In 2007 a sharply divided Supreme Court struck down plans to integrate the Seattle and Louisville public schools. Both districts faced the geographic dilemma that confounds most American cities: their neighborhoods were highly segregated by race and therefore so were many of their schools. To compensate, each district occasionally considered a student’s race in making school assignments. Seattle, for instance, used race as a tie-breaking factor in filling some oversubscribed high schools. Across the country, hundreds of districts had similar plans.

Justice Stephen G. Breyer, writing for the court’s liberal wing in the case, Parents Involved in Community Schools v. Seattle School District No. 1, argued that the modest use of race served essential educational and democratic goals and kept faith with the Court’s “finest hour,” its rejection of segregation a half-century earlier in Brown v. Board of Education. But Chief Justice John G. Roberts Jr., representing a conservative plurality, called any weighing of race unconstitutional. “The way to stop discrimination on the basis of race is to stop discriminating on the basis of race,” he wrote. Crucial to his reasoning was the assertion that segregation in Seattle and Louisville was de facto, not de jure—a product of private choices, not state action. Since the state didn’t cause segregation, the state didn’t have to fix it—and couldn’t fix it by sorting students by race.

Richard Rothstein, an education analyst at the left-leaning Economic Policy Institute, thinks John Roberts is a bad historian. The Color of Law, his powerful history of governmental efforts to impose housing segregation, was written in part as a retort. “Residential segregation was created by state action,” he writes, not merely by amorphous “societal” influences. While private discrimination also deserves some share of the blame, Rothstein shows that “racially explicit policies of federal, state, and local governments…segregated every metropolitan area in the United States.” Government agencies used public housing to clear mixed neighborhoods and create segregated ones. Governments built highways as buffers to keep the races apart. They used federal mortgage insurance to usher in an era of suburbanization on the condition that developers keep blacks out. From New Dealers to county sheriffs, government agencies at every level helped impose segregation—not de facto but de jure.

Rothstein calls his story a “forgotten history,” not a hidden one. Indeed, part of the book’s shock is just how explicit the government’s racial engineering often was. The demand for segregation was made plain in workaday documents like the Federal Housing Administration’s Underwriting Manual, which specified that loans should be made in neighborhoods that “continue to be occupied by the same social and racial classes” but not in those vulnerable to the influx of “inharmonious racial groups.” A New Deal agency, the Home Owners’ Loan Corporation, drew color-coded maps with neighborhoods occupied by whites shaded green and approved for loans and black areas marked red and denied credit—the original “redlining.” The FHA financed Levittown, the emblem of postwar suburbanization, on the condition that none of its 17,500 homes be sold to blacks. The policies on black and white were spelled out in black and white.

De jure segregation is long gone from the books, but its significance is more than historical. The conditions it created endure. American cities remain highly segregated. Schools are highly unequal. Huge gaps in wealth persist between blacks and whites, largely driven by differences in home equity. Compared to poor whites, poor blacks are much more likely to live in poor neighborhoods, which compounds their disadvantages. Since the government helped impose segregation, Rothstein argues that it has a constitutional obligation to remedy it. He has thoughts on solutions, though none, he readily admits, that are politically feasible. The current racial polarization is part of his point—one reason American politics is so divided is that American census tracts are. The Color of Law is designed more to start a conversation than to prescribe a solution, and on those grounds it succeeds, joining works by writers like Ta-Nehisi Coates and Nikole Hannah-Jones that achieve the difficult feat of taking a fresh look at race.

Among the government’s tools for imposing segregation, few were as powerful as public housing, which both reinforced color lines and drew them where they hadn’t existed. Public housing typically conjures high-rise black ghettos. But it started during the Depression mostly to help working-class whites. The first agency to build public housing was the Public Works Administration, which was launched in 1933. It happened to be run by a racial liberal, Harold Ickes, a former head of the Chicago NAACP. Yet Ickes created a “neighborhood composition rule”—projects in white areas could only house whites, and projects in black neighborhoods could only house blacks.

Advertisement

Perhaps he was trying to appease southerners in the New Deal coalition. Or perhaps segregation was the only way to get blacks housed at all. Rothstein doesn’t say. But across the country officials used the program to raze integrated neighborhoods and build projects that kept the races apart. The first project, Techwood Homes in Atlanta, destroyed a racially mixed neighborhood of 1,600 families and built 600 apartments for whites. A Miami civic leader said the city used public housing to “remove the entire colored population” from areas it wanted white. The same thing happened across the Northeast and Midwest.

In 1937, the federal government stopped building apartments directly and started financing local housing authorities, but it maintained its segregationist principles. The agency in charge, the US Housing Authority, specified that projects should ensure “the preservation rather than the disruption of community social structures.” The first USHA project was built in Austin, Texas, where a go-getter congressman named Lyndon B. Johnson secured the funds. Until then, Austin’s black residents were scattered throughout the city, but officials built a black project on the east side of town and a white project to the west, creating “a more rigid segregation than had previously existed.” In supposedly liberal San Francisco, the Board of Supervisors in 1949 called for “nonsegregation” in future projects, a policy the housing authority spurned. Its chairman testified that the authority wanted to “localize occupancy of Negroes.” In already segregated cities like Chicago, the building of segregated public housing made racial division more entrenched.

Whites started leaving public housing in the 1950s for better options in the private market, from which African-Americans were largely excluded. As housing projects became mostly black, disputes over where to build them intensified. The infamous high-rises, like the Robert Taylor Homes in Chicago, were largely concentrated in isolated black areas far from the white parts of town. Some states passed constitutional amendments requiring local referendums before projects could be built, which gave white suburbs veto power. In 1976 the Supreme Court upheld lower court rulings that the federal government and the Chicago Housing Authority, by concentrating projects in black neighborhoods, had unconstitutionally imposed segregation. But when the Court ordered that future projects be constructed in white areas, the authority simply stopped building them. Rothstein, who was a young researcher on the case, argues that it was too late anyway—vacant land in white areas was mostly gone and the chance for integration had passed.

Zoning laws gave governments another way to impose segregation. The first codes were openly racial, simply banning blacks from buying houses on white blocks. But the Supreme Court in 1917 ruled racial proscriptions unconstitutional—not because they hurt blacks but because they violated property rights, by limiting owners’ ability to sell. Some cities just ignored the Court: until 1968, Apopka, Florida, had a law that banned blacks from living north of the railroad tracks. But most codes switched to economic criteria to achieve the same goals; they banned apartment buildings in certain parts of town or allowed only single-family houses. In 1921, Commerce Secretary Herbert Hoover created an Advisory Committee on Zoning to draft a model statute and stacked the group with segregationists. One member said zoning was needed to “maintain the nation and the race.” Hoover bet the economic criteria would pass Court muster, and proved right. The class bias was genuine, not merely a subterfuge, but Rothstein sees enough racism intertwined to call exclusionary zoning “integral to the story of de jure segregation.”

Exclusionary zoning was effective, but it couldn’t protect white neighborhoods from blacks with money. The government’s mortgage insurance programs did. Their profound contribution to de jure segregation is largely unappreciated. Starting during the New Deal and accelerating in the postwar years, the government transformed American life with a campaign to promote homeownership and suburbanization. But the sale of the American Dream explicitly excluded blacks.

Before the New Deal, it was hard to buy a home. Buyers generally had to put down 50 percent and rely on interest-only loans that came due in five to seven years. Since borrowers didn’t acquire equity, they had to make big payments at the end of the term or borrow again. To fight Depression-era foreclosures, the Home Owners Loan Corporation bought troubled mortgages and reissued them on easier terms, with longer repayment and amortization schedules that allowed borrowers to pay down their debt. But the agency’s pioneering color-coded maps generally barred loans in neighborhoods with black residents.

The Federal Housing Administration aided first-time buyers by insuring loans, which made it cheaper to borrow. The standard FHA loan covered 80 percent of the purchase price, with a twenty-year term and full amortization. (Later terms were even more liberal.) The FHA’s twenty-year loan was a revolution in social policy, bringing homeownership to millions of Americans. But it was also a force for segregation, banning loans to blacks—or even to neighborhoods that contained blacks—on the theory, as the Underwriting Manual explained, that such “adverse influences” threatened property values.

Advertisement

The FHA didn’t segregate America just one loan at a time. By underwriting mass developments, Rothstein writes, it created “entire subdivisions, in many cases entire suburbs, as racially exclusive white suburbs.” None was more celebrated than Levittown, an ingenious solution to the postwar housing shortage—thousands of affordable, mass-produced homes offered to veterans with no down payment. But only the government’s promise to insure the mortgages allowed William Levitt to secure the construction loans. “We are 100 percent dependent on Government,” he said. Among the FHA’s conditions, in Levittown and other mass projects, was that no homes be sold to blacks. By 1950, the FHA and the Veterans Administration insured half of all new mortgages on such terms. If that wasn’t de jure segregation, it’s hard to know what is.

Not least among the ways in which government supported segregation was through collusion in vigilante violence. The Color of Law has an entire chapter on the cross-burning mobs that threatened blacks in white neighborhoods while police stood by or aided the harassment. In a famous Louisville case from the 1950s, a white couple, Carl and Anne Braden, bought a house in a white neighborhood for black friends, Andrew and Charlotte Wade. White crowds threw rocks through the Wades’ window, shot at the house, and finally dynamited it. The bomber went free, but Andrew Wade was arrested for disturbing the peace and Carl Braden prosecuted for “sedition.” (His conviction was overturned on appeal.) Yet when the Supreme Court struck down Louisville’s school integration plan in 2007, it argued that the city’s segregation was “a product not of state action but of private choices.”

The federal government adopted a fair housing law in 1968; explicitly segregationist policies are long gone. Is it fair to blame them for segregation today? To a large extent it is. Residential segregation is uniquely long-lasting. As Rothstein argues, a lunch counter can be integrated overnight, but neighborhoods resist change. Communities are organic. People sink roots. An affluent white neighborhood can only integrate if African-Americans can afford the homes. With government support for segregation, a die was cast. Even today, blacks are about one percent of the population of Levittown.

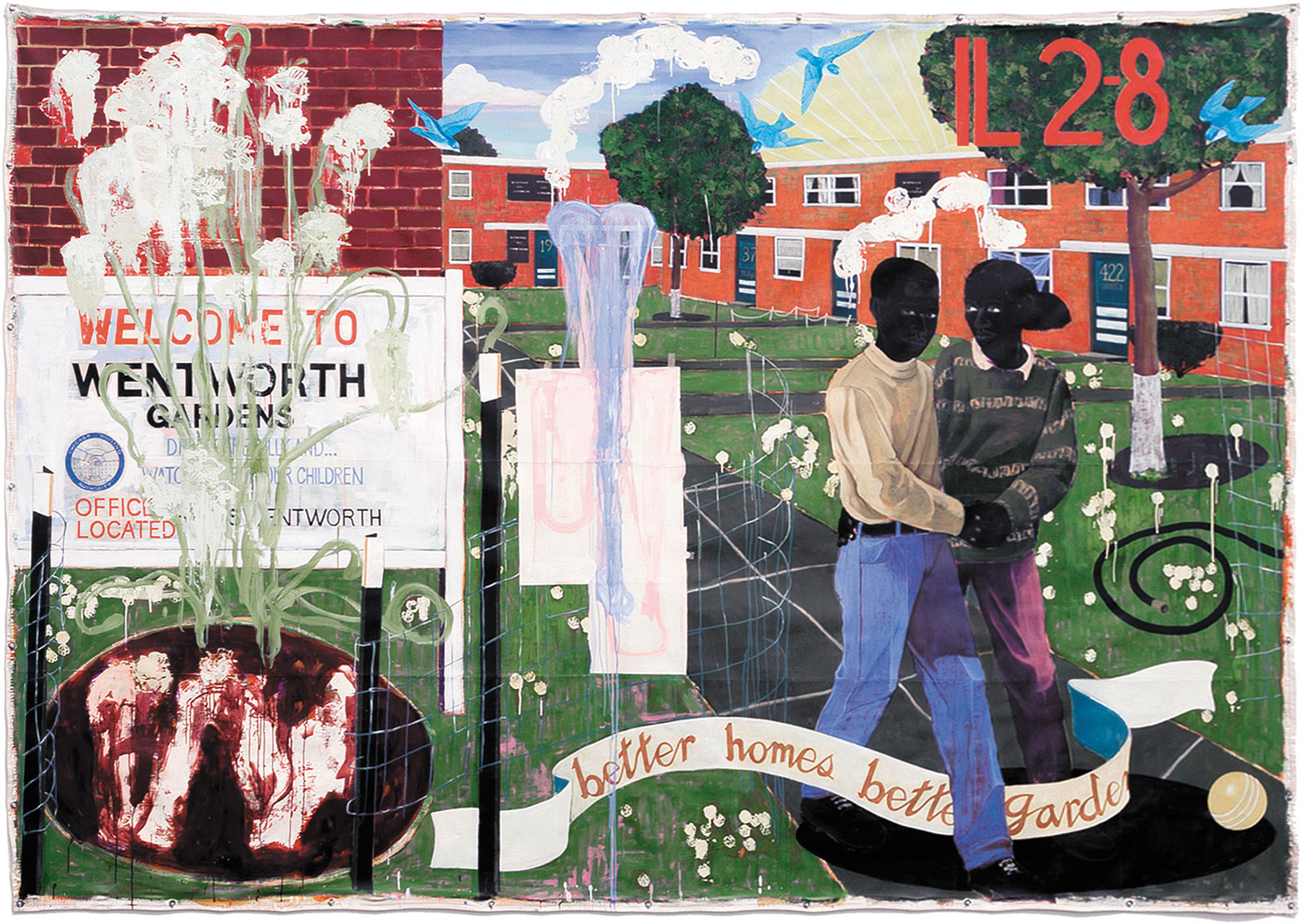

The Gordon Parks Foundation

Mr. and Mrs. Albert Thornton, Mobile, Alabama, 1956; photograph by Gordon Parks from Segregation Story, published by the Gordon Parks Foundation and Steidl. Parks’s work is on view in the two-part exhibition ‘I Am You,’ at the Jack Shainman Gallery, New York City, January 11–March 24, 2018.

The problems African-Americans faced were compounded by terrible timing: by the time the government allowed them to buy in, many were priced out. The first three postwar decades were uniquely auspicious for the growing suburban middle class. Real wages nearly doubled, and the stock of affordable housing rapidly grew. Postmen, firefighters, auto mechanics—all could afford their own patch of crabgrass. Beset by job and neighborhood discrimination, African-Americans largely missed the postwar boom. Later, as racial barriers eased, economic barriers rose—wages stagnated and housing prices soared. From 1973 to 1990, average black wages fell by about 2 percent, while housing prices rose more than 50 percent. When Levittown was built in the late 1940s, homes in the Long Island development sold for about twice the median income. Now they sell for six or eight times the median. As Rothstein puts it, “the window of opportunity for an integrated nation had mostly closed.”

One legacy of housing segregation is the large racial disparity in wealth. Most Americans get their wealth from home equity. Shunted to segregated developments and forced to pay higher borrowing costs, African-Americans for the most part lost out on the gains that benefited many whites. Blacks have about 60 percent of the family income of whites, but less than 10 percent of the wealth—a huge gap and one that impedes advancement. Nest eggs finance education; they tame emergencies.

Residential segregation isn’t the only reason for the difference in wealth between blacks and whites, but it’s a big one. Rothstein tells the story of a black trucker and World War II veteran named Vince Mereday, who carried building supplies to Levittown but was barred by government policy from buying a home there. Rebuffed, he bought in a black subdivision called Lakeview, with a large down payment and a higher interest rate since he couldn’t get FHA insurance. Lakeview remains predominantly black, and Rothstein estimates that its properties have enjoyed only a fifth of the appreciation of Levittown. That means a family like the Meredays would have missed $200,000 in gains over three generations, simply because of the color of their skin.

One can quibble with nuances of Rothstein’s account. He may overstate the extent to which the problems of the black underclass stemmed from housing discrimination alone, as opposed to, say, deindustrialization or the social disorder (high crime, low educational attainment, early and nonmarital child-bearing) linked to the injustice of the sharecropping experience in the South. In fact, as William Julius Wilson demonstrated three decades ago in The Truly Disadvantaged, the “social dislocation” of the black ghettos worsened in the wake of fair housing laws as middle-class families left. Rothstein also doesn’t fully explore the segregationists’ motives. Were they primarily social or economic? Sometimes he dismisses the argument that integration threatened property values. Elsewhere he notes that when blacks moved into white neighborhoods, panicked whites often bailed out at fire-sale prices. Fears about property values don’t justify discrimination, but a fuller discussion of the economics would better illuminate the politics.

The Color of Law ends at the Nixon administration. A lot has changed since then. The growth of the black middle class and better (if not great) fair housing enforcement has reduced segregation, although it remains high. A standard segregation measure, the “dissimilarity index,” peaked in 1970 at 79 (meaning that 79 percent of blacks in a typical metro area would need to move to achieve an even distribution). By 2010 the figure had fallen to 59. Cities are divided in new ethnic and economic ways. Latinos outnumber blacks, and segregation by income has soared—largely from rich families flocking to rich neighborhoods. The changing landscape affects access to opportunity in ways still not fully understood.

But blacks continue to face big disadvantages. Sean Reardon and his colleagues at Stanford recently found that black families with incomes of $55,000 to $60,000 a year live in neighborhoods similar to those of whites with just $12,000. The old African-American lament—that blacks have to be twice as good as whites to earn equal treatment—turns out to be wildly optimistic. When it comes to housing, the spread looks more like five to one.

Rothstein hesitates to offer solutions, arguing that the ground hasn’t been laid for the kinds of policies he thinks are constitutionally required. He prefers the word “remedy” to “reparations” but supports the concept either way (unpersuasively, I think). He cites Levittown as an illustration. To promote integration and redistribute wealth, he suggests that the government buy Levittown houses and sell them to black families at the equivalent of the original price—i.e., buy them at the market price of $350,000 and sell them to black buyers for $75,000. In most cases, the beneficiaries would have no connection to the original victims. But fixes for historic injustices cannot be “precisely calibrated,” Rothstein writes. “De jure segregation is too massive a historical wrong to satisfy this principle” of limiting compensation to individual victims. He rejects the idea that other minorities would raise comparable claims and seems unconcerned about backlash from whites.

More modestly, he calls for an assault on exclusionary zoning laws and floats an idea to require localities to house a share of poor people and African-Americans proportional to the metro average. In areas that fall short, homeowners would lose an escalating share of their mortgage interest and property tax deductions. He would add money to Section 8 vouchers so that poor families could move to higher-income neighborhoods. He is clear-eyed, however, that any effort to move poor, black families into white neighborhoods will meet strong resistance. He warns that an influx of disadvantaged families could hurt property values in affluent suburbs “because racial and economic snobbery is now part of their appeal.” It could also increase petty crime, and force upper middle class schools to spend more on “special counseling and remedial programs.” While he thinks such costs are manageable, he warns they are not zero. “We delude ourselves if we think that desegregation can only be a win-win experience for all,” he writes. The federal official who pushed hardest for housing integration was George Romney, Richard Nixon’s housing secretary, who said the federal government had put a “white noose” around black cities. Nixon forced him to resign.

But it’s unfair to judge a work of history as important as The Color of Law by the feasibility of its remedies. Rothstein is in the business of raising awareness, not prescribing policy. That he mines sources as dry as the FHA’s Underwriting Manual to tell a story of epic injustice lends his account a special eloquence. When he started the project a decade ago, Rothstein couldn’t have known that he would publish it into a storm of take-back-our-nation white militancy—timing both bad and good. The racial hostility of the moment is one measure of the need the book fills. As I finished it, a new poll revealed that 55 percent of whites believe that discrimination persists—discrimination against whites.* Among Republicans, the figure is nearly three quarters.

It may credit Americans too much to call this a “forgotten history.” I doubt most whites ever knew it. Rothstein summons special indignation at history textbooks that fail to explain the government’s role in imposing residential segregation. A Holt McDougal volume says that “African Americans found themselves forced into segregated neighborhoods,” without describing the government policies that did the forcing. A Pearson textbook celebrates Levittown with no mention of the exclusion of blacks and says that “de facto segregation, or segregation by unwritten custom or tradition, was a fact of life.” Rothstein seethes. “There was nothing unwritten about government policy to promote segregation,” he writes. “It was spelled out in the FHA’s Underwriting Manual.” He calls such history “mendacious,” and he’s right. The Color of Law makes it harder for future textbook writers, and the rest of us, to make that mistake again.

This Issue

February 22, 2018

God’s Own Music

The Heart of Conrad

Doing the New York Hustle

-

*

The poll, by NPR, the Robert Wood Johnson Foundation, and the Harvard T.H. Chan School of Public Health, was published in November. ↩