that a new economic elite—wealthy managers and holders of capital—is now able to operate on a global scale, outside the constraints of any legal framework. In a particularly chilling moment, it shows one of the beneficiaries of the system cheerfully announcing on camera: “I don’t feel any remorse about not paying taxes. I think it’s a marvelous way in life.”

Gabriel Zucman, who teaches at the University of California at Berkeley, has two goals in his new book, The Hidden Wealth of Nations: to specify the costs of tax havens, and to figure out how to reduce those costs. While much of his analysis is technical, he writes with moral passion, even outrage; he sees tax havens as a “scourge.” His figures are arresting. About 8 percent of the world’s wealth, or $7.6 trillion, is held in tax havens. In 2015, Switzerland alone held $2.3 trillion in foreign wealth. As a result of fraud from unreported foreign accounts, governments around the world lose about $200 billion in tax revenue each year. Most of this amount comes from the evasion of taxes on investment income, but a significant chunk comes from fraud on inheritances. In the United States, the annual tax loss is $35 billion; in Europe, it is $78 billion. In African nations, it is $14 billion.

The fractions of wealth held abroad are highly variable. In Europe, it is about 10 percent. In African and Latin countries, it is much higher—between 20 percent and 30 percent. In Russia, it is a whopping 52 percent. It follows that while tax havens hit wealthy nations hardest in absolute terms, they can have especially destructive effects on poorer or developing countries, because such a high percentage of their money is offshore. Zucman does not explain why this is so, but it is possible to speculate that one reason is rampant corruption within both the public and private sectors. The extraordinarily high figure for Russia might be best understood as involving money corruptly acquired or invested, which suggests an important point: all uses of tax havens are not the same. Sometimes government officials are the ones who are evading taxes, and they do not want to stop that evasion.

In the aftermath of the financial crisis, you might expect that there would be an international crackdown on the use of tax havens, and as we shall see, international attention is indeed growing. But the numbers demonstrate that no crackdown has occurred. In Luxembourg, offshore wealth actually increased from 2008 to 2012 (by 20 percent). In Switzerland, the increase has been comparable; foreign holdings are now close to an all-time high. Disturbingly, the new wealth is coming mostly from developing countries, which poses a serious problem in light of the severe strains on their limited budgets.

Zucman is the first economist to produce specific numbers of this kind, and to do so, he had to undertake some creative detective work. In order to identify hidden wealth, he focuses on “anomalies”—situations in which international balance sheets show, in aggregate, more liabilities than assets. To see the importance of that inquiry, Zucman asks readers to imagine that a citizen of the United Kingdom holds an American security—say, stock in Google—in a bank account in Switzerland. In the United States, statisticians estimating US wealth overall will record a liability, because a foreigner owns US equities. But in Switzerland, statisticians will see nothing, and for a good reason: Google stock held in Switzerland by a UK resident will be, for Switzerland, neither an asset nor a liability. In the UK too, nothing will be registered, but for a bad reason: the UK has no way of knowing that one of its citizens owns Google stock in Switzerland. From this example, we can see the anomaly: on the global level, liabilities will be recorded as exceeding assets.

Zucman puts it this way: “as far back as statistics go, there is a ‘hole’; if we look at the world balance sheet, more financial assets are recorded as liabilities than as assets, as if planet Earth were in part held by Mars.” For the purpose of producing an accounting of hidden wealth, that is actually helpful, because “money doesn’t evaporate randomly into the ether, but instead follows a precise pattern of tax evasion.” In 2015, for example, the nations of the world reported $2 trillion as mutual fund holdings in Luxembourg; this is the total of recorded liabilities. But Luxembourg’s own statisticians calculated that worldwide, $3.5 trillion in mutual fund holdings were kept in Luxembourg; that is the total of recorded assets. What happened to the missing $1.5 trillion? In global statistics, that amount had no owners. For Zucman’s purposes, the anomaly is a revealing one: the amount by which assets exceed liabilities is a measure of wealth hidden in offshore accounts.

Advertisement

Zucman acknowledges that his measure is only an estimate. He must rely heavily on just two nations, Switzerland and Luxembourg, since both provide useful statistics about assets and liabilities; most tax havens do not do so. To make up for the missing information, he enlists some indirect measures. The technical issues need not concern us here. What matters is that Zucman convincingly argues that his accounting is at least pretty close, and that the grand total has to be in the general vicinity of $7.6 trillion.

How might this problem be solved? Zucman points to several recent efforts. An illuminating failure comes from the Organization for Economic Cooperation and Development (OECD), which instituted, in 2009, what it saw as a promising “on-demand” system for exchanging relevant information about the nationality and holdings of investors. Under that system, any nation may request information about investors from foreign banks, but only if it can establish a well-founded suspicion that fraud has occurred. The problem is that in order to have a well-founded suspicion of fraud, nations need to have relevant information in the first place. Often they don’t. Even though the 2009 reform has been widely praised, it seems to have had little or no effect, and Zucman denounces it as a “masquerade.” Recall that since 2009, the use of tax havens has increased significantly.

Zucman is also unimpressed by the Savings Tax Directive, adopted with considerable fanfare by the European Union in 2005. That directive imposes a simple requirement. When, for example, citizens of the UK earn interest on French accounts, the French government must automatically inform tax officials in the UK. That sounds like a solution, but it runs into three problems. First, it excludes dividends altogether. Second, it has been successfully avoided by the creation of shell corporations and trusts, which make it hard to know who, exactly, owns what. Third, nations are not treated equally; for example, Luxembourg and Austria are not required to send information automatically.

Zucman much prefers the Foreign Account Tax Compliance Act (FATCA), which was signed into law by President Obama in 2010. Under FATCA, all foreign banks are required to identify any American citizens among their clients and to disclose to the Internal Revenue Service the amount of their holdings and any dividends and interest paid on them. What Zucman emphasizes, and especially admires, is the automatic nature of the act’s requirements. The IRS need not name names or show grounds for suspicion. Every year, foreign banks are required to comply. If they fail to do so, they face a severe sanction, in the form of a 30 percent withholding tax on gross income (including dividends and interest) from US sources. In Zucman’s account, the sanction appears to be working; foreign banks are meeting their obligations, and some initially skeptical nations (including China) are even praising the new law.

With this precedent in mind, Zucman unveils his principal proposal: an automatic, fully global register, so that every government in the world can know where money is kept, and who is trying to escape national taxes. Under his proposal, the register would record “who owns all the financial securities in circulation, stocks, bonds, and shares of mutual funds throughout the world.” If rich people in the United States or Germany are depositing their money into Swiss banks, the Swiss authorities would have to inform American and German officials of the deposits. Zucman emphasizes that all this should be done automatically, so as to make special inquiries or evidence of suspicion unnecessary.

With the register, tax authorities could tell, essentially immediately, if their citizens are using tax havens. Zucman notes that a global register of this kind could have other benefits, helping to combat the financing of terrorism, bribery, and money laundering; public and private corruption might be added to this list. He notes too (and here he will immediately lose some readers) that such a register could facilitate the imposition of a global wealth tax, of the sort proposed, very controversially, by Thomas Piketty.

Advertisement

To avoid the charge of utopianism, Zucman emphasizes that there is a clear international movement in the direction he favors. With respect to the approach taken in FATCA, some nations are already considering emulating the United States, and importantly, Luxembourg, Singapore, and Switzerland have said that they would agree to automatic sharing of bank information. But he acknowledges some serious obstacles to the current reform efforts. The first is that, with the exception of the United States, nations are not threatening to impose penalties. That is a major problem, because a polite “please” will not do the job, especially since foreign banks have so much to gain from continuing business as usual.

The second obstacle is financial opacity. Many offshore accounts remain hidden through trusts and shell corporations, which makes it difficult for anyone to link those accounts with their real owners, even when information is formally exchanged. Zucman emphasizes the need to promote financial “transparency” (a principal term for him) and to ensure verification. To this end, he calls for serious economic sanctions against tax havens (as in the US approach), potentially including customs tariffs against nations that help “defrauders evade their home countries’ laws.”

Zucman has a final concern: tax avoidance by multinational corporations. As he is aware, this is a quite different problem from tax evasion, because it is typically done without violating a national law. Under US law, for example, American companies have significant discretion to locate their operations where they please, and also to shift their profits to nations with lower tax rates. Even if this is lawful, Zucman thinks that it is a problem. As a result of tax avoidance, US firms are able to save $130 billion annually, contributing to a decline in the effective corporate tax rate from 30 percent in the late 1990s to about 20 percent today.

In response, he wants “a radical reform of corporate taxation.” He favors a kind of tax on global profits, one that starts with the worldwide profits of firms, and then apportions them to each country. If, for example, a multinational company earns $900 billion in global profits in 2016, a formula would be used to allocate that amount among the various nations in which it does business. Each nation would be free to apply its ordinary tax rate to the profits allocated by that formula. Zucman notes that in the United States, corporate taxes within states already operate a bit like this, with national profit calculations followed by an apportionment formula.

On this particular issue, Zucman’s approach seems naive; many tax specialists believe that the apportionment system works very poorly in the United States, and any kind of international formula would produce serious challenges of accounting (let alone politics). Nonetheless, Zucman has produced an important book, above all because of his effort to calculate the magnitude of the world’s hidden wealth. As he acknowledges, his estimates depend on a degree of guesswork, not least because of the absence of reliable worldwide statistics. Even so, he has used the most rigorous methods to date, and he makes a convincing argument that the global figure is unlikely to be much lower than his $7.6 trillion estimate. It might well be higher.

The result is a substantial loss of revenue worldwide, with unfortunate consequences for both public services and deficits. According to Zucman, the United States is losing $35 billion in annual taxes, and some estimates say that the real loss is as high as $100 billion.* If so, and if those who successfully evade taxes are mostly the wealthiest people, there is a serious problem. By way of comparison, the entire annual budget of the Department of State is in the vicinity of $50 billion.

At the same time, Zucman’s proposed solution raises an assortment of questions. Should nations really want a global institution to keep a register of everyone’s ownership of stocks, bonds, shares of mutual funds, and other financial securities? Might there be a risk to personal privacy? To be sure, Zucman does not want everyone’s holdings to be visible on the Internet. A global institution could be required to maintain privacy. But many people would undoubtedly fear that it would not respect that requirement, and that people with nefarious purposes might be able to get access to it. And who, exactly, would serve as that global institution? Zucman suggests the International Monetary Fund, which is probably the most natural candidate. The IMF has a great deal of credibility in many circles, but hardly in all. Should the IMF be given full access to people’s financial holdings?

These questions might well have answers. With respect to privacy, domestic banks are already required to make reports to the IRS, and the privacy concerns do not seem severe; perhaps the risks could be controlled at the global level as well. Nonetheless, an international effort to negotiate a global register might not be feasible. A less provocative suggestion, in the spirit of Zucman’s proposal, would be that other nations should move on their own toward adoption of the approach embodied in FATCA—by which banks must identify their clients and report their holdings—complete with stiff penalties for noncompliance.

In Europe, which is losing a lot of tax revenue, that approach could prove especially helpful. True, some developing countries might lack the leverage to enforce requirements of this kind, and because of domestic corruption, some nations would be reluctant to impose those requirements. To these problems, the best solution might be an international treaty to uncover hidden wealth, through which participants generalize the requirements of FATCA. That approach might have significant advantages over the global register that Zucman favors.

But there are counterarguments here as well. Zucman largely praises FATCA, but in the United States, the law has turned out to be highly controversial, and some people are loudly calling for its repeal or modification. One reason is expense. Foreign financial institutions are not at all happy with the considerable administrative burdens that it imposes. Another reason involves unintended adverse consequences. Because FATCA increases the costs of having American investors, it gives some foreign banks an incentive not to allow Americans to invest at all (or to charge them higher fees). The law is also a blunt instrument. A lot of law-abiding Americans, living abroad, use foreign financial institutions, and they do not need FATCA to ensure that they obey the law. The same is true of many Americans who choose, for one or another reason, to invest abroad.

But if we keep the size of Zucman’s estimates in mind, these concerns need not be taken as decisive. If the effect of FATCA is to produce major reductions in tax evasion, and to ensure that people pay what they owe, then it might well be worthwhile to incur the costs. Of course foreign banks do not like the law, not only because compliance can be burdensome, but also because it makes it much harder to provide tax havens. That is not exactly an argument against FATCA.

A strong virtue of Zucman’s book is that it puts a bright spotlight on an area in which significant reforms might appeal to people who otherwise disagree on a great deal. You might believe that the tax system should be made more progressive, or you might believe that it should be made less so. But whatever you think, you are unlikely to support a situation in which trillions of dollars are hardly taxed at all.

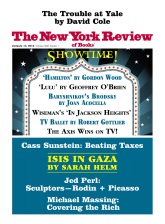

This Issue

January 14, 2016

ISIS in Gaza

How to Cover the One Percent

A Ghost Story

-

*

See Jane G. Gravelle, “Tax Havens: International Tax Avoidance and Evasion,” Congressional Research Service, Library of Congress, January 15, 2015. ↩